Enterprise Ai Market Synopsis

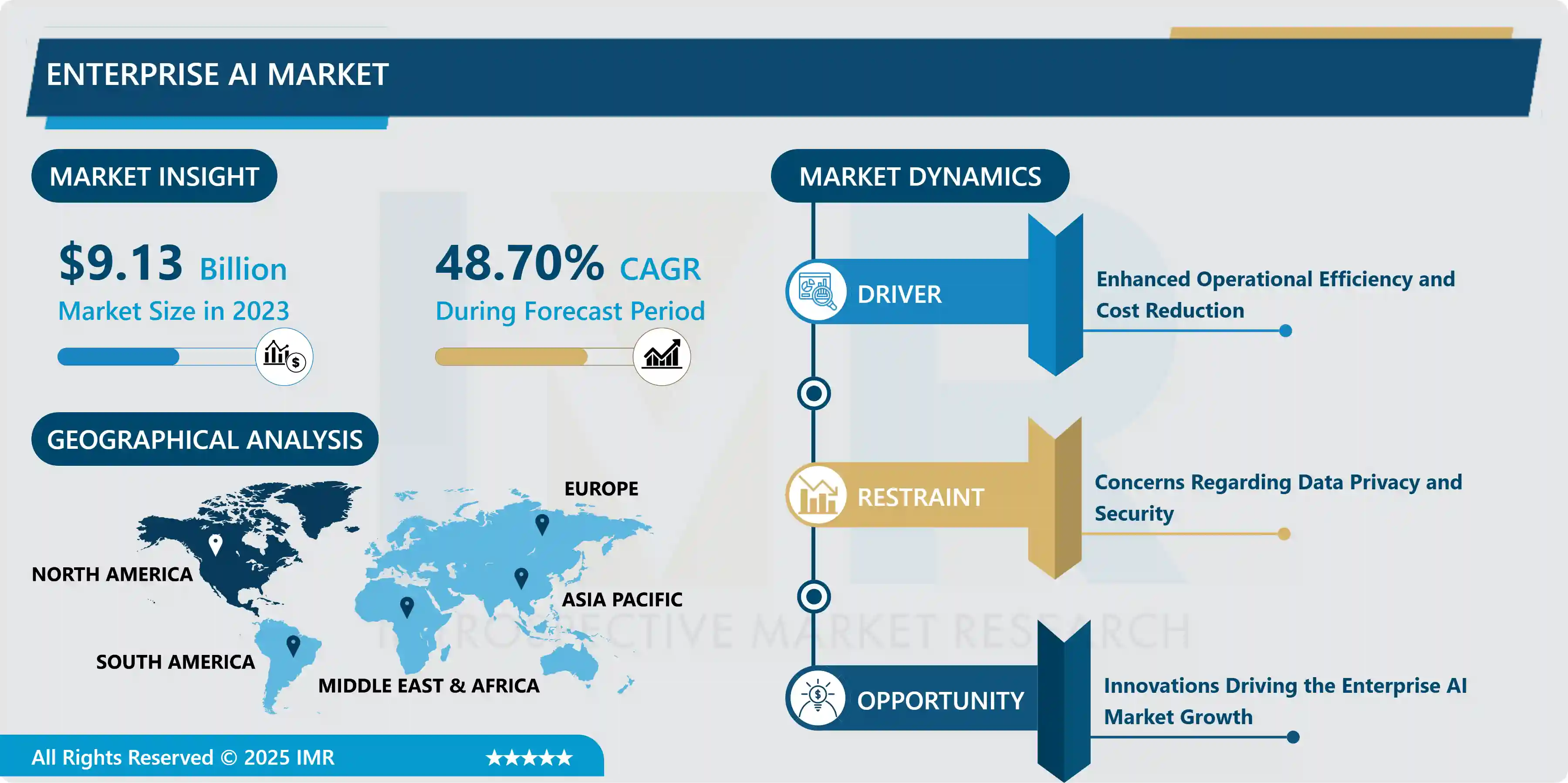

Enterprise Ai Market Size is Valued at USD 9.13 Billion in 2023, and is Projected to Reach USD 323.54 Billion by 2032, Growing at a CAGR of 48.70% From 2024-2032.

The Enterprise AI (Artificial Intelligence) market relates to the deployment of the AI technologies in organizations for different functions with the intention of optimizing processes, decisions that are made, as well as to deliver an improved value to customers. It consists of intelligent technologies and related services, implemented in financial, health care, trade, and manufacturing fields. To the market, it is defined by the availability of an extensive array of AI software, platforms, and services that are designed to address the needs of enterprises of different sizes.

The key factors that are driving the enterprise AI market are the enhanced level of AI technology utilization across multiple industries for better performance, customer satisfaction, and innovation. AI solutions are now being applied in organizations to perform routine tasks, process and gather big data and support decision-making processes among others. However, the increasing need for enhancing customer relations with the help of artificial intelligent chatbots or virtual personal assistants and the increasing trend towards big data and predictive analytics and machine learning algorithms contribute to the growth of the enterprise AI market.

In addition, the popularity of big data and the improved cloud service and IoT technology also promote the use of AI in enterprises. AI integration with IoT is allowing companies to gather data from various devices, and use the data gathered for creating innovative solutions that can be customized for clients. Also, a growing number of AIaaS solutions are being introduced, that enables the use of AI for enterprise of various sizes, thus stimulating the growth of the enterprise AI market.

Enterprise Ai Market Trend Analysis

Transforming Industries, Current Trends in Enterprise AI

- The Enterprise AI Market is undergoing a period of growth as more markets embrace the AI technologies already in the market. One trend is the combination of AI with big data analysis, so that an enterprise can make useful conclusions based on the latter. This integration enables organizations to analyze information that can be used in decision-making processes and to streamline activities as well as deliver better experiences to customers. The fourth trend is the AI Automation that has emerged as a phenomenon that is reinventing business by replacing the need for human input on repetitive tasks. It is most apparent in the manufacturing sector where artificial intelligence enhances efficient production and reduces time wastage.

- Also, the need for AI solutions to complement Security and protection is increasing with each passing day. As shown by the examples of cyber threats facing businesses, companies are now looking for AI as an efficient solution for tracking and addressing threats in real-time. AI is also applied to other areas, such as, for example, the use of AI algorithms to analyze customer data in order to offer them more individualized products and services. There is still more to come in the Enterprise AI market place as AI technologies advance and get better in the future.

Maximizing Potential, The Strategic Advantages of Enterprise AI

- The market for Enterprise AI is quite vast and is a promising market for organizations in all kinds of industries. One such opportunity is the potential to improve the operational performance of corporations through AI technologies. The use of artificial intelligence solutions in a business enterprise enables the automation of several processes and even the entire business, thus reducing the workload on employees and enhancing efficiency. Not only does it mean that there is no need for manual work and, therefore, there is less chance for mistakes, but also it allows employees to spend time on more useful and valuable tasks, and thus increase the overall organizational performance and cut costs.

- The last opportunity is the one that relates to the ability of AI to foster new products and services and bring new opportunities for business models. Digital technologies like machine learning, natural language processing and computer vision assist businesses in getting a better insight into the data generated and can help in decision making and innovation of new products and services. Furthermore, customer experience can be improved by the use of AI to personalize various aspects of the customer’s life hence improving customer satisfaction and loyalty. In conclusion, the Enterprise AI market is an appealing proposition to businesses as it can help them adapt to the circumstances, come up with new ideas, and outcompete rivals in their field.

Enterprise Ai Market Segment Analysis:

Enterprise Ai Market Segmented on the basis of Component, Technology, Deployment Mode, and Vertical.

By Component, Solution segment is expected to dominate the market during the forecast period

- The segmentation of the Enterprise AI market can be done based on the component offered which includes solutions and services. Some are AI software and platform solutions for various purposes like machine learning, natural language processing, and computer visions. On the other hand, services include professional services, which is a set of services that help in the implementation and integration of AI solutions, and managed services, which comprises of services required to maintain the solutions in the long run.

By Technology, Machine Learning segment held the largest share in 2024

- The Enterprise AI market is segmented by technology in Machine Learning, Natural Language Processing, Computer vision and Others. Machine learning is the process of designing and building of models and algorithms that allow the system to make improvements in predictions or actions based on data without having to be programmed.

- Natural language processing is centered on the usage of algorithms to allow computers to understand, evaluate and generate human language. Computer vision is subfield of artificial intelligence that aims at making computers for see and understand visual information in the form of still images and videos. The “other” category may involve new AI trends or specific AI solutions outside the three discussed disciplines.

Enterprise Ai Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Further, North America is a dominant region in the Enterprise AI market owing to the presence of significant market players, innovative developments, and high AI technology penetration across diverse sectors. The region can be characterized by a high level of IT development and a focus on innovation, which will assure the demand for AI solutions. The United States is one of the most significant players in the market, given that organizations are increasing their investments in the technology to enhance its performance, customer interactions, and business decisions. Deployments across industries are observed with BFSI, healthcare, retail and manufacturing sectors leveraging AI to achieve competitive differentiation and superior customer experience.

- Furthermore, the North American market enjoys a favorable legal landscape and multiplicative AI venture companies and research centers. It is becoming quite evident that there is an increase in the number of strategic partnerships, mergers, and acquisitions across the market players in the region to enhance their AI capacities and services. The enterprise AI market is also expected to grow in the future with North America continuing its reign in the coming years owing to the rising popularity of AI-based solutions and services.

Active Key Players in the Enterprise Ai Market

- IBM (US)

- Microsoft (US)

- AWS (US)

- Intel (US)

- Google (US)

- SAP (Germany)

- Sentient Technologies (US)

- Oracle (US)

- HPE (US)

- Wipro (India)

- Others

|

Enterprise Ai Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.13 Bn. |

|

Forecast Period 2024-32 CAGR: |

48.70 % |

Market Size in 2032: |

USD 324.54 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By Deployment Mode |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

IBM (US), Microsoft (US), AWS (US), Intel (US), Google (US), SAP (Germany), Sentient Technologies (US), Oracle (US), HPE (US), and Wipro (India), and Other Major Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Enterprise Ai Market by Component (2018-2032)

4.1 Enterprise Ai Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Service

Chapter 5: Enterprise Ai Market by Technology (2018-2032)

5.1 Enterprise Ai Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Machine Learning

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Natural Language Processing

5.5 Computer Vision

5.6 Others

Chapter 6: Enterprise Ai Market by Deployment Mode (2018-2032)

6.1 Enterprise Ai Market Snapshot and Growth Engine

6.2 Market Overview

6.3 On-Premises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cloud

Chapter 7: Enterprise Ai Market by Vertical (2018-2032)

7.1 Enterprise Ai Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Banking

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Financial Services

7.5 and Insurance (BFSI)

7.6 Healthcare and Life Sciences

7.7 Retail and eCommerce

7.8 Telecom and IT

7.9 Manufacturing

7.10 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Enterprise Ai Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IBM (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MICROSOFT (US)

8.4 AWS (US)

8.5 INTEL (US)

8.6 GOOGLE (US)

8.7 SAP (GERMANY)

8.8 SENTIENT TECHNOLOGIES (US)

8.9 ORACLE (US)

8.10 HPE (US)

8.11 WIPRO (INDIA)

8.12 OTHERS

8.13

Chapter 9: Global Enterprise Ai Market By Region

9.1 Overview

9.2. North America Enterprise Ai Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Solution

9.2.4.2 Service

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Machine Learning

9.2.5.2 Natural Language Processing

9.2.5.3 Computer Vision

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size by Deployment Mode

9.2.6.1 On-Premises

9.2.6.2 Cloud

9.2.7 Historic and Forecasted Market Size by Vertical

9.2.7.1 Banking

9.2.7.2 Financial Services

9.2.7.3 and Insurance (BFSI)

9.2.7.4 Healthcare and Life Sciences

9.2.7.5 Retail and eCommerce

9.2.7.6 Telecom and IT

9.2.7.7 Manufacturing

9.2.7.8 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Enterprise Ai Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Solution

9.3.4.2 Service

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Machine Learning

9.3.5.2 Natural Language Processing

9.3.5.3 Computer Vision

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size by Deployment Mode

9.3.6.1 On-Premises

9.3.6.2 Cloud

9.3.7 Historic and Forecasted Market Size by Vertical

9.3.7.1 Banking

9.3.7.2 Financial Services

9.3.7.3 and Insurance (BFSI)

9.3.7.4 Healthcare and Life Sciences

9.3.7.5 Retail and eCommerce

9.3.7.6 Telecom and IT

9.3.7.7 Manufacturing

9.3.7.8 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Enterprise Ai Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Solution

9.4.4.2 Service

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Machine Learning

9.4.5.2 Natural Language Processing

9.4.5.3 Computer Vision

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size by Deployment Mode

9.4.6.1 On-Premises

9.4.6.2 Cloud

9.4.7 Historic and Forecasted Market Size by Vertical

9.4.7.1 Banking

9.4.7.2 Financial Services

9.4.7.3 and Insurance (BFSI)

9.4.7.4 Healthcare and Life Sciences

9.4.7.5 Retail and eCommerce

9.4.7.6 Telecom and IT

9.4.7.7 Manufacturing

9.4.7.8 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Enterprise Ai Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Solution

9.5.4.2 Service

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Machine Learning

9.5.5.2 Natural Language Processing

9.5.5.3 Computer Vision

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size by Deployment Mode

9.5.6.1 On-Premises

9.5.6.2 Cloud

9.5.7 Historic and Forecasted Market Size by Vertical

9.5.7.1 Banking

9.5.7.2 Financial Services

9.5.7.3 and Insurance (BFSI)

9.5.7.4 Healthcare and Life Sciences

9.5.7.5 Retail and eCommerce

9.5.7.6 Telecom and IT

9.5.7.7 Manufacturing

9.5.7.8 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Enterprise Ai Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Solution

9.6.4.2 Service

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Machine Learning

9.6.5.2 Natural Language Processing

9.6.5.3 Computer Vision

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size by Deployment Mode

9.6.6.1 On-Premises

9.6.6.2 Cloud

9.6.7 Historic and Forecasted Market Size by Vertical

9.6.7.1 Banking

9.6.7.2 Financial Services

9.6.7.3 and Insurance (BFSI)

9.6.7.4 Healthcare and Life Sciences

9.6.7.5 Retail and eCommerce

9.6.7.6 Telecom and IT

9.6.7.7 Manufacturing

9.6.7.8 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Enterprise Ai Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Solution

9.7.4.2 Service

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Machine Learning

9.7.5.2 Natural Language Processing

9.7.5.3 Computer Vision

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size by Deployment Mode

9.7.6.1 On-Premises

9.7.6.2 Cloud

9.7.7 Historic and Forecasted Market Size by Vertical

9.7.7.1 Banking

9.7.7.2 Financial Services

9.7.7.3 and Insurance (BFSI)

9.7.7.4 Healthcare and Life Sciences

9.7.7.5 Retail and eCommerce

9.7.7.6 Telecom and IT

9.7.7.7 Manufacturing

9.7.7.8 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Enterprise Ai Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.13 Bn. |

|

Forecast Period 2024-32 CAGR: |

48.70 % |

Market Size in 2032: |

USD 324.54 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By Deployment Mode |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

IBM (US), Microsoft (US), AWS (US), Intel (US), Google (US), SAP (Germany), Sentient Technologies (US), Oracle (US), HPE (US), and Wipro (India), and Other Major Players. |

||