Food Safety Monitoring System Market Synopsis

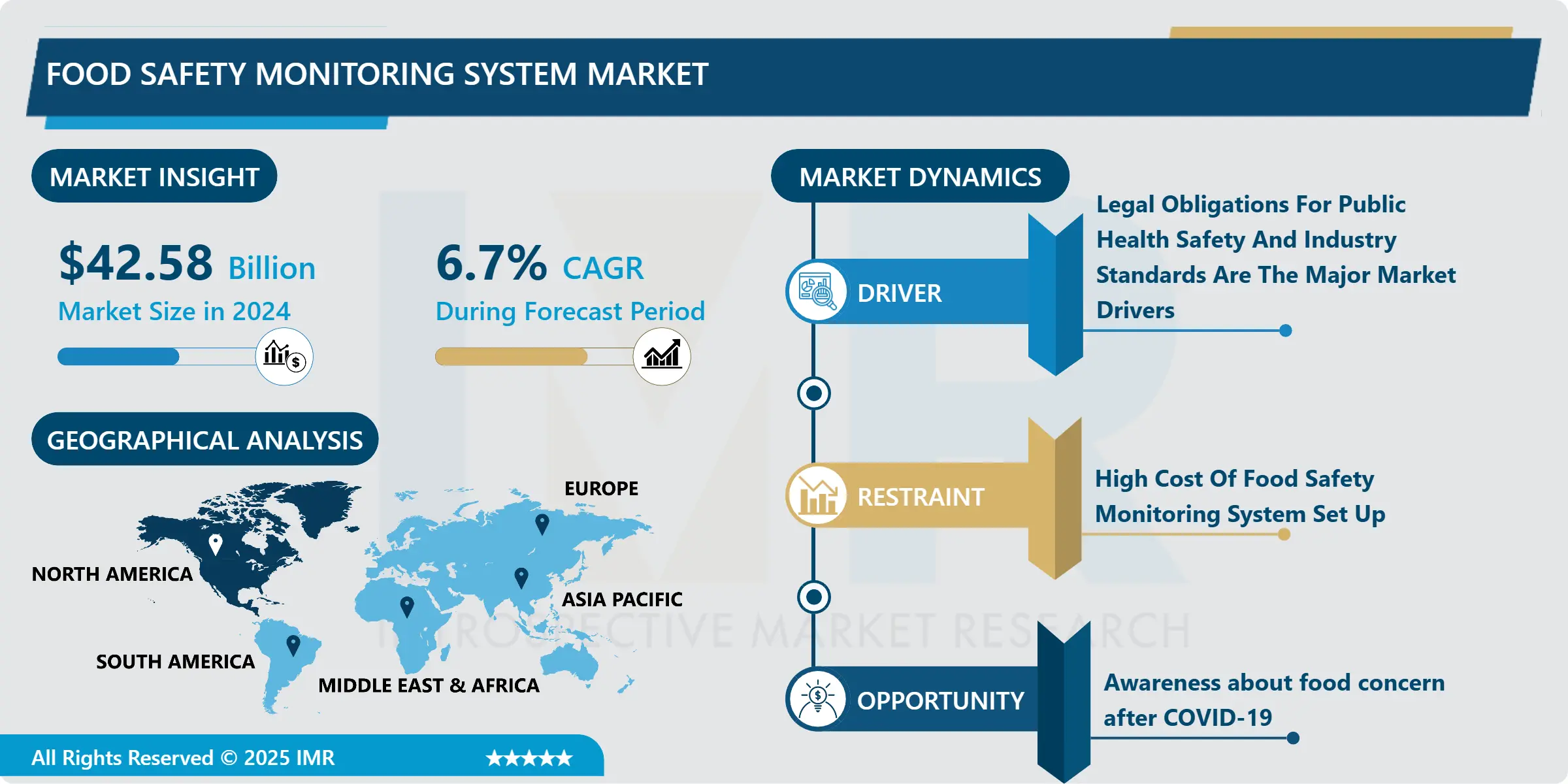

Food Safety Monitoring System Market Size Was Valued at USD 42.58 Million in 2024 and is Projected to Reach USD 71.54 Million by 2032, Growing at a CAGR of 6.7 % From 2025-2032.

The food safety monitoring System is the comprehensive framework that ensures that food safety hazards are under control, and procedures are being followed and implemented to support the safety status of our food production and supply.

Globally the monitoring process is regulated by the food safety regulations. It includes approval certifications from various agencies including SQF, BRC, FSSC 22000, IFS, Global GAP, etc.

It is an integration of If you have a HACCP-based food safety program implemented in your food business, you should be familiar with CCP monitoring or monitoring of critical limits. Food safety monitoring, in this context, seeks to ensure that potential hazards do not become uncontrolled and subsequently result in illness or injury to food consumers.

Another aspect under food safety monitoring is for GMP programs or PRP programs which say allergenic materials and non-allergenic materials should be placed separately, then it's necessary to install some system to keep check about the same. Food monitoring ensures that food is handled securely throughout the whole process, safeguarding the quality and safety of our food supply. Food service organizations can monitor temperature and trace the history of each item to spot problems before they make customers sick by implementing best practices and temperature monitoring to prevent contamination.

Reliable temperature monitoring is a must for freezers, coolers, and refrigerators in the food service sector. When food storage temperatures approach the danger zone, modern food safety systems use wireless, remote technology to notify staff and management.

|

Food Safety Monitoring System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

42.58 Million |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

71.54 Million |

|

Segments Covered: |

By Type |

|

|

|

By End-user |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Safety Monitoring System Market by Type (2018-2032)

4.1 Food Safety Monitoring System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hardware

Chapter 5: Food Safety Monitoring System Market by End-user (2018-2032)

5.1 Food Safety Monitoring System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food Processing Companies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food Retailers

5.5 Food Manufacturers

5.6 Restaurants

5.7 Bakeries

5.8 Beverages Companies

Chapter 6: Food Safety Monitoring System Market by Technology (2018-2032)

6.1 Food Safety Monitoring System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cloud

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 On-Premises

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Food Safety Monitoring System Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NEOGEN CORPORATION (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 3M FOOD SAFETY (UNITED STATES)

7.4 THERMO FISHER SCIENTIFIC (UNITED STATES)

7.5 EUROFINS SCIENTIFIC (LUXEMBOURG)

7.6 ROMER LABS (AUSTRIA)

7.7 MÉRIEUX NUTRISCIENCES (FRANCE)

7.8 BIO-RAD LABORATORIES (UNITED STATES)

7.9 HYGIENA (UNITED STATES)

7.10 CHARM SCIENCES (UNITED STATES)

7.11 INTERTEK GROUP PLC (UNITED KINGDOM)

7.12 BUREAU VERITAS (FRANCE)

7.13 SGS SA (SWITZERLAND)

7.14 WATERS CORPORATION (UNITED STATES)

7.15 PERKINELMER (UNITED STATES)

7.16 RANDOX LABORATORIES (UNITED KINGDOM)

7.17 QIAGEN (GERMANY)

7.18 AGILENT TECHNOLOGIES (UNITED STATES)

7.19 SHIMADZU CORPORATION (JAPAN)

7.20 LABCORP (UNITED STATES)

7.21 AGRI-NEO (CANADA)

7.22 FOODLOGIQ (UNITED STATES)

7.23 CLEAR LABS (UNITED STATES)

7.24 CERTUS (UNITED STATES)

7.25 KEMIN INDUSTRIES (UNITED STATES)

7.26 DNV GL (NORWAY)

7.27 NSF INTERNATIONAL (UNITED STATES)

7.28 CARGILL (UNITED STATES)

7.29 TYSON FOODS (UNITED STATES)

7.30 NESTLÉ (SWITZERLAND)

7.31 DANONE (FRANCE) OTHER KEY PLAYERS

Chapter 8: Global Food Safety Monitoring System Market By Region

8.1 Overview

8.2. North America Food Safety Monitoring System Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Software

8.2.4.2 Hardware

8.2.5 Historic and Forecasted Market Size by End-user

8.2.5.1 Food Processing Companies

8.2.5.2 Food Retailers

8.2.5.3 Food Manufacturers

8.2.5.4 Restaurants

8.2.5.5 Bakeries

8.2.5.6 Beverages Companies

8.2.6 Historic and Forecasted Market Size by Technology

8.2.6.1 Cloud

8.2.6.2 On-Premises

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Food Safety Monitoring System Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Software

8.3.4.2 Hardware

8.3.5 Historic and Forecasted Market Size by End-user

8.3.5.1 Food Processing Companies

8.3.5.2 Food Retailers

8.3.5.3 Food Manufacturers

8.3.5.4 Restaurants

8.3.5.5 Bakeries

8.3.5.6 Beverages Companies

8.3.6 Historic and Forecasted Market Size by Technology

8.3.6.1 Cloud

8.3.6.2 On-Premises

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Food Safety Monitoring System Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Software

8.4.4.2 Hardware

8.4.5 Historic and Forecasted Market Size by End-user

8.4.5.1 Food Processing Companies

8.4.5.2 Food Retailers

8.4.5.3 Food Manufacturers

8.4.5.4 Restaurants

8.4.5.5 Bakeries

8.4.5.6 Beverages Companies

8.4.6 Historic and Forecasted Market Size by Technology

8.4.6.1 Cloud

8.4.6.2 On-Premises

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Food Safety Monitoring System Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Software

8.5.4.2 Hardware

8.5.5 Historic and Forecasted Market Size by End-user

8.5.5.1 Food Processing Companies

8.5.5.2 Food Retailers

8.5.5.3 Food Manufacturers

8.5.5.4 Restaurants

8.5.5.5 Bakeries

8.5.5.6 Beverages Companies

8.5.6 Historic and Forecasted Market Size by Technology

8.5.6.1 Cloud

8.5.6.2 On-Premises

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Food Safety Monitoring System Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Software

8.6.4.2 Hardware

8.6.5 Historic and Forecasted Market Size by End-user

8.6.5.1 Food Processing Companies

8.6.5.2 Food Retailers

8.6.5.3 Food Manufacturers

8.6.5.4 Restaurants

8.6.5.5 Bakeries

8.6.5.6 Beverages Companies

8.6.6 Historic and Forecasted Market Size by Technology

8.6.6.1 Cloud

8.6.6.2 On-Premises

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Food Safety Monitoring System Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Software

8.7.4.2 Hardware

8.7.5 Historic and Forecasted Market Size by End-user

8.7.5.1 Food Processing Companies

8.7.5.2 Food Retailers

8.7.5.3 Food Manufacturers

8.7.5.4 Restaurants

8.7.5.5 Bakeries

8.7.5.6 Beverages Companies

8.7.6 Historic and Forecasted Market Size by Technology

8.7.6.1 Cloud

8.7.6.2 On-Premises

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Food Safety Monitoring System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

42.58 Million |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

71.54 Million |

|

Segments Covered: |

By Type |

|

|

|

By End-user |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||