Crude Oil Market Synopsis

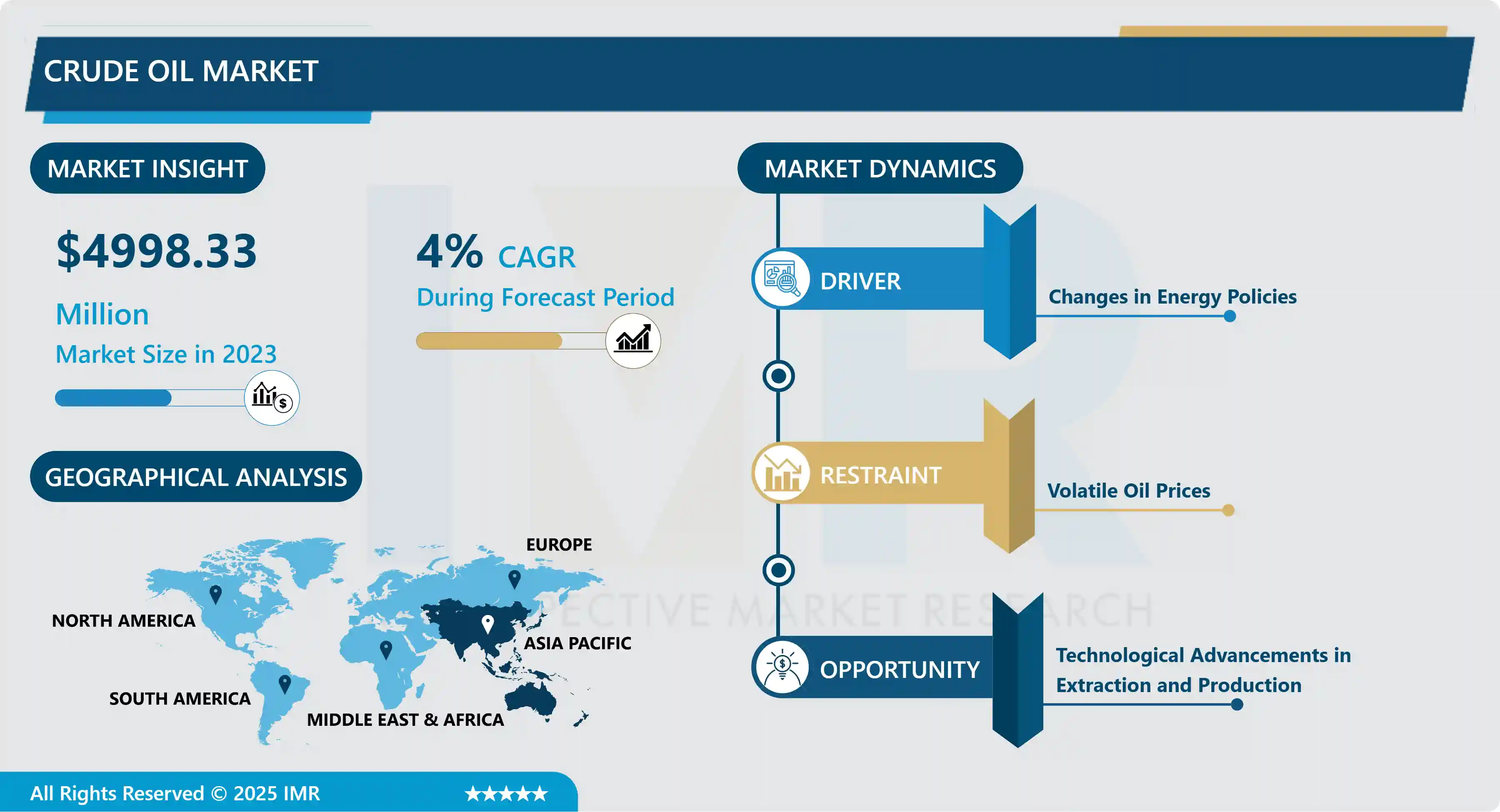

Crude Oil Market Size Was Valued at USD 4,998.33 Million in 2023 and is Projected to Reach USD 6,949.68 Million by 2032, Growing at a CAGR of 4% From 2024-2032.

Petroleum is a flammable, bitter, amber liquid that occurs naturally and has not been processed except for shifting it in the ground. It is a liquid that contains aggregate of hydrocarbons with other organic compounds in relatively small concentrations. Crude oil is herein obtained via drilling and mainly applied in the production of fuels like gasoline and diesel as well as a number of petrochemicals. The quality of this material and its characteristics in some cases may significantly differ based on their origin.

Crude oil market is quite an important market in the global economy since it plays an important role of being an energy source in many sectors such as transportation, industry, and electricity. They include, but are not limited to the following elements; Political climate, sociological aspects, technological innovations and globalization, demand stimuli and environmental factors affecting commerce. Political instability and wars in producing countries for instance the Middle East affects supplies and gives high volatility in prices. For instance, on-going fights or political turmoil in nations such as Saudi Arabia, Iraq or Iran tends to affect global supply of oil and, thus, oil prices. Furthermore, decisions made by producers which are the oil exporting nations and organizations like the OPEC and other non-OPEC producers like Russia influence the conditions of the markets. These are the companies that synch production rates to control global oil stock and the rates of pricing.

Based on the demand side factors, the global economy and industrialization are vital to the amount of oil demanded. Generally, economic activities provide boost for the increase in demand for energy such as crude oil while on the other end of the scale we have a contraction in growth areas bringing about a decrease in consumption. Socio Political Technology factors include developments in electric cars, renewable energy sources that have a gradual effect on oil demand in the long run. Additionally, regulatory factors and policies repeat the same effects stipulating environmental policies referring to the limitation of emission of greenhouse gas. The government of various nations and internationally active organizations are setting policies to reduce carbon emission that could impact the growth path of the oil industry. Similarly, the price of crude oil varies because of speculation in the market and mainly because of expensive sentimentality. Price fluctuation for commodities can be resulted from trader’s beliefs and expectations of supply and demand in the future; this is also caused by unpredictable occurrences like natural disasters or technological advancement affecting the extraction and processes of oil. In total, it is possible to note that the market of crude oil is more sensitive, unstable, and reactive in relation to various factors. Old and new economy players from governments to consumers benefit from grasping this layer of market interaction complexity. Therefore, the crude oil market will also remain influenced by the traditional and new factors in the future due to effect of technology and changes in the energy policies globally.

Crude Oil Market Trend Analysis

Shift Toward Renewable Energy Sources

- Renewable energies are a contemporary process which is affecting the demand for crude oil as well as the investment on it in a great manner. In the current world, many governments and industries are focusing on lesser emission of carbon and combating climate change thus; there is more focus on clean energy sources like solar, wind, and hydroelectric power sources. Renewable Technology, cost reduction and favourable policies are the key factors that are reducing the compact between the consumer and the use of fossils.

- Therefore, global demand forecasts for crude oil has reduced and the price movement has slowed due to inexpensive renewable energy sources. Also, crude oil and natural gas investment in the exploration and production are coming down due to capital migration to renewable energy projects affecting the oil market volatility and future potential growth. Therefore, crude oil industry has undergone a change that future development of the sector might will be characterized by slower economic growth and the need to search for other ways of making the sector relevant in the constantly changing energy market.

Technological Advancements in Extraction and Production

- In as much as the extraction and production of crude oil may have been impacted negatively by technology the same has brought a number of improvements that improves the efficiency of the process and at the same time bringing in less effects on the environment. Technological advancements like the horizontal drilling and the hydraulic fracturing or fracking opened up production from shale formations and ultra-deep offshore fields considerably augmenting production potential. Refinements in such areas as seismic imaging and reservoir simulation has enhanced accuracy in the positioning and appraisal of oil resources, the modelling of the extraction procedures. Techniques such as steam injection and chemical flooding, amongst others have helped to increase recovery rates of old oil fields hence increasing their operational days.

- Also, digital technologies like real-time monitoring, data analytics, along with artificial intelligence are enhancing performance, predicting maintenance requirements and improving production line processes. Besides, promotion of the carbon capture and storage (CCS) technologies are said to be instrumental in lowering emissions of green house gases from oil production. Altogether, these technological advancements are contributing to increased efficiency, utilization of resources and concerns about the environment and the surroundings hence making the crude oil industry to be productive and sustainable.

Crude Oil Market Segment Analysis:

Crude Oil Market Segmented based on Type of Crude, Production Technology , and End Use Sector.

By Type of Crude, Brent Crude segment is expected to dominate the market during the forecast period

- The major crude oil market is primarily evaluated with reference to a number of market indicators that refer to different forms of crude with various characteristics that exercise influence on the global oil prices and flow. The Brent Crude, which originates from the North Sea, is one of the most reference benchmarks for the crude oil prices globally that defines the price of the oil sourced from Europe, African and the Middle East. West Texas Intermediate (WTI) mainly originates from the United States and is used as primary measure of many North American crude oils, due to it being light and sweet, and ideal to produce gasoline and other petroleum products.

- Dubai Crude is the Mediterranean oil that is benchmark for the oil on Middle East that dominate the Asian market and used to price the oil imported to Asia. The OPEC Basket is a set of crude oils drawn from the member countries of the Organization of the Petroleum Exporting Countries and it is an indication of the general relative prices of the OPEC’s crude oil production. All of these markers present different angles to crude oil pricing because of the differing geographical source, quality attributes and market requirements for the crude oil, and thus impact the local and international crude oil flows and price determinations.

By Production Technology, Crude Oil segment held the largest share in 2023

- Depending on the production technology the crude oil market mainly covers conventional and unconventional crude oil. Conventional crude oil means those resources that can be pumped out using conventional means of extracting through drilling the resource is found in permeable rock layers through which the fluid gravitationally migrates to the surface or with slight pressure. This method remains the most used extraction method because of the low cost as well as the existing well-established infrastructure. On the other hand, the unconventional crude oil is a type of oil that lies in resource that cannot be produced through the conventional RFT techniques because it is located in less permeable, or less accessible formations.

- Contained here are oil sands that require either surface mining or in-situ techniques like steam assisted gravity drainage (SAGD) and tight oil, shale oil from hydraulic fracturing or fracking. The play includes production technologies that, though causing greater operational expense and environmental effects because of the way they are managed, are turning into progressively vital resources because of new technologies for extraction and a growing requirement for them. The increasing focus on energy security coupled with the increasing attention to the lack of sources of energy other than crude oil have influenced the global oil markets as well as the strategies of obtaining energy in many states.

Crude Oil Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The crude oil market is also expected to be controlled by the Asia Pacific region throughout the foreseen range of time on account of several factors. This dominance is especially due to a high economic growth rate, industrialization and growing energy demands from the growing economies such as China and India. Regarding these countries, their infrastructure and industrial base is rapidly developing and in future, the requirement of crude oil as a basic energy input is foreseen to rise.

- Also, the capacities for refining and processing facilities in the region have been developed side by side with strong attempts in the improvement of oil exploration and production technologies, all of which add strength to the region as a player in the global market. These include increasing automobile industry, urbanization, and improved standards of living of the Asia Pacific countries which in turn continues to fuel the demand for crude oil. As a result, this is expected to put the Asia Pacific in a proper position to challenge other regions and be a forerunner in meeting the crude oil demands over the forecast period as the economic and industrial front expands its growth path steadily.

Active Key Players in the Crude Oil Market

- ExxonMobil (USA)

- Chevron (USA)

- BP (UK)

- Royal Dutch Shell (Netherlands/UK)

- TotalEnergies (France)

- ConocoPhillips (USA)

- Eni (Italy)

- Occidental Petroleum (USA)

- Marathon Oil (USA)

- Equinor (Norway) and Other Active Player

|

Crude Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4,998.33 Mn. |

|

Forecast Period 2024-32 CAGR: |

4% |

Market Size in 2032: |

USD 6,949.68 Bn. |

|

Segments Covered: |

By Type of Crude |

|

|

|

By Production Technology |

|

||

|

By End Use Sector |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Crude Oil Market by Type of Crude (2018-2032)

4.1 Crude Oil Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Brent Crude

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 West Texas Intermediate (WTI)

4.5 Dubai Crude

4.6 OPEC Basket

Chapter 5: Crude Oil Market by Production Technology (2018-2032)

5.1 Crude Oil Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Crude Oil

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Unconventional Crude Oil

Chapter 6: Crude Oil Market by End Use Sector (2018-2032)

6.1 Crude Oil Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Transportation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial

6.5 Residential

6.6 Electric Power Generation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Crude Oil Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 EXXONMOBIL (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CHEVRON (USA)

7.4 BP (UK)

7.5 ROYAL DUTCH SHELL (NETHERLANDS/UK)

7.6 TOTALENERGIES (FRANCE)

7.7 CONOCOPHILLIPS (USA)

7.8 ENI (ITALY)

7.9 OCCIDENTAL PETROLEUM (USA)

7.10 MARATHON OIL (USA)

7.11 EQUINOR (NORWAY) OTHER ACTIVE PLAYER

7.12

Chapter 8: Global Crude Oil Market By Region

8.1 Overview

8.2. North America Crude Oil Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type of Crude

8.2.4.1 Brent Crude

8.2.4.2 West Texas Intermediate (WTI)

8.2.4.3 Dubai Crude

8.2.4.4 OPEC Basket

8.2.5 Historic and Forecasted Market Size by Production Technology

8.2.5.1 Crude Oil

8.2.5.2 Unconventional Crude Oil

8.2.6 Historic and Forecasted Market Size by End Use Sector

8.2.6.1 Transportation

8.2.6.2 Industrial

8.2.6.3 Residential

8.2.6.4 Electric Power Generation

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Crude Oil Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type of Crude

8.3.4.1 Brent Crude

8.3.4.2 West Texas Intermediate (WTI)

8.3.4.3 Dubai Crude

8.3.4.4 OPEC Basket

8.3.5 Historic and Forecasted Market Size by Production Technology

8.3.5.1 Crude Oil

8.3.5.2 Unconventional Crude Oil

8.3.6 Historic and Forecasted Market Size by End Use Sector

8.3.6.1 Transportation

8.3.6.2 Industrial

8.3.6.3 Residential

8.3.6.4 Electric Power Generation

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Crude Oil Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type of Crude

8.4.4.1 Brent Crude

8.4.4.2 West Texas Intermediate (WTI)

8.4.4.3 Dubai Crude

8.4.4.4 OPEC Basket

8.4.5 Historic and Forecasted Market Size by Production Technology

8.4.5.1 Crude Oil

8.4.5.2 Unconventional Crude Oil

8.4.6 Historic and Forecasted Market Size by End Use Sector

8.4.6.1 Transportation

8.4.6.2 Industrial

8.4.6.3 Residential

8.4.6.4 Electric Power Generation

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Crude Oil Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type of Crude

8.5.4.1 Brent Crude

8.5.4.2 West Texas Intermediate (WTI)

8.5.4.3 Dubai Crude

8.5.4.4 OPEC Basket

8.5.5 Historic and Forecasted Market Size by Production Technology

8.5.5.1 Crude Oil

8.5.5.2 Unconventional Crude Oil

8.5.6 Historic and Forecasted Market Size by End Use Sector

8.5.6.1 Transportation

8.5.6.2 Industrial

8.5.6.3 Residential

8.5.6.4 Electric Power Generation

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Crude Oil Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type of Crude

8.6.4.1 Brent Crude

8.6.4.2 West Texas Intermediate (WTI)

8.6.4.3 Dubai Crude

8.6.4.4 OPEC Basket

8.6.5 Historic and Forecasted Market Size by Production Technology

8.6.5.1 Crude Oil

8.6.5.2 Unconventional Crude Oil

8.6.6 Historic and Forecasted Market Size by End Use Sector

8.6.6.1 Transportation

8.6.6.2 Industrial

8.6.6.3 Residential

8.6.6.4 Electric Power Generation

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Crude Oil Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type of Crude

8.7.4.1 Brent Crude

8.7.4.2 West Texas Intermediate (WTI)

8.7.4.3 Dubai Crude

8.7.4.4 OPEC Basket

8.7.5 Historic and Forecasted Market Size by Production Technology

8.7.5.1 Crude Oil

8.7.5.2 Unconventional Crude Oil

8.7.6 Historic and Forecasted Market Size by End Use Sector

8.7.6.1 Transportation

8.7.6.2 Industrial

8.7.6.3 Residential

8.7.6.4 Electric Power Generation

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Crude Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4,998.33 Mn. |

|

Forecast Period 2024-32 CAGR: |

4% |

Market Size in 2032: |

USD 6,949.68 Bn. |

|

Segments Covered: |

By Type of Crude |

|

|

|

By Production Technology |

|

||

|

By End Use Sector |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||