Food Allergy Market Synopsis

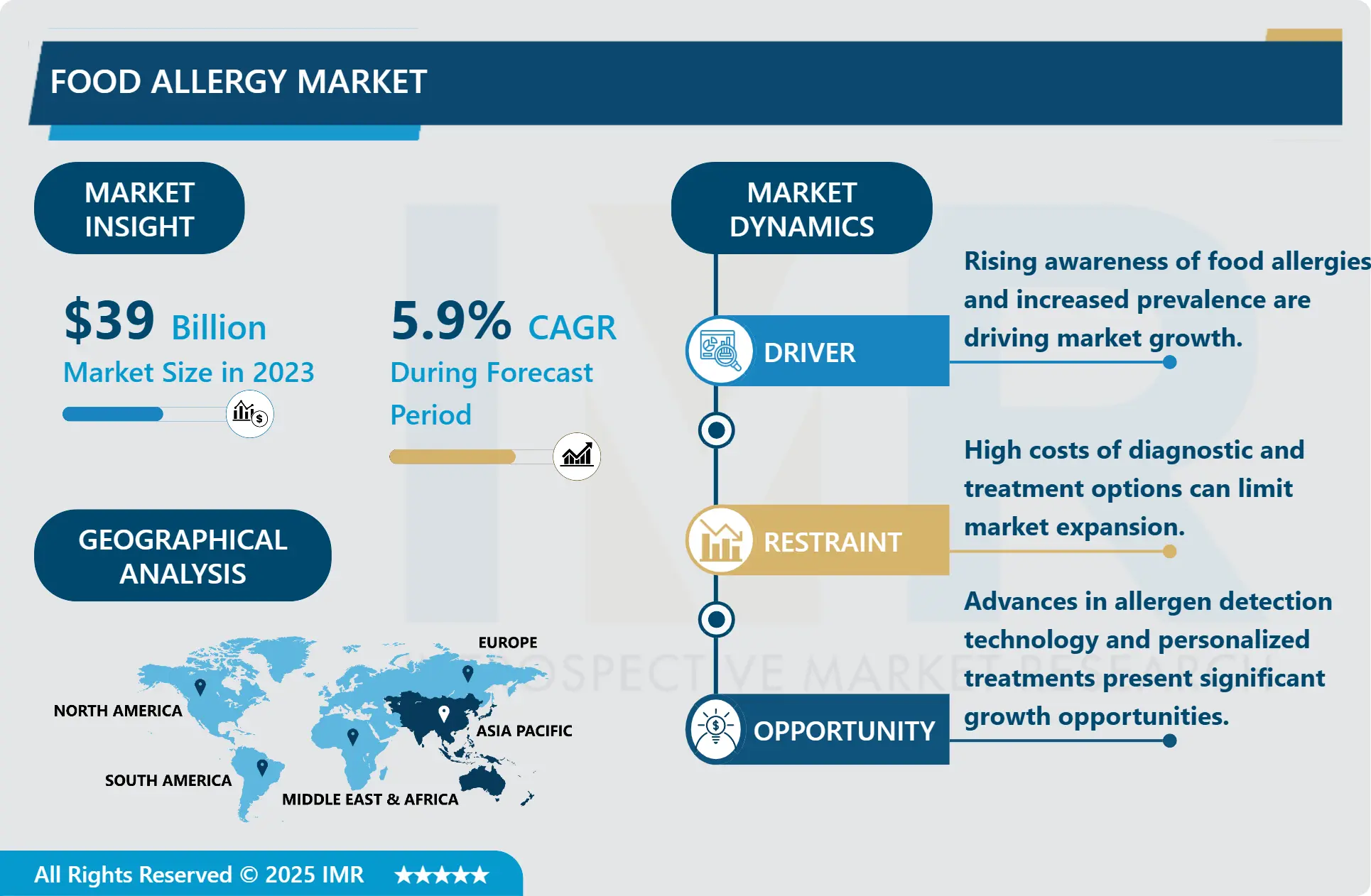

Food Allergy Market Size is Valued at USD 41.3 Billion in 2024, and is Projected to Reach USD 65.33 Billion by 2032, Growing at a CAGR of 5.9% From 2025-2032.

The food allergy market is rapidly growing due to increasing awareness and diagnosis of food allergies across all age groups. Factors such as the rising prevalence of allergic conditions, heightened awareness among consumers, and advances in diagnostic technologies are driving market expansion. The market includes a range of products, from allergen-free food alternatives to specialized testing and treatment solutions. Challenges include the need for stringent labelling regulations and managing cross-contamination risks. However, opportunities abound in developing innovative allergen-free products and personalized treatment approaches. As the global awareness of food allergies continues to rise, the market is poised for significant growth and innovation.

The food allergy market is experiencing growth as consumers and healthcare professionals become more cognizant of food allergies and sensitivities. This market encompasses allergen-free food products, medical remedies, and allergy tests, all of which are associated with the diagnosis, treatment, and management of food allergies.

Environmental changes and dietary habits are influencing the increasing prevalence of food allergies, driving the demand for innovative solutions tailored to the needs of those affected. Furthermore, regulatory advancements and increased research are facilitating the development of new and effective products to manage and prevent allergic reactions.

The market is witnessing a notable surge in the introduction of hypoallergenic and allergen-free food products, aimed at satisfying the growing consumer demand for safe and health-conscious options. Technological advancements in food processing and diagnostics are improving the capacity to detect and manage allergies.

However, obstacles like the complexity of regulatory requirements and the exorbitant cost of products can influence market growth. Despite these challenges, we anticipate the food allergy market to experience ongoing development and innovation due to the growing awareness of food allergies and the emphasis on personalized healthcare.

Food Allergy Market Trend Analysis- Increased Awareness and Diagnostic Advancements

- Increased awareness and advancements in diagnostic technologies are driving the food allergy market's significant growth. As the public becomes more aware of food allergies, there is a growing demand for specialized tests and remedies, as more people seek accurate diagnoses and effective management strategies.

- Innovative products specifically designed to accommodate individuals with food allergies are emerging as a result of this increased awareness, along with improved education on allergen avoidance. As a result, the market is expanding to encompass a broader selection of therapeutic solutions and diagnostic instruments.

- Advances in diagnostic technologies, such as allergen-specific immunoassays and molecular techniques, are revolutionizing the food allergy landscape. These advancements facilitate personalized treatment plans and improve patient outcomes by allowing for more precise and earlier detection of food allergies.

- We anticipate that the integration of these advanced diagnostic tools into routine clinical practice will further drive market growth, as healthcare providers and patients increasingly rely on these cutting-edge solutions to effectively manage food allergies.

Expansion of Allergen-Free and Specialized Products

- A growing awareness of food allergies and intolerances is driving a significant transition in the food allergy market toward allergen-free and specialized products. There is a growing demand among consumers for foods that are devoid of common allergens, including dairy, gluten, and nuts.

- This trend is motivating manufacturers to implement innovative strategies and create allergen-free alternatives that satisfy rigorous safety regulations while simultaneously offering nutritional benefits. As a result, the availability of specialized products, specifically designed to meet the needs of individuals with food allergies, has significantly increased, ensuring their access to safe and enjoyable dietary options.

- Growing regulatory support for allergen labeling and safety measures, along with advancements in food technology, are driving the sector's expansion. Companies are investing in research and development to improve production processes and create new formulations. Increased consumer awareness and advocacy, which drive demand for allergen-free foods and contribute to the overall growth of the food allergy market, further bolster the market's expansion.

Food Allergy Market Segment Analysis:

Food Allergy Market Segmented on the basis of By Diagnosis, By Symptoms, and By Food Source.

By Diagnosis, Elimination Diet segment is expected to dominate the market during the forecast period

- In the food allergy market, diagnostic methods are critical for the precise identification and management of allergic reactions. Elimination diets, which involve the removal of suspected allergens from the diet to identify triggers, continue to be a fundamental approach, particularly for the identification of food sensitivities.

- Skin-prick tests involve exposing the skin to potential allergens and observing reactions, whereas blood tests measure specific IgE antibodies to pinpoint allergens. The gold standard, oral food challenges, involves consuming the suspected allergen under medical supervision to confirm allergies. Newer, emerging technologies and patch testing are potential alternative diagnostic methods.

- The increasing prevalence of food allergies and the growing awareness of their management are stimulating the food allergy market. The market is expanding as a result of increased research into novel allergens and advancements in diagnostic technologies.

- Nevertheless, obstacles such as the necessity for personalized approaches and the variability in diagnostic accuracy may influence market growth. We anticipate that advancements in diagnostic methods and increased healthcare accessibility will improve market dynamics and patient outcomes.

By Symptoms, Atopic Dermatitis segment held the largest share in 2024

- The prevalence and severity of symptoms experienced by individuals influence key categories of the food allergy market, such as anaphylaxis, atopic dermatitis, and other allergic reactions. Atopic dermatitis, or chronic skin inflammation and irritation, is frequently associated with food allergies, particularly in children.

- Foods like crustaceans, nuts, or dairy frequently precipitate anaphylaxis, a severe, life-threatening reaction that necessitates immediate medical intervention. These symptoms have a significant impact on patient's quality of life and drive the demand for effective treatments and preventive measures.

- The market is experiencing growth as a result of a rise in allergy cases worldwide, enhanced diagnostic methods, and increased awareness. The management of these conditions is contingent upon the development of innovative diagnostic instruments and therapies.

- Additionally, consumers' increasing awareness of food allergies and the development of allergen-free food products position the market for expansion. This is due to healthcare providers and companies' efforts to cater to the diverse needs of individuals with food allergies.

Food Allergy Market Regional Insights:

Asia-Pacific to witness the highest growth during the assessment period

- During the assessment period, we anticipate the food allergy market to expand at the most rapid pace in the Asia-Pacific region. The increasing prevalence of allergic conditions, growing awareness of food allergies, and the enhancement of healthcare infrastructure in countries throughout the region fuel this expansion. Urbanization and dietary changes are also contributing to a heightened emphasis on food safety and allergy management, which is driving market expansion.

- In this ever-changing environment, we anticipate substantial progress in the food allergy market in the areas of diagnostic instruments, treatment options, and preventive measures. We anticipate innovations in allergen detection and personalized therapies to meet the increasing consumer demand for effective solutions.

- As the region continues to develop economically and healthcare systems advance, we expect the food allergy market to benefit from increased investment and research, leading to improved outcomes for individuals affected by food allergies.

Active Key Players in the Food Allergy Market

- Akorn, Incorporated (US)

- Pfizer Inc. (US)

- GlaxoSmithKline plc (UK)

- Novartis AG (Switzerland)

- Mylan N.V. (US)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Boehringer Ingelheim International GmbH. (Germany)

- AstraZeneca (UK)

- Johnson & Johnson Private Limited (US)

- Bayer AG (Germany)

- Merck & Co., Inc. (US)

- Prestige Consumer Healthcare Inc. (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Bristol-Myers Squibb Company (US)

- Almirall, S.A (Spain)

- Zenomed Healthcare Private Limited (India)

- Cadila Pharmaceuticals (India)

- Astellas Pharma Inc. (Japan)

- Eli Lilly and Company (US), Other Active Players

|

Global Food Allergy Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 41.3Bn. |

|

Forecast Period 2025-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 65.33 Bn. |

|

Segments Covered: |

By Diagnosis |

|

|

|

By Symptoms |

|

||

|

By Food Source |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Allergy Market by Diagnosis (2018-2032)

4.1 Food Allergy Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Elimination Diet

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Blood Test

4.5 Skin-Prick Tests

4.6 Oral Food Challenge

4.7 Others

Chapter 5: Food Allergy Market by Symptoms (2018-2032)

5.1 Food Allergy Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Atopic Dermatitis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Anaphylaxis

5.5 Others

Chapter 6: Food Allergy Market by Food Source (2018-2032)

6.1 Food Allergy Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Wheat

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Soy

6.5 Poultry Products

6.6 Dairy Products

6.7 Shellfish

6.8 Peanuts

6.9 Tree Nuts

6.10 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Food Allergy Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 KAWASAKI HEAVY INDUSTRIES LTD. (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIEMENS ENERGY (GERMANY)

7.4 CAPSTONE GREEN ENERGY CORPORATION (USA)

7.5 GENERAL ELECTRIC (USA)

7.6 ANSALDO ENERGIA (ITALY)

7.7 MITSUBISHI HEAVY INDUSTRIES (JAPAN)

7.8 NORDEX SE (GERMANY)

7.9 SUZLON ENERGY LIMITED (INDIA)

7.10 VESTAS WIND SYSTEMS AS (DENMARK)

7.11 LITOSTROJ POWER GROUP (SLOVENIA)

7.12 ANDRITZ AG (AUSTRIA)

7.13 BHARAT HEAVY ELECTRICALS LTD. (INDIA)

7.14 ROLLS-ROYCE PLC (UK)

7.15 ABB (SWITZERLAND)

7.16 SINOVEL WIND GROUP CO. (CHINA)

7.17 OTHERS

Chapter 8: Global Food Allergy Market By Region

8.1 Overview

8.2. North America Food Allergy Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Diagnosis

8.2.4.1 Elimination Diet

8.2.4.2 Blood Test

8.2.4.3 Skin-Prick Tests

8.2.4.4 Oral Food Challenge

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Symptoms

8.2.5.1 Atopic Dermatitis

8.2.5.2 Anaphylaxis

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size by Food Source

8.2.6.1 Wheat

8.2.6.2 Soy

8.2.6.3 Poultry Products

8.2.6.4 Dairy Products

8.2.6.5 Shellfish

8.2.6.6 Peanuts

8.2.6.7 Tree Nuts

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Food Allergy Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Diagnosis

8.3.4.1 Elimination Diet

8.3.4.2 Blood Test

8.3.4.3 Skin-Prick Tests

8.3.4.4 Oral Food Challenge

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Symptoms

8.3.5.1 Atopic Dermatitis

8.3.5.2 Anaphylaxis

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size by Food Source

8.3.6.1 Wheat

8.3.6.2 Soy

8.3.6.3 Poultry Products

8.3.6.4 Dairy Products

8.3.6.5 Shellfish

8.3.6.6 Peanuts

8.3.6.7 Tree Nuts

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Food Allergy Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Diagnosis

8.4.4.1 Elimination Diet

8.4.4.2 Blood Test

8.4.4.3 Skin-Prick Tests

8.4.4.4 Oral Food Challenge

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Symptoms

8.4.5.1 Atopic Dermatitis

8.4.5.2 Anaphylaxis

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size by Food Source

8.4.6.1 Wheat

8.4.6.2 Soy

8.4.6.3 Poultry Products

8.4.6.4 Dairy Products

8.4.6.5 Shellfish

8.4.6.6 Peanuts

8.4.6.7 Tree Nuts

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Food Allergy Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Diagnosis

8.5.4.1 Elimination Diet

8.5.4.2 Blood Test

8.5.4.3 Skin-Prick Tests

8.5.4.4 Oral Food Challenge

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Symptoms

8.5.5.1 Atopic Dermatitis

8.5.5.2 Anaphylaxis

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size by Food Source

8.5.6.1 Wheat

8.5.6.2 Soy

8.5.6.3 Poultry Products

8.5.6.4 Dairy Products

8.5.6.5 Shellfish

8.5.6.6 Peanuts

8.5.6.7 Tree Nuts

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Food Allergy Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Diagnosis

8.6.4.1 Elimination Diet

8.6.4.2 Blood Test

8.6.4.3 Skin-Prick Tests

8.6.4.4 Oral Food Challenge

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Symptoms

8.6.5.1 Atopic Dermatitis

8.6.5.2 Anaphylaxis

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size by Food Source

8.6.6.1 Wheat

8.6.6.2 Soy

8.6.6.3 Poultry Products

8.6.6.4 Dairy Products

8.6.6.5 Shellfish

8.6.6.6 Peanuts

8.6.6.7 Tree Nuts

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Food Allergy Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Diagnosis

8.7.4.1 Elimination Diet

8.7.4.2 Blood Test

8.7.4.3 Skin-Prick Tests

8.7.4.4 Oral Food Challenge

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Symptoms

8.7.5.1 Atopic Dermatitis

8.7.5.2 Anaphylaxis

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size by Food Source

8.7.6.1 Wheat

8.7.6.2 Soy

8.7.6.3 Poultry Products

8.7.6.4 Dairy Products

8.7.6.5 Shellfish

8.7.6.6 Peanuts

8.7.6.7 Tree Nuts

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Food Allergy Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 41.3Bn. |

|

Forecast Period 2025-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 65.33 Bn. |

|

Segments Covered: |

By Diagnosis |

|

|

|

By Symptoms |

|

||

|

By Food Source |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||