Fluoropolymer Market Synopsis:

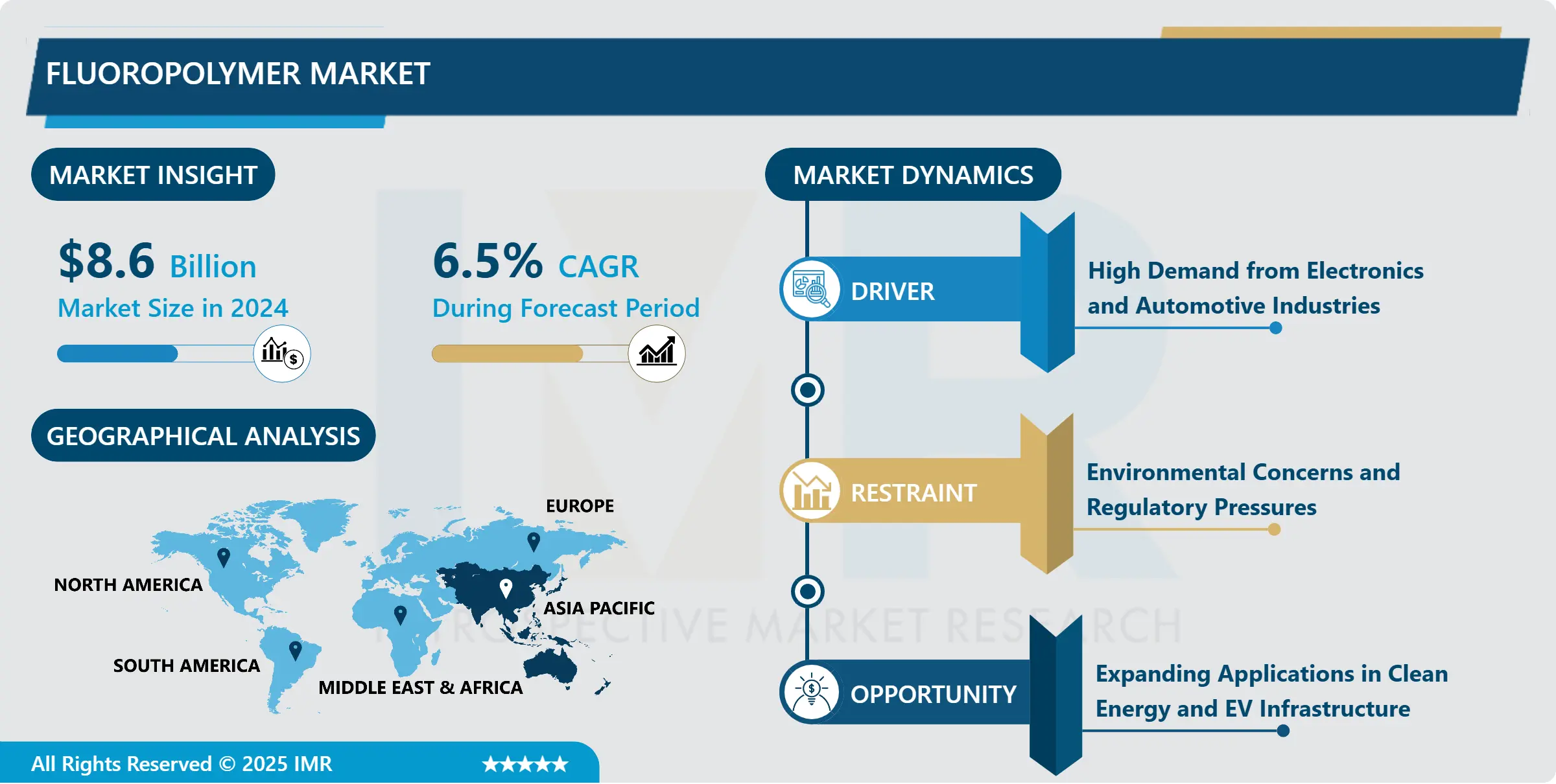

Global Fluoropolymer Market Size Was Valued at USD 8.6 Billion in 2024, and is Projected to Reach USD 17.19 Billion by 2035, Growing at a CAGR of 6.5% From 2025–2035.

Fluoropolymers are synthetic materials known for their high resistance to heat, chemicals, and electrical conductivity, making them ideal for use in harsh environments. Common types include polytetrafluoroethylene (PTFE), fluorinated ethylene propylene (FEP), and polyvinylidene fluoride (PVDF). These materials are widely used in wire insulation, semiconductors, coatings, and non-stick cookware.

The growth of the semiconductor and 5G communication sectors has further expanded the demand for high-performance materials like fluoropolymers. Their use in electric vehicles, solar panels, and hydrogen fuel cells also contributes to market growth. Governments promoting clean energy and low-emission technologies are supporting industries that rely on fluoropolymers.

The product’s durability, efficiency, and versatility make it suitable for advanced applications, leading to increased investments in production capacity and R&D across Asia, North America, and Europe.

Fluoropolymer Market Growth and Trend Analysis:

Driver

High Demand from Electronics and Automotive Industries

- Fluoropolymers are extensively used in electronics and automotive applications due to their exceptional insulation properties, chemical stability, and heat resistance. In electronics, they are used in cable insulation, printed circuit boards, and connectors, especially in high-voltage and high-frequency devices. With the rise of electric vehicles, autonomous driving systems, and smart infrastructure, the demand for durable materials that withstand extreme conditions is growing.

- In the automotive sector, fluoropolymers are used in fuel systems, gaskets, and under-hood components to improve fuel efficiency and reduce emissions. As more countries move toward electric mobility and smart electronics, fluoropolymers are playing a key role in ensuring component reliability and performance, thus accelerating market growth.

Restraint

Environmental Concerns and Regulatory Pressures

- Despite their industrial advantages, fluoropolymers face criticism over their environmental impact, particularly regarding production emissions and disposal challenges. Some fluorinated compounds are considered persistent pollutants and may accumulate in the environment. Regulatory agencies in Europe and North America are tightening rules related to per- and polyfluoroalkyl substances (PFAS), which are sometimes present in fluoropolymer production.

- Compliance with new environmental standards requires costly upgrades in manufacturing and waste treatment processes. The challenges increase the operational cost for manufacturers and limit their ability to expand freely in environmentally sensitive regions. Growing consumer preference for eco-friendly materials also presents a restraint for traditional fluoropolymer applications.

Opportunity

Expanding Applications in Clean Energy and EV Infrastructure

- A major opportunity for the fluoropolymer market lies in its increasing use in clean energy technologies and electric vehicle (EV) infrastructure. Fluoropolymers possess high thermal, chemical, and weather resistance, making them ideal for solar panels, battery packs, fuel cells, and hydrogen pipelines. As governments worldwide push for cleaner energy alternatives and green mobility, the need for high-performance, durable materials is rising. In solar applications, fluoropolymer coatings protect surfaces from UV radiation and environmental corrosion, thus increasing product life.

- In EVs, they are used for wiring insulation, cooling systems, and under-the-hood parts that face high stress. Moreover, hydrogen fuel cells—an emerging clean energy source require fluoropolymer membranes for efficient gas separation and durability. With many countries offering tax benefits for sustainable tech adoption, OEMs are turning to advanced fluoropolymers to meet quality and compliance standards. This opens up new long-term contracts in renewable energy and automotive sectors. Companies that invest in R&D for cost-effective, environmentally safe fluoropolymer variants can capture a large share of this evolving and future-ready market.

Challenge

Environmental Regulations and Disposal Restrictions

- Despite their utility, fluoropolymers face growing scrutiny from environmental authorities due to concerns over waste disposal and the potential toxicity of certain compounds used in their production. Specifically, the manufacturing of some fluoropolymers involves per- and polyfluoroalkyl substances (PFAS), which are now under regulatory restriction in many countries. These substances are non-biodegradable and accumulate in the environment, leading to potential health risks. Disposal of end-use fluoropolymer products is also problematic, as they do not decompose easily and require specialized waste treatment methods. This makes recycling and waste management costly.

- In Europe and the U.S.A, new policies are being drafted to restrict the use of PFAS-containing materials, which may force manufacturers to reformulate or discontinue specific product lines. Compliance with these environmental guidelines increases production costs and creates uncertainty in long-term planning. As environmental standards tighten globally, companies that fail to transition to greener alternatives may face product bans, fines, or reputational loss posing a significant challenge for sustained growth.

Fluoropolymer Market Segment Analysis:

Fluoropolymer Market is segmented based on Type, Application, End-Users, and Region

By Type – PTFE (Polytetrafluoroethylene) Segment is expected to dominate the market during the forecast period

- PTFE is widely used because it is extremely resistant to heat and chemicals. It does not stick to other materials, which is why it’s used in non-stick cookware and industrial gaskets. In electronics and automotive,

- PTFE is used in wire insulation and fuel system parts because it can handle high temperatures and tough environments. Its long life and reliability make it popular in many industries like chemicals, electronics, and automotive.

By Application, Wire & Cable Insulation Segment is Expected to Dominate the Market During the Forecast Period

- Wire and cable insulation is one of the most widely used applications of fluoropolymers due to their high thermal resistance, excellent electrical insulation, and chemical durability. The global growth in 5G networks, electric vehicles (EVs), and renewable energy systems has increased the demand for safe and reliable power and data transmission, where fluoropolymer-insulated cables play a crucial role.

- PTFE, FEP, and PVDF are commonly used materials in high-performance cable insulation, especially in aerospace, automotive, and industrial control systems. As power grids modernize and electronic systems become more advanced, the need for cables that can perform under high heat, voltage, and mechanical stress is rising. Manufacturers are expanding this segment with lightweight, flexible, and flame-retardant insulation solutions that comply with strict safety and environmental standards.

Fluoropolymer Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific holds the largest share in the fluoropolymer market due to its robust manufacturing base, particularly in China, Japan, South Korea, and India. The region is a global hub for electronics, automotive, and industrial processing, all of which are major consumers of fluoropolymers. With rising investments in 5G infrastructure, EV production, and solar energy, the need for high-performance materials like PTFE and PVDF is rapidly increasing.

- Leading companies such as Daikin, AGC Inc., and Dengue Group are based in this region and are expanding capacity to meet global and local demand. Government support for clean energy projects and industrial automation further fuels the adoption of fluoropolymers across key applications. Rapid urbanization and population growth also push demand for safe and efficient electrical and construction systems, where fluoropolymers are essential.

Fluoropolymer Market Active Players:

- 3M Company (USA)

- AGC Inc. (Asahi Glass Co.) (Japan)

- Arkema S.A. (France)

- BASF SE (Germany)

- Celanese Corporation (USA)

- Chemours Company (USA)

- Daikin Industries Ltd (Japan)

- Dongyue Group Co. Ltd (China)

- Dupont de Nemours Inc (USA)

- Gujarat Fluorochemicals Ltd (India)

- Halopolymer OJSC (Russia)

- Honeywell International Inc (USA)

- Kureha Corporation (Japan)

- Merck KGaA (Germany)

- Mitsubishi Chemical Corp (Japan)

- Saint-Gobain S.A. (France)

- Shin-Etsu Chemical Co., Ltd (Japan)

- Solvay S.A. (Belgium)

- SRF Limited (India)

- Zhejiang Juhua Co Ltd (China)

- Others Active Players

Key Industry Developments in the Fluoropolymer Market:

In April 2025, Chemours is actively involved in discussions regarding the classification and regulation of PFAS (per- and polyfluoroalkyl substances). The company emphasizes the distinction between fluoropolymers and other PFAS, advocating for science-based regulatory approaches.

In November 2023, Solvay announced plans to construct a new battery-grade polyvinylidene fluoride (PVDF) facility in Augusta, Georgia, USA. This initiative aims to support the growing electric vehicle (EV) battery market in North America.

In April 2023, AGC Inc. expanded its fluoropolymer production capacity at its Ichihara plant in Japan, investing approximately EUR 240 million. The new facilities are expected to be operational by mid-2025, enhancing the company’s ability to meet global demand.

|

Fluoropolymer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018-2023 |

Market Size in 2024: |

USD 8.6 Billion |

|

Forecast Period 2025-35 CAGR: |

6.5% |

Market Size in 2035: |

USD 17.19 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Fluoropolymer Market by Product (2018-2035)

4.1 Fluoropolymer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed Price

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cost Plus

4.5 Self-Operated

4.6 Outsourced

4.7 Others

Chapter 5: Fluoropolymer Market by Application (2018-2035)

5.1 Fluoropolymer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Meal Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Canteen Management

5.5 Event Based

5.6 Disaster Relief

Chapter 6: Fluoropolymer Market by Distribution Channel (2018-2035)

6.1 Fluoropolymer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Event Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Direct

6.5 Indirect

Chapter 7: Fluoropolymer Market by End User (2018-2035)

7.1 Fluoropolymer Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Educational Institution

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare Facilities

7.5 Corporate Office

7.6 Transportation Hub

7.7 OthersS

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Fluoropolymer Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 3M COMPANY (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 AGC INC. (ASAHI GLASS CO.) (JAPAN)

8.4 ARKEMA S.A. (FRANCE)

8.5 BASF SE (GERMANY)

8.6 CELANESE CORPORATION (USA)

8.7 CHEMOURS COMPANY (USA)

8.8 DAIKIN INDUSTRIES LTD (JAPAN)

8.9 DONGYUE GROUP CO. LTD (CHINA)

8.10 DUPONT DE NEMOURS INC (USA)

8.11 GUJARAT FLUOROCHEMICALS LTD (INDIA)

8.12 HALOPOLYMER OJSC (RUSSIA)

8.13 HONEYWELL INTERNATIONAL INC (USA)

8.14 KUREHA CORPORATION (JAPAN)

8.15 MERCK KGAA (GERMANY)

8.16 MITSUBISHI CHEMICAL CORP (JAPAN)

8.17 SAINT-GOBAIN S.A. (FRANCE)

8.18 SHIN-ETSU CHEMICAL CO.

8.19 LTD (JAPAN)

8.20 SOLVAY S.A. (BELGIUM)

8.21 SRF LIMITED (INDIA)

8.22 ZHEJIANG JUHUA CO LTD (CHINA)

8.23 OTHERS ACTIVE PLAYERS.

Chapter 9: Global Fluoropolymer Market By Region

9.1 Overview

9.2. North America Fluoropolymer Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Fluoropolymer Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Fluoropolymer Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Fluoropolymer Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Fluoropolymer Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Fluoropolymer Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Fluoropolymer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018-2023 |

Market Size in 2024: |

USD 8.6 Billion |

|

Forecast Period 2025-35 CAGR: |

6.5% |

Market Size in 2035: |

USD 17.19 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||