Global Electrical Conduit Market Overview

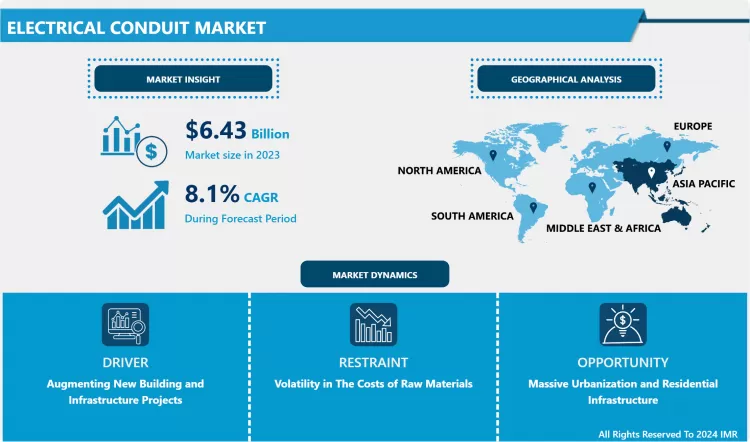

Electrical Conduit Market Size Was Valued at USD 6.43 Billion In 2023 And Is Projected to Reach USD 12.96 Billion By 2032, Growing at A CAGR of 8.1% From 2024-2032.

A Conduit is manufactured from plastic or metallic internal which electric cord runs smoothly. This is referred to as an electrical conduit. The open wall from the outdoor is usually determined withinside the open surroundings which protect the cable. It is used for unfinished locations along with attics, crawlspaces, basements, and outdoors mounts. This conduit seems like an armored cable. Similarly, Electrical Conduit is insulated and wires are enclosed in an armored cable. This cable is used for the AC device, electrical wire systems, building units and is generally installed in open areas. The main objective of the electrical conduit is to protect the wires at vulnerable spots, organize the wires and provide insulation and protect from any mishap occurred in the short circuit. Electrical conduit has high demand in the developing countries with large residential and commercial building infrastructure development. Availability in various materials, types, and sizes according to the application type has benefited the electrical conduit market as a large adoption rate of standard electrical conduit devices in the building units for safe electrical as well as other wire management. Although Covid19 has hampered the growth of the global electrical conduit market, recovery is expected in the next 2-3 years as business activities are getting back on track.

Covid-19 Impact on Electrical Conduit Market

The electric conduit market was highly affected by the Covid19 pandemic. Major countries imposed nationwide lockdown halting all the ongoing building and construction projects, disrupted manufacturing of electrical conduits, and delay due to disturbed supply chain making it slowing the growth of the electrical conduit market. The Covid19pandemic has affected each commercial enterprise throughout the world. The federal authority’s steerage to save you the unfold of the virus, in addition to Shelter-in-Place Orders issued on the kingdom and neighborhood levels, have pressured organizations to adjust or extrude their everyday commercial enterprise operations. Electrical conduit producers had been affected in 2020 because of commercial enterprise shutdown mandates, social distancing norms, and restrained neighborhood and kingdom authority’s workplace activities. However, the call for electric conduits became hampered with the aid of using the pandemic, majorly because of the decline in the demand for electric conduits from the development industry.

Market Dynamics and Factors

Drivers:

An electrical conduit is an electrical piping device used for the safety and routing of electrical wiring. It is used for protective cables, wires, and statistics hyperlinks towards heat, cold, tensile stress, stress, and different outside impacts withinside the mechanical and electric engineering industry. Many special brands/producers provide numerous kinds of conduits for various packages with numerous technical requirements.

These electric conduit structures were one of the reliable & famous wiring structures withinside the marketplace and are typically used for protection purposes. Electrical conduit is one of the most secure wiring structures and gives a cultured view of electrical wiring. These conduit structures are experiencing a lift in call because it protects the enclosed conductors from impact, moisture, and chemical vapors. Furthermore, it gives sturdiness and may be used for plenty of years. In addition to this, an electric conduit prevents unintended harm to the insulation. When hooked up with the right sealing fittings, a conduit will now no longer allow the float of flammable gases and vapors, which protects from hearthplace and explosion risks in regions dealing with risky substances. These homes of electrical conduit make it a desired wiring device.

Government across the world has issued certain rules and guidelines for the electrical wiring installation and electrical conduit standard specifying in the circulation creating set standard rules for manufacturing standards as well as application-based installation guidelines that have streamlined the demand of electrical conduit globally.

New building and infrastructure projects in the countries like India, China, South Korea, Philippines create a growing demand for electrical conduits in central and east Asia markets. This regional demand caused the growth of local manufacturers in India, China, and South Korea.

Restraints:

The fundamental raw material used for the production of electrical conduits consists of plastic (HDPE, PP, PVC, and others), stainless steel, and aluminum, amongst others. Volatility in the costs of strength and crude oil, which might be used for production and transporting those substances, is the primary purpose of fluctuations of costs of raw material These fluctuations affected largely of costs of the completed merchandise.

A large part of the restraining factor is the delay in supply chain creating price inflation of the finished product created a less demanding commodity in the past 3 years. Hence, the costs of those substances have an immediate effect on the value of electrical conduits.

Opportunities:

Rising energy consumption due to developing countries with massive urbanization and residential infrastructure created a demand for electrical equipment, wiring, and electrical conduit systems. According to the United States Energy Information Administration, the worldwide energy demand is possible to boom to 736 quadrillions Btu through 2040. Such high demand for energy needs high-performance conductors and wires which will need durable and premium electrical conduits to manage and safeguard the electrical wire system of the large building and industrial units.

High opportunity for the growth of PVC and flexible electrical conduit in a variety of industries due to low costing and great durability provides complete protection of wires indoors and outdoors. In the last 5 years, demand for PVC electrical conduits has grown significantly. The new building adopts flexible conduits due to the versatility of flexible functions. Such demand trend is expected to grow in the coming 5-7 years as building technology and new practices are being acquired by builders and developers.

Challenges:

Electrical conduit system is problematic to install in narrow spaces and post construction and more time is required for the installation of this wiring system. The connection process of conduit is much complex for HVAC system where duct space is limited and installation required safety and precession without disturbing the internals of heating, ventilating and air conditioning system of the building. Once electrical conduit installed in the building the fault-finding process gets very difficult due to complex wiring installation. position of switches as well. Moreover, it is very difficult to manage supplementary connections in the future. Less outlets, limited junction box and lack of RCCB can destroy the wiring by sudden upsurge or disruption of electricity. In such case replacement of wiring is real challenge and also a very common problem in electrical conduit market.

Market Segmentation

Segmentation Analysis of Electrical Conduit Market:

By Type, Flexible conduit is the dominating segment in the electrical conduit market. This flexible electric conduit is lightweight, generally much less pricey than different options, and versatile & clean to install. Flexible electric conduit is a lot less difficult to paintings with than inflexible steel or plastic conduit. This is due to the fact there may be no bending involved. However, Flexible electric conduits will now no longer provide pretty as a lot of safety as an inflexible electric conduit. It is bendy and might snake thru partitions and different structures. This electric conduit is used thanks to its benefits which include lightweight conduit, generally much less pricey than different options, and versatile & clean to install.

By Material, the Non-Metallic segment is dominating the electric conduit market globally. A nonmetallic conduit is a Widley used conduit that comes in both rigid and flexible conduit. Non-Metallic conduit provides higher resistance to corrosion and great protection from moisture ingress. The non-Metallic conduit includes PVC, PP, HDPE, and other various materials. Generally, a non-metallic conduit is installed above ground and provides excellent heat resistance, protection from constant sunlight, and low-temperature effects. Thus, the non-metallic conduit has a significantly larger demand in the electrical conduit market.

By End-Use Application, Building and construction are the dominating segments in the electric conduit market. Electric conduit is generally used in the building where large web electrical wires travel throughout the building. Electric conduit is used to organize and keep it in single tube channeling to each part of the building creating as smart and safe management of electrical wires. Wiring structures in homes can be a challenge to common alterations. Frequent wiring modifications are made less complicated and more secure thru the usage of electric conduit, as present conductors may be withdrawn and new conductors installed, with little disruption alongside the route of the conduit. Furthermore, an electrical conduit is used to guard and direction electric wiring in construction or structure. For workshops and public homes, conduit wiring is the fine and maximum suitable gadget of wiring and additionally offers safety and protection towards hearthplace.

Regional Analysis of Electrical Conduit Market:

The Asia Pacific is the dominating region in the electronic conduit market. The Asia Pacific led the electric conduit market accounting for a percentage of 37.8% in 2020. Emerging economies in the Asia Pacific are predicted to have tremendous potential for electric conduits because rapid growth in developing enterprises led via way of means of the speedy monetary improvement and authorities projects in infrastructural developments. In addition, the growing population in the Asia Pacific created a larger customer base with higher purchase power in the domestic and commercial segments. APAC is predicted to be the fastest-developing marketplace for electric conduits globally for the duration of the forecast period. Significant client base, growing city population, low exertions costs, and smooth availability of uncooked substances are attracting global agencies to shift their manufacturing centers to the location, for this reason growing an excessive call for electric conduits in those industries. The boom in call for electric conduit may be in large part attributed to the developing infrastructure and building & creation industries. The call for electric conduits is growing unexpectedly withinside the location due to the excessive call for from the infrastructural sector.

North America region is expected to grow at a steady pace. Sophisticated building infrastructure and planned construction project execution making room for modification and installation of electrical circuits as well as an electrical conduit to the structured wiring system of the building which makes it a constant demanding market of electrical conduit in the United States and Canada.

Players Covered in Electrical Conduit Market are:

- Atkore International Group Inc

- Hubbell Incorporated

- Legrand S.A

- Schneider Electric SE Ltd

- Aliaxis Group S.A

- Sekisui Chemical Co Ltd

- Wienerberger AG

- National Pipe & Plastics Inc

- Cantex Inc

- Orbia Advance Corporation

- Astral Polytechnik Limited

- China Lesso Group Holdings Ltd

- JM Eagle Inc

- Nan Ya Plastics Corp

- D.P. Jindal Group

- Pipelife International GmbH

- Zekelman Industries Inc

- OPW Corporation

- Premier Conduit Inc

- International Metal Hose Company

- Sanco Industries Ltd. and other major players.

Key Industry Developments In Electrical Conduit Market

- In February 2021, Atkore International Group Inc. took over FRE Composites Group which is the main producer of fiberglass conduit answers for the electric, transportation, telecommunication, and infrastructure markets. This acquisition helped Atkore International to widen its electrical conduit product portfolio.

- In October 2020, Atkore International Group Inc. acquired the assets of Queen City Plastics Inc. which is a manufacturer of PVC conduit, elbows, and fittings for the electric market. Queen City Plastics Inc has a stronghold in the southeast and mid-Atlantic region of the United States. This acquisition strengthened Atkore’s current product portfolio and enabled a wide client base in the United States.

|

Electrical Conduit Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.1% |

Market Size in 2032: |

USD 12.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electrical Conduit Market by Type (2018-2032)

4.1 Electrical Conduit Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rigid

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Flexible

Chapter 5: Electrical Conduit Market by Material (2018-2032)

5.1 Electrical Conduit Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Metallic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-Metallic

Chapter 6: Electrical Conduit Market by End User (2018-2032)

6.1 Electrical Conduit Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Building & Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial Manufacturing

6.5 IT & Telecommunication

6.6 Oil & Gas

6.7 Energy & Utility

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Electrical Conduit Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARPENTER TECHNOLOGY CORPORATION (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CONSTELLIUM SE (FRANCE)

7.4 RIO TINTO GROUP (UK)

7.5 TORAY INDUSTRIES INC. (JAPAN)

7.6 ALCOA CORPORATION (US)

7.7 TEIJIN LIMITED (JAPAN)

7.8 HEXCEL CORPORATION (US)

7.9 AMG N.V. (NETHERLANDS)

7.10 NOVELIS (US)

7.11 HEXCEL (US)

7.12 ALERIS CORPORATION (US)

7.13 ARCONICINC. (THE US)

7.14 ALLEGHENY TECHNOLOGIES INCORPORATED (US)

7.15 ATI METALS (US)

7.16 KAISER ALUMINUM (US)

7.17 VSMPO-AVISMA CORPORATION (RUSSIA)

7.18 KOBE STEELLTD. (JAPAN)

7.19 TIMET (BERKSHIRE HATHAWAY INC.) (US)

7.20 DUPONT DE NEMOURSINC. (THE US)

7.21 AND OTHERS MAJOR PLAYERS.

Chapter 8: Global Electrical Conduit Market By Region

8.1 Overview

8.2. North America Electrical Conduit Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Rigid

8.2.4.2 Flexible

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Metallic

8.2.5.2 Non-Metallic

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Building & Construction

8.2.6.2 Industrial Manufacturing

8.2.6.3 IT & Telecommunication

8.2.6.4 Oil & Gas

8.2.6.5 Energy & Utility

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Electrical Conduit Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Rigid

8.3.4.2 Flexible

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Metallic

8.3.5.2 Non-Metallic

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Building & Construction

8.3.6.2 Industrial Manufacturing

8.3.6.3 IT & Telecommunication

8.3.6.4 Oil & Gas

8.3.6.5 Energy & Utility

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Electrical Conduit Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Rigid

8.4.4.2 Flexible

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Metallic

8.4.5.2 Non-Metallic

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Building & Construction

8.4.6.2 Industrial Manufacturing

8.4.6.3 IT & Telecommunication

8.4.6.4 Oil & Gas

8.4.6.5 Energy & Utility

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Electrical Conduit Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Rigid

8.5.4.2 Flexible

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Metallic

8.5.5.2 Non-Metallic

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Building & Construction

8.5.6.2 Industrial Manufacturing

8.5.6.3 IT & Telecommunication

8.5.6.4 Oil & Gas

8.5.6.5 Energy & Utility

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Electrical Conduit Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Rigid

8.6.4.2 Flexible

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Metallic

8.6.5.2 Non-Metallic

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Building & Construction

8.6.6.2 Industrial Manufacturing

8.6.6.3 IT & Telecommunication

8.6.6.4 Oil & Gas

8.6.6.5 Energy & Utility

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Electrical Conduit Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Rigid

8.7.4.2 Flexible

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Metallic

8.7.5.2 Non-Metallic

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Building & Construction

8.7.6.2 Industrial Manufacturing

8.7.6.3 IT & Telecommunication

8.7.6.4 Oil & Gas

8.7.6.5 Energy & Utility

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Electrical Conduit Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.1% |

Market Size in 2032: |

USD 12.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Electrical Conduit Market research report is 2024-2032.

Atkore International Group Inc, Hubbell Incorporated, Legrand S.A, Schneider Electric SE Ltd, Aliaxis Group S.A, Sekisui Chemical Co Ltd, Wienerberger AG, National Pipe & Plastics Inc, Cantex Inc, Orbia Advance Corporation, Astral Polytechnik Limited, China Lesso Group Holdings Ltd, JM Eagle Inc, Nan Ya Plastics Corp, D.P. Jindal Group, Pipelife International GmbH, Zekelman Industries Inc, OPW Corporation, Premier Conduit Inc, International Metal Hose Company, Sanco Industries Ltd. and other major players.

The Electrical Conduit Market is segmented into Type, Material, End-User, and region. By Type, the market is categorized into Rigid, Flexible. By Material, the market is categorized into Metallic, Non-Metallic. By End-User, the market is categorized into Building & Construction, Industrial Manufacturing, IT & Telecommunication, Oil & Gas Energy & Utility, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A Conduit is manufactured from plastic or metallic internal which electric cord runs smoothly. This is referred to as an electrical conduit. The open wall from the outdoor is usually determined with inside the open surroundings which protect the cable.

Electrical Conduit Market Size Was Valued at USD 6.43 Billion In 2023 And Is Projected to Reach USD 12.96 Billion By 2032, Growing at A CAGR of 8.1% From 2024-2032.