Key Cleanroom Technology Market Highlights:

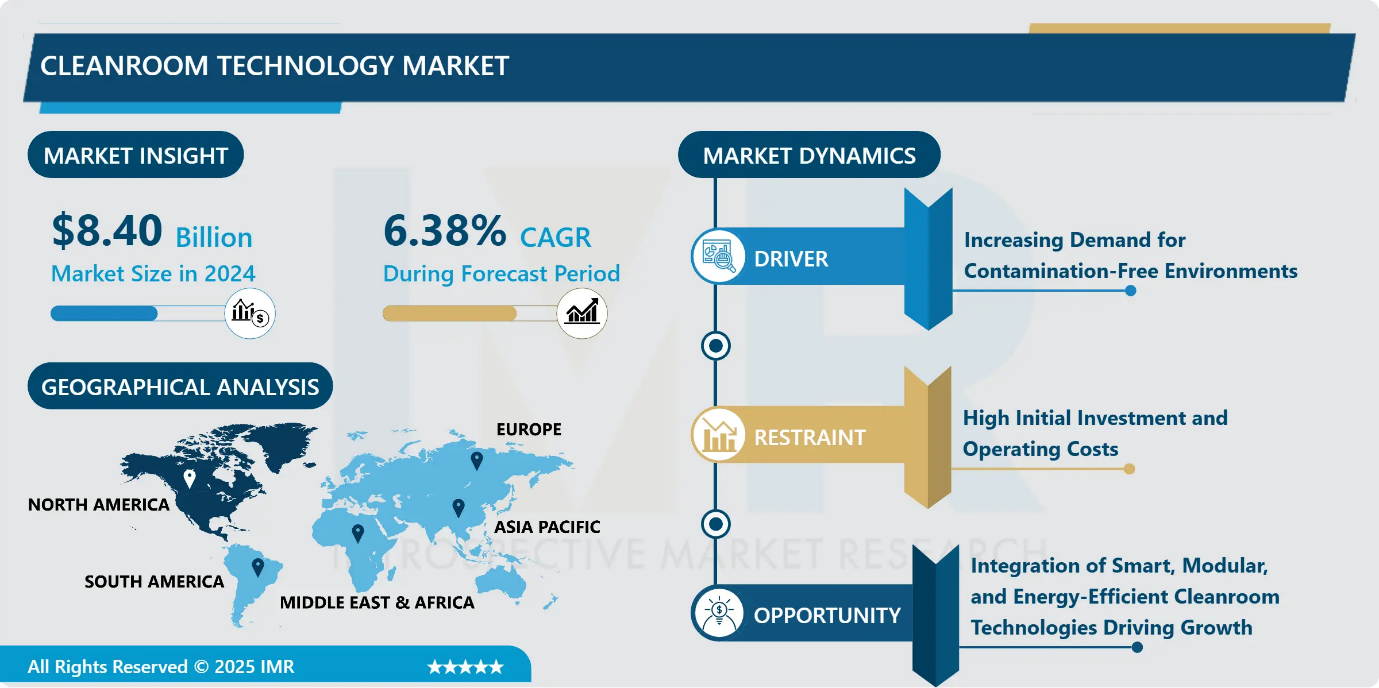

Cleanroom Technology Market Size Was Valued at USD 8.40 Billion in 2024, and is Projected to Reach USD 16.59 Billion by 2035, Growing at a CAGR of 6.38% from 2025-2035.

- Cleanroom Technology Market Size in 2024: USD 8.40 Billion

- Projected Cleanroom Technology Market Size by 2035: USD 16.59 Billion

- CAGR (2025–2035): 6.38%

- Leading Cleanroom Technology Market in 2024: North America

- Fastest-Growing Cleanroom Technology Market: Asia-Pacific

- By Component: The Consumables segment is anticipated to lead the Cleanroom Technology Market by accounting for 56.12% of the Cleanroom Technology Market share throughout the forecast period.

- By End-User: The Pharmaceutical Industry segment is expected to capture 28.80% of the Cleanroom Technology Market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.4% of the Cleanroom Technology Market share during the forecast period.

- Active Players: ABN Cleanroom Technology (Belgium), Advanced Technology Group (U.S.), Airtech Japan, Ltd. (Japan), Ardmac (Ireland), Azbil Corporation (Japan), and Other Active Players, and Other Active Players.

Cleanroom Technology Market Synopsis:

Cleanroom technology involves specialized engineering systems and strict operational practices used to control airborne contaminants such as dust, microorganisms, aerosols, and chemical vapors. It provides a controlled environment that is essential for industries including pharmaceuticals, biotechnology, medical devices, semiconductors, electronics, and food processing. Cleanrooms function by passing external air through advanced filtration systems such as HEPA and ULPA filters to regulate airflow, temperature, humidity, and pressure. The Cleanroom Technology Market is witnessing steady growth due to the rising demand for sterile manufacturing, especially in pharmaceutical production, biopharmaceutical processing, and semiconductor fabrication. The increasing adoption of modular cleanrooms, automation, and digital monitoring systems has improved operational efficiency and reduced installation time. Regulatory standards enforced by organizations such as the FDA and ISO continue to encourage investments in validated cleanroom facilities. During the COVID-19 pandemic, cleanroom demand increased sharply due to the urgent need for vaccines, medicines, and medical supplies. Despite high installation and maintenance costs, expanding healthcare infrastructure, growing research activities, and advanced manufacturing continue to support long-term Cleanroom Technology Market growth.

Cleanroom Technology Market Dynamics and Trend Analysis:

Cleanroom Technology Market Growth Driver

Increasing Demand for Contamination-Free Environments

- The growing need for sterile and contamination-free production is a key driver of the cleanroom technology Cleanroom Technology Market. Rising investments in pharmaceutical, biotechnology, and semiconductor manufacturing have increased the requirement for controlled environments to ensure product quality and regulatory compliance. The expanding production of biologics, vaccines, and cell and gene therapies demands strict aseptic conditions to avoid cross-contamination.

- At the same time, advanced semiconductor and electronics manufacturing require ultra-clean environments to support precision processes. Increasing investments in laboratory and research infrastructure across developing countries are further supporting Cleanroom Technology Market growth. The use of modular cleanrooms, real-time monitoring systems, and automated airflow solutions is improving operational efficiency and reducing risks. In addition, tightening regulatory standards across healthcare and life science industries continue to strengthen long-term demand for cleanroom technologies.

Cleanroom Technology Market Limiting Factor

High Initial Investment and Operating Costs

- The installation of cleanroom facilities involves a very high initial investment for planning, construction, advanced HVAC systems, air filtration units, monitoring devices, and controlled environment technologies. These costs create a major challenge for small and medium-sized enterprises, as many lack the financial capacity to invest in such high-value infrastructure. In addition to setup costs, cleanrooms also require continuous spending on electricity, regular filter replacement, equipment calibration, and system validation to remain compliant with industry regulations.

- The need for skilled professionals to operate and maintain cleanroom systems further increases labor expenses. Cleanroom customization for industries such as pharmaceuticals and biotechnology adds more cost through frequent upgrades and strict compliance audits. As a result, the heavy financial burden associated with both installation and long-term maintenance remains one of the key factors limiting the widespread adoption of cleanroom technology, especially among budget-sensitive end users.

Cleanroom Technology Market Expansion Opportunity

Integration of Smart, Modular, and Energy-Efficient Cleanroom Technologies Driving Growth

- The cleanroom technology Cleanroom Technology Market is expanding due to increasing use of smart, modular, and energy-efficient solutions. Automation, real-time monitoring, and IoT-based sensors help control environmental conditions, reduce errors, and optimize energy consumption. Modular cleanrooms are preferred for their flexibility, rapid installation, and scalability across industries. Rising demand from advanced manufacturing sectors pharmaceuticals, semiconductors, electronics, and aerospace further supports adoption.

- At the same time, sustainability concerns are driving energy-efficient designs, including low-resistance HEPA filters, advanced HVAC systems, and LED lighting. Companies that focus on smart, adaptable, and eco-friendly cleanroom solutions can enhance operational efficiency, reduce costs, and meet regulatory standards, giving them a competitive edge while addressing the growing need for high-performance, contamination-controlled environments.

Cleanroom Technology Market Challenge and Risk

Design and Implementation Challenges in Cleanroom Technology

- Custom cleanroom designs are a key challenge in the Cleanroom Technology Market, as facilities must be tailored to specific industry requirements, products, and regulatory standards. Industries such as pharmaceuticals, biotechnology, microelectronics, and aerospace demand specialized environments with precise control over air filtration, temperature, humidity, and contamination. Clients often require flexible layouts, modular components, and scalable solutions, complicating design and construction. Balancing strict regulatory compliance with cost and energy efficiency adds further complexity. Integrating automation, monitoring systems, and specialized materials also presents challenges. Collaboration between manufacturers and end users, along with standardizing implementation, operation, and maintenance procedures, can help address these customization hurdles.

Cleanroom Technology Market Trend

Energy Efficiency and Advanced Environmental Management

- Energy efficiency is becoming a major focus in the cleanroom technology market. Systems such as variable air volume, demand-controlled ventilation, and heat recovery help reduce energy consumption while maintaining precise airflow and environmental conditions. Replacing traditional lighting with LED systems, often combined with motion sensors and daylight harvesting, further lowers electricity use. In June 2023, Motorola optimized temperature and humidity control in its cleanrooms, achieving significant energy savings without compromising operational standards. Growing demand for cleanrooms in healthcare, pharmaceuticals, and semiconductor manufacturing, along with strict contamination control requirements, is supporting this trend. Initiatives such as Cleanroom Academy and industry training programs are helping organizations adopt energy-efficient solutions while improving operational performance and maintaining regulatory compliance.

Cleanroom Technology Market Segment Analysis:

Cleanroom Technology Market is segmented based on Component, Equipment Type, Construction Type, End-Users, and Region

By Component, Consumables segment is expected to dominate the Cleanroom Technology Market with around 56.12% share during the forecast period.

- The consumables segment is expected to lead the cleanroom technology market with a share of 56.12%, driven by the ongoing need for gloves, garments, wipes, disinfectants, and face masks. These items are critical for maintaining hygiene, preventing contamination, and ensuring regulatory compliance across industries such as pharmaceuticals, biotechnology, and semiconductors. The recurring nature of consumable usage, along with rising quality standards and GMP protocols, supports consistent Cleanroom Technology Market growth.

- Consumables are divided into safety items, including gloves and apparel, and cleaning products, such as disinfectants and wipes, all essential for maintaining controlled environments. Meanwhile, the equipment segment is projected to grow at a higher CAGR due to the increasing adoption of modular cleanrooms, laminar airflow systems, HVAC units, and IoT-enabled environmental monitoring, catering to advanced manufacturing and high-value applications.

By End-User, Pharmaceutical Industry is expected to dominate with close to 28.80% Cleanroom Technology Market share during the forecast period.

- The pharmaceutical industry remains the dominant end user in the global cleanroom technology Cleanroom Technology Market, accounting for approximately 28.80% of total Cleanroom Technology Market revenue. This leadership is supported by strict regulatory frameworks such as GMP, FDA, and EMA guidelines, which require highly controlled environments for sterile drug manufacturing, injectable formulations, and quality testing. Cleanrooms are essential across multiple stages, including formulation, aseptic filling, packaging, and validation. The growing production of generics, biosimilars, vaccines, and specialty medicines has significantly increased the installation of cleanroom facilities worldwide. In addition, rising investments in pharmaceutical manufacturing infrastructure across North America, Europe, and Asia are further strengthening the demand for advanced cleanroom equipment and consumables within this segment.

Cleanroom Technology Market Regional Insights:

North America region is estimated to lead the Cleanroom Technology Market with around 31.4% share during the forecast period.

- North America holds the leading position in the global cleanroom technology market with around 31.4% revenue share in 2024. This dominance is supported by strict regulatory frameworks, advanced healthcare infrastructure, and strong demand from pharmaceutical, biotechnology, aerospace, and semiconductor industries. The United States remains the largest contributor, driven by FDA compliance requirements, heavy investments in research and development, and the expansion of semiconductor manufacturing under government-supported programs. The widespread adoption of automated systems, smart monitoring solutions, and modular cleanrooms continues to strengthen Cleanroom Technology Market growth across the region.

- Europe follows with steady growth driven by pharmaceutical manufacturing and gene therapy facilities, while Asia-Pacific is expected to grow at the fastest pace due to large-scale semiconductor and battery production investments.

Cleanroom Technology Market Active Players:

- ABN Cleanroom Technology (Belgium)

- Advanced Technology Group (U.S.)

- Airtech Japan, Ltd. (Japan)

- Ardmac (Ireland)

- Azbil Corporation (Japan)

- Bouygues Group (France)

- Camfil (Sweden)

- Clean Air Products (U.S.)

- Clean Rooms International, Inc. (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Exyte AG (Germany)

- Illinois Tool Works, Inc. (U.S.)

- Kimberly-Clark Corporation (U.S.)

- Labconco Corporation (U.S.)

- Taikisha Ltd. (Japan)

- Other Active Players

Key Industry Developments in the Cleanroom Technology Market:

- In July 2025, Clean Air Products (US) strengthened its manufacturing footprint by launching a new facility in the Midwest to support rising regional demand for cleanroom solutions. This expansion is expected to enhance supply chain efficiency and shorten delivery timelines, improving overall customer service.

- In January 2025, Exyte completed the acquisition of Kinetics Group to broaden its global capabilities in delivering advanced high-tech production facilities. This strategic move enhanced Exyte’s expertise in controlled environments, automation, and precision engineering across semiconductor, pharmaceutical, and life science segments.

Operational Technologies Shaping the Cleanroom Industry:

- Cleanroom technology involves the design and operation of highly controlled environments where airborne particles, microorganisms, temperature, and humidity are kept within strict limits. These environments use advanced HVAC systems, HEPA and ULPA filters, pressure control mechanisms, and continuous environmental monitoring to maintain cleanliness. Cleanrooms are categorized based on allowable particle concentration and operate under global standards such as ISO 14644 and GMP regulations.

- Earlier, uncontrolled contamination often resulted in product failures, safety hazards, and regulatory violations. Cleanroom systems eliminate these risks by maintaining sterile conditions, improving production efficiency, and ensuring consistent product quality. Modern cleanrooms also incorporate automated airflow management, digital monitoring systems, and modular construction methods, allowing quicker installation and reduced operational risk. These technologies are essential across highly sensitive industries such as pharmaceuticals, biotechnology, semiconductor manufacturing, and medical devices, where even the smallest level of contamination can cause major financial and operational setbacks.

|

Cleanroom Technology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.40 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.38% |

Market Size in 2035: |

USD 16.59 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Equipment Type |

|

||

|

By Construction Type |

|

||

|

By End- User

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Cleanroom Technology Market by Component (2018-2035)

4.1 Cleanroom Technology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Consumables

Chapter 5: Cleanroom Technology Market by Equipment Type (2018-2035)

5.1 Cleanroom Technology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Laminar Air Flow

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 HEPA Filters

5.5 Cleanroom Air Showers

5.6 Cleanroom Filters

5.7 and Others

Chapter 6: Cleanroom Technology Market by Construction Type (2018-2035)

6.1 Cleanroom Technology Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Standard Stick-Built Cleanrooms

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Modular Hardwall Cleanrooms

6.5 Softwall Cleanrooms

6.6 and Mobile Cleanrooms

Chapter 7: Cleanroom Technology Market by End User (2018-2035)

7.1 Cleanroom Technology Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceutical Industry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Biotechnology R&D and Production

7.5 Medical Device Manufacturing

7.6 Research Laboratories

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cleanroom Technology Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ABN CLEANROOM TECHNOLOGY (BELGIUM)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ADVANCED TECHNOLOGY GROUP (U.S.)

8.4 AIRTECH JAPAN LTD. (JAPAN)

8.5 ARDMAC (IRELAND)

8.6 AZBIL CORPORATION (JAPAN)

8.7 BOUYGUES GROUP (FRANCE)

8.8 CAMFIL (SWEDEN)

8.9 CLEAN AIR PRODUCTS (U.S.)

8.10 CLEAN ROOMS INTERNATIONAL INC. (U.S.)

8.11 DUPONT DE NEMOURS INC. (U.S.)

8.12 EXYTE AG (GERMANY)

8.13 ILLINOIS TOOL WORKS INC. (U.S.)

8.14 KIMBERLY-CLARK CORPORATION (U.S.)

8.15 LABCONCO CORPORATION (U.S.)

8.16 TAIKISHA LTD. (JAPAN)

8.17 OTHER ACTIVE PLAYERS

Chapter 9: Global Cleanroom Technology Market By Region

9.1 Overview

9.2. North America Cleanroom Technology Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Cleanroom Technology Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Cleanroom Technology Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Cleanroom Technology Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Cleanroom Technology Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Cleanroom Technology Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Cleanroom Technology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.40 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.38% |

Market Size in 2035: |

USD 16.59 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Equipment Type |

|

||

|

By Construction Type |

|

||

|

By End- User

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||