Fat Replacers, Salt Reducers, And Replacers Market Synopsis

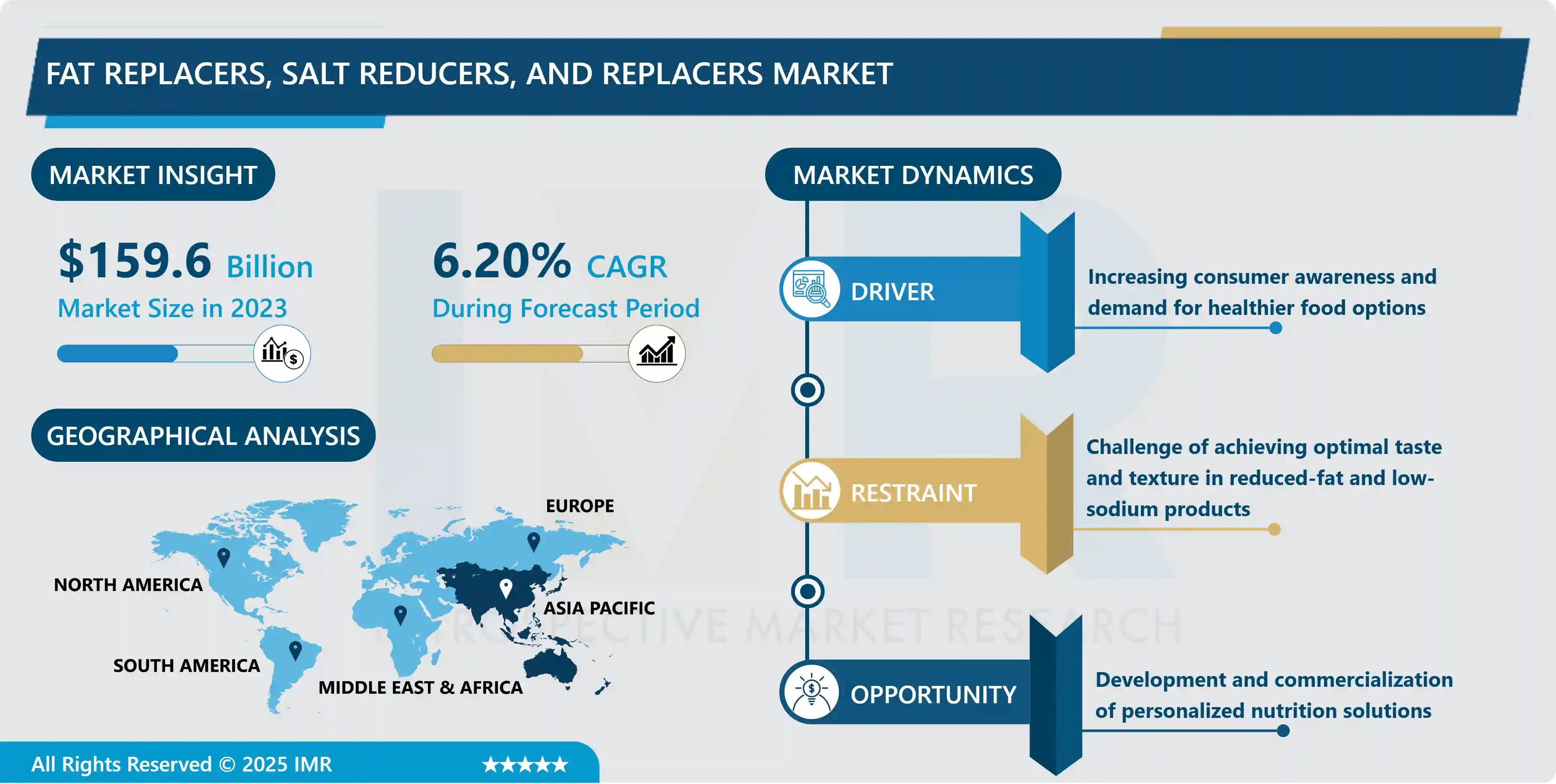

Fat Replacers, Salt Reducers, And Replacers Market Size Was Valued at USD 3.24 Billion in 2023, and is Projected to Reach USD 5.71 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.

Fat replacers, salt reducers and replacers are wide ranging commodity and ingredients which help manufacturers to replace fats and salts in foods by providing similar taste, texture and caloric value but with fewer calories and sodium. It is driven by the retiring demographics desiring or wanting to shift away from low-quality, unhealthy food products. Fat replacers are available in protein based systems, carbohydrate based systems and fat based systems but all of them give the similar mouth feel and stability as of fats. Substitutes include comprising potassium chloride, sea salt and flavor boosters whose role is to ensure that they offer the required salty feel while being relatively less containing sodium. This market is very crucial to the food manufacturers so that they can address the heath requirements and other regulations that are being put in place to control obesity and cardiovascular ailments.

The market of fat substitutes/functional food ingredient and salt substitutes is growing due to the consumer demand of healthier products and struggling governments and food manufacturers trying to reduce the calorie and sodium intake in their foods. They explained that fat replacers can be categorized into protein based (whey protein and soy protein) carbohydrate based (starches and fibers) and fat based (emusifiers and lipid analogs) and are used in just about any food product including baked goods and dairy products. Such products offer the signal and role of fat in terms of textural/mouthfeel properties and stability at a fraction of the energy value. And with the growing awareness of health implications of increased fat consumption especially saturated and trans fat, the market for fat REPLACERS is steadily growing.

Likewise, there is increasing a market for salt reducers and replacers owing to initiatives by food producers who are looking for ways to counter a looming global health problem of high salt consumption, reportedly felt to have connection with hypertension and cardiovascular diseases. Some examples of these products are the mineral salts like potassium chloride for partially replacing sodium chloride and high and lowP?i author’s check: Some examples of such products are the mineral salts for the partial replacement of sodium chloride to potassium chloride, the flavor enhancers and natural extracts which help to maintain the necessary taste of the low-sodium products. A new wave of food processing technology and availability of natural and synthetic ingredients which have the ability to reduce the salt content in food and still maintain flavors that are suitable in the diet has enhanced the production of foods that meet consumer health demands. It is therefore evident that the fat and salt replacers markets will continue to grow in unison through large demand for healthier foods and high regulatory measures demanded from the foods to be produced.

Fat Replacers, Salt Reducers, And Replacers Market Trend Analysis

Increasing use of plant-based and natural ingredients

- The current trends seen in the fat replacers, salt reducers and replacer market includes the incorporation of plant derived and natural products. The market trend of the clean label has been rapidly rising as consumers are becoming more concerned with products made of natural and minimally processed ingredients with no added chemicals. It is mainly attributed to the developing concern and appreciation of the connection between healthy living and plant-based diets and more so the option for vegetarian products, organic foods, and animal-friendly nutritious food.

- For that reason, food manufacturers have been looking for novel plant-based sources for fats and salts replacers such as the legumes, oats, seaweeds, and even the derived fruit extracts. These natural additives are also beloved by modern consumers focused on maintaining a healthy lifestyle and also beneficial for the product’s sensory attributes and nutritional characteristics of the final delicacies. Such tendencies for natural and plant products are becoming more and more popular and define the further advancement of new healthy foods.

Development and commercialization of personalized nutrition solutions

- Another upcoming trend in fat replacers, salt reducers, and replacers is that ready opportunities are being sought for in product segmentation of customized nutrition. As more research is conducted on the individual and dietary health and with the progression of technology, there is an increasing ability to produce tailored food products to correlate with disease states and specific lifestyles. Data analytics, genetic testing and health assessment offers a company an opportunity to explore and identify potential fat and salt replacements that can directly meet the dietary needs of its consumers, for instance low sodium intake for hypertension patients or low cholesterol products for those with high cholesterol content. This directed application is not only suitable to meet the consumers’ demands but also encourages people to be loyal to certain brands and ultimately increases customer satisfaction, putting these companies in a competitive edge among other establishments especially in the line of health and wellness.

Fat Replacers, Salt Reducers, And Replacers Market Segment Analysis:

Fat Replacers, Salt Reducers, And Replacers Market Segmented on the basis of Fat Replacers Type, Salt Reducers and Replacer Type and Application.

By Salt Reducers and Replacer Type, Salt replacers segment is expected to dominate the market during the forecast period

- Out of the total volume demand for salt reducers and salt replacers during the forecast period, the salt replacers segment is expected to outpace the rest due to the growing demand for low sodium products mainly because of health consciousness among consumer regarding high consumption of sodium. Potassium chloride, calcium chloride, and magnesium sulfate are becoming more popular, as products possessing the same taste as conventional table salt but without undesirable consequences for human health. The rise of hypertension and cardiovascular diseases has led to consumer pressure, and regulatory reformative actions that encourage low-sodium diets, which in turn drives the use of salt replacers in foods.

- Moreover, technology and new reformulation strategies have continuously improved on the flavor and other qualities of these replacers thus making them more acceptable by the consumers. For this reason, the salt replacers segment is expected to hold the largest share in the market with increasing focus on healthy diets and regulatory policies implemented to control people’s salt intake.

By Application, Foods segment expected to held the largest share

- From the analysis of various segments, the foods segment is also forecasted to take the largest market share in fat replacers, salt reducers, and replacers due to the spanning use of these ingredients with foods products. This segment consists of biscuits and baked products, dairy products, meat and Poultry products, snacks, ready to eat food items where it is a big challenge to keep the taste, texture profile intact and simultaneously wanted to make them more healthy. Namely, there is growing concern for healthy foods among consumers and thus utilizing fat and salt substitutes to lower calorie and sodium content remains vital but does not affect the quality of products produced by manufacturers.

- The penetration of technology in the food processing industry and modification of food components have created food products that imitate the roles of fats and salts required in cooking and use in foods. This innate versatility where it can be applied across different types of foods is one of the major reasons why the foods segment has taken a commanding lead in the market.

Fat Replacers, Salt Reducers, And Replacers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is expected to be the largest market for fat replacers, salt reducers, and replacers during the forecast period due to factors such as change in the proportion of urban inhabitants, increase in awareness regarding health, and growth in the middle-class population. Lifestyle diseases such as obesity, diabetes, hypertensions and other chronic diseases areoccasioning consumers to change their lifestyles and looking for healthier foods meaning more demand for fat and salt reduction products. Furthermore, governments of all nations in the region are stressing more on better health standards and health regulation thus passing policies and projects that encourage proper nutrition hence boosting the market even further. There is also a good prospect of new and distinctive product releases blending with the diverse culture and taste of the region.

- further more, due to increased food and beverage industry coupled with sophisticated food technology and the strong manufacture industry of Asia pacific this makes this region a strong contender in the global fat replacers and salt reducers market. Consequently, it will be apparent that this region will gradually attract number of local and foreign food industry intending to penetrate the growing market share.

Active Key Players in the Fat Replacers, Salt Reducers, And Replacers Market

- Cargill, Incorporated (USA)

- Tate & Lyle PLC (UK)

- Archer Daniels Midland Company (USA)

- Ingredion Incorporated (USA)

- Kerry Group plc (Ireland)

- Koninklijke DSM N.V. (Netherlands)

- Corbion N.V. (Netherlands)

- DuPont Nutrition & Biosciences (USA)

- Givaudan (Switzerland)

- Mitsubishi Corporation Life Sciences Limited (Japan)

- Ashland Global Holdings Inc. (USA)

- BASF SE (Germany)

- FMC Corporation (USA)

- Sensient Technologies Corporation (USA)

- Roquette Frères (France), and Other key Players.

|

Fat Replacers, Salt Reducers, And Replacers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 159.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.2 % |

Market Size in 2032: |

USD 275.0 Bn. |

|

Segments Covered: |

By Fat Replacers Type |

|

|

|

By Salt Reducers and Replacer Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fat Replacers, Salt Reducers, And Replacers Market by Fat Replacers Type (2018-2032)

4.1 Fat Replacers, Salt Reducers, And Replacers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Carbohydrate based fat replacers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Protein based fat replacers

4.5 Fat based fat replacers

Chapter 5: Fat Replacers, Salt Reducers, And Replacers Market by Salt Reducers and Replacer Type (2018-2032)

5.1 Fat Replacers, Salt Reducers, And Replacers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Salt replacers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Salt reducers

5.5 Physical modification of ingredients

Chapter 6: Fat Replacers, Salt Reducers, And Replacers Market by Application (2018-2032)

6.1 Fat Replacers, Salt Reducers, And Replacers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Foods

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Beverages

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fat Replacers, Salt Reducers, And Replacers Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARGILL INCORPORATED (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TATE & LYLE PLC (UK)

7.4 ARCHER DANIELS MIDLAND COMPANY (USA)

7.5 INGREDION INCORPORATED (USA)

7.6 KERRY GROUP PLC (IRELAND)

7.7 KONINKLIJKE DSM N.V. (NETHERLANDS)

7.8 CORBION N.V. (NETHERLANDS)

7.9 DUPONT NUTRITION & BIOSCIENCES (USA)

7.10 GIVAUDAN (SWITZERLAND)

7.11 MITSUBISHI CORPORATION LIFE SCIENCES LIMITED (JAPAN)

7.12 ASHLAND GLOBAL HOLDINGS INC. (USA)

7.13 BASF SE (GERMANY)

7.14 FMC CORPORATION (USA)

7.15 SENSIENT TECHNOLOGIES CORPORATION (USA)

7.16 ROQUETTE FRÈRES (FRANCE)

7.17 ANDOTHER KEY PLAYERS

Chapter 8: Global Fat Replacers, Salt Reducers, And Replacers Market By Region

8.1 Overview

8.2. North America Fat Replacers, Salt Reducers, And Replacers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Fat Replacers Type

8.2.4.1 Carbohydrate based fat replacers

8.2.4.2 Protein based fat replacers

8.2.4.3 Fat based fat replacers

8.2.5 Historic and Forecasted Market Size by Salt Reducers and Replacer Type

8.2.5.1 Salt replacers

8.2.5.2 Salt reducers

8.2.5.3 Physical modification of ingredients

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Foods

8.2.6.2 Beverages

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fat Replacers, Salt Reducers, And Replacers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Fat Replacers Type

8.3.4.1 Carbohydrate based fat replacers

8.3.4.2 Protein based fat replacers

8.3.4.3 Fat based fat replacers

8.3.5 Historic and Forecasted Market Size by Salt Reducers and Replacer Type

8.3.5.1 Salt replacers

8.3.5.2 Salt reducers

8.3.5.3 Physical modification of ingredients

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Foods

8.3.6.2 Beverages

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fat Replacers, Salt Reducers, And Replacers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Fat Replacers Type

8.4.4.1 Carbohydrate based fat replacers

8.4.4.2 Protein based fat replacers

8.4.4.3 Fat based fat replacers

8.4.5 Historic and Forecasted Market Size by Salt Reducers and Replacer Type

8.4.5.1 Salt replacers

8.4.5.2 Salt reducers

8.4.5.3 Physical modification of ingredients

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Foods

8.4.6.2 Beverages

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fat Replacers, Salt Reducers, And Replacers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Fat Replacers Type

8.5.4.1 Carbohydrate based fat replacers

8.5.4.2 Protein based fat replacers

8.5.4.3 Fat based fat replacers

8.5.5 Historic and Forecasted Market Size by Salt Reducers and Replacer Type

8.5.5.1 Salt replacers

8.5.5.2 Salt reducers

8.5.5.3 Physical modification of ingredients

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Foods

8.5.6.2 Beverages

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fat Replacers, Salt Reducers, And Replacers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Fat Replacers Type

8.6.4.1 Carbohydrate based fat replacers

8.6.4.2 Protein based fat replacers

8.6.4.3 Fat based fat replacers

8.6.5 Historic and Forecasted Market Size by Salt Reducers and Replacer Type

8.6.5.1 Salt replacers

8.6.5.2 Salt reducers

8.6.5.3 Physical modification of ingredients

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Foods

8.6.6.2 Beverages

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fat Replacers, Salt Reducers, And Replacers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Fat Replacers Type

8.7.4.1 Carbohydrate based fat replacers

8.7.4.2 Protein based fat replacers

8.7.4.3 Fat based fat replacers

8.7.5 Historic and Forecasted Market Size by Salt Reducers and Replacer Type

8.7.5.1 Salt replacers

8.7.5.2 Salt reducers

8.7.5.3 Physical modification of ingredients

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Foods

8.7.6.2 Beverages

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Fat Replacers, Salt Reducers, And Replacers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 159.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.2 % |

Market Size in 2032: |

USD 275.0 Bn. |

|

Segments Covered: |

By Fat Replacers Type |

|

|

|

By Salt Reducers and Replacer Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||