Connected Care Market Overview

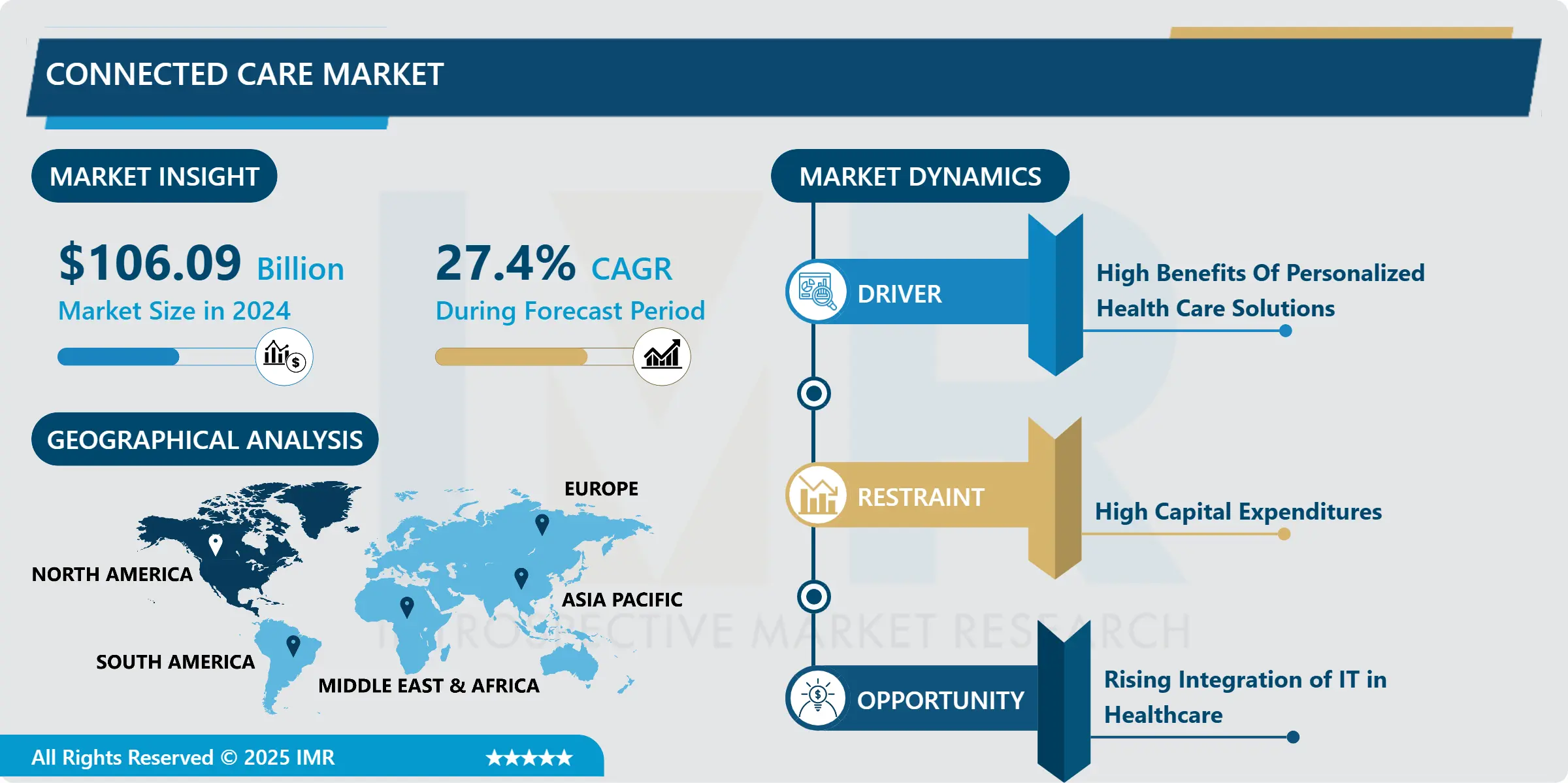

The Global Connected Care Market was estimated at USD 106.09 Billion in 2024, and is projected to reach USD 1522.43 Billion by 2035, growing at a CAGR of 27.4% during the analysis period.

Technology Enabled Care or Connected Health Care is a term that refers to the use of modern technology to enable patients to obtain healthcare remotely, outside of traditional care delivery models. In actuality, it refers to any method that enables Health Care to be delivered in a more patient-centered and participatory manner. Telehealth programs, remote care such as home visits, illness, and lifestyle management, and new technologies to enhance patient connectedness are examples of this sort of care. It also entails linking a patient's caregivers to improve information exchange and, as a result, patient care. According to the United States, Government Accounting Office (GAO), remote patient monitoring technology is still evolving, and there is no consensus on how to utilize and charge for the variety of delivery models, including the breadth of services and procedures. Within the Physician Fee Schedule, CMS has defined codes that reflect non-face-to-face care management services that include contacts provided through communication technologies. The Indian government's National Digital Health Blueprint study stressed the need of leveraging efficient and effective delivery of all digital healthcare services in the country. During the projected period, such initiatives are likely to enhance market expansion.

Market Dynamics and Factors For Connected Care:

Drivers

Growing trend and benefits of personalized health care solutions boosting the market.

- Personalized healthcare, based on new findings in genetics, behavioral sciences, diagnostics, and clinical medicine, can bring remedies to chronic health problems and many lifestyle disorders. Roche will offer a remote patient monitoring system in September 2020, allowing healthcare practitioners to monitor individuals with diabetes outside of the hospital. Additionally, businesses all over the world have discovered the value of using individualized healthcare solutions to boost employee abilities and profits. According to McKinsey, the market has experienced unusual activity, such as an increase in venture capital financing. Teladoc Health, for example, announced the purchase of Livongo for USD 18.5 billion in October 2020, which would assist the firm in speed virtual care delivery, such as remote monitoring. As a result, such tailored healthcare solutions and corporate investment are laying a strong basis for the connected healthcare sector, propelling the market's growth.

Smart wearable devices and health monitoring applications provide a potent environment for growth.

- The popularity of smartphones and wearable devices has risen as technology continues to revolutionize patient care and the demand for patients to monitor their health has expanded, bringing a new set of advantages to the market. Trackers, blood pressure monitors, and glucose meters are examples of wearable devices that may be used to measure activities such as calories burnt, heart rate, and distance traveled. The expenditures of frequent checks are significantly lowered when these gadgets are used, since patients may analyze self-medical parameters. Philips, for example, gained FDA approval in May 2020 for its wearable biosensor (Philips Biosensor BX100), which will aid in the management of proven and suspected COVID-19 patients in the hospital. Several firms are also developing mHealth services throughout the world. According to a Sensor Tower Inc. article, in 2020, European regions' expenditure on health and fitness category mobile applications would increase by 70.2 percent year-over-year to an anticipated USD 544.2 million, as individuals seek new methods to stay active.

Restraints

- Despite the enormous potential of linked healthcare goods and services, industry development is hampered by technological and infrastructure limitations. The installation of necessary devices, systems, and equipment associated with real-time measurement of healthcare indicators is extremely expensive, posing a significant market constraint. Furthermore, despite an increase in the use of mHealth apps, many developing countries are lagging in the adoption of these technologies and products due to issues such as the availability of high-speed internet with high bandwidth, storage integration, and data transmission, which is further limiting the market growth.

Opportunities

- Data security is still an issue in a variety of businesses, including healthcare. Thus, the healthcare industry is embracing blockchain technology as a way to more efficiently and securely handle store, and access patient information, among other things. According to a blockchain council article, the blockchain-based technology protects patient identification and keeps track of where it came from. Medicalchain launched its telemedicine website, MyClinic.com in May 2018 where users may have doctor consultations through video and pay using MedTokens. Furthermore, several businesses are adopting blockchain technology to safeguard patient data. BurstIQ, a big data, and software business, for example, offers a platform that enables healthcare organizations to safely and securely handle massive volumes of patient data. Companies may use blockchain technology to store, share, and license data while staying in strict compliance with HIPAA standards, which provide you choice over how your health information is shared.

Challenges

- One of the major challenges is digital security and data exchange conveniently. Health data exchange and usage are sometimes hampered by geographic borders and end-of-network hurdles, which may be difficult for both patients and clinicians. The gaps involved with managing paper trails, having to remember specifics of every health care (and related) that a person receives, and functioning outside of networked channels all contribute to the discontinuity of treatment. Also, Telemedicine is not covered by all insurance companies. Only 26 states in the US presently mandate insurance companies to cover or reimburse telemedicine costs. These laws, on the other hand, are continually changing. State regulations differ, and clinicians may not be authorized to practice medicine across state boundaries based on the state in which they hold their license and the state where the patient resides.

-

Market Segmentation For Connected Care

- By Type, mHealth services dominate the connected care market. Increased smartphone adoption rate allows people to access a variety of healthcare services via wireless technology, resulting in increased acceptance of mHealth services. According to the State of Mobile Internet Connectivity Report 2020, at the end of 2019, about 3.8 billion people were utilizing mobile internet, up 250 million from the previous year. Because of the convenience and cost-effectiveness of employing wearable devices, as well as increased government activities toward health, the MHealth devices category is rising steadily. Due to factors such as the growing use of EHR systems and a greater focus on decreasing medical mistakes, the e-Prescription sector is expected to drive market expansion. Additionally, the worldwide market is being strengthened by the introduction of many platforms and the entry of new market competitors with massive finance. CirrusMD, a provider of on-demand virtual care services raised USD 20 million in a Series C round of investment headed by Blue Venture Fund in March 2021.

- By Function, Telemedicine dominates the function segment of the Connected Care Market. Due to factors such as the surging adoption of telemedicine services. For instance, according to the Multidisciplinary Digital Publishing Institute (MDPI) journals survey, up to 89% of patients prefer telemedicine as an acceptable form of medical care. This is, therefore, likely to boost segmental growth. Additionally, according to Mckinsey's research, the massive shift to virtual care has been observed. The number of telehealth visits has been reported approx. 50 to 175 higher as compared to pre-pandemic. Remote patient monitoring is growing faster due to factors such as the constant rise in the geriatric population. For instance, as per the Hindu center for politics and public policy article, persons aged 65 or over in 2020 are around 727 million. The proportion of the aged population is expected to increase from 9.3 percent in 2020 to approximately 16.0 percent by 2050.

- By Application, Wellness & Prevention is dominating the Connected Care Market. Wellness and prevention are some of the most used applications of connected care. The option to get experts' opinions from home has captured a large audience. Most of the time, nominal health problems like cold and flu do not require immediate hospitalization, In this case, connected care offers remote consulting and prevention treatment and diagnosis of the cause. During a pandemic, most of the hospitals and healthcare facilities opted for connected care options to provide wellness and preventive measures to educate the mass population. Therefore, wellness & prevention are expected to grow steadily during the forecasted period.

Players Covered in Connected Care market are :

- Allscripts Healthcare LLC. (U.S.)

- Cerner Corporation (U.S.)

- Koninklijke Philips N. V (Netherlands)

- McKesson Corporation (U.S.)

- Apple Inc. (U.S.)

- Omron Corporation (Japan)

- General Electric Company (U.S.)

- Fitbit Inc. (U.S.)

- IBM Corporation (U.S.)

- NXGN Management LLC and other major players.

Regional Analysis of Connected Care Market

- North America is dominating the Connected Care Market. The market size in North America stood at USD 27.20 billion in 2020. The region dominated the global market in 2020 due to increasing healthcare costs, growing adoption of smartphones, rising demand for connected healthcare products, and remote patient monitoring. North American healthcare system is always adopting relatively new technologies and practice methods which includes connected care systems. The majority of the population uses digital platform which allows them to operate various tasks from home or elsewhere. Such a trend is helpful to boost the connected care market. The options of healthcare treatment remotely are increasing in the United States and Canada. For instance, in May 2020, According to Mckinsey, there is an enormous upsurge in the use of telehealth services in the U.S. The adoption of telehealth services by consumers increased by 46% in 2020 and 11% in the previous year 2019 to avoid exposure to covid-19 and substitute the canceled visits.

- Europe marked the second leading position in the market due to the significant increase in the use of smartphones by individuals and physicians. Furthermore, the increase in remote patient monitoring services to monitor various health and medical conditions from a remote location propels the market growth. Countries like Germany, France, Netherlands, Denmark, and Sweden possess the best healthcare facilities and response procedures. With the adoption of connected care with both sides, the market is estimated to grow at large on European soil. According to Healthcare IT News, in 2020, the Digital Healthcare Act (DVG) officially allowed doctors in Germany to prescribe medications through apps to their patients.

- Furthermore, Asia Pacific is anticipated to show the fastest growth in the region owing to the increased adoption rate of smart wearable devices and rising demand for mHealth services. According to Health Catalyst white paper, a collision of influential factors such as the continued shift to telemedicine and virtual care is boosting the market growth. Latin America and the Middle East & Africa will have a slower growth rate due to the lesser awareness and reluctance to adopt connected healthcare in low-income countries.

Key Developments of Connected Care Market

- In April 2024, Tembo Health, a telemedicine provider focused on senior care, partnered with Springwell Senior Living, a 250-resident community in northwest Baltimore. The collaboration will integrate Tembo Health's telemedicine services into Springwell’s independent living, assisted living, and memory care programs, enhancing healthcare accessibility for residents.

- In March 2024, Garmin Malaysia introduced the HRM-Fit, a heart rate monitor tailored for women. Designed for comfort, the clip-on device attaches seamlessly to medium- and high-support sports bras, offering accurate real-time heart rate and workout data tracking.

- In February 2024, HealthSnap, a provider of Chronic Care Management solutions, raised USD 25 million in Series B funding. The round was led by Sands Capital, with participation from new investors Comcast Ventures and Florida Opportunity Fund.

- In June 2023, Apixio, an AI-driven healthcare analytics company, merged with ClaimLogiq, a healthcare technology firm specializing in reducing claim errors, to create a leading connected care platform. Backed by New Mountain Capital and Eir Partners, the combined entity, branded as Apixio, integrates advanced AI, clinical, and financial data to enhance value-based care delivery, minimize reimbursement inaccuracies, and optimize healthcare outcomes for health plans and provider groups.

|

Connected Care Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 106.09 Bn. |

|

Forecast Period 2025-35 CAGR: |

27.4 % |

Market Size in 2035: |

USD 1522.43 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Connected Care Market by Type (2018-2035)

4.1 Connected Care Market Snapshot and Growth Engine

4.2 Market Overview

4.3 mHealth services

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 mHealth devices

4.5 e-Prescription

Chapter 5: Connected Care Market by Function (2018-2035)

5.1 Connected Care Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Remote patient monitoring

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Clinical Monitoring

5.5 Telemedicine

5.6 Others

Chapter 6: Connected Care Market by Application (2018-2035)

6.1 Connected Care Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Diagnosis & Treatment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Monitoring Applications

6.5 Wellness & Prevention

6.6 Healthcare Management

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Connected Care Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAIN & COMPANY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COGNIZANT

7.4 PWC

7.5 ELBIT SYSTEMS LTDMCKINSEY & COMPANY

7.6 ERNST & YOUNG

7.7 ACCENTURE CONSULTING

7.8 HURON CONSULTING

7.9 STREIT GROUP

7.10 BOSTON CONSULTING GROUP

7.11 DELOITTE TOUCHE TOHMATSU LIMITED

7.12 KPMG

7.13 OSHKOSH CORPORATION

Chapter 8: Global Connected Care Market By Region

8.1 Overview

8.2. North America Connected Care Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 mHealth services

8.2.4.2 mHealth devices

8.2.4.3 e-Prescription

8.2.5 Historic and Forecasted Market Size by Function

8.2.5.1 Remote patient monitoring

8.2.5.2 Clinical Monitoring

8.2.5.3 Telemedicine

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Diagnosis & Treatment

8.2.6.2 Monitoring Applications

8.2.6.3 Wellness & Prevention

8.2.6.4 Healthcare Management

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Connected Care Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 mHealth services

8.3.4.2 mHealth devices

8.3.4.3 e-Prescription

8.3.5 Historic and Forecasted Market Size by Function

8.3.5.1 Remote patient monitoring

8.3.5.2 Clinical Monitoring

8.3.5.3 Telemedicine

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Diagnosis & Treatment

8.3.6.2 Monitoring Applications

8.3.6.3 Wellness & Prevention

8.3.6.4 Healthcare Management

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Connected Care Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 mHealth services

8.4.4.2 mHealth devices

8.4.4.3 e-Prescription

8.4.5 Historic and Forecasted Market Size by Function

8.4.5.1 Remote patient monitoring

8.4.5.2 Clinical Monitoring

8.4.5.3 Telemedicine

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Diagnosis & Treatment

8.4.6.2 Monitoring Applications

8.4.6.3 Wellness & Prevention

8.4.6.4 Healthcare Management

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Connected Care Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 mHealth services

8.5.4.2 mHealth devices

8.5.4.3 e-Prescription

8.5.5 Historic and Forecasted Market Size by Function

8.5.5.1 Remote patient monitoring

8.5.5.2 Clinical Monitoring

8.5.5.3 Telemedicine

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Diagnosis & Treatment

8.5.6.2 Monitoring Applications

8.5.6.3 Wellness & Prevention

8.5.6.4 Healthcare Management

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Connected Care Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 mHealth services

8.6.4.2 mHealth devices

8.6.4.3 e-Prescription

8.6.5 Historic and Forecasted Market Size by Function

8.6.5.1 Remote patient monitoring

8.6.5.2 Clinical Monitoring

8.6.5.3 Telemedicine

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Diagnosis & Treatment

8.6.6.2 Monitoring Applications

8.6.6.3 Wellness & Prevention

8.6.6.4 Healthcare Management

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Connected Care Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 mHealth services

8.7.4.2 mHealth devices

8.7.4.3 e-Prescription

8.7.5 Historic and Forecasted Market Size by Function

8.7.5.1 Remote patient monitoring

8.7.5.2 Clinical Monitoring

8.7.5.3 Telemedicine

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Diagnosis & Treatment

8.7.6.2 Monitoring Applications

8.7.6.3 Wellness & Prevention

8.7.6.4 Healthcare Management

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Connected Care Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 106.09 Bn. |

|

Forecast Period 2025-35 CAGR: |

27.4 % |

Market Size in 2035: |

USD 1522.43 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||