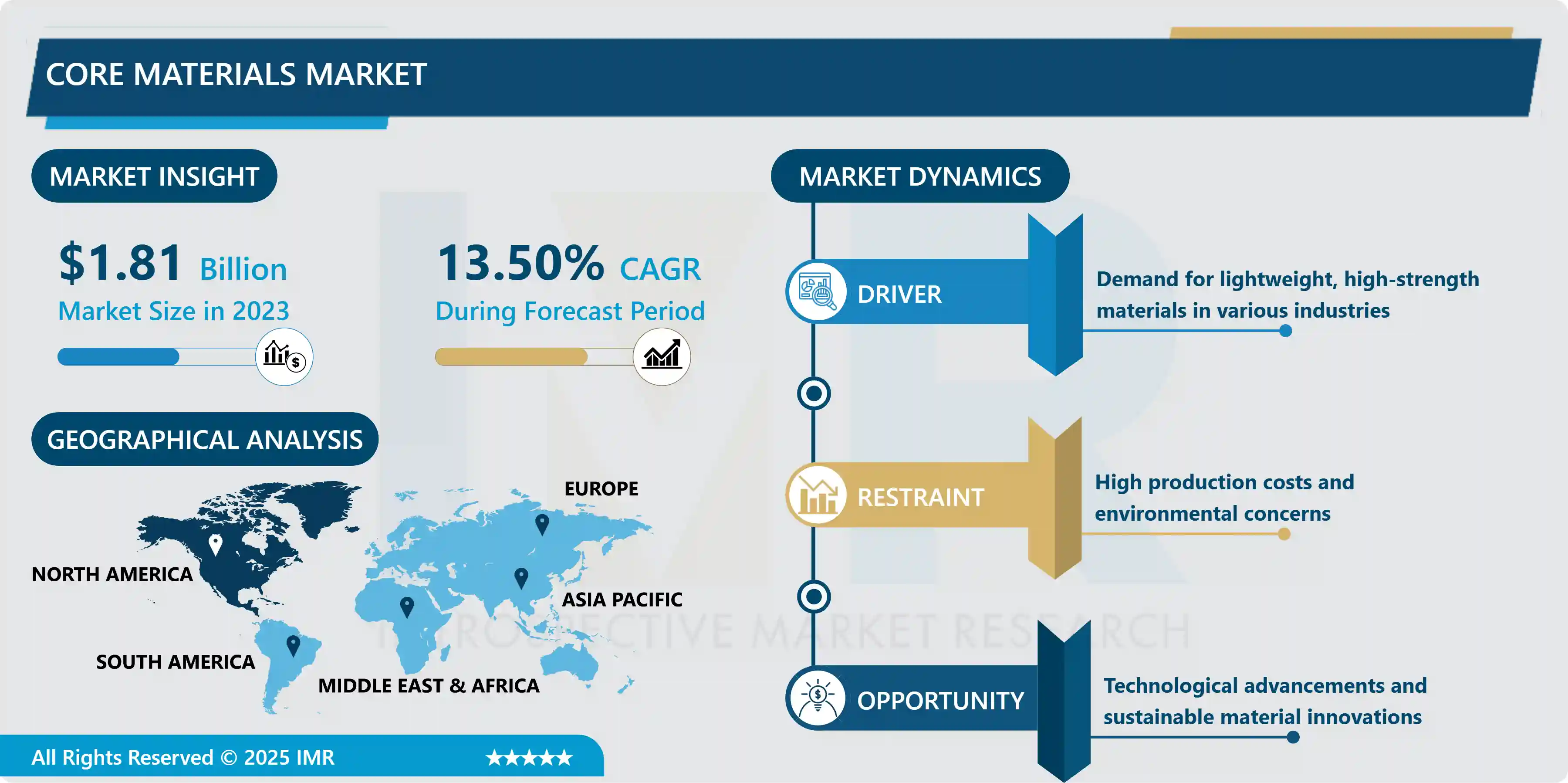

Core Materials Market Synopsis

Core Materials Market Size is Valued at USD 1.81 Billion in 2023, and is Projected to Reach USD 5.00 Billion by 2032, Growing at a CAGR of 13.50% From 2024-2032.

Core materials are fundamental substances used in the construction and manufacturing of various products and structures. These materials typically include metals, ceramics, polymers, and composites, each with unique properties that make them suitable for specific applications. Metals, such as steel and aluminum, are known for their strength and durability, making them essential in construction and manufacturing. Ceramics, including glass and porcelain, offer excellent thermal and electrical insulation properties.

Polymers, like plastics, are versatile and can be molded into various shapes while being lightweight and resistant to corrosion. Composites, which combine two or more materials, provide enhanced performance characteristics, such as increased strength-to-weight ratios and improved durability, making them invaluable in high-performance applications such as aerospace and automotive industries. Core materials are essential for the production of aircraft components in the aerospace industry, as they guarantee structural integrity while reducing weight. This improves performance and decreases fuel consumption. Likewise, in the wind energy sector, core materials are instrumental in the creation of turbine blades that are more efficient and lighter, which are necessary for the more effective capture of wind energy.

The marine industry enhances vessel performance and fuel efficiency by utilizing primary materials to construct lightweight, durable hulls and decks. Additionally, automotive manufacturers employ these materials to manufacture lighter vehicles, which results in improved fuel efficiency and reduced emissions. The core materials market is on the brink of substantial development due to the growing adoption of these materials across a variety of industries and the ongoing advancements in material science. The ever-changing demands for efficiency and sustainability will likely be met by further expansion, which will be driven by innovations that seek to enhance the properties of these materials.

Core Materials Market Trend Analysis

Sustainability and Eco-Friendly Material

- In the core materials market, there is a substantial trend toward the adoption of eco-friendly materials and sustainability. Stringent regulations and growing awareness of environmental issues, aimed at minimizing carbon footprints, have led to this change. In response to consumer and regulatory demands, companies are investing in research and development to develop materials that are both environmentally friendly and high-performing.

- Bio-based composites, recycled metals, and natural fibers are among the innovative core materials that are gaining popularity. Not only do these materials provide sustainability benefits, but they also satisfy the technical specifications of a variety of industries, such as aerospace, automotive, and construction. These materials are a preferred choice for eco-conscious manufacturers due to their ability to reduce waste, lower emissions, and conserve natural resources.

- The integration of circular economy principles into the main materials market is another significant trend. Businesses are prioritizing the creation of materials that are easily recyclable or repurposed at the end of their lifecycles. This method not only reduces the need for virgin material extraction but also minimizes pollution, thereby preserving natural ecosystems and reducing the environmental impact.

- Advancements in technology are also contributing to the shift toward sustainability in the core materials market. Advancements in material science, such as the development of biodegradable polymers and lightweight composites, are enabling the production of eco-friendly materials without compromising performance. As the market continues to evolve, we expect the increasing emphasis on sustainability and eco-friendly materials to shape the future of core materials.

Advanced Manufacturing Techniques

- The field of sophisticated manufacturing techniques has experienced substantial growth and transformation. Technologies like additive manufacturing, also known as 3D printing, and sophisticated robotics are driving this revolution. These methods allow for the integration of intelligent functionalities into products as well as the development of intricate geometries, resulting in improved performance and shorter production times.

- Material science advancements significantly influence the evolution of advanced manufacturing. Carbon fiber composites, advanced alloys, and nanomaterials are among the new core materials that are being developed to satisfy the rigorous demands of contemporary manufacturing processes. Manufacturers are able to produce more efficient and long-lasting products by utilizing these materials, which provide superior strength-to-weight ratios, enhanced durability, and tailored properties.

- The Internet of Things (IoT) and Artificial Intelligence (AI) are becoming more and more integrated into manufacturing processes. AI algorithms enhance quality control, anticipate maintenance requirements, and optimize production workflows. In the interim, IoT devices gather real-time data, which offers valuable insights into the operational efficacy and performance of machines. This integration leads to more responsive and intelligent manufacturing systems that can adjust to evolving demands and reduce disruptions.

- These enhanced manufacturing techniques are propelling the core materials market to significant expansion. These new materials are in high demand and are being invested in by industries such as aerospace, automotive, and healthcare. This market expansion is not only stimulating economic growth but also promoting innovation and competitiveness in the manufacturing sector.

Core Materials Market Segment Analysis:

Core Materials Market Segmented on the basis of By Type, and By End-user

By Type, Foam Core Materials segment is expected to dominate the market during the forecast period

- Foam core materials are frequently employed because of their cost-effectiveness, versatility, and simplicity of processing. They are the preferred choice for applications that necessitate buoyancy, thermal insulation, and sound absorption. In the transportation and construction sectors, foam core materials are in high demand due to their ability to enhance structural integrity and improve fuel efficiency.

- Honeycomb core materials are distinguished by their exceptional rigidity and superior strength-to-weight ratio. These materials are primarily employed in the aerospace and automotive industries, where durability and efficacy are essential. The honeycomb structure is optimal for high-stress environments due to its exceptional energy absorption and impact resistance.

- Balsa core materials are widely employed in marine and wind energy applications due to their inherent lightweight properties and sustainability. Balsa wood is the preferred option for environmentally conscious industries due to its exceptional mechanical performance and renewable nature. In the years ahead, the demand for balsa core materials is expected to increase due to the increasing emphasis on sustainable practices.

By End-user, Aerospace and Defense segment held the largest share in 2024

- The core materials market, which is segmented by end-users such as the aerospace and defense, wind energy, marine, and automotive industries, is experiencing substantial growth as a result of technological advancements and the growing demand for lightweight and durable materials. The adoption of advanced core materials, such as honeycomb and foam cores, which offer high strength-to-weight ratios, has been driven by the emphasis on fuel efficiency and enhanced performance in the aerospace and defense sector..

- The wind energy sector has experienced a significant increase in the utilization of core materials in turbine blades as a result of the drive for renewable energy sources. These materials, particularly balsa wood and foam, enhance the energy output and reduce maintenance costs by providing structural integrity and reducing weight, thereby contributing to the overall efficiency and longevity of wind turbines.

- Additionally, the marine industry is increasingly dependent on core materials to enhance the durability and performance of vessels. The utilization of lightweight composites in boat hulls, platforms, and other components is on the rise in order to improve buoyancy, decrease fuel consumption, and extend the lifespan of marine vessels. This trend is especially evident in the manufacturing of high-speed crafts and leisure vessels.

- The adoption of core materials in the automotive sector is being driven by the demand for fuel-efficient and electric vehicles, which are being used to reduce vehicle weight and enhance energy efficiency. Advanced composites and lightweight materials are increasingly being employed in the production of car bodies and components, which is consistent with the industry's objectives to improve vehicle performance and reduce emissions.

Core Materials Market Regional Insights:

North America has emerged as a dominating region in the global core materials market.

- North America has become a prominent region in the global core materials market as a result of a combination of technological advancements, robust industrial infrastructure, and substantial investments in research and development. The region's prominence is further enhanced by the presence of significant market players and a well-established manufacturing sector that is committed to innovation and the expansion of its capabilities.

- North America's dominance is significantly influenced by the aerospace and defense industries. The performance and efficacy of aircraft and defense systems are improved by the use of high-performance materials that provide superior strength-to-weight ratios. These sectors require these materials. Consequently, the market is experiencing significant growth due to the high demand for core materials, including balsa wood, honeycomb, and foam.

- Furthermore, the market's expansion is substantially influenced by the renewable energy sector, particularly wind energy. Advanced core materials are necessary for the construction of wind turbine blades in the United States, which is a global frontrunner in wind energy production. North America's strategic initiatives to reduce carbon footprints and adopt renewable technologies are consistent with the increasing demand for sustainable energy solutions.

- Additionally, the automotive sector in North America is progressively integrating lightweight core materials to enhance fuel efficiency and mitigate emissions. The demand for innovative core materials is expected to increase as a result of the transition to electric vehicles and the implementation of stringent environmental regulations. In general, North America's strategic investments and diverse industrial applications establish it as a dominant force in the global core materials market.

Active Key Players in the Core Materials Market

- Hexcel Corporation (US)

- Gurit Holding AG (Switzerland)

- Owens Corning (US)

- Diab Group (Sweden)

- Armacell International S.A. (Luxembourg)

- Solvay S.A. (Belgium)

- Evonik Industries AG (Germany)

- SGL Carbon SE (Germany)

- Toray Industries, Inc. (Japan)

- CoreLite, Inc. (US)

- Euro-Composites S.A. (Luxembourg)

- 3A Composites GmbH (Switzerland)

- Huntsman Corporation (US)

- Changzhou Tiansheng New Materials Co., Ltd. (China)

- Carbon-Core Corp. (US), Others

|

Core Materials Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.81 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.50 % |

Market Size in 2032: |

USD 5.00 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Core Materials Market by Type (2018-2032)

4.1 Core Materials Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Foam Core Materials

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Honeycomb Core Materials

4.5 Balsa Core Materials

Chapter 5: Core Materials Market by End-user (2018-2032)

5.1 Core Materials Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Aerospace and Defense

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Wind Energy

5.5 Marine

5.6 Automotive

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Core Materials Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 HEXCEL CORPORATION (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 GURIT HOLDING AG (SWITZERLAND)

6.4 OWENS CORNING (US)

6.5 DIAB GROUP (SWEDEN)

6.6 ARMACELL INTERNATIONAL S.A. (LUXEMBOURG)

6.7 SOLVAY S.A. (BELGIUM)

6.8 EVONIK INDUSTRIES AG (GERMANY)

6.9 SGL CARBON SE (GERMANY)

6.10 TORAY INDUSTRIES INC. (JAPAN)

6.11 CORELITE INC. (US)

6.12 EURO-COMPOSITES S.A. (LUXEMBOURG)

6.13 3A COMPOSITES GMBH (SWITZERLAND)

6.14 HUNTSMAN CORPORATION (US)

6.15 CHANGZHOU TIANSHENG NEW MATERIALS COLTD. (CHINA)

6.16 CARBON-CORE CORP. (US)

6.17 OTHERS

6.18

Chapter 7: Global Core Materials Market By Region

7.1 Overview

7.2. North America Core Materials Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Foam Core Materials

7.2.4.2 Honeycomb Core Materials

7.2.4.3 Balsa Core Materials

7.2.5 Historic and Forecasted Market Size by End-user

7.2.5.1 Aerospace and Defense

7.2.5.2 Wind Energy

7.2.5.3 Marine

7.2.5.4 Automotive

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Core Materials Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Foam Core Materials

7.3.4.2 Honeycomb Core Materials

7.3.4.3 Balsa Core Materials

7.3.5 Historic and Forecasted Market Size by End-user

7.3.5.1 Aerospace and Defense

7.3.5.2 Wind Energy

7.3.5.3 Marine

7.3.5.4 Automotive

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Core Materials Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Foam Core Materials

7.4.4.2 Honeycomb Core Materials

7.4.4.3 Balsa Core Materials

7.4.5 Historic and Forecasted Market Size by End-user

7.4.5.1 Aerospace and Defense

7.4.5.2 Wind Energy

7.4.5.3 Marine

7.4.5.4 Automotive

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Core Materials Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Foam Core Materials

7.5.4.2 Honeycomb Core Materials

7.5.4.3 Balsa Core Materials

7.5.5 Historic and Forecasted Market Size by End-user

7.5.5.1 Aerospace and Defense

7.5.5.2 Wind Energy

7.5.5.3 Marine

7.5.5.4 Automotive

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Core Materials Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Foam Core Materials

7.6.4.2 Honeycomb Core Materials

7.6.4.3 Balsa Core Materials

7.6.5 Historic and Forecasted Market Size by End-user

7.6.5.1 Aerospace and Defense

7.6.5.2 Wind Energy

7.6.5.3 Marine

7.6.5.4 Automotive

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Core Materials Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Foam Core Materials

7.7.4.2 Honeycomb Core Materials

7.7.4.3 Balsa Core Materials

7.7.5 Historic and Forecasted Market Size by End-user

7.7.5.1 Aerospace and Defense

7.7.5.2 Wind Energy

7.7.5.3 Marine

7.7.5.4 Automotive

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Core Materials Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.81 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.50 % |

Market Size in 2032: |

USD 5.00 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||