Firewall as a Service (FWaaS) Market Synopsis

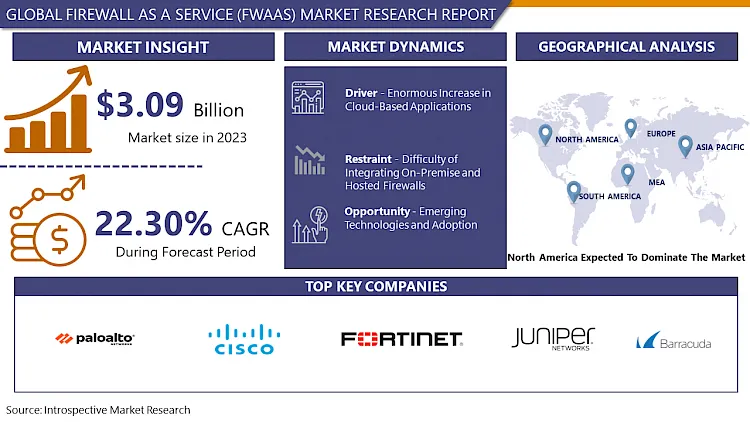

Firewall as a Service (FWaaS) Market Size Was Valued at USD 3.78 Billion in 2024 and is Projected to Reach USD 18.92 Billion by 2032, Growing at a CAGR of 22.30% From 2025-2032

Firewall as a Service (FWaaS) is a security solution based in the cloud that provides organizations with firewall capabilities through a subscription model. FWaaS enables users to remotely deploy, manage, and monitor firewall policies and controls via the cloud, offering scalable and adaptable protection for their network infrastructure against cyber threats.

Firewall as a Service (FWaaS) is a security solution delivered via the cloud, offering firewall functionality as a service. It allows organizations to remotely deploy, manage, and maintain firewall services through a cloud-based platform. FWaaS serves diverse applications across industries such as cybersecurity, network security, and cloud security. Organizations utilize FWaaS to safeguard their networks, applications, and data from unauthorized access, malware, and other cyber threats.

FWaaS provides several advantages, including scalability, flexibility, and cost-effectiveness. Unlike traditional firewall solutions requiring on-premises hardware appliances and manual setup, FWaaS enables organizations to scale their firewall services dynamically based on changing needs and network traffic patterns. Moreover, FWaaS offers flexibility in deployment, allowing organizations to implement firewall policies across distributed network environments, including branch offices, remote locations, and cloud infrastructure.

FWaaS eliminates upfront hardware investments and ongoing maintenance costs linked to traditional firewall deployments, making it a cost-effective solution for organizations of all sizes. As organizations increasingly adopt cloud computing and digital transformation initiatives, the demand for FWaaS is expected to surge, driven by the need for scalable and adaptable security solutions that can counter the dynamic threat landscape and meet evolving business requirements.

Firewall as a Service (FWaaS) Market Trend Analysis:

Enormous Increase in Cloud-Based Applications

- The significant surge in cloud-based applications propels growth in the Firewall as a Service (FWaaS) market. As businesses increasingly depend on cloud computing for data storage, software deployment, and infrastructure management, the necessity for robust cybersecurity solutions becomes paramount. FWaaS offers organizations a scalable and flexible approach to network security, enabling them to safeguard their cloud-based applications and data from cyber threats without the need for on-premises hardware or complex configurations.

- The proliferation of remote work and mobile workforce trends further boosts the demand for FWaaS solutions. With employees accessing corporate networks and cloud-based applications from various locations and devices, the traditional perimeter-based security model becomes less effective. FWaaS provides centralized security controls and threat detection capabilities, empowering organizations to enforce consistent security policies across distributed networks and endpoints, regardless of their physical location.

- The scalability and cost-effectiveness of FWaaS solutions make them appealing options for businesses of all sizes, from startups to large enterprises. By outsourcing firewall management to a third-party service provider, organizations can alleviate the burden on their IT teams and streamline their security operations. This enables them to focus on core business activities while ensuring robust protection against evolving cyber threats. As the adoption of cloud-based applications continues to soar, the FWaaS market is anticipated to experience sustained growth, driven by the ongoing need for effective and agile cybersecurity solutions in the digital era.

Emerging Technologies and Adoption

- The growth of the Firewall as a Service (FWaaS) market is an opportunity for emerging technologies and their widespread adoption. With organizations embracing cloud computing, IoT (Internet of Things), and remote work, the traditional perimeter-based security approach becomes less effective against cyber threats. FWaaS provides a scalable and flexible solution by offering cloud-based firewall services that can adapt to dynamic network environments and evolving security threats.

- The integration of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) technologies enables the incorporation of FWaaS into existing network infrastructures. This integration streamlines the deployment and management of firewall services, eliminating the need for dedicated hardware appliances. Moreover, advancements in artificial intelligence and machine learning empower FWaaS providers to deliver advanced threat detection and mitigation capabilities, bolstering the overall security posture of organizations' networks.

- The growing demand for managed security services and the prevalence of hybrid and multi-cloud environments fuel the adoption of FWaaS among enterprises of all sizes. FWaaS providers offer comprehensive security solutions that safeguard cloud workloads, applications, and data across distributed environments, addressing the intricate security challenges posed by modern IT architectures. As organizations prioritize cybersecurity and seek scalable, cloud-native security solutions, FWaaS emerges as a strategic opportunity for enhancing network security and mitigating cyber risks in today's digital landscape.

Firewall as a Service (FWaaS) Market Segment Analysis:

Firewall as a Service (FWaaS) Market Segmented on the basis of Type, Service Model, Deployment Model, Organizational Size, Industry Vertical and Region.

By Deployment Model, Public Segment is expected to dominate the market during the forecast period

- The public sector is expected to lead the market due to several key factors. public organizations, such as government agencies, educational institutions, and non-profit organizations, prioritize cybersecurity to safeguard sensitive data and critical infrastructure from cyber threats. FWaaS provides a cost-effective and scalable solution for these organizations to bolster their network security posture and adhere to regulatory requirements.

- The growing adoption of cloud services and digital transformation initiatives in the public sector fuels the demand for FWaaS. As public organizations transition their IT infrastructure and applications to the cloud, they require cloud-native security solutions like FWaaS to secure their cloud environments and defend against cyber-attacks. Additionally, the scalability and flexibility of FWaaS make it well-suited for public organizations with dynamic and distributed network environments, enabling them to adapt to evolving security threats and business needs. the public segment is positioned to dominate the FWaaS market as public organizations prioritize cybersecurity and embrace cloud-based security solutions.

By Organizational Size, Large Enterprises Segment Held the Largest Share in 2024

- The dominance of the large enterprises segment in the market is attributed to several key factors. large enterprises possess extensive IT infrastructures and intricate network environments that demand robust and scalable security solutions. FWaaS offers these organizations the flexibility to deploy and manage firewall services across their distributed network architecture, ensuring consistent security policies and protection against cyber threats.

- Large enterprises have greater resources and budgets to invest in advanced security technologies and managed services like FWaaS. These organizations prioritize cybersecurity as a strategic imperative to safeguard their sensitive data, intellectual property, and business continuity. Moreover, large enterprises often operate in regulated industries with stringent compliance requirements, further propelling the adoption of FWaaS to achieve regulatory compliance and demonstrate due diligence in protecting their networks and digital assets. the large enterprises segment dominates the FWaaS market as organizations prioritize scalable and comprehensive security solutions to mitigate cyber risks and secure their business operations.

Firewall as a Service (FWaaS) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is anticipated to lead the market for several reasons. the region possesses a mature and sophisticated IT infrastructure, characterized by widespread adoption of cloud computing, IoT, and digital transformation initiatives. This technological advancement fuels the demand for FWaaS as organizations seek scalable and adaptable security solutions to safeguard their digital assets and networks.

- North America hosts a plethora of cybersecurity vendors and solution providers, offering a diverse array of FWaaS offerings tailored to meet the requirements of enterprises across various industries. Leveraging the region's innovation ecosystem and skilled workforce, these vendors develop cutting-edge security technologies and provide value-added services to their clientele. Additionally, the stringent regulatory landscape and escalating cybersecurity threats prompt organizations in North America to prioritize investments in FWaaS to bolster their cyber resilience and mitigate risks. North America is positioned to sustain its dominance in the FWaaS market as organizations persist in prioritizing cybersecurity and adopting cloud-native security solutions.

Firewall as a Service (FWaaS) Market Top Key Players:

- Palo Alto Networks (USA)

- Cisco Systems (USA)

- Fortinet (USA)

- Juniper Networks (USA)

- Barracuda Networks (USA)

- SonicWall (USA)

- Zscaler (USA)

- WatchGuard Technologies (USA)

- IBM (USA)

- McAfee (USA)

- Forcepoint (USA)

- F5 Networks (USA)

- Citrix Systems (USA)

- Trustwave (USA)

- Akamai Technologies (USA)

- Symantec Corporation (USA)

- AT&T (USA)

- Verizon (USA)

- Netskope (USA)

- Sophos (UK)

- Huawei (China)

- Sangfor Technologies (China)

- Trend Micro (Japan)

- Check Point Software Technologies (Israel)

- Cato Networks (Israel)

- Other Active players

|

Global Firewall as a Service (FWaaS) Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.78 Billion |

|

Forecast Period 2025-32 CAGR: |

21.82 % |

Market Size in 2032: |

USD 18.92 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Service Model |

|

||

|

By Deployment Model |

|

||

|

By Organizational Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: FireWall as a Service (FWaaS) Market by Type (2018-2032)

4.1 FireWall as a Service (FWaaS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Compliance & Audit Management

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Automation & Orchestration

4.5 Security Management

4.6 Traffic Monitoring & Control

4.7 Reporting & Log Management

4.8 Others {Managed Services

4.9 Professional Services

4.10 Connectivity & Configuration Management})

Chapter 5: FireWall as a Service (FWaaS) Market by Service Model (2018-2032)

5.1 FireWall as a Service (FWaaS) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Software-As-A-Service (Saas)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Infrastructure-As-A-Service (Iaas)

5.5 Platform-As-A-Service (Paas)

Chapter 6: FireWall as a Service (FWaaS) Market by Deployment Model (2018-2032)

6.1 FireWall as a Service (FWaaS) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Private

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Public

6.5 Hybrid

Chapter 7: FireWall as a Service (FWaaS) Market by Organizational Size (2018-2032)

7.1 FireWall as a Service (FWaaS) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Small And Medium-Sized Enterprises (SMEs)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Large Enterprises

Chapter 8: FireWall as a Service (FWaaS) Market by Industry Vertical (2018-2032)

8.1 FireWall as a Service (FWaaS) Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Banking

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Financial Services And Insurance (BFSI)

8.5 Energy & Utilities

8.6 Government & Public Sector

8.7 Manufacturing

8.8 Healthcare And Life Sciences

8.9 Others {Education

8.10 Retail And Ecommerce

8.11 Telecommunication & IT

8.12 Travel & Transportation

8.13 Hospitality

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 FireWall as a Service (FWaaS) Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ALERT LOGIC INCBARRACUDA NETWORKS INCCISCO SYSTEMS INCDELL TECHNOLOGIES INCFORTINET INCINTERNATIONAL BUSINESS MACHINES CORPORATION

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 MCAFEE LLC

9.4 MICROSOFT CORPORATION

9.5 OKTA INCPROOFPOINT INCQUALYS INCRADWARE LTDTREND MICRO INCORPORATED

9.6 ZSCALER INCOTHER KEY PLAYERS

Chapter 10: Global FireWall as a Service (FWaaS) Market By Region

10.1 Overview

10.2. North America FireWall as a Service (FWaaS) Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Compliance & Audit Management

10.2.4.2 Automation & Orchestration

10.2.4.3 Security Management

10.2.4.4 Traffic Monitoring & Control

10.2.4.5 Reporting & Log Management

10.2.4.6 Others {Managed Services

10.2.4.7 Professional Services

10.2.4.8 Connectivity & Configuration Management})

10.2.5 Historic and Forecasted Market Size by Service Model

10.2.5.1 Software-As-A-Service (Saas)

10.2.5.2 Infrastructure-As-A-Service (Iaas)

10.2.5.3 Platform-As-A-Service (Paas)

10.2.6 Historic and Forecasted Market Size by Deployment Model

10.2.6.1 Private

10.2.6.2 Public

10.2.6.3 Hybrid

10.2.7 Historic and Forecasted Market Size by Organizational Size

10.2.7.1 Small And Medium-Sized Enterprises (SMEs)

10.2.7.2 Large Enterprises

10.2.8 Historic and Forecasted Market Size by Industry Vertical

10.2.8.1 Banking

10.2.8.2 Financial Services And Insurance (BFSI)

10.2.8.3 Energy & Utilities

10.2.8.4 Government & Public Sector

10.2.8.5 Manufacturing

10.2.8.6 Healthcare And Life Sciences

10.2.8.7 Others {Education

10.2.8.8 Retail And Ecommerce

10.2.8.9 Telecommunication & IT

10.2.8.10 Travel & Transportation

10.2.8.11 Hospitality

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe FireWall as a Service (FWaaS) Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Compliance & Audit Management

10.3.4.2 Automation & Orchestration

10.3.4.3 Security Management

10.3.4.4 Traffic Monitoring & Control

10.3.4.5 Reporting & Log Management

10.3.4.6 Others {Managed Services

10.3.4.7 Professional Services

10.3.4.8 Connectivity & Configuration Management})

10.3.5 Historic and Forecasted Market Size by Service Model

10.3.5.1 Software-As-A-Service (Saas)

10.3.5.2 Infrastructure-As-A-Service (Iaas)

10.3.5.3 Platform-As-A-Service (Paas)

10.3.6 Historic and Forecasted Market Size by Deployment Model

10.3.6.1 Private

10.3.6.2 Public

10.3.6.3 Hybrid

10.3.7 Historic and Forecasted Market Size by Organizational Size

10.3.7.1 Small And Medium-Sized Enterprises (SMEs)

10.3.7.2 Large Enterprises

10.3.8 Historic and Forecasted Market Size by Industry Vertical

10.3.8.1 Banking

10.3.8.2 Financial Services And Insurance (BFSI)

10.3.8.3 Energy & Utilities

10.3.8.4 Government & Public Sector

10.3.8.5 Manufacturing

10.3.8.6 Healthcare And Life Sciences

10.3.8.7 Others {Education

10.3.8.8 Retail And Ecommerce

10.3.8.9 Telecommunication & IT

10.3.8.10 Travel & Transportation

10.3.8.11 Hospitality

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe FireWall as a Service (FWaaS) Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Compliance & Audit Management

10.4.4.2 Automation & Orchestration

10.4.4.3 Security Management

10.4.4.4 Traffic Monitoring & Control

10.4.4.5 Reporting & Log Management

10.4.4.6 Others {Managed Services

10.4.4.7 Professional Services

10.4.4.8 Connectivity & Configuration Management})

10.4.5 Historic and Forecasted Market Size by Service Model

10.4.5.1 Software-As-A-Service (Saas)

10.4.5.2 Infrastructure-As-A-Service (Iaas)

10.4.5.3 Platform-As-A-Service (Paas)

10.4.6 Historic and Forecasted Market Size by Deployment Model

10.4.6.1 Private

10.4.6.2 Public

10.4.6.3 Hybrid

10.4.7 Historic and Forecasted Market Size by Organizational Size

10.4.7.1 Small And Medium-Sized Enterprises (SMEs)

10.4.7.2 Large Enterprises

10.4.8 Historic and Forecasted Market Size by Industry Vertical

10.4.8.1 Banking

10.4.8.2 Financial Services And Insurance (BFSI)

10.4.8.3 Energy & Utilities

10.4.8.4 Government & Public Sector

10.4.8.5 Manufacturing

10.4.8.6 Healthcare And Life Sciences

10.4.8.7 Others {Education

10.4.8.8 Retail And Ecommerce

10.4.8.9 Telecommunication & IT

10.4.8.10 Travel & Transportation

10.4.8.11 Hospitality

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific FireWall as a Service (FWaaS) Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Compliance & Audit Management

10.5.4.2 Automation & Orchestration

10.5.4.3 Security Management

10.5.4.4 Traffic Monitoring & Control

10.5.4.5 Reporting & Log Management

10.5.4.6 Others {Managed Services

10.5.4.7 Professional Services

10.5.4.8 Connectivity & Configuration Management})

10.5.5 Historic and Forecasted Market Size by Service Model

10.5.5.1 Software-As-A-Service (Saas)

10.5.5.2 Infrastructure-As-A-Service (Iaas)

10.5.5.3 Platform-As-A-Service (Paas)

10.5.6 Historic and Forecasted Market Size by Deployment Model

10.5.6.1 Private

10.5.6.2 Public

10.5.6.3 Hybrid

10.5.7 Historic and Forecasted Market Size by Organizational Size

10.5.7.1 Small And Medium-Sized Enterprises (SMEs)

10.5.7.2 Large Enterprises

10.5.8 Historic and Forecasted Market Size by Industry Vertical

10.5.8.1 Banking

10.5.8.2 Financial Services And Insurance (BFSI)

10.5.8.3 Energy & Utilities

10.5.8.4 Government & Public Sector

10.5.8.5 Manufacturing

10.5.8.6 Healthcare And Life Sciences

10.5.8.7 Others {Education

10.5.8.8 Retail And Ecommerce

10.5.8.9 Telecommunication & IT

10.5.8.10 Travel & Transportation

10.5.8.11 Hospitality

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa FireWall as a Service (FWaaS) Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Compliance & Audit Management

10.6.4.2 Automation & Orchestration

10.6.4.3 Security Management

10.6.4.4 Traffic Monitoring & Control

10.6.4.5 Reporting & Log Management

10.6.4.6 Others {Managed Services

10.6.4.7 Professional Services

10.6.4.8 Connectivity & Configuration Management})

10.6.5 Historic and Forecasted Market Size by Service Model

10.6.5.1 Software-As-A-Service (Saas)

10.6.5.2 Infrastructure-As-A-Service (Iaas)

10.6.5.3 Platform-As-A-Service (Paas)

10.6.6 Historic and Forecasted Market Size by Deployment Model

10.6.6.1 Private

10.6.6.2 Public

10.6.6.3 Hybrid

10.6.7 Historic and Forecasted Market Size by Organizational Size

10.6.7.1 Small And Medium-Sized Enterprises (SMEs)

10.6.7.2 Large Enterprises

10.6.8 Historic and Forecasted Market Size by Industry Vertical

10.6.8.1 Banking

10.6.8.2 Financial Services And Insurance (BFSI)

10.6.8.3 Energy & Utilities

10.6.8.4 Government & Public Sector

10.6.8.5 Manufacturing

10.6.8.6 Healthcare And Life Sciences

10.6.8.7 Others {Education

10.6.8.8 Retail And Ecommerce

10.6.8.9 Telecommunication & IT

10.6.8.10 Travel & Transportation

10.6.8.11 Hospitality

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America FireWall as a Service (FWaaS) Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Compliance & Audit Management

10.7.4.2 Automation & Orchestration

10.7.4.3 Security Management

10.7.4.4 Traffic Monitoring & Control

10.7.4.5 Reporting & Log Management

10.7.4.6 Others {Managed Services

10.7.4.7 Professional Services

10.7.4.8 Connectivity & Configuration Management})

10.7.5 Historic and Forecasted Market Size by Service Model

10.7.5.1 Software-As-A-Service (Saas)

10.7.5.2 Infrastructure-As-A-Service (Iaas)

10.7.5.3 Platform-As-A-Service (Paas)

10.7.6 Historic and Forecasted Market Size by Deployment Model

10.7.6.1 Private

10.7.6.2 Public

10.7.6.3 Hybrid

10.7.7 Historic and Forecasted Market Size by Organizational Size

10.7.7.1 Small And Medium-Sized Enterprises (SMEs)

10.7.7.2 Large Enterprises

10.7.8 Historic and Forecasted Market Size by Industry Vertical

10.7.8.1 Banking

10.7.8.2 Financial Services And Insurance (BFSI)

10.7.8.3 Energy & Utilities

10.7.8.4 Government & Public Sector

10.7.8.5 Manufacturing

10.7.8.6 Healthcare And Life Sciences

10.7.8.7 Others {Education

10.7.8.8 Retail And Ecommerce

10.7.8.9 Telecommunication & IT

10.7.8.10 Travel & Transportation

10.7.8.11 Hospitality

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Firewall as a Service (FWaaS) Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.78 Billion |

|

Forecast Period 2025-32 CAGR: |

21.82 % |

Market Size in 2032: |

USD 18.92 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Service Model |

|

||

|

By Deployment Model |

|

||

|

By Organizational Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

_MARKET.webp)