Construction Camera Market Synopsis

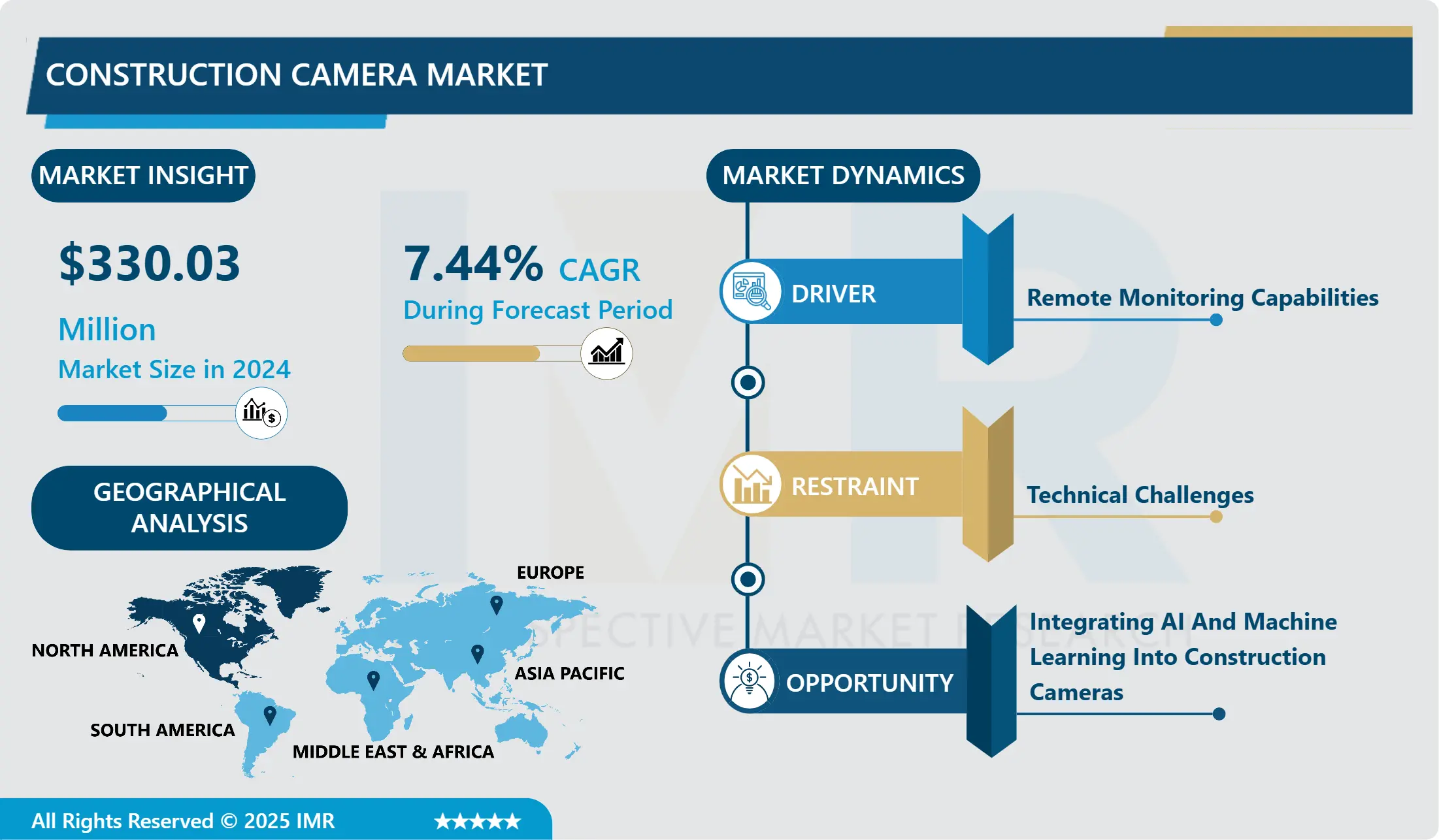

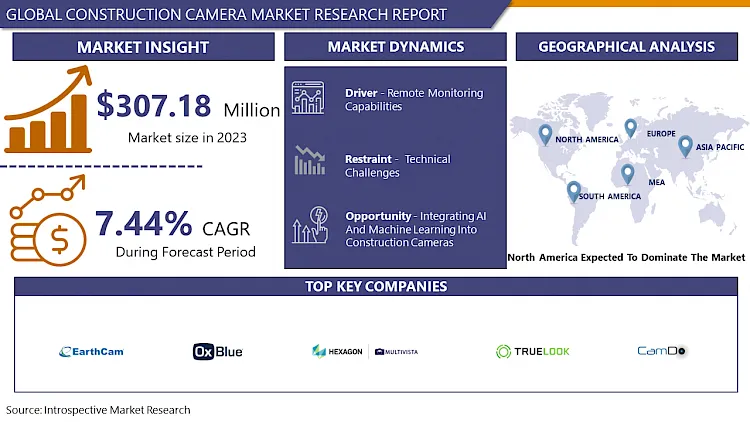

The global Construction Camera Market was valued at USD 330.03 million in 2024 and is likely to reach USD 585.98 million by 2032, increasing at a CAGR of 7.44% from 2025 to 2032.

A construction camera is the device you need to cover a construction site with a complete eye view. What we call the perfect eye is exactly the level of excellence that a construction camera can provide to balance the implementation and execution of the project with regular monitoring and surveillance of the site environment. These lenses capture the entire process at different scales, from the beginning of construction to the plot and beyond.

A construction camera is also known as a time-lapse camera. It's a hassle-free way to maintain any construction project. It provides a function how to set it once and no need to set it repeatedly. This camera records the video at the desired speed and plays it back at the speed the viewer wants to play back after the project is finished. From new construction to renovation, from the contractor to the subcontractor, the construction camera (the camera of the child of time) shows the entire history of the construction site. Managers or people involved in a project watch time-lapse videos simply to see the actions performed at that time and think about the same process or an alternative to it.

It can be either slow motion, time-lapse, hyper-motion or even normal frame rate. An on-site inspection is just as important as the completion of the project, as it can help minimize potential damage to the site. Construction cameras provide real-time construction site monitoring, image comparison, event marking, project timeline and other functions. The construction camera is the most used device in the construction industry and one of the main parts of construction technology today.

These construction cameras provide high-resolution real-time construction site monitoring while sitting on the job site. Not only this, but it also helps to define the project schedule so that we can check whether our plan is working according to our schedule or not. As a project manager, you always want to monitor the progress of your project and closely monitor the progress of the construction site. When done well, progress tracking helps complete projects on time.

As an advantage for the project manager, it thus helps to monitor progress on the construction site. With advanced monitoring, you can access the latest images of the construction site in real time, including equipment logs, battery health, signal strength, video quality and many other useful information. A project manager doesn't need to go to the construction site. It helps you save your time by recording the best timelapse of various required angles and parameters to get an overview of the overall progress of the project.

Construction Camera Market Trend Analysis

Construction Camera Market Growth Driver- Remote Monitoring Capabilities

- Remote monitoring capabilities have become a basic asset within the construction industry, altogether upgrading project management and oversight. Construction cameras prepared with inaccessible observing technology permit stakeholders, including project managers, architects, and investors, to see live bolsters and recorded film of the development location from any location with internet access. This capability eliminates the require for visit site visits, sparing time and diminishing travel costs. It too guarantees that stakeholders can make timely and educated choices based on real-time information, which can be significant for maintaining venture timelines and budgets.

- Remote monitoring makes a difference in rapidly identifying and tending to issues such as delays, security dangers, or deviations from the planned work, thereby minimizing disturbances. The capacity to monitor multiple sites at the same time further boosts operational efficiency, enabling way better resource allotment and extend coordination. In general, remote monitoring changes construction site administration by giving continuous visibility and control, driving to made strides effectiveness, security, and decision-making.

Construction Camera Market Expansion Opportunity- Integrating AI And Machine Learning Into Construction Cameras

- Integrating AI and machine learning into construction cameras altogether raises their functionality and impact on project management. AI-driven analytics can consequently track construction progress by comparing real-time images with venture diagrams and schedules, giving exact updates and recognizing any deviations. This automation reduces the require for manual reviews and detailing, freeing up profitable time for extend managers. Machine learning algorithms can moreover upgrade security monitoring by analyzing camera footage to detect potential risks, hazardous practices, or unauthorized personnel on site, issuing real-time cautions to avoid accidents.

- Predictive maintenance capabilities empowered by AI can analyze designs and historical information to figure equipment failures or support needs, permitting for proactive intercessions that minimize downtime and amplify the lifespan of apparatus. By leveraging AI and machine learning, development cameras change from passive recording devices into intelligent systems that upgrade productivity, security, and operational unwavering quality over construction projects.

Construction Camera Market Segment Analysis:

Market Segmented based on Product Type, Powered Covered, Resolution, Application, Distribution Channels and Region.

By Product Type, PTZ Is Expected to Dominate the Market During the Forecast Period 2024-2032

- PTZ (Pan-Tilt-Zoom) cameras dominate the construction camera market due to their exceptional flexibility and comprehensive scope capabilities. Their capacity to pan, tilt, and zoom allows a single PTZ camera to screen huge development sites from different points, altogether reducing the require for various settled cameras and in this way bringing down overall costs. The zoom function gives point by point surveillance, enabling venture managers and security staff to closely look at specific exercises or critical operations, ensuring quality control and adherence to security conventions. In addition, PTZ cameras can be remotely controlled, offering real-time adjustments to the camera’s see based on the dynamic needs of the construction site, which is priceless for keeping up efficient oversight in changing situations.

- In spite of higher initial costs, their wide scope and diminished need for different establishments make PTZ cameras a cost-effective arrangement within the long term, cutting down on establishment and support costs. Moreover, PTZ cameras are compatible with progressed technologies such as AI and machine learning, enhancing their capabilities for mechanized advance following, security checking, and prescient support. This integration makes them a profoundly effective and smart venture for modern construction projects.

By Application, Jobsite Progress Monitoring held the largest share

- Jobsite progress monitoring is the dominant application within the construction camera market due to its basic part in ensuring compelling venture management. This capability allows project directors to track construction exercises in real-time, ensuring projects stay on plan and inside budget by expeditiously distinguishing and tending to delays or issues. Standard visual observing too gives a comprehensive record of the development prepare, which is priceless for creating progress reports, overseeing stakeholder desires, and keeping up transparency with clients. This documentation can serve as vital prove in case of debate or claims.

- Visual monitoring enhances coordination and communication among different groups and subcontractors by advertising a clear visual context, making it easier to convey data and instructions precisely. It too helps in asset management by ensuring that materials, hardware, and labor are utilized proficiently, optimizing asset assignment, diminishing squander, and boosting efficiency. Also, continuous checking maintains quality control by allowing project managers to rapidly identify and amend deviations from plan specifications or construction guidelines, subsequently guaranteeing the project's quality and judgment.

Construction Camera Market Regional Insights:

North America Region is Expected to Dominate the Market Over the Forecast Period

- North America's dominance within the construction camera market can be attributed to a few interrelated components. The region, especially the United States, experiences substantial construction action across residential, commercial, and infrastructure divisions, driving reliable request for advanced monitoring and security solutions. This tall level of development movement requires the utilize of advanced camera systems to guarantee extend efficiency and safety. North America is additionally a center for innovative innovation, with numerous driving companies creating cutting-edge camera technologies such as AI and machine learning integration, high-resolution imaging, and cloud-based solutions. These progressions improve the functionality and effectiveness of construction cameras.

- Stringent regulatory necessities within the construction industry advance amplify the require for strong checking and documentation. Development cameras give the necessary visual prove to guarantee compliance with security conventions and regulatory guidelines. Also, the locale faces critical security challenges on construction sites, counting burglary and vandalism. As a result, the broad utilize of construction cameras for surveillance and security purposes is pivotal to relieve these dangers.

- The North American market's maturity, characterized by a well-established framework for receiving and integrating new technologies, moreover contributes to its dominance. The presence of key industry players like EarthCam, OxBlue, and TrueLook solidifies the market’s quality. Substantial financial investment in development innovation from both private and open sectors bolsters the selection of progressed checking arrangements, improving project efficiency and security. In addition, companies in North America are ceaselessly innovating, advertising upgraded features such as real-time inaccessible checking, AI-driven analytics, and automated advance detailing. These innovations draw in a wide run of development firms looking to optimize their operations, fortifying North America's driving position in the construction camera market.

- In the United States, Canon cameras were the most rented cameras as of 2023, with a share of roughly 33.4 percent in 2023. Sony ranked second, with a share of 32.7 percent. Other brads occupy smaller ratios of the market.

Construction Camera Market Top Key Players:

- EarthCam, Inc. (USA)

- Oxblue Corporation (USA)

- Sensera Systems (USA)

- Ibeam Systems, Inc. (USA)

- Truelook, Inc. (USA)

- Brinno Inc. (Taiwan)

- Multivista (USA)

- Evercam (Ireland)

- Onsiteview (USA)

- Jobsite Security (USA)

- Sitecam (USA)

- Ecamsecure (USA)

- Enlaps (France)

- Senstar Corporation (Canada)

- Reolink (China)

- Solink (Canada)

- Builtworld Technology (Germany)

- Wireless Cctv Llc (USA)

- Camdo Solutions (Canada)

- Spotcam Co., Ltd. (Taiwan)

- Digital Watchdog (USA)

- Mobile Video Guard (USA)

- Monitorcam (UK)

- Site Surveillance Inc. (USA)

- Other Active Players.

Key Industry Developments in the Construction Camera Market:

- In May 2024, Riyadh, Saudi Arabia – EarthCam®, the leading provider of construction camera solutions, and WakeCap, a leader in smart solutions for construction site management, today announced their collaboration to integrate EarthCam visual data and WakeCap’s connected worker solutions on construction sites in Saudi Arabia.

- In May 2024, Sensera Systems, a company that offers real time workplace data management solutions, has introduced its complete workplace information security solution.The complete solution includes the SiteWatch Pro3 compact solar camera, the recently released TalkDown alarm and professional monitoring services, all deployed using Sensera's SiteCloud software. Sensera Systems now offers comprehensive workplace security and meets risk requirements for projects of all sizes.

|

Global Construction Camera Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 330.03 Million |

|

Forecast Period 2025-32 CAGR: |

7.44% |

Market Size In 2032: |

USD 585.98 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Power Covered |

|

||

|

By Resolution |

|

||

|

By Application |

|

||

|

By Distribution |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Construction Camera Market by Product Type (2018-2032)

4.1 Construction Camera Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed Camera

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 PTZ (Pan-Tilt-Zoom) Camera

4.5 Indoor Camera

4.6 Mobile Camera Trailers

Chapter 5: Construction Camera Market by Power Covered (2018-2032)

5.1 Construction Camera Market Snapshot and Growth Engine

5.2 Market Overview

5.3 AC (Alternating Current) Power Driven

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 DC (Direct Current) Power Driven

5.5 Solar Power Driven

Chapter 6: Construction Camera Market by Resolution (2018-2032)

6.1 Construction Camera Market Snapshot and Growth Engine

6.2 Market Overview

6.3 4k UHD

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 1080p

6.5 720p

6.6 Others (8K

6.7 420p

6.8 Etc.)

Chapter 7: Construction Camera Market by Application (2018-2032)

7.1 Construction Camera Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Jobsite Progress Monitoring

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Security and Surveillance

7.5 Marketing and Promotion

Chapter 8: Construction Camera Market by Distribution (2018-2032)

8.1 Construction Camera Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Online

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Company-owned websites

8.5 Third Party Websites

8.6 Offline

8.7 Direct Sales

8.8 Indirect Sales

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Construction Camera Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 EARTHCAM INC. (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 OXBLUE CORPORATION (USA)

9.4 SENSERA SYSTEMS (USA)

9.5 IBEAM SYSTEMS INC. (USA)

9.6 TRUELOOK INC. (USA)

9.7 BRINNO INC. (TAIWAN)

9.8 MULTIVISTA (USA)

9.9 EVERCAM (IRELAND)

9.10 ONSITEVIEW (USA)

9.11 JOBSITE SECURITY (USA)

9.12 SITECAM (USA)

9.13 ECAMSECURE (USA)

9.14 ENLAPS (FRANCE)

9.15 SENSTAR CORPORATION (CANADA)

9.16 REOLINK (CHINA)

9.17 SOLINK (CANADA)

9.18 BUILTWORLD TECHNOLOGY (GERMANY)

9.19 WIRELESS CCTV LLC (USA)

9.20 CAMDO SOLUTIONS (CANADA)

9.21 SPOTCAM CO. LTD. (TAIWAN)

9.22 DIGITAL WATCHDOG (USA)

9.23 MOBILE VIDEO GUARD (USA)

9.24 MONITORCAM (UK)

9.25 SITE SURVEILLANCE INC. (USA) AND OTHER MAJOR PLAYERS.

Chapter 10: Global Construction Camera Market By Region

10.1 Overview

10.2. North America Construction Camera Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Fixed Camera

10.2.4.2 PTZ (Pan-Tilt-Zoom) Camera

10.2.4.3 Indoor Camera

10.2.4.4 Mobile Camera Trailers

10.2.5 Historic and Forecasted Market Size by Power Covered

10.2.5.1 AC (Alternating Current) Power Driven

10.2.5.2 DC (Direct Current) Power Driven

10.2.5.3 Solar Power Driven

10.2.6 Historic and Forecasted Market Size by Resolution

10.2.6.1 4k UHD

10.2.6.2 1080p

10.2.6.3 720p

10.2.6.4 Others (8K

10.2.6.5 420p

10.2.6.6 Etc.)

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Jobsite Progress Monitoring

10.2.7.2 Security and Surveillance

10.2.7.3 Marketing and Promotion

10.2.8 Historic and Forecasted Market Size by Distribution

10.2.8.1 Online

10.2.8.2 Company-owned websites

10.2.8.3 Third Party Websites

10.2.8.4 Offline

10.2.8.5 Direct Sales

10.2.8.6 Indirect Sales

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Construction Camera Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Fixed Camera

10.3.4.2 PTZ (Pan-Tilt-Zoom) Camera

10.3.4.3 Indoor Camera

10.3.4.4 Mobile Camera Trailers

10.3.5 Historic and Forecasted Market Size by Power Covered

10.3.5.1 AC (Alternating Current) Power Driven

10.3.5.2 DC (Direct Current) Power Driven

10.3.5.3 Solar Power Driven

10.3.6 Historic and Forecasted Market Size by Resolution

10.3.6.1 4k UHD

10.3.6.2 1080p

10.3.6.3 720p

10.3.6.4 Others (8K

10.3.6.5 420p

10.3.6.6 Etc.)

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Jobsite Progress Monitoring

10.3.7.2 Security and Surveillance

10.3.7.3 Marketing and Promotion

10.3.8 Historic and Forecasted Market Size by Distribution

10.3.8.1 Online

10.3.8.2 Company-owned websites

10.3.8.3 Third Party Websites

10.3.8.4 Offline

10.3.8.5 Direct Sales

10.3.8.6 Indirect Sales

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Construction Camera Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Fixed Camera

10.4.4.2 PTZ (Pan-Tilt-Zoom) Camera

10.4.4.3 Indoor Camera

10.4.4.4 Mobile Camera Trailers

10.4.5 Historic and Forecasted Market Size by Power Covered

10.4.5.1 AC (Alternating Current) Power Driven

10.4.5.2 DC (Direct Current) Power Driven

10.4.5.3 Solar Power Driven

10.4.6 Historic and Forecasted Market Size by Resolution

10.4.6.1 4k UHD

10.4.6.2 1080p

10.4.6.3 720p

10.4.6.4 Others (8K

10.4.6.5 420p

10.4.6.6 Etc.)

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Jobsite Progress Monitoring

10.4.7.2 Security and Surveillance

10.4.7.3 Marketing and Promotion

10.4.8 Historic and Forecasted Market Size by Distribution

10.4.8.1 Online

10.4.8.2 Company-owned websites

10.4.8.3 Third Party Websites

10.4.8.4 Offline

10.4.8.5 Direct Sales

10.4.8.6 Indirect Sales

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Construction Camera Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Fixed Camera

10.5.4.2 PTZ (Pan-Tilt-Zoom) Camera

10.5.4.3 Indoor Camera

10.5.4.4 Mobile Camera Trailers

10.5.5 Historic and Forecasted Market Size by Power Covered

10.5.5.1 AC (Alternating Current) Power Driven

10.5.5.2 DC (Direct Current) Power Driven

10.5.5.3 Solar Power Driven

10.5.6 Historic and Forecasted Market Size by Resolution

10.5.6.1 4k UHD

10.5.6.2 1080p

10.5.6.3 720p

10.5.6.4 Others (8K

10.5.6.5 420p

10.5.6.6 Etc.)

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Jobsite Progress Monitoring

10.5.7.2 Security and Surveillance

10.5.7.3 Marketing and Promotion

10.5.8 Historic and Forecasted Market Size by Distribution

10.5.8.1 Online

10.5.8.2 Company-owned websites

10.5.8.3 Third Party Websites

10.5.8.4 Offline

10.5.8.5 Direct Sales

10.5.8.6 Indirect Sales

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Construction Camera Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Fixed Camera

10.6.4.2 PTZ (Pan-Tilt-Zoom) Camera

10.6.4.3 Indoor Camera

10.6.4.4 Mobile Camera Trailers

10.6.5 Historic and Forecasted Market Size by Power Covered

10.6.5.1 AC (Alternating Current) Power Driven

10.6.5.2 DC (Direct Current) Power Driven

10.6.5.3 Solar Power Driven

10.6.6 Historic and Forecasted Market Size by Resolution

10.6.6.1 4k UHD

10.6.6.2 1080p

10.6.6.3 720p

10.6.6.4 Others (8K

10.6.6.5 420p

10.6.6.6 Etc.)

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Jobsite Progress Monitoring

10.6.7.2 Security and Surveillance

10.6.7.3 Marketing and Promotion

10.6.8 Historic and Forecasted Market Size by Distribution

10.6.8.1 Online

10.6.8.2 Company-owned websites

10.6.8.3 Third Party Websites

10.6.8.4 Offline

10.6.8.5 Direct Sales

10.6.8.6 Indirect Sales

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Construction Camera Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Fixed Camera

10.7.4.2 PTZ (Pan-Tilt-Zoom) Camera

10.7.4.3 Indoor Camera

10.7.4.4 Mobile Camera Trailers

10.7.5 Historic and Forecasted Market Size by Power Covered

10.7.5.1 AC (Alternating Current) Power Driven

10.7.5.2 DC (Direct Current) Power Driven

10.7.5.3 Solar Power Driven

10.7.6 Historic and Forecasted Market Size by Resolution

10.7.6.1 4k UHD

10.7.6.2 1080p

10.7.6.3 720p

10.7.6.4 Others (8K

10.7.6.5 420p

10.7.6.6 Etc.)

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Jobsite Progress Monitoring

10.7.7.2 Security and Surveillance

10.7.7.3 Marketing and Promotion

10.7.8 Historic and Forecasted Market Size by Distribution

10.7.8.1 Online

10.7.8.2 Company-owned websites

10.7.8.3 Third Party Websites

10.7.8.4 Offline

10.7.8.5 Direct Sales

10.7.8.6 Indirect Sales

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Construction Camera Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 330.03 Million |

|

Forecast Period 2025-32 CAGR: |

7.44% |

Market Size In 2032: |

USD 585.98 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Power Covered |

|

||

|

By Resolution |

|

||

|

By Application |

|

||

|

By Distribution |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

|

||