Feed Phosphate Market Overview

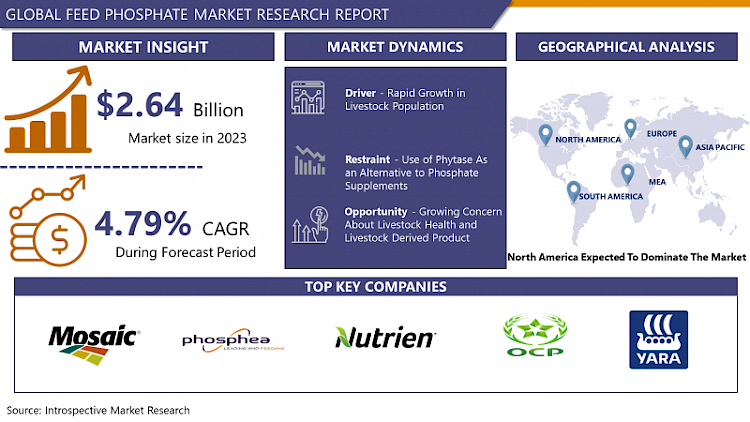

The Global Feed Phosphate Market size is expected to grow from USD 2.64 billion in 2023 to USD 4.02 billion by 2032, at a CAGR of 4.79% during the forecast period (2024-2032).

The global feed phosphate market is experiencing steady growth due to the increasing demand for livestock products worldwide. Feed phosphates are essential for animal growth and are widely used in feed formulations to ensure optimal nutrition levels. Factors such as rising meat consumption, expanding aquaculture industry, and growing awareness about animal health are driving the market growth.

Asia-Pacific region dominates the feed phosphate market, with China being the largest producer and consumer of feed phosphates. The region's booming livestock industry and increasing focus on animal welfare are contributing to the market expansion. Europe and North America are also significant markets for feed phosphates, driven by the high demand for quality meat products and strict regulations on animal feed.

Key players in the global feed phosphate market are focusing on product innovation and strategic partnerships to strengthen their market position. They are investing in research and development activities to introduce advanced feed phosphate products that offer improved efficiency and performance. With the increasing emphasis on sustainable livestock production practices, the demand for eco-friendly feed phosphates is expected to rise in the coming years.

Market Dynamics and Factors in Feed Phosphate Market

Drivers:

Rapid growth in livestock population

The growing population of livestock and poultry farmers is the main driving force for the expansion of the feed phosphate additive market. Moreover, economic losses faced by livestock holders due to poor animal growth subjected to phosphate deficiency are propelling the growth of the market. Additionally, the increase in demand for dairy products across the globe is supporting the market growth. Growing awareness towards the benefits of phosphate additives and the rise in quality of meat products has boosted livestock holders to add phosphate as the main ingredient in animal feed. Moreover, phosphate aids in the digestion process, thus helping the absorbance of other vital minerals and nutrients. Recently, there is a rise in the frequency of disease outbreaks forcing the livestock holders to add phosphate as an additive in animal feed to ensure proper growth and health of livestock. In addition, in certain instances livestock growers are compelled to cull all the animals in the herd if a single animal is found infected with a deadly disease thus, to boost the overall health of animals and to enhance their immunity against infectious diseases livestock growers are increasing the amount of phosphate in animal feed, therefore accelerating the development of the market during the forecast period.

Restraints:

Use of phytase as an alternative to phosphate supplements

The rising prices of the raw material required for phosphate production and global scarcity of phosphate reserves are some of the factors that are restraining the growth of the market in the forecast period. Moreover, the use of alternatives such as phytase in animal feed additives fulfills performances of phosphates like bone growth, elevating digestion process, the absorbance of calcium, amino acids, and utilization of energy thus hampering the growth of the market. Further, phytase encourages higher feed intake than the traditional use of phosphate additives, which eventually leads to better performance of livestock. Moreover, inflexible government rules and regulations on the rearing of animals are hampering the growth of the market. Vendors have to meet various regulatory standards which result in a slow and expensive production process thus, hindering the market growth.

Opportunities:

Growing concern about livestock health and livestock derived product

Livestock holders are paying keen attention to increasing yields from livestock as this is going to economically benefit them. The ever-growing demand for dairy and meat products and to meet this rising demand, animal nutrition plays an important role. Moreover, vulnerability to various diseases due to incompetent fodder is opening doors for feed phosphate market players to launch their phosphate-rich animal feed to recompensate the nutrition loss. Several methods can be applied for phosphorous recoveries like crystallization, biological phosphorous removal, chemical precipitation, and wet chemical process using fly ash. Recently, many innovations have been made on the phosphate recovery process thus, providing ample opportunities for the market players to invest in the research and development programs to tackle the depleting sources of phosphate.

Challenges:

Uninterrupted supply of good quality phosphate feed

Enhancing animal feed and assuring a continuous supply of good quality phosphate feed for livestock holders is the biggest challenge for market players. Moreover, strict quality control should be there to assure the right concentration of phosphate is provided to livestock. A high concentration of phosphate in feed can cause toxicity posing a threat to animal health and leading to mortality. High intake of phosphate can even alter the absorption process of calcium and magnesium resulting in reduced intake of feed and a gradual decrease in milk yield of cattle.

Market Segmentation

- The Dicalcium Phosphate (DCP), segment is expected to have the highest share of the feed phosphate market in the forecast period. For the health and equilibrium of animals, it is essential to maintain an ideal calcium-to-phosphorus ratio. DCP plays a key role in maintaining this equilibrium by offering a calcium-phosphorus supply that is easily absorbed and well-balanced, supporting bone growth, neuron function, and general physiological health. DCP is well known for having a high bioavailability and being effectively absorbed by animals. Its quick absorption in the digestive system, which enables animals to get the most nutrients out of the supplement, has been shown by extensive study. Significant gains in growth rates and overall animal performance result from this increased bioavailability, which reduces waste and increases efficacy.

- DCP is a versatile mineral supplement that is popular among farmers and feed makers due to its adaptability and compatibility with various feed components and processing techniques. It is easy to incorporate into various livestock feed formulas, including those for pigs, poultry, and cattle. DCP's affordability is a significant advantage, as it is less expensive than other options like bone meal or monocalcium phosphate, allowing farmers to feed their animals essential minerals without significantly increasing production costs. DCP's stability and longer shelf life make it an appealing mineral supplement. Its resilience to caking and degradation ensures constant quality in animal meals, minimizing losses and making handling and storage easier for farmers.

Players Covered in Feed Phosphate Market are :

- The Mosaic Company (US)

- Phosphea (France)

- Nutrien Ltd. (Canada)

- OCP Group (Morocco)

- Yara International ASA (Norway)

- EuroChem Group AG (Switzerland)

- PhosAgro (Russia)

- Ecophos Group (Belgium)

- Fosfitalia Group (Italy)

- J. R. Simplot Company (US)

- Quimpac S.A. (Peru)

- Sichuan Lomon Corporation (China)

- Sinochem Yunlong Co. Ltd. (China)

- Wengfu Group (China)

- Rotem Turkey (Turkey) and other major players.

Regional Analysis of Feed Phosphate Market:

Asia-Pacific Dominates the Market

The Asia-Pacific region holds a dominant position in the feed phosphate market, accounting for a significant share of global consumption. With a growing population and rising demand for meat products, countries in this region have witnessed a surge in the use of feed phosphates for animal nutrition. China, India, and Japan are among the major players in the market, driven by their large livestock industries and increasing focus on food security. Moreover, advancements in feed phosphate production technologies and the presence of key manufacturers in countries like China have further strengthened the region's market position. The Asia-Pacific market is characterized by intense competition, with players striving to introduce innovative products and cater to the evolving needs of the animal feed industry. Additionally, favorable government initiatives and policies supporting sustainable agriculture practices are expected to drive continued growth in the feed phosphate market across the Asia-Pacific region.

Key Industry Developments in Feed Phosphate Market

- In May 2023, OCP Group, a well-known worldwide supplier of phosphate-based plant and animal nutrition solutions, and Fertinagro Biotech S.L., a significant fertilizer manufacturer in Spain, completed the acquisition of Global Feed S.L. With this purchase, OCP can further strengthen its position as a leading player in the market and further solidify its devotion to developing a strong presence in the animal nutrition sector.

- In April 2022, PHOSPHEA launched HumIPHORA, a new phosphate innovation. This calcium humophosphate, listed in the European Animal Feed Phosphea, provides high-quality phosphorus and improves the use of plant-based phosphorus. Its chelation properties reduce phosphate incorporation in formulas, making it a more effective alternative to conventional sources.

- In April 2024, The Mosaic Company (NYSE: MOS) has agreed to sell its 25% stake in the Ma’aden Wa’ad Al Shamal Phosphate Company to the Saudi Arabian Mining Company (Ma’aden) for approximately $1.5 billion in Ma’aden shares. The transaction, subject to regulatory and shareholder approvals, is expected to close by the end of 2024. Mosaic, a leading producer of phosphate and potash fertilizers, is represented by Simpson Thacher. Ma’aden is the Middle East's largest mining and metals company.

|

Global Feed Phosphate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.79% |

Market Size in 2032: |

USD 4.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By Form

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Feed Phosphate Market by Type

4.1 Feed Phosphate Market Overview Snapshot and Growth Engine

4.2 Feed Phosphate Market Overview

4.3 Monocalcium Phosphate (MCP)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Monocalcium Phosphate (MCP): Grographic Segmentation

4.4 Dicalcium Phosphate (DCP)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Dicalcium Phosphate (DCP): Grographic Segmentation

4.5 Tricalcium Phosphate (TCP)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Tricalcium Phosphate (TCP): Grographic Segmentation

4.6 Mono Dicalcium Phosphate (MDCP)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Mono Dicalcium Phosphate (MDCP): Grographic Segmentation

4.7 Monosodium Phosphate (MSP)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Monosodium Phosphate (MSP): Grographic Segmentation

Chapter 5: Feed Phosphate Market by Application

5.1 Feed Phosphate Market Overview Snapshot and Growth Engine

5.2 Feed Phosphate Market Overview

5.3 Swine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Swine: Grographic Segmentation

5.4 Poultry

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Poultry: Grographic Segmentation

5.5 Ruminants

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Ruminants: Grographic Segmentation

5.6 Aquaculture

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Aquaculture: Grographic Segmentation

Chapter 6: Feed Phosphate Market by Form

6.1 Feed Phosphate Market Overview Snapshot and Growth Engine

6.2 Feed Phosphate Market Overview

6.3 Powder

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Powder: Grographic Segmentation

6.4 Granule

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Granule: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Feed Phosphate Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Feed Phosphate Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Feed Phosphate Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 THE MOSAIC COMPANY (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 PHOSPHEA (FRANCE)

7.4 NUTRIEN LTD. (CANADA)

7.5 OCP GROUP (MOROCCO)

7.6 YARA INTERNATIONAL ASA (NORWAY)

7.7 EUROCHEM GROUP AG (SWITZERLAND)

7.8 PHOSAGRO (RUSSIA)

7.9 ECOPHOS GROUP (BELGIUM)

7.10 FOSFITALIA GROUP (ITALY)

7.11 J. R. SIMPLOT COMPANY (US)

7.12 QUIMPAC S.A. (PERU)

7.13 SICHUAN LOMON CORPORATION (CHINA)

7.14 SINOCHEM YUNLONG CO.

7.15 LTD. (CHINA)

7.16 WENGFU GROUP (CHINA)

7.17 ROTEM TURKEY (TURKEY)

Chapter 8: Global Feed Phosphate Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Monocalcium Phosphate (MCP)

8.2.2 Dicalcium Phosphate (DCP)

8.2.3 Tricalcium Phosphate (TCP)

8.2.4 Mono Dicalcium Phosphate (MDCP)

8.2.5 Monosodium Phosphate (MSP)

8.3 Historic and Forecasted Market Size By Application

8.3.1 Swine

8.3.2 Poultry

8.3.3 Ruminants

8.3.4 Aquaculture

8.4 Historic and Forecasted Market Size By Form

8.4.1 Powder

8.4.2 Granule

Chapter 9: North America Feed Phosphate Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Monocalcium Phosphate (MCP)

9.4.2 Dicalcium Phosphate (DCP)

9.4.3 Tricalcium Phosphate (TCP)

9.4.4 Mono Dicalcium Phosphate (MDCP)

9.4.5 Monosodium Phosphate (MSP)

9.5 Historic and Forecasted Market Size By Application

9.5.1 Swine

9.5.2 Poultry

9.5.3 Ruminants

9.5.4 Aquaculture

9.6 Historic and Forecasted Market Size By Form

9.6.1 Powder

9.6.2 Granule

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Feed Phosphate Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Monocalcium Phosphate (MCP)

10.4.2 Dicalcium Phosphate (DCP)

10.4.3 Tricalcium Phosphate (TCP)

10.4.4 Mono Dicalcium Phosphate (MDCP)

10.4.5 Monosodium Phosphate (MSP)

10.5 Historic and Forecasted Market Size By Application

10.5.1 Swine

10.5.2 Poultry

10.5.3 Ruminants

10.5.4 Aquaculture

10.6 Historic and Forecasted Market Size By Form

10.6.1 Powder

10.6.2 Granule

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Feed Phosphate Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Monocalcium Phosphate (MCP)

11.4.2 Dicalcium Phosphate (DCP)

11.4.3 Tricalcium Phosphate (TCP)

11.4.4 Mono Dicalcium Phosphate (MDCP)

11.4.5 Monosodium Phosphate (MSP)

11.5 Historic and Forecasted Market Size By Application

11.5.1 Swine

11.5.2 Poultry

11.5.3 Ruminants

11.5.4 Aquaculture

11.6 Historic and Forecasted Market Size By Form

11.6.1 Powder

11.6.2 Granule

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Feed Phosphate Market Analysis, Insights and Forecast,2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Monocalcium Phosphate (MCP)

12.4.2 Dicalcium Phosphate (DCP)

12.4.3 Tricalcium Phosphate (TCP)

12.4.4 Mono Dicalcium Phosphate (MDCP)

12.4.5 Monosodium Phosphate (MSP)

12.5 Historic and Forecasted Market Size By Application

12.5.1 Swine

12.5.2 Poultry

12.5.3 Ruminants

12.5.4 Aquaculture

12.6 Historic and Forecasted Market Size By Form

12.6.1 Powder

12.6.2 Granule

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Feed Phosphate Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Monocalcium Phosphate (MCP)

13.4.2 Dicalcium Phosphate (DCP)

13.4.3 Tricalcium Phosphate (TCP)

13.4.4 Mono Dicalcium Phosphate (MDCP)

13.4.5 Monosodium Phosphate (MSP)

13.5 Historic and Forecasted Market Size By Application

13.5.1 Swine

13.5.2 Poultry

13.5.3 Ruminants

13.5.4 Aquaculture

13.6 Historic and Forecasted Market Size By Form

13.6.1 Powder

13.6.2 Granule

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Feed Phosphate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.79% |

Market Size in 2032: |

USD 4.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FEED PHOSPHATE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FEED PHOSPHATE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FEED PHOSPHATE MARKET COMPETITIVE RIVALRY

TABLE 005. FEED PHOSPHATE MARKET THREAT OF NEW ENTRANTS

TABLE 006. FEED PHOSPHATE MARKET THREAT OF SUBSTITUTES

TABLE 007. FEED PHOSPHATE MARKET BY TYPE

TABLE 008. MONOCALCIUM PHOSPHATE (MCP) MARKET OVERVIEW (2016-2028)

TABLE 009. DICALCIUM PHOSPHATE (DCP) MARKET OVERVIEW (2016-2028)

TABLE 010. TRICALCIUM PHOSPHATE (TCP) MARKET OVERVIEW (2016-2028)

TABLE 011. MONO DICALCIUM PHOSPHATE (MDCP) MARKET OVERVIEW (2016-2028)

TABLE 012. MONOSODIUM PHOSPHATE (MSP) MARKET OVERVIEW (2016-2028)

TABLE 013. FEED PHOSPHATE MARKET BY APPLICATION

TABLE 014. SWINE MARKET OVERVIEW (2016-2028)

TABLE 015. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 016. RUMINANTS MARKET OVERVIEW (2016-2028)

TABLE 017. AQUACULTURE MARKET OVERVIEW (2016-2028)

TABLE 018. FEED PHOSPHATE MARKET BY FORM

TABLE 019. POWDER MARKET OVERVIEW (2016-2028)

TABLE 020. GRANULE MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA FEED PHOSPHATE MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA FEED PHOSPHATE MARKET, BY APPLICATION (2016-2028)

TABLE 023. NORTH AMERICA FEED PHOSPHATE MARKET, BY FORM (2016-2028)

TABLE 024. N FEED PHOSPHATE MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE FEED PHOSPHATE MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE FEED PHOSPHATE MARKET, BY APPLICATION (2016-2028)

TABLE 027. EUROPE FEED PHOSPHATE MARKET, BY FORM (2016-2028)

TABLE 028. FEED PHOSPHATE MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC FEED PHOSPHATE MARKET, BY TYPE (2016-2028)

TABLE 030. ASIA PACIFIC FEED PHOSPHATE MARKET, BY APPLICATION (2016-2028)

TABLE 031. ASIA PACIFIC FEED PHOSPHATE MARKET, BY FORM (2016-2028)

TABLE 032. FEED PHOSPHATE MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA FEED PHOSPHATE MARKET, BY TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA FEED PHOSPHATE MARKET, BY APPLICATION (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA FEED PHOSPHATE MARKET, BY FORM (2016-2028)

TABLE 036. FEED PHOSPHATE MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA FEED PHOSPHATE MARKET, BY TYPE (2016-2028)

TABLE 038. SOUTH AMERICA FEED PHOSPHATE MARKET, BY APPLICATION (2016-2028)

TABLE 039. SOUTH AMERICA FEED PHOSPHATE MARKET, BY FORM (2016-2028)

TABLE 040. FEED PHOSPHATE MARKET, BY COUNTRY (2016-2028)

TABLE 041. THE MOSAIC COMPANY (US): SNAPSHOT

TABLE 042. THE MOSAIC COMPANY (US): BUSINESS PERFORMANCE

TABLE 043. THE MOSAIC COMPANY (US): PRODUCT PORTFOLIO

TABLE 044. THE MOSAIC COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. PHOSPHEA (FRANCE): SNAPSHOT

TABLE 045. PHOSPHEA (FRANCE): BUSINESS PERFORMANCE

TABLE 046. PHOSPHEA (FRANCE): PRODUCT PORTFOLIO

TABLE 047. PHOSPHEA (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. NUTRIEN LTD. (CANADA): SNAPSHOT

TABLE 048. NUTRIEN LTD. (CANADA): BUSINESS PERFORMANCE

TABLE 049. NUTRIEN LTD. (CANADA): PRODUCT PORTFOLIO

TABLE 050. NUTRIEN LTD. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. OCP GROUP (MOROCCO): SNAPSHOT

TABLE 051. OCP GROUP (MOROCCO): BUSINESS PERFORMANCE

TABLE 052. OCP GROUP (MOROCCO): PRODUCT PORTFOLIO

TABLE 053. OCP GROUP (MOROCCO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. YARA INTERNATIONAL ASA (NORWAY): SNAPSHOT

TABLE 054. YARA INTERNATIONAL ASA (NORWAY): BUSINESS PERFORMANCE

TABLE 055. YARA INTERNATIONAL ASA (NORWAY): PRODUCT PORTFOLIO

TABLE 056. YARA INTERNATIONAL ASA (NORWAY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. EUROCHEM GROUP AG (SWITZERLAND): SNAPSHOT

TABLE 057. EUROCHEM GROUP AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 058. EUROCHEM GROUP AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 059. EUROCHEM GROUP AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. PHOSAGRO (RUSSIA): SNAPSHOT

TABLE 060. PHOSAGRO (RUSSIA): BUSINESS PERFORMANCE

TABLE 061. PHOSAGRO (RUSSIA): PRODUCT PORTFOLIO

TABLE 062. PHOSAGRO (RUSSIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ECOPHOS GROUP (BELGIUM): SNAPSHOT

TABLE 063. ECOPHOS GROUP (BELGIUM): BUSINESS PERFORMANCE

TABLE 064. ECOPHOS GROUP (BELGIUM): PRODUCT PORTFOLIO

TABLE 065. ECOPHOS GROUP (BELGIUM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. FOSFITALIA GROUP (ITALY): SNAPSHOT

TABLE 066. FOSFITALIA GROUP (ITALY): BUSINESS PERFORMANCE

TABLE 067. FOSFITALIA GROUP (ITALY): PRODUCT PORTFOLIO

TABLE 068. FOSFITALIA GROUP (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. J. R. SIMPLOT COMPANY (US): SNAPSHOT

TABLE 069. J. R. SIMPLOT COMPANY (US): BUSINESS PERFORMANCE

TABLE 070. J. R. SIMPLOT COMPANY (US): PRODUCT PORTFOLIO

TABLE 071. J. R. SIMPLOT COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. QUIMPAC S.A. (PERU): SNAPSHOT

TABLE 072. QUIMPAC S.A. (PERU): BUSINESS PERFORMANCE

TABLE 073. QUIMPAC S.A. (PERU): PRODUCT PORTFOLIO

TABLE 074. QUIMPAC S.A. (PERU): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SICHUAN LOMON CORPORATION (CHINA): SNAPSHOT

TABLE 075. SICHUAN LOMON CORPORATION (CHINA): BUSINESS PERFORMANCE

TABLE 076. SICHUAN LOMON CORPORATION (CHINA): PRODUCT PORTFOLIO

TABLE 077. SICHUAN LOMON CORPORATION (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. SINOCHEM YUNLONG CO.: SNAPSHOT

TABLE 078. SINOCHEM YUNLONG CO.: BUSINESS PERFORMANCE

TABLE 079. SINOCHEM YUNLONG CO.: PRODUCT PORTFOLIO

TABLE 080. SINOCHEM YUNLONG CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. LTD. (CHINA): SNAPSHOT

TABLE 081. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 082. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 083. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. WENGFU GROUP (CHINA): SNAPSHOT

TABLE 084. WENGFU GROUP (CHINA): BUSINESS PERFORMANCE

TABLE 085. WENGFU GROUP (CHINA): PRODUCT PORTFOLIO

TABLE 086. WENGFU GROUP (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. ROTEM TURKEY (TURKEY): SNAPSHOT

TABLE 087. ROTEM TURKEY (TURKEY): BUSINESS PERFORMANCE

TABLE 088. ROTEM TURKEY (TURKEY): PRODUCT PORTFOLIO

TABLE 089. ROTEM TURKEY (TURKEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FEED PHOSPHATE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FEED PHOSPHATE MARKET OVERVIEW BY TYPE

FIGURE 012. MONOCALCIUM PHOSPHATE (MCP) MARKET OVERVIEW (2016-2028)

FIGURE 013. DICALCIUM PHOSPHATE (DCP) MARKET OVERVIEW (2016-2028)

FIGURE 014. TRICALCIUM PHOSPHATE (TCP) MARKET OVERVIEW (2016-2028)

FIGURE 015. MONO DICALCIUM PHOSPHATE (MDCP) MARKET OVERVIEW (2016-2028)

FIGURE 016. MONOSODIUM PHOSPHATE (MSP) MARKET OVERVIEW (2016-2028)

FIGURE 017. FEED PHOSPHATE MARKET OVERVIEW BY APPLICATION

FIGURE 018. SWINE MARKET OVERVIEW (2016-2028)

FIGURE 019. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 020. RUMINANTS MARKET OVERVIEW (2016-2028)

FIGURE 021. AQUACULTURE MARKET OVERVIEW (2016-2028)

FIGURE 022. FEED PHOSPHATE MARKET OVERVIEW BY FORM

FIGURE 023. POWDER MARKET OVERVIEW (2016-2028)

FIGURE 024. GRANULE MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA FEED PHOSPHATE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE FEED PHOSPHATE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC FEED PHOSPHATE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA FEED PHOSPHATE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA FEED PHOSPHATE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Feed Phosphate Market research report is 2023-2032.

Mosaic Company (US), Phosphea (France), Nutrien Ltd. (Canada), OCP Group (Morocco), Yara International ASA (Norway), EuroChem Group AG (Switzerland), PhosAgro (Russia), Ecophos Group (Belgium), Fosfitalia Group (Italy), J. R. Simplot Company (US), Quimpac S.A. (Peru), Sichuan Lomon Corporation (China), Sinochem Yunlong Co. Ltd. (China), Wengfu Group (China), Rotem Turkey (Turkey) and other major players.

The Feed Phosphate Market is segmented into Type, Form, Application, and region. By Type, the market is categorized into Monocalcium Phosphate (MCP), Dicalcium Phosphate (DCP), Tricalcium Phosphate (TCP), Mono Dicalcium Phosphate (MDP), Monosodium Phosphate (MSP). By Form, the market is categorized into Powder, Granule. By Application, the market is categorized into Swine, Poultry, Ruminants, Aquaculture. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Phosphorous is one of the vital minerals in animal nutrition. After calcium, it is the second most mineral found in the animal body, predominantly in animal teeth and bones. Moreover, phosphorus plays an important role in the development and maintenance of skeletal tissue, maintaining osmotic pressure in body fluids, acid-base balance, energy utilization, protein synthesis, growth of cells, the efficiency of feed utilization, and fertility.

The Global Enterprise Asset Management (EAM) Market size is expected to grow from USD 5.39 billion in 2023 to USD 13.23 billion by 2032, at a CAGR of 10.49% during the forecast period (2024-2032).