Data Center UPS Market Synopsis

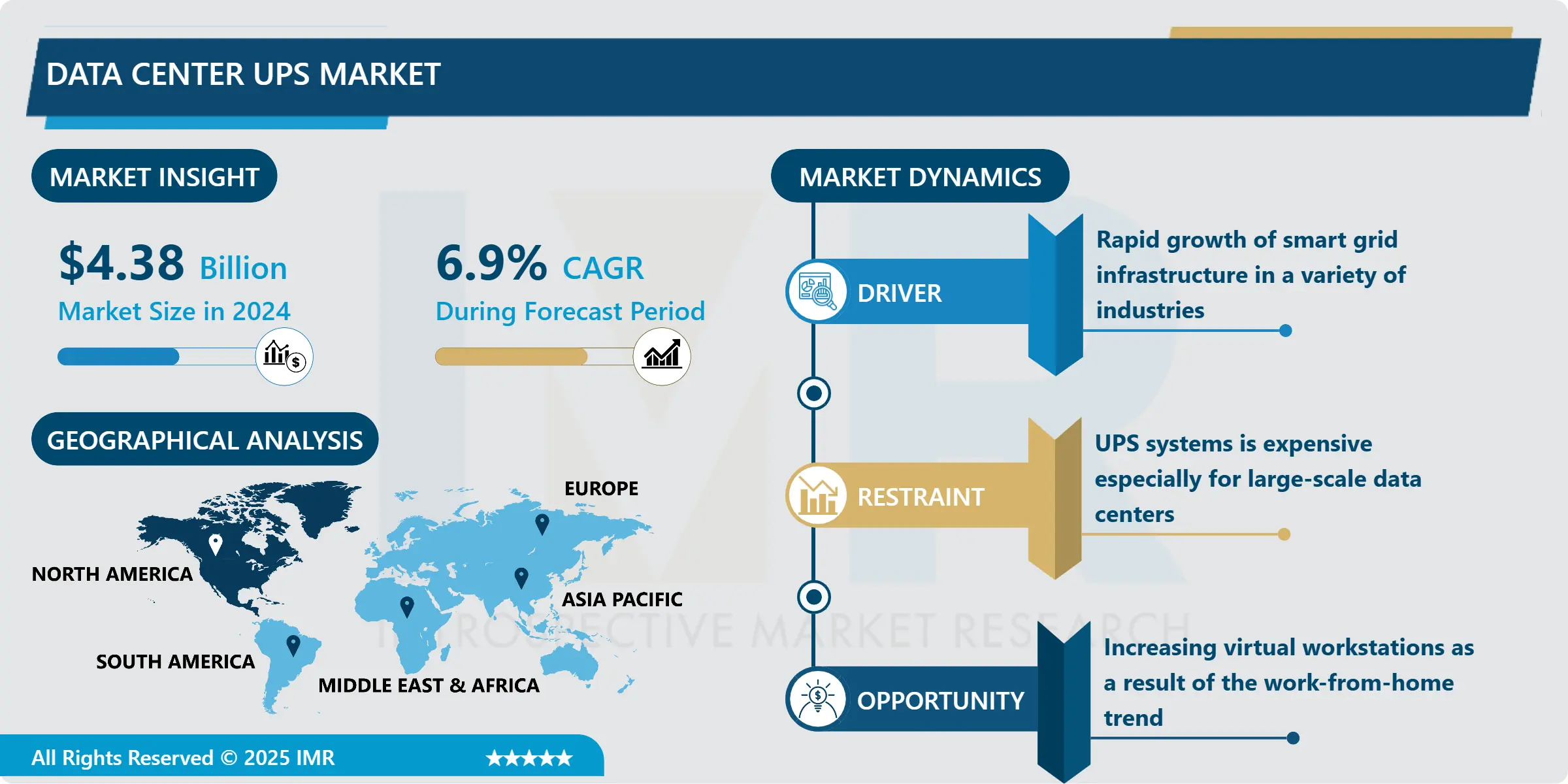

Data Center UPS Market Size Was Valued at USD 4.38 Billion in 2024, and is Projected to Reach USD 7.47 Billion by 2032, Growing at a CAGR of 6.9% From 2025-2032.

A Data Center UPS (Uninterruptible Power Supply) is a critical component of data center infrastructure designed to provide continuous, uninterrupted power to servers, networking equipment, and other critical systems in the event of a power outage or fluctuation. UPS systems typically consist of batteries or flywheels that store energy and can instantly supply power to connected devices when the main power source fails.

Data Center UPS (Uninterruptible Power Supply) systems are essential components of data centers, providing backup power in the event of a mains power failure. Data centers require uninterrupted power to ensure the availability of critical services and applications. UPS systems provide seamless power backup to keep servers, networking equipment, and other infrastructure running during power outages. UPS systems protect sensitive electronic equipment from voltage fluctuations, power surges, and spikes that can occur due to lightning strikes, utility grid issues, or internal electrical system faults.

Maintaining data integrity and availability is crucial for data centers. UPS systems prevent unexpected power interruptions that could lead to data loss, corruption, or downtime, ensuring continuous operation and access to stored information. UPS systems help protect data center equipment from damage caused by sudden power loss or irregularities in the electrical supply, moreover helps in extending the lifespan of servers, storage devices, and networking gear. In facilities equipped with backup generators, UPS systems act as a bridge between the mains power failure and the activation of generator power. They provide immediate backup power until the generators come online, ensuring a smooth transition without disruptions.

UPS systems often include features for load shedding, load balancing, and energy management, allowing data center operators to optimize power usage, reduce energy costs, and maximize the efficiency of their infrastructure. Many modern UPS systems offer remote monitoring and management capabilities, allowing administrators to monitor power status, battery health, and system performance from a centralized management console or via mobile apps. This enables proactive maintenance, troubleshooting, and alerting to potential issues before they escalate. Data centers may be subject to regulatory requirements or industry standards related to power reliability, availability, and continuity.

UPS systems provide backup power during utility power failures, minimizing downtime and ensuring data integrity. UPS systems also help businesses comply with strict regulations on data protection and uptime by ensuring continuous power supply and data integrity. They also play a critical role in disaster preparedness, providing backup power during emergencies like natural disasters or grid failures, ensuring operations can continue even in challenging circumstances. Overall, UPS systems play a vital role in data center operations.

Data Center UPS Market Trend Analysis

Rapid growth of smart grid infrastructure in a variety of industries

- The rapid growth of smart grid infrastructure in a variety of industries plays a significant impact on the drivers of Data Center UPS (Uninterruptible Power Supply) systems. Smart grids enable more efficient energy distribution, management, and monitoring, which directly affects the reliability and stability of power supply to data centers.

- As smart grid infrastructure expands, data centers are increasingly interconnected with the broader energy ecosystem. This connectivity allows data center operators to leverage real-time data and analytics to optimize their energy usage, minimize costs, and enhance overall operational efficiency. Smart grids facilitate better monitoring and control of power distribution, reducing the likelihood of grid disturbances and outages.

- Smart grids enable dynamic load management and demand response capabilities, allowing data center operators to adjust their power consumption based on grid conditions and pricing. By optimizing energy usage in real-time, UPS systems can operate more efficiently and cost-effectively. Smart grids support the integration of renewable energy sources such as solar and wind power into the grid infrastructure.

- Data centers can leverage these clean energy sources to reduce their carbon footprint and reliance on traditional fossil fuels. UPS systems play a vital role in ensuring the seamless integration of renewable energy into the data center's power supply, providing backup power during periods of low renewable generation or grid instability. The deployment of smart grid technologies improves the overall stability and resilience of the electrical grid by enabling advanced monitoring, predictive maintenance, and rapid response to grid disturbances.

UPS systems is expensive especially for large-scale data centers

- The upfront cost of purchasing UPS hardware and associated components can be substantial, especially for larger data centers that require high-capacity systems to support their critical loads. UPS equipment often represents a significant portion of the overall data center infrastructure investment. Installing UPS systems involves various expenses, including site preparation, electrical wiring, and system integration.

- Large-scale data centers may require complex installation procedures to ensure seamless integration with existing infrastructure and compliance with safety and regulatory standards. Ongoing maintenance and servicing are essential to ensure the reliability and performance of UPS systems. For large-scale data centers with multiple UPS units, the cost of maintenance can quickly add up over time, especially considering the need for specialized personnel and spare parts.

- UPS systems consume electricity to operate, adding to the overall operational expenses of the data center. While modern UPS systems are designed to be energy-efficient, the continuous operation of these systems still contributes to the data center's utility bills. Large-scale data centers must carefully evaluate the TCO of UPS solutions and weigh them against the potential risks and costs associated with power disruptions and downtime.

- These cost-related issues, many data centers recognize the critical importance of UPS systems in safeguarding their operations against power interruptions and outages. To mitigate the cost impact, data center operators may explore various strategies. However, advancements in UPS technology, such as improvements in efficiency and reliability, helps to mitigate some of the cost barriers associated with these systems over time.

Increasing virtual workstations as a result of the work-from-home trend

- The rise of virtual workstations due to the work-from-home trend offers a significant opportunity for Data Center UPS (Uninterruptible Power Supply) systems. These systems provide scalable and flexible IT infrastructure to accommodate fluctuating user demands and workloads, ensuring uninterrupted power supply.

- virtual workstations also provide remote accessibility and reliability, ensuring uninterrupted access to critical applications and data for remote workers. UPS systems mitigate the risk of downtime by providing backup power during outages, ensuring uninterrupted access to critical applications and data. They also offer data security and protection, as sensitive business data and applications are hosted centrally in data centers or cloud environments.

- These systems help mitigate power-related risks by providing reliable power protection and backup capabilities. Furthermore, they are crucial for business continuity and disaster recovery, ensuring essential IT infrastructure remains operational during crises, allowing organizations to continue supporting remote work initiatives without interruption.

Integration with other systems

- Integrating Data Center UPS systems with other systems is a complex task that requires seamless communication and compatibility between different equipment and software. This includes integrating UPS systems with monitoring and management software, generators, cooling systems, and power distribution units. Interoperability is crucial as UPS systems need to interface with different vendors using different protocols and communication standards.

- Reliability and accuracy of data exchange are also essential, as even small discrepancies can have significant consequences. Careful planning and coordination are necessary to avoid disruptions to data center operations, such as scheduling maintenance windows or implementing redundant systems.

Data Center UPS Market Segment Analysis:

Data Center UPS Market Segmented on the basis of data center size component, End-users, and Region.

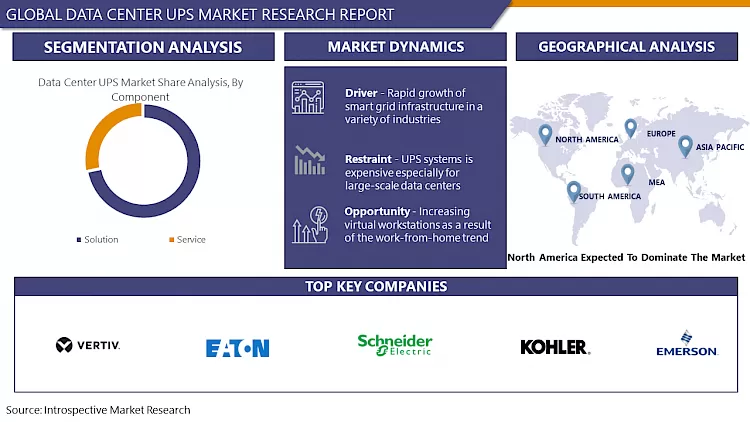

By Component, Solution segment is expected to dominate the market during the forecast period

- The increasing demand for reliable power backup in data centers is driven by the increasing reliance on digital services and the critical nature of operations. UPS systems play a crucial role in providing backup power during mains power failures, safeguarding data integrity and preventing downtime.

- Technological advancements have led to the development of efficient, scalable, and reliable solutions, such as modular architecture, high power density, advanced monitoring, and seamless integration with other critical infrastructure components.

- Energy efficiency is a top priority for operators, and UPS systems contribute to this by improving power resource utilization, reducing wastage, and minimizing operational costs. As data center operators invest in building and upgrading facilities, they prioritize the deployment of reliable power protection solutions like UPS systems to ensure business continuity and mitigate risks.

By End User, IT & Telecom segment held the largest share in 2024

- The IT and Telecom sector, including data centers, telecommunications facilities, and IT infrastructure providers, heavily invests in UPS systems to ensure uninterrupted power supply. These systems are crucial for meeting high power demands, regulatory compliance, and infrastructure investments.

- UPS systems provide backup power during outages and fluctuations in the main power supply, ensuring uninterrupted operation and data integrity. They also meet regulatory requirements for data protection, uptime, and business continuity.

- UPS systems are a fundamental component of infrastructure investments, providing a reliable and resilient power backup solution. The IT and Telecom sector is also characterized by rapid technological advancements, with UPS manufacturers continuously developing new technologies to meet evolving needs.

Data Center UPS Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's data centers, both large hyperscale facilities and smaller colocation centers, require robust UPS systems to ensure uninterrupted power supply and protect critical IT infrastructure. The region is known for its technological advancements, leading to the development of advanced UPS systems with high efficiency, scalability, and integration.

- High reliability requirements drive the demand for UPS systems, which provide high availability and fault tolerance to minimize downtime and data loss. Compliance with regulations and investments in renewable energy sources also drive the adoption of UPS systems in the region.

Data Center UPS Market Top Key Players:

- Vertiv (US)

- Eaton Corporation (US)

- Kohler Co. (US)

- Chloride Power Protection (Emerson Network Power) (US)

- Piller Power Systems (Germany)

- Riello UPS Limited (UK)

- Uninterruptible Power Supplies Ltd (UPSL) (UK)

- Legrand SA (France)

- Schneider Electric (France)

- Hitec Power Protection (Netherlands)

- Riello UPS (Italy)

- Riello Elettronica (Italy)

- Borri S.p.A. (Italy)

- ABB (Switzerland)

- Huawei Technologies Co., Ltd. (China)

- ZTE Corporation (China)

- Kstar New Energy Co., Ltd. (China)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- Delta Electronics (Taiwan)

- Gamatronic Electronic Industries Ltd. (Israel)

- Other Active players

Key Industry Developments in the Data Center UPS Market:

- In June 2023, Schneider Electric, the leader in digital transformation of energy management and automation, launched of its new Easy Modular Data Center All-in-One Solution in Europe. Schneider Electric's Easy Modular 'All-in-One' Data Centers combine all Power, Cooling, and IT equipment into a single, pre-configured solution, and provide exceptional value for enterprise and IT organizations looking to implement an edge computing strategy.

- In February 2023, Mitsubishi Electric Corporation announced that its U.S. subsidiary Mitsubishi Electric Power Products, Inc. acquired Computer Protection Technology, Inc. (CPT), headquartered in San Diego, California, aiming to expand its uninterruptible power supply (UPS) business in North America. Going forward, MEPPI and CPT will strengthen their respective business structures to provide highly reliable and professional one-stop services-from installation to maintenance-for UPS systems in the North American market.

|

Global Data Center UPS Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

4.38 Bn |

|

Forecast Period 2025-32 CAGR: |

6.9 % |

Market Size in 2032: |

7.47 Bn |

|

Segments Covered: |

By Data Center Size |

|

|

|

By Component |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Center UPS Market by Data Center Size (2018-2032)

4.1 Data Center UPS Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Small

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium

4.5 Large

Chapter 5: Data Center UPS Market by Component (2018-2032)

5.1 Data Center UPS Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Solution

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Service

Chapter 6: Data Center UPS Market by End User (2018-2032)

6.1 Data Center UPS Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Energy

6.5 Government

6.6 Healthcare

6.7 Manufacturing

6.8 IT & Telecom

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Data Center UPS Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARINGO (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CLOUDIAN (USA)

7.4 COHESITY (USA)

7.5 DELL TECHNOLOGIES (USA)

7.6 FUJITSU LIMITED (JAPAN)

7.7 HEWLETT PACKARD ENTERPRISE (USA)

7.8 HUAWEI TECHNOLOGIES COLTD. (CHINA)

7.9 IBM CORPORATION (USA)

7.10 NETAPP (USA)

7.11 PURE STORAGE (USA)

7.12 OTHERS

Chapter 8: Global Data Center UPS Market By Region

8.1 Overview

8.2. North America Data Center UPS Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Data Center Size

8.2.4.1 Small

8.2.4.2 Medium

8.2.4.3 Large

8.2.5 Historic and Forecasted Market Size by Component

8.2.5.1 Solution

8.2.5.2 Service

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 BFSI

8.2.6.2 Energy

8.2.6.3 Government

8.2.6.4 Healthcare

8.2.6.5 Manufacturing

8.2.6.6 IT & Telecom

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Data Center UPS Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Data Center Size

8.3.4.1 Small

8.3.4.2 Medium

8.3.4.3 Large

8.3.5 Historic and Forecasted Market Size by Component

8.3.5.1 Solution

8.3.5.2 Service

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 BFSI

8.3.6.2 Energy

8.3.6.3 Government

8.3.6.4 Healthcare

8.3.6.5 Manufacturing

8.3.6.6 IT & Telecom

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Data Center UPS Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Data Center Size

8.4.4.1 Small

8.4.4.2 Medium

8.4.4.3 Large

8.4.5 Historic and Forecasted Market Size by Component

8.4.5.1 Solution

8.4.5.2 Service

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 BFSI

8.4.6.2 Energy

8.4.6.3 Government

8.4.6.4 Healthcare

8.4.6.5 Manufacturing

8.4.6.6 IT & Telecom

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Data Center UPS Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Data Center Size

8.5.4.1 Small

8.5.4.2 Medium

8.5.4.3 Large

8.5.5 Historic and Forecasted Market Size by Component

8.5.5.1 Solution

8.5.5.2 Service

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 BFSI

8.5.6.2 Energy

8.5.6.3 Government

8.5.6.4 Healthcare

8.5.6.5 Manufacturing

8.5.6.6 IT & Telecom

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Data Center UPS Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Data Center Size

8.6.4.1 Small

8.6.4.2 Medium

8.6.4.3 Large

8.6.5 Historic and Forecasted Market Size by Component

8.6.5.1 Solution

8.6.5.2 Service

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 BFSI

8.6.6.2 Energy

8.6.6.3 Government

8.6.6.4 Healthcare

8.6.6.5 Manufacturing

8.6.6.6 IT & Telecom

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Data Center UPS Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Data Center Size

8.7.4.1 Small

8.7.4.2 Medium

8.7.4.3 Large

8.7.5 Historic and Forecasted Market Size by Component

8.7.5.1 Solution

8.7.5.2 Service

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 BFSI

8.7.6.2 Energy

8.7.6.3 Government

8.7.6.4 Healthcare

8.7.6.5 Manufacturing

8.7.6.6 IT & Telecom

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Data Center UPS Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

4.38 Bn |

|

Forecast Period 2025-32 CAGR: |

6.9 % |

Market Size in 2032: |

7.47 Bn |

|

Segments Covered: |

By Data Center Size |

|

|

|

By Component |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||