Global Animal Feed Enzymes Market Overview

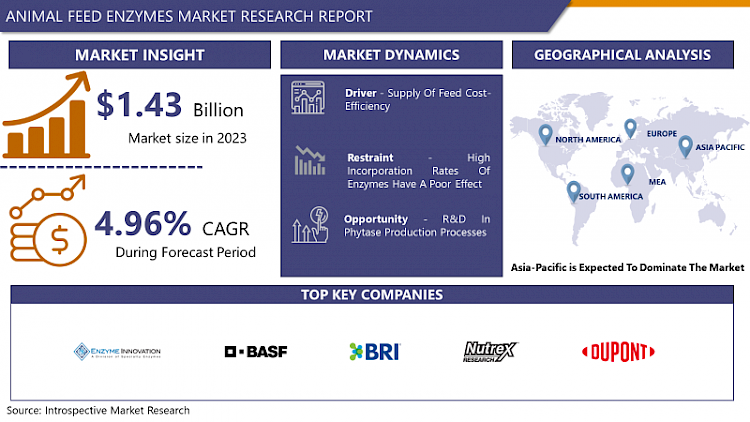

The Global Animal Feed Enzymes market was estimated at USD 1.43 billion in 2023 and is anticipated to reach USD 2.21 billion by 2032, growing at a CAGR of 4.96%.

Enzymes are proteins that aids in the breakdown, and absorption of naturally occurring elements like fiber and phytate in various feed ingredients. Due to the excessive use of synthetic and inorganic fertilizers, the crops are losing their nutritional qualities and some harmful by-products are formed once they are ingested by the livestock. Due to the ongoing crisis, livestock keepers are facing economic challenges because of which the livestock is fed with incompetent fodder. Moreover, this fodder contains harmful elements which hinder the digestion process of the livestock so to compensate certain important enzymes are used which aids the livestock indigestion and this would help the animal feed market to flourish during the forecast period. The cellulase enzyme helps in the digestion of the cellulose polysaccharide and breakdowns the fiber, glucan’s acts on non-starch polysaccharides and breaks down the fiber. Proteases act on the protein components and help in the degradation of the proteins into amino acids which are the essential building blocks for livestock. The rapidly growing livestock sector and the decrease in the productivity of competent fodder are expected to give a boost to the sector.

Furthermore, the enzymes enhance the energy level as well as the rate of metabolism in the livestock which significantly boots the livestock's resistance to diseases. Animal feed is expensive Moreover, only 25% of feed is absorbed by the livestock rest is excreted in the form of waste so to lower the expenditure feed enzymes will play a vital role as it will enhance the uptake of nutrients as well as enhance the nutritional attributes of feed. All these efforts are made to elevate the nutrition quality and to reduce the expenditure on animal feed.

Market Dynamic Factors of The Animal Feed Enzymes Market

Drivers:

Supply Of Feed Cost-Efficiency

Animal feed manufacturing accounts for a major operational cost, which involves 50%–60% of the total cost in animal feed production. Hence, decreasing feed costs per livestock remains a priority for every livestock rearer. The potential to enhance the digestibility of feed depends largely on the nutritional value of the diet itself. It has been shown that feed can record up to 90% of the variance in response to enzyme addition. By boosting digestibility, the nutrient density of diets and production costs can be minimized. Based on the evaluation overall effect of enzymes on the indigestible dietary fraction, feed enzymes are applied to maintain livestock performance, while decreasing feed costs.

Restraints:

High Incorporation Rates Of Enzymes Have A Poor Effect

Even though animal feed enzymes considerably influence the growth of the livestock industry, there are physiological limits foisted by the conditions to enzyme responses in the digestive tract of livestock. High levels of feed enzymes could impact the levels of endogenous enzymes in the gastrointestinal tract, with a poor impact on health. Differentiations in the segments of this effect depend on many factors, such as type of diet, age, and enzyme inclusion rates in feed products. Feed enzymes may set off various side effects, such as diarrhea, vomiting, gas, and swelling of the legs and feet. Additionally, some animals may occurrence allergic reactions to digestive enzymes. For example, Bromelain, the enzyme from pineapple, has anti-platelet properties. If this enzyme is offered to livestock in high quantities along with feed, it could raise the risk of bleeding as play as a blood thinner.

Opportunities:

R&D In Phytase Production Processes

According to the primary research, it is known that some fungi can grow in POME (palm oil mill effluent) and have the capability to manufacture phytase enzymes. The applications of phytase enzymes containing feed products for monogastric and digastric livestock could raise the efficiency of nutrient uptake and livestock resistance to disease attacks. Palm oil mill effluent (POME) is one type of waste that has not been used extensively in enzyme production. Some fungi that grow on POME indicate their capability of manufacturing phytase. The POME is disposed of and contaminates the environment. Apart from this, POME is one of the wastes that hold large concentrations of carbohydrates, proteins, nitrogen compounds, lipids, and minerals. Hence, they also play as remarkable raw material for bioconversion by biotechnological techniques.

Market Segmentation

Segmentation for the Animal Feed Enzymes Market

Based on the Livestock, the swine segment is projected to dominate the market over the forecast period. After poultry, the swine segment holds the maximum share in the market during the forecast period. After all swine livestock is unfit to utilize all components of its diet fully, specific enzymes can be added to the feed to help break down complex carbohydrates, protein, and phytate, through carbohydrase, protease, and phytase. Carbohydrates are the most successful in the feed of starters. The main carbohydrate in the swine diet is glucose, supplied by starch in corn. About 95% of the starch in corn can be digested. Therefore, not all carbohydrates in corn are starch. The more complex carbohydrates are known as fibers and are not well-utilized by pigs.

Based on the Source, the microorganism segment is expected to hold maximum share in the market over the forecast period, due to the higher usage of these sources to extract feed enzymes. Microorganisms remain highly important and suitable hosts to manufacture stable and industrially important feed enzymes. Enzymes obtained from microorganisms are of great importance in the production of animal feed.

Based on Product Type, carbohydrase dominates the market during the projected period. Carbohydrase’s are chosen by most animal feed-produced and livestock producers to be utilized as an enzyme. Hence, the segment is approximated to be the fastest-growing feed enzymes market over the projected period. The incorporation of carbohydrates in the feed caters to many advantages to the livestock. Monogastric animals are typically able to digest around 90% of accessible starch, but carbohydrates support them to boost this percentage. Carbohydrase enzymes are also very effective in growing the amount of energy made available from feed ingredients.

Based on the Form, the dry segment is projected to account for the largest share in the animal feed enzymes market during the forecast period. These products are highly preferred across liquid-based additives due to factors such as ease of handling, good thermal stability during fodder processing operations, and advanced enzyme activity. Dry formulations are accessible in powdered and pellet grades in the global market. This segment is expected to have significant penetration in ruminant and poultry applications over the years ahead.

Regional Analysis for Animal Feed Enzymes Market:

Asia Pacific region is projected to observe the most significant growth for the animal feed enzymes market owing to key socio-economic factors including growing meat consumption in China, India, and other economies in Southeast Asia. Moreover, increasing awareness about livestock diseases has led to the acceptance of safe animal nutrition practices. This factor, in turn, is probably to play a vital role in driving the demand for animal feed additives in the region.

Europe region is expected to witness the highest growth of the animal feed enzymes market after APAC. The major economies such as Spain and Russia are expected to witness significant industry growth during the projected period. Currently, Germany and Spain hold the maximum livestock production sector over the entire of Europe. The presence of a strong customers industry coupled with a properly working distribution network is the major growth supporter. Economies in the eastern part of Europe, including Russia, are expected to portray the fastest reach due to rising livestock production and growing pork consumption.

Players Covered in Animal Feed Enzymes Market are:

- Enzyme Innovation (US)

- BASF SE(Germany)

- Bioresource International Inc. (US)

- Eukaryotic Biologicals Pvt Ltd (India)

- Nutrex BE (Central Florida)

- AB Enzymes GmbH (Germany)

- Koninklijke DSM (Netherlands)

- DuPont (US)

- Chr. Hansen Holding a/s (Denmark)

- Novozymes (Denmark)

- Aum enzymes (India)

- Caprienzymes (India) and Others Major players

Key Industry Development in Animal Feed Enzymes Market

- In January 2023, Novus International completed the acquisition of Agrivida, a biotech company, intending to create new feed additives.

- In March 2024, Novus International was set to bolster its innovation pipeline through the acquisition of US enzyme company BioResource International, BRI's existing product portfolio, Novus, a prominent methionine manufacturer, will assume control of the company's facilities in North Carolina.

|

Global Animal Feed Enzymes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.96% |

Market Size in 2032: |

USD 2.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product

3.2 By Livestock

3.3 By Form

3.4 By Source

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Animal Feed Enzymes Market by Product

4.1 Animal Feed Enzymes Market Overview Snapshot and Growth Engine

4.2 Animal Feed Enzymes Market Overview

4.3 Cellulase

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2017 - 2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cellulase: Grographic Segmentation

4.4 Proteases

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2017 - 2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Proteases: Grographic Segmentation

4.5 Phytases

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2017 - 2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Phytases: Grographic Segmentation

4.6 Alpha-Amylase

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2017 - 2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Alpha-Amylase: Grographic Segmentation

4.7 Carbohydrase

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2017 - 2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Carbohydrase: Grographic Segmentation

4.8 Non-Starch Polysaccharides

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size (2017 - 2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Non-Starch Polysaccharides: Grographic Segmentation

4.9 And Others

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size (2017 - 2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 And Others: Grographic Segmentation

Chapter 5: Animal Feed Enzymes Market by Livestock

5.1 Animal Feed Enzymes Market Overview Snapshot and Growth Engine

5.2 Animal Feed Enzymes Market Overview

5.3 Swine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017 - 2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Swine: Grographic Segmentation

5.4 Poultry

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017 - 2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Poultry: Grographic Segmentation

5.5 Aquaculture

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017 - 2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Aquaculture: Grographic Segmentation

5.6 Sheep's

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2017 - 2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Sheep's: Grographic Segmentation

5.7 Goats

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2017 - 2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Goats: Grographic Segmentation

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2017 - 2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Grographic Segmentation

Chapter 6: Animal Feed Enzymes Market by Form

6.1 Animal Feed Enzymes Market Overview Snapshot and Growth Engine

6.2 Animal Feed Enzymes Market Overview

6.3 Liquid

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017 - 2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Liquid: Grographic Segmentation

6.4 Dry

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017 - 2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Dry: Grographic Segmentation

Chapter 7: Animal Feed Enzymes Market by Source

7.1 Animal Feed Enzymes Market Overview Snapshot and Growth Engine

7.2 Animal Feed Enzymes Market Overview

7.3 Animal

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017 - 2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Animal: Grographic Segmentation

7.4 Microorganisms

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017 - 2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Microorganisms: Grographic Segmentation

7.5 Plant

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017 - 2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Plant: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Animal Feed Enzymes Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Animal Feed Enzymes Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Animal Feed Enzymes Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ENZYME INNOVATION (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 BASF SE(GERMANY)

8.4 BIORESOURCE INTERNATIONAL INC. (US)

8.5 EUKARYOTIC BIOLOGICALS PVT LTD (INDIA)

8.6 NUTREX BE (CENTRAL FLORIDA)

8.7 AB ENZYMES GMBH (GERMANY)

8.8 KONINKLIJKE DSM (NETHERLANDS)

8.9 DUPONT (US)

8.10 CHR. HANSEN HOLDING A/S (DENMARK)

8.11 NOVOZYMES (DENMARK)

8.12 AUM ENZYMES (INDIA)

8.13 CAPRIENZYMES (INDIA)

8.14 OTHERS

Chapter 9: Global Animal Feed Enzymes Market Analysis, Insights and Forecast, 2017 - 2032

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Product

9.2.1 Cellulase

9.2.2 Proteases

9.2.3 Phytases

9.2.4 Alpha-Amylase

9.2.5 Carbohydrase

9.2.6 Non-Starch Polysaccharides

9.2.7 And Others

9.3 Historic and Forecasted Market Size By Livestock

9.3.1 Swine

9.3.2 Poultry

9.3.3 Aquaculture

9.3.4 Sheep's

9.3.5 Goats

9.3.6 Others

9.4 Historic and Forecasted Market Size By Form

9.4.1 Liquid

9.4.2 Dry

9.5 Historic and Forecasted Market Size By Source

9.5.1 Animal

9.5.2 Microorganisms

9.5.3 Plant

Chapter 10: North America Animal Feed Enzymes Market Analysis, Insights and Forecast, 2017 - 2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product

10.4.1 Cellulase

10.4.2 Proteases

10.4.3 Phytases

10.4.4 Alpha-Amylase

10.4.5 Carbohydrase

10.4.6 Non-Starch Polysaccharides

10.4.7 And Others

10.5 Historic and Forecasted Market Size By Livestock

10.5.1 Swine

10.5.2 Poultry

10.5.3 Aquaculture

10.5.4 Sheep's

10.5.5 Goats

10.5.6 Others

10.6 Historic and Forecasted Market Size By Form

10.6.1 Liquid

10.6.2 Dry

10.7 Historic and Forecasted Market Size By Source

10.7.1 Animal

10.7.2 Microorganisms

10.7.3 Plant

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11: Europe Animal Feed Enzymes Market Analysis, Insights and Forecast, 2017 - 2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product

11.4.1 Cellulase

11.4.2 Proteases

11.4.3 Phytases

11.4.4 Alpha-Amylase

11.4.5 Carbohydrase

11.4.6 Non-Starch Polysaccharides

11.4.7 And Others

11.5 Historic and Forecasted Market Size By Livestock

11.5.1 Swine

11.5.2 Poultry

11.5.3 Aquaculture

11.5.4 Sheep's

11.5.5 Goats

11.5.6 Others

11.6 Historic and Forecasted Market Size By Form

11.6.1 Liquid

11.6.2 Dry

11.7 Historic and Forecasted Market Size By Source

11.7.1 Animal

11.7.2 Microorganisms

11.7.3 Plant

11.8 Historic and Forecast Market Size by Country

11.8.1 Germany

11.8.2 U.K.

11.8.3 France

11.8.4 Italy

11.8.5 Russia

11.8.6 Spain

Chapter 12: Asia-Pacific Animal Feed Enzymes Market Analysis, Insights and Forecast, 2017 - 2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product

12.4.1 Cellulase

12.4.2 Proteases

12.4.3 Phytases

12.4.4 Alpha-Amylase

12.4.5 Carbohydrase

12.4.6 Non-Starch Polysaccharides

12.4.7 And Others

12.5 Historic and Forecasted Market Size By Livestock

12.5.1 Swine

12.5.2 Poultry

12.5.3 Aquaculture

12.5.4 Sheep's

12.5.5 Goats

12.5.6 Others

12.6 Historic and Forecasted Market Size By Form

12.6.1 Liquid

12.6.2 Dry

12.7 Historic and Forecasted Market Size By Source

12.7.1 Animal

12.7.2 Microorganisms

12.7.3 Plant

12.8 Historic and Forecast Market Size by Country

12.8.1 China

12.8.2 India

12.8.3 Japan

12.8.4 Southeast Asia

Chapter 13: South America Animal Feed Enzymes Market Analysis, Insights and Forecast, 2017 - 2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product

13.4.1 Cellulase

13.4.2 Proteases

13.4.3 Phytases

13.4.4 Alpha-Amylase

13.4.5 Carbohydrase

13.4.6 Non-Starch Polysaccharides

13.4.7 And Others

13.5 Historic and Forecasted Market Size By Livestock

13.5.1 Swine

13.5.2 Poultry

13.5.3 Aquaculture

13.5.4 Sheep's

13.5.5 Goats

13.5.6 Others

13.6 Historic and Forecasted Market Size By Form

13.6.1 Liquid

13.6.2 Dry

13.7 Historic and Forecasted Market Size By Source

13.7.1 Animal

13.7.2 Microorganisms

13.7.3 Plant

13.8 Historic and Forecast Market Size by Country

13.8.1 Brazil

13.8.2 Argentina

Chapter 14: Middle East & Africa Animal Feed Enzymes Market Analysis, Insights and Forecast, 2017 - 2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product

14.4.1 Cellulase

14.4.2 Proteases

14.4.3 Phytases

14.4.4 Alpha-Amylase

14.4.5 Carbohydrase

14.4.6 Non-Starch Polysaccharides

14.4.7 And Others

14.5 Historic and Forecasted Market Size By Livestock

14.5.1 Swine

14.5.2 Poultry

14.5.3 Aquaculture

14.5.4 Sheep's

14.5.5 Goats

14.5.6 Others

14.6 Historic and Forecasted Market Size By Form

14.6.1 Liquid

14.6.2 Dry

14.7 Historic and Forecasted Market Size By Source

14.7.1 Animal

14.7.2 Microorganisms

14.7.3 Plant

14.8 Historic and Forecast Market Size by Country

14.8.1 Saudi Arabia

14.8.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Animal Feed Enzymes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.96% |

Market Size in 2032: |

USD 2.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ANIMAL FEED ENZYMES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ANIMAL FEED ENZYMES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ANIMAL FEED ENZYMES MARKET COMPETITIVE RIVALRY

TABLE 005. ANIMAL FEED ENZYMES MARKET THREAT OF NEW ENTRANTS

TABLE 006. ANIMAL FEED ENZYMES MARKET THREAT OF SUBSTITUTES

TABLE 007. ANIMAL FEED ENZYMES MARKET BY PRODUCT

TABLE 008. CELLULASE MARKET OVERVIEW (2016-2028)

TABLE 009. PROTEASES MARKET OVERVIEW (2016-2028)

TABLE 010. PHYTASES MARKET OVERVIEW (2016-2028)

TABLE 011. ALPHA-AMYLASE MARKET OVERVIEW (2016-2028)

TABLE 012. CARBOHYDRASE MARKET OVERVIEW (2016-2028)

TABLE 013. NON-STARCH POLYSACCHARIDES MARKET OVERVIEW (2016-2028)

TABLE 014. AND OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. ANIMAL FEED ENZYMES MARKET BY LIVESTOCK

TABLE 016. SWINE MARKET OVERVIEW (2016-2028)

TABLE 017. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 018. AQUACULTURE MARKET OVERVIEW (2016-2028)

TABLE 019. SHEEP'S MARKET OVERVIEW (2016-2028)

TABLE 020. GOATS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. ANIMAL FEED ENZYMES MARKET BY FORM

TABLE 023. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 024. DRY MARKET OVERVIEW (2016-2028)

TABLE 025. ANIMAL FEED ENZYMES MARKET BY SOURCE

TABLE 026. ANIMAL MARKET OVERVIEW (2016-2028)

TABLE 027. MICROORGANISMS MARKET OVERVIEW (2016-2028)

TABLE 028. PLANT MARKET OVERVIEW (2016-2028)

TABLE 029. NORTH AMERICA ANIMAL FEED ENZYMES MARKET, BY PRODUCT (2016-2028)

TABLE 030. NORTH AMERICA ANIMAL FEED ENZYMES MARKET, BY LIVESTOCK (2016-2028)

TABLE 031. NORTH AMERICA ANIMAL FEED ENZYMES MARKET, BY FORM (2016-2028)

TABLE 032. NORTH AMERICA ANIMAL FEED ENZYMES MARKET, BY SOURCE (2016-2028)

TABLE 033. N ANIMAL FEED ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 034. EUROPE ANIMAL FEED ENZYMES MARKET, BY PRODUCT (2016-2028)

TABLE 035. EUROPE ANIMAL FEED ENZYMES MARKET, BY LIVESTOCK (2016-2028)

TABLE 036. EUROPE ANIMAL FEED ENZYMES MARKET, BY FORM (2016-2028)

TABLE 037. EUROPE ANIMAL FEED ENZYMES MARKET, BY SOURCE (2016-2028)

TABLE 038. ANIMAL FEED ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 039. ASIA PACIFIC ANIMAL FEED ENZYMES MARKET, BY PRODUCT (2016-2028)

TABLE 040. ASIA PACIFIC ANIMAL FEED ENZYMES MARKET, BY LIVESTOCK (2016-2028)

TABLE 041. ASIA PACIFIC ANIMAL FEED ENZYMES MARKET, BY FORM (2016-2028)

TABLE 042. ASIA PACIFIC ANIMAL FEED ENZYMES MARKET, BY SOURCE (2016-2028)

TABLE 043. ANIMAL FEED ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA ANIMAL FEED ENZYMES MARKET, BY PRODUCT (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA ANIMAL FEED ENZYMES MARKET, BY LIVESTOCK (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA ANIMAL FEED ENZYMES MARKET, BY FORM (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA ANIMAL FEED ENZYMES MARKET, BY SOURCE (2016-2028)

TABLE 048. ANIMAL FEED ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 049. SOUTH AMERICA ANIMAL FEED ENZYMES MARKET, BY PRODUCT (2016-2028)

TABLE 050. SOUTH AMERICA ANIMAL FEED ENZYMES MARKET, BY LIVESTOCK (2016-2028)

TABLE 051. SOUTH AMERICA ANIMAL FEED ENZYMES MARKET, BY FORM (2016-2028)

TABLE 052. SOUTH AMERICA ANIMAL FEED ENZYMES MARKET, BY SOURCE (2016-2028)

TABLE 053. ANIMAL FEED ENZYMES MARKET, BY COUNTRY (2016-2028)

TABLE 054. ENZYME INNOVATION (US): SNAPSHOT

TABLE 055. ENZYME INNOVATION (US): BUSINESS PERFORMANCE

TABLE 056. ENZYME INNOVATION (US): PRODUCT PORTFOLIO

TABLE 057. ENZYME INNOVATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BASF SE(GERMANY): SNAPSHOT

TABLE 058. BASF SE(GERMANY): BUSINESS PERFORMANCE

TABLE 059. BASF SE(GERMANY): PRODUCT PORTFOLIO

TABLE 060. BASF SE(GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. BIORESOURCE INTERNATIONAL INC. (US): SNAPSHOT

TABLE 061. BIORESOURCE INTERNATIONAL INC. (US): BUSINESS PERFORMANCE

TABLE 062. BIORESOURCE INTERNATIONAL INC. (US): PRODUCT PORTFOLIO

TABLE 063. BIORESOURCE INTERNATIONAL INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. EUKARYOTIC BIOLOGICALS PVT LTD (INDIA): SNAPSHOT

TABLE 064. EUKARYOTIC BIOLOGICALS PVT LTD (INDIA): BUSINESS PERFORMANCE

TABLE 065. EUKARYOTIC BIOLOGICALS PVT LTD (INDIA): PRODUCT PORTFOLIO

TABLE 066. EUKARYOTIC BIOLOGICALS PVT LTD (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. NUTREX BE (CENTRAL FLORIDA): SNAPSHOT

TABLE 067. NUTREX BE (CENTRAL FLORIDA): BUSINESS PERFORMANCE

TABLE 068. NUTREX BE (CENTRAL FLORIDA): PRODUCT PORTFOLIO

TABLE 069. NUTREX BE (CENTRAL FLORIDA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. AB ENZYMES GMBH (GERMANY): SNAPSHOT

TABLE 070. AB ENZYMES GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 071. AB ENZYMES GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 072. AB ENZYMES GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. KONINKLIJKE DSM (NETHERLANDS): SNAPSHOT

TABLE 073. KONINKLIJKE DSM (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 074. KONINKLIJKE DSM (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 075. KONINKLIJKE DSM (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. DUPONT (US): SNAPSHOT

TABLE 076. DUPONT (US): BUSINESS PERFORMANCE

TABLE 077. DUPONT (US): PRODUCT PORTFOLIO

TABLE 078. DUPONT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. CHR. HANSEN HOLDING A/S (DENMARK): SNAPSHOT

TABLE 079. CHR. HANSEN HOLDING A/S (DENMARK): BUSINESS PERFORMANCE

TABLE 080. CHR. HANSEN HOLDING A/S (DENMARK): PRODUCT PORTFOLIO

TABLE 081. CHR. HANSEN HOLDING A/S (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. NOVOZYMES (DENMARK): SNAPSHOT

TABLE 082. NOVOZYMES (DENMARK): BUSINESS PERFORMANCE

TABLE 083. NOVOZYMES (DENMARK): PRODUCT PORTFOLIO

TABLE 084. NOVOZYMES (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. AUM ENZYMES (INDIA): SNAPSHOT

TABLE 085. AUM ENZYMES (INDIA): BUSINESS PERFORMANCE

TABLE 086. AUM ENZYMES (INDIA): PRODUCT PORTFOLIO

TABLE 087. AUM ENZYMES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. CAPRIENZYMES (INDIA): SNAPSHOT

TABLE 088. CAPRIENZYMES (INDIA): BUSINESS PERFORMANCE

TABLE 089. CAPRIENZYMES (INDIA): PRODUCT PORTFOLIO

TABLE 090. CAPRIENZYMES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OTHERS: SNAPSHOT

TABLE 091. OTHERS: BUSINESS PERFORMANCE

TABLE 092. OTHERS: PRODUCT PORTFOLIO

TABLE 093. OTHERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ANIMAL FEED ENZYMES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ANIMAL FEED ENZYMES MARKET OVERVIEW BY PRODUCT

FIGURE 012. CELLULASE MARKET OVERVIEW (2016-2028)

FIGURE 013. PROTEASES MARKET OVERVIEW (2016-2028)

FIGURE 014. PHYTASES MARKET OVERVIEW (2016-2028)

FIGURE 015. ALPHA-AMYLASE MARKET OVERVIEW (2016-2028)

FIGURE 016. CARBOHYDRASE MARKET OVERVIEW (2016-2028)

FIGURE 017. NON-STARCH POLYSACCHARIDES MARKET OVERVIEW (2016-2028)

FIGURE 018. AND OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. ANIMAL FEED ENZYMES MARKET OVERVIEW BY LIVESTOCK

FIGURE 020. SWINE MARKET OVERVIEW (2016-2028)

FIGURE 021. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 022. AQUACULTURE MARKET OVERVIEW (2016-2028)

FIGURE 023. SHEEP'S MARKET OVERVIEW (2016-2028)

FIGURE 024. GOATS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. ANIMAL FEED ENZYMES MARKET OVERVIEW BY FORM

FIGURE 027. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 028. DRY MARKET OVERVIEW (2016-2028)

FIGURE 029. ANIMAL FEED ENZYMES MARKET OVERVIEW BY SOURCE

FIGURE 030. ANIMAL MARKET OVERVIEW (2016-2028)

FIGURE 031. MICROORGANISMS MARKET OVERVIEW (2016-2028)

FIGURE 032. PLANT MARKET OVERVIEW (2016-2028)

FIGURE 033. NORTH AMERICA ANIMAL FEED ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. EUROPE ANIMAL FEED ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. ASIA PACIFIC ANIMAL FEED ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. MIDDLE EAST & AFRICA ANIMAL FEED ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. SOUTH AMERICA ANIMAL FEED ENZYMES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Animal Feed Enzymes Market research report is 2024-2032.

Koninklijke DSM N.V., Novozymes, BASF SE, DuPont, Enzyme Innovation, AB Enzymes GmbH, and Other Major Players.

The Animal Feed Enzymes Market is segmented into Type, Source, Form, Livestock, and Region. By Type, the market is categorized into Cellulase, Proteases, Phytases, Alpha-Amylase, Carbohydrase, Non-Starch Polysaccharides, and Others. By Source the market is categorized into Animal, Microorganisms, and Plant. By Form, the market is categorized into Dry, and Liquid. By Livestock, the market is categorized into Swine, Poultry, Aquaculture, Sheep's, Goats, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Enzymes are proteins that aids in the breakdown, and absorption of naturally occurring elements like fiber and phytate in various feed ingredients. Due to the excessive use of synthetic and inorganic fertilizers, the crops are losing their nutritional qualities and some harmful by-products are formed once they are ingested by the livestock. Enzymes enhance the energy level as well as the rate of metabolism in the livestock which significantly boots the livestock's resistance to diseases.

The Global Animal Feed Enzymes market was estimated at USD 1.43 billion in 2023 and is anticipated to reach USD 2.21 billion by 2032, growing at a CAGR of 4.96%.