Food Amino Acid Market Synopsis

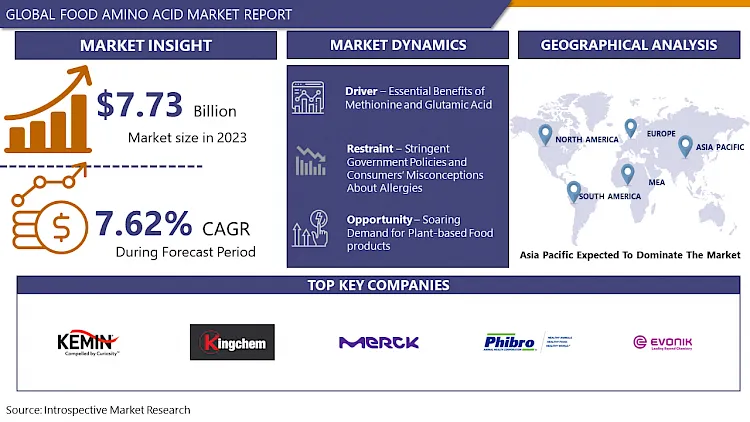

The Food Amino Acid market estimated at USD 8.32 Billion in the year 2024, is projected to reach a revised size of USD 14.96 Billion by 2032, growing at a CAGR of 7.62% over the analysis period 2025-2032.

Food Amino Acids are molecules combined and used by all living things to form proteins. Essential amino acids include isoleucine, histidine, leucine, methionine, lysine, phenylalanine, threonine, valine, and tryptophan. Major foods that contain amino acids are meat, poultry, soy, black beans, cheese, mushroom, peanuts, dairy, beans, legumes, fish, chicken, quinoa, grains, and nuts.

The Food Amino Acid Market has witnessed significant growth in recent years, driven by increasing consumer awareness about the health benefits of amino acids and their essential role in the human diet. Amino acids are the building blocks of proteins and play a crucial role in various physiological functions.

The market is propelled by the rising demand for protein-rich food products, especially in the context of the growing fitness and health-conscious consumer base. Amino acids are not only essential for muscle development but also contribute to overall well-being, making them a key ingredient in sports nutrition and dietary supplements.

Additionally, the food industry's focus on product innovation and the development of functional foods has further boosted the demand for amino acids. The market is characterized by a diverse range of amino acid products, including glutamic acid, lysine, methionine, and others, catering to different nutritional needs.

Food Amino Acid Market Trend Analysis

Food Amino Acid Market Growth Drivers- Essential Benefits of Methionine and Glutamic Acid

- Methionine and glutamic acid play pivotal roles in the Food Amino Acid Market, driving its growth due to their essential benefits. Methionine, an indispensable amino acid, is crucial for protein synthesis, aiding in muscle development and supporting overall growth. It serves as a building block for various proteins and enzymes, contributing to the nutritional value of food products. Additionally, methionine is vital for the synthesis of other amino acids, making it an essential component for maintaining a balanced amino acid profile.

- Glutamic acid, another key amino acid, enhances the flavor of food as it is a major component of umami, the fifth basic taste. This amino acid is a natural flavor enhancer, commonly found in protein-rich foods, and is widely used in the food industry to improve taste and palatability. Beyond its role in flavor enhancement, glutamic acid also participates in various metabolic processes, supporting overall health.

- The demand for food products enriched with these essential amino acids has surged, driven by the growing awareness of their nutritional benefits. As a result, the Food Amino Acid Market is experiencing significant expansion, with manufacturers incorporating methionine and glutamic acid into a variety of food formulations to meet consumer preferences for healthier and more flavourful dietary options.

Food Amino Acid Market Opportunities- Soaring Demand for Plant-based Food products creates an Opportunity Line Here

- The surging demand for plant-based food products presents a lucrative opportunity for the Food Amino Acid Market. As consumers increasingly prioritize health, sustainability, and ethical considerations, there has been a remarkable shift towards plant-based diets. Amino acids, essential building blocks of proteins, play a crucial role in the nutritional profile of plant-based foods, enhancing their appeal.

- Plant-based food products require careful formulation to ensure they offer complete and balanced protein profiles, making amino acids a vital component in product development. Manufacturers can capitalize on this trend by incorporating amino acids into plant-based formulations, addressing nutritional gaps and enhancing the overall quality of these products. Additionally, amino acids contribute to flavor enhancement, providing a savory and satisfying taste that appeals to consumers transitioning from traditional meat-based diets.

- Furthermore, the Food Amino Acid Market can explore innovative solutions to enhance the nutritional content of plant-based foods, creating opportunities for fortified products that meet the diverse needs of health-conscious consumers. This growing market aligns with the global shift towards sustainable and plant-centric lifestyles, positioning the Food Amino Acid Market as a key player in the evolving landscape of modern dietary preferences.

Food Amino Acid Market Segment Analysis:

Food Amino Acid Market Segmented on the basis of type, application, and source.

By Type, Glutamic acid segment is expected to dominate the market during the forecast period

- Food Amino Acid Market, the Glutamic Acid segment is poised to assert its dominance. Glutamic acid, a non-essential amino acid, plays a crucial role in enhancing the taste and flavor of various food products, making it a key component in the food industry. As a type of amino acid, glutamic acid contributes to the umami taste, which is often described as a savory or meaty flavor, thereby elevating the overall palatability of food items.

- The growing consumer preference for flavorsome and savory food experiences is a major driver behind the prominence of the glutamic acid segment. Additionally, the food processing industry recognizes glutamic acid as a versatile ingredient with applications in a wide range of products, including snacks, soups, sauces, and seasonings. Its multifaceted uses and ability to enhance the sensory appeal of food make glutamic acid a go-to choose for food manufacturers seeking to meet consumer demand for rich and satisfying taste profiles.

- As global food preferences evolve and demand for enhanced sensory experiences continues to rise, the glutamic acid segment is expected to maintain its leading position in the Food Amino Acid Market, reflecting its significant contribution to the flavor enhancement of diverse food products.

By Source, Plant-based segment held the largest share in 2024

- The Food Amino Acid Market is poised for significant growth, with the plant-based segment expected to dominate, driven by evolving consumer preferences and a growing awareness of health and sustainability. As consumers increasingly seek plant-derived protein sources, the demand for plant-based amino acids has surged.

- Plant-based amino acids are derived from various plant proteins such as soy, peas, and wheat, offering a sustainable and ethical alternative to animal-based sources. This trend aligns with the rising popularity of vegetarian and vegan diets, as well as the broader shift towards sustainable and environmentally friendly food choices.

- Moreover, advancements in technology and processes for extracting amino acids from plant sources have enhanced the quality and availability of plant-based amino acids, further boosting their market share. The plant-based segment's dominance is also fueled by the rising concerns over animal welfare, environmental impact, and the desire for cleaner, more ethical food production practices.

Food Amino Acid Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to assert its dominance in the food amino acid market, exhibiting robust growth and emerging as a key player in the global landscape. Several factors contribute to this anticipated dominance, including the region's large and diverse population, rapid urbanization, and a burgeoning middle class with an increasing demand for processed and protein-rich foods.

- As consumer preferences shift towards healthier and more nutritious dietary choices, the demand for food amino acids, essential building blocks of proteins, is expected to surge. Additionally, the Asia Pacific region is home to several key economies with a thriving food and beverage industry, further fueling the market's growth. The rising awareness of the health benefits associated with amino acids, such as improved metabolism and muscle development, is propelling the market forward.

- Government initiatives supporting the food industry, coupled with advancements in food technology and production processes, contribute to the region's dominance. Major players in the food amino acid market are strategically focusing on expanding their presence in Asia Pacific to capitalize on the burgeoning market opportunities, further solidifying the region's anticipated leadership in this sector.

Food Amino Acid Market Top Key Players:

- Kemin Industries, Inc. (USA)

- Pacific Rainbow International Inc. (US)

- Kingchem LLC (US)

- Sigma-Aldrich, Co. LLC. (US)

- Prinova Group LLC. (US)

- Phibro Animal Health Corporation (USA)

- ANGUS Chemical Company (USA)

- Rochem International Inc. (New York)

- Evonik Industries AG (Germany)

- Taiyo International (Germany)

- Brenntag AG (Germany)

- Azelis S.A (Europe)

- Mycsa AG (Switzerland)

- Royal DSM N.V. (Netherlands)

- Sunthenine By Taiyo International Inc. (Japan)

- Donboo Amino Acid Co., Ltd. (Japan)

- Ajinomoto Co., Inc. (Japan)

- Kyowa Hakko Kirin Co., Ltd. (Japan)

- Daesang Corporation (Korea)

- Qingdao Samin Chemical Co., Ltd. (China)

- Hugestone Enterprise Co., Ltd. (China)

- Qingdao Samin Chemical Co., Ltd (China)

- Taiwan Amino Acids Co. Ltd. (China)

- Other Active Players

Key Industry Developments in the Food Amino Acid Market:

- In July 2023, South Korean food giant CJ CheilJedang acquired US-based vegan ingredient start-up Biotech Foods for an undisclosed amount. This move bolstered CJ CheilJedang's presence in the growing plant-based amino acid market, particularly pea protein.

- In May 2023, Kyowa Hakko Bio announced a breakthrough in fermentation technology for L-arginine, a conditionally essential amino acid with various health benefits. This innovation has the potential to make L-arginine production more efficient and cost-effective.

|

Global Food Amino Acid Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.32 Bn. |

|

Forecast Period 2023-30 CAGR: |

7.62% |

Market Size in 2032: |

USD 14.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Amino Acid Market by Type (2018-2032)

4.1 Food Amino Acid Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Glutamic Acid

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Lysine

4.5 Tryptophan

4.6 Methionine

Chapter 5: Food Amino Acid Market by Application (2018-2032)

5.1 Food Amino Acid Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dietary Supplements

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Infant Formula

5.5 Food Fortification

5.6 Convenience Foods

Chapter 6: Food Amino Acid Market by Source (2018-2032)

6.1 Food Amino Acid Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Plant-Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Animal-Based

6.5 Synthetic

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Food Amino Acid Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MONAGHAN MUSHROOMS (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 WALSH MUSHROOMS GROUP (IRELAND)

7.4 MYCELIA (BELGIUM)

7.5 SOUTH MILL MUSHROOMS SALES (US)

7.6 SMITHY MUSHROOMS LTD. (UK)

7.7 RHEINISCHE PILZ ZENTRALE GMBH (GERMANY)

7.8 ITALSPWAN (ITALY)

7.9 MUSHROOM SAS (ITALY)

7.10 HIRANO MUSHROOM LLC (KOSOVO)

7.11 FUJISHUKIN CO. LTD. (JAPAN)

7.12 LAMBERT SPAWN (US)

7.13 MYCOTERRA FARM (US)

7.14 COMMERCIAL MUSHROOM PRODUCERS (EUROPE)

7.15 SOCIETA AGRICOLA PORRETTA (ITALY)

7.16 BLUFF CITY FUNGI (US)

Chapter 8: Global Food Amino Acid Market By Region

8.1 Overview

8.2. North America Food Amino Acid Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Glutamic Acid

8.2.4.2 Lysine

8.2.4.3 Tryptophan

8.2.4.4 Methionine

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Dietary Supplements

8.2.5.2 Infant Formula

8.2.5.3 Food Fortification

8.2.5.4 Convenience Foods

8.2.6 Historic and Forecasted Market Size by Source

8.2.6.1 Plant-Based

8.2.6.2 Animal-Based

8.2.6.3 Synthetic

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Food Amino Acid Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Glutamic Acid

8.3.4.2 Lysine

8.3.4.3 Tryptophan

8.3.4.4 Methionine

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Dietary Supplements

8.3.5.2 Infant Formula

8.3.5.3 Food Fortification

8.3.5.4 Convenience Foods

8.3.6 Historic and Forecasted Market Size by Source

8.3.6.1 Plant-Based

8.3.6.2 Animal-Based

8.3.6.3 Synthetic

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Food Amino Acid Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Glutamic Acid

8.4.4.2 Lysine

8.4.4.3 Tryptophan

8.4.4.4 Methionine

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Dietary Supplements

8.4.5.2 Infant Formula

8.4.5.3 Food Fortification

8.4.5.4 Convenience Foods

8.4.6 Historic and Forecasted Market Size by Source

8.4.6.1 Plant-Based

8.4.6.2 Animal-Based

8.4.6.3 Synthetic

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Food Amino Acid Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Glutamic Acid

8.5.4.2 Lysine

8.5.4.3 Tryptophan

8.5.4.4 Methionine

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Dietary Supplements

8.5.5.2 Infant Formula

8.5.5.3 Food Fortification

8.5.5.4 Convenience Foods

8.5.6 Historic and Forecasted Market Size by Source

8.5.6.1 Plant-Based

8.5.6.2 Animal-Based

8.5.6.3 Synthetic

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Food Amino Acid Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Glutamic Acid

8.6.4.2 Lysine

8.6.4.3 Tryptophan

8.6.4.4 Methionine

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Dietary Supplements

8.6.5.2 Infant Formula

8.6.5.3 Food Fortification

8.6.5.4 Convenience Foods

8.6.6 Historic and Forecasted Market Size by Source

8.6.6.1 Plant-Based

8.6.6.2 Animal-Based

8.6.6.3 Synthetic

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Food Amino Acid Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Glutamic Acid

8.7.4.2 Lysine

8.7.4.3 Tryptophan

8.7.4.4 Methionine

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Dietary Supplements

8.7.5.2 Infant Formula

8.7.5.3 Food Fortification

8.7.5.4 Convenience Foods

8.7.6 Historic and Forecasted Market Size by Source

8.7.6.1 Plant-Based

8.7.6.2 Animal-Based

8.7.6.3 Synthetic

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Food Amino Acid Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.32 Bn. |

|

Forecast Period 2023-30 CAGR: |

7.62% |

Market Size in 2032: |

USD 14.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||