E-Commerce Software Market Overview

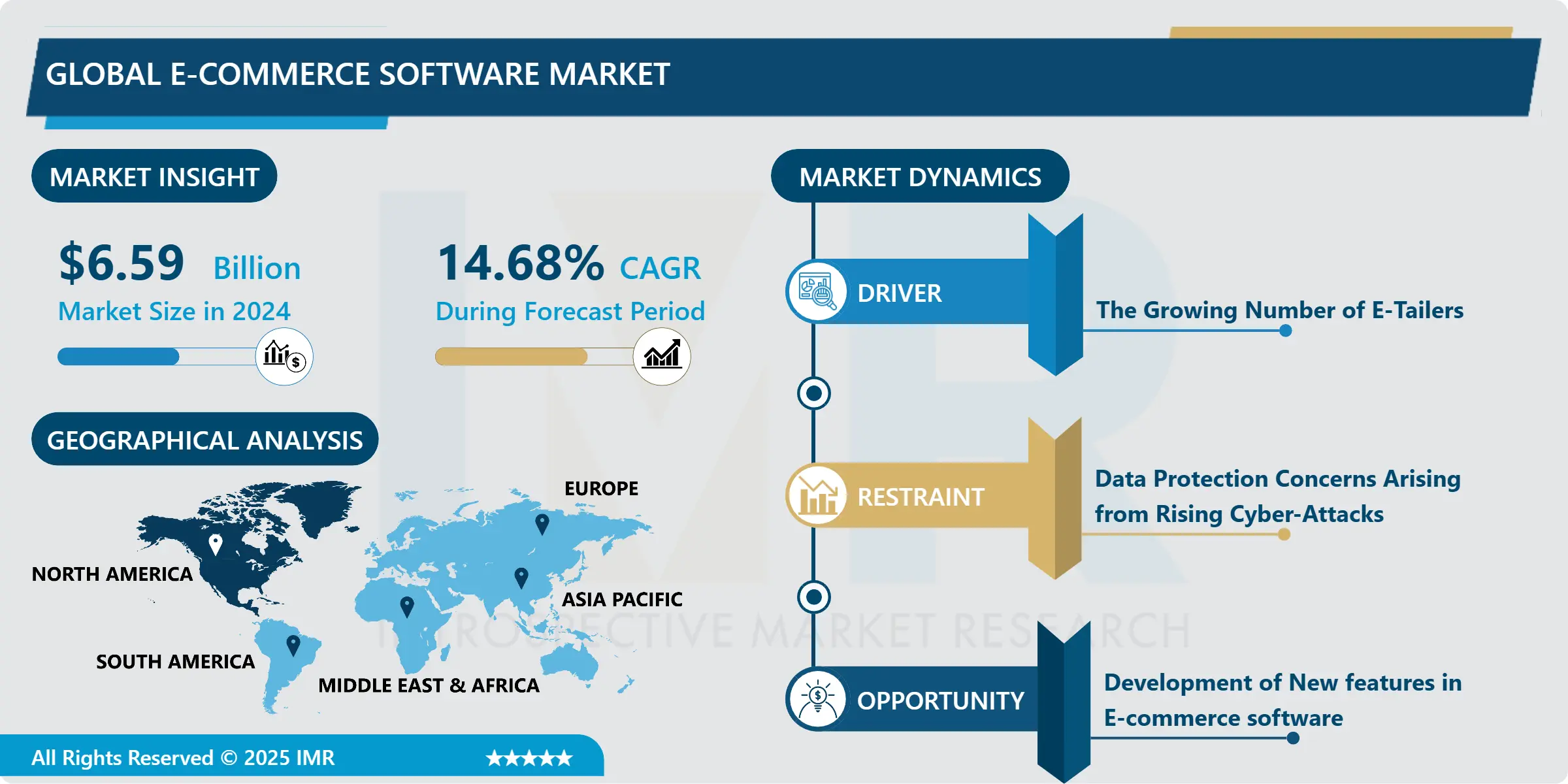

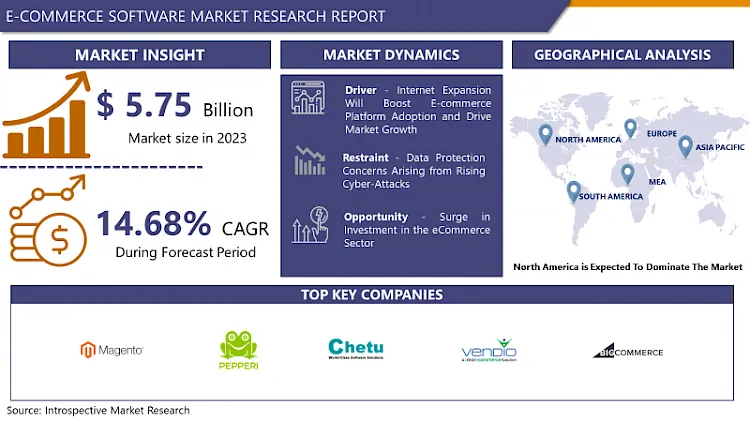

The global E-Commerce Software Market was valued at USD 6.59 Billion in 2024 and is expected to reach USD 19.71 Billion by the year 2032, at a CAGR of 14.68%

E-commerce software is a tool or engine for controlling and managing inventory, adding and removing goods, calculating taxes, processing payments, maintaining an e-commerce website, and fulfilling orders. E-commerce software allows consumers and companies to simplify online retailers' multifaceted and dynamic operations and processes. Also, with the aid of E-commerce software apps, several small, medium, and large companies are focused on providing the best possible shopping experience. Catalog management, channel management, customer accounts, email marketing, inventory management, loyalty program management, and multi-store management are all applications that e-commerce software help companies handle easily and efficiently.

Applications allow e-commerce software to automate shipping and taxes while also simplifying marketing. Furthermore, e-commerce software vendors are providing applications that can integrate with a variety of enterprise software, such as ERP, accounting software, 3PL, social media, and customer relationship management (CRM), to provide companies with an all-in-one platform. E-commerce software also includes features such as custom e-commerce content management systems (CMS), security, and E-commerce software point-of-sale (POS) creation. Customers may also customize the delivery date and time with the app, which improves the customer experience. Artificial Intelligence (AI) tools are being integrated by companies like Shopify to help retailers evaluate consumer purchasing trends and predict future demand for different goods.

Trend Analysis

Internet expansion will boost eCommerce platform adoption and drive market growth

- Over the past two decades, the Internet has fundamentally transformed global society, affecting various facets of life, from personal interactions to business operations. The rapid adoption of high-tech innovations and the proliferation of mobile phones have revolutionized communication, making it more instantaneous and accessible. This digital evolution has seamlessly integrated into everyday life, leading to a substantial shift in how people live, shop, socialize, and entertain themselves. The widespread availability of high-speed Internet has facilitated the rise of e-commerce, allowing businesses to reach a broader audience and consumers to access products and services with unprecedented convenience.

- The growth of e-commerce has been significantly fueled by the increasing use of the Internet. Online platforms have become essential tools for both businesses and consumers, streamlining transactions and providing a diverse range of options at the fingertips of users. This expansion has simplified the process of buying and selling and created new opportunities for businesses to innovate and compete in a global marketplace. As digital technology continues to advance, the role of e-commerce is likely to become even more prominent, further enhancing the efficiency and scope of online business activities. This ongoing digital revolution underscores the critical role of the Internet in shaping modern economic and social landscapes.

Surge in Investment in the eCommerce Sector

- The surge in digital literacy has significantly accelerated investments in eCommerce, creating a dynamic landscape ripe with opportunities for both new and established players. As digital literacy improves globally, consumers increasingly turn to online platforms for their shopping needs, driving a wave of investment into eCommerce firms. This influx of capital allows platforms to engage in extensive research and development, enabling them to integrate cutting-edge technologies such as artificial intelligence and machine learning. These technologies enhance customer experiences through personalized recommendations and streamlined services, setting the stage for innovative disruptions in traditional retail models. With increased funding, eCommerce platforms can expand their operations into emerging markets, tapping into new consumer bases and diversifying their service offerings to include advanced logistics and personalized shopping solutions.

- The capital infusion empowers eCommerce firms to bolster their infrastructure and scalability. By investing in robust digital frameworks and optimizing supply chain operations, these platforms can handle larger volumes of transactions and provide seamless user experiences across various devices. Enhanced marketing efforts, supported by data-driven strategies, enable more effective customer engagement and brand building. Collaboration with other businesses, such as tech startups and logistics companies, further strengthens their market position. Moreover, the growth of the eCommerce sector translates into job creation, from tech development roles to logistics and customer service positions, contributing positively to the economy. This multi-faceted investment approach not only drives innovation but also fosters a competitive environment that benefits consumers and businesses alike.

Key Market Dynamics

- Because of the growing popularity of mobile phones for online shopping, companies like Shopify have customized their apps to work on these devices. With such a high rate of internet penetration and an increasing number of smartphone users, online shopping on these devices is only going to become more common. Over the forecast period, the growing number of e-tailers is expected to drive up demand for e-commerce apps. E-tailers do not need to own or rent a physical store to offer their goods and services to consumers via online platforms. As compared to other retailers, their reliance on e-commerce sites is strong. However, data protection concerns arising from rising cyber-attacks are expected to pose a challenge to the e-commerce software industry.

- Various governments have imposed strict lockdown legislation to avoid the spread of the COVID-19 virus in the wake of the outbreak. Shops, malls, and other shopping outlets have closed, resulting in bulk purchases made via online platforms. Shopping for all but life-essential items are becoming the new standard. To meet a rise in demand for these items, retailers are changing their business strategies. This factor is expected to have a long-term positive impact on the development of the e-commerce software industry. Even after the lockout restrictions are lifted, the online shopping trend is expected to continue. As a result of this aspect, E-commerce software market participants are employing a variety of strategies to increase their customer base.

Market Segmentation

Cloud Segment To Contribute Largest Revenue Share

The cloud segment accounted for the largest share of E-commerce software market. This can be due to the growing use of cloud-based technology in a variety of industries. High storage space, unified access, high speed, and reliability are all advantages of cloud-based deployment. Furthermore, major market players such as Oracle, SAP SE, and Adobe are concentrating heavily on cloud-based solutions.

Clothing And Fashion Segment To Dominate The Market

The clothing and fashion segment had the largest share of the e-commerce software industry, accounting for 40.3%. This is due to the rising popularity of online clothes, bag and accessory shopping, and jewelry shopping. Clothing retailers have embraced online channels to broaden their consumer base due to low digital entry barriers.

E-commerce Software Market Segmentation

Based on Industry, E-commerce software market can be distributed across consumer electronics, food & beverage, fashion & lifestyle, media & entertainment, and automotive. By deployment type, E-commerce software market can be divided into cloud and on-premise. Based on application, E-commerce software market can be classified into catalog management, email marketing, channel management, multi-store management, and order management. By end-user, the market can be divided into brick & mortar stores, grocery, e-commerce, and c-store. Based on regions, E-commerce software market can be segmented into Asia Pacific, Europe, Latin America, North America, and Middle East & Africa.

Regional Outlook of E-commerce Software Market

Owing to the presence of major industry players such as Oracle Corporation, Shopify, and Salesforce.com, Inc., North America held the largest E-commerce software market share. Also, increasing e-commerce revenues in the United States are pushing up demand for e-commerce software among a variety of retailers. Retailers are also introducing new products and heavily investing in e-commerce software to achieve a strategic edge in their respective industries. During the forecast period, Asia Pacific is expected to have the highest CAGR, exceeding 18.0%. This increase can be attributed to government initiatives in countries such as China and India to encourage digitalization in their respective countries. The high rate of internet penetration has provided a huge opportunity for the E-commerce software sector to develop.

Players Covered in E-Commerce Software Market are :

- PEPPERI

- Belavier Commerce LLC

- Magento Inc.

- CS-CART

- SAP SE

- Chetu Inc.

- Vendio Services Inc.

- BigCommerce Pty. Ltd.

- Ability Commerce

- Infusionsoft

- Volusion LLC

- Brightpearl

- Automattic Inc.

- Episerver group

- Kiva Logic LLC and other active players.

Key Industry Developments

- In April 2023, Square announced a major product release in April 2023, which included over 100 new features across its entire product ecosystem. The new features are designed to help businesses automate their operations, increase revenue, and provide a better customer experience. Square is committed to providing businesses with the tools they need to succeed, and this release is a significant step in that direction.

- In May 2023, Cardinal Health introduced new payment solutions in collaboration with Square to support independent pharmacies. These modern payment solutions aim to enhance operational efficiency, keep up with customer payment preferences, and provide integrated software tools for business management. Through this partnership with Square, Cardinal Health can offer independent pharmacy customers access to cutting-edge products that facilitate seamless business operations management.

|

Global E-Commerce Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.68% |

Market Size in 2032: |

USD 19.71 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: E-Commerce Software Market by Type (2018-2032)

4.1 E-Commerce Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloud

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-premise

Chapter 5: E-Commerce Software Market by Application (2018-2032)

5.1 E-Commerce Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Apparel & Fashion

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food & Beverage

5.5 Automotive

5.6 Home & Electronics

5.7 Healthcare

5.8 BFSI & Technology

5.9 Other

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 E-Commerce Software Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MILLENNIUM CHEMICALS (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 QINGDAO HAIYANG CHEMICAL (CHINA)

6.4 DOWDUPONT (US)

6.5 NISSAN CHEMICAL INDUSTRIES (JAPAN)

6.6 FUJI SILYSIA CHEMICAL (CHINA)

6.7 CHINA NATIONAL BLUESTAR COMPANY LIMITED (CHINA)

6.8 MERCK GROUP (GERMANY)

6.9 SOLVAY (BELGIUM)

6.10 CLARIANT (SWITZERLAND)

6.11 EVONIK INDUSTRIES (GERMANY)

6.12 W.R. GRACE & CO. (USA)

6.13 THERMO FISHER SCIENTIFIC (USA)

6.14 MERCK KGAA (GERMANY)

6.15 BASF SE (GERMANY)

6.16 AGC CHEMICALS AMERICAS INC. (USA)

6.17 OSAKA SODA COLTD. (JAPAN)

6.18 SILICYCLE INC. (CANADA)

6.19 MULTISORB TECHNOLOGIES (USA)

6.20 HENGYE INC. (USA)

6.21 DESSICARE INC. (USA)

6.22 PQ CORPORATION (USA

Chapter 7: Global E-Commerce Software Market By Region

7.1 Overview

7.2. North America E-Commerce Software Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Cloud

7.2.4.2 On-premise

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Apparel & Fashion

7.2.5.2 Food & Beverage

7.2.5.3 Automotive

7.2.5.4 Home & Electronics

7.2.5.5 Healthcare

7.2.5.6 BFSI & Technology

7.2.5.7 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe E-Commerce Software Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Cloud

7.3.4.2 On-premise

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Apparel & Fashion

7.3.5.2 Food & Beverage

7.3.5.3 Automotive

7.3.5.4 Home & Electronics

7.3.5.5 Healthcare

7.3.5.6 BFSI & Technology

7.3.5.7 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe E-Commerce Software Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Cloud

7.4.4.2 On-premise

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Apparel & Fashion

7.4.5.2 Food & Beverage

7.4.5.3 Automotive

7.4.5.4 Home & Electronics

7.4.5.5 Healthcare

7.4.5.6 BFSI & Technology

7.4.5.7 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific E-Commerce Software Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Cloud

7.5.4.2 On-premise

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Apparel & Fashion

7.5.5.2 Food & Beverage

7.5.5.3 Automotive

7.5.5.4 Home & Electronics

7.5.5.5 Healthcare

7.5.5.6 BFSI & Technology

7.5.5.7 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa E-Commerce Software Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Cloud

7.6.4.2 On-premise

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Apparel & Fashion

7.6.5.2 Food & Beverage

7.6.5.3 Automotive

7.6.5.4 Home & Electronics

7.6.5.5 Healthcare

7.6.5.6 BFSI & Technology

7.6.5.7 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America E-Commerce Software Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Cloud

7.7.4.2 On-premise

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Apparel & Fashion

7.7.5.2 Food & Beverage

7.7.5.3 Automotive

7.7.5.4 Home & Electronics

7.7.5.5 Healthcare

7.7.5.6 BFSI & Technology

7.7.5.7 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global E-Commerce Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.68% |

Market Size in 2032: |

USD 19.71 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||