Detergent Chemicals Market Synopsis:

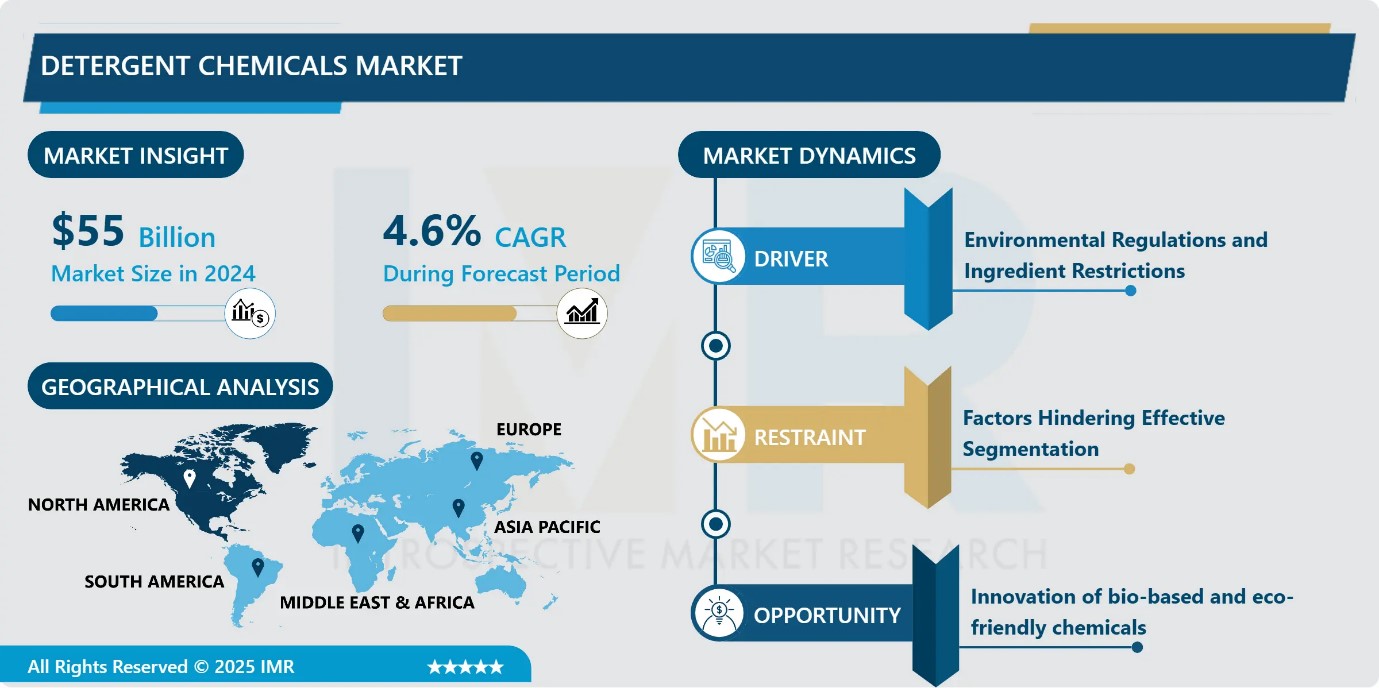

Detergent chemicals Market Size Was Valued at USD 55 Billion in 2024, and is Projected to Reach USD 90.20 Billion by 2035, Growing at a CAGR of 4.6% From 2025–2035.

Detergent chemicals are important ingredients used in many cleaning products to help remove dirt, stains, grease, and germs. They work by breaking down oils and sticky grime, making it easier to clean surfaces and keep them safe and hygienic. These chemicals not only clean well but also help kill harmful bacteria and viruses, which is important for maintaining health at home and in public places.

We can find detergent chemicals in common products like laundry powders, liquid detergents, dishwashing liquids, floor cleaners, and surface sprays. They are used in homes for daily cleaning and are also very important in places like factories, hotels, hospitals, schools, and restaurants, where high standards of cleanliness are needed. A detergent is usually made of several ingredients. Surfactants help loosen dirt, enzymes break down food and other stains, and other additives improve how well the product works. Together, these ingredients make cleaning faster and more effective.

As people become more aware of cleanliness and hygiene, especially after the COVID-19 pandemic, the demand for strong and effective cleaning products has increased. Because of this, detergent chemicals are now more important than ever for keeping both our homes and public spaces clean, healthy, and safe.

Detergent Chemicals Market Growth and Trend Analysis:

Detergent Chemicals Market Growth Driver- Environmental Regulations and Ingredient Restrictions

- Affecting the growth of the detergent chemicals market is the tightening of environmental regulations and restrictions on harmful ingredients. Governments around the world are increasingly banning or limiting the use of substances such as phosphates and chlorine due to their negative impact on ecosystems and public health. Phosphates, for example, contribute to water pollution by causing algae overgrowth, which harms aquatic life. As a result, more than 30 countries have imposed full or partial bans on their use in detergents. These regulations require manufacturers to invest heavily in research and development to create new formulations that are both effective and environmentally safe. This increases production costs and delays product development, making it difficult for companies to quickly adapt to market trends and consumer demands. The need for constant reformulation also affects the industry's ability to innovate efficiently, which slows overall market growth. Compliance challenges with varying international standards further complicate the issue for global manufacturers.

Detergent Chemicals Market Limiting Factor- Factors Hindering Effective Segmentation

- One of the key restraints in market segmentation for detergent chemicals is the increasing pressure from environmental and regulatory bodies. Strict regulations around the use of phosphates, non-biodegradable surfactants, and other potentially harmful ingredients significantly limit the flexibility of chemical manufacturers in targeting different consumer or industrial segments. Additionally, cost sensitivity across various customer groups, especially in price-driven markets such as developing regions, restricts the ability to segment based on premium or value-added product features.

- Consumers are also shifting toward eco-friendly and health-conscious options, creating challenges for traditional chemical formulations and requiring companies to reformulate without losing performance or affordability. Moreover, the volatile prices of raw materials add another layer of complexity, making it difficult to maintain consistent pricing strategies across segmented offerings. Finally, technical limitations in customizing detergent chemicals for niche needs, Such as ultra-concentrated formulas or hypoallergenic product can hinder scalable segmentation efforts. These restraints collectively complicate the development of clear and effective market segmentation strategies within the detergent chemicals industry.

Detergent Chemicals Market Expansion Opportunity- Innovation of bio-based and eco-friendly chemicals

- The rise in demand for sustainable and environmentally friendly products has motivated detergent manufacturers to incorporate more bio-based and eco-friendly ingredients into their formulations. Consumers are increasingly aware of the impact synthetic chemicals can have on the environment and prefer products with natural or plant-based components.

- This change in attitude provides a significant opportunity for innovation in the detergent chemicals market. By developing bio-sourced surfactants, builders, enzymes and other functional materials, companies can make their detergents more sustainable without compromising on performance. Some manufacturers have already started utilizing renewable feedstocks such as palm, coconut and sugar beet oils to synthesize fatty acid-based chemicals that can effectively clean while degrading more readily than conventional petrochemical detergent ingredients.

- For example, certain European brands have launched bio-laundry detergents made with over 90% ingredients sourced from plants. The demand for such greener products is expected to grow substantially in the coming years. According to data from the European Consumer Association released in 2021, over 60% of European consumers reported being willing to pay a premium for eco-friendly cleaning products.

Detergent Chemicals Market Challenge and Risk- Impact of Strict Regulations on the Growth of the Detergent Chemicals Market

- Strict government rules about which ingredients can be used in detergents are slowing down the growth of the detergent chemicals market. Many countries are banning harmful substances due to their negative effects on health and the environment. For example, phosphates once widely used to soften water and remove stains are now banned in several countries because they pollute lakes and rivers by encouraging excessive algae growth, which depletes oxygen and harms aquatic life.

- The U.S. banned phosphates in detergents in 2011, and over 30 countries have imposed similar restrictions. Other ingredients like chlorine are also being regulated because they release toxic by-products into water. These regulations force manufacturers to reformulate their products using safer alternatives, which requires heavy investment in research and development. As a result, production costs go up, and it becomes harder for companies to innovate quickly. This makes it challenging for detergent makers to keep up with market demands, limiting overall growth.

Detergent Chemicals Market Segment Analysis:

Detergent Chemicals Market is segmented based on Type, Application, End-Users, and Region

By Application, Detergent Chemicals Market segment held the largest share in 2024

- The detergent chemicals market is divided into several application areas. These include laundry detergents, dishwashing detergents, household cleaners, industrial and institutional cleaning, and personal care products.

- Among these, laundry detergents are the most widely used. In 2024, this segment held the largest share of the market, accounting for about 35%. This means that more than one-third of the demand for detergent chemicals came from products used for washing clothes. Laundry detergents are used in homes, laundromats, and commercial laundry services, which keeps the demand high.

- Dishwashing detergents are another important segment in the market. These are used for cleaning dishes both at home and in restaurants or food service businesses. This segment is expected to grow steadily in the coming years. This means the market for dishwashing detergents will continue to expand at a healthy pace each year.

By End-User, Detergent Chemicals Market segment is expected to dominate the market during the forecast period

- The detergent chemicals market is divided into different types of users. These include household consumers, commercial and institutional users, and industrial users. Household consumers make up the largest part of the market. This means most detergent chemicals are used by people at home, mainly for washing clothes. As more people use washing machines and become more aware of cleanliness, the demand for laundry detergents is growing. This rising demand is helping the detergent market grow faster.

- Commercial and institutional users are also a big part of the market. These include places like hotels, restaurants, hospitals, and schools. Such places use a large amount of detergent chemicals every day to clean rooms, kitchens, restrooms, and other areas. Cleanliness and hygiene are very important in these places, which is why they need strong and effective cleaning products. Their constant use of detergents makes this a strong and steady market segment.

- Industrial users are another important group. These include industries such as textile manufacturing, food processing, and chemical plants. In these settings, detergents are used for tasks like removing grease, cleaning equipment, and helping in the production process.

- The growing need for detergents in all these areas homes, businesses, and factories is expected to keep the detergent chemicals market growing in the future. As more people and companies focus on hygiene, cleaning, and safety, the use of detergent chemicals will likely increase even more. In summary, household consumers are the largest users, followed by commercial, institutional, and industrial users, all of which support strong growth in the detergent chemicals market.

Detergent Chemicals Market Regional Insights:

- The North American detergent chemicals market is a mature and well-established sector, driven by high consumer awareness, technological advancements, and stringent regulatory frameworks. The United States leads the region in terms of demand and innovation, followed closely by Canada and Mexico. With an increasing focus on sustainability and environmental responsibility, manufacturers are investing heavily in the development of eco-friendly, biodegradable detergent chemicals. Enzyme-based formulations and low-temperature washing solutions are gaining popularity, reflecting the region’s commitment to reducing energy consumption and carbon emissions. Regulatory bodies such as the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) play a critical role in shaping product formulations and ensuring consumer safety, encouraging the use of safer, less toxic chemicals.

- Additionally, the market is witnessing a steady rise in demand for concentrated and water-efficient detergent products, influenced by consumer preference for convenience and environmental benefits. Innovation remains a core driver, with companies focusing on multifunctional cleaning agents that combine efficiency with gentleness on fabrics and skin. The presence of major global and regional players fosters healthy competition, resulting in consistent product upgrades and marketing innovations. E-commerce has also emerged as a strong distribution channel, allowing brands to reach a broader consumer base and offer personalized solutions. Meanwhile, Mexico, with its expanding industrial base and rising middle class, is becoming a key growth area within the region. Overall, North America’s detergent chemicals market continues to evolve, shaped by a blend of innovation, environmental consciousness, and regulatory compliance.

Detergent Chemicals Market Active Players:

- 3M (USA)

- AkzoNobel N.V. (Netherlands)

- Arkema (France)

- Ashland (USA)

- BASF SE (Germany)

- Celanese Corporation (USA)

- Chemische Werke Kluthe GmbH (Germany)

- Chemoxy International Ltd (United Kingdom)

- Clariant AG (Switzerland)

- Colgate-Palmolive Company (USA)

- Croda International Plc (United Kingdom)

- Dow (USA)

- Eastman Chemical Company (USA)

- Ecolab Inc. (USA)

- Evonik Industries AG (Germany)

- Galaxy Surfactants Ltd. (India)

- Henkel AG & Co. KGaA (Germany)

- Huntsman Corporation (USA)

- Kao Corporation (Japan)

- Kimetsan (Turkey)

- Nouryon (Netherlands)

- Reckitt Benckiser Group PLC (United Kingdom)

- Saponia d.d. (US)

- Sasol (South Africa)

- SNF Floerger (France)

- Solvay (Belgium)

- Stepan Company (USA)

- Tata Chemicals Ltd. (India)

- The Procter & Gamble Company (USA)

- Unilever (United Kingdom)

- Other active players

|

Detergent Chemical Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 55 Billion

|

|

Forecast Period 2025-32 CAGR: |

4.6% |

Market Size in 2035: |

USD 90.20 Billion |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

Product Type

|

|

||

|

Type |

|

||

|

chemical type |

|

||

|

Form |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Detergents Chemicals Market by Product (2018-2032)

4.1 Detergents Chemicals Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Surfactants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Builders

4.5 Enzymes

4.6 Bleaching Agents

4.7 Fragrances

Chapter 5: Detergents Chemicals Market by Application (2018-2032)

5.1 Detergents Chemicals Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Laundry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Household Cleaning Products

5.5 Dishwashing Detergents

5.6 Industrial Cleaning

5.7 Fuel Additives

5.8 Biological Reagent

Chapter 6: Detergents Chemicals Market by End-Use (2018-2032)

6.1 Detergents Chemicals Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Household

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial

6.5 Personal

Chapter 7: Detergents Chemicals Market by Detergent Type (2018-2032)

7.1 Detergents Chemicals Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Anionic Detergents

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Cationic Detergents

7.5 Non-Ionic Detergents

7.6 Zwitterionic

Chapter 8: Detergents Chemicals Market by Chemical Type (2018-2032)

8.1 Detergents Chemicals Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Surfactants

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Builders

8.5 Enzymes

8.6 Bleaching Agents

Chapter 9: Detergents Chemicals Market by

Form (2018-2032)

9.1 Detergents Chemicals Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Powder

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Liquid

9.5 Gel

9.6 Tablets

9.7 Capsules

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Detergents Chemicals Market Share by Manufacturer/Service Provider(2024)

10.1.3 Industry BCG Matrix

10.1.4 PArtnerships, Mergers & Acquisitions

10.2 3M

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Recent News & Developments

10.2.10 SWOT Analysis

10.3 ASHLAND

10.4 CELANESE CORPORATION

10.5 COLGATE-PALMOLIVE COMPANY

10.6 DOW

10.7 EASTMAN CHEMICAL COMPANY

10.8 ECOLAB INC.

10.9 HUNTSMAN CORPORATION

10.10 STEPAN COMPANY

10.11 THE PROCTER & GAMBLE COMPANY

10.12 AKZONOBEL N.V. (NETHERLANDS)

10.13 ARKEMA (FRANCE)

10.14 BASF SE (GERMANY)

10.15 CHEMISCHE WERKE KLUTHE GMBH (GERMANY)

10.16 CHEMOXY INTERNATIONAL LTD (UNITED KINGDOM)

10.17 CLARIANT AG (SWITZERLAND)

10.18 CRODA INTERNATIONAL PLC (UNITED KINGDOM)

10.19 EVONIK INDUSTRIES AG (GERMANY)

10.20 HENKEL AG & CO. KGAA (GERMANY)

10.21 NOURYON (NETHERLANDS)

10.22 RECKITT BENCKISER GROUP PLC (UNITED KINGDOM)

10.23 SAPONIA D.D. (CROATIA)

10.24 SNF FLOERGER (FRANCE)

10.25 AND SOLVAY (BELGIUM)

10.26 GALAXY SURFACTANTS LTD. (INDIA)

10.27 TATA CHEMICALS LTD. (INDIA)

10.28 KAO CORPORATION (JAPAN)

10.29 KIMETSAN (TURKEY)

10.30 AND SASOL (SOUTH AFRICA)

10.31 OTHER ACTIVE PLAYERS.

Chapter 11: Global Detergents Chemicals Market By Region

11.1 Overview

11.2. North America Detergents Chemicals Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecast Market Size by Country

11.2.4.1 US

11.2.4.2 Canada

11.2.4.3 Mexico

11.3. Eastern Europe Detergents Chemicals Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecast Market Size by Country

11.3.4.1 Russia

11.3.4.2 Bulgaria

11.3.4.3 The Czech Republic

11.3.4.4 Hungary

11.3.4.5 Poland

11.3.4.6 Romania

11.3.4.7 Rest of Eastern Europe

11.4. Western Europe Detergents Chemicals Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecast Market Size by Country

11.4.4.1 Germany

11.4.4.2 UK

11.4.4.3 France

11.4.4.4 The Netherlands

11.4.4.5 Italy

11.4.4.6 Spain

11.4.4.7 Rest of Western Europe

11.5. Asia Pacific Detergents Chemicals Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecast Market Size by Country

11.5.4.1 China

11.5.4.2 India

11.5.4.3 Japan

11.5.4.4 South Korea

11.5.4.5 Malaysia

11.5.4.6 Thailand

11.5.4.7 Vietnam

11.5.4.8 The Philippines

11.5.4.9 Australia

11.5.4.10 New Zealand

11.5.4.11 Rest of APAC

11.6. Middle East & Africa Detergents Chemicals Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecast Market Size by Country

11.6.4.1 Turkiye

11.6.4.2 Bahrain

11.6.4.3 Kuwait

11.6.4.4 Saudi Arabia

11.6.4.5 Qatar

11.6.4.6 UAE

11.6.4.7 Israel

11.6.4.8 South Africa

11.7. South America Detergents Chemicals Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecast Market Size by Country

11.7.4.1 Brazil

11.7.4.2 Argentina

11.7.4.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Detergent Chemical Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 55 Billion

|

|

Forecast Period 2025-32 CAGR: |

4.6% |

Market Size in 2035: |

USD 90.20 Billion |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

Product Type

|

|

||

|

Type |

|

||

|

chemical type |

|

||

|

Form |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||