Bioburden Testing Market Synopsis

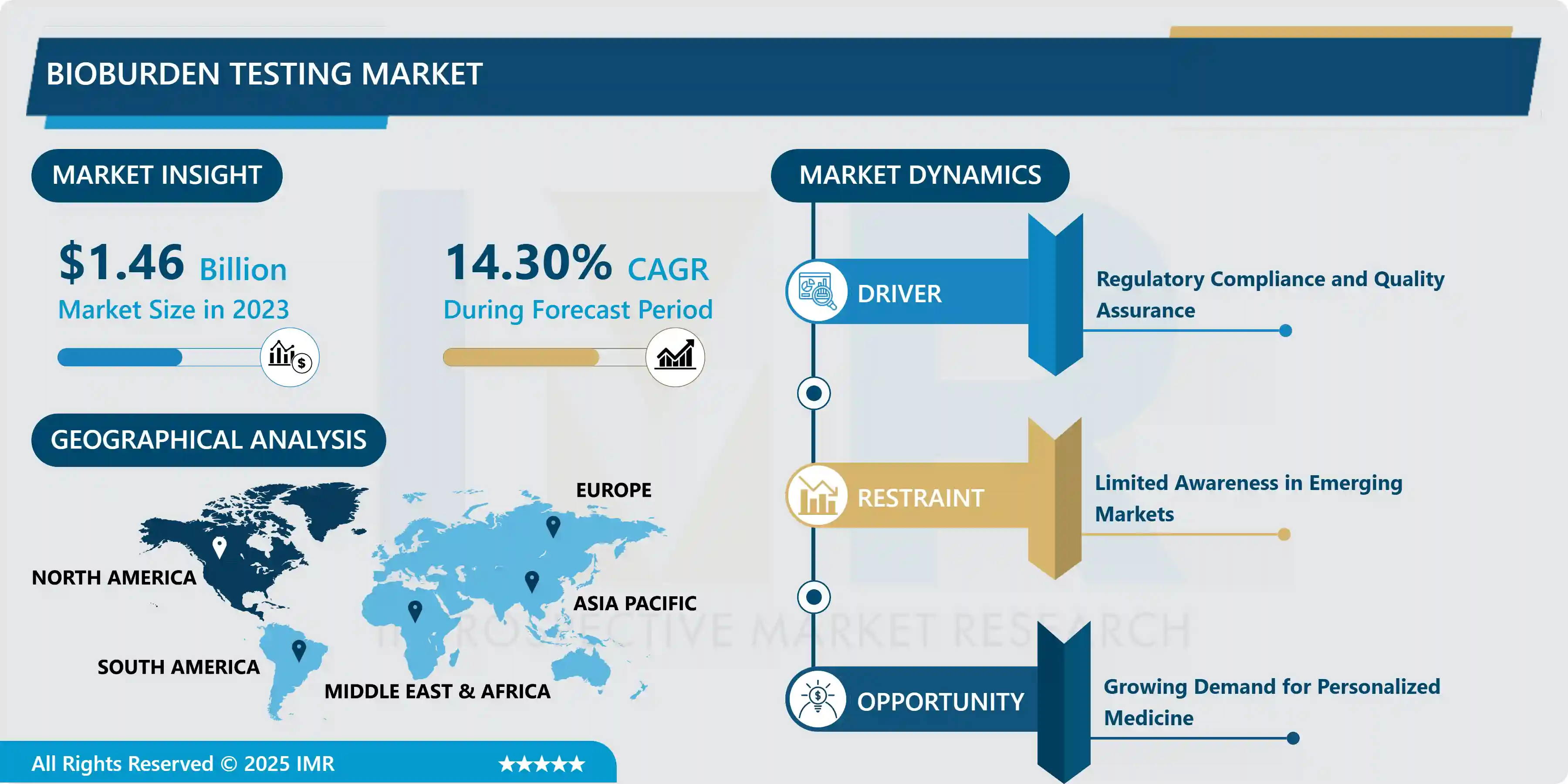

Bioburden Testing Market Size is Valued at USD 1.46 Billion in 2023 and is Projected to Reach USD 4.26 Billion by 2032, Growing at a CAGR of 14.30% From 2024-2032.

The Bioburden testing market entails the assessment of microbial presence on products like drugs, equipment and cosmetics among others. This detection establishes the count of the live bacterial count within a given sample to enable a guarantee of the sterility of products. Basically, bioburden testing is a necessity in many industries where it ensures that companies meet set quality standards as well as safeguard the public from dangerous pathogens.

Thus, the primary reason for rising demand for the services is the demand for compliance with regulatory standards in the field of pharmaceuticals and biotechnology. Given that highly-regarded authorities such as the FDA and EMA have made quality control measures more stringent, the need for bioburden testing has shot up recently. This compliance is important so there will be assurance that the products themselves are safe and the threat of contamination is greatly reduced, especially important with pharmaceuticals and medical devices.

Another factor behind this growth is increasing focus on the microbial quality control in healthcare and life science industry. With the importance place on cleanliness in manufacturing processes and shift in patient safety practice the need for bioburden testing services has soared. Moreover, an increase in biologic growth and biosimilars also has increased the importance of an effective bioburden assessment to meet safety measures.

Bioburden Testing Market Trend Analysis

Increasing adoption of automated testing systems.

- One thing that should be of interest when analyzing the market for bioburden testing is the fact that more and more companies are using automated testing systems. By automating ways of performing bioburden tests, numerous accidents implying human input are eliminated, and a large number of tests can be performed simultaneously. Bigger than the idea of innovation is the pursuit of efficiency thus; there is a significant investment in the usage of sophisticated technologies such as the rapid microbiological testing methods that enhances faster and shorter time-to-market for products in the industry.

- Another new trend is the use of big data and applied software technologies in the process of bioburden testing. Test strategies are being optimized by data analytics, the identification of microbial contamination patterns, and to support other managerial decisions. This trend is indicative with the current world advanced technologies’ reliance on Biopharmaceuticals and Medical Device industries’ increasingly reliance on data to improve quality and adherence to industry standards.

Increase in pharmaceutical and biotechnology industries, there is a rising demand for bioburden testing services.

- Global industry for bioburden testing is also expected to have substantial growth prospects especially in the developing countries. With the continued expansion of these regions in pharmaceutical and biotechnology industries there is a growing demand for bioburden testing services. Those who seek to increase their portfolio share should benefit from this trend by partnering and operating locally in these regions meeting the surging need for quality assurance.

- Further opportunities are the implementation of the new approaches to the bioburden testing technologies, for instance, rapid and molecular testing. Such innovations do not only increase the quality and efficiency of the testing process but also open the possibility of the company to carve out the niche in a highly saturated field. With organisations continuing to look for effective and cost-effective means of performing test, those organisations willing and able to invest in highly innovative test solutions are likely to do so at the expense of their competitors.

Bioburden Testing Market Segment Analysis:

Bioburden Testing Market Segmented on the basis of By Product, Test Type, application, and end-users.

By Test Type, Membrane Filtration segment is expected to dominate the market during the forecast period

- Bioburden testing is comprised of numerous tests differentiated by the application that the results of the tests will answer. Membrane filtration is commonly used where the actual liquid sample is passed through a membrane filter to trap microorganisms; hence the method can be used to test solutions which include, Pharmaceuticals and water. The pour plate method is the procedure of mixing a sample with agar and then putting the mixture in a petri dish in order to count microorganisms, used in environmental and pharmaceutical investigations. The RTT could also include ‘Others’ which will comprise surface testing, where the primary focus is the microbial count available on surfaces since the sterile manufacturing environment is of paramount importance, broader testing categories that may contain molecular techniques, rapid tests and counts—in case the need arises. Combined, these methods give maximum microbial coverage and conformity to set standards in a wide range of industries.

By Application, Pharmaceutical segment held the largest share in 2024

- The Bioburden testing market is used in numerous applications across the different verticals, all of which requires certain level of microbial control. Especially in the field of Pharmaceuticals, the bioburden testing plays a significant role in checking the prospects of sterility and safety of the products, even low level of the microbial presence can be hazardous to health. It’s also evident that these tests are useful in biotechnology in as much as other tests are used to ensure that biologic products and research, cultures, and assays are free of unwanted microorganisms. The same is true for medical devices industry where bioburden testing is required to ensure that the product, especially those that come into contact with sterile surfaces or are implanted within patient’s body, is safe. In cosmetics bioburden testing is essential where microbial contamination can cause change in the product shelf life and be a potential threat to the consumer’s health hence serves to ensure compliance to the quality standards. Microbial control is also critical in other industries that the ‘Others’ category comprises, such as the food and beverage and water and environmental testing sectors. All together these uses emphasize the need to conduct bioburden test an attribute that helps preserve public health as well as the integrity of the product in numerous disciplines.

Bioburden Testing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The Bioburden testing market in North America is the largest due to prosen foundations in the sector such as the large no. of pharmaceutical and biotechnology firms and sound regulatory frame work. Bioburden testing is critical in the region due to its well-developed health sector and the region’s high investment on research and development. In addition, the growing need for microbial quality assurance in creating novel products and in production operations in North America also fuels the use of testing services.

- In addition, contract research organizations that are based in this region provide bioburden testing services for the region. These organizations are important to supplement pharma and biotech companies’ capabilities by offering knowledge in compliance and testing strategies. Stakeholder engagement in North America has been strong and has enhanced market novelty and solidity to meet emerging challenges in the bioburden testing market.

Active Key Players in the Bioburden Testing Market

- Merck KGaA (Germany)

- Charles River Laboratories (United States)

- bioMérieux SA (France)

- Thermo Fisher Scientific (United States)

- Eppendorf AG (Germany)

- Pall Corporation (United States)

- Becton, Dickinson and Company (United States)

- Sartorius AG (Germany)

- Lonza Group (Switzerland)

- Abbott Laboratories (United States) and Others Active Players

|

Global Bioburden Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.30 % |

Market Size in 2032: |

USD 4.26 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Test Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bioburden Testing Market by Product (2018-2032)

4.1 Bioburden Testing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Consumables

4.5 Services

Chapter 5: Bioburden Testing Market by Test Type (2018-2032)

5.1 Bioburden Testing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Membrane Filtration

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pour Plate

5.5 Surface Testing

5.6 Others

Chapter 6: Bioburden Testing Market by Application (2018-2032)

6.1 Bioburden Testing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmaceutical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Biotechnology

6.5 Medical Devices

6.6 Cosmetics

6.7 Others

Chapter 7: Bioburden Testing Market by End User (2018-2032)

7.1 Bioburden Testing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceutical Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Biotechnology Companies

7.5 Contract Research Organizations (CROs)

7.6 Academic and Research Institutes

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bioburden Testing Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MERCK KGAA (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CHARLES RIVER LABORATORIES (UNITED STATES)

8.4 BIOMÉRIEUX SA (FRANCE)

8.5 THERMO FISHER SCIENTIFIC (UNITED STATES)

8.6 EPPENDORF AG (GERMANY)

8.7 PALL CORPORATION (UNITED STATES)

8.8 BECTON

8.9 DICKINSON AND COMPANY (UNITED STATES)

8.10 SARTORIUS AG (GERMANY)

8.11 LONZA GROUP (SWITZERLAND)

8.12 ABBOTT LABORATORIES (UNITED STATES) OTHERS ACTIVE PLAYERS

8.13

Chapter 9: Global Bioburden Testing Market By Region

9.1 Overview

9.2. North America Bioburden Testing Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Instruments

9.2.4.2 Consumables

9.2.4.3 Services

9.2.5 Historic and Forecasted Market Size by Test Type

9.2.5.1 Membrane Filtration

9.2.5.2 Pour Plate

9.2.5.3 Surface Testing

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Pharmaceutical

9.2.6.2 Biotechnology

9.2.6.3 Medical Devices

9.2.6.4 Cosmetics

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Pharmaceutical Companies

9.2.7.2 Biotechnology Companies

9.2.7.3 Contract Research Organizations (CROs)

9.2.7.4 Academic and Research Institutes

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bioburden Testing Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Instruments

9.3.4.2 Consumables

9.3.4.3 Services

9.3.5 Historic and Forecasted Market Size by Test Type

9.3.5.1 Membrane Filtration

9.3.5.2 Pour Plate

9.3.5.3 Surface Testing

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Pharmaceutical

9.3.6.2 Biotechnology

9.3.6.3 Medical Devices

9.3.6.4 Cosmetics

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Pharmaceutical Companies

9.3.7.2 Biotechnology Companies

9.3.7.3 Contract Research Organizations (CROs)

9.3.7.4 Academic and Research Institutes

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bioburden Testing Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Instruments

9.4.4.2 Consumables

9.4.4.3 Services

9.4.5 Historic and Forecasted Market Size by Test Type

9.4.5.1 Membrane Filtration

9.4.5.2 Pour Plate

9.4.5.3 Surface Testing

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Pharmaceutical

9.4.6.2 Biotechnology

9.4.6.3 Medical Devices

9.4.6.4 Cosmetics

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Pharmaceutical Companies

9.4.7.2 Biotechnology Companies

9.4.7.3 Contract Research Organizations (CROs)

9.4.7.4 Academic and Research Institutes

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bioburden Testing Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Instruments

9.5.4.2 Consumables

9.5.4.3 Services

9.5.5 Historic and Forecasted Market Size by Test Type

9.5.5.1 Membrane Filtration

9.5.5.2 Pour Plate

9.5.5.3 Surface Testing

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Pharmaceutical

9.5.6.2 Biotechnology

9.5.6.3 Medical Devices

9.5.6.4 Cosmetics

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Pharmaceutical Companies

9.5.7.2 Biotechnology Companies

9.5.7.3 Contract Research Organizations (CROs)

9.5.7.4 Academic and Research Institutes

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bioburden Testing Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Instruments

9.6.4.2 Consumables

9.6.4.3 Services

9.6.5 Historic and Forecasted Market Size by Test Type

9.6.5.1 Membrane Filtration

9.6.5.2 Pour Plate

9.6.5.3 Surface Testing

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Pharmaceutical

9.6.6.2 Biotechnology

9.6.6.3 Medical Devices

9.6.6.4 Cosmetics

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Pharmaceutical Companies

9.6.7.2 Biotechnology Companies

9.6.7.3 Contract Research Organizations (CROs)

9.6.7.4 Academic and Research Institutes

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bioburden Testing Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Instruments

9.7.4.2 Consumables

9.7.4.3 Services

9.7.5 Historic and Forecasted Market Size by Test Type

9.7.5.1 Membrane Filtration

9.7.5.2 Pour Plate

9.7.5.3 Surface Testing

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Pharmaceutical

9.7.6.2 Biotechnology

9.7.6.3 Medical Devices

9.7.6.4 Cosmetics

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Pharmaceutical Companies

9.7.7.2 Biotechnology Companies

9.7.7.3 Contract Research Organizations (CROs)

9.7.7.4 Academic and Research Institutes

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Bioburden Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.30 % |

Market Size in 2032: |

USD 4.26 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Test Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||