Global DTG Printing Machine Market Overview

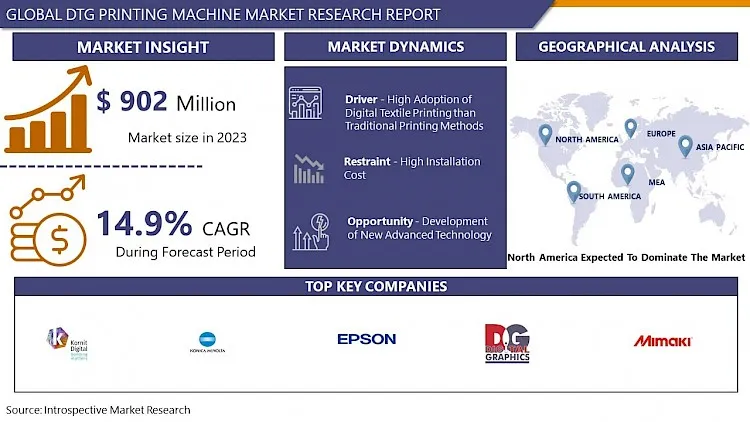

DTG Printing Machine Market Size Was Valued at USD 902 Million in 2023 and is Projected to Reach USD 3148.38 Million by 2032, Growing at a CAGR of 14.9% From 2024-2032.

Reproducing a digital image on a physical surface is called digital printing. The physical surface can be in the form of paper, cloth, plastic, foil, etc. Digital textile printing allows printing a design once created directly on the fabric with a computer. No additional steps are required for this process. Dye sublimation printers are used to digitally print designs on cloth. It performs the printing process by using heat to transfer the design to the fabric. Digital printing requires pre-treatment of the fabric which allows the fabric to hold the ink firmly and achieve different colors throughout the pre-treatment process. Digital textile printing is the latest innovation in textile printing, bridging the supply-demand gap that traditional textile printing machines couldn't fill. Digital printers enable uninterrupted printing, cost-effective production, a variety of designs, and high reliability. An important factor that helps increase production and drive business growth which is a supplementing factor for the growth of the DTG Printing machine market.

Market Dynamics And Key Factors For DTG Printing Machine Market

Drivers:

- Digital textile printing has many advantages over traditional printing methods. The excellent element of digital printing technology is that there are no restrictions on the use of colors or repeat sizes on the surface cloth design. Unlike traditional printing techniques, users can print multiple shades of color on the fabric at the same time. Digital textile printing (DTP) systems are said to be able to produce 16 million colors and shades. Therefore, this procedure saves time and is inexpensive. Digital printing has proven to be beneficial to designers, textile companies, and retailers. This allows users to print as quickly and accurately as they need to in order to achieve the result. Traditional printing requires a minimum amount to print therefore, the overall cost of creating the sample is significantly reduced. Designers can control and customize the design and printing process from anywhere. Modifications and changes can be made at no additional cost. This facilitates timely delivery and reduces storage requirements. The Designs can easily be digitally printed from files saved or transferred to your computer. Moreover, Due to the serious problem of pollution by the textile industry, digital printing technology is environmentally friendly and saves water compared to traditional printing methods and also, less pollution as no dyes or chemicals are released.

- Digitization has become a powerful tool for the textile industry. Digital printing has become an ideal way for textile artists to print digital-based images. Increasing acceptance of digital printing by textile artists with more color options and designs is driving the market growth. In addition, by offering a variety of colors and CMYK design options, digital textile printing allows for flexibility in customization, making the fabric more beautiful, unique, and attractive. Changing consumer tastes for garments and increasing demand for customized products continue to drive the global digital textile printing machine market.

Restraints:

- DTG Printing Machine cannot print metallic colors. Flat color printing also needs to produce colors that the device cannot handle. In addition, the maximum width that this machine can print on the fabric is 150 cm. The degree of rejection of printed fabrics is higher than in other forms of printing which makes it a major restraining factor for the DTG Printing Machines. Also, higher investment in installation and maintenance costs makes it less desirable for a large number of business owners.

Opportunities:

- The latest advances in ink products and color management software have contributed significantly to producing a wide variety of colors with the highest print quality. New technology can manage complex colors in prints. The new DTP system uses ‘drop-on-demand technology’ to enable rapid production on a variety of substrates. The current market features several innovations in DTP technology including some of the developments are thermal inkjet, piezo inkjet, continuous inkjet, thermal transfer, static electricity, electrophotographic, each with its quality, advantages, and limitations. With the latest advances in inkjet technology, most fabrics can be digitally printed.

Challenges:

- As end-user demand for textile innovation grows, apparel makers are choosing efficient printing processes that can contribute to increased profits. Screen printing and DTG presses are the two most common methods designers use to meet their customers' needs. DTG printing is an affordable way to not print many textiles, but screen printers can print hundreds of sheets in less time. Given this, many developers may prefer other methods instead of choosing a DTG printer. Therefore, in the long run, such competition with other processes can be a major challenge for the DTG printing machine market.

Market Segmentation

Segmentation Analysis of DTG Printing Machine Market

- By Type, Multi-Pass Printing is dominating the DTG Printing Machine Market. Multi-pass printing enables high printing capacity compared to the single-pass printing machine. For Multi Pass scan printing, the printhead is mounted on a carriage that moves from left to right and right to left across the width of the fabric. After moving along the entire board width, the fabric advances at half the depth of the carriage (2-pass printing) or a quarter of it (4-pass printing) and begins printing another horizontal bar. Moreover, multipath digital textile printers are also suitable for textile printers with low monthly or yearly production capacity. Although single-pass printing offers a low price per meter output it requires higher investment and lower return on investment, Multi-pass printing offers great value to the investment, quality as well as capacity.

- By Ink Type, Pigment is dominating in the ink type segment of DTG Printing Machine Market. DTG pigment ink printing can be easily used in different types of fabrics such as 100% cotton blends, poly blends (50% cotton / 50% polyester), and tri-blends. Unlike other ink sets, pigment printing allows instant color matching and design approval on the machine at the time of printing. At the control approval stage, the prints are displayed only on paper, and unlike the sublimation type, which needs to be developed with a hot press to achieve the final product display, the prints are displayed to be displayed after fixing and finishing. This creates a difficult and practical environment for product approval. There, the sublimation pattern must be transcribed and then approved before production begins. DTG pigment printing has a less harmful effect environment due to less water consumption up to 35%, 45% less energy, and no water pollution compared to traditional pigment screen printing. Therefore, the Pigment ink type is expected to continue its domination in the market.

- By Application, Consumer clothing is dominating in the DTG Printing Machine Market. As textile manufacturers are becoming more aware of the garment and apparel industry, they are looking for machines and technologies that can improve the design of their garments and give them the flexibility to choose the type and color of their materials. Digital textile printing machines have the advantage of being flexible in design and material selection, so demand is expected to increase around the world. Growing fashion awareness across the globe pushes the demand for digital textile printing machines. A large part of the demand for digitally printed textiles is generated from consumer clothing. Demand for aesthetically sound designs in clothing among youth and middle-aged population created high demand for such products which eventually reflected in the printing machinery and equipment. Therefore, the Consumer clothing segment dominates the DTG Printing Machine Market.

Regional Analysis of DTG Printing Machine Market

- North America is expected to hold the largest market share due to the presence of developed countries combined with technological advances and developed infrastructure. In addition, high per capita income and rapidly changing fashion trends are expected to further drive the growth of the digital textile printing machine market. There is a large commercial market in North America that generates large demand for DTG printed textiles such as clothing, sportswear, designer home décor textiles. Due to the ready availability of high-performance DTG printers and primary access to the latest innovative printing technologies, North American countries get the upper hand to dominate the DTG Printing Machine Market.

- The Asia Pacific region is expected to experience rapid growth with a constant increase in market share, driven by rising disposable income, coupled with increased awareness of the latest fashions and ongoing trends. In addition, the growing demand for creative and innovative designs, eco-friendly fabrics, and dyes is expected to drive the growth of the digital textile printing machine market. Due to the large textile markets in India and China, the digital textile press market is expected to grow fastest in the Asia Pacific region. India is the second-largest textile exporter in the world after China. Manual hand-printed textiles are famous in India. The digital textile printing machine market is expected to grow at a good pace with increasing awareness and technical know-how in the Indian textile printing industry. Therefore, the global digital textile printing machine market in the Asia Pacific region is expected to expand at the highest rate.

Players Covered in DTG Printing Machine Market are:

- Kornit Digital (Israel)

- Brother International Corporation (Japan)

- Epson (Japan)

- Aeoon Technologies (Austria)

- M&R Printing Equipment, Inc. (USA)

- Ricoh (Japan)

- Mimaki (Japan)

- OmniPrint International (USA)

- Col-Desi, Inc. (USA)

- ROQ International (Portugal)

- TexJet (Polyprint S.A.) (Greece)

- DTG Digital (Pigment.Inc) (Australia)

- Stahls' International (USA)

- AnaJet (Ricoh) (USA)

- Vastex International (USA)

- Seiko Epson Corporation (Japan)

- Lawson Screen & Digital Products, Inc. (USA)

- DTG Mart (USA)

- AstroNova (USA)

- Hanwha Techwin (South Korea)

Key Industry Developments In DTG Printing Machine Market

- In Jan 2024, Caldera announced new solutions for direct-to-garment (DTG) and direct-to-film (DTF) printing, representing a strategic move into one of the fastest growing segments of digital inkjet printing. The Caldera Direct-to-X product range will initially only be available in a bundle from selected DTG and DTF printer OEMs, as the first of a suite of linked products. It will be followed by Caldera Direct-to-Object and Caldera Direct-to-Fabric, and new software will form a suite of Direct-to-X RIPs, aimed squarely at the garment decoration market.

- In Jan 2024, Epson launched New SureColor F1070 Direct-to-Garment Desktop Printer. Epson’s new SureColor F1070 printer is its first entry level printer for the direct-to-garment space, bringing SureColor’s advances to small business owners.

|

Global DTG Printing Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 902 Mn. |

|

Forecast Period 2024-32 CAGR: |

14.9% |

Market Size in 2032: |

USD 3148.38 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Ink Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: DTG Printing Machine Market by Type (2018-2032)

4.1 DTG Printing Machine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Single Pass

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Multi-Pass

Chapter 5: DTG Printing Machine Market by Ink Type (2018-2032)

5.1 DTG Printing Machine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sublimation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Reactive

5.5 Acid

5.6 Pigment

Chapter 6: DTG Printing Machine Market by Application (2018-2032)

6.1 DTG Printing Machine Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Consumer Clothing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial & Technical Textile

6.5 Soft Signage

6.6 Sportswear

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 DTG Printing Machine Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HEXCEL CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SGL CARBON SE

7.4 SOLVAY

7.5 TOHO TENAX (TENJIN CARBON)

7.6 TORAY INDUSTRIES INC.

7.7 TENCATE

7.8 DUPONT

7.9 MITSUBISHI RAYON

7.10 BASF SE

7.11 OTHER MAJOR PLAYERS

Chapter 8: Global DTG Printing Machine Market By Region

8.1 Overview

8.2. North America DTG Printing Machine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Single Pass

8.2.4.2 Multi-Pass

8.2.5 Historic and Forecasted Market Size by Ink Type

8.2.5.1 Sublimation

8.2.5.2 Reactive

8.2.5.3 Acid

8.2.5.4 Pigment

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Consumer Clothing

8.2.6.2 Industrial & Technical Textile

8.2.6.3 Soft Signage

8.2.6.4 Sportswear

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe DTG Printing Machine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Single Pass

8.3.4.2 Multi-Pass

8.3.5 Historic and Forecasted Market Size by Ink Type

8.3.5.1 Sublimation

8.3.5.2 Reactive

8.3.5.3 Acid

8.3.5.4 Pigment

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Consumer Clothing

8.3.6.2 Industrial & Technical Textile

8.3.6.3 Soft Signage

8.3.6.4 Sportswear

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe DTG Printing Machine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Single Pass

8.4.4.2 Multi-Pass

8.4.5 Historic and Forecasted Market Size by Ink Type

8.4.5.1 Sublimation

8.4.5.2 Reactive

8.4.5.3 Acid

8.4.5.4 Pigment

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Consumer Clothing

8.4.6.2 Industrial & Technical Textile

8.4.6.3 Soft Signage

8.4.6.4 Sportswear

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific DTG Printing Machine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Single Pass

8.5.4.2 Multi-Pass

8.5.5 Historic and Forecasted Market Size by Ink Type

8.5.5.1 Sublimation

8.5.5.2 Reactive

8.5.5.3 Acid

8.5.5.4 Pigment

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Consumer Clothing

8.5.6.2 Industrial & Technical Textile

8.5.6.3 Soft Signage

8.5.6.4 Sportswear

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa DTG Printing Machine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Single Pass

8.6.4.2 Multi-Pass

8.6.5 Historic and Forecasted Market Size by Ink Type

8.6.5.1 Sublimation

8.6.5.2 Reactive

8.6.5.3 Acid

8.6.5.4 Pigment

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Consumer Clothing

8.6.6.2 Industrial & Technical Textile

8.6.6.3 Soft Signage

8.6.6.4 Sportswear

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America DTG Printing Machine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Single Pass

8.7.4.2 Multi-Pass

8.7.5 Historic and Forecasted Market Size by Ink Type

8.7.5.1 Sublimation

8.7.5.2 Reactive

8.7.5.3 Acid

8.7.5.4 Pigment

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Consumer Clothing

8.7.6.2 Industrial & Technical Textile

8.7.6.3 Soft Signage

8.7.6.4 Sportswear

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global DTG Printing Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 902 Mn. |

|

Forecast Period 2024-32 CAGR: |

14.9% |

Market Size in 2032: |

USD 3148.38 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Ink Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||