Business Intelligence Software Market Synopsis

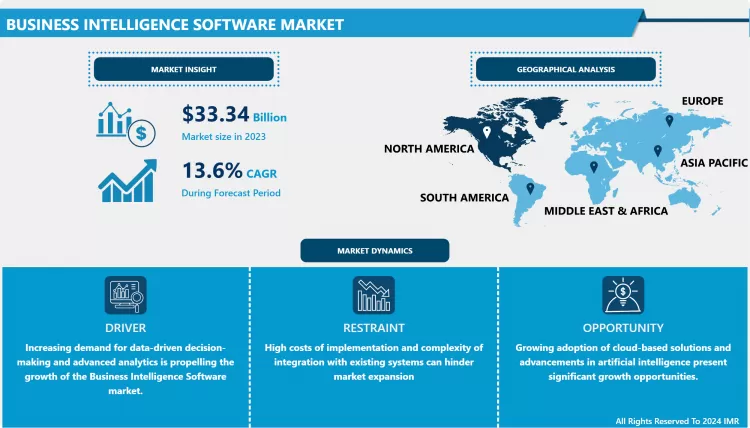

Business Intelligence Software Market Size is Valued at USD 33.34 Billion in 2024, and is Projected to Reach USD 89.6 Billion by 2032, Growing at a CAGR of 13.6% From 2024-2032.

The Business Intelligence (BI) software market is a rapidly growing sector driven by increasing data complexity and the need for actionable insights across industries. BI software enables organizations to collect, analyze, and visualize data, facilitating informed decision-making and strategic planning. As businesses continue to seek competitive advantages through data-driven strategies, the market for BI solutions is expanding, with key trends including the adoption of advanced analytics, integration with artificial intelligence, and the shift toward cloud-based platforms. The rise in data generation and the demand for real-time insights are fueling this growth, making BI software a critical component in modern business operations.

- The growing demand for data-intensive decision-making has fueled substantial development in the Business Intelligence (BI) Software Market in recent years. Organizations are progressively utilizing business intelligence (BI) tools to analyze vast quantities of data, extract actionable insights, and improve overall business performance. A variety of solutions, including data visualization, reporting, and analytics platforms, are available in the market to assist businesses in optimizing operations and gaining a competitive edge.

- Artificial intelligence and machine learning, along with the rapid advancement of technology, distinguish the market. These innovations are augmenting the capabilities of BI software, enabling more sophisticated data analysis and predictive insights. Furthermore, the transition to cloud-based solutions is enhancing the accessibility and scalability of BI tools for businesses of all sizes.

- North America's market share is significant because of its sophisticated technological infrastructure and high adoption rate of BI solutions. However, we anticipate the Asia-Pacific region to experience the most rapid development due to the increasing investment in data analytics and digital transformation initiatives.

Business Intelligence Software Market Trend Analysis

Integration with Artificial Intelligence (AI) and Machine Learning (ML)

- The integration of artificial intelligence (AI) and machine learning (ML) technologies is accelerating the evolution of the business intelligence (BI) software market. These developments are substantially improving data analytics capabilities, thereby simplifying the process of extracting actionable insights from enormous quantities of data. AI and ML algorithms are automating data processing tasks, reducing human error, and accelerating decision-making processes.

- AI-driven business intelligence tools provide sophisticated data visualization and predictive analytics capabilities, thereby enabling organizations to anticipate trends and make well-informed strategic decisions. Businesses can now detect patterns and anomalies in their data that were previously difficult to identify by utilizing machine learning models. This not only enhances accuracy but also grants a competitive advantage in the market.

- Additionally, the incorporation of natural language processing (NLP) enables users to engage with business intelligence (BI) tools through conversational interfaces. This simplifies the process of querying data and generating reports for non-technical users, thereby democratizing access to valuable business insights at all levels of an organization.

- As organizations strive to harness the capabilities of cutting-edge technologies to stay agile and competitive in a rapidly evolving environment, we anticipate that the convergence of AI, ML, and BI software will drive substantial market expansion. As these technologies continue to mature, we expect their applications in BI to expand, offering even more sophisticated tools for data-driven decision-making.

Increased Emphasis on Data Privacy and Security

- There is a substantial trend in the Business Intelligence (BI) software market toward a greater emphasis on data privacy and security. The necessity of protecting sensitive information has become increasingly critical as organizations continue to rely heavily on BI tools for data-driven decision-making. This growing concern is driving the demand for BI solutions that offer sophisticated security features like encryption and access controls.

- BI software providers are implementing comprehensive security measures into their platforms in response to increased regulations and data protection laws. This encompasses adhering to regulations such as GDPR and CCPA, which necessitate rigorous data management procedures. Business intelligence solutions that incorporate these features not only assist organizations in satisfying regulatory obligations but also foster trust with their stakeholders and clients.

- The emphasis on data privacy is also influencing the development of BI software, as companies are investing in technologies that improve data anonymization and secure data sharing. These developments ensure that data analysis does not disclose sensitive information or compromise individual privacy.

- The emphasis on data privacy and security is generally transforming the BI software market, spurring innovation and creating new opportunities for vendors to provide secure and compliant solutions. This trend is indicative of the more general trend of promoting trust and safeguarding data integrity in the digital era.

Business Intelligence Software Market Segment Analysis:

Business Intelligence Software Market Segmented on the basis of by Deployment, by Component, By Enterprise Size, By End-User

By Deployment, On-premises segment is expected to dominate the market during the forecast period

- The Business Intelligence (BI) Software Market has experienced significant growth as organizations increasingly seek data-driven insights to enhance decision-making and operational efficiency. BI software is available in two primary deployment models: on-premises and cloud-based. Each model offers distinct advantages tailored to different business needs and infrastructure.

- On-premises BI solutions are hosted within an organization's own IT infrastructure. This deployment offers greater control over data security and customization, making it suitable for enterprises with strict compliance requirements or those needing extensive integration with legacy systems. However, on-premises solutions often require substantial upfront investments in hardware and ongoing maintenance.

- Cloud-based BI software, conversely, is hosted on remote servers and accessed via the internet. This model provides flexibility, scalability, and cost-efficiency, as it eliminates the need for physical infrastructure and reduces maintenance burdens. Cloud BI solutions are particularly attractive to smaller businesses and those seeking rapid deployment and accessibility from multiple locations.

- The choice between on-premises and cloud BI solutions depends on an organization’s specific requirements, including budget constraints, security considerations, and desired level of customization. Both deployment options are evolving rapidly, driven by advancements in technology and changing business needs.

By End-User, Manufacturing segment held the largest share in 2024

- The Business Intelligence (BI) software market is experiencing substantial growth in a variety of end-user sectors as a result of its capacity to convert data into actionable insights. BI tools improve operational efficiency in the manufacturing sector by analyzing production data, predicting maintenance requirements, and optimizing supply chain management. This results in increased productivity and cost savings.

- BI software is essential in the healthcare sector for patient data management, clinical workflow optimization, and overall patient care enhancement. It is critical for healthcare providers to be able to identify trends, optimize resource allocation, and improve decision-making processes in order to improve operational efficiency and patient outcomes.

- BI enhances customer insights, inventory management, and personalized marketing strategies in the retail and consumer goods sectors. Retailers can enhance their understanding of consumer behavior, optimize pricing strategies, and enhance supply chain logistics by employing data analytics.

- BI software is essential for regulatory compliance, customer relationship management, and risk management in the BFSI (Banking, Finance, Services, Insurance) sector. It assists institutions in analyzing financial trends, detecting fraudulent activities, and improving strategic decision-making, thereby enhancing overall financial stability and consumer satisfaction.

Business Intelligence Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- We expect North America to dominate the Business Intelligence (BI) software market for the duration of the forecast period. A large number of leading BI software vendors, high adoption rates of cutting-edge technologies, and an advanced technological infrastructure all contribute to the region's dominance. Companies in North America are increasingly investing in BI solutions to improve data-driven decision-making and obtain a competitive advantage.

- The increasing demand for real-time analytics and actionable insights in a variety of industries, including finance, healthcare, and retail, is driving the adoption of BI tools. North American businesses employ these tools to optimize overall performance, enhance consumer experiences, and streamline operations.

- Additionally, the region is characterized by a favorable business environment that encourages technological innovation and a strong network of competent IT professionals. This ecosystem facilitates the development and deployment of advanced business intelligence solutions.

- We anticipate that North America's BI software market leadership will persist due to its robust technological foundation, the growing adoption of data-driven strategies, and a supportive infrastructure for innovation.

Active Key Players in the Business Intelligence Software Market

- IBM Corporation (United States)

- Microsoft Corporation ( United States)

- Tableau Software, LLC ( United States)

- Oracle Corporation (United States)

- Sisense Inc. (United States)

- Yellowfin International PVT. LTD. (Australia)

- Qlik ( Sweden)

- SAP ( Germany)

- Board International ( Switzerland)

- MicroStrategy ( United States)

- Other Active Players

|

Business Intelligence Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 33.34 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.6% |

Market Size in 2032: |

USD 89.6 Bn. |

|

Segments Covered: |

by Deployment |

|

|

|

By Component |

|

||

|

By Enterprise Size |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Business Intelligence Software Market by Deployment (2018-2032)

4.1 Business Intelligence Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-premises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud

Chapter 5: Business Intelligence Software Market by Component (2018-2032)

5.1 Business Intelligence Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Services

Chapter 6: Business Intelligence Software Market by Enterprise Size (2018-2032)

6.1 Business Intelligence Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small-Medium size

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Size

Chapter 7: Business Intelligence Software Market by End-User (2018-2032)

7.1 Business Intelligence Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Manufacturing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare

7.5 Retail and Consumer goods

7.6 Banking

7.7 Finance

7.8 Services

7.9 Insurance (BFSI)

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Business Intelligence Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IBM CORPORATION (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MICROSOFT CORPORATION ( UNITED STATES)

8.4 TABLEAU SOFTWARE

8.5 LLC ( UNITED STATES)

8.6 ORACLE CORPORATION (UNITED STATES)

8.7 SISENSE INC. (UNITED STATES)

8.8 YELLOWFIN INTERNATIONAL PVT. LTD. (AUSTRALIA)

8.9 QLIK ( SWEDEN)

8.10 SAP ( GERMANY)

8.11 BOARD INTERNATIONAL ( SWITZERLAND)

8.12 MICROSTRATEGY ( UNITED STATES)

8.13

Chapter 9: Global Business Intelligence Software Market By Region

9.1 Overview

9.2. North America Business Intelligence Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Deployment

9.2.4.1 On-premises

9.2.4.2 Cloud

9.2.5 Historic and Forecasted Market Size by Component

9.2.5.1 Software

9.2.5.2 Services

9.2.6 Historic and Forecasted Market Size by Enterprise Size

9.2.6.1 Small-Medium size

9.2.6.2 Large Size

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Manufacturing

9.2.7.2 Healthcare

9.2.7.3 Retail and Consumer goods

9.2.7.4 Banking

9.2.7.5 Finance

9.2.7.6 Services

9.2.7.7 Insurance (BFSI)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Business Intelligence Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Deployment

9.3.4.1 On-premises

9.3.4.2 Cloud

9.3.5 Historic and Forecasted Market Size by Component

9.3.5.1 Software

9.3.5.2 Services

9.3.6 Historic and Forecasted Market Size by Enterprise Size

9.3.6.1 Small-Medium size

9.3.6.2 Large Size

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Manufacturing

9.3.7.2 Healthcare

9.3.7.3 Retail and Consumer goods

9.3.7.4 Banking

9.3.7.5 Finance

9.3.7.6 Services

9.3.7.7 Insurance (BFSI)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Business Intelligence Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Deployment

9.4.4.1 On-premises

9.4.4.2 Cloud

9.4.5 Historic and Forecasted Market Size by Component

9.4.5.1 Software

9.4.5.2 Services

9.4.6 Historic and Forecasted Market Size by Enterprise Size

9.4.6.1 Small-Medium size

9.4.6.2 Large Size

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Manufacturing

9.4.7.2 Healthcare

9.4.7.3 Retail and Consumer goods

9.4.7.4 Banking

9.4.7.5 Finance

9.4.7.6 Services

9.4.7.7 Insurance (BFSI)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Business Intelligence Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Deployment

9.5.4.1 On-premises

9.5.4.2 Cloud

9.5.5 Historic and Forecasted Market Size by Component

9.5.5.1 Software

9.5.5.2 Services

9.5.6 Historic and Forecasted Market Size by Enterprise Size

9.5.6.1 Small-Medium size

9.5.6.2 Large Size

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Manufacturing

9.5.7.2 Healthcare

9.5.7.3 Retail and Consumer goods

9.5.7.4 Banking

9.5.7.5 Finance

9.5.7.6 Services

9.5.7.7 Insurance (BFSI)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Business Intelligence Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Deployment

9.6.4.1 On-premises

9.6.4.2 Cloud

9.6.5 Historic and Forecasted Market Size by Component

9.6.5.1 Software

9.6.5.2 Services

9.6.6 Historic and Forecasted Market Size by Enterprise Size

9.6.6.1 Small-Medium size

9.6.6.2 Large Size

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Manufacturing

9.6.7.2 Healthcare

9.6.7.3 Retail and Consumer goods

9.6.7.4 Banking

9.6.7.5 Finance

9.6.7.6 Services

9.6.7.7 Insurance (BFSI)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Business Intelligence Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Deployment

9.7.4.1 On-premises

9.7.4.2 Cloud

9.7.5 Historic and Forecasted Market Size by Component

9.7.5.1 Software

9.7.5.2 Services

9.7.6 Historic and Forecasted Market Size by Enterprise Size

9.7.6.1 Small-Medium size

9.7.6.2 Large Size

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Manufacturing

9.7.7.2 Healthcare

9.7.7.3 Retail and Consumer goods

9.7.7.4 Banking

9.7.7.5 Finance

9.7.7.6 Services

9.7.7.7 Insurance (BFSI)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Business Intelligence Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 33.34 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.6% |

Market Size in 2032: |

USD 89.6 Bn. |

|

Segments Covered: |

by Deployment |

|

|

|

By Component |

|

||

|

By Enterprise Size |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Business Intelligence Software Market research report is 2024-2032.

IBM Corporation (United States), Microsoft Corporation (United States), Tableau Software, LLC (United States), Oracle Corporation (United States), Sisense Inc. (United States), Yellowfin International PVT. LTD. (Australia), Qlik (Sweden), SAP (Germany), Board International (Switzerland), MicroStrategy (United States), Others

The Business Intelligence Software Market is segmented into by Deployment (On-premises, Cloud) Component (Software, Services), By Enterprise Size (Small-Medium size, Large Size), By End-User (Manufacturing, Healthcare, Retail and Consumer goods, Banking, Finance, Services, Insurance (BFSI). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Business Intelligence (BI) software encompasses a range of tools and technologies designed to collect, analyze, and present data in actionable formats. By integrating data from various sources, BI software enables organizations to make informed decisions, uncover insights, and drive strategic initiatives. Key features often include data visualization, reporting, and dashboards that facilitate real-time analysis. As businesses increasingly rely on data-driven strategies, the demand for BI software has surged, with innovations in cloud computing and artificial intelligence further enhancing its capabilities. Despite the advantages, challenges such as high implementation costs and integration complexities can pose hurdles. Overall, BI software is crucial for organizations seeking to leverage data for competitive advantage and operational efficiency.

Business Intelligence Software Market Size is Valued at USD 33.34 Billion in 2024, and is Projected to Reach USD 89.6 Billion by 2032, Growing at a CAGR of 13.6% From 2024-2032.