Cast Elastomer Market Overview

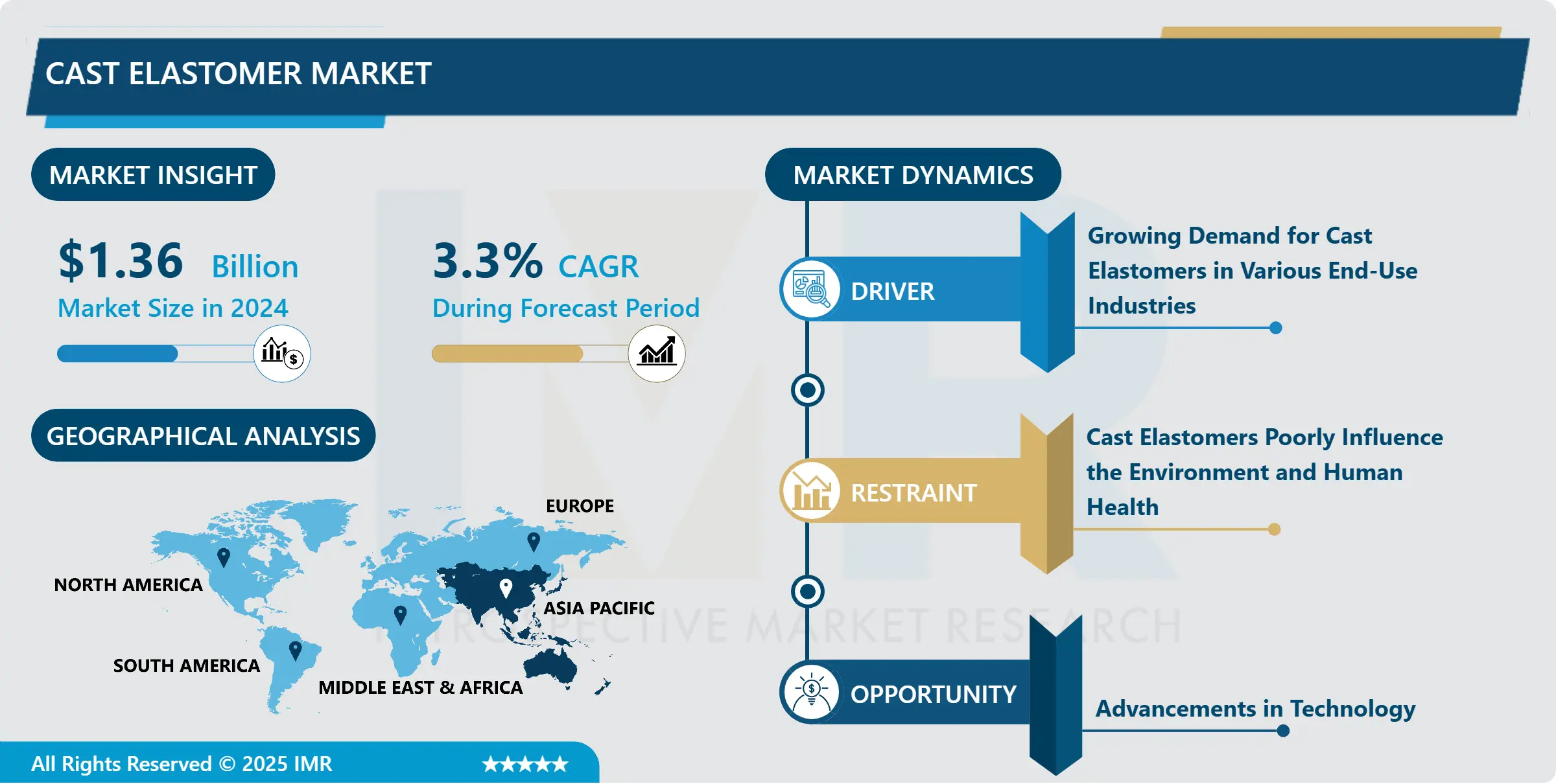

Cast Elastomer Market Size Was Valued at USD 1.36 Billion in 2024 and is Projected to Reach USD 1.94 Billion by 2035, Growing at a CAGR of 3.3% From 2025-2035.

Cast elastomers are referred to as thermosetting, akin to natural and synthetic rubbers. These elastomers are based on either polyether and/or polyesters. Cast elastomers possess significant physical properties, incorporating abrasion resistance and load-bearing. They also have other beneficial properties such as tensile strength and tear resistance. Cast elastomers offer different innate capabilities such as abrasion resistance, resilience, impact strength, and resistance to oil and grease. Elastomers are polymers distinguished by possessing viscoelasticity. Furthermore, elastomers are known to retain their original structure and characteristics for utilization in longer and high-performance systems. These are utilized in various applications including slide plates, bearings, shock absorbers, bumpers, wear strips, and many others.

Cast elastomers provide better longevity as compared to plastics rubbers, and metals. Moreover, cast elastomers are accessible in two types namely hot cast and cold cast. Hot cast elastomers are applied in attentive applications that need strong performance. Processing of these elastomers generally requires heated components and tooling, along with hot post-cure to optimize properties. These elastomers are particularly utilized in the mining industry. In addition, cold cast elastomers are two or three-component PU high-performance systems. Cold cast elastomers are utilized in various applications, ranging from flexible polyurethane resin or foam to very hard plastics. These elastomers are composed for applications at room temperature and do not require heat post curation, making them simple and fast to produce.

COVID-19 Impact on the Cast Elastomers Market

COVID-19 has helped the industrial and manufacturing sectors into an unknown operating environment globally. Government restrictions on the number of people that can gather at one place have poorly influenced the sectors. For instance, the component manufacturing sector is highly impacted by the covid-19. The production and factory operations in the automotive, aerospace and electronics, industries were temporarily shut down during the lockdown period. Many of the industries are dependent on China for raw material supply. Therefore, supply chain disruptions also have had a major impact on industrial output. The global economy had contracted owing to the pandemic. The impact of COVID-19 on all industries will continue as long as the pandemic lasts. Factors such as liquidity scarcity, loss in investments, labor shortage, supply chain constraints, and the overall global economic uncertainty are affecting the growth of the industrial sector. For the last few months, most of the economies, such as India, China, and the US, have opened the economy, and industrial activities have started but with limited workforce and materials. The industrial output is anticipated to rebound as most of the economies have started opening. The manufacturers of cast elastomers have also faced an adverse impact of COVID-19 on sales volume in the first and second quarters of 2020. Key players in the market are mitigating the risk by particularly targeting local management and by focusing on untapped market opportunities.

Market Dynamics And Factors For The Cast Elastomers Market

Drivers:

Growing demand for cast elastomers in various end-use industries, superior significance over conventional materials, and rise in demand for these elastomers in developing countries are major factors turning the cast elastomers market. The cast elastomers market has been growing owing to the increase in the application of cast elastomers in end-use industries such as industrial, automotive & transportation, mining, and oil & gas. Additionally, in the mining industry, hot cast polyurethane elastomers are especially utilized in mineral processing applications such as conveyor scrapers, separating screens, and other components. The high load-bearing capacity, high abrasion resistance, resilience, and influence strength properties of cast polyurethane elastomers assist raise the performance and longevity of mining equipment. The development in the cast elastomers market will also be helped by the rising output in the mining industry with increasing exploration activities, particularly in the developing countries.

Restraints:

Cast elastomers poorly influence the environment and human health. For instance, Isocyanates are mostly reactive and low molecular weight chemicals which are utilized in the manufacturing of products such as flexible and rigid foams, coatings, fibers, varnishes, and elastomers. Isocyanates such as MDI, TDI, and HDI, which are toxic, are the major raw materials used for the manufacturing of polyurethane cast elastomers. Therefore, there is widespread opposition against the sales and utilization of these chemicals. These are major factors hindering the global cast elastomers market. Moreover, compliance with strict regulations and standards and differentiation in prices of raw materials are the key challenges being experienced by producers of cast elastomers.

Opportunities:

Continuous technological advancements present profitable opportunities to the global cast elastomers market. Growth in demand for cast elastomers in developing countries and a rise in manufacturing activities are also creating opportunities for the cast elastomers market in the upcoming years.

Market Segmentation

Segmentation Analysis of Cast Elastomers Market:

Based on Type, the hot cast elastomer segment is expected to dominate the cast elastomers market over the forecast period. The major growth driver of the high utilization of these cast elastomers is due to their properties such as cost-effectiveness, adaptability, and durability. Hot cast elastomers possess an extensive range of applications and exhibit properties of polyurethane. These elastomers are utilized in applications such as rollers and industrial wheels, which demand a high degree of performance. These elastomers find usage in mining, oil, heavy-duty equipment, medical, automotive, and transport industries. Rising demand for machinery and equipment in these end-use industries is anticipated to support the growth of the hot cast elastomer segment.

Based on Application, the industrial sector is the highest end-use industry for the cast elastomer market during the forecast period. The rising demand in this segment is attributed to its extensive variety of applications in the industrial sector. The rising number of industries producing high demand for equipment and machinery is helping enhance the demand for cast elastomers in this sector. Cast elastomers are used in the industrial sector in a wide range of applications such as conveyor belts, coupling elements, forklift wheels, seals & gaskets, and others. These are used in various sectors such as paper, construction, heavy industries, and others. Rising demand for machinery is directly anticipated to affect the cast elastomers market positively.

Based on Distribution Channels, online distribution channels are expected to dominate the market during the forecast period. Owing to the penetration of the internet as well as smart devices such including smartphones, accessible laptops. The online distribution mode enables the seller to serve the larger market which expands their domestic location.

Regional Analysis of Cast Elastomers Market:

The Asia Pacific is expected to dominate the cast elastomers market during the forecast period. Significant economic development and a growing customer base have led to this rise in demand. Furthermore, growth in population and rising urbanization are also driving the manufacturing sector. Additionally, growth in industrialization, rising demand due to changing demographics, and government initiatives to attract business investments in industries such as automotive, power, oil & gas, are also turning the market for cast elastomers in the region. Growing production of automotive in this region will also spur the demand in the coming years.

Players Covered in Cast Elastomer market are :

- DowDuPont Inc.

- BASF SE

- VCM Polyurethanes Pvt. Ltd.

- LANXESS AG

- Accella Polyurethane Systems

- Tosoh Corporation

- Axson Technologies

- Chemline Inc.

- Coim S.p.A (Coim Group)

- Covestro AG

- Wanhua Chemical Group Co.Ltd

- Herikon; Huntsman Corporation

- Luc Group

- Everchem Specialty Chemicals

- Makro Chemical Endustriyel Kimyasallar San. Ve Tic. Ltd. Ti

- Mitsui Chemicals Inc.

- TAIWAN PU CORPORATION

- Notedome Ltd.

- Perstorp Holding AB

- Synthesia Internacional SLU

- Polycoat Products LLC.

- RECKLI GmbH

- Sapici S.p.A.

- Era Polymers Pty. Ltd and others active players.

Key Industry Developments In The Cast Elastomers Market

- In December 2020, Huntsman Corporation announced the signing agreement for the collaboration with Lintech International LLC for the distribution of DALTOCAST, a polyurethane-based hot-cast elastomer system.

- In August 2020, Lanxess designed the latest range of MDI polyether prepolymers from bio-based raw materials under the brand name Adiprene Green. The properties of Adiprene Green are similar to the fossil-based polyether elastomers offered by the company.

|

Cast Elastomer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.36 Bn. |

|

Forecast Period 2025-35 CAGR: |

3.3% |

Market Size in 2035: |

USD 1.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cast Elastomer Market by Type (2018-2035)

4.1 Cast Elastomer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hot Cast Elastomer

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cold Cast Elastomer

Chapter 5: Cast Elastomer Market by Application (2018-2035)

5.1 Cast Elastomer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive & Transportation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Agriculture

5.5 Industrial

5.6 Oil & Gas

5.7 Other

Chapter 6: Cast Elastomer Market by Distribution Channels (2018-2035)

6.1 Cast Elastomer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cast Elastomer Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M COMPANY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DUPONT DE NEMOURS INCTRANSTAR AUTOBODY TECHNOLOGIES INCBONDO CORPORATION

7.4 ARKEMA S.ABOSTIK S.AASHLAND GLOBAL HOLDINGS INCBASF SE

7.5 BEMIS ASSOCIATES INCCOVESTRO AG

7.6 EMS-CHEMIE HOLDING AG

7.7 PERMATEX INCH.B. FULLER COMPANY

7.8 NITTO DENKO CORPORATION

7.9 HENKEL AG & CO. KGAA

7.10 HUNTSMAN CORPORATION

7.11 ILLINOIS TOOL WORKS INCLORD CORPORATION

7.12 NIPPON PAINT CO. LTDRPM INTERNATIONAL INCROYAL ADHESIVES AND SEALANTS LLC

7.13 THE DOW CHEMICAL COMPANY

7.14 THREEBOND CO. LTDWACKER-CHEMIE AG

Chapter 8: Global Cast Elastomer Market By Region

8.1 Overview

8.2. North America Cast Elastomer Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Hot Cast Elastomer

8.2.4.2 Cold Cast Elastomer

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Automotive & Transportation

8.2.5.2 Agriculture

8.2.5.3 Industrial

8.2.5.4 Oil & Gas

8.2.5.5 Other

8.2.6 Historic and Forecasted Market Size by Distribution Channels

8.2.6.1 Online

8.2.6.2 Offline

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cast Elastomer Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Hot Cast Elastomer

8.3.4.2 Cold Cast Elastomer

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Automotive & Transportation

8.3.5.2 Agriculture

8.3.5.3 Industrial

8.3.5.4 Oil & Gas

8.3.5.5 Other

8.3.6 Historic and Forecasted Market Size by Distribution Channels

8.3.6.1 Online

8.3.6.2 Offline

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cast Elastomer Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Hot Cast Elastomer

8.4.4.2 Cold Cast Elastomer

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Automotive & Transportation

8.4.5.2 Agriculture

8.4.5.3 Industrial

8.4.5.4 Oil & Gas

8.4.5.5 Other

8.4.6 Historic and Forecasted Market Size by Distribution Channels

8.4.6.1 Online

8.4.6.2 Offline

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cast Elastomer Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Hot Cast Elastomer

8.5.4.2 Cold Cast Elastomer

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Automotive & Transportation

8.5.5.2 Agriculture

8.5.5.3 Industrial

8.5.5.4 Oil & Gas

8.5.5.5 Other

8.5.6 Historic and Forecasted Market Size by Distribution Channels

8.5.6.1 Online

8.5.6.2 Offline

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cast Elastomer Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Hot Cast Elastomer

8.6.4.2 Cold Cast Elastomer

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Automotive & Transportation

8.6.5.2 Agriculture

8.6.5.3 Industrial

8.6.5.4 Oil & Gas

8.6.5.5 Other

8.6.6 Historic and Forecasted Market Size by Distribution Channels

8.6.6.1 Online

8.6.6.2 Offline

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cast Elastomer Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Hot Cast Elastomer

8.7.4.2 Cold Cast Elastomer

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Automotive & Transportation

8.7.5.2 Agriculture

8.7.5.3 Industrial

8.7.5.4 Oil & Gas

8.7.5.5 Other

8.7.6 Historic and Forecasted Market Size by Distribution Channels

8.7.6.1 Online

8.7.6.2 Offline

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Cast Elastomer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.36 Bn. |

|

Forecast Period 2025-35 CAGR: |

3.3% |

Market Size in 2035: |

USD 1.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||