Ethylene Tetrafluoroethylene (ETFE) Market Synopsis

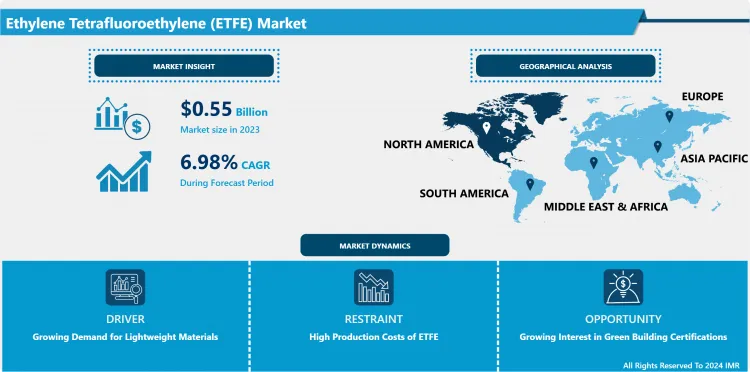

Ethylene Tetrafluoroethylene (ETFE) Market Size is Valued at USD 0.55 Billion in 2023, and is Projected to Reach USD 0.94 Billion by 2032, Growing at a CAGR of 6.98% From 2024-2032.

Ethylene Tetrafluoroethylene (ETFE) is a high-performance fluoropolymer that shows excellent chemical, thermal and mechanical stability and the material has low density. Made from ethylene and tetrafluoro ethylene this material will have uses in building and construction, aerospace engineering as well as electrical and electronics as well as the car manufacturing industries. ETFE has a very high transparency, good UV stability and therefore has versatile applications in architecture, industrial applications like cladding, roofing or insulating materials.

- The main force behind the ETFE market is the growing need for lightweight and high-impact products in construction. ETFE is a particularly appropriate material for construction because architects and builders want sustainable and efficient options, and ETFE offers high strength-to-weight ratio, as well as good thermal insulation. This has led to an increased uptake of ETFE in several projects due to the increasing concerns in energy efficiency in structures and new materials in construction.

- Another major factor is an increasing use of demand from aerospace and automotive, where light weight and performance are critical. As a result, ETFE has significant chemical and thermal stability, with application in aerospace and automotive components, often consisting of some level of complexity. The automotive and aerospace industries are currently seeking lightweight materials to enhance fuel economy and lower emissions; therefore, these industries will create a large demand for ETFE.

Ethylene Tetrafluoroethylene (ETFE) Market Trend Analysis:

Increasing Focus on Sustainability And Environmental Responsibility

- One of the key trends in the ETFE market can be noted the constantly growing demand for eco-friendly and environmentally safe products and processes. More and more organisations are seeking environmental solutions to premature building failures such as the use of ETFE as it meets the current stringent energy efficiency and emissions regulations. As it is recyclable and has a long-life span, it also fits the recently emerging theme of sustainable construction that has led to many projects looking for more ways to include ETFE solutions in their architectures. Further, improvements in the ETFE technology continue to facilitate emerging markets through the creation of new market opportunities.

- The last trend is the utilization of smart technologies in applications involving ETFE material. ETFE is increasingly being used together with sensors and other IoT related systems for smart buildings and advanced systems integration. The implementation of this material is opening up opportunities for ETFE manufactures to produce enhanced systems that are not just visually acceptable but more importantly can also facilitate improved system environments.

Rapid urbanization and infrastructure development are taking place.

- The global ETFE market has vast growing prospects as the world undergoes rapid development, especially the Asia-Pacific region where the construction industry is recording high growth. Infrastructure projects in countries like China and India currently require high quality materials such as ETFE which the two nations are in the process of acquiring by investing heavily in infrastructure. This expansion gives the ETFE manufacturers an opportunity to extend its market niche and seek out the local builders and architects to popularize their products.

- Moreover, ever increasing improvements in technology relating to ETFE manufacturing and continual discovery of novel uses in multiple relevant sectors make these markets highly attractive for businesses in this field. The properties of ETFE are still being studied and developed and with increased use in fields like photovoltaic applications and medical technology, manufacturers can continue to explore new opportunities over the years ahead.

Ethylene Tetrafluoroethylene (ETFE) Market Segment Analysis:

Ethylene Tetrafluoroethylene (ETFE) Market Segmented on the basis of Type, Form, Application, End-User, and Region

By Type, ETFE Films segment is expected to dominate the market during the forecast period

- The Ethylene Tetrafluoroethylene (ETFE) market is primarily segmented into three types: sheets, films, and coatings. ETFE sheets can boast of their mechanical properties and therefore the sheets mostly used in architectural design such as roofing systems and facades where issues to do with transparency and weather endurance come into the picture. The property of ETFE films is that they are lighter compared to steel but can be applied under proper conditions of flexibility as a result of which they are even used in packing and insulation where efficiency and resilience is desired. ETFE based coating thus offer a protective layer that can increase the durability of many substrates with a chemically and thermally and UV stable barrier benefiting applications across automotive to aerospace industries. All of them take advantage of the characteristics of ETFE to fulfill particular requirements, which has led to the increasing applications of ETFE in various industries.

By Application, Building & Construction segment held the largest share in 2023

- The product type segment of the Ethylene Tetrafluoroethylene market is used in application areas like building and construction, aerospace, electrical as well as electronics, automobile as well as others. ETFE is used in building and construction where it is appreciated for its lightweight, stability, and high durability to be used, inter alia, in the transparent roofs, façades, and other architectural applications requiring aesthetically appealing yet functional and sturdy clear processor. The aerospace industry uses ETFE owing to its thermal stability and resistance to environmental degradation; typically, in part designs that call for lightweight materials to optimize fuel use. In electrical and electronics, it is employed in insulation and protective coatings because of electrical characteristics and chemistry of ETFE. The automotive industry also reaps the benefits of using ETFE because it can offer lightweight substitutes for most of its parts; therefore, increase automobile efficiency. Furthermore, OUTREACH which applies to categorize ‘others; all the products like medical devices and consumer products; prove the flexibility of ETFE in the different sectors.

Ethylene Tetrafluoroethylene (ETFE) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is in a commanding position regarding the ETFE market mainly owing to the construction and aerospace sectors of this area. ETFE has become copious in use as a material for construction activities in commercial as well as residential buildings particularly in places where weight and durabilities are major concerns. ESFA has identified the use of ETFE mainly for roofing and cladding on major architecturally significant structures and green buildings across the United States, underscoring the emerging trend of new age sustainable architecture.

- Additionally, demand for ETFE by North American aerospace manufacturing and automotive industries has been strengthen by the presence of more industry players. Based on these aspects, as more and more the sectors that incorporate ETFE in the manufacture of their commercial products develop new applications, and where weight reduction and performance efficiency remain important goals, there will be an increased use of ETFE in high-performance applications. Primarily, North America is expected to grow because the region invests significantly in research and development and shows concern for sustainable products.

Active Key Players in the Ethylene Tetrafluoroethylene (ETFE) Market

- Saint-Gobain (France)

- DuPont (United States)

- 3M (United States)

- Chemours (United States)

- Gurit Holding AG (Switzerland)

- Daikin Industries, Ltd. (Japan)

- Fujikura Ltd. (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Solvay S.A. (Belgium)

- Krehalon (Netherlands)

- Others Active Players

|

Global Ethylene Tetrafluoroethylene (ETFE) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.98% |

Market Size in 2032: |

USD 0.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ethylene Tetrafluoroethylene (ETFE) Market by Type (2018-2032)

4.1 Ethylene Tetrafluoroethylene (ETFE) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sheets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Films

4.5 Coatings

Chapter 5: Ethylene Tetrafluoroethylene (ETFE) Market by Form (2018-2032)

5.1 Ethylene Tetrafluoroethylene (ETFE) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sheets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Films

5.5 Coatings

Chapter 6: Ethylene Tetrafluoroethylene (ETFE) Market by Application (2018-2032)

6.1 Ethylene Tetrafluoroethylene (ETFE) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Building & Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aerospace

6.5 Electrical & Electronics

6.6 Automotive

6.7 Others

Chapter 7: Ethylene Tetrafluoroethylene (ETFE) Market by End User (2018-2032)

7.1 Ethylene Tetrafluoroethylene (ETFE) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Industrial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Ethylene Tetrafluoroethylene (ETFE) Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SAINT-GOBAIN (FRANCE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DUPONT (UNITED STATES)

8.4 3M (UNITED STATES)

8.5 CHEMOURS (UNITED STATES)

8.6 GURIT HOLDING AG (SWITZERLAND)

8.7 DAIKIN INDUSTRIES LTD. (JAPAN)

8.8 FUJIKURA LTD. (JAPAN)

8.9 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

8.10 SOLVAY S.A. (BELGIUM)

8.11 KREHALON (NETHERLANDS)

8.12 OTHERS ACTIVE PLAYERS

8.13

Chapter 9: Global Ethylene Tetrafluoroethylene (ETFE) Market By Region

9.1 Overview

9.2. North America Ethylene Tetrafluoroethylene (ETFE) Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Sheets

9.2.4.2 Films

9.2.4.3 Coatings

9.2.5 Historic and Forecasted Market Size by Form

9.2.5.1 Sheets

9.2.5.2 Films

9.2.5.3 Coatings

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Building & Construction

9.2.6.2 Aerospace

9.2.6.3 Electrical & Electronics

9.2.6.4 Automotive

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.7.3 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Ethylene Tetrafluoroethylene (ETFE) Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Sheets

9.3.4.2 Films

9.3.4.3 Coatings

9.3.5 Historic and Forecasted Market Size by Form

9.3.5.1 Sheets

9.3.5.2 Films

9.3.5.3 Coatings

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Building & Construction

9.3.6.2 Aerospace

9.3.6.3 Electrical & Electronics

9.3.6.4 Automotive

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.7.3 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Ethylene Tetrafluoroethylene (ETFE) Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Sheets

9.4.4.2 Films

9.4.4.3 Coatings

9.4.5 Historic and Forecasted Market Size by Form

9.4.5.1 Sheets

9.4.5.2 Films

9.4.5.3 Coatings

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Building & Construction

9.4.6.2 Aerospace

9.4.6.3 Electrical & Electronics

9.4.6.4 Automotive

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.7.3 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Ethylene Tetrafluoroethylene (ETFE) Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Sheets

9.5.4.2 Films

9.5.4.3 Coatings

9.5.5 Historic and Forecasted Market Size by Form

9.5.5.1 Sheets

9.5.5.2 Films

9.5.5.3 Coatings

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Building & Construction

9.5.6.2 Aerospace

9.5.6.3 Electrical & Electronics

9.5.6.4 Automotive

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.7.3 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Ethylene Tetrafluoroethylene (ETFE) Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Sheets

9.6.4.2 Films

9.6.4.3 Coatings

9.6.5 Historic and Forecasted Market Size by Form

9.6.5.1 Sheets

9.6.5.2 Films

9.6.5.3 Coatings

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Building & Construction

9.6.6.2 Aerospace

9.6.6.3 Electrical & Electronics

9.6.6.4 Automotive

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.7.3 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Ethylene Tetrafluoroethylene (ETFE) Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Sheets

9.7.4.2 Films

9.7.4.3 Coatings

9.7.5 Historic and Forecasted Market Size by Form

9.7.5.1 Sheets

9.7.5.2 Films

9.7.5.3 Coatings

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Building & Construction

9.7.6.2 Aerospace

9.7.6.3 Electrical & Electronics

9.7.6.4 Automotive

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.7.3 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Ethylene Tetrafluoroethylene (ETFE) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.98% |

Market Size in 2032: |

USD 0.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Ethylene Tetrafluoroethylene (ETFE) Market research report is 2024-2032.

Saint-Gobain (France), DuPont (United States), 3M (United States), Chemours (United States), Gurit Holding AG (Switzerland), Daikin Industries, Ltd. (Japan), Fujikura Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), Solvay S.A. (Belgium), Krehalon (Netherlands), and Other Major Players.

The Ethylene Tetrafluoroethylene (ETFE) Market is segmented into by Type (ETFE Films, ETFE Coatings), By Form (Sheets, Films, Coatings), By Application (Building & Construction, Aerospace, Electrical & Electronics, Automotive, Others), End-User (Residential, Commercial, Industrial). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Ethylene Tetrafluoroethylene (ETFE) is a high-performance fluoropolymer that shows excellent chemical, thermal and mechanical stability and the material has low density. Made from ethylene and tetrafluoro ethylene this material will have uses in building and construction, aerospace engineering as well as electrical and electronics as well as the car manufacturing industries. ETFE has a very high transparency, good UV stability and therefore has versatile applications in architecture, industrial applications like cladding, roofing or insulating materials.

Ethylene Tetrafluoroethylene (ETFE) Market Size is Valued at USD 0.55 Billion in 2023, and is Projected to Reach USD 0.94 Billion by 2032, Growing at a CAGR of 6.98% From 2024-2032.