Cladding Systems Market Synopsis:

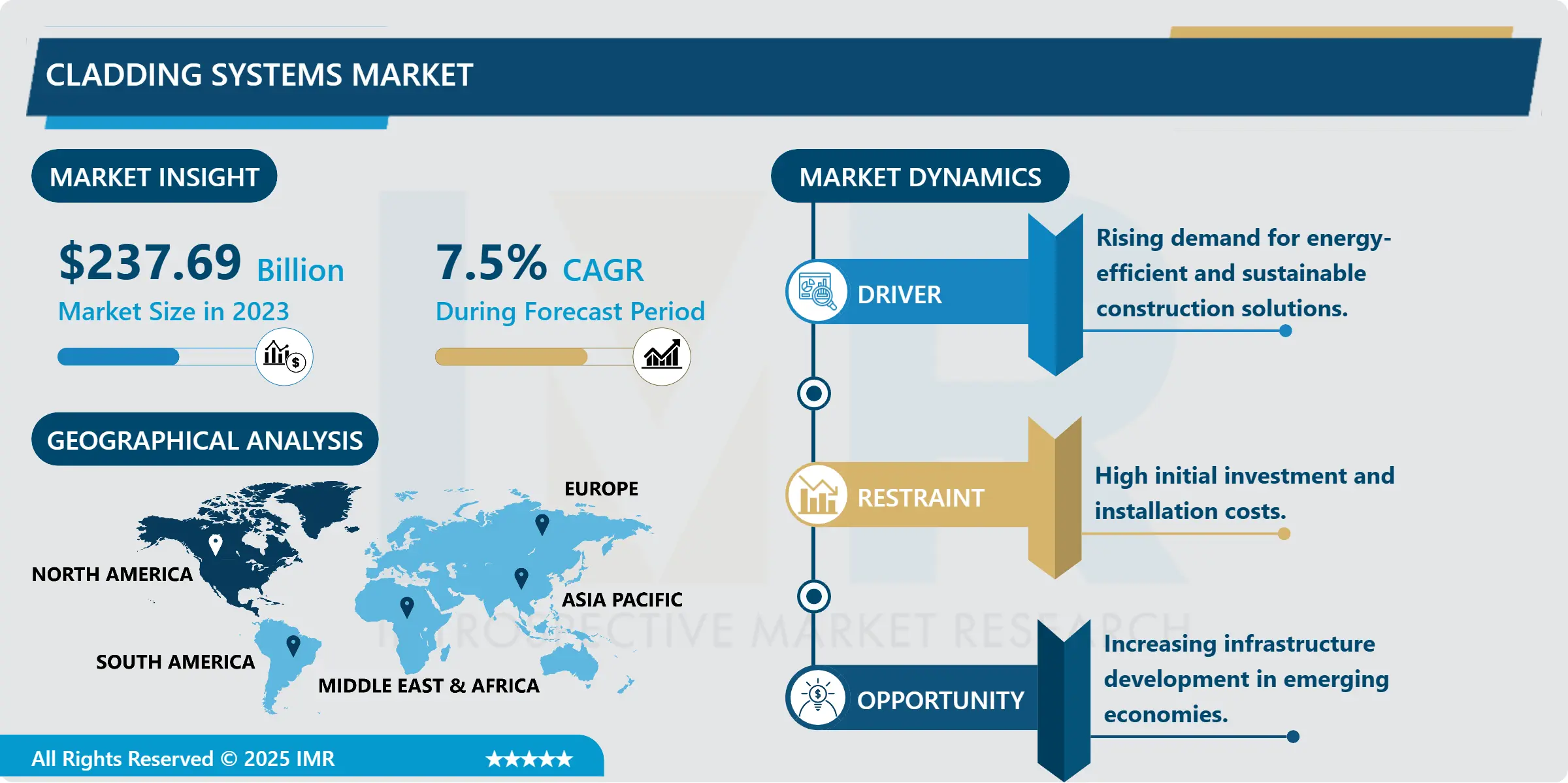

Cladding Systems Market Size Was Valued at USD 237.69 Billion in 2023, and is Projected to Reach USD 455.71 Billion by 2032, Growing at a CAGR of 7.5 % From 2024-2032.

The Cladding Systems Market is an industry, focused mainly on the production, application and offering of the outer layer of building structures that serves both as protection of the structure from outside weather and decorative and insulating layer to both residential, commercial, and industrial applications. These systems are then available in different materials which include ceramic, wood, aluminum, vinyl, and fiber cement among others. Experts discovered that cladding systems seem to be an effective aspect of modern architecture as well as necessary for Ventilation, weather/thermal protection, and aesthetics.

The market for cladding systems is escalating due to a growing construction sector in the world, especially in developing nations. The universal pressure to adopt energy-efficient designs to the building and the ready demand for sustainable construction materials was also found to drive the innovation of efficient cladding systems. These systems in addition to insulating and protecting structures from the weather endow them with looks, and this is why these systems are most in demand in the urban and industrial structures. All the more the existing legal conditions and demands on energy saving, and construction norms and regulations help in creating new faces for veneering materials that are lightweight, durable, and eco-friendly.

The alteration in the green buildings and the sustainable architectural designs is affecting the market trend. International regulators and third parties are sourcing funds for favorable infrastructure on cladding that supports green compatibility, efficiency on energy, and sustainability on recyclability. Nevertheless, the increasing interest to refurbishment and retrofitting in developed countries has become a key driver to the market, where owners and managers look for modern and efficient cladding.

Cladding Systems Market Trend Analysis:

Adoption of Sustainable Cladding Solutions

- The increasing focus on sustainability has led to a growing demand for eco-friendly cladding materials in construction. Manufacturers are responding by developing innovative solutions that reduce environmental impact. Products like ceramic tiles made from recycled materials and lightweight aluminum sheets with high thermal value are gaining popularity. These materials not only align with local regulations but also cater to the rising demand for environmentally conscious building practices.

- As the construction industry continues to prioritize sustainability, these green cladding options are expected to play a crucial role in shaping future developments. The shift toward using recyclable and energy-efficient materials helps reduce the overall carbon footprint of buildings, meeting both environmental standards and consumer expectations. This trend is anticipated to influence market growth and drive further innovation in the industry.

Expansion in Emerging Economies

- There seems to be quite a lot of airborne growth in a number of emerging economies due to the advance prospects for cladding systems in the global market establishing them. Continuation of construction and infrastructure in urban areas, extending population, and constantly enhancing per capita consumption are some of the aspects that are encouraging construction across the Asia Pacific and the Middle East countries.

- The governments of the regions investing a lot of money in constructing residential and commercial buildings and industries, and thus, the demand in improved varieties of cladding systems is escalating. The modern utilization of new materials and modern constructional technologies offer great opportunities for market development in these regions.

Cladding Systems Market Segment Analysis:

Cladding Systems market is segmented on the basis of Material, Application, Type, and Region.

By Material, the Ceramic segment is expected to dominate the market during the forecast period

- The ceramic segment is expected to lead the cladding market during the forecast period, due to its superior strength and aesthetic appeal compared to other materials. Ceramic cladding systems are well-suited to withstand harsh environmental conditions, including exposure to UV radiation and thermal expansion. These qualities make ceramics a long-lasting choice for both residential and commercial buildings. The material's ability to retain its structural integrity under such stress contributes significantly to its dominance in the market.

- Advancements in ceramic production have further enhanced its appeal, as manufacturers now offer lightweight and specialized ceramics tailored to specific needs. These innovations have made ceramic cladding even more attractive for modern architectural projects, particularly in the growing green construction sector, where sustainability and durability are key priorities. The material's versatility and performance in diverse applications ensure its continued popularity and market dominance.

By Type, the Wall segment is expected to held the largest share

- The Wall segment should remain the largest segment of cladding systems out of all the segments that comprise the market. External shells of buildings are most often defined by walls therefore, they need effective protection against various environmental impacts: etc. as wind, precipitation, temperature variations and so on.

- Wall cladding systems are not only a shield from architectural and environmental influences but also many of them possess insulating properties against heat and noise, making them highly popular in today’s congested urban and industrial environments. The development of the segment is further supported by the increasing expenditures towards the residential and commercial space where the nature and need for the wall cladding systems are valued.

Cladding Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- It also helps boost the region's growth since construction activities are regulated through legislation that meets energy, safety, and legal measures to observe a standardized environment. The development of green buildings together with the development of the retrofit business also contribute to the development of the market in North America.

- Being one of the leading countries, the US has noticed a fairly high uptake of highly developed cladding systems for purposes of commerce and homes. Factors such as the progressive rise of the urban populace, a relatively high degree of the population’s ‘buying power,’ and the focus on modern trends in architecture are stimulating it. Both Canada and Mexico also contribute; large projects with power infrastructure and authorities are paying importance to efficient buildings.

Active Key Players in the Cladding Systems Market:

- Alcoa Corporation (United States)

- Alucobond USA (United States)

- Arconic Corporation (United States)

- BASF SE (Germany)

- Etex Group (Belgium)

- James Hardie Industries PLC (Ireland)

- Kingspan Group (Ireland)

- Nichiha Corporation (Japan)

- Owens Corning (United States)

- Rockwool International A/S (Denmark)

- Saint-Gobain S.A. (France)

- Tata Steel Limited (India)

- The Dow Chemical Company (United States)

- Trespa International B.V. (Netherlands)

- Wienerberger AG (Austria), and Other Active Players

|

Global Cladding Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 237.69 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5 % |

Market Size in 2032: |

USD 455.71 Billion |

|

Segments Covered: |

By Material |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cladding Systems Market by Material

4.1 Cladding Systems Market Snapshot and Growth Engine

4.2 Cladding Systems Market Overview

4.3 Ceramic Brick & Stone Metal Wood Vinyl Stucco & EIFS Fiber Cement Other

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Ceramic Brick & Stone Metal Wood Vinyl Stucco & EIFS Fiber Cement Other : Geographic Segmentation Analysis

Chapter 5: Cladding Systems Market by Type

5.1 Cladding Systems Market Snapshot and Growth Engine

5.2 Cladding Systems Market Overview

5.3 Wall Roofs Windows and Doors Others

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Wall Roofs Windows and Doors Others: Geographic Segmentation Analysis

Chapter 6: Cladding Systems Market by Application

6.1 Cladding Systems Market Snapshot and Growth Engine

6.2 Cladding Systems Market Overview

6.3 Residential Non-residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential Non-residential: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cladding Systems Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALCOA CORPORATION (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALUCOBOND USA (UNITED STATES)

7.4 ARCONIC CORPORATION (UNITED STATES)

7.5 BASF SE (GERMANY)

7.6 ETEX GROUP (BELGIUM)

7.7 JAMES HARDIE INDUSTRIES PLC (IRELAND)

7.8 KINGSPAN GROUP (IRELAND)

7.9 NICHIHA CORPORATION (JAPAN)

7.10 OWENS CORNING (UNITED STATES)

7.11 ROCKWOOL INTERNATIONAL A/S (DENMARK)

7.12 SAINT-GOBAIN S.A. (FRANCE)

7.13 TATA STEEL LIMITED (INDIA)

7.14 THE DOW CHEMICAL COMPANY (UNITED STATES)

7.15 TRESPA INTERNATIONAL B.V. (NETHERLANDS)

7.16 WIENERBERGER AG (AUSTRIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Cladding Systems Market By Region

8.1 Overview

8.2. North America Cladding Systems Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Material

8.2.4.1 Ceramic Brick & Stone Metal Wood Vinyl Stucco & EIFS Fiber Cement Other

8.2.5 Historic and Forecasted Market Size By Type

8.2.5.1 Wall Roofs Windows and Doors Others

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Residential Non-residential

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cladding Systems Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Material

8.3.4.1 Ceramic Brick & Stone Metal Wood Vinyl Stucco & EIFS Fiber Cement Other

8.3.5 Historic and Forecasted Market Size By Type

8.3.5.1 Wall Roofs Windows and Doors Others

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Residential Non-residential

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cladding Systems Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Material

8.4.4.1 Ceramic Brick & Stone Metal Wood Vinyl Stucco & EIFS Fiber Cement Other

8.4.5 Historic and Forecasted Market Size By Type

8.4.5.1 Wall Roofs Windows and Doors Others

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Residential Non-residential

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cladding Systems Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Material

8.5.4.1 Ceramic Brick & Stone Metal Wood Vinyl Stucco & EIFS Fiber Cement Other

8.5.5 Historic and Forecasted Market Size By Type

8.5.5.1 Wall Roofs Windows and Doors Others

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Residential Non-residential

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cladding Systems Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Material

8.6.4.1 Ceramic Brick & Stone Metal Wood Vinyl Stucco & EIFS Fiber Cement Other

8.6.5 Historic and Forecasted Market Size By Type

8.6.5.1 Wall Roofs Windows and Doors Others

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Residential Non-residential

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cladding Systems Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Material

8.7.4.1 Ceramic Brick & Stone Metal Wood Vinyl Stucco & EIFS Fiber Cement Other

8.7.5 Historic and Forecasted Market Size By Type

8.7.5.1 Wall Roofs Windows and Doors Others

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Residential Non-residential

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Cladding Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 237.69 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5 % |

Market Size in 2032: |

USD 455.71 Billion |

|

Segments Covered: |

By Material |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||