Flow Cytometry Market Synopsis

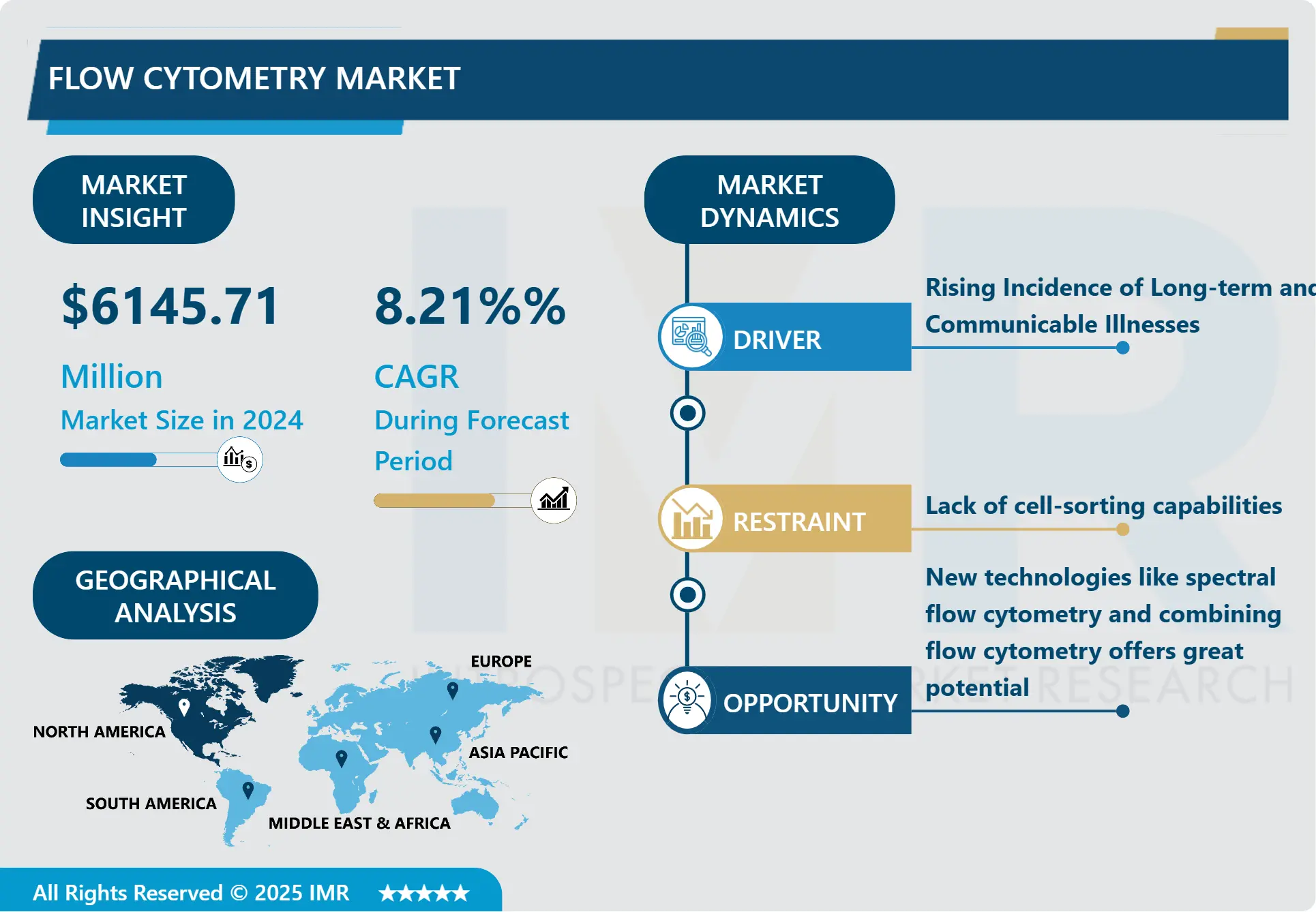

Flow Cytometry Market Size Was Valued at USD 6145.71 Million in 2024, and is Projected to Reach USD 11553.44 Million by 2032, Growing at a CAGR of 8.21% From 2025-2032.

Flow cytometry is a laser-based technology generating a scattered and a fluorescent light signal that enables rapid analysis of the size and granularity of a particle or single cell. In addition, it offers the opportunity to phenotypically characterize and collect the cell with the use of a variety of fluorescent reagents. These reagents include but are not limited to fluorochrome-conjugated antibodies, fluorescent expressing protein-viability, and DNA-binding dyes.

The advancement of technology in flow cytometry has resulted in the creation of multicolour flow cytometry, imaging flow cytometry, and high-throughput systems. These developments enable more in-depth examination of various factors on single cells, observation of cells, and quick analysis of substantial sample sizes, enhancing effectiveness in research and diagnostics. So, technical advances in the development of flow cytometers have allowed the establishment of a wide spectrum of clinical applications.

Flow cytometry plays a crucial role in cancer, immunology, and stem cell studies. Assisting in examining tumour cells, comprehending immune reactions, and pinpointing stem cells is beneficial for creating focused therapies, immunotherapies, and possible treatments. Major developments in reagents, electronics, and software within the last 30 years have greatly expanded the ability to combine up to 50 antibodies in one single tube. However, these advances also harbor technical risks and interpretation issues in the identification of certain cell populations.

Flow cytometry is essential for diagnosing diseases, such as blood disorders and infections, because of its quick and accurate outcomes. The rise in personalized medicine and the need for customized treatments is driving an increase in the demand for flow cytometry for detailed cellular analysis. Education and training programs are on the rise to create qualified professionals who can effectively use these tools.

Flow Cytometry Market Trend Analysis

Flow Cytometry Market Growth Driver- Increasing Occurrence of Chronic Diseases

- Flow cytometry is an authoritative analytical tool used to analyse and quantify single cells or particles in a heterogeneous mixture. It uses lasers and optics to detect and measure cells or particles such as size, shape and fluorescence intensity. This technique involves labelling cells or particles with fluorescent dyes or antibodies that bind to specific cell surface markers or intracellular molecules. The labelled cells or particles are then passed through a flow cytometer, which detects and measures the fluorescence emitted by each cell or particle.

- Flow cytometry is widely used in many research fields, including immunology, microbiology, stem cell research, cancer research, drug discovery and development, and clinical diagnostics. The technique is constantly evolving with new applications and hardware and software improvements, making it an important tool in the study of biological systems. Understanding the cellular mechanisms of chronic diseases such as cancer, autoimmune disorders, and infectious diseases relies on the importance of flow cytometry.

- Flow cytometry is helpful in identifying and confirming biomarkers associated with diseases. These biomarkers aid in diagnosing, categorizing patients, and tracking the efficacy of treatments for personalized medicine approaches in managing intricate chronic illnesses. Assisting researchers and clinicians in examining immune cells, cancer cells, and patient samples aids in understanding disease progression and treatment response.

Flow Cytometry Market Opportunity- Integration of AI and Machine Learning with Flow Cytometry

- Flow cytometry produces intricate multidimensional data for every individual cell. Conventional analysis takes a lot of time and is based on personal judgement, necessitating manual understanding. AI and ML algorithms have the ability to automate and make more efficient the procedure for quicker, unbiased evaluation. AI algorithms excel at detecting patterns and relationships within vast amounts of data.

- In flow cytometry, artificial intelligence can distinguish differences among cell groups, infrequent occurrences, and markers of diseases, assisting scientists in comprehending cellular activities and illnesses. ML techniques are able to create predictive models by utilizing flow cytometry data to forecast disease progression, treatment response, and patient outcomes. Examining patient information can detect predictive biomarkers and steer personalized medicine strategies.

- AI can assist with flow cytometry data quality control by detecting anomalies, recognizing instrument abnormalities, and maintaining uniformity to enhance result reproducibility. Advancements in flow cytometry techniques enable the measurement of multiple parameters simultaneously (high-dimensional cytometry). AI algorithms are capable of efficiently analysing and interpreting intricate data, assisting researchers in discovering fresh biological discoveries and recognizing previously overlooked cell groups.

Flow Cytometry Market Segment Analysis:

Flow Cytometry Market is Segmented on the basis of Product Type, Technology, Applications, End-User, And Region.

By Technology, Cell-based flow cytometry Segment Is Expected to Dominate the Market During the Forecast Period

- Cell-based flow cytometry is crucial in clinical diagnostics for cancer diagnosis, treatment monitoring, and detecting minimal residual disease. It is also important for diagnosing and monitoring hematological disorders like leukaemia and lymphoma by analysing blood cell populations in detail. Immune profiling plays a critical role in comprehending immune reactions and identifying disorders. In transplantation, it tracks immune status and identifies rejection episodes by examining immune cell populations.

- Flow cytometry is crucial in cell biology for examining cell cycle, apoptosis, and interactions, whereas stem cell research detects stem cells and tracks differentiation for potential therapy. The progress in multicolor flow cytometry technology enables in-depth analysis of intricate cell populations using numerous parameters. Improved fluorescence detection, automated systems, and increased throughput enhance efficiency and reproducibility. Data analysis software makes it easier to understand complex data for valuable insights.

- Approval from the FDA has increased the use of cell-based flow cytometry in clinical diagnostic settings. Efforts to standardize enhance reliability and reproducibility, increasing appeal to clinical laboratories. The rising investment from both the government and private sector in cancer and immunology research is boosting the need for cell-based flow cytometry. Partnerships among academia, research institutions, and companies stimulate innovation and broaden its application.

By End-User, Hospitals and Clinics Segment Held the Largest Share in 2024

- Flow cytometry is crucial for medical diagnostics in healthcare facilities, employed for the diagnosis of cancer, monitoring of hematological disorders, detection of immunodeficiency diseases, testing for infectious diseases, and organ transplants. It is included in standard testing procedures for prompt and precise disease detection. Flow cytometry helps doctors customize treatment plans for cancer patients. It enables observation of the advancement of the disease in individuals receiving chemotherapy or immunosuppressive treatment.

- Healthcare providers have the ability to monitor alterations in markers of disease and modify treatment accordingly. Hospitals and clinics located close to patients offer easy access to flow cytometry services for diagnosis and treatment advice. Having all healthcare services available in one place makes flow cytometry testing easier to access for patients requiring comprehensive diagnostic assessments. Getting accreditation from regulatory bodies and professional organizations is important for ensuring that diagnostic testing standards are met.

- Flow cytometry findings are seamlessly incorporated into digital medical documents for healthcare facilities, simplifying diagnostic processes and ensuring convenient retrieval of patient information. Findings are communicated among various experts to enhance teamwork in patient care and holistic health management in healthcare settings. Hospitals and clinics adhere to stringent regulatory standards and quality assurance protocols for flow cytometry testing in order to guarantee precise and dependable outcomes.

Flow Cytometry Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, which includes the US and Canada, boasts a sophisticated healthcare system with top-notch facilities and reputable clinical labs. These facilities have cutting-edge technologies that help with the use of flow cytometry for diagnostics, research, and treatment monitoring. North American companies and research institutions are at the forefront of flow cytometry innovation, making advancements in laser technology, dyes, and software to enhance system capabilities and accuracy.

- The United States leads in worldwide research and development (R&D) investment, with significant funding from entities such as NIH and private organizations. Research efforts, which involve cutting-edge projects in cancer studies, immune system research, and stem cell studies, employ flow cytometry to analyse cell groups and comprehend disease processes. Strong healthcare and biopharmaceutical sectors are fuelling the need for high-tech flow cytometry platforms and services in the area.

- North America's regulations encourage the advancement of flow cytometry products. Organizations such as the FDA provide easily understandable rules for approval, simplifying market entry for makers of diagnostic tests and medical devices. Prominent companies in the field of flow cytometry, including those that make instruments, supply reagents, and offer services, are located or have a significant presence in North America, leading to extensive use of the technology in the region.

Flow Cytometry Market Active Players

- Becton, Dickinson and Company (BD) (USA)

- Beckman Coulter, Inc. (USA)

- Thermo Fisher Scientific, Inc. (USA)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (USA)

- Agilent Technologies, Inc. (USA)

- Sysmex Corporation (Japan)

- Luminex Corporation (USA)

- Miltenyi Biotec GmbH (Germany)

- Sony Biotechnology Inc. (USA)

- Stratedigm, Inc. (USA)

- Cytek Biosciences (USA)

- Apogee Flow Systems Ltd. (UK)

- BioLegend, Inc. (USA)

- ACEA Biosciences, Inc. (USA)

- Cytonome/ST LLC (USA)

- Union Biometrica, Inc. (USA)

- Fluidigm Corporation (USA)

- Nexcelom Bioscience LLC (USA)

- Biospherix, Ltd. (USA)

- NanoCellect Biomedical, Inc. (USA)

- On-chip Biotechnologies Co., Ltd. (Japan)

- Enzo Life Sciences, Inc. (USA)

- Takara Bio Inc. (Japan)

- Sartorius AG (Germany)

- Mindray Medical International Limited (China)

- Other Active Player

Key Industry Developments in the Flow Cytometry Market:

- In Jan 2024, Thermo Fisher Scientific and the Centre for Cellular and Molecular Platforms (C-CAMP) announced a collaborative initiative to establish a Centre of Excellence in Bengaluru. This state-of-the-art facility will serve as a hub for fostering innovation, accelerating breakthroughs in the biotechnology sector and enabling researchers to enhance their expertise and achieve their entrepreneurial ambitions. As a part of this strategic partnership, C-CAMP will provide the necessary infrastructure on their premises to set up the Centre of Excellence.

- In Feb 2024, Biotium Expands Selection of Novel Nuclear Stains for Enhanced Multiplexing Flexibility for Microscopy and Flow Cytometry Ap

|

Global Flow Cytometry Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 6145.71 Million |

|

Forecast Period 2025-32 CAGR: |

8.21 % |

Market Size in 2032: |

USD 11553.44 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Applications |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Becton, Dickinson and Company (BD) (USA), Beckman Coulter, Inc. (USA), Thermo Fisher Scientific, Inc. (USA), Merck KGaA (Germany), Bio-Rad Laboratories, Inc. (USA), and Other Active Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Flow Cytometry Market by Product Type (2018-2032)

4.1 Flow Cytometry Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Instrument

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Kit and Reagent

4.5 Software

4.6 Services

4.7 Accessories

Chapter 5: Flow Cytometry Market by Technology (2018-2032)

5.1 Flow Cytometry Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cell-based Flow Cytometry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Bead-based Flow Cytometry

Chapter 6: Flow Cytometry Market by Applications (2018-2032)

6.1 Flow Cytometry Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Research Applications

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinical Applications

6.5 Industrial Applications

Chapter 7: Flow Cytometry Market by End-User (2018-2032)

7.1 Flow Cytometry Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals and Clinics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Academia and Research Institutes

7.5 Pharmaceutical and Biotechnology Companies

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Flow Cytometry Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BECTON

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DICKINSON AND COMPANY (BD) (USA)

8.4 BECKMAN COULTER INC. (USA)

8.5 THERMO FISHER SCIENTIFIC INC. (USA)

8.6 MERCK KGAA (GERMANY)

8.7 BIO-RAD LABORATORIES INC. (USA)

8.8 AGILENT TECHNOLOGIES INC. (USA)

8.9 SYSMEX CORPORATION (JAPAN)

8.10 LUMINEX CORPORATION (USA)

8.11 MILTENYI BIOTEC GMBH (GERMANY)

8.12 SONY BIOTECHNOLOGY INC. (USA)

8.13 STRATEDIGM INC. (USA)

8.14 CYTEK BIOSCIENCES (USA)

8.15 APOGEE FLOW SYSTEMS LTD. (UK)

8.16 BIOLEGEND INC. (USA)

8.17 ACEA BIOSCIENCES INC. (USA)

8.18 CYTONOME/ST LLC (USA)

8.19 UNION BIOMETRICA INC. (USA)

8.20 FLUIDIGM CORPORATION (USA)

8.21 NEXCELOM BIOSCIENCE LLC (USA)

8.22 BIOSPHERIX LTD. (USA)

8.23 NANOCELLECT BIOMEDICAL INC. (USA)

8.24 ON-CHIP BIOTECHNOLOGIES COLTD. (JAPAN)

8.25 ENZO LIFE SCIENCES INC. (USA)

8.26 TAKARA BIO INC. (JAPAN)

8.27 SARTORIUS AG (GERMANY)

8.28 MINDRAY MEDICAL INTERNATIONAL LIMITED (CHINA)

Chapter 9: Global Flow Cytometry Market By Region

9.1 Overview

9.2. North America Flow Cytometry Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Instrument

9.2.4.2 Kit and Reagent

9.2.4.3 Software

9.2.4.4 Services

9.2.4.5 Accessories

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Cell-based Flow Cytometry

9.2.5.2 Bead-based Flow Cytometry

9.2.6 Historic and Forecasted Market Size by Applications

9.2.6.1 Research Applications

9.2.6.2 Clinical Applications

9.2.6.3 Industrial Applications

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Hospitals and Clinics

9.2.7.2 Academia and Research Institutes

9.2.7.3 Pharmaceutical and Biotechnology Companies

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Flow Cytometry Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Instrument

9.3.4.2 Kit and Reagent

9.3.4.3 Software

9.3.4.4 Services

9.3.4.5 Accessories

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Cell-based Flow Cytometry

9.3.5.2 Bead-based Flow Cytometry

9.3.6 Historic and Forecasted Market Size by Applications

9.3.6.1 Research Applications

9.3.6.2 Clinical Applications

9.3.6.3 Industrial Applications

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Hospitals and Clinics

9.3.7.2 Academia and Research Institutes

9.3.7.3 Pharmaceutical and Biotechnology Companies

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Flow Cytometry Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Instrument

9.4.4.2 Kit and Reagent

9.4.4.3 Software

9.4.4.4 Services

9.4.4.5 Accessories

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Cell-based Flow Cytometry

9.4.5.2 Bead-based Flow Cytometry

9.4.6 Historic and Forecasted Market Size by Applications

9.4.6.1 Research Applications

9.4.6.2 Clinical Applications

9.4.6.3 Industrial Applications

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Hospitals and Clinics

9.4.7.2 Academia and Research Institutes

9.4.7.3 Pharmaceutical and Biotechnology Companies

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Flow Cytometry Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Instrument

9.5.4.2 Kit and Reagent

9.5.4.3 Software

9.5.4.4 Services

9.5.4.5 Accessories

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Cell-based Flow Cytometry

9.5.5.2 Bead-based Flow Cytometry

9.5.6 Historic and Forecasted Market Size by Applications

9.5.6.1 Research Applications

9.5.6.2 Clinical Applications

9.5.6.3 Industrial Applications

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Hospitals and Clinics

9.5.7.2 Academia and Research Institutes

9.5.7.3 Pharmaceutical and Biotechnology Companies

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Flow Cytometry Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Instrument

9.6.4.2 Kit and Reagent

9.6.4.3 Software

9.6.4.4 Services

9.6.4.5 Accessories

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Cell-based Flow Cytometry

9.6.5.2 Bead-based Flow Cytometry

9.6.6 Historic and Forecasted Market Size by Applications

9.6.6.1 Research Applications

9.6.6.2 Clinical Applications

9.6.6.3 Industrial Applications

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Hospitals and Clinics

9.6.7.2 Academia and Research Institutes

9.6.7.3 Pharmaceutical and Biotechnology Companies

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Flow Cytometry Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Instrument

9.7.4.2 Kit and Reagent

9.7.4.3 Software

9.7.4.4 Services

9.7.4.5 Accessories

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Cell-based Flow Cytometry

9.7.5.2 Bead-based Flow Cytometry

9.7.6 Historic and Forecasted Market Size by Applications

9.7.6.1 Research Applications

9.7.6.2 Clinical Applications

9.7.6.3 Industrial Applications

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Hospitals and Clinics

9.7.7.2 Academia and Research Institutes

9.7.7.3 Pharmaceutical and Biotechnology Companies

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Flow Cytometry Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 6145.71 Million |

|

Forecast Period 2025-32 CAGR: |

8.21 % |

Market Size in 2032: |

USD 11553.44 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Applications |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Becton, Dickinson and Company (BD) (USA), Beckman Coulter, Inc. (USA), Thermo Fisher Scientific, Inc. (USA), Merck KGaA (Germany), Bio-Rad Laboratories, Inc. (USA), and Other Active Players. |

||