Corrugated Box Making Machine Market Synopsis:

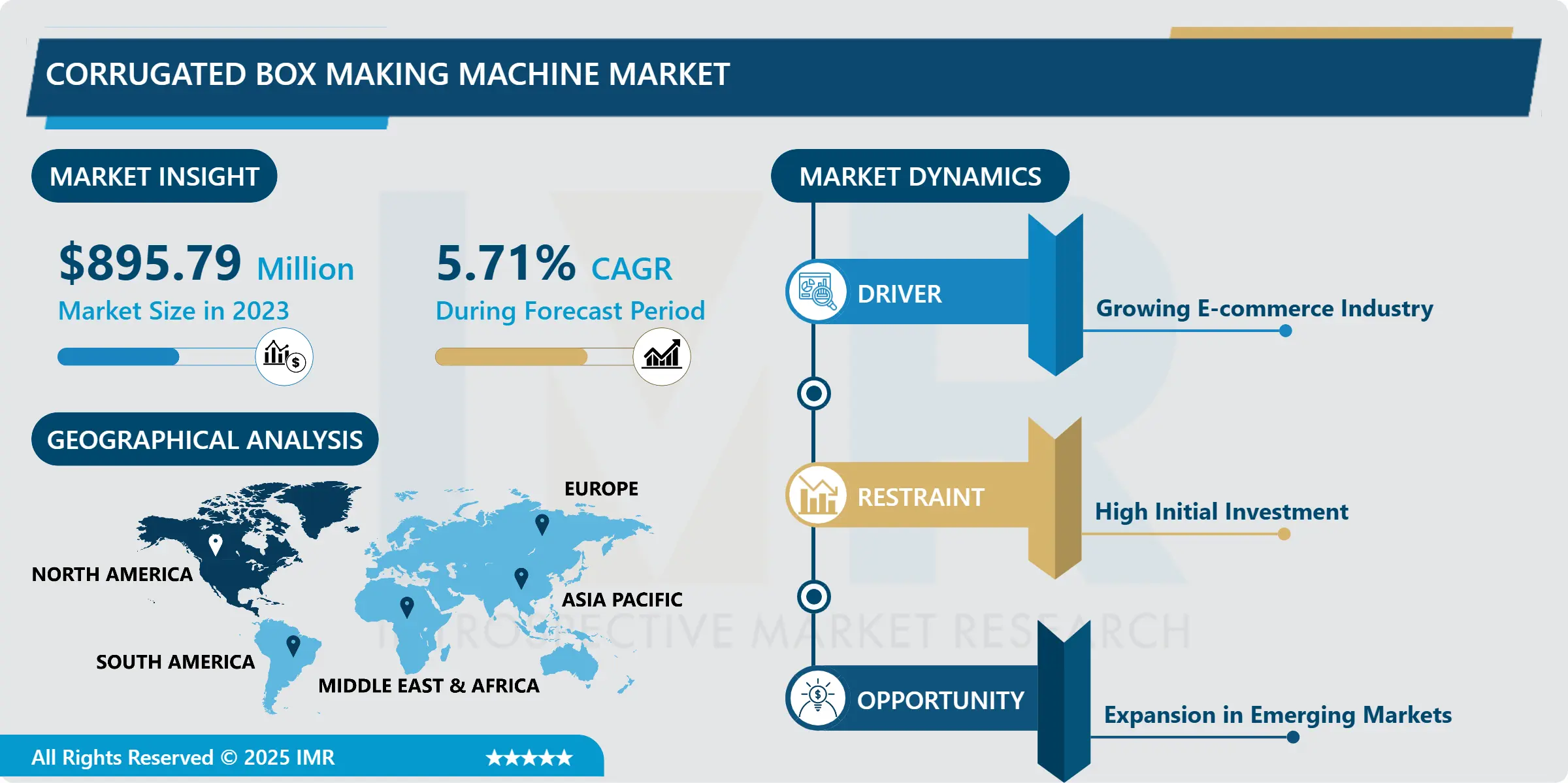

Corrugated Box Making Machine Market Size Was Valued at USD 895.79 Million in 2023, and is Projected to Reach USD 1476.56 Million by 2032, Growing at a CAGR of 5.71% From 2024-2032.

The corrugated box making machine market means the industry related to manufacturing of corrugated box making machines which are widely used in packaging, storage and transport sectors. These are special manufacturing machines which are used in converting the unprocessed materials like paper board and kraft papers into corrugated boards that are cuts, folded and make into different sizes and shapes of boxes. The market is stimulated by trends in the consumption of innovative, efficient, and, at the same time, effective packaging materials, especially in e-commerce, retail, and logistics sectors, the demand for which is necessary protective, durable, and recyclable packaging is steadily growing. So are the means through automation, energy efficient technologies, and digital systems in defining the market’s growth path.

The market for corrugated box making machine is rapidly developing mainly because of the growing consumption of eco-friendly and cost-effective packaging systems in different sectors. Thus, with the increased popularity of e-commerce, the preference of consumers to switch towards environment friendly and financially more viable packaging solution like corrugated boxes is rising high. These machines are built specifically to produce quality corrugated paper that it is widely demanded in shipping, storage and packaging in various industries like food and beverages, electronics, automotive and retail. Flutting, cutting and gluing form the manufacturing process of the corrugated box that comes to the characteristic feature of the custom-designed boxes need by the consumers.

Application of automation, digital printing and integration of artificial intelligence has aided the developments of the corrugated box making machines in terms of performance and effectiveness. Such developments make it possible for manufacturers to generate and deliver the boxes in large quantities at obscene wages, and with more efficacy. In addition, the implementation of Industry 4.0 technology investment increases the continuation of production lines to increase production volume with little to no interruption. Regionally, Asia-Pacific continues to dominate the market due to factors such as increased industrialization, manufacturing giants such as China and India’s exportation of made products. Still, the market has challenges such as volatility of raw material costs and the pressure for ongoing development to address the increasing demands for personalization and environmentally-friendly packaging. The corrugated box making machine market has many opportunities in the future such as continuous customer demand for the packaging and increase use of technology in this market.

Corrugated Box Making Machine Market Trend Analysis:

Growth Drivers in the Corrugated Box Making Machine Market

-

The proliferation of online shopping hastened the years long trend of looking for packaging materials that are stronger but lighter. With the growth in e-commerce operations, it is apparent that products need to have packaging that can shield them adequately from shock impacts during transport at a reasonable price. Corrugated boxes have gained acceptance because of their strength, flexibility and adaptability as well as by fashioning the form of the product. This change has resulted in high demand for the corrugated box making machines since companies seek to develop efficient methods in the production of high standard secure packing as enabled by the increasing e-commerce business challenges.

-

The growth of functional packaging and longer focus on sustainable use have ensured further sales for corrugated box making machines. These machines also help the creation of reusable and highly environmentally friendly packing materials that most industries strive to achieve. Since consumers and regulatory agencies have continued pressing companies to embrace sustainable packaging designs, corrugated boxes have grown in popularity as being more environmentally friendly. With sustainability as a current important aspect, putting emphasis on the packaging industry, the usage of the complex box-making machines, environmentally safe, will increase in the future of the packaging manufacturing line.

Advancements in the Corrugated Box Making Machine Market

-

E-commerce has been experiencing enormous growth, and this is a perfect chance for the corrugated box making machine market. With the advancement of e-commerce platforms, companies need a sustainable and affordable material to package their products. This demand is even more apparent in developing regions where the e-commerce demand is rapidly growing creating new market niches for manufacturers. These locations provide enormous unexplored market prospects for corrugated box producers to broaden their capacity while the world’s increasing flow of products demands it. Since several companies are in need of quality packaging materials, producers who are able to provide this need with unique, highly developed corrugated boxes will reap big from the growing e-commerce market.

-

The growth in customer consciousness and awareness regarding the environment gives the corrugated box making industry the chance to create new products. Given that consumer and business clients alike are paying more heed to dealing with the effects of environmental degradation, there is a trend towards the manufacture of products with environmentally friendly processes. Incorporation of recycled materials as well as implementing environmentally friendly manufacturing processes make multifunctional manufacturing attainable while improving the competiveness of the manufacturers. With this in mind, corrugated box makers can capitalize on the market’s move towards green solutions and be in the middle of an environmentally conscious industry. These considerations of sustainability appear set to fuel additional growth and segmentation in the competition.

Corrugated Box Making Machine Market Segment Analysis:

Corrugated Box Making Machine Market is Segmented on the basis of By Technology, Operating Speed, Machine Type, End-User, and Region.

By Technology, Automatic segment is expected to dominate the market during the forecast period

-

Automated machines are designed to undertake operations with less or no interaction from human personnel, with an enhanced automation system. These are specialized machines with the aim of maximizing production to give high efficiency. High capacity working is one of the strongest suits of automatic machines, especially when the industries require precision and speed simultaneously such as the operations in the pharmaceuticals, food and beverages industries. The reduction of these systems indeed decreases the chances or people making mistakes with the resultant improvement in the quality of the products produced as well as standards set in the industry.

-

Continuous operations without having to rely on direct supervision makes it easy to expand operations and meet the high production requirements of a business. Automated machines can be easily applied in areas where a number of similar operations need to be performed, and consistency is essential for production performance and therefore for profitability. Besides, they help eliminate the risk of operators having direct contact with dangerous processes, and they also help to rationalize many processes, so that the business can work on improving other areas of production. For these reasons automatic machines are regarded as suitable for large scale manufacturers who have a goal of achieving high productivity and reliability in their production processes.

By End-User, Food and Beverage segment expected to held the largest share

-

In the food and beverage sector, equipment is reliably used for packaging, labeling, and processing different food products such as snack foods, drinks, and any other convenience foods. The need for safe, good-quality and correctly labelled products has promoted development of the packaging technology. Tenders for machines in this sector need to confirm that products are packed in a way that retains their freshness as well as customers’ quality expectations. The packaging systems must also be sensitive to meet hygiene requirement of the foods and other food regulatory such as the requirement of meeting specific certifications so as to address the food hygiene and safe food production requirements.

-

Food and beverages are perhaps the most sensitive sector that the leading consumers demand packaging that will enable the provision of convenience and quality with ease while also addressing the efficiency of the packaging machinery in high demanding packaging. These are machines that are intended for industrial production but at the same time preserving the food’s quality. Furthermore, packaging equipment must be flexible to contain a diverse packaging type and material, ranging from bottles and canned to flexible packaging and cartons with substances that keep products fresh, protected, and presentable for the entire shelf-life period. It is important since it allows an equilibrium between speed, quality, and safety which are of paramount concern when it comes to competitiveness in this swine production that is characterized by high and increasing rate of regulation.

Corrugated Box Making Machine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America, one of the primary factors stimulating market development is the rapid growth of the internet market. The growth of e-business is one driver to the high demand for proper, effective, reliable and cheap packaging services. Increasingly, consumers are choosing home delivery and here companies are looking for packaging materials that are lightweight and reusable that will easily contain their goods as they undergo delivery without being damaged. Thus, the requirement for retarded and damaging packaging has influenced makers to purchase sophisticated leveled box-making apparatuses, enabling tailored and proficient fabrication. These machines are particularly appealing for the fact that they create recyclable and biodegradable packaging to feed the growing revolution for sustainable products and regulatory compliance.

-

Of the three regions, North America occupies the dominant position in the global market due to the high level of industrialization and the widespread use of automated packaging solutions in the United States. Corrugated boxes are popular and very much in demand in the country for many industries such as retail, electronics, and food industries. In the current world, operation costs and labor in particular have become a major concern to manufacturing companies in the U.S through outsourcing of productivity and efficiency via automation. Thus, expectations for the sustainability of the packaging continue to influence the choice in this area, while companies use materials and methods to reduce the negative impact on the environment. This means that as the companies fight to ensure they meet the consumer expectations on sustainability, the demand for the corrugated box-making machines rises thus promoting the market in the region.

Active Key Players in the Corrugated Box Making Machine Market

- Acme Machinery

- BCS Corrugated

- Box On Demand

- Dongguang Ruichang Carton Machinery

- EMBA Machinery

- Fosber Group

- MarquipWardUnited

- Mitsubishi Heavy Industries America

- Natraj Industries

- Serpa Packaging Solutions

- SUN Automation Group (Langston)

- T-Roc Equipment

- Valco Melton

- Zemat Technology Group

- Zhongke Packaging Machinery

- Other Active Players

Key Industry Developments in the Corrugated Box Making Machine Market:

-

In October 2023, Visy, an Australian packaging and resource recovery firm, opened a new corrugated cardboard box factory in Hemmant. The new A$175m (USD 111m) plant can make up to one million boxes daily and will provide Queensland farmers, growers, and food and drink firms with cardboard packaging. Visy executive chair Anthony Pratt has pledged to invest A$2 billion in packaging infrastructure in the country over the next decade, with A$700 million set aside for usage in Queensland. The plant is a component of this investment.

|

Global Corrugated Box Making Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD XX Billion |

|

Forecast Period 2024-32 CAGR: |

XX% |

Market Size in 2032: |

USD XX Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Operating Speed |

|

||

|

By Machine Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Corrugated Box Making Machine Market by Technology

4.1 Corrugated Box Making Machine Market Snapshot and Growth Engine

4.2 Corrugated Box Making Machine Market Overview

4.3 Automatic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Automatic: Geographic Segmentation Analysis

4.4 Semi-Automatic and Manual

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Semi-Automatic and Manual: Geographic Segmentation Analysis

Chapter 5: Corrugated Box Making Machine Market by Operating Speed

5.1 Corrugated Box Making Machine Market Snapshot and Growth Engine

5.2 Corrugated Box Making Machine Market Overview

5.3 Below 100 BPM

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Below 100 BPM: Geographic Segmentation Analysis

5.4 100 to 300 BPM and Above 300 BPM

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 100 to 300 BPM and Above 300 BPM: Geographic Segmentation Analysis

Chapter 6: Corrugated Box Making Machine Market by Machine Type

6.1 Corrugated Box Making Machine Market Snapshot and Growth Engine

6.2 Corrugated Box Making Machine Market Overview

6.3 Stand-alone

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Stand-alone: Geographic Segmentation Analysis

6.4 Integrated

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Integrated: Geographic Segmentation Analysis

Chapter 7: Corrugated Box Making Machine Market by End-User

7.1 Corrugated Box Making Machine Market Snapshot and Growth Engine

7.2 Corrugated Box Making Machine Market Overview

7.3 Food and Beverage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Food and Beverage: Geographic Segmentation Analysis

7.4 Pharmaceuticals

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Pharmaceuticals: Geographic Segmentation Analysis

7.5 Automotive

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Automotive: Geographic Segmentation Analysis

7.6 Cosmetic and Personal Care

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Cosmetic and Personal Care: Geographic Segmentation Analysis

7.7 Chemicals and Electrical and Electronics

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Chemicals and Electrical and Electronics: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Corrugated Box Making Machine Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 FOSBER GROUP

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ZEMAT TECHNOLOGY GROUP

8.4 ZHONGKE PACKAGING MACHINERY

8.5 BCS CORRUGATED

8.6 DONGGUANG RUICHANG CARTON MACHINERY

8.7 MITSUBISHI HEAVY INDUSTRIES AMERICA

8.8 NATRAJ INDUSTRIES

8.9 SERPA PACKAGING SOLUTIONS

8.10 T-ROC EQUIPMENT

8.11 VALCO MELTON

8.12 SUN AUTOMATION GROUP (LANGSTON)

8.13 ACME MACHINERY

8.14 BOX ON DEMAND

8.15 EMBA MACHINERY

8.16 MARQUIPWARDUNITED

8.17 OTHER ACTIVE PLAYERS

Chapter 9: Global Corrugated Box Making Machine Market By Region

9.1 Overview

9.2. North America Corrugated Box Making Machine Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Technology

9.2.4.1 Automatic

9.2.4.2 Semi-Automatic and Manual

9.2.5 Historic and Forecasted Market Size By Operating Speed

9.2.5.1 Below 100 BPM

9.2.5.2 100 to 300 BPM and Above 300 BPM

9.2.6 Historic and Forecasted Market Size By Machine Type

9.2.6.1 Stand-alone

9.2.6.2 Integrated

9.2.7 Historic and Forecasted Market Size By End-User

9.2.7.1 Food and Beverage

9.2.7.2 Pharmaceuticals

9.2.7.3 Automotive

9.2.7.4 Cosmetic and Personal Care

9.2.7.5 Chemicals and Electrical and Electronics

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Corrugated Box Making Machine Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Technology

9.3.4.1 Automatic

9.3.4.2 Semi-Automatic and Manual

9.3.5 Historic and Forecasted Market Size By Operating Speed

9.3.5.1 Below 100 BPM

9.3.5.2 100 to 300 BPM and Above 300 BPM

9.3.6 Historic and Forecasted Market Size By Machine Type

9.3.6.1 Stand-alone

9.3.6.2 Integrated

9.3.7 Historic and Forecasted Market Size By End-User

9.3.7.1 Food and Beverage

9.3.7.2 Pharmaceuticals

9.3.7.3 Automotive

9.3.7.4 Cosmetic and Personal Care

9.3.7.5 Chemicals and Electrical and Electronics

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Corrugated Box Making Machine Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Technology

9.4.4.1 Automatic

9.4.4.2 Semi-Automatic and Manual

9.4.5 Historic and Forecasted Market Size By Operating Speed

9.4.5.1 Below 100 BPM

9.4.5.2 100 to 300 BPM and Above 300 BPM

9.4.6 Historic and Forecasted Market Size By Machine Type

9.4.6.1 Stand-alone

9.4.6.2 Integrated

9.4.7 Historic and Forecasted Market Size By End-User

9.4.7.1 Food and Beverage

9.4.7.2 Pharmaceuticals

9.4.7.3 Automotive

9.4.7.4 Cosmetic and Personal Care

9.4.7.5 Chemicals and Electrical and Electronics

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Corrugated Box Making Machine Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Technology

9.5.4.1 Automatic

9.5.4.2 Semi-Automatic and Manual

9.5.5 Historic and Forecasted Market Size By Operating Speed

9.5.5.1 Below 100 BPM

9.5.5.2 100 to 300 BPM and Above 300 BPM

9.5.6 Historic and Forecasted Market Size By Machine Type

9.5.6.1 Stand-alone

9.5.6.2 Integrated

9.5.7 Historic and Forecasted Market Size By End-User

9.5.7.1 Food and Beverage

9.5.7.2 Pharmaceuticals

9.5.7.3 Automotive

9.5.7.4 Cosmetic and Personal Care

9.5.7.5 Chemicals and Electrical and Electronics

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Corrugated Box Making Machine Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Technology

9.6.4.1 Automatic

9.6.4.2 Semi-Automatic and Manual

9.6.5 Historic and Forecasted Market Size By Operating Speed

9.6.5.1 Below 100 BPM

9.6.5.2 100 to 300 BPM and Above 300 BPM

9.6.6 Historic and Forecasted Market Size By Machine Type

9.6.6.1 Stand-alone

9.6.6.2 Integrated

9.6.7 Historic and Forecasted Market Size By End-User

9.6.7.1 Food and Beverage

9.6.7.2 Pharmaceuticals

9.6.7.3 Automotive

9.6.7.4 Cosmetic and Personal Care

9.6.7.5 Chemicals and Electrical and Electronics

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Corrugated Box Making Machine Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Technology

9.7.4.1 Automatic

9.7.4.2 Semi-Automatic and Manual

9.7.5 Historic and Forecasted Market Size By Operating Speed

9.7.5.1 Below 100 BPM

9.7.5.2 100 to 300 BPM and Above 300 BPM

9.7.6 Historic and Forecasted Market Size By Machine Type

9.7.6.1 Stand-alone

9.7.6.2 Integrated

9.7.7 Historic and Forecasted Market Size By End-User

9.7.7.1 Food and Beverage

9.7.7.2 Pharmaceuticals

9.7.7.3 Automotive

9.7.7.4 Cosmetic and Personal Care

9.7.7.5 Chemicals and Electrical and Electronics

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Corrugated Box Making Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD XX Billion |

|

Forecast Period 2024-32 CAGR: |

XX% |

Market Size in 2032: |

USD XX Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Operating Speed |

|

||

|

By Machine Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||