Event Management Software Market Synopsis

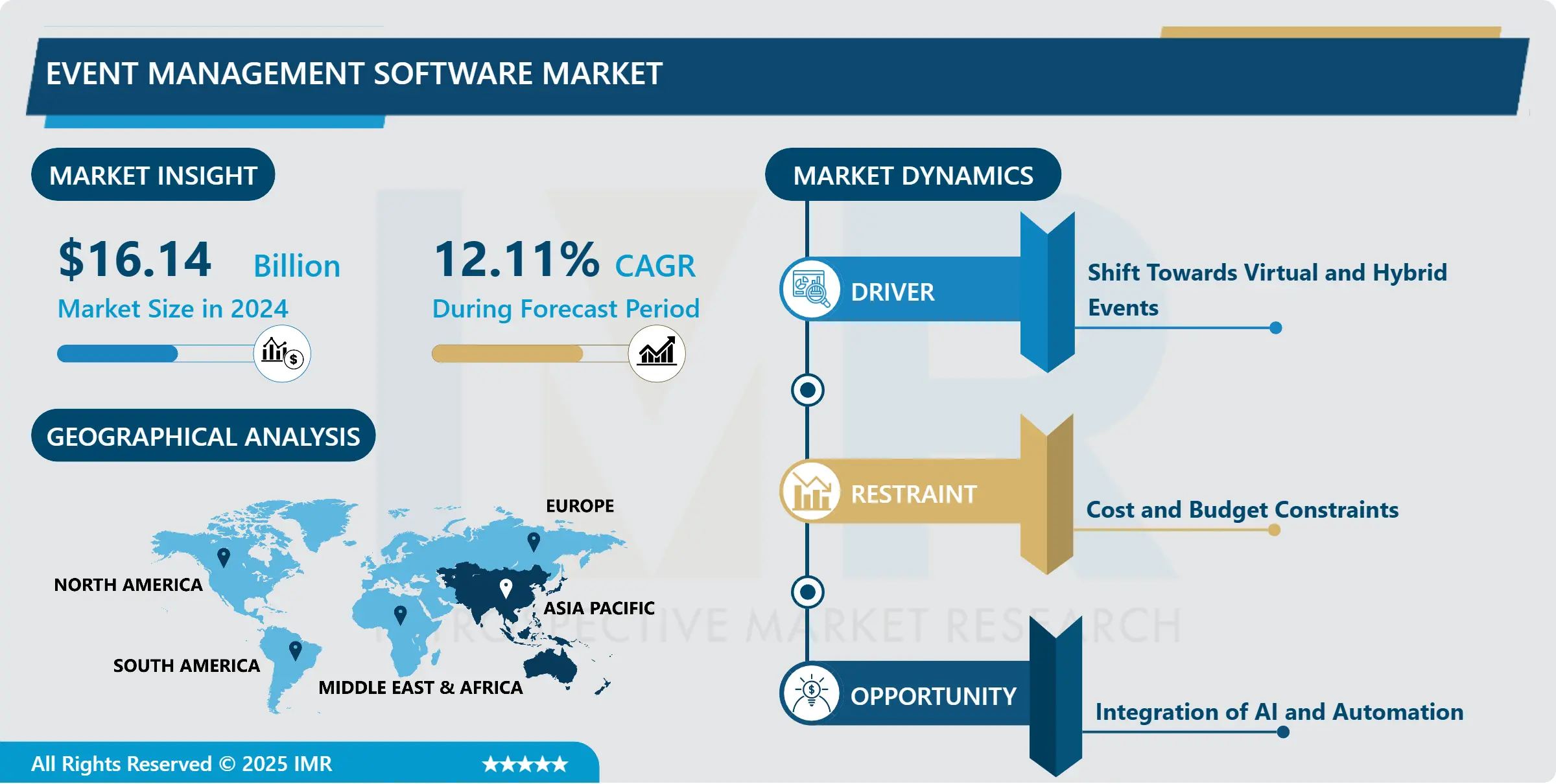

Event Management Software Market Size Was Valued at USD 16.14 Billion in 2024, and is Projected to Reach USD 40.29 Billion by 2032, Growing at a CAGR of 12.11% From 2025-2032.

The sector centered on software solutions intended to simplify and manage several facets of planning conferences, trade exhibits, events, and other meetings is known as the "event management software market Usually, these software systems encompass some of the features such as budgeting, scheduling, ticketing, venues, data analysis, as well as attendee registration. It offers product ideas to enhance its planner’s, organizer’s, and marketer’s efficiency, engagement levels of the attendees, and overall, event management. The market is constituted of multiple software vendors that offer combined systems as well as individual tools to meet the multitude of requirements of event management specialists worldwide and across different fields.

The audience of event management software has increased over the years based on the increasing size and complications involved in events in a diversity of global industries. This increase is driven by the growing need from enterprises to have a one-stop solution for every aspects of event management leaving no option to chance. Some of the software features include; budgeting, scheduling, attendee management, venue management, event registration, and marketing automation.

Another market driver which cannot be overlooked is the fact that, technology is improving at a very high rate. Making services available through the internet instead of local servers or computers, while making computing power much more affordable and flexible, cloud computing has revolutionized the business. Mobile applications have to be a godsent for event organizers and attendees because they have been crucial in flows of communications, engagements and real-time management.

The recent trend toward hybrid and virtual events has further accelerated industry expansion. These forms have become more popular because they may reach a larger audience beyond geographic boundaries, providing flexibility and accessibility at a lower cost than traditional in-person events. To satisfy the changing needs of organizers and participants, event management software has adapted and integrated virtual event capabilities including live streaming, virtual networking, and interactive workshops.

These chatbots can take an opportunity to address real time inquiries regarding registration, event information and technical support in order to allow easy communication and hereby increase guest satisfaction. When managers of events rely on software featuring AI management for events, they may focus on plans for events and content that has to be created since other things, such as appointment of reminders, surveys after an event, and registrations are completed by the software automatically. This automation ensures standardization in event delivery, reduces errors from people and enhances logistics.

Further still, in the process of planning an event, AI predictive analytics allows for relevant data decision-making to be made. Machine learning (ML) algorithms are capable of foretelling future attendance, efficient utilization of resources and discovering event logistical execution discrepancies based on historical and real-time data. Through such a kind of proactive planning, the risks and potential accesses may be minimized and controlled on advance and event outcomes may planned in a better way. AI and its implications on the event management software show a possible scope for the advancement of the rapidly evolving events business.

Event Management Software Market Trend Analysis

Event Management Software Market Growth Drivers- Shift Towards Virtual and Hybrid Events

- The pandemic has accelerated the use of virtual and hybrid events, changing the market for event management software. Organizations looked to digital alternatives to maintain connection, participation, and information sharing when traditional in-person events were unfeasible or prohibited. In response, providers of event management software upgraded their offerings with functions specifically designed for online and hybrid events. These platforms now have strong live streaming features that let participants join from all around the world for keynote addresses, panel discussions, and workshops. Through virtual lounges, chat rooms, and one-on-one video meetings, virtual networking elements imitate face-to-face interactions and encourage connections among participants despite geographical boundaries.

- Furthermore, interactive sessions—which are made possible by sophisticated event management software—have emerged as a key component of virtual and hybrid events. To improve participant participation and involvement, organizers can include tools for audience polling, Q&A sessions, and real-time feedback methods. This change has increased the reach and scalability of meetings that were previously constrained by venue capacities, in addition to democratizing access to events. Moreover, event management software facilitates the smooth integration of several digital platforms and social media channels, hence increasing the visibility and engagement of events. The trend of using advanced event management software for these reasons is anticipated to continue influencing the industry landscape for the foreseeable future as businesses come to understand the advantages of virtual and hybrid formats in terms of accessibility, cost-effectiveness, and environmental benefits.

Event Management Software Market Opportunities- Integration of AI and Automation

- The way that events are planned, carried out, and analyzed is being revolutionized by the substantial advancement of AI and automation integrated into event management software. Personalized experiences can be provided by organizers thanks to AI-powered solutions, which are becoming more and more skilled at comprehending participant preferences and actions. To increase participant happiness and engagement, AI systems, for example, might evaluate attendee data to suggest pertinent courses, speakers, and networking opportunities based on personal preferences. This tailored approach raises the possibility of accomplishing event goals like networking, education, and company development in addition to improving the guest experience.

- Furthermore, AI-powered chatbots are now essential for delivering effective customer service at every stage of an event's lifetime. Inquiries about registration, event information, and technical support can be handled by these chatbots in real time, facilitating easy communication and raising guest satisfaction. Event managers may concentrate more on strategic planning and content production when they use AI-powered event management software, which automates repetitive activities like scheduling reminders, sending post-event surveys, and registering attendees. This automation guarantees consistency in event execution, lowers human error, and increases operational efficiency.

- Moreover, throughout the event planning phase, organizers may make data-driven decisions thanks to AI-powered predictive analytics. Artificial intelligence (AI) algorithms can estimate attendance trends, optimize resource allocation, and pinpoint areas for event logistical improvement by evaluating historical data and real-time insights. With this proactive strategy, organizers may reduce risks, foresee obstacles, and improve overall event outcomes. In the quickly changing events sector, artificial intelligence (AI) and its integration with event management software have the potential to drive innovation, efficiency, and improved attendee experiences.

Event Management Software Market Segment Analysis:

Event Management Software Market Segmented based on By Component, By Deployment, By Enterprise Size and By Application.

By Component, Software segment is expected to dominate the market during the forecast period

- The Software segment within Event Management Software holds the dominant share due to its pivotal role in facilitating virtually every aspect of event organization and management. Fundamentally, event planning software offers strong capabilities for accurately and effectively generating and overseeing event schedules, venue layouts, and logistical details. For event planners in a variety of industries, this feature is essential since it allows them to simplify intricate processes and guarantee smooth task coordination from conception to completion.

- Additionally, software solutions for event management are excellent at managing registrations, including secure payment processing, attendance data management, and configurable registration forms. These features are necessary to process registrations for attendees in an efficient manner, keep accurate records of participants, and enable seamless communication between organizers and attendees. Additionally, by providing interactive elements like event apps, live polling, and networking opportunities, software features created with audience engagement in mind improve the entire experience of the event and encourage attendee satisfaction and loyalty.

- The Software segment's dominance in the event management software market essentially highlights the critical role that this industry plays in enabling event organizers to produce successful events. These software solutions improve organizational workflows and the overall efficacy and impact of events in a variety of sectors, from corporate conferences to sizable exhibitions and community gatherings, by offering comprehensive tools for planning, registration, and attendee engagement. This dominance is the result of ongoing innovation in software features designed to satisfy the changing requirements and standards of both contemporary event organizers and attendees

By Deployment, Cloud-based segment held the largest share in 2024

- In the realm of Event Management Software deployment, the Cloud-based model has risen to prominence as the largest segment, driven by several compelling advantages. Cloud-based solutions offer unparalleled scalability, allowing event organizers to effortlessly scale their infrastructure up or down based on event size and requirements. This flexibility is crucial for handling fluctuating attendee numbers and evolving event dynamics without the constraints of physical hardware limitations. Moreover, the scalability of cloud solutions ensures that organizers can efficiently manage peak loads during registration periods or live event streaming, enhancing overall operational efficiency.

- Another factor that greatly influencs the Market, to have cloud-based deployment type dominant is cost-efficient. This is in contrast to most on-premise implementations where clients have to invest in the hardware and license costs of the software besides annual maintenance costs. This subscription model generally offers software update, the fixed responsibility of software maintenance, and the infrastructure, which decreases the total cost of owning the software. From the cost and investment angle, this unpredictable cost and low initial investment is the key reason why cloud deployments are so appealing to ‘rent’ for organizations especially the smaller and medium enterprises – SMEs – to be able to free up funds and effort to improve event experiences than being bogged down by having to maintain their own IT structures.

- Furthermore, the ease of access associated with cloud deployments significantly enhances operational agility and collaboration among event stakeholders. Event management technologies and available information are also available to the organizers from any internet connection, enabling actual time updates, planning, and cross-functional and cross-attendee communication where any team is dispersed. Apart from enhancing the organizational dynamics, it also provides real-time updated, related engagements for the attendee; thus increasing the effectiveness of the event and hence sustaining the Cloud-based deployment model that ruled the Event Management Software Market..

Event Management Software Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Driven by a number of important factors, Asia Pacific is starting to emerge as a major area in the event management software industry. Sophisticated event management solutions are becoming more and more in demand as nations like China and India experience rapid urbanization. Corporate events, trade shows, conferences, and exhibitions are becoming more and more common in urban areas, which means that effective software tools are needed to handle registrations, logistics, attendee engagement, and post-event analytics. A trend toward more efficient and technologically aware methods is shown in the growing use of digital platforms for event planning and execution, which is propelling the industry forward.

- Additionally, the region's growing internet usage is a major driver of event management software growth. There is a greater demand for seamless digital experiences in event management as more people get access to mobile devices and the internet. Because they may provide cost-effectiveness, scalability, and real-time collaboration, cloud-based platforms are especially preferred. With the help of these platforms, event planners may remotely handle a variety of event-related tasks, including as marketing, ticket sales, attendee management, and live streaming, all of which improve operational effectiveness and guest satisfaction

- In the Asia Pacific market, localized solutions that take into account language and cultural diversity are likewise becoming more and more popular. To improve customer uptake and satisfaction, businesses are increasingly tailoring their software solutions to local preferences, languages, and legal constraints. The need for cutting-edge event management software solutions is anticipated to rise as the region embraces digital transformation in a number of industries, establishing Asia Pacific as a key player in the global market landscape.

Active Key Players in the Event Management Software Market

- Active Network LLC

- Arlo

- Stova

- Bitrix24

- Eventdex.com

- Hopin

- webMOBI

- Whova

- Certain, Inc.

- Cvent, Inc.

- EMS Software LLC

- EventBrite

- Rainfocus

- Ungerboeck

- Zoho Corporation Pvt. Ltd.

- Other Active Players

Key Industry Developments in the Event Management Software Market:

- In April 2023, Cevent, Inc. announced a strategic partnership with Jifflenow, a B2B meeting platform. The partnership is aimed at streamlining bookings of in-person meetings at corporate events and tradeshows for customers of both companies.

- In April 2023, Eventbrite launched RECONVENE Accelerator in 2022, a mentorship and award program, to empower and motivate the next generation of event creators. In addition to the following development, the company introduced a panel of judges to select five winners, who are expected to receive a sum of USD 20 thousand, along with a personal mentorship program from Eventbrite.

- In March 2023, Whova announced that its event registration system is now available in 39 countries, with newly added 16 countries in the list. The following initiative is expected to help Whova in expanding its global reach and serve customers globally.

|

Global Event Management Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.14 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.11 % |

Market Size in 2032: |

USD 40.29 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Event Management Software Market by Component (2018-2032)

4.1 Event Management Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Event Management Software Market by Deployment (2018-2032)

5.1 Event Management Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud-based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-premises

Chapter 6: Event Management Software Market by Enterprise Size (2018-2032)

6.1 Event Management Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium-sized Enterprise

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprise

Chapter 7: Event Management Software Market by Application (2018-2032)

7.1 Event Management Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Event Organizers & Planners

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Corporate

7.5 Government

7.6 Education

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Event Management Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LANDSCAPE.ACTIVE KEY PLAYERS IN THE EVENT MANAGEMENT SOFTWARE MARKET ACTIVE NETWORK LLC

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ARLO

8.4 STOVA

8.5 BITRIX24

8.6 EVENTDEX.COM

8.7 HOPIN

8.8 WEBMOBI

8.9 WHOVA

8.10 CERTAIN INCCVENT INCEMS SOFTWARE LLC

8.11 EVENTBRITE

8.12 RAINFOCUS

8.13 UNGERBOECK

8.14 ZOHO CORPORATION PVT. LTDOTHER KEY PLAYERS

Chapter 9: Global Event Management Software Market By Region

9.1 Overview

9.2. North America Event Management Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Software

9.2.4.2 Services

9.2.5 Historic and Forecasted Market Size by Deployment

9.2.5.1 Cloud-based

9.2.5.2 On-premises

9.2.6 Historic and Forecasted Market Size by Enterprise Size

9.2.6.1 Small and Medium-sized Enterprise

9.2.6.2 Large Enterprise

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Event Organizers & Planners

9.2.7.2 Corporate

9.2.7.3 Government

9.2.7.4 Education

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Event Management Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Software

9.3.4.2 Services

9.3.5 Historic and Forecasted Market Size by Deployment

9.3.5.1 Cloud-based

9.3.5.2 On-premises

9.3.6 Historic and Forecasted Market Size by Enterprise Size

9.3.6.1 Small and Medium-sized Enterprise

9.3.6.2 Large Enterprise

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Event Organizers & Planners

9.3.7.2 Corporate

9.3.7.3 Government

9.3.7.4 Education

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Event Management Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Software

9.4.4.2 Services

9.4.5 Historic and Forecasted Market Size by Deployment

9.4.5.1 Cloud-based

9.4.5.2 On-premises

9.4.6 Historic and Forecasted Market Size by Enterprise Size

9.4.6.1 Small and Medium-sized Enterprise

9.4.6.2 Large Enterprise

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Event Organizers & Planners

9.4.7.2 Corporate

9.4.7.3 Government

9.4.7.4 Education

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Event Management Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Software

9.5.4.2 Services

9.5.5 Historic and Forecasted Market Size by Deployment

9.5.5.1 Cloud-based

9.5.5.2 On-premises

9.5.6 Historic and Forecasted Market Size by Enterprise Size

9.5.6.1 Small and Medium-sized Enterprise

9.5.6.2 Large Enterprise

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Event Organizers & Planners

9.5.7.2 Corporate

9.5.7.3 Government

9.5.7.4 Education

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Event Management Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Software

9.6.4.2 Services

9.6.5 Historic and Forecasted Market Size by Deployment

9.6.5.1 Cloud-based

9.6.5.2 On-premises

9.6.6 Historic and Forecasted Market Size by Enterprise Size

9.6.6.1 Small and Medium-sized Enterprise

9.6.6.2 Large Enterprise

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Event Organizers & Planners

9.6.7.2 Corporate

9.6.7.3 Government

9.6.7.4 Education

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Event Management Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Software

9.7.4.2 Services

9.7.5 Historic and Forecasted Market Size by Deployment

9.7.5.1 Cloud-based

9.7.5.2 On-premises

9.7.6 Historic and Forecasted Market Size by Enterprise Size

9.7.6.1 Small and Medium-sized Enterprise

9.7.6.2 Large Enterprise

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Event Organizers & Planners

9.7.7.2 Corporate

9.7.7.3 Government

9.7.7.4 Education

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Event Management Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.14 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.11 % |

Market Size in 2032: |

USD 40.29 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||