Electric Vehicle Fluids Market Synopsis

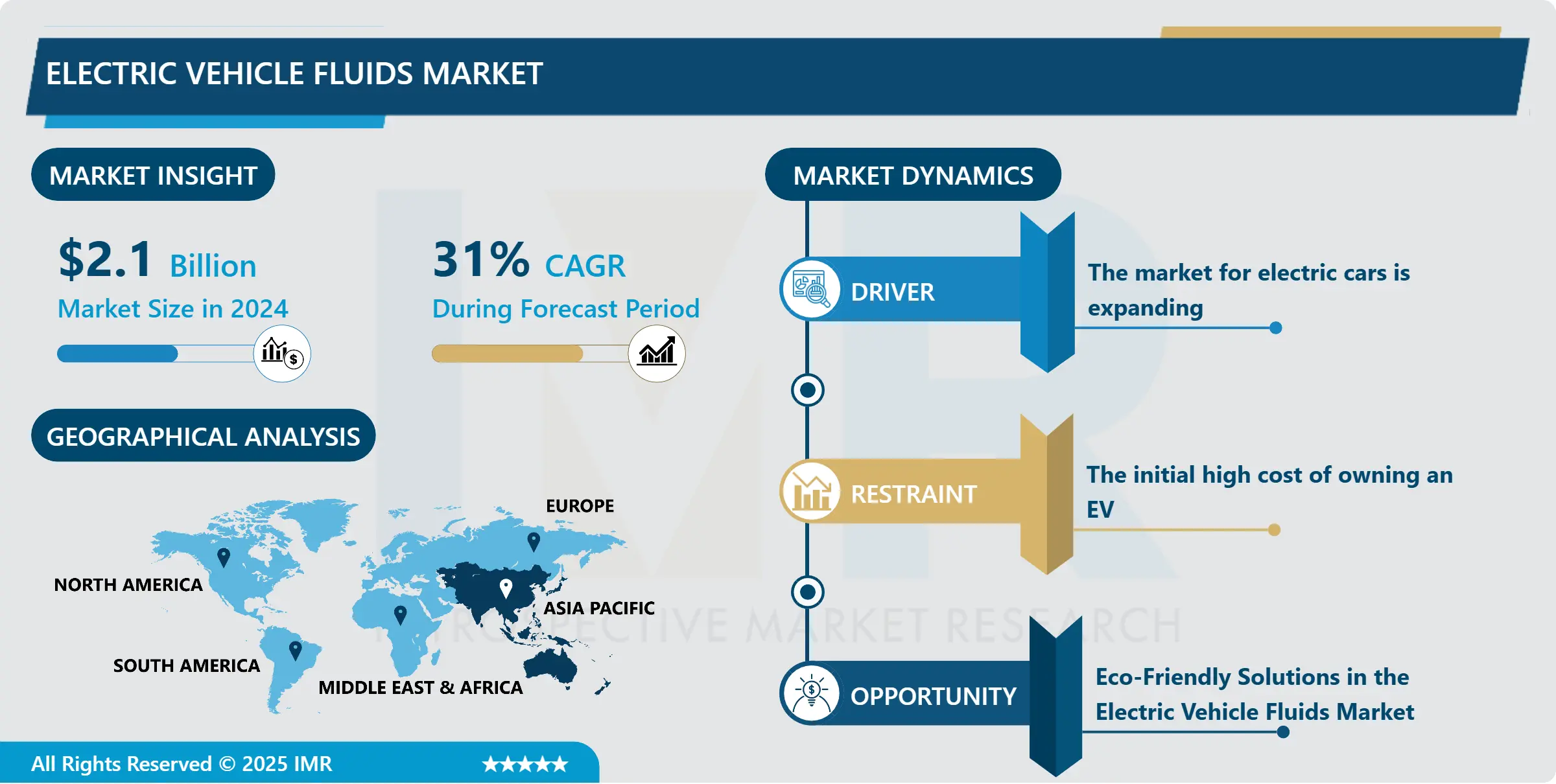

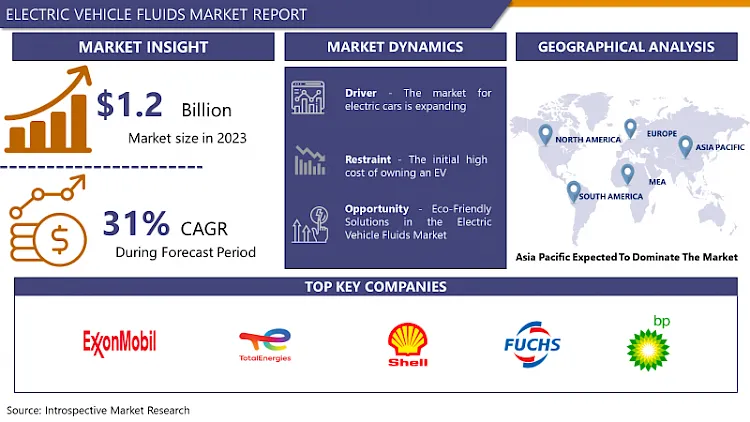

Electric Vehicle Fluids Market Size Was Valued at USD 2.1 Billion in 2024 and is Projected to Reach USD 18.21 Billion by 2032, Growing at a CAGR of 31% From 2025-2032.

The electric vehicle (EV) fluids market is an industry that focuses on developing and delivering the specific fluids required to ensure the safe and efficient operation of EVs. There are certain fluids that EVs require for them to keep on running efficiently and effectively. These luids are brake fluids for safe braking, electric motor coolants for better motor efficiency and battery coolants for temperature regulation. Lubricants are also required for the wear and friction of specific drivetrain components in EVs. The demand for high-performance EV fluids is expected to rise as the transition to EVs accelerates, and companies are expected to adapt to the evolving needs of EV technology.

The demand for electric vehicle fluids is growing rapidly due to the increased adoption of electric vehicles (EVs) worldwide. Demand for fluids designed for EVs also rises due to the increased focus on electrification of the automotive industry. The key factors influencing this market growth include government initiatives for sustainable energy, advancements in battery technology, and an increase in consumer awareness concerning the environment.

One of the primary growth factors for fluids for electric vehicles is the growing need for electric drivetrain-specific fluids for cooling and lubrication. To maintain the optimal working temperatures of their batteries, motors, and power electronics, EVs require certain cooling fluids. In this way, lubricants specifically developed for electric drivetrains are essential to minimize friction and ensure efficient power transmission, which helps to improve the durability of components and the performance of the vehicle.

In addition, advanced fluid compositions that can meet these challenging performance specifications are needed due to the increased system complexity of electric vehicles. To develop innovative fluid solutions that enhance thermal performance, reduce energy consumption, and increase the overall efficiency of EVs, manufacturers are investing in research and development. This emphasis on product innovation makes the market more competitive as companies are developing new formulas that meet the dynamic needs of consumers and electric car companies.

In addition, huge investments are being made in the infrastructure development of the electric vehicle fluids industry to support the wider adoption of electric vehicles. Various governments and individuals are financing research initiatives, recycling centers for old EV batteries, and the establishment of charging stations in a bid to promote EV efficiency. As the market for EVs is increasing and the demand for high-performance fluids is increasing, these investments should increase the opportunities for fluid suppliers and manufacturers.

Electric Vehicle Fluids Market Trend Analysis

Electric Vehicle Fluids Market Drivers- The market for electric cars is expanding

- The significant increase in the number of EVs sold in all markets across the world is also reflected in the increased demand for specialty fluids that are exclusively intended for use in electric vehicles. Substances that are able to effectively tackle the specific problems posed by electric drivetrains are urgently required as more people are turning to EVs due to advancements in EV technology.

- It is crucial to use cooling solutions that are designed specifically for components such as batteries and electric motors because these are the parts that must be maintained at the optimal working temperatures for maximum durability and performance. As batteries are the heart of electric cars, their temperature regulation is of utmost importance for their performance and preservation from aging and capacity loss. Likewise, electric car drivetrain-specific lubricants reduce friction and prevent important components from wearing out or failing prematurely.

- There will be an increased need for the specialized fluids due to the innovation of the electric car technology. As vehicle manufacturers seek to achieve more performance and greater range in their electric models, fluids’ role in heat management and ensuring vehicle reliability and durability becomes even more critical. They need fluids that can respond to dynamic conditions and ensure consistent operation throughout the vehicle’s life cycle because of the continuous advancements in electric motor technologies and battery technologies.

- Moreover, sustainability and environmental awareness in fluid formulations is growing as the demands of EV consumers evolve. Since the automotive industry faces the trend of switching to electric vehicles, manufacturers pay more and more attention to ways that do not harm the environment but ensure high performance. These efforts are in line with the larger sustainability goals in the industry. In conclusion, the increasing demand for specialty fluids for EVs is also a sign of the industry’s commitment to developing innovative fluids to address specific issues of environmentally friendly mobility as well as progress in EV technology.

Electric Vehicle Fluids Market Opportunities- Eco-Friendly Solutions in the Electric Vehicle Fluids Market

- Sustainability in the Electric Vehicle Fluids Market: Understanding the Role of Sustainability in a Transforming Industry. Climate change and pollution have made people conscious of their consumption and the need for changes in environmentally responsible ways, including in automotive fluids. With rising concerns over the hazardous effects of conventional automotive fluids on the environment and the need to mitigate global warming, there is a growing need for solutions that help protect the environment and reduce carbon emissions. Manufacturers have a golden opportunity to push fluids to meet the performance needs of electric vehicles as well as a wider vision of sustainability.

- To cater for this rising market need, many manufacturers are developing new environmentally sustainable fluids from naturally occurring materials. The use of these fluids like biodegradable lubricants and cooling liquids presents perhaps one of the most attractive solutions for addressing the concerns over the environmental effects of automotive operations. Through the use of biogenic materials and responsible manufacturing practices, industries could effectively mitigate atmospheric gas concentrations and diminish the consumption of depleting resources. Furthermore, the introduction of non-hazardous formulations also increases the environmental friendliness of these fluids by reducing the potential danger of these fluids not only to humans but also to various ecosystems during their use.

- Besides, the focus on sustainability in the EV fluids market does not only concern the products offered but also the entire supply chain and manufacturing process. Companies are launching programs to reduce the use of raw materials, waste, and energy in manufacturing plants. Through the implementation of sustainable production methods and the application of the circular economy model, companies can improve their environmental performance and support the environmental responsibility of the automotive sector.

- In the end, the trend towards sustainability in electric vehicle fluids demonstrates the overall efforts towards developing a sustainable transport system that integrates economic growth with environmental protection. Given the increased consumer knowledge and demands together with the rising regulatory challenges, manufacturers have an imperative to focus on sustainable and innovative product development to achieve positive change towards a safer planet.

Electric Vehicle Fluids Market Segment Analysis:

Electric Vehicle Thermal Management Solutions Market is Segmented based on Type, Vehicle Type, Propulsion Type, and Fill Type.

By Type, Product Type segment is expected to dominate the market during the forecast period

- In the forecast period, the Product Type segment would continue to lead the market with an emphasis on engine oil, coolants, transmission fluids, and greases. These fluids are crucial in ensuring vehicles of all power-trains operate at peak efficiency and experience prolonged useful lifetimes.

- Lubricants such as engine oil reduce friction between the moving parts of an engine to promote its smooth functioning while the other fluids play a role in keeping the engine cool.

- Other fluids such as transmission fluids help in easy gear-changing and less friction in the transmission system for more efficiency. oils are very essential in the lubrication of components including bearings and joints to minimise wear and tear.

- This share of dominance is due to several categories of products like engine oil, coolants, transmission fluids, and greases. Still the most important part of this segment Engine oil remains necessary for lubrication and protection of the moving parts within the engine. Coolants which are used to regulate the temperature of the engine also adds significantly in this regard since without them it is possible for the engine to overheat.

- Transmission fluids, which are meant for smooth gear shifting and for ensuring that there is no wear and tear within the transmission system, have their own fair share. Further, greases that are essential in lubricating different components like bearings and joints further support the Product Type segment’s significance.

By Vehicle Type, On-highway Electric Vehicles and Off-highway Electric Vehicles segment held the largest share in 2024

- Regarding the type of vehicle segment in the electric vehicles fluids market, the electric vehicles (EVs) fluids segment is a prominent one.

- Electric vehicles fluids segment held the highest market share in 2023 due to a high demand for on-highway electric vehicles.

- The fluids’ market has seen a rapid shift with the increased use of EVs in urban and suburban areas, resulting in increased demand for fluids optimized for EVs to improve battery performance and vehicle cooling.

- Passenger cars, buses, and trucks fall under the On-highway Electric Vehicles segment, while Off-highway Electric Vehicles encompass a wide range of equipment used for construction, agricultural, industrial, and forestry purposes. The prominence of this segment implies the overall increasing popularity of electric propulsion for different types of vehicles.

Electric Vehicle Fluids Market Regional Insights:

Asia-Pacific to Dominate the Market

- Asia-Pacific will be the leading market for Electric Vehicle Fluids during the forecast period due to high demand in countries like China and India.

- The region is expected to grow with the increased consumption of EVs and increased government spending to increase the production of EVs to reduce emissions.

- The China Association of Automobile Manufacturers (CAAM) reported that China is the leading automotive production country in the world. July 2022 witnessed the rise of battery-powered electric vehicles by 117. 2% compared to January-July 2021. Statistics indicate that the country sold approximately 617 thousand electric cars in July 2022.

- Additionally, with increasing government supports in India to promote the e-mobility of the country, the sale number of two-wheeler electric vehicles is increasing rapidly.

- Federation of Automobile Dealers Associations revealed that the number of two-wheel electric vehicles sold in the country was nearly 231000. Hence, there will be a need to increase the market for EV fluids throughout the forecast period.

- All the above-mentioned factors along with government support are driving the demand for electric vehicle fluids market in the Asia-pacific region during the forecast period.

Active Key Players in the Electric Vehicle Fluids Market

- Exxon Mobil Corporation

- Total Energies

- Shell plc

- FUCHS

- BP p.l.c.

- Royal Dutch Shell plc

- FUCHS Petrolub AG

- Petronas

- ENEOS Corporation

- Repsol S.A.

- Valvoline Inc.

- PTT

- Petroliam Nasional Berhad (PETRONAS)

- Saudi Arabian Oil Co.

- Other Active players

Key Industry Developments in the Electric Vehicle Fluids Market:

- November 2022: Total Energies Marketing India Private Limited (TEMIPL) revealed the introduction of the new EV Fluid collection of electric and hybrid cars and motorcycles in India.

- August 2022: India: Shell Lubricants launches heat transfer fluids for EV motors suitable for climatic and geographical conditions.

|

Global Electric Vehicle Fluids Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

31% |

Market Size in 2032: |

USD 18.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle |

|

||

|

By Propulsion Type |

|

||

|

By Fill Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Fluids Market by Type (2018-2032)

4.1 Electric Vehicle Fluids Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Engine oil

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Coolants

4.5 Transmission fluids

4.6 Greases

Chapter 5: Electric Vehicle Fluids Market by Vehicle (2018-2032)

5.1 Electric Vehicle Fluids Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-highway Electric Vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Off-highway Electric Vehicles

Chapter 6: Electric Vehicle Fluids Market by Propulsion Type (2018-2032)

6.1 Electric Vehicle Fluids Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Battery electric vehicles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hybrid electric vehicles

Chapter 7: Electric Vehicle Fluids Market by Fill Type (2018-2032)

7.1 Electric Vehicle Fluids Market Snapshot and Growth Engine

7.2 Market Overview

7.3 First fill

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Service fill

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Electric Vehicle Fluids Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AEROVIRONMENT INC (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AGEAGLE AERIAL SYSTEMS INC (US)

8.4 BOEING COMPANY (US)

8.5 DJI INNOVATIONS (CHINA)

8.6 IDEAFORGE (INDIA)

8.7 ISRAEL AEROSPACE INDUSTRIES LTD (ISRAEL)

8.8 LATITUDE ENGINEERING (US)

8.9 LOCKHEED MARTIN CORPORATION (US)

8.10 NORTHROP GRUMMAN CORPORATION (US)

8.11 SAAB GROUP (SWEDEN)

8.12 SCHIEBEL ELEKTRONISCHE GERATE GMBH (AUSTRIA)

8.13 TEXTRON INC (US)

8.14 PARROT SA (FRANCE)

8.15 GENERAL ATOMICS AERONAUTICAL SYSTEMS INC. (US)

8.16 AEROVIRONMENT INC. (US)

8.17 SENSEFLY SA (SWITZERLAND)

8.18 KESPRY INC. (US)

8.19 TURKISH AEROSPACE INDUSTRIES INC (TURKEY)

8.20 OTHER KEY PLAYERS

Chapter 9: Global Electric Vehicle Fluids Market By Region

9.1 Overview

9.2. North America Electric Vehicle Fluids Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Engine oil

9.2.4.2 Coolants

9.2.4.3 Transmission fluids

9.2.4.4 Greases

9.2.5 Historic and Forecasted Market Size by Vehicle

9.2.5.1 On-highway Electric Vehicles

9.2.5.2 Off-highway Electric Vehicles

9.2.6 Historic and Forecasted Market Size by Propulsion Type

9.2.6.1 Battery electric vehicles

9.2.6.2 Hybrid electric vehicles

9.2.7 Historic and Forecasted Market Size by Fill Type

9.2.7.1 First fill

9.2.7.2 Service fill

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Electric Vehicle Fluids Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Engine oil

9.3.4.2 Coolants

9.3.4.3 Transmission fluids

9.3.4.4 Greases

9.3.5 Historic and Forecasted Market Size by Vehicle

9.3.5.1 On-highway Electric Vehicles

9.3.5.2 Off-highway Electric Vehicles

9.3.6 Historic and Forecasted Market Size by Propulsion Type

9.3.6.1 Battery electric vehicles

9.3.6.2 Hybrid electric vehicles

9.3.7 Historic and Forecasted Market Size by Fill Type

9.3.7.1 First fill

9.3.7.2 Service fill

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Electric Vehicle Fluids Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Engine oil

9.4.4.2 Coolants

9.4.4.3 Transmission fluids

9.4.4.4 Greases

9.4.5 Historic and Forecasted Market Size by Vehicle

9.4.5.1 On-highway Electric Vehicles

9.4.5.2 Off-highway Electric Vehicles

9.4.6 Historic and Forecasted Market Size by Propulsion Type

9.4.6.1 Battery electric vehicles

9.4.6.2 Hybrid electric vehicles

9.4.7 Historic and Forecasted Market Size by Fill Type

9.4.7.1 First fill

9.4.7.2 Service fill

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Electric Vehicle Fluids Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Engine oil

9.5.4.2 Coolants

9.5.4.3 Transmission fluids

9.5.4.4 Greases

9.5.5 Historic and Forecasted Market Size by Vehicle

9.5.5.1 On-highway Electric Vehicles

9.5.5.2 Off-highway Electric Vehicles

9.5.6 Historic and Forecasted Market Size by Propulsion Type

9.5.6.1 Battery electric vehicles

9.5.6.2 Hybrid electric vehicles

9.5.7 Historic and Forecasted Market Size by Fill Type

9.5.7.1 First fill

9.5.7.2 Service fill

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Electric Vehicle Fluids Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Engine oil

9.6.4.2 Coolants

9.6.4.3 Transmission fluids

9.6.4.4 Greases

9.6.5 Historic and Forecasted Market Size by Vehicle

9.6.5.1 On-highway Electric Vehicles

9.6.5.2 Off-highway Electric Vehicles

9.6.6 Historic and Forecasted Market Size by Propulsion Type

9.6.6.1 Battery electric vehicles

9.6.6.2 Hybrid electric vehicles

9.6.7 Historic and Forecasted Market Size by Fill Type

9.6.7.1 First fill

9.6.7.2 Service fill

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Electric Vehicle Fluids Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Engine oil

9.7.4.2 Coolants

9.7.4.3 Transmission fluids

9.7.4.4 Greases

9.7.5 Historic and Forecasted Market Size by Vehicle

9.7.5.1 On-highway Electric Vehicles

9.7.5.2 Off-highway Electric Vehicles

9.7.6 Historic and Forecasted Market Size by Propulsion Type

9.7.6.1 Battery electric vehicles

9.7.6.2 Hybrid electric vehicles

9.7.7 Historic and Forecasted Market Size by Fill Type

9.7.7.1 First fill

9.7.7.2 Service fill

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Electric Vehicle Fluids Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

31% |

Market Size in 2032: |

USD 18.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle |

|

||

|

By Propulsion Type |

|

||

|

By Fill Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||