Key Market Highlights

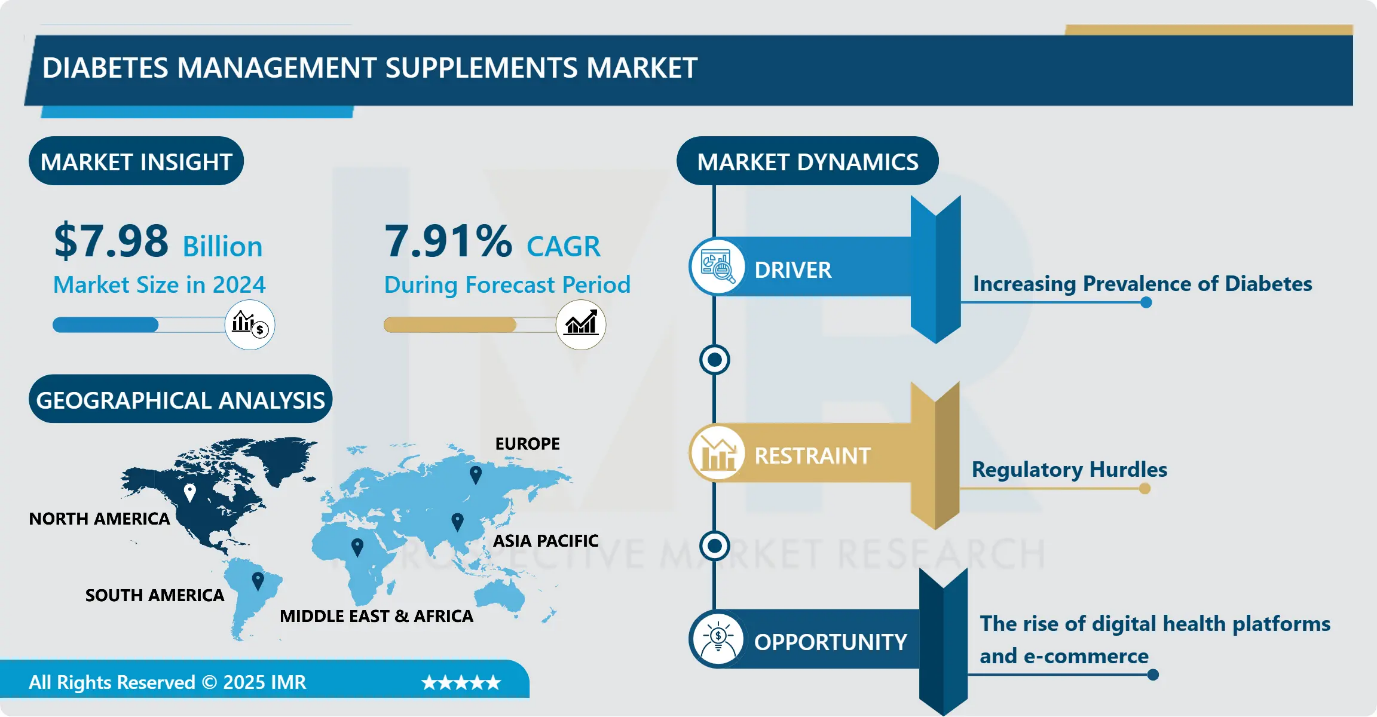

Diabetes Management Supplements Market Size Was Valued at USD 7.98 Billion in 2024, and is Projected to Reach USD 17.09 Billion by 2035, Growing at a CAGR of 7.91% from 2025-2035.

- Market Size in 2024: USD 7.98 Billion

- Projected Market Size by 2035: USD 17.09 Billion

- CAGR (2025–2035): 7.91%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia pacific

- By Product type: The Herbal segment is anticipated to lead the market by accounting for 26.31% of the market share throughout the forecast period.

- By Form: The Capsules segment is expected to capture 32.48% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 34.61% of the market share during the forecast period.

- Active Players: Herbalife Nutrition (USA), Amway (USA), Nature’s Bounty (USA), Nature’s Way Products, LLC (USA), NOW Foods (USA), Swanson Health Products (USA), Glanbia plc, (Ireland), Glucose Health, (USA), Other Active Players,

Diabetes Management Supplements Market Synopsis:

The diabetes management supplements market involves selling vitamins, minerals, herbs (like Gymnema Sylvestre), amino acids, and botanicals to help control blood sugar, improve insulin sensitivity, reduce oxidative stress, and manage complications (neuropathy, cholesterol) associated with diabetes, especially Type 2, as natural complements to conventional care, encompassing both single-ingredient and multi-ingredient formulations sold via online and offline channels

Diabetes Management Supplements Market Dynamics and Trend Analysis:

Diabetes Management Supplements Market Growth Driver- Increasing Prevalence of Diabetes

-

The diabetes management supplements market is growing rapidly due to increasing diabetes prevalence worldwide, especially type 2 diabetes. Rising health awareness and a shift towards preventive care encourage people to use supplements alongside medication. Consumers prefer natural and herbal products, driving demand for plant-based supplements.

- Easy availability through online channels and pharmacies also supports market growth. Additionally, ongoing research and innovation in supplement formulations improve effectiveness, boosting consumer trust. Together, these factors are creating a strong environment for sustained market expansion.

Diabetes Management Supplements Market Limiting Factor- Lack of Robust Clinical Evidence For Many Supplements

-

The diabetes management supplements market faces several challenges and risks. A key issue is the lack of robust clinical evidence for many supplements, which can reduce consumer confidence and limit recommendations by healthcare professionals. Regulatory differences across countries create uncertainty around product quality and safety.

- There is also a risk of misuse or over-reliance on supplements without proper medical supervision, potentially affecting health outcomes. Additionally, intense competition and the presence of well-established pharmaceutical treatments limit market penetration. These challenges must be addressed for sustainable growth in this sector.

Diabetes Management Supplements Market Expansion Opportunity- The rise of digital health platforms and e-commerce

-

The diabetes management supplements market is expanding thanks to several emerging trends. Increasing consumer preference for natural and herbal ingredients is pushing demand for safer, plant-based supplements. Advances in scientific research are helping develop more effective products, boosting consumer confidence. The rise of digital health platforms and e-commerce has made supplements more accessible to a wider audience.

- Additionally, growing awareness about preventive health and early diabetes management encourages people to adopt supplements alongside conventional treatments. These factors, combined with expanding healthcare infrastructure in developing regions, create significant growth opportunities for the market in the coming years.

Diabetes Management Supplements Market Challenge and Risk- Regulatory Hurdles

-

A major limiting factor in the diabetes management supplements market is lack of strong scientific evidence for many products. While supplements can support diabetes care, not all have been thoroughly tested in clinical trials, which makes some consumers and healthcare professionals hesitant to fully trust them. Additionally, regulatory challenges and varying quality standards across regions can lead to inconsistent product safety and effectiveness.

- Another challenge is consumer awareness some people may rely solely on supplements without proper medical guidance, which can affect outcomes. Lastly, the presence of prescription medications as the primary treatment limits the supplements’ role to only supportive care, restricting market growth

Diabetes Management Supplements Market Trend- Shift Towards Natural and Herbal Ingredients

-

The diabetes management supplements market is evolving with several notable trends. There is a strong shift towards natural and herbal ingredients, as consumers seek safer, plant-based alternatives. Personalized nutrition and supplements tailored to individual health needs are gaining popularity.

- The rise of digital health platforms and e-commerce is making it easier for consumers to access and purchase supplements. Additionally, manufacturers are focusing on clinically backed formulations to build consumer trust. Growing awareness about preventive healthcare and early diabetes management is encouraging wider adoption of these supplements globally.

Diabetes Management Supplements Market Segment Analysis:

Diabetes Management Supplements Market is segmented based on Type, Form, Distribution Channels, and Region

By Product Type, Herbal segment is expected to dominate the market with around 26.31% share during the forecast period.

-

Among the product types in the diabetes management supplements market, herbal supplements are experiencing the fastest growth. This is mainly because many people prefer natural and plant-based options to manage their blood sugar levels. Herbal supplements like cinnamon extract, bitter melon, and gymnema sylvestre are popular for their traditional use and proven benefits in supporting diabetes care. Consumers see them as safer alternatives to synthetic drugs, with fewer side effects.

- Additionally, growing awareness about holistic health and wellness is encouraging more people to choose herbal products. The demand is further boosted by easy availability through online stores and health shops. Overall, the combination of safety, effectiveness, and consumer trust makes herbal supplements the fastest-growing segment in this market.

By Form, Capsules is expected to dominate with close to 32.48% market share during the forecast period.

-

In the diabetes management supplements market, the capsules segment is growing rapidly. Capsules are preferred because they are easy to swallow, convenient to carry, and provide accurate dosing. Many consumers find capsules more comfortable compared to powders or liquids, which may have unpleasant tastes or require preparation.

- Additionally, capsules often have better shelf life and preserve the potency of active ingredients effectively. The rise of online shopping and busy lifestyles also boosts capsule demand, as people look for quick and simple ways to manage their health. Overall, capsules offer a practical and user-friendly option, driving their strong growth in this market.

Diabetes Management Supplements Market Regional Insights:

North America region is estimated to lead the market with around 34.61% share during the forecast period.

-

North America is the leading market for diabetes management supplements due to several key factors. The region has a high prevalence of diabetes, especially type 2, which drives strong demand for supportive supplements. People in North America are health-conscious and actively seek natural products to manage their condition alongside medication.

- Additionally, the well-developed healthcare infrastructure and easy access to pharmacies and online stores make these supplements widely available. Companies in this market also invest heavily in research and innovation, offering effective and trustworthy products. Favorable regulations further support product development and distribution, making North America the top market globally.

Diabetes Management Supplements Market Active Players:

- Amway (USA)

- Glanbia plc,(Ireland)

- Glucose Health, (USA)

- Herbalife Nutrition (USA)

- Nature’s Bounty (USA)

- Nature’s Way Products, LLC (USA)

- NOW Foods (USA)

- Swanson Health Products (USA)

- Other Active Players

Key Industry Developments in the Diabetes Management Supplements Market:

- In June 2025, Nature’s Bounty introduced several new products several new products to support the body's natural greatness in the areas of women's wellness, healthy longevity and digestive health. The new products include Nature's Bounty® Advanced Menopause Relief, Nature's Bounty® Ultra Collagen Booster Capsules, Nature's Bounty® Advanced Vital Heart, Nature's Bounty® Superfoods Plus Energy and Nature's Bounty® Prebiotic + Postbiotic + Probiotic Gummies.

- In February 2024, Herbalife introduced nutrition product combos designed to supplement nutritional needs in individuals taking GLP?1 and other weight?loss medications, addressing nutrition support in metabolic health.

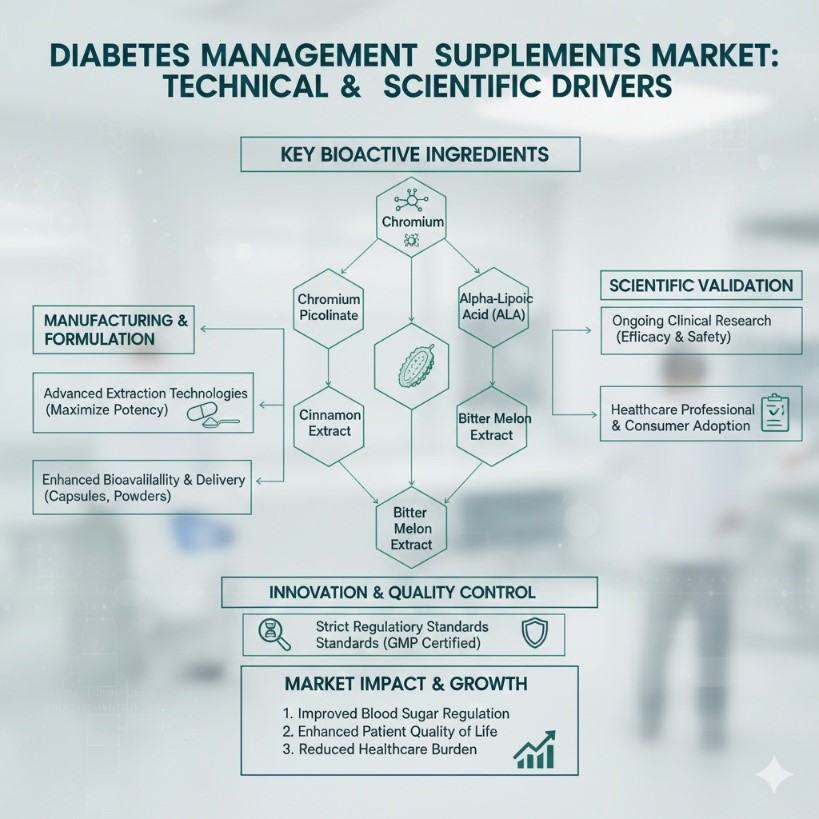

Science-Driven Nutritional Support Enhancing Modern Diabetes Management

- The Diabetes Management Supplements Market is driven by a growing focus on supporting traditional diabetes care with nutritional solutions that help regulate blood sugar, improve insulin sensitivity, and reduce complications. Technically, these supplements combine key bioactive ingredients such as chromium, alpha-lipoic acid, cinnamon extract, and bitter melon each scientifically studied for their role in glucose metabolism and oxidative stress reduction.

- Manufacturers use advanced extraction and formulation technologies to maximize ingredient potency and bioavailability, ensuring that supplements deliver measurable benefits. Delivery forms like capsules and powders are designed for ease of use and optimal absorption.

- From a scientific standpoint, ongoing clinical research is validating the effectiveness of natural compounds, encouraging wider adoption by healthcare professionals and consumers. Innovations in personalized nutrition also allow formulations to target specific diabetic profiles, improving outcomes.

- Quality control is critical in this market, with strict adherence to regulatory standards ensuring safety and consistency. With diabetes prevalence rising globally, the integration of these supplements into comprehensive management plans represents a promising avenue to improve patient quality of life while reducing healthcare burdens. This blend of traditional knowledge and modern science makes the diabetes supplements market a dynamic and impactful sector.

|

Diabetes Management Supplements Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 7.98 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.91 % |

Market Size in 2035: |

USD 17.09 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

Distribution Channels |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Diabetes Management Supplements Market by Product Type (2018-2035)

4.1 Diabetes Management Supplements Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vitamins & Minerals

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Herbal Supplements

4.5 Amino Acids

4.6 Probiotics & Prebiotics

4.7 Antioxidants

Chapter 5: Diabetes Management Supplements Market by Form (2018-2035)

5.1 Diabetes Management Supplements Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tablets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Capsules

5.5 Powders

5.6 Liquids

5.7 Soft gels

Chapter 6: Diabetes Management Supplements Market by Distribution Channel (2018-2035)

6.1 Diabetes Management Supplements Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmacies & Drug Stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online Retail / E?commerce

6.5 Health & Wellness Stores

6.6 Direct Sales / MLM

6.7 Supermarkets & Hypermarket

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Diabetes Management Supplements Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 HERBALIFE NUTRITION (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 AMWAY (USA)

7.4 NATURES BOUNTY (USA)

7.5 NATURES WAY PRODUCTS LLC (USA)

7.6 NOW FOODS (USA)

7.7 SWANSON HEALTH PRODUCTS (USA)

7.8 GLANBIA PLC

7.9 (IRELAND)

7.10 GLUCOSE HEALTH(USA)

7.11 OTHER ACTIVE PLAYERS

7.12

Chapter 8: Global Diabetes Management Supplements Market By Region

8.1 Overview

8.2. North America Diabetes Management Supplements Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Diabetes Management Supplements Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Diabetes Management Supplements Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Diabetes Management Supplements Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Diabetes Management Supplements Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Diabetes Management Supplements Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Diabetes Management Supplements Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 7.98 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.91 % |

Market Size in 2035: |

USD 17.09 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

Distribution Channels |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||