Brazil Automotive Market Synopsis

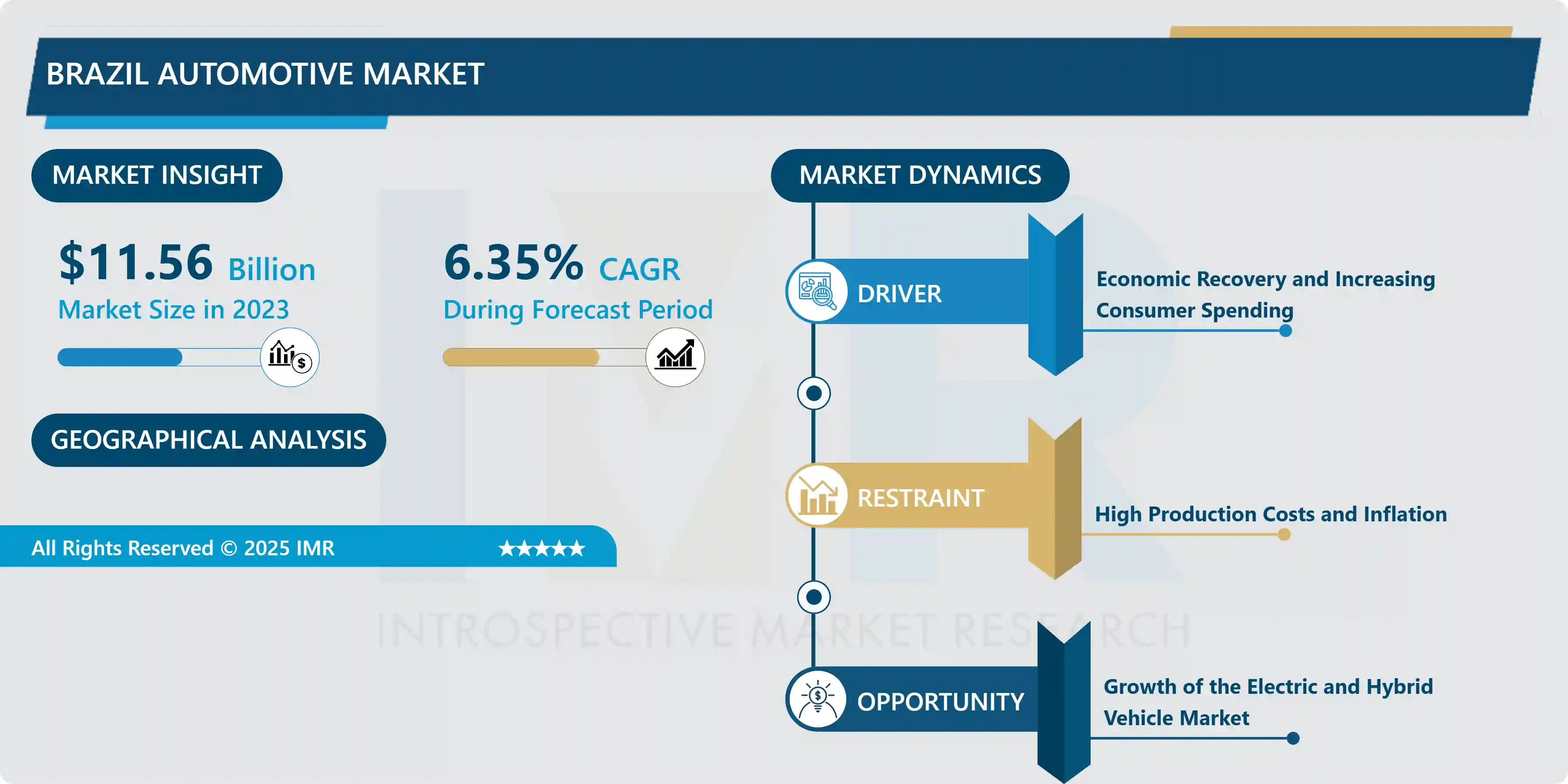

Brazil Automotive Market Size Was Valued at USD 11.56 Billion in 2023 and is Projected to Reach USD 20.12 Billion by 2032, Growing at a CAGR of 6.35 % From 2023-2032.

Automotive market is limited to the manufacture, importation and sales of automobiles, carriages and other motor vehicles including automobiles of the class requiring driver, automobiles of the class not requiring driver, buses, trucks and other motor cars. The market depends both on domestically produced and imported vehicles, the segments that are currently experiencing steady growth are EVs and hybrid models because of worsening environmental situation and enactments of relevant laws. They include private users and continuing to large fleets, agriculture, and logistics uses. The automotive sector in Brazil is well developed and receives backing from infrastructure, favorable location, and skilled human capital. Automotive industry in Brazil plays an important role in industrial potential with its large share in employment and gross domestic product in South American region.

The automotive industry of Brazil is now one of the most promising in Latin America, thanks to factors as industrial politics, entirely appropriate scale of production and high internal demand.. The automobile industry in Brazil sells over 2 million automobiles in a year and is therefore strategic in the economy of Brazil as it is in its standing as a manufacturing country of automobiles. The sector has government support especially in the matter of encouraging hardware technology innovations in electric or hybrid vehicles although the ICE vehicles dominate the sector. The automotive industry in Brazil consists of local manufacture by both Brazilian owned and foreign investment companies such as Volkswagen, General Motors, Fiat Chrysler, and Ford. In addition, Brazil is the largest export market for auto parts and components therefore; it is one of the most important supply chain nation for automobiles in Latin America.

The COVID-19 affected the automotive market in Brazil and there is a clear indication of its recovery as more people purchase cars as the economy grows.. The government efforts towards achieving the economic revival via offering fiscal incentives and large investment in the infrastructure is likely to compensate the sales of CVs. Furthermore, the growing demand for environmentally uplifting and energy-wise vehicles is creating prospects for electric and hybrid vehicles while constraints such as charging stations for electric vehicles. In a broad view, the Brazil automotive market remains dependent on several factors including domestic demand and global trade policies besides breakthrough technological methods used in the development of efficient propulsive systems.

Brazil Automotive Market Trend Analysis

Electric Vehicle Adoption

- Among all the trends, the most notable is the increase of demand for electric vehicles and hybrid automobile in the automobile market of Brazil.. And as concerns with the environment rises and the push for cleaner air intensifies consumers and manufacturers are looking for other modes of power. Brazil declared its general policies to minimize its emissions and concurrently, there are worldwide efforts to promote the use of electric and hybrid cars, and therefore, the market for manufacturing such vehicles has enhanced. While the level of EV penetration in Brazil is considerably lower than in Europe or North American countries, nevertheless, the society’s demand for higher fuel efficiency and environmental friendly vehicles is gradually emerging. Car manufacturers are launching more diverse models of electric cars and hybrids for both luxury and the popular classes. Moreover, from the perspectives of energy resources, Brazil has a fairly rich resource potential for sustained development of a renewable energy electricity grid, which may accommodation the gradual development of the EV structure in the future.

Infrastructure Development for EVs

- The most emerging prospect for the Brazil automotive market is the establishment of infrastructure for the battery electric vehicles (BEVs).Rising demand for electric vehicles will push the need for robust charging infrastructure that supports it. This thus open up wide investment opportunities for both local and foreign investors to partner with the government in putting up charging centers in almost all major cities and along most popular highways. As the government is committed to environment sustainability policies in line with the international target of reducing carbon emission, demand for infrastructure, incentives on electric vehicles and research and development in automobile industry is increasing.

- Also, there is an absolute availability of electric power resources like hydropower to support power for EV infrastructure so in this market segment Brazil has a significant prospect.. Development of EV can also create employment opportunities and economic development in remote areas of the country or the underdeveloped regions.

Brazil Automotive Market Segment Analysis:

Brazil Automotive Market Segmented on the basis of type, Fuel Type and end user.

By Type, Commercial Vehicles segment is expected to dominate the market during the forecast period

- The Commercial Vehicles segment is expected to remain the largest market in Brazil automotive during the forecast period due to the growing requirement of transport in the logistics, construction, and e-commerce industries.. Growing demand of infrastructure and improving economy of Brazil has also contributed in large demand of heavy motive power vehicles for transporting goods and buses for public transportation systems.

- Besides, online retail also known as e-commerce coupled with last mile transit deliveries requires LCVs more so in urban place.. Government support for construction of roads and other public utility services and investment in incentives for fleet renewal is another factor contributing to buoyant growth among commercial vehicles, as enterprises seek for means to optimize operational requirements. The adoption of electric and hybrid commercial vehicles is also projected to expand at a steady pace in response to the push by companies to contain fuel expenditure and chemical emissions. In conclusion, this segment is attributed to improved manufacturing situation in Brazil and nevertheless the significance of the LV stake commercial vehicles in a nation.

By Fuel Type, Electric segment expected to held the largest share

- The EV segment is expected to dominate the fuel type category in the Brazil automotive market in terms of market share in the period under review alluding to the country’s increasing adoption of environmentally friendly modes of transport.. This growth is complimented with the growing awareness of environmental conservation, government policies, and innovation in EV technology. There are policies such as tax credit, tax exemptions and subsidies which enable user and business organisations to afford electric vehicles in Brazil.

- Moreover the global automobile manufacturers are pulling up their socks in the Brazilian automobile market and they have brought in various electric vehicles and hybrids in the Brazilian market to meet the variety of needs.. This trend can be attributed to the advancement of EV infrastructure for instance charging station for electric vehicles. In addition, a number of renewable resources, including hydropower, is dominant in Brazil which makes the country is an attractive market for electric car penetration and thus promote visually sustainable energy patterns. Therefore, the electric segment should be expected to head the chemical and materials market, this being a trend seen across the globe as people look for ways to reduce greenhouse emissions and adopt environmentally friendly means of transport.

Brazil Automotive Market Regional Insights:

Sao Paulo is Expected to Dominate the Market Over the Forecast period

- Currently, São Paulo boasts of being a dominant player in automotive market of Brazil being talented for the largest proportion of car production and sales.. According to data from 2023, São Paulo represented around 50% of Brazil’s vehicle production, which contrasts with the fact that it is the main location of all the automotive activities of the country. The fact is that this region has a strong industrial background, highly developed transportation system, and a highly qualified workforce that is suitable for large auto industry giants like General Motors, Volkswagen, and Fiat Chrysler. Tapping more into São Paulo’s competitive advantage is its access to major ports and transport links, both of which are crucial for exports in terms of Brazil and some other Latin American countries’ supply chain. Moreover, it is a consumer market with a significant population of the urban population applying demand for the passengers and commercial vehicles. Due to the current economic importance São Paulo holds for the Brazilian economy, it is poised that the sales of automobiles in this region will remain on an upward trend through 2023 and beyond.

Active Key Players in the Brazil Automotive Market

- Chery Automobile Co. (China)

- Fiat Chrysler Automobiles (FCA) (Italy/USA)

- Ford Motor Company (USA)

- General Motors (USA)

- Honda Motor Co., Ltd. (Japan)

- Hyundai Motor Company (South Korea)

- Kia Motors (South Korea)

- Mercedes-Benz Group AG (Germany)

- Nissan Motor Co., Ltd. (Japan)

- Peugeot S.A. (France)

- Renault S.A. (France)

- Scania AB (Sweden)

- Toyota Motor Corporation (Japan)

- Volkswagen AG (Germany)

- Volvo Cars (Sweden) and Other key Players

Brazil Automotive Market Scope:

|

Brazil Automotive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.56 Bn. |

|

Forecast Period 2023-32 CAGR: |

6.35 % |

Market Size in 2032: |

USD 20.12 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Fuel Type |

|

||

|

|

By End User |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Brazil Automotive Market by Type (2018-2032)

4.1 Brazil Automotive Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Passenger

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Commercial

Chapter 5: Brazil Automotive Market by Fuel Type (2018-2032)

5.1 Brazil Automotive Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Gasoline

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Diesel

5.5 Electric

5.6 Hybrid

5.7 CNG

5.8 LPG

Chapter 6: Brazil Automotive Market by End User (2018-2032)

6.1 Brazil Automotive Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Personal Use

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial Use

6.5 Fleet Management Companies

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Brazil Automotive Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CHERY AUTOMOBILE CO. (CHINA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 FIAT CHRYSLER AUTOMOBILES (FCA) (ITALY/USA)

7.4 FORD MOTOR COMPANY (USA)

7.5 GENERAL MOTORS (USA)

7.6 HONDA MOTOR COLTD. (JAPAN)

7.7 HYUNDAI MOTOR COMPANY (SOUTH KOREA)

7.8 KIA MOTORS (SOUTH KOREA)

7.9 MERCEDES-BENZ GROUP AG (GERMANY)

7.10 NISSAN MOTOR COLTD. (JAPAN)

7.11 PEUGEOT S.A. (FRANCE)

7.12 RENAULT S.A. (FRANCE)

7.13 SCANIA AB (SWEDEN)

7.14 TOYOTA MOTOR CORPORATION (JAPAN)

7.15 VOLKSWAGEN AG (GERMANY)

7.16 VOLVO CARS (SWEDEN) OTHER KEY PLAYERS

7.17

Chapter 8: Global Brazil Automotive Market By Region

8.1 Overview

8.2. North America Brazil Automotive Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Passenger

8.2.4.2 Commercial

8.2.5 Historic and Forecasted Market Size by Fuel Type

8.2.5.1 Gasoline

8.2.5.2 Diesel

8.2.5.3 Electric

8.2.5.4 Hybrid

8.2.5.5 CNG

8.2.5.6 LPG

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Personal Use

8.2.6.2 Commercial Use

8.2.6.3 Fleet Management Companies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Brazil Automotive Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Passenger

8.3.4.2 Commercial

8.3.5 Historic and Forecasted Market Size by Fuel Type

8.3.5.1 Gasoline

8.3.5.2 Diesel

8.3.5.3 Electric

8.3.5.4 Hybrid

8.3.5.5 CNG

8.3.5.6 LPG

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Personal Use

8.3.6.2 Commercial Use

8.3.6.3 Fleet Management Companies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Brazil Automotive Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Passenger

8.4.4.2 Commercial

8.4.5 Historic and Forecasted Market Size by Fuel Type

8.4.5.1 Gasoline

8.4.5.2 Diesel

8.4.5.3 Electric

8.4.5.4 Hybrid

8.4.5.5 CNG

8.4.5.6 LPG

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Personal Use

8.4.6.2 Commercial Use

8.4.6.3 Fleet Management Companies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Brazil Automotive Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Passenger

8.5.4.2 Commercial

8.5.5 Historic and Forecasted Market Size by Fuel Type

8.5.5.1 Gasoline

8.5.5.2 Diesel

8.5.5.3 Electric

8.5.5.4 Hybrid

8.5.5.5 CNG

8.5.5.6 LPG

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Personal Use

8.5.6.2 Commercial Use

8.5.6.3 Fleet Management Companies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Brazil Automotive Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Passenger

8.6.4.2 Commercial

8.6.5 Historic and Forecasted Market Size by Fuel Type

8.6.5.1 Gasoline

8.6.5.2 Diesel

8.6.5.3 Electric

8.6.5.4 Hybrid

8.6.5.5 CNG

8.6.5.6 LPG

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Personal Use

8.6.6.2 Commercial Use

8.6.6.3 Fleet Management Companies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Brazil Automotive Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Passenger

8.7.4.2 Commercial

8.7.5 Historic and Forecasted Market Size by Fuel Type

8.7.5.1 Gasoline

8.7.5.2 Diesel

8.7.5.3 Electric

8.7.5.4 Hybrid

8.7.5.5 CNG

8.7.5.6 LPG

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Personal Use

8.7.6.2 Commercial Use

8.7.6.3 Fleet Management Companies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Brazil Automotive Market Scope:

|

Brazil Automotive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.56 Bn. |

|

Forecast Period 2023-32 CAGR: |

6.35 % |

Market Size in 2032: |

USD 20.12 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Fuel Type |

|

||

|

|

By End User |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||