Cloud Infrastructure-as-a-Service Market Synopsis

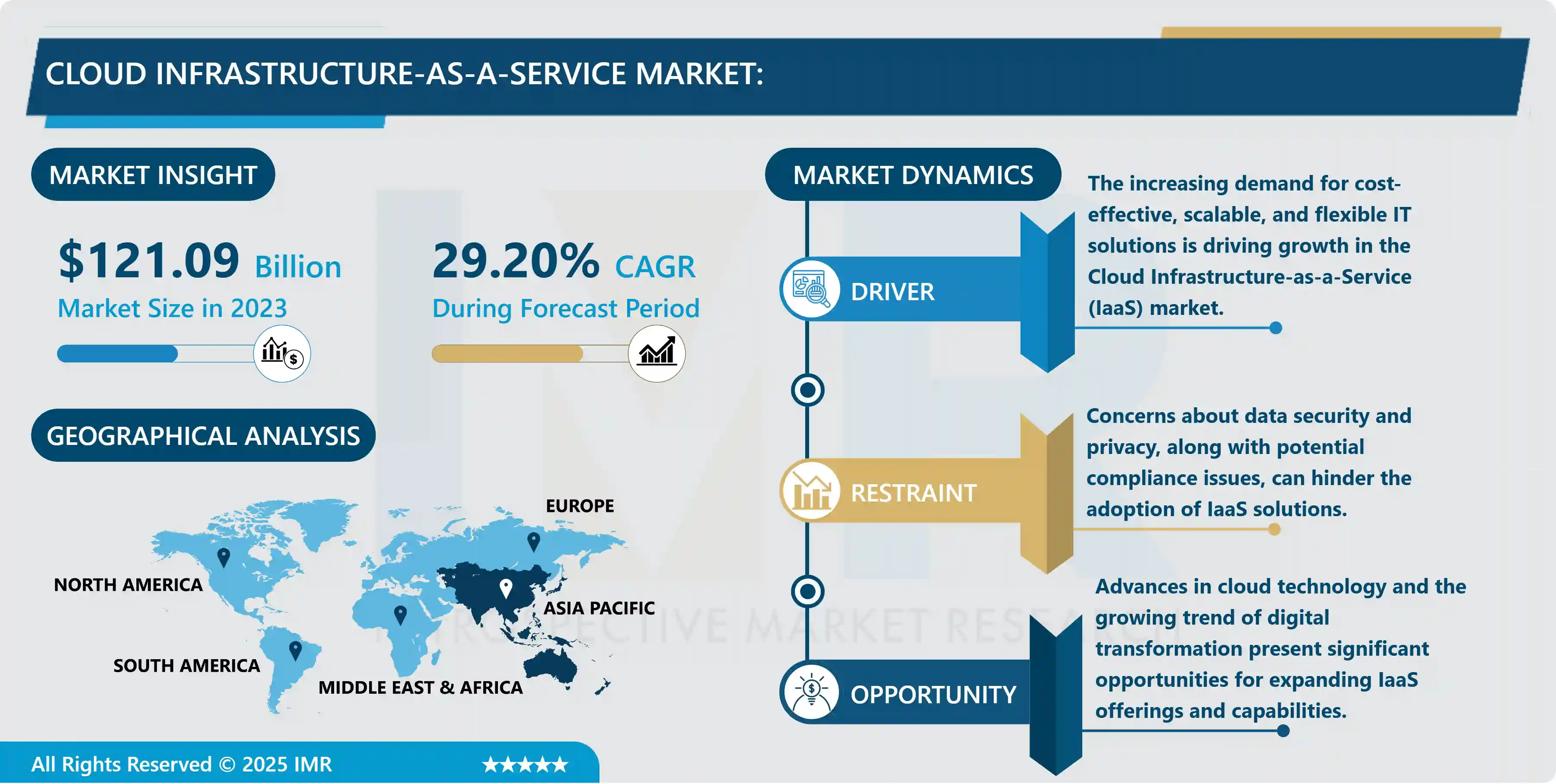

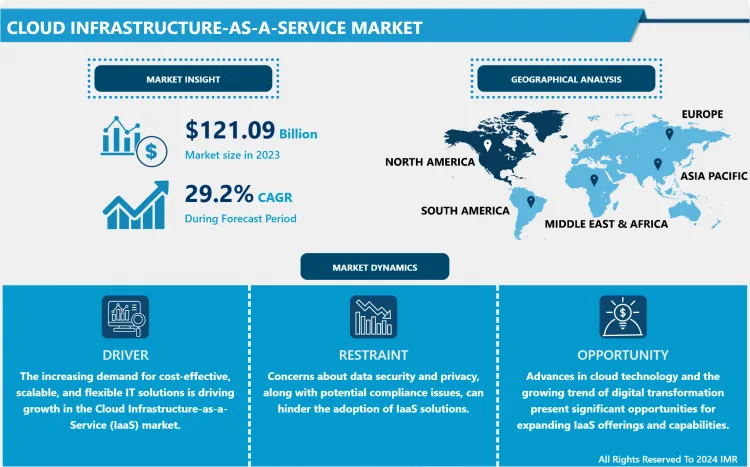

Cloud Infrastructure-as-a-Service Market Size is Valued at USD 121.09 Billion in 2023 and is Projected to Reach USD 1214.71 Billion by 2032, Growing at a CAGR of 29.20% From 2024-2032.

IaaS is one of the sub segment of the Cloud Market that is rapidly growing due to high demand for the cloud technologies in this field. IaaS is a flexible and cost-effective model for acquiring virtualized computing resources which helps organizations to manage their IT assets at different scale without large investments into such assets. The market is highly dynamic, moving from on premise to cloud, where companies are moreflexible, cost effective, and efficient. The major industry participants provide computing services such as processing and storage and connectivity services such as networking services through different deployment models including public, private, and hybrid clouds to support various organizations’ requirements. In addition, the demand for shifting to the usage of IT services, including the results of AI and big data, has lead to development of the IaaS market and makes it an essential part of modern IT plans.

One type of cloud computing is IaaS and the market for IaaS has been steadily growing over the past several years. IaaS allows businesses to use internet based metered and flexible computational resources including virtual servers, storage and network. This model helps organization to respond quickly to the dynamically scaling demands for resources, decrease the costs of IT support, and avoid large initial investments. The IaaS market is being driven by the rising adoption of IT solutions that are flexible and inexpensive, as well as the shift to digitalization.

To meet these disparate needs, market actors continually launch various services, including the hybrid cloud, analytics, and improved security services. AWS and Microsoft Azure remain the leaders in the market, and Google Cloud Platform is continuously growing as well; all these cloud providers add more services and locations over the time. This competition is a feature of this market that has been most evident in defining it. New developments in IaaS are being prompted by other new technologies like artificial intelligence and machine learning, which would enable organisations to leverage on new better tools and functionalities. Based on this view of an increasingly cloud-centric business world, especially for development, we expect IaaS market to expand further.

Cloud Infrastructure-as-a-Service Market Trend Analysis

Increased Adoption of Hybrid Cloud Solutions

- One interesting trend in this aspect is connected with the integration of the hybrid facilities in the cloud IaaS market. Business and companies are slowly and steadily trying to integrate multi-cloud solution with on premise setting for maximum investment, cloud flexibility and scale. Private Cloud is an approach by which organizations retain their data and applications in their own private data center while utilizing the public cloud for other applications that aren’t sensitive and have a public cloud hybrid model and the other gives the organizations the best of both worlds. It also allows organizations to harness that cloud feature directly for the day to day tasks of the enterprise without the risk of the security of the most sensitive data.

- The prospect of a changing demand and a need to find an equillibrium between a company’s central IT needs and the regulatory measures that must be implemented is the main driver of the shift to the hybrid cloud. Businesses remain to shift towards hybrid cloud solutions in order to enjoy better resource utilization, availability of better disaster recovery solutions and increased operational efficiency. It is crucial to expect that the further development and adoption of the IaaS market will change according to this tendency in the following years of cloud infrastructure deployment and management.

Integration of Artificial Intelligence and Machine Learning

- The IaaS market is being impacted by AI and more specifically by machine learning. The IaaS providers are gradually deploying AI and ML solutions to improve atomization and resource control as well as to add analytical features to their solutions. The integration of AI and ML in cloud computing helps cloud providers introduce solutions smarter in handling workloads, optimising performance, and enabling real-time scaling. This integration helps the organizations to get more better and enhanced cloud services, reduced cost and further enhanced operational performance.

- Also, there are various new developments in IaaS due to the incorporation of AI and ML in market security and compliance. Advanced algorithms guarantee compliance supervision and the identification of emergent threats preventing security breaches.A control over the capability of AI, and particularly of ML, running within cloud infrastructure will become a competitive advantage, furthering innovation, and meeting ascending market requirements as digital transformation expands across organizations.

Cloud Infrastructure-as-a-Service Market Segment Analysis:

Cloud Infrastructure-as-a-Service Market Segmented on the basis of By Service Model, By Deployment Model, By Organization Size, and By Industry Vertical.

By Service Model, Networking segment is expected to dominate the market during the forecast period

- IaaS cloud infrastructure services market consists of the Service Model which highlights areas and features of the services being offered. Compute services are servers offering virtual machine environment to host, run, and process applications and workloads without investment in physical infrastructure. Storage services give clients cost-effective and secure solutions for storage of their big data with high availability and fault tolerance.

- The networking services allow interaction of the cloud resources with other resources on the internet, and forging security enhanced and optimized transfer and communication solutions. Backup & Recovery services which guarantee that data is backed up and can be recovered in case of loss or corruption while Disaster Recovery services provide total solutions to the problem of recovery in business during disaster or failure.

- These service models combined address all these business requirements as organizations seek to improve on their IT infrastructure and avoid huge capital investments while improving on their operating effectiveness. The increasing trends of IaaS in different industries give it priority in the digital shift and in facilitating the current sophisticated enterprise applications and business processes. As organizations shift their focus on innovation and managing of IT resources through cloud solutions, the need for multi-hyped and solid infrastructures has been on the rise comes in the form of IaaS service models.

By Industry Vertical, Banking segment held the largest share in 2024

- The Cloud Infrastructure-as-a-Service (IaaS) market is undergoing substantial growth in a variety of industry verticals, each of which is utilizing cloud technologies to improve operational efficiency and scalability. Infrastructure as a service (IaaS) solutions are utilized in the Banking, Financial Services, and Insurance (BFSI) sector to manage sensitive financial data, support complex transactions, and ensure disaster recovery.

- These solutions are secure and compliant. Healthcare organizations employ IaaS to manage substantial quantities of patient data, enable telemedicine services, and adhere to regulations such as HIPAA. IaaS helps the retail sector by facilitating the management of inventory systems with high availability and performance, as well as by enabling scalable e-commerce platforms.

- IaaS is employed by telecommunications companies to support network operations and customer management systems, while the government sector utilizes it to administer public services, data storage, and disaster recovery at a cost-effective rate.

- IaaS is utilized by manufacturing industries to integrate supply chain management, production analytics, and IoT applications. In general, the scalability and adaptability of IaaS are designed to meet the diverse requirements of various industries, thereby fostering innovation and growth in various sectors.

Cloud Infrastructure-as-a-Service Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- How it is expected to impact is that Asia Pacific will be the market leader in cloud infrastructure-as-a-service (IaaS) for the entire forecast period. This is due to technological breakthrough in this region, increased penetration of internet use and increase in digitization. The main driver behind the development of cloud infrastructure within the region is the continued need for high flexibility and cost-efficient measures from establishments that are aiming to advance their function and minimize on their sunk costs through the use of enhanced IT solutions. The first three countries in this respect are China, India, and Japan, which are actively building cloud infrastructure in order to support digital business transformations and rapidly growing technology industries.

- In addition, increases in the number of SMEs, the migration to the hybrid and multi-cloud models, also contribute to market growth. The IaaS technology has become common among APAC governments and enterprises because of valuable applications, business continuity, and flexibility. It can be expected that Asia Pacific will continue to lead the way in the worldwide IaaS market, due in part to the economy’s current state in the region and steady innovations in cloud technology.

Active Key Players in the Cloud Infrastructure-as-a-Service Market

- Amazon Web Services, Inc. (United States)

- Google LLC (United States)

- Microsoft Corporation (United States)

- IBM Corporation (United States)

- Oracle Corporation (United States)

- Alibaba Cloud (China)

- Rackspace Inc. (United States)

- Fujitsu Limited (Japan)

- CenturyLink, Inc. (United States)

- VMware, Inc. (United States)

- DXC Technology (United States)

- Dimension Data (South Africa)

- Verizon Wireless (United States)

- Tencent Holdings Ltd. (China)

- AT&T Mobility LLC (United States)

- NEC Corporation (Japan)

- Others

|

Global Cloud Infrastructure-as-a-Service Market: |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 121.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

29.20% |

Market Size in 2032: |

USD 1214.71 Bn. |

|

Segments Covered: |

By Service Model |

|

|

|

By Deployment Model |

|

||

|

By Organization Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cloud Infrastructure-as-a-Service Market by Service Model (2018-2032)

4.1 Cloud Infrastructure-as-a-Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Compute

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Storage

4.5 Networking

4.6 Backup & Recovery

4.7 Disaster Recovery

Chapter 5: Cloud Infrastructure-as-a-Service Market by Deployment Model (2018-2032)

5.1 Cloud Infrastructure-as-a-Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Public Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Private Cloud

5.5 Hybrid Cloud

Chapter 6: Cloud Infrastructure-as-a-Service Market by Organization Size (2018-2032)

6.1 Cloud Infrastructure-as-a-Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium Enterprises (SMEs)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Cloud Infrastructure-as-a-Service Market by Industry Vertical (2018-2032)

7.1 Cloud Infrastructure-as-a-Service Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Banking

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Financial Services

7.5 Insurance (BFSI)

7.6 Healthcare

7.7 Retail

7.8 Government

7.9 Telecommunications

7.10 Manufacturing

7.11 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cloud Infrastructure-as-a-Service Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ACCENTURE PLC (IRELAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ACELOT INC (US)

8.4 CLOUD PHARMACEUTICALS INC. (US)

8.5 DASSAULT SYSTEMES (FRANCE)

8.6 IBM CORPORATION (US)

8.7 SAS INSTITUTE INC. (THE US)

8.8 TATA CONSULTANCY SERVICES LTD. (INDIA)

8.9 WUXI APPTEC (CHINA)

8.10 COLLABORATIVE DRUG DISCOVERY (CDD)

8.11 SCYNEXIS INC. (THE US)

8.12 MEDIDATA (US)

8.13 CERTARA (US)

8.14 GOOGLE (US)

8.15 CLOUDPHARM

8.16 AMAZON WEB SERVICES INC. (US)

Chapter 9: Global Cloud Infrastructure-as-a-Service Market By Region

9.1 Overview

9.2. North America Cloud Infrastructure-as-a-Service Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Service Model

9.2.4.1 Compute

9.2.4.2 Storage

9.2.4.3 Networking

9.2.4.4 Backup & Recovery

9.2.4.5 Disaster Recovery

9.2.5 Historic and Forecasted Market Size by Deployment Model

9.2.5.1 Public Cloud

9.2.5.2 Private Cloud

9.2.5.3 Hybrid Cloud

9.2.6 Historic and Forecasted Market Size by Organization Size

9.2.6.1 Small and Medium Enterprises (SMEs)

9.2.6.2 Large Enterprises

9.2.7 Historic and Forecasted Market Size by Industry Vertical

9.2.7.1 Banking

9.2.7.2 Financial Services

9.2.7.3 Insurance (BFSI)

9.2.7.4 Healthcare

9.2.7.5 Retail

9.2.7.6 Government

9.2.7.7 Telecommunications

9.2.7.8 Manufacturing

9.2.7.9 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Cloud Infrastructure-as-a-Service Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Service Model

9.3.4.1 Compute

9.3.4.2 Storage

9.3.4.3 Networking

9.3.4.4 Backup & Recovery

9.3.4.5 Disaster Recovery

9.3.5 Historic and Forecasted Market Size by Deployment Model

9.3.5.1 Public Cloud

9.3.5.2 Private Cloud

9.3.5.3 Hybrid Cloud

9.3.6 Historic and Forecasted Market Size by Organization Size

9.3.6.1 Small and Medium Enterprises (SMEs)

9.3.6.2 Large Enterprises

9.3.7 Historic and Forecasted Market Size by Industry Vertical

9.3.7.1 Banking

9.3.7.2 Financial Services

9.3.7.3 Insurance (BFSI)

9.3.7.4 Healthcare

9.3.7.5 Retail

9.3.7.6 Government

9.3.7.7 Telecommunications

9.3.7.8 Manufacturing

9.3.7.9 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Cloud Infrastructure-as-a-Service Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Service Model

9.4.4.1 Compute

9.4.4.2 Storage

9.4.4.3 Networking

9.4.4.4 Backup & Recovery

9.4.4.5 Disaster Recovery

9.4.5 Historic and Forecasted Market Size by Deployment Model

9.4.5.1 Public Cloud

9.4.5.2 Private Cloud

9.4.5.3 Hybrid Cloud

9.4.6 Historic and Forecasted Market Size by Organization Size

9.4.6.1 Small and Medium Enterprises (SMEs)

9.4.6.2 Large Enterprises

9.4.7 Historic and Forecasted Market Size by Industry Vertical

9.4.7.1 Banking

9.4.7.2 Financial Services

9.4.7.3 Insurance (BFSI)

9.4.7.4 Healthcare

9.4.7.5 Retail

9.4.7.6 Government

9.4.7.7 Telecommunications

9.4.7.8 Manufacturing

9.4.7.9 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Cloud Infrastructure-as-a-Service Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Service Model

9.5.4.1 Compute

9.5.4.2 Storage

9.5.4.3 Networking

9.5.4.4 Backup & Recovery

9.5.4.5 Disaster Recovery

9.5.5 Historic and Forecasted Market Size by Deployment Model

9.5.5.1 Public Cloud

9.5.5.2 Private Cloud

9.5.5.3 Hybrid Cloud

9.5.6 Historic and Forecasted Market Size by Organization Size

9.5.6.1 Small and Medium Enterprises (SMEs)

9.5.6.2 Large Enterprises

9.5.7 Historic and Forecasted Market Size by Industry Vertical

9.5.7.1 Banking

9.5.7.2 Financial Services

9.5.7.3 Insurance (BFSI)

9.5.7.4 Healthcare

9.5.7.5 Retail

9.5.7.6 Government

9.5.7.7 Telecommunications

9.5.7.8 Manufacturing

9.5.7.9 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Cloud Infrastructure-as-a-Service Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Service Model

9.6.4.1 Compute

9.6.4.2 Storage

9.6.4.3 Networking

9.6.4.4 Backup & Recovery

9.6.4.5 Disaster Recovery

9.6.5 Historic and Forecasted Market Size by Deployment Model

9.6.5.1 Public Cloud

9.6.5.2 Private Cloud

9.6.5.3 Hybrid Cloud

9.6.6 Historic and Forecasted Market Size by Organization Size

9.6.6.1 Small and Medium Enterprises (SMEs)

9.6.6.2 Large Enterprises

9.6.7 Historic and Forecasted Market Size by Industry Vertical

9.6.7.1 Banking

9.6.7.2 Financial Services

9.6.7.3 Insurance (BFSI)

9.6.7.4 Healthcare

9.6.7.5 Retail

9.6.7.6 Government

9.6.7.7 Telecommunications

9.6.7.8 Manufacturing

9.6.7.9 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Cloud Infrastructure-as-a-Service Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Service Model

9.7.4.1 Compute

9.7.4.2 Storage

9.7.4.3 Networking

9.7.4.4 Backup & Recovery

9.7.4.5 Disaster Recovery

9.7.5 Historic and Forecasted Market Size by Deployment Model

9.7.5.1 Public Cloud

9.7.5.2 Private Cloud

9.7.5.3 Hybrid Cloud

9.7.6 Historic and Forecasted Market Size by Organization Size

9.7.6.1 Small and Medium Enterprises (SMEs)

9.7.6.2 Large Enterprises

9.7.7 Historic and Forecasted Market Size by Industry Vertical

9.7.7.1 Banking

9.7.7.2 Financial Services

9.7.7.3 Insurance (BFSI)

9.7.7.4 Healthcare

9.7.7.5 Retail

9.7.7.6 Government

9.7.7.7 Telecommunications

9.7.7.8 Manufacturing

9.7.7.9 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Cloud Infrastructure-as-a-Service Market: |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 121.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

29.20% |

Market Size in 2032: |

USD 1214.71 Bn. |

|

Segments Covered: |

By Service Model |

|

|

|

By Deployment Model |

|

||

|

By Organization Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||