Docking Station Market Synopsis

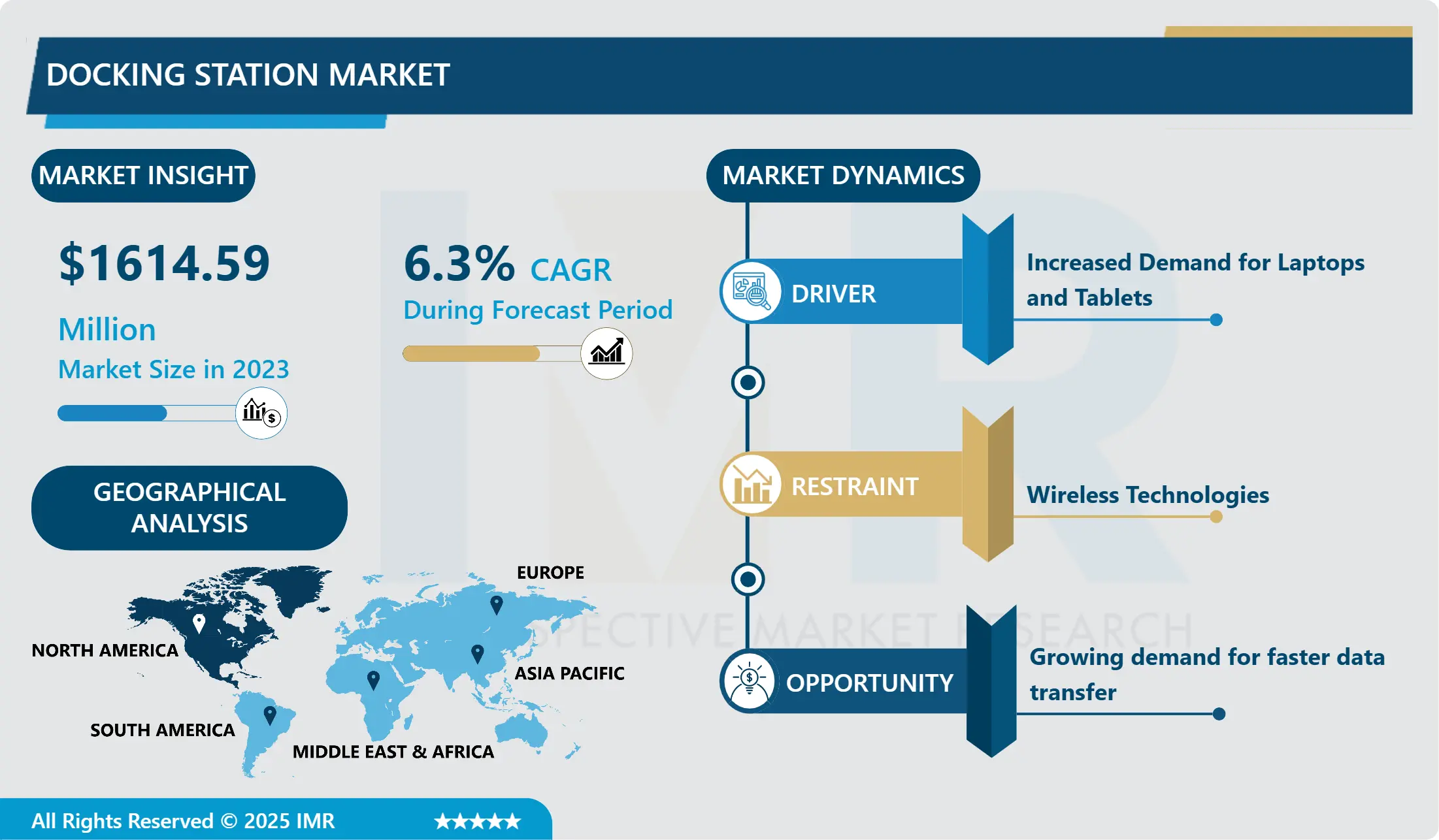

Docking Station Market Size Was Valued at USD 1716.31 Million in 2024 and is Projected to Reach USD 2798.09 million by 2032, Growing at a CAGR of 6.3 % From 2025-2032.

A docking station is a device that connects portable devices to peripherals and external displays, offering multiple ports like USB, HDMI, Ethernet, and audio jacks. It simplifies workspace setup by eliminating the need for multiple cables. Docking stations enhance productivity by facilitating seamless transitions between mobile and desktop environments, making them popular accessories for professionals.

Docking stations are versatile devices that enhance connectivity, productivity, and convenience across various industries. They consolidate multiple ports into a hub, facilitating easy connection between laptops, smartphones, tablets, and other peripherals. Docking stations support high-speed data transfer, enabling swift file sharing and seamless integration of external storage devices. In professional settings, docking stations enhance productivity by providing additional USB ports, HDMI or DisplayPort outputs, Ethernet ports for stable network connections, and audio jacks for enhanced multimedia experiences. They transform laptops into desktop-like workstations, enabling efficient multitasking and collaboration.

Docking stations also cater to the growing demand for flexible work arrangements, particularly in remote and hybrid work models. They enable users to quickly connect their laptops to external monitors, keyboards, and other peripherals, creating a comfortable and productive work environment regardless of location. Beyond traditional office settings, docking stations find applications in healthcare, education, finance, and creative sectors. In healthcare, medical professionals use docking stations to connect laptops or tablets to specialized medical equipment, enhancing patient care and streamlining workflow processes.

Docking stations enhance device longevity and versatility by reducing wear and tear on ports, extending the lifespan of laptops, smartphones, and tablets. The increasing adoption of remote collaboration tools and video conferencing platforms fuels the demand for docking stations, which facilitate seamless integration with cameras, microphones, and speakers, enhancing audiovisual quality in virtual meetings and presentations.

Docking Station Market Trend Analysis

Increased Demand for Laptops and Tablets

- The rise in demand for laptops and tablets has led to the rise in the popularity of docking stations. This is largely due to the shift towards remote work and flexible work arrangements, which demand portable computing solutions that offer versatility and mobility. Advancements in technology have led to the development of more powerful and feature-rich laptops and tablets, equipped with high-performance processors, vibrant displays, and various connectivity options. This has led to consumers and businesses turning to laptops and tablets as their primary computing devices.

- The growing popularity of hybrid work environments, where employees split their time between office and remote locations, has also fueled the demand for laptops and tablets. Docking stations play a crucial role in enhancing the functionality and usability of these devices by providing additional connectivity options like extra USB ports, HDMI outputs, and Ethernet connections. This allows users to create ergonomic work setups, connect to external displays for enhanced productivity, and streamline their workflow.

Growing Demand For Faster Data Transfer

- The demand for faster data transfer is on the rise, presenting a significant opportunity for docking stations to meet the evolving needs of users across various industries. The increasing size and complexity of digital files, such as high-definition multimedia content, large software applications, and data-intensive workflows, necessitate faster data transfer speeds. Creative professionals working with high-resolution images, videos, and 3D models rely on fast data transfer to streamline their workflow and meet tight deadlines.

- The rise of remote work and collaboration tools has also accelerated the need for faster data transfer. Docking stations equipped with high-speed connectivity options like Thunderbolt 3 or USB 3.1 Gen 2 enable users to transfer large files quickly and securely, regardless of their location. Faster data transfer enhances the overall user experience by reducing wait times and improving workflow efficiency.

- Docking stations serve as central hubs for connecting multiple peripherals simultaneously while maintaining fast data transfer speeds, enhancing productivity and versatility. The growing demand for faster data transfer presents a significant opportunity for docking stations to provide users with the connectivity and performance they need to thrive in today's data-driven world. By offering solutions that enable seamless and high-speed data transfer, manufacturers can capitalize on this opportunity to meet user needs and drive market growth.

Docking Station Market Segment Analysis:

Docking Station Market Segmented on the basis of Type, Application, End-users, and Region.

By Type, Laptop Docking Stations segment is expected to dominate the market during the forecast period

- The Laptop Docking Stations segment dominates the docking station market due to its adaptability and versatility. Laptops have become the primary computing devices for professionals and consumers due to their portability, versatility, and performance capabilities. As more people adopt laptops for work, education, and entertainment, the demand for accessories that enhance the functionality and connectivity of laptops increases. Docking stations serve as central hubs, enabling users to connect their laptops to a wide range of peripherals, transforming them into full-fledged desktop workstations. This versatility appeals to users who need a seamless transition between mobile and desktop computing environments without sacrificing productivity.

- The rise of remote work and hybrid work models has accelerated the adoption of Laptop Docking Stations, as professionals seek solutions to create ergonomic work setups and maximize productivity from any location. Docking stations facilitate the connection of laptops to external monitors, keyboards, and other peripherals, creating comfortable and efficient work environments in homes, offices, or co-working spaces.

- Advancements in technology have expanded the capabilities of Laptop Docking Stations, with features like Thunderbolt 3 connectivity, USB Type-C ports, and wireless charging support becoming increasingly common. These features enable faster data transfer speeds, broader device compatibility, and enhanced convenience, further driving the adoption of Laptop Docking Stations among users.

By Application, Wired (USB-C, HDMI, DisplayPort) segment is expected to dominate the market during the forecast period

- The wired segment, including USB-C, HDMI, and DisplayPort connections, is expected to dominate the docking station market due to its consistent and reliable performance, high data transfer speeds, enhanced security, compatibility, and cost-effectiveness. These connections are ideal for tasks requiring high-speed data transfer, such as video editing, graphic design, and software development. They provide stable and high-bandwidth links between devices, ensuring smooth transmission of data, audio, and video signals without interruption or latency.

- Wired connections also offer higher data transfer speeds compared to wireless alternatives, making them suitable for handling large files and data-intensive applications. USB-C, in particular, supports high-speed data transfer rates of up to 40Gbps, making it ideal for demanding tasks and workflows. In industries like finance, healthcare, and government, data security and confidentiality are paramount concerns.

- The widespread availability and compatibility of wired connectivity standards, such as USB-C, HDMI, and DisplayPort, further contribute to their dominance in the docking station market. The cost-effectiveness of wired connections compared to wireless alternatives makes them an attractive choice for both consumers and businesses. the wired segment, encompassing USB-C, HDMI, and DisplayPort connections, is the dominant choice in the docking station market, catering to diverse user needs across various industries and applications.

Docking Station Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the docking station market due to its status as a hub for technological innovation, leading technology companies, research institutions, and innovation hubs. These companies are at the forefront of developing cutting-edge docking stations that cater to global users' evolving needs. Docking stations provide flexibility and convenience for ergonomic work setups, enhancing productivity and comfort.

- North America's robust infrastructure and high internet penetration rates make it an ideal environment for the adoption of docking stations and other technology products. The region's advanced network infrastructure supports high-speed data transfer, allowing users to leverage docking stations for file sharing, multimedia streaming, and collaborative work.

- The large base of tech-savvy consumers and businesses in North America drives demand for innovative technology products, with a strong culture of tech adoption and a willingness to invest in cutting-edge solutions. As a result, North American consumers and businesses are early adopters of docking stations, driving market growth and innovation in the region.

Docking Station Market Top Key Players:

- Dell Technologies (US)

- HP Inc. (US)

- Microsoft Corporation (US)

- Kensington Technology Group (US)

- Targus (US)

- Plugable Technologies (US)

- Belkin International, Inc. (US)

- Apple Inc. (US)

- CalDigit (US)

- OWC (Other World Computing) (US)

- IOGEAR (US)

- Henge Docks (US)

- Brydge Technologies (US)

- LandingZone (US)

- SIIG, Inc. (US)

- Sabrent (US)

- StarTech.com (Canada)

- Toshiba Corporation (Japan)

- Sony Corporation (Japan)

- Anker Innovations (China)

- Lenovo Group Ltd. (China)

- Samsung Electronics Co., Ltd. (South Korea)

- ASUS (Taiwan)

- Acer Inc. (Taiwan)

- j5create (Taiwan)

- Other Active Players.

Key Industry Developments in the Docking Station Market:

- In October 2024, Kensington, a global leader in desktop computing and mobility solutions for IT, business, and home office professionals, significantly enhanced the visual productivity of MacBook users with the launch of the SD5900T EQ Thunderbolt™ 4 Quad 4K 40Gbps Dock featuring DisplayLink® Technology.

- In May 2024, Targus®, the leading third-party docking station and laptop bag brand in the US, announced the availability of its new USB4 Triple Video Docking Station with 100W Power (DOCK460). Offering full USB4 (and Thunderbolt™) speeds in a triple video enterprise-grade dock, this Alternate Mode dock provides all the necessary ports and power to support a wide range of laptop brands and platforms.

|

Global Docking Station Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1716.31 Mn. |

|

Forecast Period 2025-32 CAGR: |

6.3% |

Market Size in 2032: |

USD 2798.09 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Connectivity Type |

|

||

|

By Usage |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Docking Station Market by Type (2018-2032)

4.1 Docking Station Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Laptop Docking Stations

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Smartphone Docking Stations

4.5 Tablet Docking Stations

4.6 Hybrid Docking Stations

Chapter 5: Docking Station Market by Connectivity Type (2018-2032)

5.1 Docking Station Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Wired (USB-C

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 HDMI

5.5 DisplayPort)

5.6 Wireless

Chapter 6: Docking Station Market by Usage (2018-2032)

6.1 Docking Station Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Home Docking Stations

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Office Docking Stations

6.5 Industrial Docking Stations

Chapter 7: Docking Station Market by Industry Vertical (2018-2032)

7.1 Docking Station Market Snapshot and Growth Engine

7.2 Market Overview

7.3 IT & Telecom

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare

7.5 Manufacturing

7.6 Finance

7.7 Education

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Docking Station Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 NIKE INC. (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 QUIKSILVER INC. (US)

8.4 O'NEILL INC. (US)

8.5 CALVIN KLEIN INC. (US)

8.6 TOMMY HILFIGER (US)

8.7 RALPH LAUREN CORPORATION (US)

8.8 PATAGONIA INC. (US)

8.9 VANS INC. (US)

8.10 VOLCOM

8.11 LLC (US)

8.12 COLUMBIA SPORTSWEAR COMPANY (US)

8.13 UNDER ARMOUR INC. (US)

8.14 HURLEY INTERNATIONAL LLC (US)

8.15 LULULEMON ATHLETICA INC. (CANADA)

8.16 SPEEDO INTERNATIONAL LTD. (UK)

8.17 ORLEBAR BROWN (UK)

8.18 PUMA SE (GERMANY)

8.19 HUGO BOSS AG (GERMANY)

8.20 ADIDAS AG (GERMANY)

8.21 LACOSTE S.A. (FRANCE)

8.22 ARENA S.P.A. (ITALY)

8.23 DOLCE & GABBANA (ITALY)

8.24 VILEBREQUIN (FRANCE)

8.25 BILLABONG INTERNATIONAL LIMITED (AUSTRALIA)

8.26 RIP CURL PTY LTD. (AUSTRALIA)

8.27 ASICS CORPORATION (JAPAN)

8.28

Chapter 9: Global Docking Station Market By Region

9.1 Overview

9.2. North America Docking Station Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Laptop Docking Stations

9.2.4.2 Smartphone Docking Stations

9.2.4.3 Tablet Docking Stations

9.2.4.4 Hybrid Docking Stations

9.2.5 Historic and Forecasted Market Size by Connectivity Type

9.2.5.1 Wired (USB-C

9.2.5.2 HDMI

9.2.5.3 DisplayPort)

9.2.5.4 Wireless

9.2.6 Historic and Forecasted Market Size by Usage

9.2.6.1 Home Docking Stations

9.2.6.2 Office Docking Stations

9.2.6.3 Industrial Docking Stations

9.2.7 Historic and Forecasted Market Size by Industry Vertical

9.2.7.1 IT & Telecom

9.2.7.2 Healthcare

9.2.7.3 Manufacturing

9.2.7.4 Finance

9.2.7.5 Education

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Docking Station Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Laptop Docking Stations

9.3.4.2 Smartphone Docking Stations

9.3.4.3 Tablet Docking Stations

9.3.4.4 Hybrid Docking Stations

9.3.5 Historic and Forecasted Market Size by Connectivity Type

9.3.5.1 Wired (USB-C

9.3.5.2 HDMI

9.3.5.3 DisplayPort)

9.3.5.4 Wireless

9.3.6 Historic and Forecasted Market Size by Usage

9.3.6.1 Home Docking Stations

9.3.6.2 Office Docking Stations

9.3.6.3 Industrial Docking Stations

9.3.7 Historic and Forecasted Market Size by Industry Vertical

9.3.7.1 IT & Telecom

9.3.7.2 Healthcare

9.3.7.3 Manufacturing

9.3.7.4 Finance

9.3.7.5 Education

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Docking Station Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Laptop Docking Stations

9.4.4.2 Smartphone Docking Stations

9.4.4.3 Tablet Docking Stations

9.4.4.4 Hybrid Docking Stations

9.4.5 Historic and Forecasted Market Size by Connectivity Type

9.4.5.1 Wired (USB-C

9.4.5.2 HDMI

9.4.5.3 DisplayPort)

9.4.5.4 Wireless

9.4.6 Historic and Forecasted Market Size by Usage

9.4.6.1 Home Docking Stations

9.4.6.2 Office Docking Stations

9.4.6.3 Industrial Docking Stations

9.4.7 Historic and Forecasted Market Size by Industry Vertical

9.4.7.1 IT & Telecom

9.4.7.2 Healthcare

9.4.7.3 Manufacturing

9.4.7.4 Finance

9.4.7.5 Education

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Docking Station Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Laptop Docking Stations

9.5.4.2 Smartphone Docking Stations

9.5.4.3 Tablet Docking Stations

9.5.4.4 Hybrid Docking Stations

9.5.5 Historic and Forecasted Market Size by Connectivity Type

9.5.5.1 Wired (USB-C

9.5.5.2 HDMI

9.5.5.3 DisplayPort)

9.5.5.4 Wireless

9.5.6 Historic and Forecasted Market Size by Usage

9.5.6.1 Home Docking Stations

9.5.6.2 Office Docking Stations

9.5.6.3 Industrial Docking Stations

9.5.7 Historic and Forecasted Market Size by Industry Vertical

9.5.7.1 IT & Telecom

9.5.7.2 Healthcare

9.5.7.3 Manufacturing

9.5.7.4 Finance

9.5.7.5 Education

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Docking Station Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Laptop Docking Stations

9.6.4.2 Smartphone Docking Stations

9.6.4.3 Tablet Docking Stations

9.6.4.4 Hybrid Docking Stations

9.6.5 Historic and Forecasted Market Size by Connectivity Type

9.6.5.1 Wired (USB-C

9.6.5.2 HDMI

9.6.5.3 DisplayPort)

9.6.5.4 Wireless

9.6.6 Historic and Forecasted Market Size by Usage

9.6.6.1 Home Docking Stations

9.6.6.2 Office Docking Stations

9.6.6.3 Industrial Docking Stations

9.6.7 Historic and Forecasted Market Size by Industry Vertical

9.6.7.1 IT & Telecom

9.6.7.2 Healthcare

9.6.7.3 Manufacturing

9.6.7.4 Finance

9.6.7.5 Education

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Docking Station Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Laptop Docking Stations

9.7.4.2 Smartphone Docking Stations

9.7.4.3 Tablet Docking Stations

9.7.4.4 Hybrid Docking Stations

9.7.5 Historic and Forecasted Market Size by Connectivity Type

9.7.5.1 Wired (USB-C

9.7.5.2 HDMI

9.7.5.3 DisplayPort)

9.7.5.4 Wireless

9.7.6 Historic and Forecasted Market Size by Usage

9.7.6.1 Home Docking Stations

9.7.6.2 Office Docking Stations

9.7.6.3 Industrial Docking Stations

9.7.7 Historic and Forecasted Market Size by Industry Vertical

9.7.7.1 IT & Telecom

9.7.7.2 Healthcare

9.7.7.3 Manufacturing

9.7.7.4 Finance

9.7.7.5 Education

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Docking Station Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1716.31 Mn. |

|

Forecast Period 2025-32 CAGR: |

6.3% |

Market Size in 2032: |

USD 2798.09 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Connectivity Type |

|

||

|

By Usage |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||