Floating Wind Turbine Market Synopsis

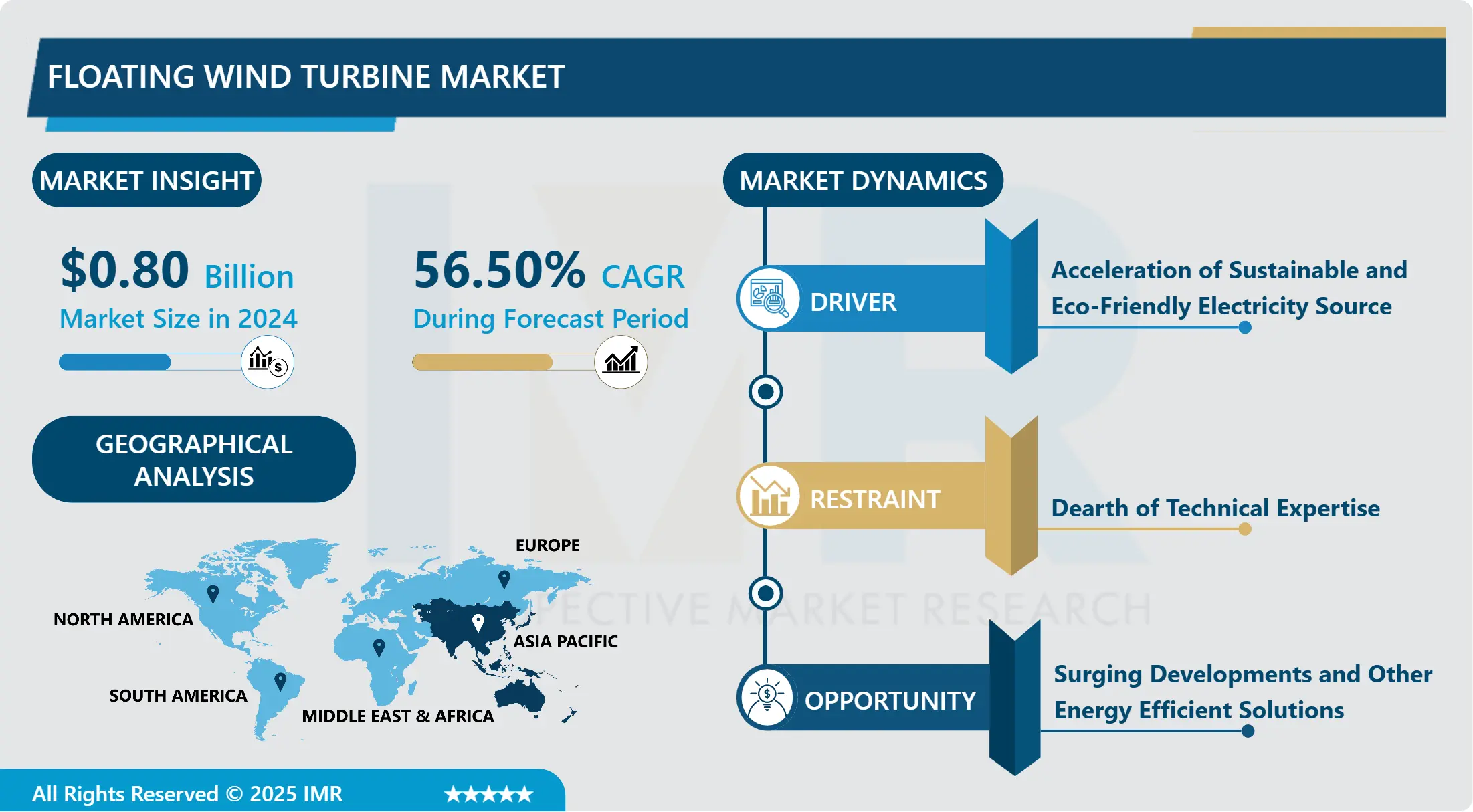

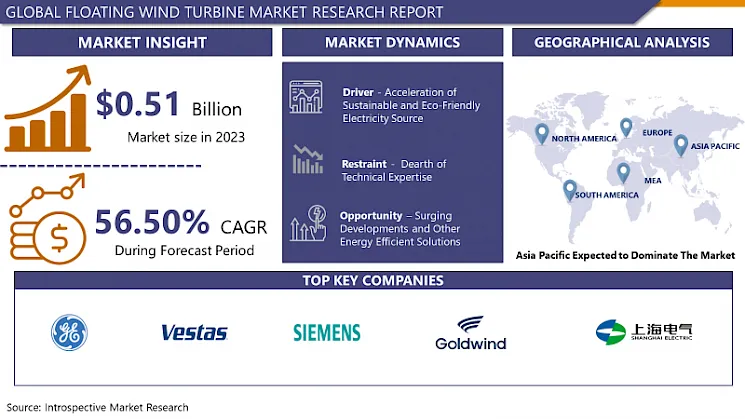

Floating Wind Turbine Market Size Was Valued at USD 0.80 Billion in 2024, and is Projected to Reach USD 28.79 Billion by 2032, Growing at a CAGR of 56.50% From 2025-2032.

The floating wind turbine market can be described as a sub sector of the renewable energy market mainly deals with the invention, manufacture and deployment of wind turbines that are installed on floating structures instead of being fixed on the seabed or on the ground. These new turbines incorporate sophisticated technologies to tapped wind power in water areas where the traditional bottom standing turbines cannot be installed. The prospect of using floating wind turbines is numerous, such opportunities as access to zones with greater wind power, as well as the relative inexp lectiveness of the impact of wind farms on the coastal zone. He stressed that banks are critical in the growth of offshore wind energy generation and help the world move towards renewable energy sources.

Analysis of the floating wind turbine market offers an interesting story of increased development and diversification of renewable power industry. In the present context of fast emerging environmental crises as the world looks for ways to shift from fossil-based energy systems to cleaner generation and storage technologies, floating wind turbines as a novel approach to offshore wind energy become an important concept at the crossroads of innovation and practical engineering. The idea of floating wind turbines is interesting due to its capacity of exploiting massive areas of deep-water terrain unavailable to ordinary bottom-attached wind turbines. The availability of more sites for wind energy harnessing has deeper implications for the global energy system particularly in areas with vast offshore wind resources but difficult subsea terrain.Moreover, the emerging problem of climate change increases the pressure on the energy industry to quickly Prince Energy Decarbonization While the world is trying to solve the urgent problem of shifting to cleaner and more efficient sources of power, floating wind turbines appear as one of the key innovative solutions to future offshore wind energy production. Greater prospects of initial development can be attributed to floating wind turbines because of navigation value, which allows companies to reach the middle and especially the deep part of any region. These opportunities for wind energy siting have far-reaching consequences for the global energy system, particularly where there are plentiful offshore wind resources but difficult subsea geophysical environments.

Moreover, the recent concern about climate change calls for even faster reduction of carbon intensity in the energy industry. Global governments and businesses are now focusing more on investments into renewable energy as a move towards universal strategies to rein in emissions of greenhouse gases, and move to a post carbon economy. In this regard, floating wind turbines are a capable solution that would expand the capacity of offshore wind and add more diversified sources of renewable energy.

The challenges facing the floating wind turbines market have their backing from factors that can spur demand and capital commitment. There is progress in the technological aspect of floating wind compared to fixed-bottom wind in terms of efficiency, dependable solution, cost of deployment, and competitiveness compared to other traditional sources of power. In addition, technological advancements are also leading to bringing down capital and operating cost continuously more due to economies of scale in turbine, installation technologies and floating platforms making the floating wind even more attractive.

The framework for supportive policies and regulatory stimuli is advancing the development of offshore wind facility, laying a foundation for market development. Offshore wind power continues to gain momentum and governments worldwide have set high targets for the deployment of renewable energy and are providing incentives such as subsidies, tax credits, and competitive procurement to catalyse investment into the development of offshore wind projects. The floating wind turbine market is benefited greatly by these policy measures such as offering support for project developers, investors, and technology providers.

Moving forward into the future, the floating wind turbine market will experience tremendous growth and will revolutionalize the world energy scenario. Additional attractive projects, expansion of investment and constantly expanding list of technology producers and suppliers indicates that the outlook for floater wind is promising. Thus, it can be stated that as the industry continues the process of their development, the use of floating wind turbines will be of significant value for creating a low-carbon energy economy.

Floating Wind Turbine Market Trend Analysis

Floating Wind Turbine Market Growth Driver- Driving the Adoption of Floating Wind Turbines

- Recent trend of the extension of floating wind turbines to deeper sea signifies a new era of offshore wind turbines. Although fixed – bottom turbines are bound by their design and can be only installed in shallow water measuring up to about 200ft, Floating turbines on the other hand can be installed in much deeper waters sometimes crossing a depth of 300 ft. It makes it possible for new leaders to embrace new offshore areas that were earlier ruled out for the development of wind energy solutions due to the depth issue. Therefore, regions with high offshore winds but short shallow shelf areas including the West Coast of United States, Mediterranean sea and Asia-Pacific are now emerging as excellent prospects for region-wide wind power generation. Leaving the shallow water not only provides more opportunities of wind energy development in deeper sea area but also has several benefits like traditional fixed-bottom turbines, which are restricted to shallow waters typically up to around 60 meters deep, floating turbines can be deployed in much deeper waters, sometimes exceeding 100 meters. This technological advancement enables developers to explore new offshore locations previously deemed unsuitable for wind energy development due to the depth limitations. As a result, regions with strong offshore winds but limited shallow seabed space, such as the West Coast of the United States, the Mediterranean Sea, and parts of Asia-Pacific, are now becoming viable candidates for large-scale wind farm installations.

- The expansion into deeper waters not only unlocks vast new areas for wind energy development but also offers several advantages. Investment in wind electricity generation from offshore structure is more attractive in deep water as opposed to shallow water areas because the wind resource is stronger and more stable, thus have more energy yields. Furthermore, water depth where offshore wind farms are constructed is deeper than shallow waters hence the structures least noticed from the shore, resulting in limited visibility of and complaints from shore based residents. In conclusion it can be pointed out that the ever rising use of floating wind turbines in deeper waters is revolutionising the layout of the offshore wind farms, expanding the areas suitable for wind power development and promoting the shift toward clean and renewable energy sources.

Floating Wind Turbine Market Expansion Opportunity- Advancements Propelling Growth in the Floating Wind Turbine Market

- Scientists and designers are working hard every day to improve the design and effectiveness of floating solutions to address the turbulent sea conditions. With the help of current advanced technologies, these innovators are improving floaters’ structural integrity, financial efficiency, and flexibility for wind turbines. Such Platforms are gradually evolving through successive design refinements, which include finer geometries and adaptation of new mooring systems so as to be constructed for a wide range of sea environments including hostile ones and at deeper waters. Further, it can also be seen that material improvements are critical to the development of the floating wind turbine.chnological progress. Engineers and developers are at the forefront of this revolution, ceaselessly refining the design and efficiency of floating platforms to overcome the challenges posed by the dynamic marine environment. By leveraging cutting-edge technologies, these innovators are enhancing the stability, cost-effectiveness, and adaptability of floating wind turbines. Through iterative design improvements, such as optimized geometries and innovative mooring systems, these platforms are becoming increasingly robust, capable of withstanding a broader spectrum of environmental conditions, including harsh seas and deep waters.

- Moreover, material advancements are pivotal in driving the evolution of floating wind turbine technology. For example, lightweight composites are now changing the construction outlook as they provide the needed strength-to-weight ratios permitting the fabrication of larger and more efficient turbine structures. In addition, modern anchoring systems are enhancing the durability of these installations for preventing frequent servicing and time losses. Through leveraging of these novelties in materials engineering, the engineers are not only making it possible to bring down the costs of construction but also ensuring that these floating wind turbines perform and last as intended in the renewable energy switch.

Floating Wind Turbine Market Segment Analysis:

Floating Wind Turbine Market is segmented based on Foundation, Capacity, Depth, and Region

By Depth, above 5MW segment is expected to dominate the market during the forecast period

- In the constantly evolving market of floating wind turbines, the turbines with capacities exceeding 5MW are on the highest pedestal offering dominating market share.. This dominance is conceived as a strategic move to counter enhanced demand for energy production efficiency in offshore wind farms. Given the growing global push towards moving to renewable power sources, there has been increased focus on getting the optimum efficiency from each turbine in order to exploit the large wind resources available offshore. Subsequently, developers and other stakeholders have thus resorted to adopting blades that can harness more power in order to add density to the unit, the general competiveness and longevity of offshore wind plants.

- The constant technological advancement within this industry means that greater numbers of turbines with output capacities of over 5 MW are being deployed further.rs, commanding a significant share of the industry. This dominance reflects a strategic response to the escalating demand for energy production efficiency in offshore wind farms. As the global focus intensifies on transitioning towards renewable energy sources, there's a heightened emphasis on maximizing the output of each turbine to harness the abundant wind resources available offshore. Consequently, developers and stakeholders are increasingly turning to higher-capacity turbines as a means to achieve greater energy yields per unit, thereby bolstering the overall competitiveness and sustainability of offshore wind projects.

- The ascendancy of turbines with capacities exceeding 5 MW is further propelled by relentless technological innovation within the industry. Manufacturers have taken the lead in terms of designing new generation turbines where best of technology is employed to extract best out of them. These innovations present a range of upgrades that can be seen as across the board improvements such as increased rotor diameter, tougher drivetrain systems, optimal aerodynamics with regard to improving the energy capturing efficiency and therefore reducing the LCOE of the offshore wind farm infrastructures. By adopting these innovations, stakeholders will successfully achieve new forms and levels of power generation and cost, contributing to the realization of global offshore wind potentials. Therefore, analysis of the current structure of turbines with capacities over 5MW proves the existence of the perfect storm of market demand, technological, and sustainability trends that propels turbines as the key enablers of growth in the sector of floating wind turbines.

By Foundation, Semi-submersible Foundation segment held the largest share in 2024

- The semi-submersible foundation has been identified in the marketMarginal Difference analysis as the pioneer of the floating wind turbine having the largest market share among the several types of the foundation. It has become widespread due to such factors as stability, flexibility, and performance whereas developers face significant issues in offshore wind energy generation. Some of the major reasons for this include its excellent stability all through ranging from placid waters to rough seas. Semi submersible platforms are designed to be resilient to the environment and are able to work through hurricanes, storms, and high seas to produce energy throughout their useful life cycle. Recall that one of the Objectives of having a DR plan is to assure investors/ stakeholders that their businesses will not be adversely affected by disruptions or downtime.

- Furthermore, not only are semi-submersible foundations stable they also prove to be more flexible with regards to water depths.re among various foundation types. Its prominence stems from a combination of robustness, adaptability, and reliability, making it the go-to choice for developers navigating the challenges of offshore wind energy production. One of the primary factors driving its dominance is its exceptional stability, even in tumultuous ocean environments. Semi-submersible platforms are engineered to withstand extreme weather conditions, including high winds, waves, and storms, ensuring uninterrupted energy generation throughout their operational lifespan. This resilience instills confidence among investors and stakeholders, mitigating concerns over potential disruptions and downtime.

- Moreover, the versatility of semi-submersible foundations extends beyond stability to encompass flexibility in water depths. These structures are successful in both shallow and the deep seas and allow developers to site turbines conveniently to take advantage of the best wind environment. But also the flexibility this approach offers increases the area of possible locations for project sites as well as contributes to the improvement of the offshore wind farms’ scalability. Also, there has been further experience to show that semi-submersible foundations can handle bigger turbines to embody the new tendency for enhanced power yield. By providing means to install more efficient and competitive turbine technologies these platforms will contribute to sustaining future market growth in the offshore wind sector. In other words, given that semi-submersible foundations make up the majority of choices currently available in the floating wind turbine market, it is evident that they are key to enabling the shift towards clean energy and producing systems that remain stable in the face of extreme weather conditions.

Floating Wind Turbine Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region stands at the forefront of renewable energy adoption, driven by a dual imperative: the urgent need for clean energy to counter act the effects of degradation as well as the demand for energy to fuel the aggrandizing industrialization. Developed Asia Pacific countries, particularly Japan, South Korea and Taiwan have a densely populated coastal cities and restricted land space, making offshore wind as a critical component of their energy mix transition. However, the installation of the conventional bottom-standing turbines is sometimes very difficult in these areas because of water depths close to the coasts. This has spurred a change towards what is known as floating wind system; this allows the installation of wind systems in deeper water, where more efficient wind is likely to be found but where it is also impossible to install fixed systems. Consequently, the Asia-Pacific is experiencing increased interest and efforts being made in the development of floating wind projects. Market factors, including feed-in tariffs and renewable energy targets established by governments, along with growing technological innovations in floating platforms fixed to wind turbines and pipe-laying vessels, are further driving the growth of Asian-Pacific floating wind turbine market. In addition, collaboration between local government and international industry players as well as knowledge sharing among developers is increasing due to the growing partnerships that have provided the impetus for the development and deployments of the floating wind projects in the region.ation. Countries like Japan, South Korea, and Taiwan, with their densely populated coastlines and limited land availability, are turning to offshore wind as a pivotal pillar of their energy transition strategies. However, the deployment of traditional fixed-bottom turbines faces challenges in these regions due to the deep waters near their shores. This challenge has catalyzed a shift towards floating wind technology, which offers the flexibility to harness wind resources in deeper waters where fixed-bottom turbines are not feasible. As a result, the Asia-Pacific region is witnessing a surge in investments and initiatives aimed at developing floating wind projects. Government incentives, such as feed-in tariffs and renewable energy targets, coupled with technological advancements in floating platform design and installation techniques, are further propelling the growth of the floating wind turbine market in Asia-Pacific.

- Moreover, partnerships between local governments, industry players, and international developers are fostering collaboration and knowledge exchange, accelerating the development and deployment of floating wind projects in the region. For example, Japan raising targets for offshore wind power and less use of fossils have seen concessions signed with European companies in floating wind. Likewise, South Korean Green New Deal emphasizes renewal energy resulting in partnerships with international key players in floating wind technologies. These partnerships enable technology transfer in addition to solving issues touching on financing of projects, policies, and supply chain. With rising demand for renewable energy security in the Asia-Pacific region, floating wind turbines have a great potential to deliver the renewable energy requirements of this region and promote sustainable development.

Active Key Players in the Floating Wind Turbine Market

- General Electric

- Vestas

- Siemens

- Goldwind

- Shanghai Electric

- ABB

- Doosan Corporation

- Hitachi Ltd.

- Nordex SE

- EEW Group

- Nexans

- DEME

- Ming Yang Smart Energy Group Co

- Envision

- Rockwell Automation Inc.

- Hyundai Motor Company

- Schneider Electric

- Zhejiang Windey Co., Ltd.

- Taiyuan Heavy Industry Co.

- Sinovel Wind Group Co., Ltd.

- Other Active Players

Key Industry Developments in the Floating Wind Turbine Market:

- In January 2024, GE Vernova announced 1.4 GW of onshore wind projects with Squadron Energy in Australia. GE Vernova's Onshore Wind business announced the signing of a strategic framework agreement with Squadron Energy for 1.4 gigawatts (GW) of onshore wind projects in New South Wales, Australia. Squadron Energy announced the agreement earlier this month, marking the commencement of construction of the Uungala Wind Farm.

- In May 2023, GE announced that it would invest $50 million in its Schenectady, NY, facility and hire about 200 additional full-time employees, including skilled union operators, manufacturing engineers, and front-line leadership, to deve

|

Global Floating Wind Turbine Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.80 Bn. |

|

Forecast Period 2025-32 CAGR: |

56.50% |

Market Size in 2032: |

USD 28.79 Bn. |

|

Segments Covered: |

By Foundation |

|

|

|

By Capacity |

|

||

|

By Depth |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Floating Wind Turbine Market by Foundation (2018-2032)

4.1 Floating Wind Turbine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Spar-buoy Foundation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Tension-leg platform (TLP) Foundation

4.5 Semi-submersible Foundation

4.6 Others

Chapter 5: Floating Wind Turbine Market by Capacity (2018-2032)

5.1 Floating Wind Turbine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Up to 1 MW

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 1-3 MW

5.5 3-5 MW

5.6 above 5MW

Chapter 6: Floating Wind Turbine Market by Depth (2018-2032)

6.1 Floating Wind Turbine Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Shallow Water

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Deep Water

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Floating Wind Turbine Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GENERAL ELECTRIC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VESTAS

7.4 SIEMENS

7.5 GOLDWIND

7.6 SHANGHAI ELECTRIC

7.7 ABB

7.8 DOOSAN CORPORATION

7.9 HITACHI LTD.

7.10 NORDEX SE

7.11 EEW GROUP

7.12 NEXANS

7.13 DEME

7.14 MING YANG SMART ENERGY GROUP CO

7.15 ENVISION

7.16 ROCKWELL AUTOMATION INCHYUNDAI MOTOR COMPANY

7.17 SCHNEIDER ELECTRIC

7.18 ZHEJIANG WINDEY COLTD.

7.19 TAIYUAN HEAVY INDUSTRY COSINOVEL WIND GROUP COLTDOTHER KEY PLAYERS

Chapter 8: Global Floating Wind Turbine Market By Region

8.1 Overview

8.2. North America Floating Wind Turbine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Foundation

8.2.4.1 Spar-buoy Foundation

8.2.4.2 Tension-leg platform (TLP) Foundation

8.2.4.3 Semi-submersible Foundation

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Capacity

8.2.5.1 Up to 1 MW

8.2.5.2 1-3 MW

8.2.5.3 3-5 MW

8.2.5.4 above 5MW

8.2.6 Historic and Forecasted Market Size by Depth

8.2.6.1 Shallow Water

8.2.6.2 Deep Water

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Floating Wind Turbine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Foundation

8.3.4.1 Spar-buoy Foundation

8.3.4.2 Tension-leg platform (TLP) Foundation

8.3.4.3 Semi-submersible Foundation

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Capacity

8.3.5.1 Up to 1 MW

8.3.5.2 1-3 MW

8.3.5.3 3-5 MW

8.3.5.4 above 5MW

8.3.6 Historic and Forecasted Market Size by Depth

8.3.6.1 Shallow Water

8.3.6.2 Deep Water

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Floating Wind Turbine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Foundation

8.4.4.1 Spar-buoy Foundation

8.4.4.2 Tension-leg platform (TLP) Foundation

8.4.4.3 Semi-submersible Foundation

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Capacity

8.4.5.1 Up to 1 MW

8.4.5.2 1-3 MW

8.4.5.3 3-5 MW

8.4.5.4 above 5MW

8.4.6 Historic and Forecasted Market Size by Depth

8.4.6.1 Shallow Water

8.4.6.2 Deep Water

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Floating Wind Turbine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Foundation

8.5.4.1 Spar-buoy Foundation

8.5.4.2 Tension-leg platform (TLP) Foundation

8.5.4.3 Semi-submersible Foundation

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Capacity

8.5.5.1 Up to 1 MW

8.5.5.2 1-3 MW

8.5.5.3 3-5 MW

8.5.5.4 above 5MW

8.5.6 Historic and Forecasted Market Size by Depth

8.5.6.1 Shallow Water

8.5.6.2 Deep Water

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Floating Wind Turbine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Foundation

8.6.4.1 Spar-buoy Foundation

8.6.4.2 Tension-leg platform (TLP) Foundation

8.6.4.3 Semi-submersible Foundation

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Capacity

8.6.5.1 Up to 1 MW

8.6.5.2 1-3 MW

8.6.5.3 3-5 MW

8.6.5.4 above 5MW

8.6.6 Historic and Forecasted Market Size by Depth

8.6.6.1 Shallow Water

8.6.6.2 Deep Water

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Floating Wind Turbine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Foundation

8.7.4.1 Spar-buoy Foundation

8.7.4.2 Tension-leg platform (TLP) Foundation

8.7.4.3 Semi-submersible Foundation

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Capacity

8.7.5.1 Up to 1 MW

8.7.5.2 1-3 MW

8.7.5.3 3-5 MW

8.7.5.4 above 5MW

8.7.6 Historic and Forecasted Market Size by Depth

8.7.6.1 Shallow Water

8.7.6.2 Deep Water

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Floating Wind Turbine Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.80 Bn. |

|

Forecast Period 2025-32 CAGR: |

56.50% |

Market Size in 2032: |

USD 28.79 Bn. |

|

Segments Covered: |

By Foundation |

|

|

|

By Capacity |

|

||

|

By Depth |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||