Key Market Highlights

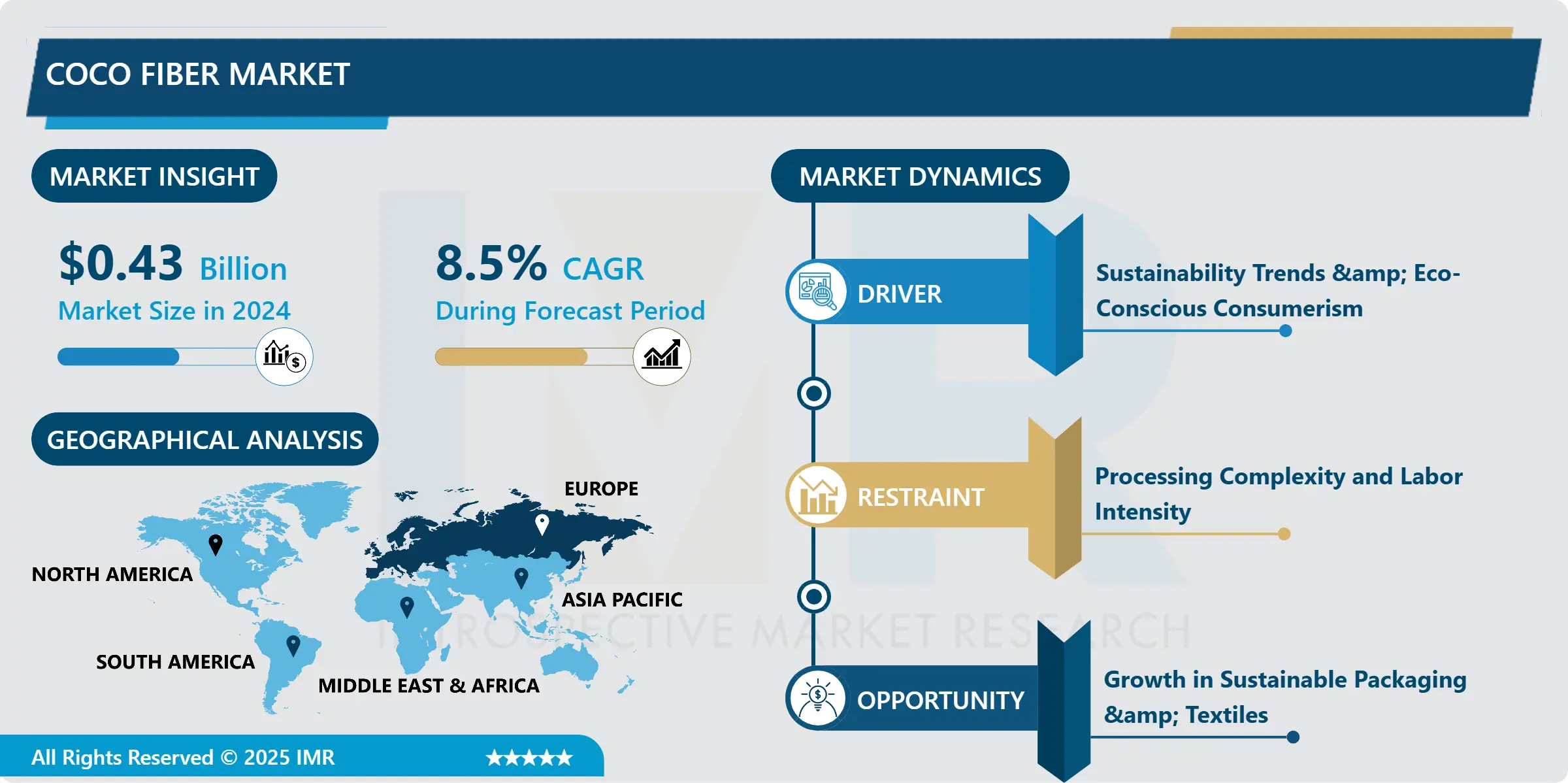

Coco Fiber Market Size Was Valued at USD 0.43 billion in 2024, and is Projected to Reach USD 1.05 billion by 2035, Growing at a CAGR of 8.5% from 2025-2035.

- Market Size in 2024: USD 0.43 billion

- Projected Market Size by 2035: USD 1.05 billion

- CAGR (2025–2035): 8.5%

- Leading Market in 2024: Asia-Pacific

- Fastest-Growing Market: North America

- By Segment 1: The Coir dust segment is anticipated to lead the market by accounting for 65% of the market share throughout the forecast period.

- By Segment 2: The Horticulture segment is expected to capture 40% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: Europe region is projected to hold 22% of the market share during the forecast period.

- Active Players: Allwin Coir (India), Asian Coir Products (Sri Lanka), Benkay Fibre (Philippines), Benlion Coir Industries (India), Classic Coir (India), Other Active Players

Coco Fiber Market Synopsis:

Coco fibre also known as coir or coconut fibre is a natural, biodegradable product extracted from coconut husks. As a sustainable alternative to synthetic materials, it finds widespread application across agriculture, construction, packaging, bedding, automotive, and more.

Coco Fiber Market Dynamics and Trend Analysis:

Coco Fiber Market Growth Driver - Sustainability Trends & Eco-Conscious Consumerism

-

In recent years, people around the world have become more aware of environmental issues like pollution, climate change, and plastic waste. As a result, there is a growing demand for eco-friendly and sustainable products that are safe for the planet. Many consumers and companies are now looking for alternatives to plastic and synthetic materials, which take hundreds of years to break down and cause harm to the environment.

- Coco fibre, also known as coir, is gaining popularity as a natural and sustainable material. It is made from the outer husk of coconuts, which is a renewable resource and often considered a waste product. Unlike plastic, coco fibre is biodegradable, which means it naturally breaks down over time without harming the environment.

- Because of these properties, coco fibre is being used in many “green” applications. In agriculture, it helps plants grow by improving soil quality and holding water. In packaging, it replaces plastic-based products that are used only once and thrown away. In construction, it is used in insulation, erosion control mats, and eco-friendly building materials.

- As more people support eco-conscious living and governments promote green solutions, the demand for coco fibre is expected to grow even more. Its natural qualities make it a strong choice for businesses and industries aiming to reduce their environmental impact.

Coco Fiber Market Limiting Factor - Processing Complexity and Labor Intensity

-

One of the major challenges in the coco fibre market is the complexity of its processing and the amount of manual labour involved. Coco fibre is extracted from the outer husk of coconuts, which requires several steps including soaking, beating, drying, and cleaning. In many regions, especially in developing countries, this process is still done by hand or with basic machines.

- This manual-intensive method makes production slow and physically demanding. Workers must separate the fibres from the husk, wash and dry them, and then sort them based on quality. These tasks require time, effort, and skill, which increases labour costs and reduces overall productivity. It also limits the scale at which coco fibre can be produced, especially when demand is high.

- In addition, inconsistent processing techniques can lead to variations in fibre quality. This makes it harder for manufacturers to meet international standards, which are important for export markets. Without modern equipment or automated systems, many small producers struggle to compete with faster and cheaper synthetic alternatives.

- To overcome these limitations, there is a need for better technology, training, and investment in machinery. By improving processing methods, the industry can produce higher-quality coco fibre more efficiently, making it easier to meet growing global demand while improving working conditions and income for labourers.

Coco Fiber Market Expansion Opportunity - Growth in Sustainable Packaging & Textiles

-

As environmental concerns continue to rise, many countries and companies are actively searching for sustainable alternatives to synthetic materials like plastic and polyester. This has created a strong opportunity for coco fibre to grow in industries such as packaging and textiles. Made from the outer husk of coconuts, coco fibre is a natural, renewable, and biodegradable material that offers an eco-friendly solution to many common products.

- In the packaging industry, coco fibre can replace plastic-based items like fillers, trays, and protective wraps. Unlike plastic, which takes hundreds of years to decompose, coco fibre breaks down naturally and does not pollute the environment. This is especially important in eco-conscious markets such as Europe and North America, where regulations are increasingly strict about single-use plastics and companies are under pressure to reduce their carbon footprints.

- In the textile industry, coco fibre is being explored for use in products like mats, rugs, insulation, and even clothing accessories. Its durability and natural appearance make it suitable for brands focused on sustainability and ethical sourcing.

- As consumer demand for green alternatives continues to grow, and as governments promote sustainable practices, coco fibre has the potential to become a key material in both packaging and textiles. With proper investment and innovation, it can help lead the shift toward a more sustainable and circular economy.

Coco Fiber Market Challenge and Risk - Global Competition from Synthetic Substitutes

-

One of the biggest challenges facing the coco fibre market is the strong competition from synthetic substitutes. Materials made from petrochemicals, such as plastic and synthetic fibres, are widely used across industries because they are cheaper to produce, more durable, and easier to scale for mass production. These advantages make it difficult for natural alternatives like coco fibre to compete, especially in price-sensitive markets.

- Synthetic materials are also more uniform in quality and can be manufactured quickly in large quantities using advanced technologies. In contrast, coco fibre requires more manual labour and time for processing, which can lead to higher costs and inconsistent quality. This puts pressure on producers and limits the ability of coco fibre to fully replace synthetic options in industries like packaging, textiles, construction, and automotive manufacturing.

- Even though coco fibre is biodegradable and environmentally friendly, many companies still choose synthetic materials because of cost efficiency, performance, and convenience. Without stronger incentives or regulations promoting sustainable alternatives, the market share of coco fibre remains at risk.

- To stay competitive, the coco fibre industry must focus on innovation, improve production methods, and raise awareness about the environmental benefits of natural fibres. Government support, eco-friendly policies, and increased consumer demand for sustainable products can also help reduce the market dominance of synthetic materials in the long term.

Coco Fiber Market Segment Analysis:

Coco Fiber Market is segmented based on Type, Application, End-Users, and Region

By Type, Coco Fiber Segment is Expected to Dominate the Market During the Forecast Period

-

Coir dust, also called coir pith, is the most widely used type of coco fibre in the market. It is a soft, spongy material that comes from the inside part of coconut husks during the process of making coir fibre. Instead of being thrown away as waste, coir dust is now used in many useful ways, especially in farming and gardening.

- The main reason for its popularity is its ability to hold water and air, which helps plants grow better. It is commonly used in potting mixes, greenhouses, hydroponic systems, and for starting seeds. Many farmers and gardeners prefer coir pith because it is natural, clean, and good for the environment. It also improves soil quality and helps retain moisture, which is useful in dry areas.

- Coir pith is a great replacement for peat moss, which is taken from bogs and is not renewable. As more people and companies look for eco-friendly options, the demand for coir dust continues to grow all over the world.

- Countries like India, Sri Lanka, and Indonesia produce large amounts of coir pith and export it to Europe, North America, and other regions. Because of its wide use and environmental benefits, coir dust has become a key product in the global coco fibre market.

By Application, Coco Fiber Segment Held the Largest Share in 2024

-

Horticulture is the biggest and most important use of coco fibre around the world. It includes activities like greenhouse farming, home gardening, and hydroponic (soil-free) farming. In this field, the most popular forms of coco fibre are coir dust and coir pith.

- These materials are highly valued because they help plants grow better. They have a soft, sponge-like texture that holds a lot of water and air. This helps plant roots stay healthy and strong. Coir pith also improves the structure of the soil, making it easier for water to drain and for nutrients to reach the plants.

- Many people are switching to coco fibre products in horticulture because they are natural, eco-friendly, and renewable. Unlike peat moss, which takes thousands of years to form, coir pith is made from coconut husks – a byproduct that would otherwise go to waste.

- Farmers, gardeners, and greenhouse owners use coco pith in potting mixes, seed starters, grow bags, and hydroponic trays. It is especially useful in dry or hot areas where water-saving is important.

- Because of its many benefits and its role in promoting sustainable farming, horticulture has become the main driver of demand in the global coco fibre market. As more people grow their own food or plants at home, this demand is expected to keep rising.

Coco Fiber Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

-

Europe is one of the biggest and most important markets for coco fibre. People and companies in Europe are very focused on protecting the environment. They prefer to use natural, eco-friendly materials instead of plastics and other synthetic products that harm the planet. Because of this, coco fibre is becoming more popular in Europe, especially in industries like gardening (horticulture) and packaging.

- In gardening, coco fibre is used as a growing medium because it holds water well, helps roots grow, and is completely natural. In packaging, coco fibre is being used to replace plastic in items like boxes, fillers, and trays. These products are biodegradable, which means they break down naturally without harming the earth.

- Countries like Germany, the Netherlands, and the United Kingdom are leading this green movement. These countries have strong environmental laws that encourage companies to use sustainable materials. Also, many European consumers are willing to pay more for products that are good for the environment.

- Since coconuts don’t grow much in Europe, most of the coco fibre used there is imported from Asia, especially from India, Sri Lanka, and Indonesia. These Asian countries supply the raw fibre that European companies turn into finished eco-friendly products. As Europe continues to support green living and reduce plastic use, the demand for coco fibre is expected to grow steadily in the years to come.

Coco Fiber Market Active Players:

- Allwin Coir (India)

- Asian Coir Products (Sri Lanka)

- Benkay Fibre (Philippines)

- Benlion Coir Industries (India)

- Classic Coir (India)

- Coir Board of India (India)

- CV Coco Mandiri (Indonesia)

- CV Coco Matic (Indonesia)

- Dutch Plantin (Netherlands)

- Eco Ceylon Exports (Sri Lanka)

- Fibredust LLC (USA)

- Geewin Exim (India)

- Greenfiber International (Netherlands)

- GrowRite Substrates (Australia)

- GVP Lanka Exports (Sri Lanka)

- Hayleys Fibre (Sri Lanka)

- Jiffy Products International (Norway)

- Klasmann-Deilmann GmbH (Germany)

- Natural Fibre Export Co. (India)

- Nedspice Processing Lanka (Sri Lanka)

- Premier Tech Horticulture (Canada)

- PT. Coco Agrindo (Indonesia)

- PT. Coco Fiber Global Indonesia (Indonesia)

- PT. Nature Coco Indonesia (Indonesia)

- Rettenmaier Group (Germany)

- Sree Mangal Moorti Coir Industry (India)

- Sri Velavan Coconut Products (India)

- Swarna Trades (India)

- Vaighai Agro Products Limited (India)

- Wilmington Fibre Specialty Company (USA)

- Other Active Players

|

Coco Fiber Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 0.43 billion |

|

Forecast Period 2025-35 CAGR: |

8.5% |

Market Size in 2035: |

USD 1.05 billion |

|

Segments Covered: |

By Fibre Type |

|

|

|

By Application |

|

||

|

By Property |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Coco Fiber Market by Fibre Type (2018-2035)

4.1 Coco Fiber Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Brown

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 White

4.5 Coir Dust

4.6 Coir Pith

4.7 Other Fibre Types

Chapter 5: Coco Fiber Market by Application (2018-2035)

5.1 Coco Fiber Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Agriculture

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Horticulture

5.5 Industrial

5.6 Geotextiles

5.7 Others

Chapter 6: Coco Fiber Market by Property (2018-2035)

6.1 Coco Fiber Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Water Absorption

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Porosity

6.5 Strength

6.6 Durability

6.7 Other Properties

Chapter 7: Coco Fiber Market by Form (2018-2035)

7.1 Coco Fiber Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Loose Fibre

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Compressed Bales

7.5 Coir Mats

7.6 Coir Yarn

7.7 Other Forms

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Coco Fiber Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ALLWIN COIR (INDIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ASIAN COIR PRODUCTS (SRI LANKA)

8.4 BENKAY FIBRE (PHILIPPINES)

8.5 BENLION COIR INDUSTRIES (INDIA)

8.6 CLASSIC COIR (INDIA)

8.7 COIR BOARD OF INDIA (INDIA)

8.8 CV COCO MANDIRI (INDONESIA)

8.9 CV COCO MATIC (INDONESIA)

8.10 DUTCH PLANTIN (NETHERLANDS)

8.11 ECO CEYLON EXPORTS (SRI LANKA)

8.12 FIBREDUST LLC (USA)

8.13 GEEWIN EXIM (INDIA)

8.14 GREENFIBER INTERNATIONAL (NETHERLANDS)

8.15 GROWRITE SUBSTRATES (AUSTRALIA)

8.16 GVP LANKA EXPORTS (SRI LANKA)

8.17 HAYLEYS FIBRE (SRI LANKA)

8.18 JIFFY PRODUCTS INTERNATIONAL (NORWAY)

8.19 KLASMANN-DEILMANN GMBH (GERMANY)

8.20 NATURAL FIBRE EXPORT CO. (INDIA)

8.21 NEDSPICE PROCESSING LANKA (SRI LANKA)

8.22 PREMIER TECH HORTICULTURE (CANADA)

8.23 PT. COCO AGRINDO (INDONESIA)

8.24 PT. COCO FIBER GLOBAL INDONESIA (INDONESIA)

8.25 PT. NATURE COCO INDONESIA (INDONESIA)

8.26 RETTENMAIER GROUP (GERMANY)

8.27 SREE MANGAL MOORTI COIR INDUSTRY (INDIA)

8.28 SRI VELAVAN COCONUT PRODUCTS (INDIA)

8.29 SWARNA TRADES (INDIA)

8.30 VAIGHAI AGRO PRODUCTS LIMITED (INDIA)

8.31 WILMINGTON FIBRE SPECIALTY COMPANY (USA)

8.32 AND OTHER ACTIVE PLAYERS

Chapter 9: Global Coco Fiber Market By Region

9.1 Overview

9.2. North America Coco Fiber Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Coco Fiber Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Coco Fiber Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Coco Fiber Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Coco Fiber Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Coco Fiber Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Coco Fiber Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 0.43 billion |

|

Forecast Period 2025-35 CAGR: |

8.5% |

Market Size in 2035: |

USD 1.05 billion |

|

Segments Covered: |

By Fibre Type |

|

|

|

By Application |

|

||

|

By Property |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||