Data Pipeline Tools Market Synopsis:

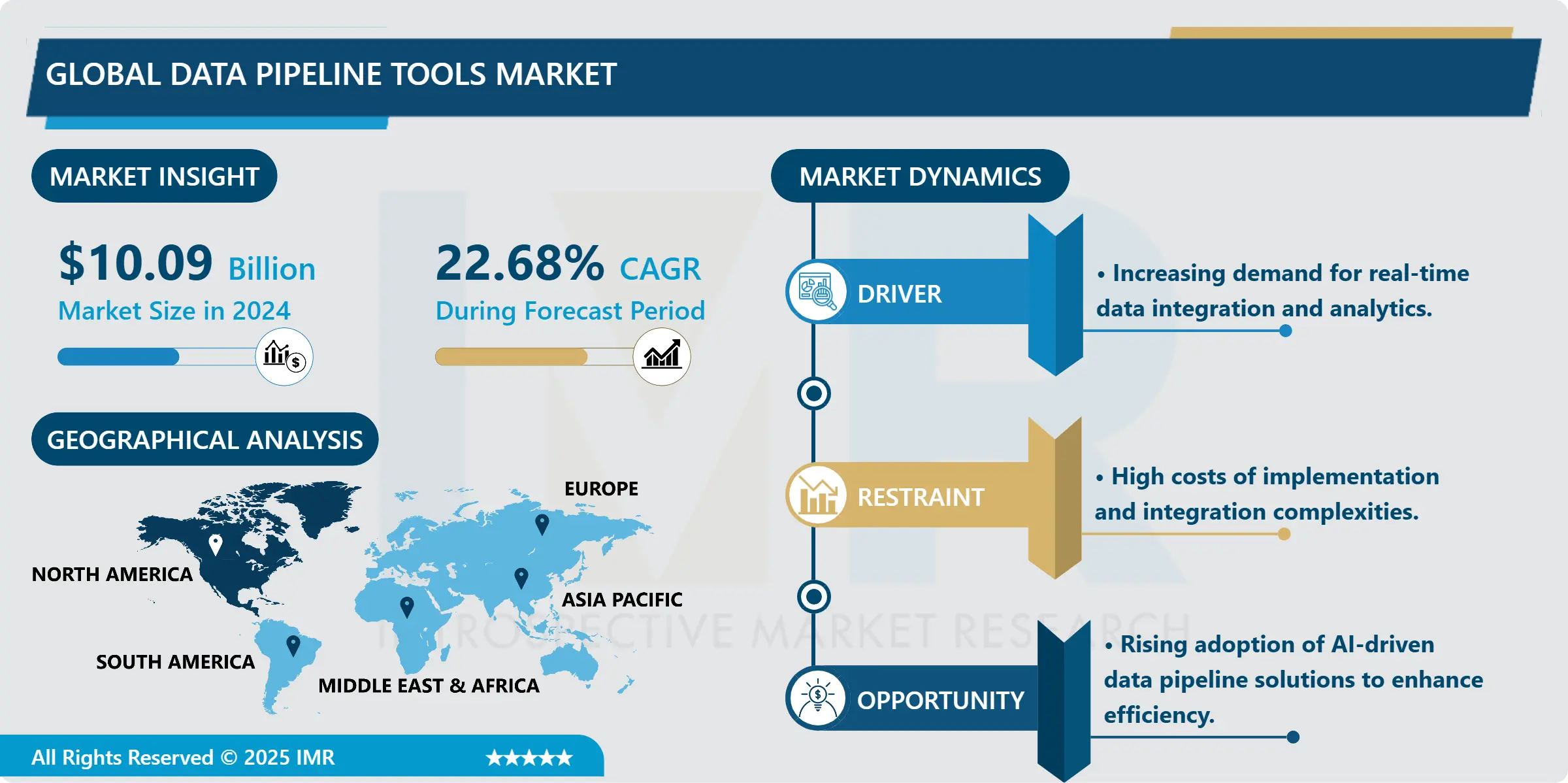

Data Pipeline Tools Market Size Was Valued at USD 10.09 Billion in 2024, and is Projected to Reach USD 51.77 Billion by 2032, Growing at a CAGR of 22.68% From 2025-2032.

The Data Pipeline Tools Market defines products to extract, transport, and load data from various sources to targets to support analysis, storage or subsequently processing. These tools enable smooth data integration across numerous levels of integrated infrastructure to maintain, scale, and access data uniformly. This is specifically so because large organizations are now largely employing real-time data processing and Big Data applications via data pipelines which are required to accommodate data of structured as well as unstructured varieties, of which they source from relational as well as non-relational databases, cloud services, as well as IoT gadgets. This market serves the sectors of retail, healthcare, banking and telecommunications among others being a key enabler of operational efficiency and decision-making through optimized data processes.

The market for data pipeline tools is growing steadily Owing to a constantly increasing need for data integration solutions amid broader trends toward growing digital transformation across industries. Many organizations produce large amounts of data, and there is a need for systems that can successfully handle this Big Data. The focus on a quantitative approach, including the use of analytics, machine learning, and AI, has driven the need for real-time data pipeline solutions that will process big data transactions. Moreover, these tools are being applied in various sectors including retail and finance to streamline arrangements of supply chains, improve customer engagement, and gain insights for market development.

Cloud computing has proven to be a disruptive technology that has revolutionized the way data pipeline tools market operates; through the availability of cost-effective solutions that provide ease of scalability and flexibility to businesses. As more applications transitioned to SaaS and as newer applications leverage cloud-native services or APIs, more enterprises turn to cloud-based pipeline solutions to lower their total cost of ownership and increase application flexibility. However, market players are still seeing barriers like data security issues, integration issues and high costly solutions for coming up in the advanced level as main hindrances.

Data Pipeline Tools Market Trend Analysis:

Growing Adoption of Real-Time Data Processing Solutions

- Real time data processing has emerged as the key driver of the data pipeline tools market. Companies in every sector require quick information in order to make appropriate decisions as well as to manage fluctuations in the market and improve organizational performance. Features allowing for constantly generated and updated data, compatibility with event-driven platforms, and APIs, as well as the compatibility with Apache Kafka and Spark become more and more sought after. This trend is fostered by sectors who need to analyze the behavior of the customers in real time such as e-commerce and financial services that require real time fraud detection and transaction monitoring.

Integration of AI and Machine Learning with Data Pipeline Tools

- A key market opportunity exists when data pipeline tools are developed with AI and machine learning features. These advanced capabilities allow for the predictive, analytical, anomaly, and decision-making circuits. This means that by implementing AI into the pipeline, businesses will be able to lower the number of interventions needed for the process, gain more efficiency in their operations and most importantly analyze data that the human eye cannot see. This opportunity is most applicable in verticals such as healthcare, manufacturing and logistics, where processing of raw data in real time could lead to great savings and enhancements. Firms that implemented AI-driven pipelines enable them to deal with the intricacies of advanced data environments, thus have an advantage.

Data Pipeline Tools Market Segment Analysis:

Data Pipeline Tools Market is Segmented on the basis of deployment, data type, function and region.

By Deployment, Cloud segment is expected to dominate the market during the forecast period

- It is expected that the cloud segment will hold the largest market share within the data pipeline tools market before 2024. This is because of the growing landscape of cloud computing and the newer movement towards SaaS delivery models. Cloud pipeline tools provide businesses with flexibility, affordability, and tight integration with other cloud-based applications. These tools help organizations in handling a large amount of real time data processing so that the organizations may not have to worry about the underlying architecture. As enterprises are continually increasing their investment in hybrid and multi-cloud solutions, the cloud segment is expected to experience a growth rate.

By Data type, the Structured data segment expected to held the largest share

- The structured data segment can be expected to be one of the most dominant ones, as it remains highly relevant for all types of conventional BI and analytics operations. The majority of organizational decisions rely on structured data, which is normally situated in databases and data warehouses respectively. The increasing occurrence of ERP systems, CRM solutions and transactional databases guarantees a steady consumer interest in the pipeline tools specialized in ordered data processing. This segment which encompasses organizations’ structured data focused on reporting and compliance is expected to sustain market leadership as organizations remain committed to structured data.

Data Pipeline Tools Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The leadership of the region is supported by high levels of penetration of big data and analytics solutions across the healthcare, finance, and retail segments. The USA has grouped key market players and dominates technological advancements in the regions of AI, machine learning & cloud solutions. This ecosystem provides the fertile ground for effective multiple data pipeline tools to be developed to support various business needs for real-time information.

- A surging base of cloud users and an increasing number of organizations embracing DC&SIM adoption also fuels the market in North America. This is especially because operating enterprises in the region are considered to be upgrading their IT systems and architectures as a strategy towards sustaining competitive advantage, thus creating an increased need for potent data pipeline technologies. Canada also participates in this growth due to its growing interest in the policy and investment impact of data-based policy and investment in AI analytic platforms. This situation makes it easier to maintain stringent pipeline tools besides fostering regulatory compliance and data security across the region making North America the leading market worldwide.

Active Key Players in the Data Pipeline Tools Market:

- Adeptia (USA)

- Alooma (USA)

- Apache Software Foundation (USA)

- Arcadia Data (USA)

- AWS (USA)

- Cloudera (USA)

- Confluent (USA)

- Dell Technologies (USA)

- Google LLC (USA)

- Informatica (USA)

- Microsoft Corporation (USA)

- Oracle Corporation (USA)

- SnapLogic (USA)

- StreamSets (USA)

- Talend (France)

- Other Active Players

|

Global Data Pipeline Tools Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 10.09 Billion |

|

Forecast Period 2025-32 CAGR: |

22.68% |

Market Size in 2032: |

USD 51.77 Billion |

|

Segments Covered: |

By Deployment |

|

|

|

By Data Type |

|

||

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Pipeline Tools Market by Deployment

4.1 Data Pipeline Tools Market Snapshot and Growth Engine

4.2 Data Pipeline Tools Market Overview

4.3 On-Premises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 On-Premises: Geographic Segmentation Analysis

4.4 Cloud

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Cloud: Geographic Segmentation Analysis

4.5 Hybrid

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hybrid: Geographic Segmentation Analysis

Chapter 5: Data Pipeline Tools Market by Data Type

5.1 Data Pipeline Tools Market Snapshot and Growth Engine

5.2 Data Pipeline Tools Market Overview

5.3 Structured Data

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Structured Data: Geographic Segmentation Analysis

5.4 Unstructured Data

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Unstructured Data: Geographic Segmentation Analysis

5.5 Semi-Structured Data

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Semi-Structured Data: Geographic Segmentation Analysis

5.6 Real-Time Data

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Real-Time Data: Geographic Segmentation Analysis

Chapter 6: Data Pipeline Tools Market by Function

6.1 Data Pipeline Tools Market Snapshot and Growth Engine

6.2 Data Pipeline Tools Market Overview

6.3 ELT (Extract

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 ELT (Extract: Geographic Segmentation Analysis

6.4 Load

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Load: Geographic Segmentation Analysis

6.5 Transform)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Transform): Geographic Segmentation Analysis

6.6 ETL (Extract

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 ETL (Extract: Geographic Segmentation Analysis

6.7 Transform

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Transform: Geographic Segmentation Analysis

6.8 Load)

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Load): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Data Pipeline Tools Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ADEPTIA (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALOOMA (USA)

7.4 APACHE SOFTWARE FOUNDATION (USA)

7.5 ARCADIA DATA (USA)

7.6 AWS (USA)

7.7 CLOUDERA (USA)

7.8 CONFLUENT (USA)

7.9 DELL TECHNOLOGIES (USA)

7.10 GOOGLE LLC (USA)

7.11 INFORMATICA (USA)

7.12 MICROSOFT CORPORATION (USA)

7.13 ORACLE CORPORATION (USA)

7.14 SNAPLOGIC (USA)

7.15 STREAMSETS (USA)

7.16 TALEND (FRANCE)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Data Pipeline Tools Market By Region

8.1 Overview

8.2. North America Data Pipeline Tools Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Deployment

8.2.4.1 On-Premises

8.2.4.2 Cloud

8.2.4.3 Hybrid

8.2.5 Historic and Forecasted Market Size By Data Type

8.2.5.1 Structured Data

8.2.5.2 Unstructured Data

8.2.5.3 Semi-Structured Data

8.2.5.4 Real-Time Data

8.2.6 Historic and Forecasted Market Size By Function

8.2.6.1 ELT (Extract

8.2.6.2 Load

8.2.6.3 Transform)

8.2.6.4 ETL (Extract

8.2.6.5 Transform

8.2.6.6 Load)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Data Pipeline Tools Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Deployment

8.3.4.1 On-Premises

8.3.4.2 Cloud

8.3.4.3 Hybrid

8.3.5 Historic and Forecasted Market Size By Data Type

8.3.5.1 Structured Data

8.3.5.2 Unstructured Data

8.3.5.3 Semi-Structured Data

8.3.5.4 Real-Time Data

8.3.6 Historic and Forecasted Market Size By Function

8.3.6.1 ELT (Extract

8.3.6.2 Load

8.3.6.3 Transform)

8.3.6.4 ETL (Extract

8.3.6.5 Transform

8.3.6.6 Load)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Data Pipeline Tools Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Deployment

8.4.4.1 On-Premises

8.4.4.2 Cloud

8.4.4.3 Hybrid

8.4.5 Historic and Forecasted Market Size By Data Type

8.4.5.1 Structured Data

8.4.5.2 Unstructured Data

8.4.5.3 Semi-Structured Data

8.4.5.4 Real-Time Data

8.4.6 Historic and Forecasted Market Size By Function

8.4.6.1 ELT (Extract

8.4.6.2 Load

8.4.6.3 Transform)

8.4.6.4 ETL (Extract

8.4.6.5 Transform

8.4.6.6 Load)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Data Pipeline Tools Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Deployment

8.5.4.1 On-Premises

8.5.4.2 Cloud

8.5.4.3 Hybrid

8.5.5 Historic and Forecasted Market Size By Data Type

8.5.5.1 Structured Data

8.5.5.2 Unstructured Data

8.5.5.3 Semi-Structured Data

8.5.5.4 Real-Time Data

8.5.6 Historic and Forecasted Market Size By Function

8.5.6.1 ELT (Extract

8.5.6.2 Load

8.5.6.3 Transform)

8.5.6.4 ETL (Extract

8.5.6.5 Transform

8.5.6.6 Load)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Data Pipeline Tools Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Deployment

8.6.4.1 On-Premises

8.6.4.2 Cloud

8.6.4.3 Hybrid

8.6.5 Historic and Forecasted Market Size By Data Type

8.6.5.1 Structured Data

8.6.5.2 Unstructured Data

8.6.5.3 Semi-Structured Data

8.6.5.4 Real-Time Data

8.6.6 Historic and Forecasted Market Size By Function

8.6.6.1 ELT (Extract

8.6.6.2 Load

8.6.6.3 Transform)

8.6.6.4 ETL (Extract

8.6.6.5 Transform

8.6.6.6 Load)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Data Pipeline Tools Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Deployment

8.7.4.1 On-Premises

8.7.4.2 Cloud

8.7.4.3 Hybrid

8.7.5 Historic and Forecasted Market Size By Data Type

8.7.5.1 Structured Data

8.7.5.2 Unstructured Data

8.7.5.3 Semi-Structured Data

8.7.5.4 Real-Time Data

8.7.6 Historic and Forecasted Market Size By Function

8.7.6.1 ELT (Extract

8.7.6.2 Load

8.7.6.3 Transform)

8.7.6.4 ETL (Extract

8.7.6.5 Transform

8.7.6.6 Load)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Data Pipeline Tools Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 10.09 Billion |

|

Forecast Period 2025-32 CAGR: |

22.68% |

Market Size in 2032: |

USD 51.77 Billion |

|

Segments Covered: |

By Deployment |

|

|

|

By Data Type |

|

||

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||