Key Market Highlights

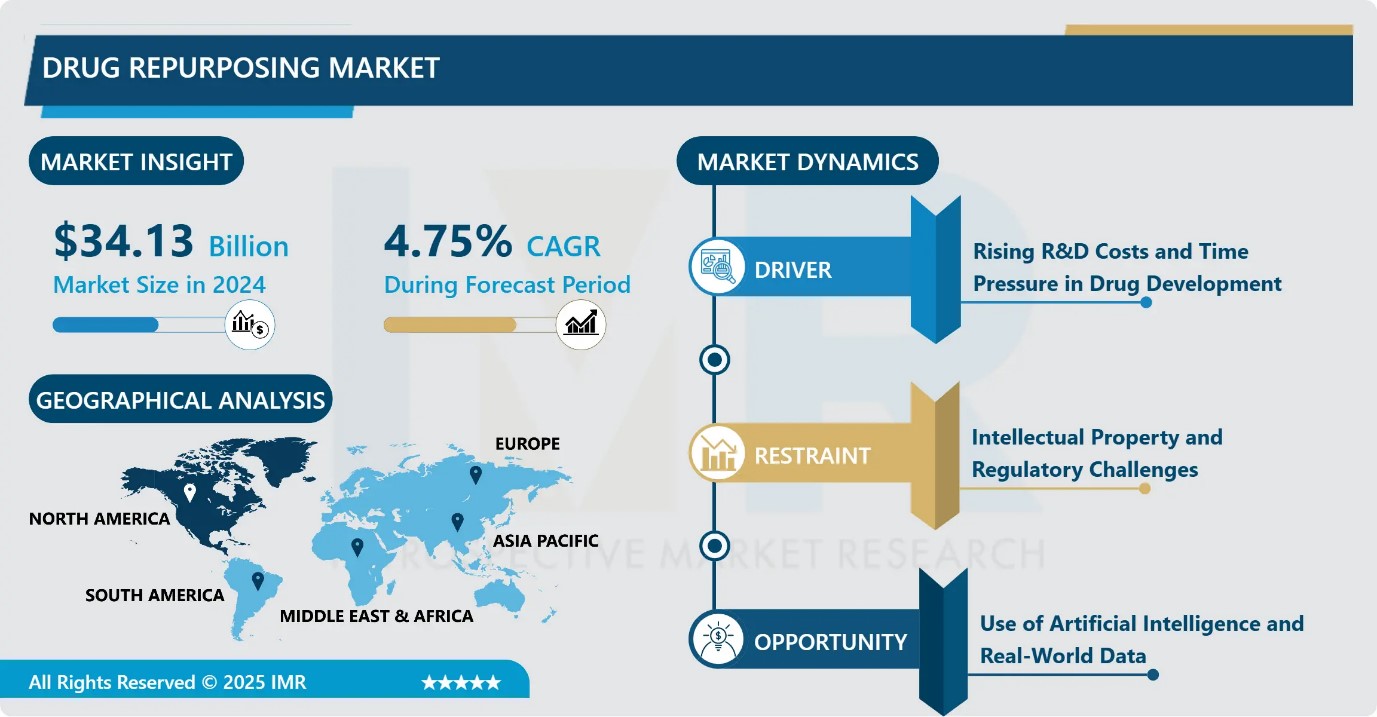

Drug Repurposing Market Size Was Valued at USD 34.13 Billion in 2024, and is Projected to Reach USD 54.28 Billion by 2035, Growing at a CAGR of 4.75% from 2025-2035.

- Market Size in 2024: USD 34.13 Billion

- Projected Market Size by 2035: USD 54.28 Billion

- CAGR (2025–2035): 4.75%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Drug Type: The Small Molecules segment is anticipated to lead the market by accounting for 39.34% of the market share throughout the forecast period.

- By Therapeutic Area: The Oncology segment is expected to capture 21.56% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 33.64% of the market share during the forecast period.

- Active Players: Eli Lilly and Company Pfizer Inc. Roche Holding AG Novartis AG Bayer AG GSK plc Amgen Inc. Biogen Inc. Teva Pharmaceutical Vertex Pharmaceuticals, and Other Active Players.

Drug Repurposing Market Synopsis:

The drug repurposing market refers to identifying new therapeutic uses for existing or approved drugs. The market scenario is positive due to rising R&D costs and faster development needs. Current market conditions favor repurposing as it reduces risk, saves time, and addresses unmet medical needs across multiple disease areas.

Drug Repurposing Market Dynamics and Trend Analysis:

Drug Repurposing Market Growth Driver- Rising R&D Costs and Time Pressure in Drug Development

- One key growth driver of the drug repurposing market is the rising cost and long timelines of traditional drug development. Developing a new drug from scratch requires significant investment, often taking more than a decade with high failure risk. Drug repurposing offers a practical alternative by using existing drugs with known safety and clinical data, which reduces development time and overall cost.

- This approach allows pharmaceutical companies to bring treatments to market faster while minimizing financial risk. In addition, increasing pressure to address unmet medical needs, especially in oncology and rare diseases, is pushing companies to adopt repurposing strategies. As a result, drug repurposing is becoming an attractive and efficient development model.

Drug Repurposing Market Limiting Factor- Intellectual Property and Regulatory Challenges

- One major limiting factor in the drug repurposing market is intellectual property and regulatory complexity. Many repurposed drugs are already off-patent, which reduces exclusivity and limits commercial returns for pharmaceutical companies. Securing new patents for alternative indications can be difficult and often offers shorter protection periods.

- In addition, regulatory requirements still demand strong clinical evidence for the new use, which can be time-consuming and costly. Differences in approval pathways across regions further add to development challenges. These factors can discourage investment, especially for smaller companies, and may slow the overall growth of the drug repurposing market despite its scientific and economic advantages.

Drug Repurposing Market Expansion Opportunity- Use of Artificial Intelligence and Real-World Data

- A major expansion opportunity in the drug repurposing market lies in the growing use of artificial intelligence (AI) and real-world data. Advanced AI tools can quickly analyze large datasets, including clinical records, genomics, and drug-disease interactions, to identify new therapeutic uses for existing drugs. This improves success rates and reduces trial-and-error in early research stages.

- Real-world evidence from hospitals and health databases further supports faster validation of new indications. Pharmaceutical companies are increasingly partnering with AI firms and research institutes to strengthen repurposing pipelines. As digital health data becomes more accessible, AI-driven drug repurposing is expected to unlock new opportunities and accelerate market expansion.

Drug Repurposing Market Challenge and Risk- Clinical Validation and Efficacy Uncertainty

- One key challenge and risk in the drug repurposing market is uncertainty around clinical efficacy in the new indication. Even though repurposed drugs have established safety profiles, their effectiveness in a different disease area is not guaranteed. Many candidates fail during mid-stage clinical trials when expected outcomes are not achieved.

- Differences in dosage, treatment duration, and patient response can further complicate trial design. In addition, limited biomarkers and unclear mechanisms of action for the new use increase development risk. These uncertainties can lead to higher costs, delayed timelines, and reduced investor confidence. As a result, companies must carefully balance scientific potential with commercial risk when pursuing drug repurposing strategies.

Drug Repurposing Market Trend- Growing Focus on AI-Driven and Data-Led Repurposing

- One major trend in the drug repurposing market is the increasing use of artificial intelligence and data-driven research models. Companies are leveraging AI, machine learning, and bioinformatics to analyze large datasets such as genomics, clinical trial data, and real-world evidence to identify new drug-disease links. This approach improves target selection and reduces early-stage research uncertainty.

- AI also helps prioritize high-potential candidates, saving time and development costs. In addition, collaborations between pharmaceutical companies, AI startups, and academic institutions are becoming more common. As healthcare data availability continues to expand, AI-led drug repurposing is emerging as a key trend that is reshaping discovery strategies and accelerating market growth.

Drug Repurposing Market Segment Analysis:

Drug Repurposing Market is segmented based on Drug Type, Therapeutic Area, End-Users, and Region

By Drug Type, Small Molecules segment is expected to dominate the market with around 39.34% share during the forecast period.

- The small molecules segment is the fastest growing in the drug repurposing market due to its proven safety, affordability, and ease of development. Most small-molecule drugs already have well-established pharmacokinetic and toxicity profiles, which significantly reduces clinical risk and development timelines. These drugs are easier to reformulate, combine, and scale for manufacturing compared to biologics.

- In addition, small molecules can be administered orally, improving patient compliance and market acceptance. Their broad mechanism of action allows researchers to test them across multiple therapeutic areas such as oncology, infectious diseases, and neurology. Strong interest from pharmaceutical companies to reduce R&D costs further supports rapid growth of this segment.

By Therapeutic Area, Oncology segment is expected to dominate with close to 21.56% market share during the forecast period.

- Oncology is the fastest growing therapeutic area in the drug repurposing market due to the high unmet need for effective and affordable cancer treatments. Cancer’s complex biology allows existing drugs to be tested across multiple tumor types and treatment lines. Many non-cancer drugs have shown anticancer potential, accelerating repurposing efforts.

- In addition, oncology trials often use adaptive and biomarker-driven designs, which reduce development time. Strong funding support, large patient populations, and rapid regulatory pathways for cancer therapies further drive growth. Pharmaceutical companies actively focus on oncology repurposing to extend product lifecycles while addressing resistance and improving patient outcomes, making it the most dynamic therapeutic segment.

Drug Repurposing Market Regional Insights:

North America region is estimated to lead the market with around 33.64% share during the forecast period.

- North America is the leading market for drug repurposing due to its strong research ecosystem and early adoption of advanced technologies. The region has a high concentration of pharmaceutical and biotechnology companies that actively invest in repurposing existing drugs to reduce development time and cost. Academic institutions and research organizations in the US and Canada play a major role by generating clinical evidence and real-world data that support new indications.

- In addition, the presence of advanced AI and data analytics platforms helps identify repurposing opportunities more efficiently. Supportive regulatory pathways, strong funding from government agencies, and high healthcare spending further accelerate market growth, making North America the most mature and commercially attractive region.

Drug Repurposing Market Active Players:

- Eli Lilly and Company, (United States)

- Pfizer Inc, (United States)

- Roche Holding AG, (Switzerland)

- Novartis AG, (Switzerland)

- Bayer AG, (Germany)

- GSK plc, (United Kingdom)

- Amgen Inc, (United States)

- Biogen Inc., (United States)

- Teva Pharmaceutical Industries Ltd, (Israel)

- Vertex Pharmaceuticals, (United States)

- Other Active Players

Key Industry Developments in the Drug Repurposing Market:

- In November 2025, Pfizer completed the acquisition of Metsera, advancing its presence in obesity drug development with a diversified pipeline

- In June 2023, GSK expanded respiratory and immunology pipelines through acquisition of Aiolos Bio (anti-TSLP antibody).

Integrated Scientific and Development Framework Driving the Drug Repurposing Market

- The drug repurposing market is technically driven by the reuse of approved or clinically tested drugs for new therapeutic indications, using a combination of computational, experimental, and clinical approaches.

- From a development perspective, repurposed drugs benefit from established pharmacokinetics, safety, and manufacturing data, which significantly reduces early-stage risk. Technologies such as artificial intelligence, machine learning, network pharmacology, and bioinformatics play a key role in identifying drug–disease relationships by analyzing genomics, proteomics, and real-world clinical data. High-throughput screening and phenotypic assays are commonly used to validate targets in preclinical stages.

- Clinically, adaptive trial designs and basket trials are preferred, especially in oncology and rare diseases, to accelerate proof of concept. Regulatory pathways often allow abbreviated development timelines, particularly when prior human data is available. From a commercial standpoint, lifecycle management, combination strategies, and indication expansion are critical technical considerations.

- However, challenges such as dose optimization, mechanism-of-action validation, and limited biomarker availability remain important technical hurdles. Overall, the market is shaped by strong integration of data science, clinical research efficiency, and regulatory science, making drug repurposing a technically efficient and strategically valuable development model for pharmaceutical and biotechnology companies.

|

Drug Repurposing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 34.13 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.75 % |

Market Size in 2035: |

USD 54.28 Bn. |

|

Segments Covered: |

By Drug Type |

|

|

|

By Therapeutic Application

|

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Drug Repurposing Market by Drug Type (2018-2035)

4.1 Drug Repurposing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Small Molecules

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Biologics

4.5 Combination Therapies

Chapter 5: Drug Repurposing Market by Therapeutic Area (2018-2035)

5.1 Drug Repurposing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oncology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Neurology & Psychiatry

5.5 Infectious Diseases

5.6 Cardiovascular Disorders

5.7 Rare Diseases

5.8 Autoimmune & Inflammatory Diseases

5.9 Metabolic Disorders

Chapter 6: Drug Repurposing Market by End User (2018-2035)

6.1 Drug Repurposing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmaceutical & Biotechnology Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Academic & Research Institutes

6.5 Contract Research Organizations (CROs)

6.6 Government & Non-profit Organizations

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Drug Repurposing Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ELI LILLY AND COMPANY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 PFIZER INC

7.4 ROCHE HOLDING AG

7.5 NOVARTIS AG

7.6 BAYER AG

7.7 GSK PLC

7.8 AMGEN INC

7.9 BIOGEN INC

7.10 TEVA PHARMACEUTICAL

7.11 VERTEX PHARMACEUTICALS

7.12 AND OTHER ACTIVE PLAYERS.

Chapter 8: Global Drug Repurposing Market By Region

8.1 Overview

8.2. North America Drug Repurposing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Drug Repurposing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Drug Repurposing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Drug Repurposing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Drug Repurposing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Drug Repurposing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Drug Repurposing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 34.13 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.75 % |

Market Size in 2035: |

USD 54.28 Bn. |

|

Segments Covered: |

By Drug Type |

|

|

|

By Therapeutic Application

|

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||