Data Broker Market Synopsis

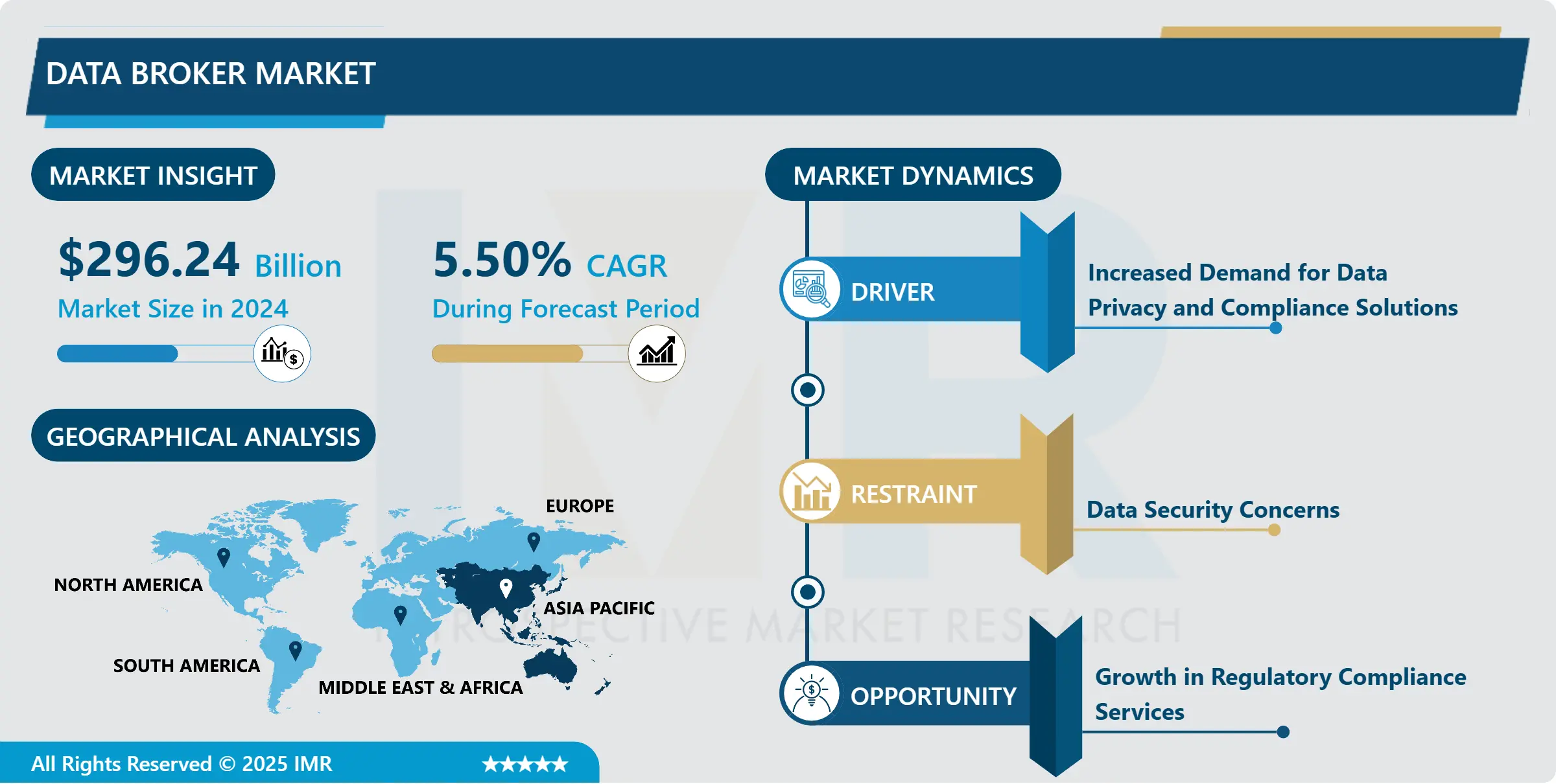

Data Broker Market Size Was Valued at USD 296.24 Billion in 2024, and is Projected to Reach USD 454.64 Billion by 2032, Growing at a CAGR of 5.50% From 2025-2032.

A data broker is an organization or firm in the market that gathers and sells personal information about people and firms. This data is usually compiled from the web activity, spending patterns, social networking sites, records, and other such legal sources. The information is then compiled and analyzed by the data brokers and turned into detailed profiles that these data brokers sell to other third parties such as marketers or advertisers and other organizations.

The previously mentioned data broker market is rather new and belongs to the constantly expanding sphere of the data economy. Data brokers obtain, process and employ individual and organisational consumers’ data including personal, financial and behavioral information and resell it. The information is collected from different sources such as public records and social media CP, e-business transactions, and membership reward programs. The information is then collated, analyzed, and marketed to any organization, advertiser, or third party interested in knowing its target clientele.

Demand has been rising with the use of big data, artificial intelligence, and machine learning. Due to the continued innovation in the field of analytics, firms have become more dependent on the use of analytics to support their marketing goals and objectives and as well as support their customer relations strategy. This trend has particularly driven the growth the data broker industry and is expected disclose tremendous growth in future. The global players in the industry includes Acxiom Corporation, Experian, Equifax, CoreLogic and TransUnion among others. These firms primarily deal with data products and services including credit score, risk evaluation, advertising, and market research.

Nevertheless, there are several issues which challenge the data broker market although it is expanding. Lack of privacy is an emerging issue because consumers and regulators become increasingly concerned with the data acquisition by brokers. Ongoing attacks on big organizations, and malicious acts using personal information have consequently attracted attention, and enhanced demands for more rigid standards of actions. Subsequently, regions like the European Union have introduced detailed data protection laws including but not limited to the General Data Protection Regulation (GDPR) which entails strict measures and policies for handling data and gives the subject a higher level of data control.

These changes in regulations depict a challenge and a potential to data brokers depending on the side they want to market on. As is often the case the cost and effort of meeting such new regulations can serve as a hindrance; however they also stimulate a certain level of market refresh and distinction. Also, ensuring consumers about the transparent and secure collection, storage, and usage of data could be a competitive advantage that would ultimately benefit the companies and their clients. Also, with an increase in the amount of data generated, data brokers have the added advantage of market diversification and the chance to look for added sources of income. Technologies like blockchain and decentralized data marketplaces might bring additional changes to the experts’ field and make data exchange more secure and transparent.

It is possible to state that the market volume of data brokers will grow constantly during the forseeable future due to the prominent role of information as an asset in the digital economy. But to succeed in this new environment it will be crucial to serve both business needs and the public’s interest in protection of their data and persona.

Data Broker Market Trend Analysis

Data Broker Market Growth Drivers- Increased Demand for Data Privacy and Compliance Solutions

- More specifically, the rise of regulatory regulations and consumer awareness on data protection leads to higher requirements for personal data brokers’ business. Various governments across the world are coming up with strict laws that regulate data privacy like GDPR in Europe, and CCPA in the United States. These regulations do call for a sound compliance program and data collection and usage to be more transparent depending on data brokers.

- Also, consumers have increased awareness comparing their online identity and personal data and are starting to claim more rights towards their personal data. The change in the direction of consumers has compelled the improvement of privacy and increased security investing by data brokers. The market is also witnessing higher levels of privacy-related investments in transactions including, encryption as well as anonymisation and greater levels of compliance solution suites to address existing laws as well as consumer skepticism. They are important for maintaining long Term Customer Relation ship In data broker Market as well as the adherence of rules and regulation Novelty This trend not only conform to the rules and regulations but also create confidence and credibility in the business.

Data Broker Market Opportunities- Growth in Regulatory Compliance Services

- Due to the continuously rising global data protection regulations and privacy laws the Data Broker Market is expanding significantly for regulatory compliance services. The emergence of regulatory measures like the General Data Protection Regulation (GDPR) in EU, the California Consumer Privacy Act (CCPA) in US, and similar laws across the global world have increased the necessity of compliance among the data brokers to fix strict standards and avoid penalties and fines besides the reputational loss. These laws require data brokers to be more clear concerning the processes of data gathering, warehousing, and utilization and to secure individuals’ permission to gather their data.

- Data brokers are now paying greater attention towards integrating more sophisticated compliance solutions and services, regarding the growing rules and regulations of the industry. This comprises of strengthening measures for data governance, stepping up protection of the information and data, performing audits and standardizing procedures for data processing to meet new legal provisions. Moreover, as various data scandals occur, consumer awareness relating to the collection and use of their information has heightened, which subsequently increases the relevance of the ‘Right to Privacy’ and thus boosts the application of regulatory compliance services in the data broker industry. Consequently, compliance services have emerged as an important requirement for data brokers – in addition to a legal requirement for their business – to ensure consumers’ confidence. Such development is predicted to persist, thus accelerating the advancement and expansion of the regulatory compliance services segment of the data broker market.

Data Broker Market Segment Analysis:

Data Broker Market Segmented based on Data Type, Data Source, and Application.

By Data Type, Business Data segment is expected to dominate the market during the forecast period

- In the Data Broker Market analysis, there are two main specifications, namely, consumer data and business data. Consumer data is a set of data that details the various aspects of the consumer such as demographics, preferences, behaviors, and identification details. This information is vital where the marketers want to sell specific products and services, want to segment their markets, and where consumer profiling is needed. While on the other hand, Business data refers to all the information that is associated with companies these include; financial data, industry information, purchasing patterns, and structural information about the company. It is used for business market research, selling purposes for the business-to-business requirements, and to conduct the competitor analysis.

- Consumers’ information as well as business data are critical to data brokers who compile, process and sell consumer data to the clients such as marketers, advertisers, researchers, and other businesses that require valuable insights and competitive edge in their industry. As trends of the market, the decision-making of data brokers is influenced by the regulatory policies, development of techniques of data analysis and new concepts of consumer privacy, affecting means of data collecting, compliance and overall market

By Data Source , Transactional Data segment held the largest share in 2024

- The Delivery of the Data Broker Market is mainly based on various data source to collect and manage the data and then sells it to the companies and organizations. Demographic, economic and regulatory information is acquired from government sources and open data bases and serves as initial stage datasets of each of the corpora. Information sourced through registrations, surveys, and users’ inputs are self-reported and can provide detailed data about people’s preferences. Owned data are also known as licensed or purchased data and are owned by some companies and acquired by data brokers; they are composed of customer data, transaction records, and proprietary segmentation.

- T-commerce data analysis is based on transactional data obtained from the commercial transactions that reflect a consumer’s tendency and market shares. Web data, resulting from the analysis of viewers’ activity in the internet space, including browsing patterns and keywords used in search, contributes to the creation of consumer profiles. Hence data from social networks particularly face book and twitter is real time data that can reveal information on consumer actions and reactions. Thus, data aggregation and analysis performed by data brokers provide useful information and data sets for marketing, risk assessment, and strategic planning in various industries..

Data Broker Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is foreseen to become the most influential market of Data Broker throughout the timeframe for the projection period due to various factors. In general, industries are adopting digitalization at a very fast rate, mainly in the emerging countries such as China, India, and the Southeast Asian countries, which in turn are creating the demand for data brokerage services. These countries exhibit high internet usage, smartphone users, as well as a rapidly growing e-commerce market which generate huge data volumes that business wants to capitalize on for properly targeted marketing information, and business process improvements.

- Moreover, latest laws and regulations concerning data privacy and its protection play an important role in data handler’s strategies, including strategies of data brokers, which concern data collection, storage, and sharing. Moreover, the growing application of artificial intelligence technologies, machine learning algorithms, and big data analytics enhances the data brokers’ abilities to gain useful insights from the raw data, which in turn increases the demand for data brokers from retail, healthcare, BFSI, and telecom segments. Thus, the Asia Pacific region boosts its importance as the crucial forward-looking market for data brokerage with more enterprises and companies adopting the data-driven strategies.

Active Key Players in the Data Broker Market

- Acxiom Corporation (USA)

- Experian plc (UK)

- Equifax Inc. (USA)

- TransUnion LLC (USA)

- CoreLogic Inc. (USA)

- Dun & Bradstreet Corporation (USA)

- Nielsen Holdings plc (USA)

- Infogroup (USA)

- Thomson Reuters Corporation (Canada)

- R.R. Donnelley & Sons Company (USA)

- Other Active Players

Key Industry Developments in the Data Broker Market

- In February 2023, CoreLogic, a leading global provider of analytics, data-enabled solutions, and property information, purchased Roostify, a top provider of digital mortgage technology. Its customers will now get information on borrowers and properties in good time after they take out loans using Roostify's digital mortgage technology platform, which combines CoreLogic’s vast data, analytics, and workflow solutions, hence saving them time and cutting their expenses.

- In March 2023, the well-known customer intelligence firm Acxiom announced a collaboration with Amazon Ads. Through this partnership, advertisers can more easily connect with their target audience by using Amazon DSP.

|

Global Data Broker Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 296.24 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.50% |

Market Size in 2032: |

USD 454.64 Bn. |

|

Segments Covered: |

By DataType |

|

|

|

By Data Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Broker Market by DataType (2018-2032)

4.1 Data Broker Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Consumer Data

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Business Data

Chapter 5: Data Broker Market by Data Source (2018-2032)

5.1 Data Broker Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Public Data

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Self-reported Data

5.5 Proprietary Data

5.6 Transactional Data

5.7 Web Data

5.8 Social Media Data

Chapter 6: Data Broker Market by Application (2018-2032)

6.1 Data Broker Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Marketing and Advertising

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Fraud Detection and Prevention

6.5 Risk Management

6.6 Customer Experience Management

6.7 Compliance Management

6.8 Personalization and Targeting

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Data Broker Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACXIOM CORPORATION (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 EXPERIAN PLC (UK)

7.4 EQUIFAX INC. (USA)

7.5 TRANSUNION LLC (USA)

7.6 CORELOGIC INC. (USA)

7.7 DUN & BRADSTREET CORPORATION (USA)

7.8 NIELSEN HOLDINGS PLC (USA)

7.9 INFOGROUP (USA)

7.10 THOMSON REUTERS CORPORATION (CANADA)

7.11 R.R. DONNELLEY & SONS COMPANY (USA)

7.12 OTHER KEY PLAYERS

Chapter 8: Global Data Broker Market By Region

8.1 Overview

8.2. North America Data Broker Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by DataType

8.2.4.1 Consumer Data

8.2.4.2 Business Data

8.2.5 Historic and Forecasted Market Size by Data Source

8.2.5.1 Public Data

8.2.5.2 Self-reported Data

8.2.5.3 Proprietary Data

8.2.5.4 Transactional Data

8.2.5.5 Web Data

8.2.5.6 Social Media Data

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Marketing and Advertising

8.2.6.2 Fraud Detection and Prevention

8.2.6.3 Risk Management

8.2.6.4 Customer Experience Management

8.2.6.5 Compliance Management

8.2.6.6 Personalization and Targeting

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Data Broker Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by DataType

8.3.4.1 Consumer Data

8.3.4.2 Business Data

8.3.5 Historic and Forecasted Market Size by Data Source

8.3.5.1 Public Data

8.3.5.2 Self-reported Data

8.3.5.3 Proprietary Data

8.3.5.4 Transactional Data

8.3.5.5 Web Data

8.3.5.6 Social Media Data

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Marketing and Advertising

8.3.6.2 Fraud Detection and Prevention

8.3.6.3 Risk Management

8.3.6.4 Customer Experience Management

8.3.6.5 Compliance Management

8.3.6.6 Personalization and Targeting

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Data Broker Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by DataType

8.4.4.1 Consumer Data

8.4.4.2 Business Data

8.4.5 Historic and Forecasted Market Size by Data Source

8.4.5.1 Public Data

8.4.5.2 Self-reported Data

8.4.5.3 Proprietary Data

8.4.5.4 Transactional Data

8.4.5.5 Web Data

8.4.5.6 Social Media Data

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Marketing and Advertising

8.4.6.2 Fraud Detection and Prevention

8.4.6.3 Risk Management

8.4.6.4 Customer Experience Management

8.4.6.5 Compliance Management

8.4.6.6 Personalization and Targeting

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Data Broker Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by DataType

8.5.4.1 Consumer Data

8.5.4.2 Business Data

8.5.5 Historic and Forecasted Market Size by Data Source

8.5.5.1 Public Data

8.5.5.2 Self-reported Data

8.5.5.3 Proprietary Data

8.5.5.4 Transactional Data

8.5.5.5 Web Data

8.5.5.6 Social Media Data

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Marketing and Advertising

8.5.6.2 Fraud Detection and Prevention

8.5.6.3 Risk Management

8.5.6.4 Customer Experience Management

8.5.6.5 Compliance Management

8.5.6.6 Personalization and Targeting

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Data Broker Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by DataType

8.6.4.1 Consumer Data

8.6.4.2 Business Data

8.6.5 Historic and Forecasted Market Size by Data Source

8.6.5.1 Public Data

8.6.5.2 Self-reported Data

8.6.5.3 Proprietary Data

8.6.5.4 Transactional Data

8.6.5.5 Web Data

8.6.5.6 Social Media Data

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Marketing and Advertising

8.6.6.2 Fraud Detection and Prevention

8.6.6.3 Risk Management

8.6.6.4 Customer Experience Management

8.6.6.5 Compliance Management

8.6.6.6 Personalization and Targeting

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Data Broker Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by DataType

8.7.4.1 Consumer Data

8.7.4.2 Business Data

8.7.5 Historic and Forecasted Market Size by Data Source

8.7.5.1 Public Data

8.7.5.2 Self-reported Data

8.7.5.3 Proprietary Data

8.7.5.4 Transactional Data

8.7.5.5 Web Data

8.7.5.6 Social Media Data

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Marketing and Advertising

8.7.6.2 Fraud Detection and Prevention

8.7.6.3 Risk Management

8.7.6.4 Customer Experience Management

8.7.6.5 Compliance Management

8.7.6.6 Personalization and Targeting

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Data Broker Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 296.24 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.50% |

Market Size in 2032: |

USD 454.64 Bn. |

|

Segments Covered: |

By DataType |

|

|

|

By Data Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||