Clear Aligners Market Synopsis

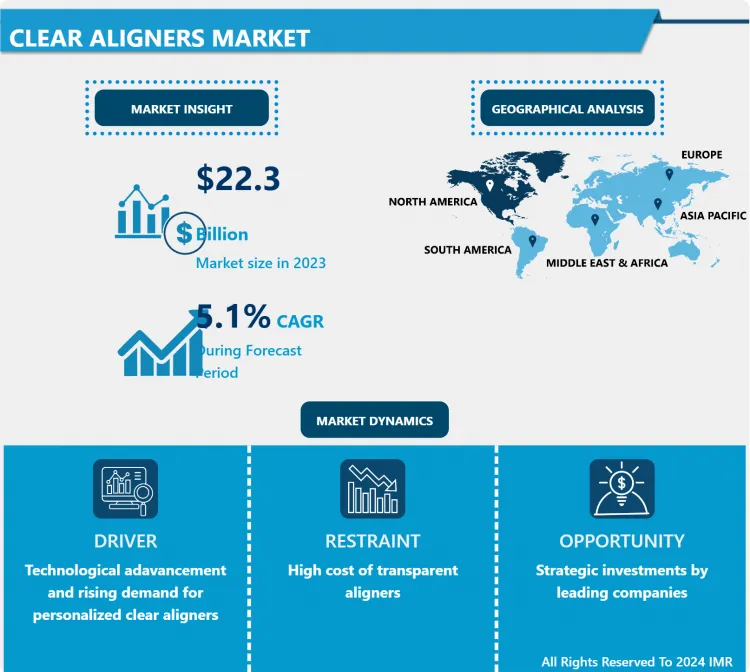

Clear Aligners Market Size Was Valued at USD 5.1 Billion in 2023, and is Projected to Reach USD 31.2 Billion by 2032, Growing at a CAGR of 22.3% From 2024-2032.

Clear aligners are one of BPA-free, thin, and transparent plastic dental braces that are used for space closure. They are wearable appliances that are used instead of the normal braces that are fixed to align teeth to their proper positions. Clear aligners work in the same concept as braces but there is a use of force to move the teeth and no brackets or metal wires like in braces. This is made of resilient plastic and is manufactured to match the phenomenal make-up of an individual’s mouth. In case a set of aligners is needed, all of them slowly move the teeth closer to the wanted position.

Like ordinary braces, aligners are made to adjust the position of the teeth in a controlled process. This study is common and can include X rays, pictures, and impressions or digital scans of the teeth will be taken before the orthodontist begins treatment on a patient. From this information, the orthodontist arrives at a diagnosis and lays out the smile, including where each tooth should go and in what order it will move – to healthier alignment. Clear orthodontic aligners work best for patients with only slightly rotated and/or crowded teeth or those with mere spacing issues.

Some cases such as severe crowding and spacing or the presence of severe under bite, over bite or cross bite require more complex treatments. These aligners are transparent, and plastic replicas of the teeth that one needs to align. They are to be worn which helps apply slight pressure on the teeth and thereby reposition them slightly. For proper functioning, aligner should be worn for 22 hours a day or as prescribed by the orthodontist. The various pairs of aligners that make up the set can be worn for a week or two before the next set of aligners is worn. Teeth shift to their correct positions gradually as a result of orchestration by the orthodontist. The total number of aligners that the patient needs depends on certain factors known as the patient’s prescription. After developping a new positions for their teeth, patients will then require retainers just like in the conventional braces.

- Market is expanding globally as there is a rise in the numbers of patients who have orthodontic issue which has boosted the demand for clear aligners. Higher risk factors for getting oral illness includes, poor diet, especially one with high sugar content, tobacco use, poor oral hygiene, and extreme alcohol intake

- The growth of this market is mainly because of technological advancements in clear aligner bracket systems and increasing demand for clear aligners in the market. Some of the companies in this industry for instance Align Technologies and DynaFlex never cease to unveil new CAD in the market. Take for instance, iTero, a digital impression technology introduced by Align Technology to help create precise clear aligner treatment options that are effective and unique to the patient.

- The factor that led to the growth of this marker was that people were less willing to visit an orthodontist to get the traditional teeth braces that led to the increased use of clear aligners. Pandemics played the role of promoting the industry in terms of adoption, sales and overall revenues, and many more such trends are predicted in the future.

Clear Aligners Market Trend Analysis

Increasing expenditure on healthcare

- Rising heath cost has reduced the human intervention and has enhanced the quality of patient service delivery. However, the use of new technology in the healthcare organizations has also benefited and offered many services to the patients satisfying their requirements. For instance, over the last decade, Middle East and Africa health care spending by the government and private sectors has been significantly increasing. The institutional background for escalating healthcare funding in this region includes things like growing urbanization and development of healthcare.

- Moreover, more product introduction is rankling market growth for clear aligners due to the growing demands of the public. In addition, over the last few years there has been a sharp increase in the spending of the Asia-Pacific countries ‘healthcare organizations together with private companies. Thus, an increase in health expense across the world is expected to increase the per capita income and eventually drive the accretion in healthcare spending that forms the basis for the market growth.

Rising number of people going for dental aesthetics

- The increased popularity of clear aligners is due to increased awareness of beauty enhancement procedures and people across the globe. This kind of aligners is very translucent and can treat many simple to average orthodontic issues. Facility in technology has seen prominent enhancement of clear aligners hence enhancing patient’s preference of clear aligners over the conventional mode of dental braces. This factor helps in market size of clear aligners to grow.

- There is a growth in the per capita income of the population across the world from one year to the other and that is why people today do not have any problem parting with their little resources to have the procedures done. Thus, the growth in the clean aligners market is further complemented by this factor. The increase in the market trends of clear aligners because of the discomfort associated with metal and ceramic braces as well as gum irritation for a long term makes people find better teeth aligner such as clear aligners. From the Dental Tribune, clear aligners are cited as the most suitable option to metal as well as ceramic braces. In addition, enhancement in the digital scanning and computer-aided design (CAD-CAM) also fuels the clear aligners market.

Clear Aligners Market Segment Analysis:

Clear Aligners Market Segmented based on Age, Material Type, End-Use, and Distribution Channel.

By Age, adults segment is expected to dominate the market during the forecast period

- The adults segment is expected to lead the market throughout the period under consideration and is expected to register a healthier growth rate in the upcoming years. Such conditions include malocclusion which is common with the population besides having an impact on the quality of life of the patient, it results in problems which include poor dentofacial aesthetics, functional disturbances of the teeth, cosmetics like mastication and swallowing, speech and higher risk of dental and periodontal trauma. Nowadays, appearance including dental appearance is an important part of the society and their acceptable appearance is a must. Importance of dental looks is perhaps observed more among the adolescents in the population. Another rapidly expanding field in orthodontics is aligner therapy; this concept has received much attention from patients because of its perceived advantages concerning comfort, convenience, and aesthetics.

By Material Type, polyurethane segment held the largest share in 2023

- Polyurethane was dominated in the market in 2023 due to the invisalign clear aligner which belongs to the polyurethane material type. Obviously, the use of polyurethane as an element in an aligner has the following benefits. If seems to be a very characteristic material for both hard and soft part because it contains many characteristics. A substance that can be used to produce such items that when these products are applied on the teeth, they can be easily put into an alignment. While still being soft enough for the wearer to even sleep with the anklets on for several hours.

- In essence, success in using aligners depend in their being kept in and not taken out by the patients. These aligners also cannot be affected by general procedures for example, grinding and biting. Moreover, while using for aligners production, polyurethane (PU) PU foils are believed to have more advantages than PETG.

Clear Aligners Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America held the largest market share in the year of 2023 and is considered to have a higher growth rate in the coming years. This is because of growing R & D expenditures and the localization of many international companies and their attempts to secure new patents. According to the research carried out among the respondents of the American Dental Association, it was evident that 85% of those who took the survey were very serious with dental health and seen oral health as part of general health care. Approximately four million Americans have braces and 25% of these people are adults; however clear tray-style aligners have been introduced and most patients who seek orthodontic treatment do not consider this option because of the ugliness of metals. Some of the important reasons have been the clients’ rising awareness regarding the new advancement in dental care, various suitable opportunities to treat teeth misalignment, and skyrocketing beauty norms that have led individuals to adopt aligners and consequently boosting the U. S. clear aligners market.

Active Key Players in the Clear Aligners Market

- Align Technology

- Dentsply Sirona

- Institute Straumann

- Envista Corporation

- 3M ESPE

- Argen Corporation

- Henry Schein Inc

- TP Orthodontics Inc

- SmileDirect Club

- Angel Aligner

- Other Key Players

Key Industry Developments in the Clear Aligners Market:

- In May 2023, SmileDirect Club announced the US introduction of a patented SmileMaker platform that will extend the possibilities of orthodontic. This platform employs the use of AI in the capturing of a 3D scan of the teeth which helps make the clear aligner treatment possible for the consumer.

- In May 2022, the PlusDental company became a part of Straumann Group to further strengthen the company’s holding in the sphere of consumer-oriented orthodontics and clear aligner treatments for potential patients.

|

Global Clear Aligners Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.3 % |

Market Size in 2032: |

USD 31.2 Bn. |

|

Segments Covered: |

By Age |

|

|

|

By Material Type |

|

||

|

By End-use |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Clear Aligners Market by Age (2018-2032)

4.1 Clear Aligners Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Adults

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Teens

Chapter 5: Clear Aligners Market by Material Type (2018-2032)

5.1 Clear Aligners Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Polyurethane

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastic Polyethylene Terephthalate Glycol

5.5 Others

Chapter 6: Clear Aligners Market by End-use (2018-2032)

6.1 Clear Aligners Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Stand Alone Practices

6.5 Group Practices

6.6 Others

Chapter 7: Clear Aligners Market by Distribution Channel (2018-2032)

7.1 Clear Aligners Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Online

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Offline

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Clear Aligners Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ALIGN TECHNOLOGY

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DENTSPLY SIRONA

8.4 INSTITUTE STRAUMANN

8.5 ENVISTA CORPORATION

8.6 3M ESPE

8.7 ARGEN CORPORATION

8.8 HENRY SCHEIN INC

8.9 TP ORTHODONTICS INC

8.10 SMILEDIRECT CLUB

8.11 ANGEL ALIGNER

8.12 OTHER KEY PLAYERS

Chapter 9: Global Clear Aligners Market By Region

9.1 Overview

9.2. North America Clear Aligners Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Age

9.2.4.1 Adults

9.2.4.2 Teens

9.2.5 Historic and Forecasted Market Size by Material Type

9.2.5.1 Polyurethane

9.2.5.2 Plastic Polyethylene Terephthalate Glycol

9.2.5.3 Others

9.2.6 Historic and Forecasted Market Size by End-use

9.2.6.1 Hospitals

9.2.6.2 Stand Alone Practices

9.2.6.3 Group Practices

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Online

9.2.7.2 Offline

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Clear Aligners Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Age

9.3.4.1 Adults

9.3.4.2 Teens

9.3.5 Historic and Forecasted Market Size by Material Type

9.3.5.1 Polyurethane

9.3.5.2 Plastic Polyethylene Terephthalate Glycol

9.3.5.3 Others

9.3.6 Historic and Forecasted Market Size by End-use

9.3.6.1 Hospitals

9.3.6.2 Stand Alone Practices

9.3.6.3 Group Practices

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Online

9.3.7.2 Offline

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Clear Aligners Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Age

9.4.4.1 Adults

9.4.4.2 Teens

9.4.5 Historic and Forecasted Market Size by Material Type

9.4.5.1 Polyurethane

9.4.5.2 Plastic Polyethylene Terephthalate Glycol

9.4.5.3 Others

9.4.6 Historic and Forecasted Market Size by End-use

9.4.6.1 Hospitals

9.4.6.2 Stand Alone Practices

9.4.6.3 Group Practices

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Online

9.4.7.2 Offline

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Clear Aligners Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Age

9.5.4.1 Adults

9.5.4.2 Teens

9.5.5 Historic and Forecasted Market Size by Material Type

9.5.5.1 Polyurethane

9.5.5.2 Plastic Polyethylene Terephthalate Glycol

9.5.5.3 Others

9.5.6 Historic and Forecasted Market Size by End-use

9.5.6.1 Hospitals

9.5.6.2 Stand Alone Practices

9.5.6.3 Group Practices

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Online

9.5.7.2 Offline

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Clear Aligners Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Age

9.6.4.1 Adults

9.6.4.2 Teens

9.6.5 Historic and Forecasted Market Size by Material Type

9.6.5.1 Polyurethane

9.6.5.2 Plastic Polyethylene Terephthalate Glycol

9.6.5.3 Others

9.6.6 Historic and Forecasted Market Size by End-use

9.6.6.1 Hospitals

9.6.6.2 Stand Alone Practices

9.6.6.3 Group Practices

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Online

9.6.7.2 Offline

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Clear Aligners Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Age

9.7.4.1 Adults

9.7.4.2 Teens

9.7.5 Historic and Forecasted Market Size by Material Type

9.7.5.1 Polyurethane

9.7.5.2 Plastic Polyethylene Terephthalate Glycol

9.7.5.3 Others

9.7.6 Historic and Forecasted Market Size by End-use

9.7.6.1 Hospitals

9.7.6.2 Stand Alone Practices

9.7.6.3 Group Practices

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Online

9.7.7.2 Offline

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Clear Aligners Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.3 % |

Market Size in 2032: |

USD 31.2 Bn. |

|

Segments Covered: |

By Age |

|

|

|

By Material Type |

|

||

|

By End-use |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Clear Aligners Market research report is 2024-2032.

Align Technology; Dentsply Sirona; Institute Straumann; Envista Corporation; 3M ESPE, Argen Corporation; Henry Schein Inc; TP Orthodontics Inc; SmileDirect Club; Angel Aligner, and Other Major Players.

The Clear Aligners Market is segmented into age, material type, end-use, distribution channel, and region. By age, the market is categorized into adults, teens. By material type, the market is categorized into polyurethane, plastic polyethylene terephthalate glycol, and others. By end-use, the market is categorized into hospitals, standalone practices, others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Clear aligner, is an invisible medical device worn on the teeth to accomplish the necessary teeth movement to the correct positions. It can even be made from medical grade plastic like Polyurethane, Poly-ethylene terephthalate glycol and Poly-vinyl chloride, and can be manually set up or designed with the help of CAD/ CAM technologies. In general the powder is invoked to by children, teenagers, and aged people in treating diastema, as well as crooked or misaligned teeth. Thirdly, it is the orthodontic appliances, which have shifted from metal and ceramic braces to clear aligners since they are removable thus allowing the patients to brush, floss and rinse their teeth without these appliances. Research has also pointed out that clear aligners such as the Invisalign have a positive impact on the periodontal health than fixed appliances such as; the metal and ceramic braces.

Clear Aligners Market Size Was Valued at USD 5.1 Billion in 2023, and is Projected to Reach USD 31.2 Billion by 2032, Growing at a CAGR of 22.3% From 2024-2032.