Fine Chemicals Market Synopsis

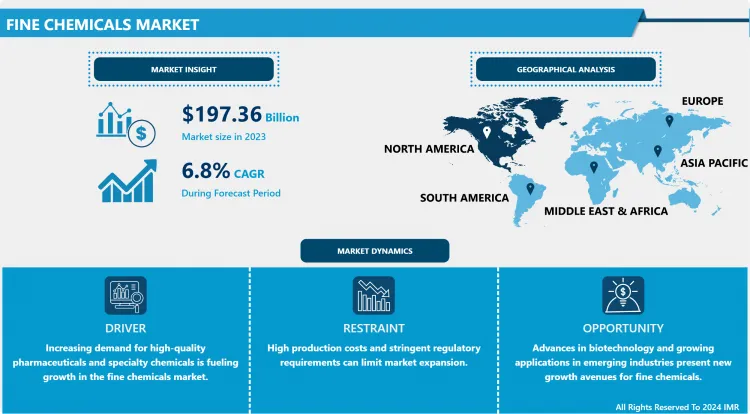

Fine Chemicals Market Size is Valued at USD 1492.33 Billion in 2024 and is Projected to Reach USD 2526.01 Billion by 2032, Growing at a CAGR of 6.8% From 2025-2032.

The fine chemicals market, which encompasses high-purity chemicals used in specialized applications, is undergoing steady development as a result of the growing demand in a variety of industries, including pharmaceuticals, agrochemicals, and electronics. The demand for delicate chemicals that provide precision and performance is increasing as these sectors continue to develop technologically. In particular, pharmaceutical companies are looking for fine chemicals for drug development and production. Conversely, the agrochemical sector requires them to provide effective agricultural protection solutions. Advances in chemical synthesis and an increasing emphasis on environmentally favorable and sustainable practices are also influencing market dynamics. The fine chemicals market is well-positioned for sustained expansion and diversification, as it prioritizes high-quality and customized chemical solutions.

Specialized, high-purity chemicals, used in a variety of applications like pharmaceuticals, agrochemicals, and electronics, distinguish the fine chemicals market. Smaller quantities of these chemicals, compared to mass chemicals, require sophisticated manufacturing processes to ensure consistency and quality. Growing demand from a variety of end-use industries fuels the market's expansion, necessitating high-performance products and customized solutions. The fine chemicals sector is able to capitalize on advancements in chemical synthesis, production technology, and rigorous quality control measures as innovation continues to accelerate.

Furthermore, the global fine chemicals market is experiencing significant growth due to increasing investments in research and development, particularly in the pharmaceutical and biotechnology sectors. The need for fine chemicals in the development of new pharmaceuticals, therapies, and advanced materials is driving the market growth. Furthermore, the trend toward sustainable and environmentally favorable production processes, aimed at reducing the environmental impact and improving the efficiency of chemical manufacturing processes, is influencing the industry's future.

Fine Chemicals Market Trend Analysis

Sustainability Initiatives

- In the fine chemicals market, sustainability initiatives are increasingly shaping industry trends as companies strive to reduce their environmental impact and adhere to stricter regulatory requirements. The growing emphasis on sustainable practices is driving innovations in green chemistry, which focuses on developing processes and products that minimize waste and reduce the use of hazardous substances.

- This shift not only aligns with global environmental goals but also responds to the rising consumer demand for eco-friendly products. Companies are investing in research and development to create more efficient and less polluting manufacturing processes, which is becoming a competitive differentiator in the market.

- Furthermore, sustainability initiatives in the fine chemicals sector are fostering collaborations across the supply chain to enhance transparency and traceability. By adopting circular economy principles, firms are working towards improving resource efficiency and reducing reliance on non-renewable resources.

- This includes the implementation of recycling programs, the use of renewable energy sources, and the development of biodegradable products. As a result, the market is seeing a surge in the adoption of sustainable practices, which is expected to drive long-term growth and resilience in the fine chemicals industry, while meeting both regulatory demands and consumer expectations.

Customization and Specialization

- The fine chemicals market is currently experiencing a significant trend of increased specialization and customization, which is being driven by the increasing demand for high-quality, customized chemical solutions and the evolving industrial requirements.

- Fine chemical manufacturers are responding to the demand for more precise and effective components in industries such as pharmaceuticals, agrochemicals, and electronics by providing highly specialized products. This customization is intended to improve the efficacy and efficiency of a variety of applications, in addition to satisfying specific customer needs. Companies are investing in advanced technologies and processes to develop customized chemical solutions that address the unique requirements of niche markets and intricate consumer requirements.

- Furthermore, the fine chemicals market's transition to specialization and customization is complemented by an emphasis on environmental impact and sustainability. Manufacturers are integrating sustainable technologies and processes into their production lines as there is an increase in consumer expectations and regulatory pressures regarding eco-friendly practices.

- This trend is fostering innovation in the development of fine compounds that are not only customized for specific applications but also produced in a more sustainable manner. The future of the fine chemicals market is being influenced by the combination of environmentally conscious practices and specialized offerings, resulting in more dynamic and responsive industry standards.

Fine Chemicals Market Segment Analysis:

Fine Chemicals Market Segmented on the basis of By Type and By Application

By Type, Pesticide segment is expected to dominate the market during the forecast period

- Pesticides, medications, vitamins, and other specialty chemicals are some of the categories that make up the fine chemicals market. Drugs are a substantial segment, as they are essential for the development of novel medications and pharmaceutical applications. The increasing prevalence of chronic diseases and an aging population, along with the ongoing progress in drug research and development, influence the demand for fine chemicals in this sector.

- Vitamins are an additional critical category that is indispensable for the development of dietary supplements and nutrition. The growing awareness of health and wellness is driving the demand for high-quality vitamins, contributing to the expansion of this segment in the fine chemicals market.

- Pesticides play a crucial role in agricultural applications, protecting crops from pests and diseases. The increasing emphasis on agricultural productivity and the necessity for effective pest management solutions are driving the demand for fine chemicals in this category.

- The fine chemicals market also encompasses a diverse array of specialty chemicals such as additives, solvents, and intermediates. Various industrial and consumer applications employ these chemicals. This category caters to diverse sectors like electronics, automotive, and manufacturing. In general, the fine chemicals market is experiencing robust development as a result of increasing demand across various industries, increased consumer awareness, and technological advancements.

By Application, Pharmaceutical segment held the largest share in 2024

- The fine chemicals market is expanding rapidly in a variety of sectors, such as pharmaceuticals, food and beverage, agriculture, and industrial additives. Fine chemicals are essential for the synthesis of active pharmaceutical ingredients (APIs) and intermediates in the pharmaceutical industry, which improves drug development and production.

- Their function in food and beverage applications is to serve as flavorings, preservatives, and colorants, thereby ensuring the safety of the product and extending its expiration life. The agricultural sector benefits from the use of fine chemicals as pesticides, herbicides, and fertilizers, which enhances the quality and yield of crops. Moreover, industries like electronics, textiles, and automotive utilize fine compounds as industrial additives to enhance the performance of their products.

- Innovations are driving new applications and solutions, further segmenting the market as the demand for high-quality, specialized fine chemicals rises. Ongoing advancements in manufacturing technologies and the growing emphasis on sustainable practices are shaping the market dynamics.

- In order to generate more eco-friendly and efficient products, organizations are allocating resources to research and development. This trend is notably apparent in the pharmaceutical and agriculture sectors, where there is a substantial emphasis on green chemistry and the reduction of environmental impact. These technological advancements and the increasing demand for fine chemicals in a variety of industrial applications are the primary drivers of the market's expansion.

Fine Chemicals Market Regional Insights:

North America is Dominating the Fine Chemicals Market

- The fine chemicals market in North America is experiencing substantial dominance, driven by a combination of advanced technological capabilities and a robust industrial infrastructure. The region's leadership is largely attributed to its strong pharmaceutical, biotechnology, and specialty chemicals sectors, which heavily rely on fine chemicals for the production of high-value, complex products.

- The presence of leading chemical manufacturers and a highly skilled workforce further bolster North America's competitive edge in this market. Additionally, the increasing demand for customized solutions and the emphasis on research and development contribute to the growth and dominance of the fine chemicals sector in this region.

- In contrast, the global fine chemicals market is witnessing significant growth across various regions, fueled by the expanding applications in pharmaceuticals, agrochemicals, and electronics. As industries worldwide seek more specialized and high-quality chemical solutions, the market is becoming increasingly diversified.

- While North America maintains a leading position, other regions, particularly Asia-Pacific and Europe, are also experiencing notable growth due to rising industrialization and technological advancements. This global expansion underscores the growing importance of fine chemicals across multiple sectors and highlights the dynamic nature of the market.

Active Key Players in the Fine Chemicals Market

- Syntor Fine Chemicals (U.K.)

- Pfizer Inc (U.S.)

- Chemada Fine Chemicals (Israel)

- GlaxoSmithKline plc (U.K.)

- Lonza (Switzerland), and Other Active Players

|

Global Fine Chemicals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1492.33 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8% |

Market Size in 2032: |

USD 2526.01 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fine Chemicals Market by Type (2018-2032)

4.1 Fine Chemicals Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Drug

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Vitamin

4.5 Pesticide

4.6 Others

Chapter 5: Fine Chemicals Market by Application (2018-2032)

5.1 Fine Chemicals Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pharmaceutical

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food & Beverage

5.5 Agriculture

5.6 Industrial Additive

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Fine Chemicals Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AKORN INCORPORATED (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 PFIZER INC. (US)

6.4 GLAXOSMITHKLINE PLC (UK)

6.5 NOVARTIS AG (SWITZERLAND)

6.6 MYLAN N.V. (US)

6.7 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

6.8 SANOFI (FRANCE)

6.9 BOEHRINGER INGELHEIM INTERNATIONAL GMBH. (GERMANY)

6.10 ASTRAZENECA (UK)

6.11 JOHNSON & JOHNSON PRIVATE LIMITED (US)

6.12 BAYER AG (GERMANY)

6.13 MERCK & COINC. (US)

6.14 PRESTIGE CONSUMER HEALTHCARE INC. (US)

6.15 F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

6.16 BRISTOL-MYERS SQUIBB COMPANY (US)

6.17 ALMIRALL

6.18 S.A (SPAIN)

6.19 ZENOMED HEALTHCARE PRIVATE LIMITED (INDIA)

6.20 CADILA PHARMACEUTICALS (INDIA)

6.21 ASTELLAS PHARMA INC. (JAPAN)

6.22 ELI LILLY AND COMPANY (US)

6.23

Chapter 7: Global Fine Chemicals Market By Region

7.1 Overview

7.2. North America Fine Chemicals Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Drug

7.2.4.2 Vitamin

7.2.4.3 Pesticide

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Pharmaceutical

7.2.5.2 Food & Beverage

7.2.5.3 Agriculture

7.2.5.4 Industrial Additive

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Fine Chemicals Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Drug

7.3.4.2 Vitamin

7.3.4.3 Pesticide

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Pharmaceutical

7.3.5.2 Food & Beverage

7.3.5.3 Agriculture

7.3.5.4 Industrial Additive

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Fine Chemicals Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Drug

7.4.4.2 Vitamin

7.4.4.3 Pesticide

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Pharmaceutical

7.4.5.2 Food & Beverage

7.4.5.3 Agriculture

7.4.5.4 Industrial Additive

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Fine Chemicals Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Drug

7.5.4.2 Vitamin

7.5.4.3 Pesticide

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Pharmaceutical

7.5.5.2 Food & Beverage

7.5.5.3 Agriculture

7.5.5.4 Industrial Additive

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Fine Chemicals Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Drug

7.6.4.2 Vitamin

7.6.4.3 Pesticide

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Pharmaceutical

7.6.5.2 Food & Beverage

7.6.5.3 Agriculture

7.6.5.4 Industrial Additive

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Fine Chemicals Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Drug

7.7.4.2 Vitamin

7.7.4.3 Pesticide

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Pharmaceutical

7.7.5.2 Food & Beverage

7.7.5.3 Agriculture

7.7.5.4 Industrial Additive

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Fine Chemicals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1492.33 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8% |

Market Size in 2032: |

USD 2526.01 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||