Drone Service Market Synopsis

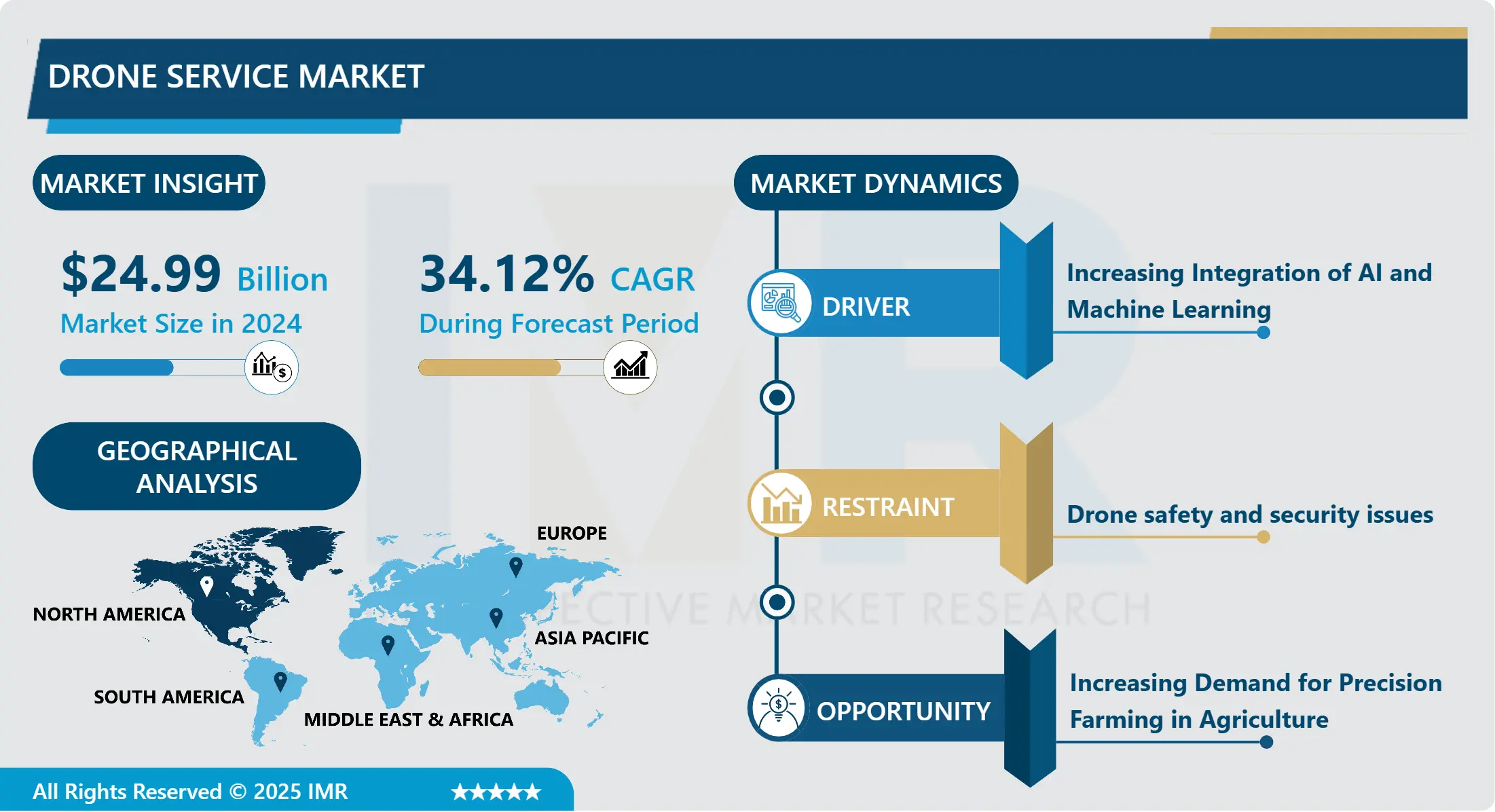

Drone Service Market Size Was Valued at USD 24.99 Billion in 2024, and is Projected to Reach USD 261.65 Billion by 2032, Growing at a CAGR of 34.12% From 2025-2032.

The drone service market encompasses a wide range of commercial activities and services related to unmanned aerial vehicles (UAVs) or drones. This market includes businesses that offer drone-related services such as aerial photography and videography, mapping and surveying, delivery services, infrastructure inspection, agricultural monitoring, security and surveillance, and more. Drone service providers may offer services to industries like construction, real estate, agriculture, film and media, public safety, and environmental monitoring, among others.

The drone service market has grown significantly in recent years due to advancements in drone technology, reduced costs of drones and related equipment, and increasing demand for automation and data-driven solutions across various sectors. Regulatory frameworks governing drone operations have also evolved, enabling more widespread and diverse use of drones in commercial applications.

Drones are effectively utilized in military operations for sting operations, search missions, and identifying threats, contributing significantly to market growth in the defence sector. Aerial surveys encompass vital programs like wildlife monitoring, deforestation tracking, and pollution assessment, all of which drive the demand for drone services.

Drones offer extended operational times and can be controlled remotely by human operators or autonomously by onboard systems. Their increased use across civil and commercial sectors is due to their endurance and cost-efficiency. The integration of cutting-edge technologies like artificial intelligence, IoT, and cloud computing will further boost demand for drone services across various industries.

The total value of the Worldwide Cargo Drone Market in 2023 was $828 million. This represents a significant growth compared to the values in previous years, with the market more than doubling from 2021 to 2022 and continuing to expand in 2023. This growth can be attributed to several factors such as advancements in drone technology, increased adoption of drones for logistics and transportation, and the growing demand for efficient delivery solutions. The market conclusion suggests a positive outlook for the cargo drone industry, indicating a trend of continuous growth and development.

Drone Service Market Trend Analysis

Drone Service Market Growth Driver- Increasing Integration of AI And Machine Learning

- Incorporating artificial intelligence (AI) and machine learning (ML) algorithms into drones enables advanced analytics, autonomous decision-making, and data processing capabilities. This trend enhances the efficiency and accuracy of tasks such as aerial surveys, inspections, and data analysis, driving demand for drone services.

- AI and machine learning algorithms enable drones to process vast amounts of data collected during flights. This capability allows for real-time analysis of aerial imagery, sensor data, and other inputs, providing valuable insights for industries such as agriculture, infrastructure, and environmental monitoring?

- Machine learning algorithms improve the accuracy and precision of drone operations. For example, in agricultural applications, drones equipped with AI can identify crop health issues, pests, and irrigation needs with high accuracy, helping farmers optimize their resources and yields. ?

- AI algorithms can improve flight safety by analysing flight patterns, detecting obstacles, and avoiding collisions. Additionally, AI can assist in regulatory compliance by ensuring drones operate within designated airspace and follow established protocols.

Drone Service Market Expansion Opportunity- Increasing Demand for Precision Farming in Agriculture

- In precision farming, drones play a crucial role by providing accurate and timely data on crop health, soil conditions, irrigation needs, and pest infestation. Drones for precision agriculture helps to increase the crop yield and reduce the usage of water compare to traditional agriculture Drone imaging enables farmers to assess crop health, identify areas of stress, monitor growth stages, and detect anomalies such as pest infestations or nutrient deficiencies. This data-driven approach optimizes resource allocation and guides precision farming practices.

- By regularly monitoring crops with drones, farmers can make timely interventions such as targeted irrigation, precision spraying of pesticides or fertilizers, and early pest management. This proactive approach minimizes yield losses and maximizes crop quality. The ability to apply inputs only where needed based on drone data reduces input wastage, lowers operational costs, and minimizes environmental impact. This creates opportunities for sustainable farming practices and improved resource management.

Drone Service Market Segment Analysis:

Drone Service Market is Segmented on The Basis of Service Type, Application, End-Users, and Region.

By Type, Drone Platform Service Segment Is Expected to Dominate the Market During the Forecast Period

- Platform service providers offer comprehensive solutions that encompass drone hardware, software, data analytics, and support services. These platforms are designed to meet diverse needs across industries such as agriculture, construction, infrastructure inspection, public safety, and more. By providing end-to-end solutions, platform services address multiple pain points for customers, streamlining operations and decision-making processes.

- Platforms allow for scalability, catering to the needs of small-scale operations as well as large enterprises with extensive drone fleets. Platform services excel in data management and analytics, offering tools for processing, storing, visualizing, and interpreting drone-generated data.

- Advanced analytics capabilities, including AI and machine learning algorithms, enable users to derive actionable insights from drone data, improving decision-making and operational efficiency. Platforms often come with features that facilitate regulatory compliance, such as airspace awareness, flight planning tools, and safety checks.

By Application, Aerial Photography segment held the largest share in 2024

- Aerial photography dominates the drone service market by application due to its broad industry applications, technological advancements, business opportunities, marketing impact, and consumer demand for visually compelling content. As drone technology continues to evolve and regulatory frameworks support aerial operations, the dominance of aerial photography in the drone service market.

- Aerial photography plays a crucial role in film production, television broadcasting, advertising campaigns, and event coverage. Drones capture stunning aerial shots and cinematic footage that enhance storytelling and visual appeal. Drones are equipped with high-resolution cameras, gimbals, and stabilizers that capture professional-grade aerial images and videos with clarity and detail.

- Businesses and industries hire aerial photographers for commercial projects such as advertising campaigns, corporate videos, architectural surveys, and environmental documentaries. Some drones offer live streaming capabilities, allowing real-time broadcasting of aerial footage for events, news coverage, and live storytelling.

Drone Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is home to some of the leading drone manufacturers, software developers, and technology innovators. Companies in the United States and Canada continuously invest in research and development, driving technological advancements in drone hardware, software, sensors, and communication systems. This technological edge enhances the capabilities and competitiveness of North American drone solutions in the global market.

- The regulatory environment in North America, particularly in the United States through the Federal Aviation Administration (FAA) and Transport Canada, has evolved to support the integration of drones into commercial operations. North American industries across sectors such as agriculture, construction, energy, infrastructure, public safety, and media have embraced drone technology for various applications.

- North America attracts significant investments and funding in the drone industry. Venture capital firms, technology accelerators, and government initiatives support drone startups, research institutions, and industry players, driving innovation, entrepreneurship, and market growth.

Drone Service Market Key Players

- DJI (Da-Jiang Innovations) (China)

- Parrot Drone SAS (France)

- Terra drones (Japan)

- AeroVironment (United States)

- PrecisionHawk (United States)

- Aloft Technologies (United States)

- Aerodyne Group (Malaysia)

- Cyberhawk Innovations (United Kingdom)

- Measure (United States)

- Kespry (United States)

- Airware (United States)

- senseFly (Switzerland)

- Delair (France)

- Flyability (Switzerland)

- Microdrones (Germany)

- Aeryon Labs (Canada)

- Insitu (a Boeing company) (United States)

- Altavian (United States)

- Intel (United States)

- FLIR Systems (United States)

- Teal Drones (United States)

- Skydio (United States)

- Auterion (Switzerland)

- Wingtra (Switzerland)

- Yuneec (China)

- Walkera (China)

- XAG (China)

- Hubsan (China)

- Other Active Players.

Key Industry Developments in the Drone Service Market:

- In March 2024, Terra Drones Invests in Aloft Technologies to enter U.S. Market, Boost Global UTM Development Terra Drone Corporation, a leading drone and advanced air mobility (AAM) technology provider headquarter in Japan, has announced an investment in Aloft technologies, a company focusing on developing UTM, and a market leader in drone fleet and airspace management in the United States

- In March 2024, DoorDash and Alphabet-owned Wing have brought their drone delivery pilot program to the United States. This expansion builds on the pilot program that the two companies launched in Australia in 2022 and have since expanded to three locations and 60 participating merchants in that country, DoorDash and Wing

- In Oct 2023, Drones to transport lab samples between two Ontario hospitals, a first in Canada. Some healthcare administrators in Canada are looking to the skies to move supplies and get lab results faster.

|

Global Drone Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 24.99 Billion |

|

Forecast Period 2025-32 CAGR: |

34.12 % |

Market Size in 2032: |

USD 261.65 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Drone Service Market by Service Type (2018-2032)

4.1 Drone Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Drone Platform Service

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Drone MRO Services

4.5 Drone Training and stimulation Services

Chapter 5: Drone Service Market by Application (2018-2032)

5.1 Drone Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Aerial Photography

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Product Delivery

5.5 Surveillance and inspection

5.6 Data Acquisition and Analytics

5.7 Mapping and surveying

Chapter 6: Drone Service Market by End-User (2018-2032)

6.1 Drone Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Agriculture

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Infrastructure

6.5 Oil and Gas

6.6 Logistics

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Drone Service Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DJI (DA-JIANG INNOVATIONS) (CHINA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PARROT DRONE SAS (FRANCE)

7.4 TERRA DRONES (JAPAN)

7.5 AEROVIRONMENT (UNITED STATES)

7.6 PRECISIONHAWK (UNITED STATES)

7.7 ALOFT TECHNOLOGIES (UNITED STATES)

7.8 AERODYNE GROUP (MALAYSIA)

7.9 CYBERHAWK INNOVATIONS (UNITED KINGDOM)

7.10 MEASURE (UNITED STATES)

7.11 KESPRY (UNITED STATES)

7.12 AIRWARE (UNITED STATES)

7.13 SENSEFLY (SWITZERLAND)

7.14 DELAIR (FRANCE)

7.15 FLYABILITY (SWITZERLAND)

7.16 MICRODRONES (GERMANY)

7.17 AERYON LABS (CANADA)

7.18 INSITU (A BOEING COMPANY) (UNITED STATES)

7.19 ALTAVIAN (UNITED STATES)

7.20 INTEL (UNITED STATES)

7.21 FLIR SYSTEMS (UNITED STATES)

7.22 TEAL DRONES (UNITED STATES)

7.23 SKYDIO (UNITED STATES)

7.24 AUTERION (SWITZERLAND)

7.25 WINGTRA (SWITZERLAND)

7.26 YUNEEC (CHINA)

7.27 WALKERA (CHINA)

7.28 XAG (CHINA)

7.29 HUBSAN (CHINA)

Chapter 8: Global Drone Service Market By Region

8.1 Overview

8.2. North America Drone Service Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Service Type

8.2.4.1 Drone Platform Service

8.2.4.2 Drone MRO Services

8.2.4.3 Drone Training and stimulation Services

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Aerial Photography

8.2.5.2 Product Delivery

8.2.5.3 Surveillance and inspection

8.2.5.4 Data Acquisition and Analytics

8.2.5.5 Mapping and surveying

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Agriculture

8.2.6.2 Infrastructure

8.2.6.3 Oil and Gas

8.2.6.4 Logistics

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Drone Service Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Service Type

8.3.4.1 Drone Platform Service

8.3.4.2 Drone MRO Services

8.3.4.3 Drone Training and stimulation Services

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Aerial Photography

8.3.5.2 Product Delivery

8.3.5.3 Surveillance and inspection

8.3.5.4 Data Acquisition and Analytics

8.3.5.5 Mapping and surveying

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Agriculture

8.3.6.2 Infrastructure

8.3.6.3 Oil and Gas

8.3.6.4 Logistics

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Drone Service Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Service Type

8.4.4.1 Drone Platform Service

8.4.4.2 Drone MRO Services

8.4.4.3 Drone Training and stimulation Services

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Aerial Photography

8.4.5.2 Product Delivery

8.4.5.3 Surveillance and inspection

8.4.5.4 Data Acquisition and Analytics

8.4.5.5 Mapping and surveying

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Agriculture

8.4.6.2 Infrastructure

8.4.6.3 Oil and Gas

8.4.6.4 Logistics

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Drone Service Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Service Type

8.5.4.1 Drone Platform Service

8.5.4.2 Drone MRO Services

8.5.4.3 Drone Training and stimulation Services

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Aerial Photography

8.5.5.2 Product Delivery

8.5.5.3 Surveillance and inspection

8.5.5.4 Data Acquisition and Analytics

8.5.5.5 Mapping and surveying

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Agriculture

8.5.6.2 Infrastructure

8.5.6.3 Oil and Gas

8.5.6.4 Logistics

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Drone Service Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Service Type

8.6.4.1 Drone Platform Service

8.6.4.2 Drone MRO Services

8.6.4.3 Drone Training and stimulation Services

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Aerial Photography

8.6.5.2 Product Delivery

8.6.5.3 Surveillance and inspection

8.6.5.4 Data Acquisition and Analytics

8.6.5.5 Mapping and surveying

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Agriculture

8.6.6.2 Infrastructure

8.6.6.3 Oil and Gas

8.6.6.4 Logistics

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Drone Service Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Service Type

8.7.4.1 Drone Platform Service

8.7.4.2 Drone MRO Services

8.7.4.3 Drone Training and stimulation Services

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Aerial Photography

8.7.5.2 Product Delivery

8.7.5.3 Surveillance and inspection

8.7.5.4 Data Acquisition and Analytics

8.7.5.5 Mapping and surveying

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Agriculture

8.7.6.2 Infrastructure

8.7.6.3 Oil and Gas

8.7.6.4 Logistics

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Drone Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 24.99 Billion |

|

Forecast Period 2025-32 CAGR: |

34.12 % |

Market Size in 2032: |

USD 261.65 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||