Contract Logistics Market Synopsis

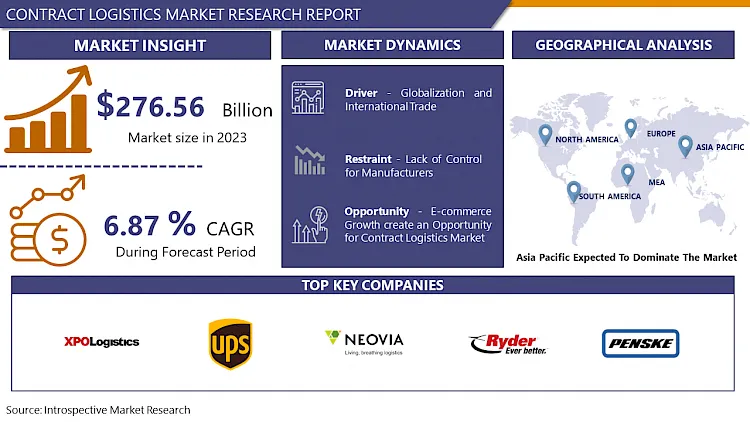

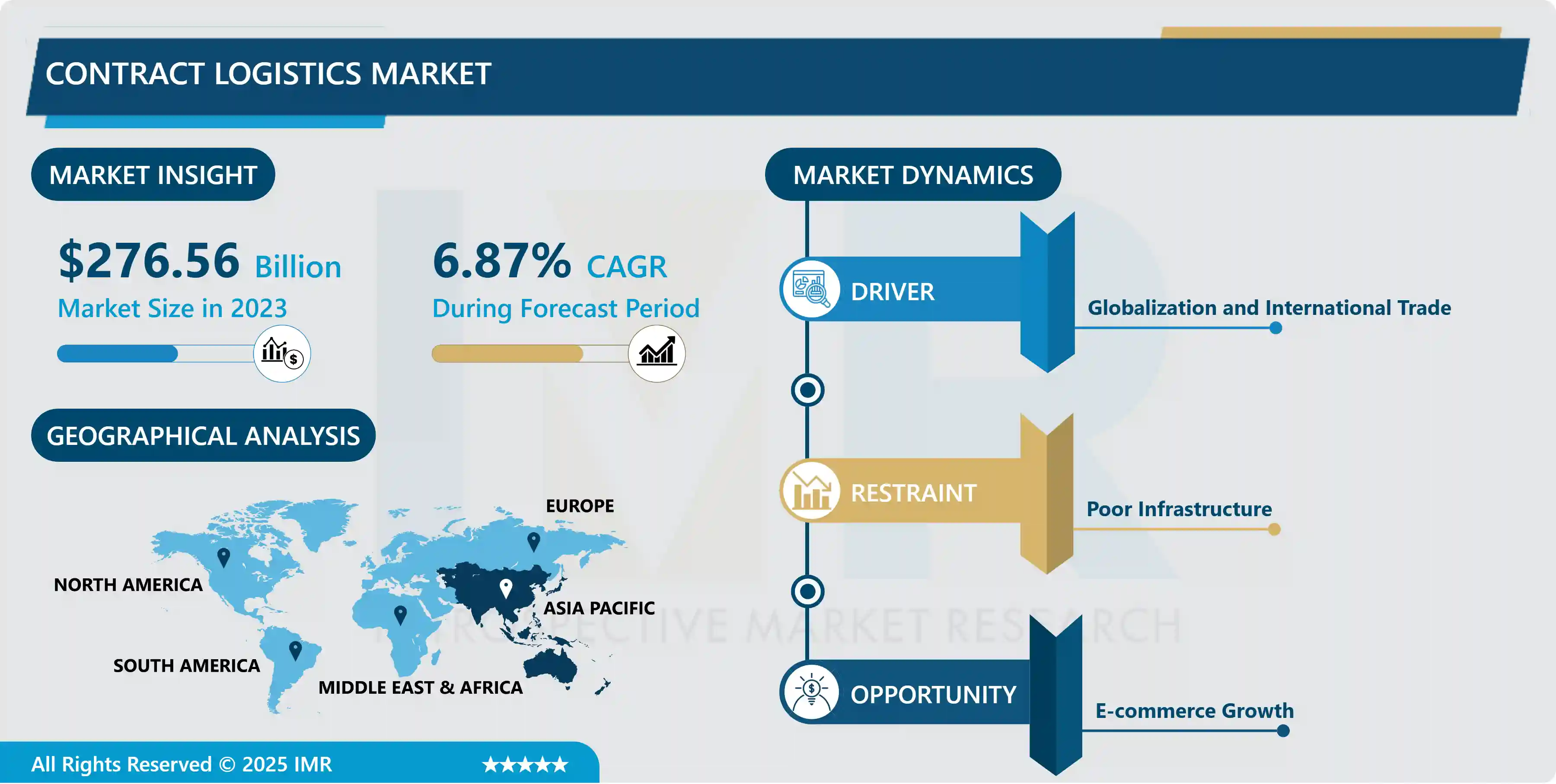

Contract Logistics Market Size Was Valued at USD 276.56 Billion in 2023, and is Projected to Reach USD 502.91 Billion by 2032, Growing at a CAGR of 6.87% From 2024-2032.

Contract logistics refers to the outsourcing of logistics and supply chain management activities to a third-party service provider. Companies often choose to engage in contract logistics to streamline their operations, reduce costs, and focus on their core competencies. In a contract logistics arrangement, the logistics provider takes responsibility for various functions such as transportation, warehousing, distribution, and order fulfilment.

This allows businesses to benefit from the expertise and efficiency of specialized logistics providers, ultimately improving overall supply chain performance and customer satisfaction. The contractual agreement typically outlines specific services, performance metrics, and agreed-upon terms between the client and the logistics service provider, ensuring a tailored and efficient logistics solution.

Technological advancements, such as the integration of automation, data analytics, and artificial intelligence, have further transformed the contract logistics landscape. These technologies help streamline operations, improve visibility across the supply chain, and enhance decision-making processes.

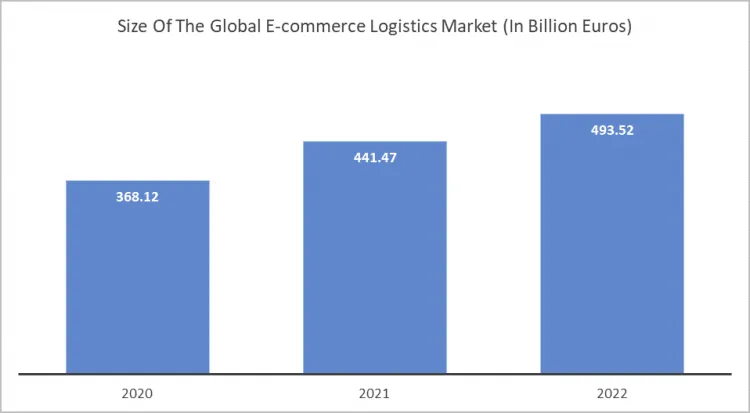

Additionally, sustainability and environmental concerns have become key drivers in the contract logistics market, prompting companies to adopt eco-friendly practices and solutions. As e-commerce continues to grow and customer expectations evolve, the contract logistics sector is poised for continued innovation and adaptation to meet the dynamic demands of the modern business environment.

Contract Logistics Market Trend Analysis

Globalization and International Trade

- Globalization and international trade serve as pivotal forces propelling the growth of the Contract Logistics market. In today's interconnected world, businesses increasingly engage in cross-border transactions, necessitating efficient and streamlined logistics solutions. The surge in global trade has led to a heightened demand for specialized services offered by contract logistics providers.

- These providers play a crucial role in managing and optimizing supply chains, ensuring the smooth flow of goods across borders. Globalization has opened new markets for businesses, prompting them to expand their operations internationally. As companies strive to reach diverse consumer bases, they rely on contract logistics to navigate complex regulatory environments, transportation challenges, and inventory management across different countries.

E-commerce Growth create an Opportunity for Contract Logistics Market

- E-commerce companies are seeking innovative solutions to streamline order fulfilment, inventory management, and last-mile delivery. Contract logistics providers can leverage technologies like artificial intelligence, robotics, and data analytics to enhance efficiency and accuracy in handling the increasing volume of online orders.

- Moreover, the global nature of e-commerce requires robust international logistics networks. Contract logistics companies can capitalize on the cross-border nature of online commerce by providing seamless and cost-effective international shipping and customs clearance services.

Contract Logistics Market Segment Analysis:

Contract Logistics Market Segmented based on Type, Service, and End User.

By Type, Outsourcing segment is expected to dominate the market during the forecast period

- Outsourcing, as a type of contract logistics, involves companies entrusting a third-party provider to manage and execute their logistics and supply chain functions. This segment's ascendancy can be attributed to several key factors.

- Businesses are increasingly recognizing the strategic advantages of outsourcing logistics operations. Specialized logistics providers bring expertise, efficiency, and scalability to the table, allowing client companies to focus on their core competencies while ensuring streamlined and cost-effective supply chain management.

- Outsourcing enables companies to leverage advanced technologies and best practices in logistics, enhancing overall operational efficiency. This is particularly crucial in an era where digitalization and automation play pivotal roles in optimizing supply chain processes.

By Service, Transportation segment held the largest share of 45.68% in 2022

- Transportation segment is at the core of the supply chain, serving as the linchpin that facilitates the movement of goods and products from manufacturers to end consumers. Efficient and reliable transportation services are paramount in meeting customer demands for timely deliveries and optimizing overall operational performance.

- The increasing globalization of supply chains has heightened the importance of transportation in connecting diverse geographical locations. As businesses expand their reach across borders, the demand for streamlined and integrated transportation solutions grows, placing the Transportation segment at the forefront of contract logistics services.

- Moreover, advancements in technology and the integration of innovative solutions, such as real-time tracking and route optimization, enhance the efficiency and reliability of transportation services. This, in turn, contributes to the overall effectiveness of contract logistics operations.

Contract Logistics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region boasts a burgeoning manufacturing sector, with several countries establishing themselves as manufacturing powerhouses. This industrial growth necessitates sophisticated and efficient logistics solutions, propelling the demand for contract logistics services.

- The rapid expansion of e-commerce and digital platforms in the region has led to an exponential increase in the movement of goods. Contract logistics providers play a pivotal role in managing and optimizing the supply chain for e-commerce companies, further fueling the demand for their services.

- Additionally, governments in the Asia Pacific are investing heavily in infrastructure development, facilitating smoother transportation and distribution networks. This infrastructure enhancement contributes to the overall efficiency of contract logistics operations, attracting businesses seeking reliable and seamless supply chain solutions.

Contract Logistics Market Top Key Players:

- XPO Logistics, Inc (US)

- United Parcel Service of America Inc. (US)

- Neovia Logistics Services, LLC. (US)

- Ryder System, Inc. (US)

- Penske (US)

- GEODIS (France)

- Ceva Logistics (France)

- DB Schenker (Germany)

- Hellmann Worldwide Logistics (Germany)

- DHL Supply Chain (Germany)

- Kuehne + Nagel (Switzerland)

- DSV (Denmark)

- CJ Logistics Corporation (South Korea)

Key Industry Developments in the Contract Logistics Market:

- In APRIL 2024, UPS announced the company had been awarded a significant air cargo contract by the United States Postal Service (USPS). This award was effective immediately and greatly expands the existing relationship between the two organizations. Following a transition period, UPS will become the USPS’s primary air cargo provider and move the majority of USPS air cargo in the US.

- In February 2024, DHL Supply Chain, America's leader in contract logistics, announced a $200 million investment dedicated to expanding its life sciences and healthcare capabilities. This strategic move includes construction of new, state-of-the-art warehouse facilities expanding their footprint to over 13 million square feet. The company will invest in cutting-edge warehouse technology to optimize operations and enhance resiliency, particularly in the face of unforeseen disruptions.

- In March 2023, Kuehne+Nagel opened its third Transport Operation Centre (TOC) for Asia Pacific in India. The center is located at the National Office in Gurugram and has been established to provide a centralized approach for pan-India distribution management. The TOC facilitates a comprehensive view of the supply chain network to streamline operations, increase efficiency and ultimately reduce costs through a tactical planning process.

- In September 2022, Yusen Logistics (Deutschland) GmbH expanded and opened a new branch. The world's leading service provider for integrated logistics has been moving step by step into the sustainable new-build complex in Altbach with around 10,000 square meters of warehouse and office space. The logistics center east of Stuttgart become the new contract logistics site of Yusen Logistics.

|

Contract Logistics Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 276.56 Billion |

|

|

CAGR (2024-2032): |

6.87% |

Market Size in 2032: |

USD 502.91 Billion |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Service |

|

|

||

|

By End User |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Contract Logistics Market by Type (2018-2032)

4.1 Contract Logistics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Insourcing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Outsourcing

Chapter 5: Contract Logistics Market by Service (2018-2032)

5.1 Contract Logistics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Transportation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Warehousing

5.5 Distribution

5.6 Aftermarket Logistics

Chapter 6: Contract Logistics Market by End User (2018-2032)

6.1 Contract Logistics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Manufacturing & Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Consumer Goods & Retail

6.5 Healthcare & Pharmaceuticals

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Contract Logistics Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PROCTER & GAMBLE (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KIMBERLY-CLARK CORPORATION (UNITED STATES)

7.4 THE CLOROX COMPANY (UNITED STATES)

7.5 JOHNSON & JOHNSON (UNITED STATES)

7.6 CHURCH & DWIGHT COINC. (UNITED STATES)

7.7 THE ESTÉE LAUDER COMPANIES INC. (UNITED STATES)

7.8 L'ORÉAL S.A. (FRANCE)

7.9 RECKITT BENCKISER GROUP PLC (UNITED KINGDOM)

7.10 HENKEL AG & CO. KGAA (GERMANY)

7.11 BEIERSDORF AG (GERMANY)

7.12 KAO CORPORATION (JAPAN)

7.13 SHISEIDO COMPANY

7.14 LIMITED (JAPAN)

7.15

Chapter 8: Global Contract Logistics Market By Region

8.1 Overview

8.2. North America Contract Logistics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Insourcing

8.2.4.2 Outsourcing

8.2.5 Historic and Forecasted Market Size by Service

8.2.5.1 Transportation

8.2.5.2 Warehousing

8.2.5.3 Distribution

8.2.5.4 Aftermarket Logistics

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Manufacturing & Automotive

8.2.6.2 Consumer Goods & Retail

8.2.6.3 Healthcare & Pharmaceuticals

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Contract Logistics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Insourcing

8.3.4.2 Outsourcing

8.3.5 Historic and Forecasted Market Size by Service

8.3.5.1 Transportation

8.3.5.2 Warehousing

8.3.5.3 Distribution

8.3.5.4 Aftermarket Logistics

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Manufacturing & Automotive

8.3.6.2 Consumer Goods & Retail

8.3.6.3 Healthcare & Pharmaceuticals

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Contract Logistics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Insourcing

8.4.4.2 Outsourcing

8.4.5 Historic and Forecasted Market Size by Service

8.4.5.1 Transportation

8.4.5.2 Warehousing

8.4.5.3 Distribution

8.4.5.4 Aftermarket Logistics

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Manufacturing & Automotive

8.4.6.2 Consumer Goods & Retail

8.4.6.3 Healthcare & Pharmaceuticals

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Contract Logistics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Insourcing

8.5.4.2 Outsourcing

8.5.5 Historic and Forecasted Market Size by Service

8.5.5.1 Transportation

8.5.5.2 Warehousing

8.5.5.3 Distribution

8.5.5.4 Aftermarket Logistics

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Manufacturing & Automotive

8.5.6.2 Consumer Goods & Retail

8.5.6.3 Healthcare & Pharmaceuticals

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Contract Logistics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Insourcing

8.6.4.2 Outsourcing

8.6.5 Historic and Forecasted Market Size by Service

8.6.5.1 Transportation

8.6.5.2 Warehousing

8.6.5.3 Distribution

8.6.5.4 Aftermarket Logistics

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Manufacturing & Automotive

8.6.6.2 Consumer Goods & Retail

8.6.6.3 Healthcare & Pharmaceuticals

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Contract Logistics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Insourcing

8.7.4.2 Outsourcing

8.7.5 Historic and Forecasted Market Size by Service

8.7.5.1 Transportation

8.7.5.2 Warehousing

8.7.5.3 Distribution

8.7.5.4 Aftermarket Logistics

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Manufacturing & Automotive

8.7.6.2 Consumer Goods & Retail

8.7.6.3 Healthcare & Pharmaceuticals

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Contract Logistics Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 276.56 Billion |

|

|

CAGR (2024-2032): |

6.87% |

Market Size in 2032: |

USD 502.91 Billion |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Service |

|

|

||

|

By End User |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||