Europe Blockchain Market Synopsis

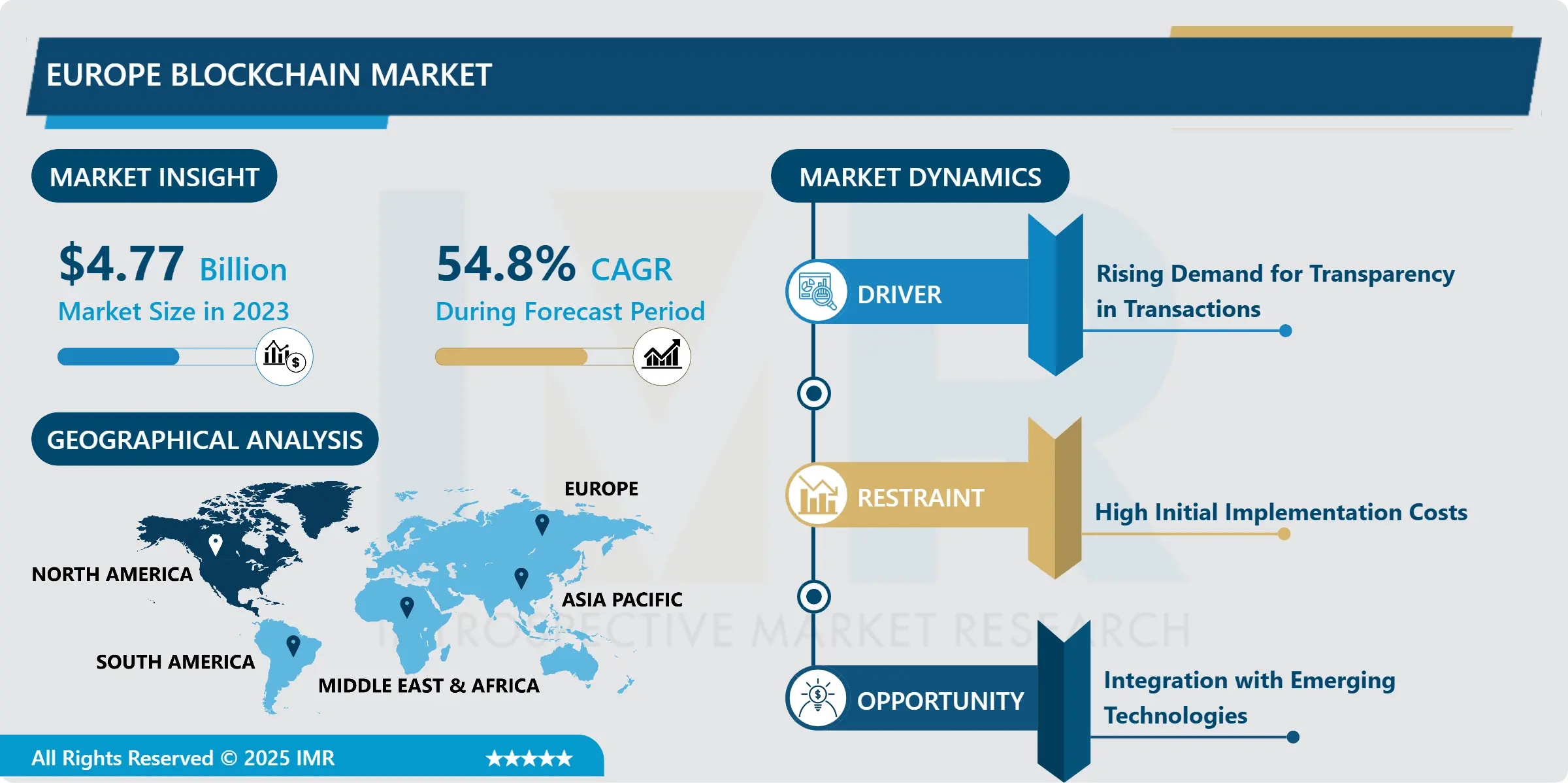

Europe's Blockchain Market Size Was Valued at USD 4.77 Billion in 2023, and is Projected to Reach USD 243.48 Billion by 2032, Growing at a CAGR of 54.8 % From 2024-2032.

The Europe blockchain market encompasses the development and adoption of decentralized digital ledger technologies across industries such as finance, supply chain, healthcare, and energy. Driven by increasing demand for secure, transparent transactions and regulatory support, it includes public, private, and consortium blockchain platforms, offering solutions for digital identity, smart contracts, and data integrity across the European economic landscape.

The Europe Blockchain Market is growing at a very healthy rate primarily because of the increased digitization across different sectors, particularly financial, logistics, and medical. Blockchain solutions are being implemented because they ensure that data and information sharing is secure and cannot be altered once a record it made. More so, European countries are among the major investors in blockchain research and development and innovative EBP and GDPR initiatives.

Its growth can also be attributed to its incorporation of advanced technologies that we have at the moment such as artificial intelligence and the Internet of Things. This work improves operation efficiency, increases fraud control, and supports secure digital ID systems. But with the help of the BaaS model, it has given start-ups a chance of implementing the contending blockchain applications without having to lose much money on huge infrastructures.

Europe Blockchain Market Trend Analysis

Rising Adoption in Supply Chain Management

-

The increasing use of blockchain in supply chain management is shaping the Europe blockchain market, as enterprises focus on improving transparency, traceability, and operational efficiency. Industries such as automotive, pharmaceuticals, and food and beverage are integrating blockchain to enhance real-time monitoring and reduce the risks associated with counterfeit products and logistical inefficiencies. With growing pressure to meet regulatory compliance and consumer expectations, companies are turning to blockchain for end-to-end visibility across complex supply networks.

- Large-scale deployments across cross-border logistics and supplier ecosystems are enabling stakeholders to access tamper-proof records, which support better decision-making and cost control. As digital transformation strategies accelerate, blockchain is becoming part of integrated supply chain solutions, often paired with IoT and AI. This adoption reflects a broader shift towards data-driven operations and secure digital infrastructures across European markets. Blockchain’s role in reshaping procurement, inventory control, and shipment verification is gaining traction across both public and private sectors.

Expanding Blockchain Use in Government Services

-

The integration of blockchain into public sector operations presents a clear growth opportunity for the Europe blockchain market. Governments across the region are exploring decentralized technologies to enhance transparency, traceability, and efficiency in service delivery. From digital identity verification to land registry management and procurement processes, blockchain is gaining traction as a reliable solution for reducing administrative overhead and enhancing data security across departments.

- As regulatory frameworks mature, adoption is expected to increase across national and municipal levels. This creates demand for blockchain infrastructure, consulting services, and specialized platforms tailored to government requirements. Vendors operating in the European blockchain market can position themselves by aligning with public sector digitalization agendas and offering scalable, secure solutions compliant with evolving data protection regulations. The shift toward trusted digital services places blockchain in a strong position within public sector innovation strategies.

Europe Blockchain Market Segment Analysis:

Europe Blockchain Market Segmented on the basis of Type, Application, End User, and Region

By Type, Public blockchain segment is expected to dominate the market during the forecast period

-

The public blockchain segment is anticipated to lead the European blockchain market throughout the forecast period. This segment offers a decentralized framework that enhances transparency and accessibility across various industries, including finance, logistics, and healthcare. Public blockchains support open-source protocols, which promote innovation and enable enterprises to adopt trustless transaction environments without centralized intermediaries. Their application is expanding across digital identity verification, supply chain traceability, and decentralized finance platforms, reinforcing their presence in commercial operations.

- Enterprises across Europe are increasingly exploring public blockchain solutions to meet regulatory demands for data integrity and auditability. These platforms offer scalability potential through active developer communities and interoperability improvements. The flexibility to execute smart contracts and the reduction of transaction costs position public blockchains as a preferred infrastructure choice in digital transformation initiatives. With investments in blockchain R&D gaining pace, public blockchain networks are emerging as a foundation for next-generation business models in the region.

By Application, the financial segment is expected to hold the largest share

-

The financial segment is projected to dominate the Europe Blockchain Market throughout the forecast period, backed by increasing investments in secure digital transaction infrastructure. Financial institutions across the region are integrating blockchain to enhance transparency, reduce operational complexities, and improve transaction speed. The shift towards decentralized finance (DeFi), digital identity verification, and smart contract deployment is gaining traction among European banks and fintech players. These developments are reinforcing blockchain adoption across core financial processes.

- Regulatory initiatives across the EU aimed at standardizing blockchain usage in finance are further accelerating its implementation. Market participants are prioritizing blockchain-enabled solutions to address fraud prevention, cross-border payments, and real-time settlement challenges. This focus is expanding the use cases within the financial ecosystem, placing this segment at the forefront of blockchain-led transformation. With increasing collaboration between technology firms and financial service providers, the financial segment remains the primary contributor to the blockchain market landscape in Europe.

Europe Blockchain Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

-

Europe is projected to lead the blockchain market throughout the forecast period, supported by robust regulatory frameworks and the increasing adoption of digital technologies across multiple industries. Governments and regulatory bodies across key European nations are actively engaging with blockchain initiatives, fostering an environment that supports enterprise-grade deployment. Industries such as finance, healthcare, and logistics are embracing blockchain to streamline operations, improve traceability, and enhance data integrity.

- Large-scale investments by public and private sectors, along with initiatives such as the European Blockchain Services Infrastructure (EBSI), are reinforcing Europe's position as a frontrunner. Enterprises are aligning their digital transformation agendas with blockchain capabilities, focusing on secure data exchange, transparency, and decentralized processes. The growing number of pilot projects and consortia is contributing to market maturity, making Europe a favorable environment for blockchain solutions and commercial adoption.

Active Key Players in the Europe Blockchain Market

- Accenture (Ireland)

- Amazon Web Services (AWS) (United States)

- Bitfury Group (Netherlands)

- Chainalysis Inc. (United States)

- ConsenSys (United States)

- Digital Asset Holdings (United States)

- IBM Corporation (United States)

- Infosys Limited (India)

- Microsoft Corporation (United States)

- Oracle Corporation (United States)

- Ripple Labs Inc. (United States)

- SAP SE (Germany)

- Sofocle Technologies (India)

- Tencent (China)

- Wipro Limited (India)

- Other Active Players

|

Europe Blockchain Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.77 Billion |

|

Forecast Period 2024-32 CAGR: |

54.8 % |

Market Size in 2032: |

USD 243.48 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Europe Blockchain Market by Type

4.1 Europe Blockchain Market Snapshot and Growth Engine

4.2 Europe Blockchain Market Overview

4.3 Public blockchain

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Public blockchain: Geographic Segmentation Analysis

4.4 Private blockchain

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Private blockchain: Geographic Segmentation Analysis

Chapter 5: Europe Blockchain Market by Application

5.1 Europe Blockchain Market Snapshot and Growth Engine

5.2 Europe Blockchain Market Overview

5.3 Financial Services Non-Financial Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Financial Services Non-Financial Services: Geographic Segmentation Analysis

Chapter 6: Europe Blockchain Market by End User

6.1 Europe Blockchain Market Snapshot and Growth Engine

6.2 Europe Blockchain Market Overview

6.3 Transportation and Logistics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Transportation and Logistics: Geographic Segmentation Analysis

6.4 Retail and E-commerce

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail and E-commerce: Geographic Segmentation Analysis

6.5 Media

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Media: Geographic Segmentation Analysis

6.6 Advertising and Entertainment

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Advertising and Entertainment: Geographic Segmentation Analysis

6.7 Travel

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Travel: Geographic Segmentation Analysis

6.8 Health care and Life Science

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Health care and Life Science: Geographic Segmentation Analysis

6.9 Banking and Financial Service (BFSI)

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Banking and Financial Service (BFSI): Geographic Segmentation Analysis

6.10 and Government

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 and Government: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Europe Blockchain Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACCENTURE (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMAZON WEB SERVICES (AWS) (UNITED STATES)

7.4 BITFURY GROUP (NETHERLANDS)

7.5 CHAINALYSIS INC. (UNITED STATES)

7.6 CONSENSYS (UNITED STATES)

7.7 DIGITAL ASSET HOLDINGS (UNITED STATES)

7.8 IBM CORPORATION (UNITED STATES)

7.9 INFOSYS LIMITED (INDIA)

7.10 MICROSOFT CORPORATION (UNITED STATES)

7.11 ORACLE CORPORATION (UNITED STATES)

7.12 RIPPLE LABS INC. (UNITED STATES)

7.13 SAP SE (GERMANY)

7.14 SOFOCLE TECHNOLOGIES (INDIA)

7.15 TENCENT (CHINA)

7.16 WIPRO LIMITED (INDIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Europe Blockchain Market By Region

8.1 Overview

8.2. North America Europe Blockchain Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Public blockchain

8.2.4.2 Private blockchain

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Financial Services Non-Financial Services

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Transportation and Logistics

8.2.6.2 Retail and E-commerce

8.2.6.3 Media

8.2.6.4 Advertising and Entertainment

8.2.6.5 Travel

8.2.6.6 Health care and Life Science

8.2.6.7 Banking and Financial Service (BFSI)

8.2.6.8 and Government

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Europe Blockchain Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Public blockchain

8.3.4.2 Private blockchain

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Financial Services Non-Financial Services

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Transportation and Logistics

8.3.6.2 Retail and E-commerce

8.3.6.3 Media

8.3.6.4 Advertising and Entertainment

8.3.6.5 Travel

8.3.6.6 Health care and Life Science

8.3.6.7 Banking and Financial Service (BFSI)

8.3.6.8 and Government

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Europe Blockchain Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Public blockchain

8.4.4.2 Private blockchain

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Financial Services Non-Financial Services

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Transportation and Logistics

8.4.6.2 Retail and E-commerce

8.4.6.3 Media

8.4.6.4 Advertising and Entertainment

8.4.6.5 Travel

8.4.6.6 Health care and Life Science

8.4.6.7 Banking and Financial Service (BFSI)

8.4.6.8 and Government

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Europe Blockchain Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Public blockchain

8.5.4.2 Private blockchain

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Financial Services Non-Financial Services

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Transportation and Logistics

8.5.6.2 Retail and E-commerce

8.5.6.3 Media

8.5.6.4 Advertising and Entertainment

8.5.6.5 Travel

8.5.6.6 Health care and Life Science

8.5.6.7 Banking and Financial Service (BFSI)

8.5.6.8 and Government

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Europe Blockchain Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Public blockchain

8.6.4.2 Private blockchain

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Financial Services Non-Financial Services

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Transportation and Logistics

8.6.6.2 Retail and E-commerce

8.6.6.3 Media

8.6.6.4 Advertising and Entertainment

8.6.6.5 Travel

8.6.6.6 Health care and Life Science

8.6.6.7 Banking and Financial Service (BFSI)

8.6.6.8 and Government

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Europe Blockchain Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Public blockchain

8.7.4.2 Private blockchain

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Financial Services Non-Financial Services

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Transportation and Logistics

8.7.6.2 Retail and E-commerce

8.7.6.3 Media

8.7.6.4 Advertising and Entertainment

8.7.6.5 Travel

8.7.6.6 Health care and Life Science

8.7.6.7 Banking and Financial Service (BFSI)

8.7.6.8 and Government

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Europe Blockchain Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.77 Billion |

|

Forecast Period 2024-32 CAGR: |

54.8 % |

Market Size in 2032: |

USD 243.48 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||