Business Document Work Process Management Market Synopsis:

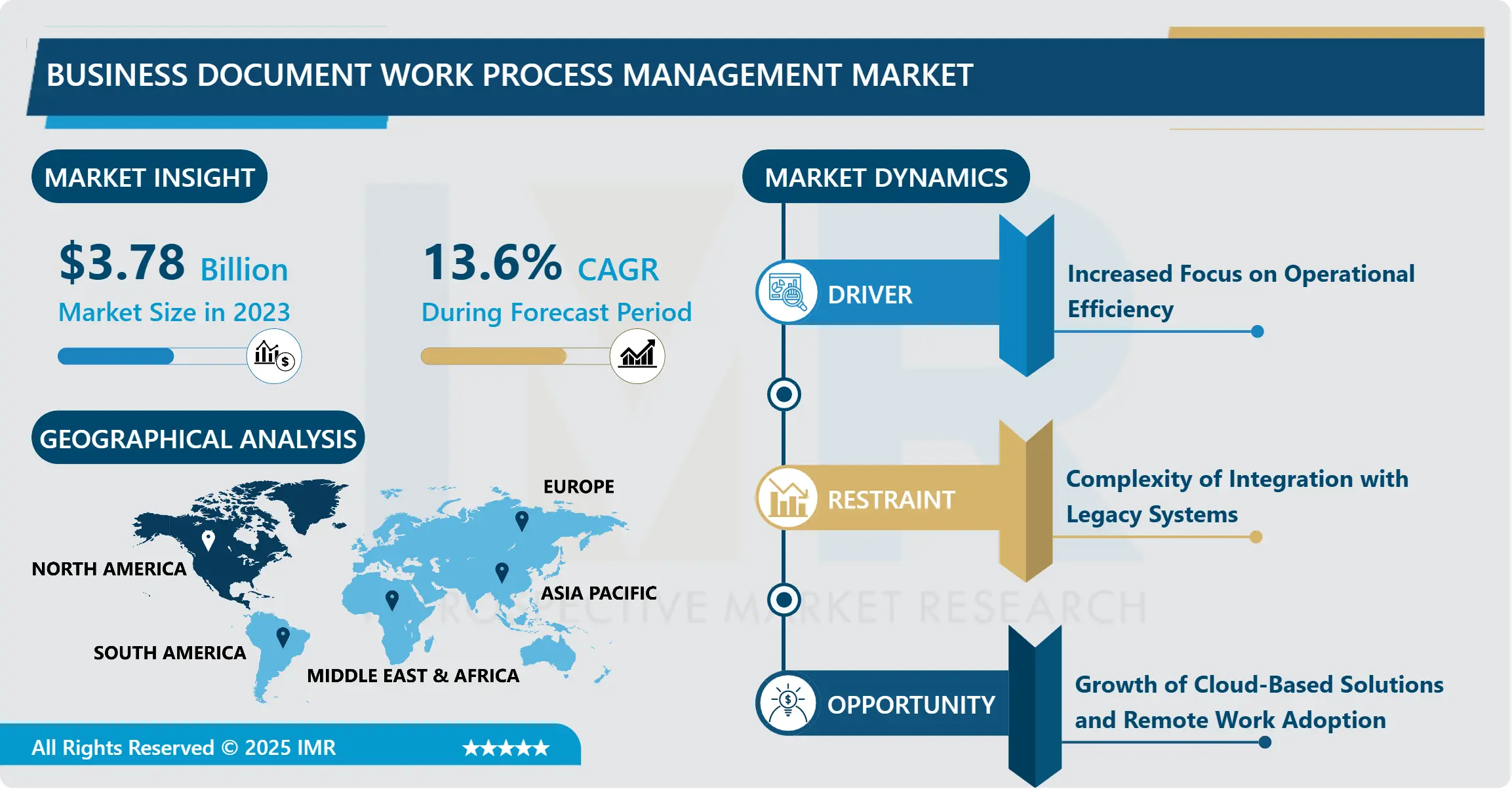

Business Document Work Process Management Market Size Was Valued at USD 3.78 Billion in 2023, and is Projected to Reach USD 11.91 Billion by 2032, Growing at a CAGR of 13.60% From 2024-2032.

Business Document Work Process Management Market means technologies and products that assist users in managing business documents effectively and enabling the enhanced work process of the sending/receiving organizations. This market covers a broad spectrum of software, services and solutions used in the conversion, capture, organization, and management of numerous business processes to minimize expenses, meet compliance standards and improve document control across industries.

Organizations looking to automate their business document processing are the main force behind the growth of the business document work process management market. Employers are already competing to minimize the possibility of human inputs and the general process flow, especially for the contemporary processes as digitization remains a core policy among organizations. The automation of document work-flow ensures that, the processes are efficient and accurate, is cost effective and as businesses expand the work flow does not skyrocket.

The other major factor is the most common – compliance and security issues. Due to increasing compliance on usage and protection of data, firms are adopting document work process management system to facilitate safe storage, review and accounting of business documents. These systems also enable a business enterprise to meet the legal requirement of the sector in which it operates by having features such as audit trail, role based access control and secure methods of sharing of documents.

Business Document Work Process Management Market Trend Analysis:

Shift towards cloud-based solutions

- The most significant trend in the Business Document Work Process Management Market is the migration to the cloud. Remote technology solution can provide more flexibility, efficiency and manageable cost compared to on premise solutions. Of late, this trend is well exhibited among the SMEs which are opting for cloud-based systems of document management to avoid major expenses on infrastructure and enhanced accessibility. Also, cloud solutions help manage the practice of work from different locations because teams get secure and real-time access to documents in the cloud.

- The first trend discussed is the use of cloud-computing systems to support document management solutions The second useful trend is the incorporation of artificial intelligence and machine learning in document management solutions. In its essence, AI is applied in document classification, data extraction in documents, even decision-making procedures. By automating numerous tasks within the business document flows, these technologies minimize the time that is spent on those tasks and improve data accuracy when processing the documents. Businesses are hence stripping their operations of inefficiencies through apply of smart solutions that can enhance on processing of documents among others.

The growing adoption of AI and machine learning

- The increasing deployments of AI and machine learning hold promising opportunities to the market participants in the Business Document Work Process Management Market. The service providers can thus seize on this need for better, more sophisticated automated and AI solutions in business, particularly the need for smart document solutions. This is also a good taste for providers to bring solutions to complement other enterprise systems, such as the customer relationship management system (CRM) and the enterprise resource planning system (ERP) to enhance the cycle of operations.

- Further, as other industries have stepped up their levels to adapt to the current online business, there appears vast potential in developing regions and the Asia Pacific & Latin American regions in particular. The rising adoption of cloud solutions and the growing requirement for increasing business process effectiveness are some of the factors that make companies in these regions seek document workflow management options. Thus, providers who can design and deliver services per local market requirements, language and legal framework will be most successful in these emerging markets.

Business Document Work Process Management Market Segment Analysis:

Business Document Work Process Management Market Segmented on the basis of Component, Deployment, End User, and Region

By Component, Service segment is expected to dominate the market during the forecast period

- The Business Document Work Process Management Market is broadly segmented into two components: solutions and services. The term solutions pertains to software applications and tools that enable businesses to deal with their document processes including among them document management systems DMS, workflow automation software, and content management systems CMS.

- These solutions make it possible for companies and businesses to fully automate the dealing, management, monitoring, and even archiving, of documents. Consulting then requires services are the consulting, implementation, and support services which enable organisations put into practice these solutions. Since today companies try to optimize their document flows and make them more effective, both solutions and services in this field are in high demand.

By Deployment, Cloud-based segment expected to held the largest share

- The market is also broadly categorized based on deployment type wherein cloud deployment type dominates the market trailed by on premise. Cloud-based deployment has received a lot of adoption because it is cheaper than the traditional deployment, flexible and more scalable.

- It provides an opportunity to access document management solutions from a distance, and, therefore, companies do not need to invest in expensive infrastructure and enhance collaboration. Solutions hosted on-premise are still used in organizations that have stringer standards on data security or regulatory compliance. Many of these systems are installed and managed on the company infrastructure which offers more control over important documents or information.

Business Document Work Process Management Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The growth of North American Business Document Work Process Management Market is primarily because of the growth in the adoption of automated systems in multiple sectors. Large organizations in the area especially in the America sub region are embracing the use of DMS in the improvement of the usual business operations as well as document flow and ensuring better compliance to the laid down laws and regulations. One emerging trend is the use of cloud-based solutions and artificial intelligence document managing solutions to achieve optimal document management amid increasing document jams and in the face of skyrocketing costs… Leveraging the use of such technologies has assisted organizations to minimize task automation, enhance document workflows while adhering to industry standard regulations.

- The market in North America is also benefited with important technology players and constant evolution in document management solutions. IBM, Oracle, Microsoft, as well as Xerox are some of the leading organizations offering effective technology to support document work process organizations. New EU-appealing GDPR rules for data protection and similar legislation in North America have additionally driven the need for safe and compliance document management programs in the region. Further, market growth has also been fuelled by the fact that with the growing adoption of remote working, documents need to be accessible at any location from the cloud. This trend is expected to continue as enterprise embrace the need to have flexibility, security and efficiency in handling their documents.

Active Key Players in the Business Document Work Process Management Market

- DocuSign, Inc. (USA)

- Hyland Software (USA)

- IBM (USA)

- Kofax, Inc. (USA)

- Microsoft Corporation (USA)

- OpenText (Canada)

- Oracle Corporation (USA)

- Ricoh Company, Ltd. (Japan)

- SAP SE (Germany)

- Xerox Corporation (USA)

- Other Active Players

|

Business Document Work Process Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.78 Billion |

|

Forecast Period 2024-32 CAGR: |

13.60% |

Market Size in 2032: |

USD 11.91 Billion |

|

|

By Component |

|

|

|

By Deployment Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Business Document Work Process Management Market by Component

4.1 Business Document Work Process Management Market Snapshot and Growth Engine

4.2 Business Document Work Process Management Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Solutions: Geographic Segmentation Analysis

4.4 Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Services: Geographic Segmentation Analysis

Chapter 5: Business Document Work Process Management Market by Deployment

5.1 Business Document Work Process Management Market Snapshot and Growth Engine

5.2 Business Document Work Process Management Market Overview

5.3 Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Services: Geographic Segmentation Analysis

5.4 Solution

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Solution: Geographic Segmentation Analysis

Chapter 6: Business Document Work Process Management Market by End User

6.1 Business Document Work Process Management Market Snapshot and Growth Engine

6.2 Business Document Work Process Management Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 BFSI: Geographic Segmentation Analysis

6.4 Healthcare

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Healthcare: Geographic Segmentation Analysis

6.5 IT & Telecom

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 IT & Telecom: Geographic Segmentation Analysis

6.6 Government

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Government: Geographic Segmentation Analysis

6.7 Retail

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Retail: Geographic Segmentation Analysis

6.8 Manufacturing

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Manufacturing: Geographic Segmentation Analysis

6.9 Others

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Business Document Work Process Management Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 IBM (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ORACLE CORPORATION (USA)

7.4 XEROX CORPORATION (USA)

7.5 OPENTEXT (CANADA)

7.6 MICROSOFT CORPORATION (USA)

7.7 SAP SE (GERMANY)

7.8 HYLAND SOFTWARE (USA)

7.9 DOCUSIGN INC. (USA)

7.10 KOFAX INC. (USA)

7.11 RICOH COMPANY

7.12 LTD. (JAPAN)

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Business Document Work Process Management Market By Region

8.1 Overview

8.2. North America Business Document Work Process Management Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Solutions

8.2.4.2 Services

8.2.5 Historic and Forecasted Market Size By Deployment

8.2.5.1 Services

8.2.5.2 Solution

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 BFSI

8.2.6.2 Healthcare

8.2.6.3 IT & Telecom

8.2.6.4 Government

8.2.6.5 Retail

8.2.6.6 Manufacturing

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Business Document Work Process Management Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Solutions

8.3.4.2 Services

8.3.5 Historic and Forecasted Market Size By Deployment

8.3.5.1 Services

8.3.5.2 Solution

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 BFSI

8.3.6.2 Healthcare

8.3.6.3 IT & Telecom

8.3.6.4 Government

8.3.6.5 Retail

8.3.6.6 Manufacturing

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Business Document Work Process Management Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Solutions

8.4.4.2 Services

8.4.5 Historic and Forecasted Market Size By Deployment

8.4.5.1 Services

8.4.5.2 Solution

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 BFSI

8.4.6.2 Healthcare

8.4.6.3 IT & Telecom

8.4.6.4 Government

8.4.6.5 Retail

8.4.6.6 Manufacturing

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Business Document Work Process Management Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Solutions

8.5.4.2 Services

8.5.5 Historic and Forecasted Market Size By Deployment

8.5.5.1 Services

8.5.5.2 Solution

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 BFSI

8.5.6.2 Healthcare

8.5.6.3 IT & Telecom

8.5.6.4 Government

8.5.6.5 Retail

8.5.6.6 Manufacturing

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Business Document Work Process Management Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Solutions

8.6.4.2 Services

8.6.5 Historic and Forecasted Market Size By Deployment

8.6.5.1 Services

8.6.5.2 Solution

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 BFSI

8.6.6.2 Healthcare

8.6.6.3 IT & Telecom

8.6.6.4 Government

8.6.6.5 Retail

8.6.6.6 Manufacturing

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Business Document Work Process Management Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Solutions

8.7.4.2 Services

8.7.5 Historic and Forecasted Market Size By Deployment

8.7.5.1 Services

8.7.5.2 Solution

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 BFSI

8.7.6.2 Healthcare

8.7.6.3 IT & Telecom

8.7.6.4 Government

8.7.6.5 Retail

8.7.6.6 Manufacturing

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Business Document Work Process Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.78 Billion |

|

Forecast Period 2024-32 CAGR: |

13.60% |

Market Size in 2032: |

USD 11.91 Billion |

|

|

By Component |

|

|

|

By Deployment Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||