Composite Doors and Windows Market Synopsis

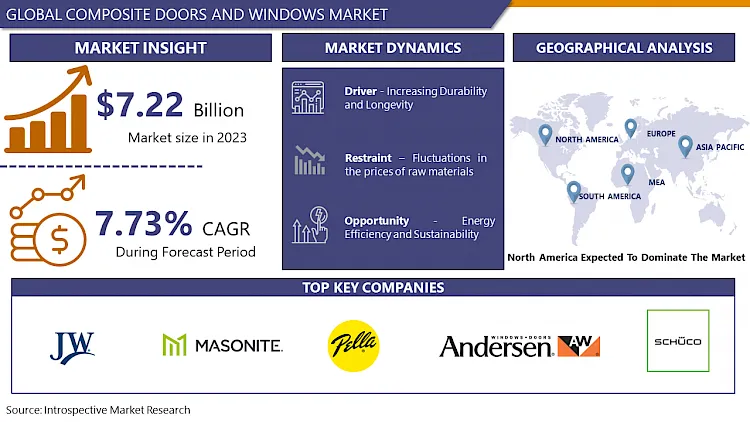

Doors and Windows Market Size Was Valued at USD 7.22 Billion in 2023, and is Projected to Reach 14.11 USD Billion by 2032, Growing at a CAGR of 7.73 % From 2024-2032.

Composite Doors and windows are constructed using a combination of materials such as wood, fiberglass, and PVC (unplasticized polyvinyl chloride), offering a blend of durability, thermal efficiency, and low maintenance.

The composite Doors and windows market have experienced significant growth and transformation in recent years, driven by increasing demand for energy-efficient and aesthetically pleasing building components.

One of the key factors fueling the market's growth is the rising awareness among consumers regarding the benefits of composite materials. These materials provide better insulation, weather resistance, and security compared to traditional alternatives. As energy efficiency becomes a crucial consideration for homeowners, composite Doors and windows are increasingly being chosen to enhance the overall performance of buildings.

The construction industry's growth, especially in residential and commercial sectors, has been a major catalyst for the composite Doors and windows market. Builders and architects are inclined towards these products due to their versatility, customizable designs, and longevity. Additionally, stringent building codes and regulations focusing on energy conservation have further propelled the adoption of composite Doors and windows.

Composite Doors and Windows Market Trend Analysis

Increasing Durability and Longevity

- The Composite Doors and Windows Market is experiencing a significant surge in demand primarily due to the growing emphasis on durability and longevity. As consumers become more discerning about the longevity of their investments, composite Doors and windows emerge as a preferred choice in the construction and home improvement sectors.

- One of the key driving factors for this market is the inherent strength and resilience of composite materials. Composite Doors and windows are typically made from a combination of materials such as fiberglass, wood, and other reinforced components, providing them with superior durability compared to traditional alternatives. This durability ensures a longer lifespan, reducing the frequency of replacements and associated costs.

- Moreover, composite materials exhibit remarkable resistance to various environmental factors, including extreme weather conditions, moisture, and pests. This resistance contributes significantly to the extended life expectancy of composite Doors and windows, making them an attractive option for homeowners and builders alike.

- In addition to durability, the market is influenced by the low maintenance requirements of composite Doors and windows. The materials used are often resistant to rot, corrosion, and fading, minimizing the need for regular upkeep. This characteristic not only enhances the overall lifespan of the products but also appeals to consumers seeking hassle-free, long-term solutions.

Energy Efficiency and Sustainability Creates an Opportunity

- The Composite Doors and Windows Market is poised for significant growth, driven by the increasing emphasis on energy efficiency and sustainability. As global awareness of environmental issues rises, consumers and businesses alike are seeking solutions that minimize energy consumption and reduce their carbon footprint. In this context, composite Doors and windows emerge as a promising opportunity within the construction industry.

- Composite materials, typically a combination of wood, fiberglass, and other synthetic materials, offer superior thermal insulation properties compared to traditional materials like wood or metal. This translates to better energy efficiency in buildings, as composite Doors and windows contribute to maintaining a consistent indoor temperature, reducing the need for excessive heating or cooling. This not only enhances comfort but also results in substantial energy savings, aligning with the growing demand for eco-friendly construction practices.

- Moreover, composite materials are known for their durability and low maintenance requirements, ensuring a longer lifespan for Doors and windows. This longevity not only reduces the frequency of replacements but also minimizes the environmental impact associated with manufacturing and disposal. As sustainability becomes a key driver in purchasing decisions, the market for composite Doors and windows is set to expand.

Composite Doors and Windows Market Segment Analysis:

Composite Doors and Windows Market is Segmented into Product, Material Type, Application.

By Product, Fibre-reinforced plastics segment is expected to dominate the market during the forecast period

- Fibre-reinforced plastics (FRP) segment is poised for dominance due to its superior material characteristics. FRP offers exceptional strength, durability, and resistance to environmental factors, making it an ideal choice for manufacturing composite Doors and windows. The material's lightweight nature also contributes to energy efficiency and ease of installation. As sustainability and performance become paramount in the construction industry, the demand for FRP-based composite Doors and windows is expected to surge, solidifying its position as the leading product segment in the market.

- Moreover, FRP materials offer versatility in design, allowing for the creation of aesthetically pleasing and customizable solutions that cater to diverse architectural preferences. The ability to mimic the appearance of traditional materials such as wood while maintaining the superior performance of FRP further enhances their appeal in the market.

- Additionally, the growing emphasis on sustainability and environmental consciousness is driving the demand for eco-friendly building materials. FRP, being a recyclable material with a lower environmental impact compared to some alternatives, aligns with this trend, contributing to its market dominance.

By Material Type, PVC segment held the largest share in 2022

- The Composite Doors and Windows Market is witnessing a significant growth trajectory, with the PVC segment emerging as a dominant force in the industry. Polyvinyl chloride (PVC) has become a preferred material for composite Doors and windows due to its remarkable combination of durability, energy efficiency, and cost-effectiveness.

- PVC's dominance can be attributed to its outstanding properties that make it an ideal material for manufacturing composite Doors and windows. One key advantage is its durability, as PVC is resistant to corrosion, rot, and insect damage, ensuring a longer lifespan for the Doors and windows. This makes it a reliable choice for consumers seeking products with low maintenance requirements.

- Additionally, PVC possesses excellent insulation properties, contributing to enhanced energy efficiency in buildings. The material helps in maintaining a comfortable indoor temperature by preventing heat loss during winters and heat gain during summers. This energy efficiency aligns with the growing emphasis on sustainable and eco-friendly construction practices, further boosting the demand for PVC-based composite Doors and windows.

Composite Doors and Windows Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to emerge as a dominant force in the composite Doors and windows market, driven by a confluence of factors that contribute to its robust growth. The escalating demand for high-performance, energy-efficient building materials, coupled with rapid urbanization and a burgeoning construction industry, positions the region as a key player in the market.

- One of the primary drivers of the composite Doors and windows market in the Asia Pacific is the increasing focus on sustainable and eco-friendly construction solutions. As governments and industries strive to meet stringent environmental standards, composite materials, known for their durability and energy efficiency, have gained prominence. This shift towards sustainable practices aligns with the region's commitment to green building initiatives, propelling the demand for composite Doors and windows.

- Furthermore, the booming construction activities in emerging economies within the Asia Pacific region contribute significantly to the market's dominance. Rising urban populations and a growing middle class drive the need for modern infrastructure and residential spaces, fostering an increased adoption of composite Doors and windows for their superior performance, aesthetic appeal, and longevity.

Composite Doors and Windows Market Top Key Players:

- JELD-WEN (United States)

- Masonite (United States)

- Pella Corporation (United States)

- Andersen Corporation (United States)

- Schüco International (Germany)

- Veka AG (Germany)

- Rehau (Germany)

- Royal Building Products (Canada)

- YKK AP, Inc. (Japan)

- Sapa Group (Norway)

- Epwin Group (United Kingdom)

- Kömmerling (Germany)

- Shanghai Yue Jia Doors and Windows (China)

- Internorm (Austria)

- Everest Limited (United Kingdom)

- Centor (Australia)

- Aluplast GmbH (Germany)

- Dortek Ltd (Ireland)

- Crystal Window & Door Systems (United States), and Other Major Players.

Key Industry Developments in the Composite Doors and Windows Market:

- In July 2023, VELUX has unveiled its latest product, the INTEGRA® skylights, featuring voice control and app integration for enhanced home management. The innovative skylights enable users to control and manage their home environment with ease, combining modern technology with traditional skylight functionality. The integration of voice control and app connectivity adds a new level of convenience, making it a smart choice for those seeking a seamless and intelligent home solution.

- In March 2023, Empower Brands has successfully acquired Koala Insulation and Wallaby Windows, significantly broadening its presence in the insulation and window installation industry. This strategic move enhances Empower Brands' influence in the sector, signaling its commitment to expansion and market diversification.

|

Global Composite Doors and Windows Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.22 Bn. |

|

Forecast Period 2023-30 CAGR: |

7.73% |

Market Size in 2032: |

USD 14.11 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Material Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Composite Doors and Windows Market by Product (2018-2032)

4.1 Composite Doors and Windows Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fibre-reinforced plastics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Wood-plastic composites

Chapter 5: Composite Doors and Windows Market by Material Type (2018-2032)

5.1 Composite Doors and Windows Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Polyester

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 PVC

5.5 Wood

Chapter 6: Composite Doors and Windows Market by Application (2018-2032)

6.1 Composite Doors and Windows Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Industrial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Residential

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Composite Doors and Windows Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CROCK-POT (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HAMILTON BEACH (USA)

7.4 TIGER CORPORATION (JAPAN)

7.5 ZOJIRUSHI AMERICA CORPORATION (USA)

7.6 PANASONIC CORPORATION (JAPAN)

7.7 TAYAMA APPLIANCE (USA)

7.8 HOT (USA)

7.9 GOURMIA (USA)

7.10 MILTON (INDIA)

7.11 BENTGO (USA)

7.12 TUPPERWARE (USA)

7.13 LOCK&LOCK (SOUTH KOREA)

7.14 SISTEMA PLASTICS (NEW ZEALAND)

7.15 THERMOS (USA)

7.16 BLACK+DECKER (USA)

7.17 PRESTIGE (INDIA)

7.18 BEAR ELECTRIC APPLIANCE (CHINA)

7.19 MIDEA GROUP (CHINA)

7.20 OMIEBOX (USA)

7.21

Chapter 8: Global Composite Doors and Windows Market By Region

8.1 Overview

8.2. North America Composite Doors and Windows Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Fibre-reinforced plastics

8.2.4.2 Wood-plastic composites

8.2.5 Historic and Forecasted Market Size by Material Type

8.2.5.1 Polyester

8.2.5.2 PVC

8.2.5.3 Wood

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Industrial

8.2.6.2 Commercial

8.2.6.3 Residential

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Composite Doors and Windows Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Fibre-reinforced plastics

8.3.4.2 Wood-plastic composites

8.3.5 Historic and Forecasted Market Size by Material Type

8.3.5.1 Polyester

8.3.5.2 PVC

8.3.5.3 Wood

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Industrial

8.3.6.2 Commercial

8.3.6.3 Residential

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Composite Doors and Windows Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Fibre-reinforced plastics

8.4.4.2 Wood-plastic composites

8.4.5 Historic and Forecasted Market Size by Material Type

8.4.5.1 Polyester

8.4.5.2 PVC

8.4.5.3 Wood

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Industrial

8.4.6.2 Commercial

8.4.6.3 Residential

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Composite Doors and Windows Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Fibre-reinforced plastics

8.5.4.2 Wood-plastic composites

8.5.5 Historic and Forecasted Market Size by Material Type

8.5.5.1 Polyester

8.5.5.2 PVC

8.5.5.3 Wood

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Industrial

8.5.6.2 Commercial

8.5.6.3 Residential

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Composite Doors and Windows Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Fibre-reinforced plastics

8.6.4.2 Wood-plastic composites

8.6.5 Historic and Forecasted Market Size by Material Type

8.6.5.1 Polyester

8.6.5.2 PVC

8.6.5.3 Wood

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Industrial

8.6.6.2 Commercial

8.6.6.3 Residential

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Composite Doors and Windows Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Fibre-reinforced plastics

8.7.4.2 Wood-plastic composites

8.7.5 Historic and Forecasted Market Size by Material Type

8.7.5.1 Polyester

8.7.5.2 PVC

8.7.5.3 Wood

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Industrial

8.7.6.2 Commercial

8.7.6.3 Residential

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Composite Doors and Windows Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.22 Bn. |

|

Forecast Period 2023-30 CAGR: |

7.73% |

Market Size in 2032: |

USD 14.11 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Material Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

.webp)