Key Market Highlights

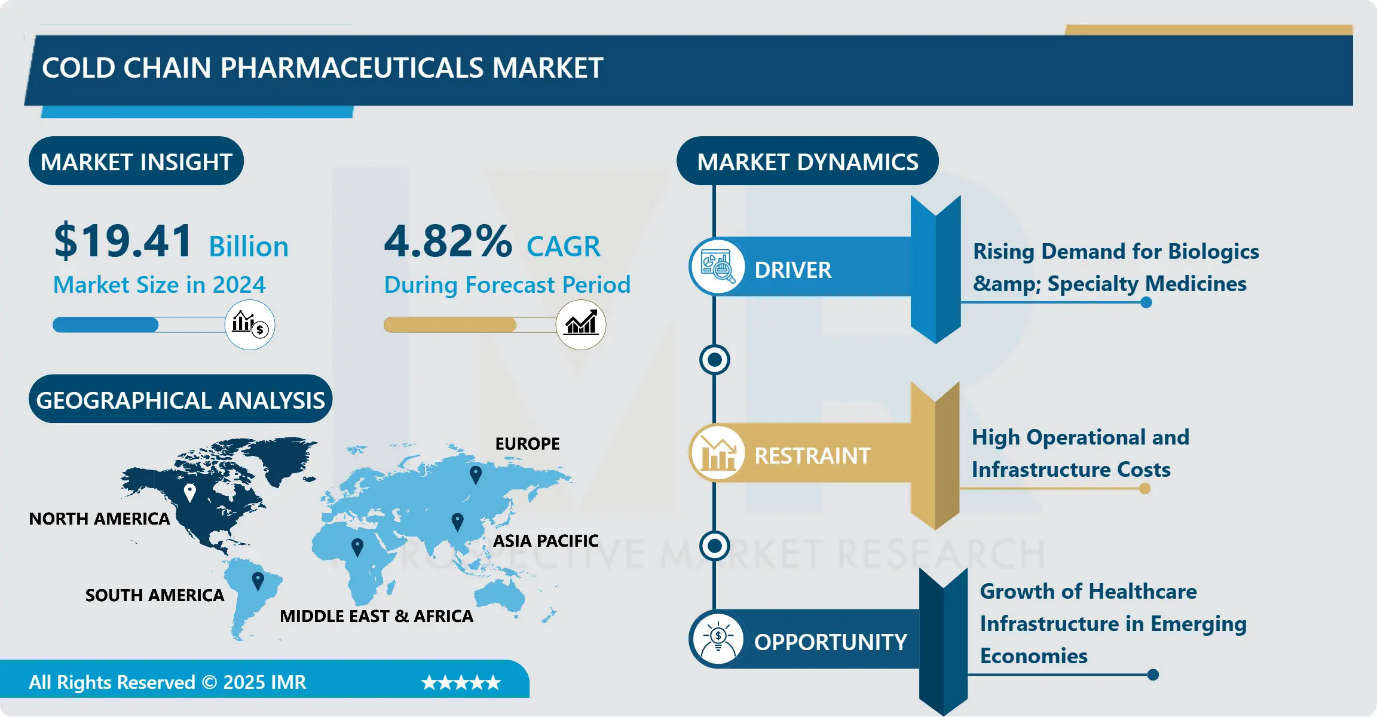

Cold Chain Pharmaceuticals Market Size Was Valued at USD 19.41 Billion in 2024, and is Projected to Reach USD 31.02 Billion by 2035, Growing at a CAGR of 4.82% from 2025-2035.

- Market Size in 2024: USD 19.41 Billion

- Projected Market Size by 2035: USD 31.02 Billion

- CAGR (2025–2035): 4.82%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Product Type: The Vaccine segment is anticipated to lead the market by accounting for 28.26% of the market share throughout the forecast period.

- By End Users: The Pharmaceuticals and Biotech Companies segment is expected to capture 25.36% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 29.76% of the market share during the forecast period.

- Active Players: Cardinal Health (USA), AmerisourceBergen Corporation (USA), Envirotainer AB (Sweden), FedEx (USA), United Parcel Service of America, Inc. (UPS) (USA), Thermo King (USA), Sonoco ThermoSafe (USA), B Medical Systems India Private Limited (India) , DoKaSch Temperature Solutions GmbH (Germany), Nordic Cold Chain Solutions (Sweden) and Other Active Players.

Cold Chain Pharmaceuticals Market Synopsis:

Cold chain pharmaceuticals refer to the unbroken, temperature-controlled supply chain required for temperature-sensitive drugs, such as vaccines and biologics, to maintain their efficacy and safety from manufacturing to the end-user. This system involves storing and transporting these products within specific temperature ranges, often between 2 Degree Celsius and 8 Degree Celsius for refrigerated items, but also requiring frozen (- 20, C) or ultra-cold (-80, C) conditions for others

Cold Chain Pharmaceuticals Market Dynamics and Trend Analysis:

Cold Chain Pharmaceuticals Market Growth Driver- Rising Demand for Biologics & Specialty Medicines

-

One of the major growth drivers for the cold-chain pharmaceutical market is the rapid increase in demand for biologics, biosimilars, vaccines, and cell- and gene-therapy products. These advanced therapies are highly temperature-sensitive and require strict refrigerated or frozen transportation and storage to maintain safety and effectiveness.

- As chronic diseases such as cancer, diabetes, and autoimmune disorders continue to rise, the use of biologic drugs is expanding globally, leading pharma companies to invest heavily in reliable cold-chain infrastructure. This trend is significantly increasing the need for specialized packaging, real-time temperature monitoring, and efficient logistics solutions, thereby driving market growth.

Cold Chain Pharmaceuticals Market Limiting Factor- High Operational and Infrastructure Costs

-

A key limiting factor for the cold-chain pharmaceutical market is the high cost associated with establishing and maintaining temperature-controlled logistics infrastructure. Cold-chain systems require specialized refrigerated vehicles, insulated packaging, advanced monitoring devices, backup power systems, and skilled workforce all of which significantly increase operational expenses.

- Additionally, rising energy costs and maintenance of deep-freezing equipment add financial pressure, especially in developing regions where logistics networks are still evolving. Small and mid-sized pharmaceutical companies often face challenges in affording these investments, which limits widespread adoption. Any failure in temperature control can result in product spoilage and financial loss, making cost management a major barrier to market expansion.

Cold Chain Pharmaceuticals Market Expansion Opportunity- Growth of Healthcare Infrastructure in Emerging Economies

-

A major expansion opportunity for the cold-chain pharmaceuticals market lies in the rapid development of healthcare infrastructure across emerging economies such as India, China, Brazil, and Southeast Asian nations. These regions are witnessing increasing investments in biotechnology, vaccine manufacturing, and specialty drug production, supported by government initiatives to improve immunization and access to advanced therapies.

- As demand for biologics and temperature-sensitive medicines grows, there is a strong need to build modern cold-chain storage, transportation networks, and digital monitoring systems. Partnerships between global logistics companies and regional healthcare providers offer significant potential for market entry, scalability, and long-term growth in these high-growth markets.

Cold Chain Pharmaceuticals Market Challenge and Risk- Supply Chain Vulnerability and Temperature Excursion

-

A major challenge and risk in the Cold Chain Pharmaceuticals market is the high vulnerability of temperature-sensitive products to supply chain disruptions. Any delay, equipment failure, power outage, or improper handling during storage or transportation can cause temperature excursions, leading to product spoilage, reduced efficacy, and safety risks for patients.

- This results in significant financial losses and regulatory non-compliance for manufacturers and logistics providers. In regions with unstable infrastructure or extreme climates, the risk becomes even higher. Maintaining real-time monitoring and backup systems is essential, but it increases operational complexity and cost, making supply chain reliability a critical challenge for market stability.

Cold Chain Pharmaceuticals Market Trend- Growing Adoption of Smart & Digital Cold Chain Technologies

-

A key trend in the Cold Chain Pharmaceuticals market is the rapid shift toward digital and technology-enabled cold-chain systems. Companies are increasingly adopting IoT sensors, RFID tracking, cloud-based monitoring, and real-time temperature and location management tools to ensure the safety and integrity of sensitive products such as vaccines, biologics, and cell-gene therapies.

- These solutions help detect temperature excursions instantly, reduce product spoilage, and improve regulatory compliance. As global distribution networks become more complex, especially with personalized medicine and long-distance transport, digitalization is becoming essential for greater transparency, efficiency, and reliability across the cold-chain logistics ecosystem.

Cold Chain Pharmaceuticals Market Segment Analysis:

Cold Chain Pharmaceuticals Market is segmented based on Product Type, Service Type, End-Users, By Temperature Range and Region

By End Users, Pharmaceuticals and Biotech companies segment is expected to dominate the market with around 25.36% share during the forecast period.

As per recent market research, the “Pharmaceutical & Biotech Companies” segment holds the largest share among end-users in the cold-chain pharmaceutical market. This is because drug manufacturers and biotech firms handle the bulk of temperature-sensitive products especially biologics, specialty medicines and vaccines requiring secure cold-chain packaging, storage and logistics from production to distribution. Their large volume output and regulatory need for strict temperature control make them the primary consumers of cold-chain services.

By Product Type, Vaccine is expected to dominate with close to 28.26% market share during the forecast period.

-

By product type, the vaccine segment currently captures the largest share of the cold-chain pharmaceutical market about 28.26% of global healthcare cold-chain logistics revenue in 2024. This dominance is because vaccines are highly temperature-sensitive, require strict and uninterrupted cold-chain integrity from production through distribution, and are distributed globally in large volumes under immunization and public-health programs

- As demand for immunizations and pandemic-response stockpiles grows, vaccines remain the principal driver for cold-chain logistics investment and capacity worldwide.

Cold Chain Pharmaceuticals Market Regional Insights:

North America region is estimated to lead the market with around 29.76% share during the forecast period.

-

This is mainly because the region has a highly developed pharmaceutical and biotechnology industry that produces a large volume of temperature-sensitive products such as vaccines, biologics, and specialty medicines. To support this demand, North America has strong cold-chain infrastructure, including advanced refrigerated storage, reliable transportation networks, and real-time monitoring technology.

- In addition, strict regulatory standards from agencies like the FDA ensure high product quality and force companies to maintain strong cold-chain systems. All these factors combined make North America the dominant market leader in cold-chain pharmaceutical logistics.

Cold Chain Pharmaceuticals Market Active Players:

- Cardinal Health, (USA)

- AmerisourceBergen, (USA)

- Envirotainer AB, (Sweden)

- FedEx, (USA)

- United Parcel Service of America, Inc. (UPS), (USA)

- Thermo King, (USA)

- Sonoco ThermoSafe, (USA)

- B Medical Systems India Private Limited, (India)

- DoKaSch Temperature Solutions GmbH, (Germany)

- Nordic Cold Chain, (Sweden)

- Other Active Players

Key Industry Developments in the Cold Chain Pharmaceuticals Market:

-

In May 2025, At the ACT Expo 2025, Thermo King unveiled a set of electrified and connected transport refrigeration solutions including the A?500e (all?electric trailer unit) and hybrid & electric refrigeration units for smaller vehicles/trucks (e-series).

- In September 2024, UPS announced that it will acquire Germany-based healthcare logistics firm Frigo-Trans to strengthen its cold?chain healthcare logistics capabilities across Europe. The acquisition includes temperature?controlled warehousing, freight forwarding operations and pan?European cold?chain transport network.

Cold Chain Infrastructure: Safeguarding Sensitive Pharmaceuticals

-

The Cold Chain Pharmaceuticals Market revolves around the storage, handling, and transportation of temperature-sensitive pharmaceutical products, including vaccines, biologics, small-molecule drugs, and clinical trial materials. These products require strict temperature control to maintain their stability, efficacy, and safety. Cold chain systems typically operate across three temperature ranges: refrigerated (2–8°C), frozen (below 0°C), and cryogenic/ultra-low temperatures (−70°C or below), depending on the sensitivity of the product.

- Key components of the cold chain include specialized packaging solutions, such as insulated containers, cold boxes, pallet shippers, vials, pre-filled syringes, gel packs, dry ice, and phase change materials. Advanced monitoring and tracking technologies, including IoT-enabled sensors and temperature data loggers, are increasingly integrated to ensure compliance with regulatory standards and minimize risks of product degradation.

- Transportation is a critical technical aspect, involving multimodal logistics through air, road, sea, and rail, with each mode requiring specific temperature-control measures. Storage infrastructure, such as refrigerated warehouses, walk-in cold rooms, and ultra-low freezers, must meet strict quality standards to prevent spoilage and ensure continuous supply.

- Recent innovations in the market focus on smart packaging with real-time temperature monitoring, reusable and sustainable packaging materials, and improved logistics management software to enhance efficiency. The growth of biologics, mRNA-based therapies, and personalized medicine is further driving demand for advanced cold chain solutions.

- Overall, the cold chain pharmaceutical market is a technically complex ecosystem that combines specialized storage, packaging, transportation, and monitoring technologies to ensure safe delivery of temperature-sensitive medicines from manufacturers to end-users, including hospitals, clinics, research organizations, and pharmacies.

|

Cold Chain Pharmaceuticals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 19.41 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.82 % |

Market Size in 2035: |

USD 31.02 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Temperature Range

|

|

||

|

By Service Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

Cardinal Health (USA), AmerisourceBergen Corporation (USA), Envirotainer AB (Sweden), FedEx (USA), United Parcel Service of America, Inc. (UPS) (USA), Thermo King (USA), Sonoco ThermoSafe (USA), B Medical Systems India Private Limited (India), DoKaSch Temperature Solutions GmbH (Germany), Nordic Cold Chain Solutions (Sweden) and Other Active Players |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Cold Chain Pharmaceuticals Market by Product Type (2018-2035)

4.1 Cold Chain Pharmaceuticals Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vaccines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Biologics & Biosimilars

4.5 Clinical Trial Materials

4.6 Cell & Gene Therapy Products

4.7 Blood & Blood Components

4.8 Diagnostic Reagents

4.9 Insulin & Hormonal Drugs

4.10 Other Temperature-Sensitive Pharmaceuticals

Chapter 5: Cold Chain Pharmaceuticals Market by Temperature Range (2018-2035)

5.1 Cold Chain Pharmaceuticals Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Refrigerated (2°C to 8°C)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Frozen (-20°C to -40°C)

5.5 Deep Frozen (-70°C to -80°C)

5.6 Cryogenic (< -150°C / Liquid Nitrogen)

Chapter 6: Cold Chain Pharmaceuticals Market by Service Type (2018-2035)

6.1 Cold Chain Pharmaceuticals Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Storage

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Transportation

6.5 Packaging

Chapter 7: Cold Chain Pharmaceuticals Market by End Users (2018-2035)

7.1 Cold Chain Pharmaceuticals Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceutical & Biotechnology Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Hospital & Clinics

7.5 Research Laboratories & Academic Institutes

7.6 Logistics & Distribution Centers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cold Chain Pharmaceuticals Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 CARDINAL HEALTH (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 AMERISOURCEBERGEN CORPORATION (USA)

8.4 ENVIROTAINER AB (SWEDEN)

8.5 FEDEX (USA)

8.6 UNITED PARCEL SERVICE OF AMERICA

8.7 INC. (UPS) (USA)

8.8 THERMO KING (USA)

8.9 SONOCO THERMOSAFE (USA)

8.10 B MEDICAL SYSTEMS INDIA PRIVATE LIMITED (INDIA)

8.11 DOKASCH TEMPERATURE SOLUTIONS GMBH (GERMANY)

8.12 NORDIC COLD CHAIN SOLUTIONS (SWEDEN) AND OTHER ACTIVE PLAYERS

Chapter 9: Global Cold Chain Pharmaceuticals Market By Region

9.1 Overview

9.2. North America Cold Chain Pharmaceuticals Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Cold Chain Pharmaceuticals Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Cold Chain Pharmaceuticals Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Cold Chain Pharmaceuticals Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Cold Chain Pharmaceuticals Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Cold Chain Pharmaceuticals Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Cold Chain Pharmaceuticals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 19.41 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.82 % |

Market Size in 2035: |

USD 31.02 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Temperature Range

|

|

||

|

By Service Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

Cardinal Health (USA), AmerisourceBergen Corporation (USA), Envirotainer AB (Sweden), FedEx (USA), United Parcel Service of America, Inc. (UPS) (USA), Thermo King (USA), Sonoco ThermoSafe (USA), B Medical Systems India Private Limited (India), DoKaSch Temperature Solutions GmbH (Germany), Nordic Cold Chain Solutions (Sweden) and Other Active Players |

||