Electronic Toll Collection (ETC) Market Synopsis

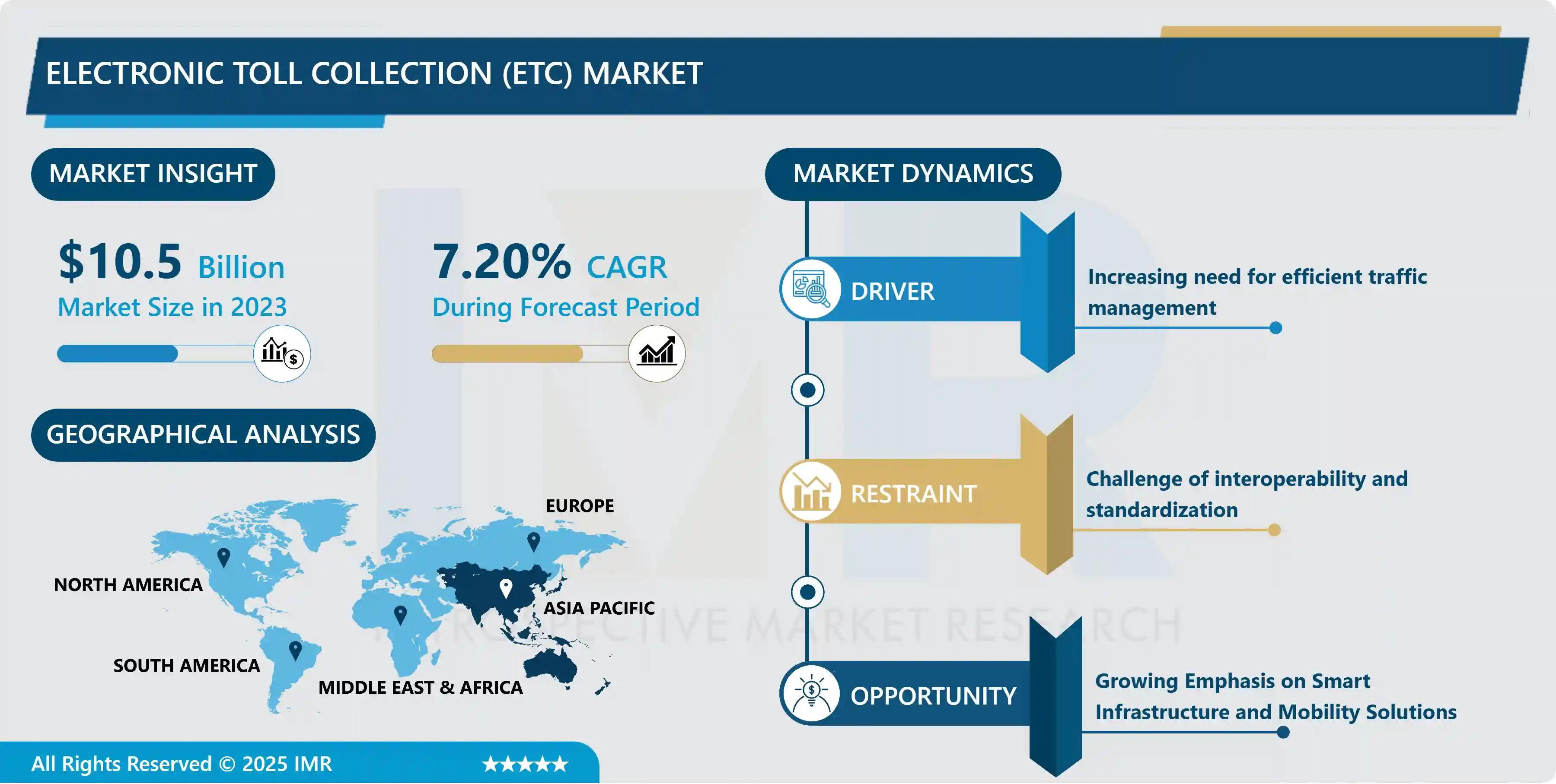

Electronic Toll Collection (ETC) Market Size Was Valued at USD 10.5 Billion in 2023, and is Projected to Reach USD 19.6 Billion by 2032, Growing at a CAGR of 7.20% From 2024-2032.

Electronic Toll Collection (ETC) refers to a system that automatically collects tolls from vehicles using electronic technology, without requiring them to stop or slow down at toll booths. Instead of traditional cash or manual toll collection methods, ETC systems typically use radio frequency identification (RFID), infrared, or other wireless communication technologies to identify vehicles and deduct tolls from prepaid accounts or electronic wallets linked to the vehicles. This technology streamlines the toll collection process, reducing traffic congestion, and improving overall transportation efficiency.

The Electronic Toll Collection (ETC) market has witnessed significant growth in recent years, driven by the increasing adoption of automated tolling systems worldwide. ETC systems offer numerous benefits, including reduced traffic congestion, enhanced road safety, and improved operational efficiency for toll operators. The market is characterized by technological advancements, such as the integration of RFID, GPS, and mobile-based solutions, catering to the diverse needs of toll facilities ranging from highways and bridges to urban areas. Additionally, government initiatives promoting cashless transactions and the modernization of transportation infrastructure are further fueling the expansion of the ETC market globally.

Furthermore, the proliferation of smart transportation initiatives and the growing emphasis on seamless mobility experiences are expected to propel the ETC market forward. As urbanization accelerates and populations grow, there's a greater demand for efficient toll-collection methods that streamline traffic flow and enhance overall transportation efficiency. Moreover, the emergence of connected vehicle technologies and the integration of ETC systems with intelligent transportation systems (ITS) are opening up new opportunities for market players to innovate and offer comprehensive solutions that address the evolving needs of the modern transportation ecosystem.

Electronic Toll Collection (ETC) Market Trend Analysis

Interoperability and seamless integration

- The Electronic Toll Collection (ETC) market is experiencing a significant trend towards interoperability and seamless integration. As governments and transportation authorities worldwide seek to streamline tolling systems, interoperable solutions are gaining traction, allowing drivers to use a single transponder or account for multiple toll roads and bridges. This trend not only enhances convenience for motorists but also reduces congestion and administrative burdens for authorities.

- Additionally, advancements in technology, such as RFID and GPS, are further fueling this trend by enabling more efficient and accurate tolling processes, promising a future where toll collection becomes virtually invisible to the user, ultimately transforming the landscape of transportation infrastructure.

Growing Emphasis on Smart Infrastructure and Mobility Solutions

- With increasing urbanization and the rise of smart cities, there's a growing emphasis on developing intelligent transportation systems and infrastructure. This presents a significant opportunity for the ETC market to expand its footprint and offerings. Governments and transportation authorities worldwide are investing in modernizing transportation networks, including toll roads, to enhance traffic flow, reduce emissions, and improve overall mobility.

- By integrating ETC systems with other smart infrastructure components such as traffic management systems, connected vehicles, and mobility-as-a-service platforms, stakeholders can create a more seamless and efficient transportation ecosystem. Furthermore, the adoption of ETC solutions aligns with sustainability goals by encouraging the use of electronic payments, reducing the environmental impact associated with traditional toll collection methods such as cash and paper tickets.

Electronic Toll Collection (ETC) Market Segment Analysis:

Electronic Toll Collection (ETC) Market Segmented based on type and application.

By Type, Vehicle Automatic Understanding System segment is expected to dominate the market during the forecast period

- In the Electronic Toll Collection (ETC) market, the Vehicle Automatic Understanding System segment is poised to take center stage and dominate the landscape throughout the forecast period. This dominance stems from the inherent advantages offered by automatic vehicle identification technology, which streamlines toll-collection processes with unprecedented efficiency and convenience. With Vehicle Automatic Understanding Systems, toll transactions are seamlessly executed as vehicles pass through toll booths, eliminating the need for manual interventions such as stopping or presenting physical toll cards. This not only reduces congestion and travel time for commuters but also enhances overall toll plaza throughput, leading to improved operational efficiency for toll operators.

- Moreover, the widespread adoption of electronic tags and transponders by vehicle owners further fuels the dominance of this segment, as it facilitates effortless and contactless toll payments, aligning perfectly with the global trend towards digitalization and cashless transactions in the transportation sector.

- As the Vehicle Automatic Understanding System segment continues to assert its dominance in the ETC market, stakeholders are poised to capitalize on the myriad opportunities it presents. Toll authorities and operators are increasingly investing in advanced infrastructure and technology upgrades to support the seamless integration of automatic vehicle identification systems into existing toll collection networks. This strategic focus not only enhances the user experience for commuters but also drives cost savings and revenue growth for toll operators.

By Application, the Highway segment held the largest share in 2023

- The dominance of the highway segment in the Electronic Toll Collection (ETC) market signifies a pivotal shift in how transportation infrastructure is managed and monetized. Highways serve as vital arteries of economic activity, facilitating the movement of goods and people across vast distances. As such, optimizing toll collection processes on highways is paramount for enhancing efficiency, reducing congestion, and improving overall traffic flow.

- Electronic toll collection systems offer a seamless and convenient solution, allowing vehicles to pass through toll points without the need to stop, thereby minimizing delays and maximizing throughput. With the highway segment holding the largest share in the ETC market, there is a clear recognition among transportation authorities and infrastructure developers of the immense value proposition offered by ETC solutions in streamlining toll operations and ensuring a smoother travel experience for commuters and cargo alike.

- Moreover, the preference for ETC systems on highways is driven by several factors, including the scalability of these systems to accommodate high volumes of traffic, their ability to integrate with existing transportation infrastructure seamlessly, and the potential for enhancing revenue generation through more efficient toll collection mechanisms. Additionally, the adoption of ETC solutions on highways aligns with broader trends in digitization and automation within the transportation sector, as stakeholders seek innovative ways to modernize infrastructure and enhance mobility.

Electronic Toll Collection (ETC) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Electronic Toll Collection (ETC) market in the Asia Pacific region is poised for significant growth and is anticipated to dominate the global market over the forecast period. Several factors contribute to this projected dominance. Firstly, rapid urbanization and population growth in countries like China, India, and Japan have led to increased demand for efficient transportation infrastructure. Governments in these countries are actively investing in the development of road networks and toll systems to address growing traffic congestion and enhance mobility. Secondly, the Asia Pacific region is witnessing a surge in economic development and disposable income levels, leading to higher vehicle ownership and usage rates. As a result, there is a greater need for streamlined toll collection processes to accommodate the expanding volume of vehicles traversing toll roads and bridges.

- Moreover, technological advancements and government initiatives further bolster the growth of the ETC market in the Asia Pacific. Many countries in the region are embracing digitalization and adopting innovative solutions to modernize their transportation systems. Governments are rolling out initiatives to promote electronic payments and discourage cash transactions, driving the adoption of ETC technologies.

Active Key Players in the Electronic Toll Collection (ETC) Market

- Abertis (Spain)

- Sanef (France)

- Atlantia S.p.A (Italy)

- Conduent Inc. (United States)

- Cubic Corporation (USA)

- Denso Corporation (Japan)

- EFKON GMBH (Austria)

- International Road Dynamics Inc. (Canada)

- Kapsch TrafficCom AG (USA)

- Neology Inc. (Austria)

- Q-Free ASA (Norway)

- Raytheon Company (USA)

- Siemens AG (Germany)

- Transcore (USA)

- Thales Group (France), Other Key Players

Key Industry Developments in the Electronic Toll Collection (ETC) Market:

- In July 2023, Axxès, a prominent European provider of electronic toll services, boasts over 300,000 equipped vehicles and over 40,000 clients. Axxès has become a member of the Avanci Aftermarket program, which Avanci describes as an independent pioneer in streamlining the process of technology sharing. Over forty patent proprietors have licensed their 4G, 3G, and 2G key patents via the program, which Avanci Aftermarket utilizes to grant licenses for connected products installed in vehicles after their initial auction. Being a licensee will grant Axxès expedient and effortless access to wireless patents, which will stimulate advancements in the European interoperable/electronic toll collection industry.

- In May 2023, The Pennsylvania Turnpike initiated development of its computerized, contactless toll collection system. According to the Pennsylvania Turnpike Commission, the new toll collection system utilizes open-road tolling, which is a contactless and unrestricted method. Highway limits will be maintained by vehicles equipped with E-ZPass transponder and Toll By Plate payment acceptance technology. Open-road tolling, as stated by the Turnpike Commission, offers environmental benefits and ensures the safety of both vehicles and personnel. The commission asserts that the installation process for interchanges will be simplified and reduced in cost. The decision will save $75 million annually, per the commission. Nineteen gantries are currently being constructed along the Northeast Extension, extending from the Reading junction to the New Jersey border.

|

Global Electronic Toll Collection (ETC) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.20 % |

Market Size in 2032: |

USD 19.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electronic Toll Collerction (ECT) Market by Type (2018-2032)

4.1 Electronic Toll Collerction (ECT) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vehicle Automatic Understanding System

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Short Range Communication

4.5 Global Position Finding Satellite System

Chapter 5: Electronic Toll Collerction (ECT) Market by Application (2018-2032)

5.1 Electronic Toll Collerction (ECT) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Highway

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Urban

5.5 Bridge

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Electronic Toll Collerction (ECT) Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 NIKE INC. (BEAVERTON

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 OREGON

6.4 USA)

6.5 ADIDAS AG (HERZOGENAURACH

6.6 GERMANY)

6.7 UNDER ARMOUR INC. (BALTIMORE

6.8 MARYLAND

6.9 USA)

6.10 PUMA SE (HERZOGENAURACH

6.11 GERMANY)

6.12 DECATHLON GROUP (VILLENEUVE-D'ASCQ

6.13 FRANCE)

6.14 ASICS CORPORATION (KOBE

6.15 JAPAN)

6.16 NEW BALANCE ATHLETICS INC. (BOSTON

6.17 MASSACHUSETTS

6.18 USA)

6.19 AMER SPORTS CORPORATION (HELSINKI

6.20 FINLAND)

6.21 VF CORPORATION (DENVER

6.22 COLORADO

6.23 USA)

6.24 COLUMBIA SPORTSWEAR COMPANY (PORTLAND

6.25 OREGON

6.26 USA)

6.27 OTHER KEY PLAYERS

Chapter 7: Global Electronic Toll Collerction (ECT) Market By Region

7.1 Overview

7.2. North America Electronic Toll Collerction (ECT) Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Vehicle Automatic Understanding System

7.2.4.2 Short Range Communication

7.2.4.3 Global Position Finding Satellite System

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Highway

7.2.5.2 Urban

7.2.5.3 Bridge

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Electronic Toll Collerction (ECT) Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Vehicle Automatic Understanding System

7.3.4.2 Short Range Communication

7.3.4.3 Global Position Finding Satellite System

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Highway

7.3.5.2 Urban

7.3.5.3 Bridge

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Electronic Toll Collerction (ECT) Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Vehicle Automatic Understanding System

7.4.4.2 Short Range Communication

7.4.4.3 Global Position Finding Satellite System

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Highway

7.4.5.2 Urban

7.4.5.3 Bridge

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Electronic Toll Collerction (ECT) Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Vehicle Automatic Understanding System

7.5.4.2 Short Range Communication

7.5.4.3 Global Position Finding Satellite System

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Highway

7.5.5.2 Urban

7.5.5.3 Bridge

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Electronic Toll Collerction (ECT) Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Vehicle Automatic Understanding System

7.6.4.2 Short Range Communication

7.6.4.3 Global Position Finding Satellite System

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Highway

7.6.5.2 Urban

7.6.5.3 Bridge

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Electronic Toll Collerction (ECT) Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Vehicle Automatic Understanding System

7.7.4.2 Short Range Communication

7.7.4.3 Global Position Finding Satellite System

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Highway

7.7.5.2 Urban

7.7.5.3 Bridge

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Electronic Toll Collection (ETC) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.20 % |

Market Size in 2032: |

USD 19.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||