Bio-MEMS Market Synopsis

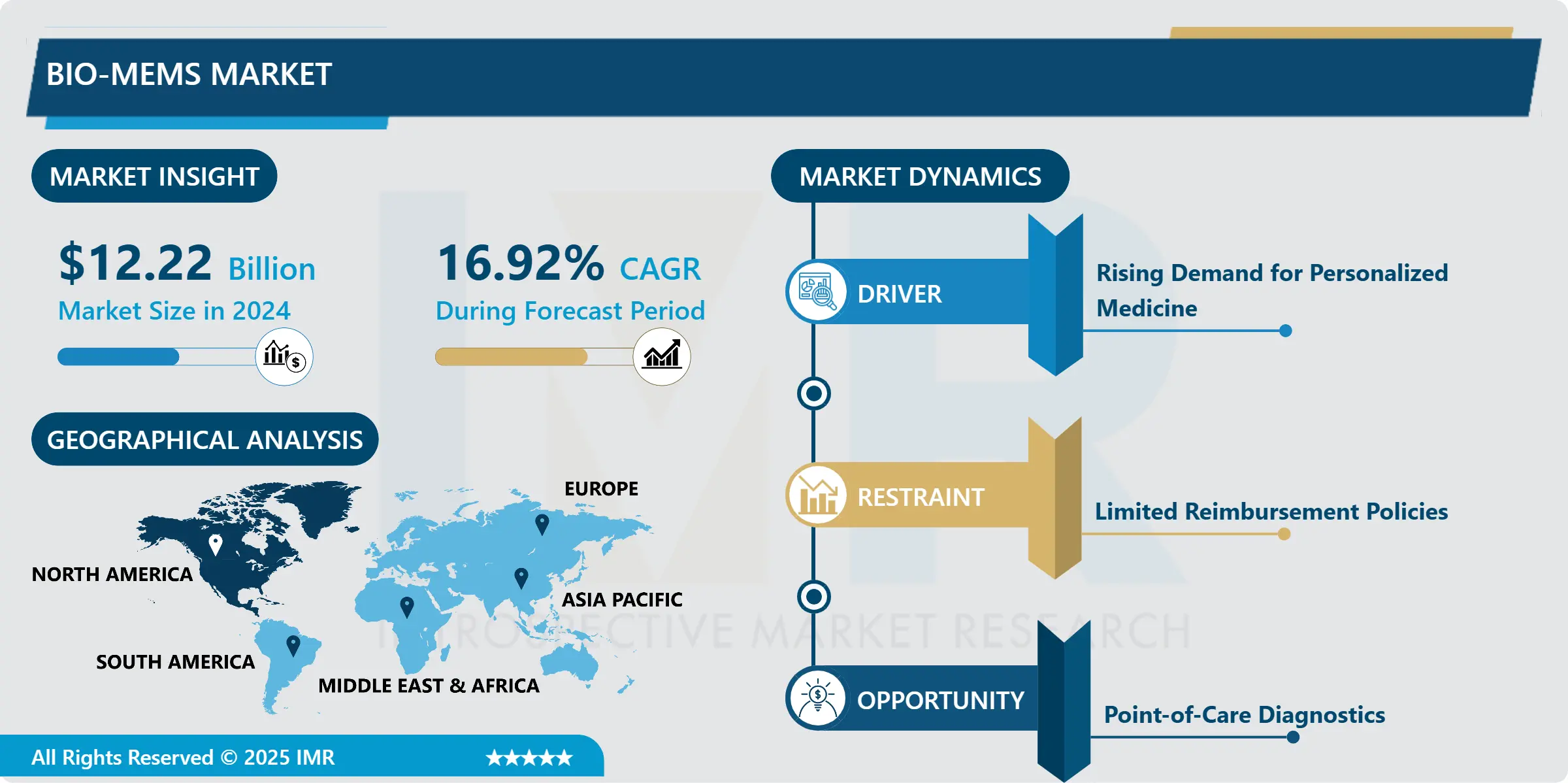

Bio-MEMS Market Size Was Valued at USD 12.22 Billion in 2024, and is Projected to Reach USD 68.21 Billion by 2035, Growing at a CAGR of 16.92% From 2025-2035.

Bio-MEMS (Biological Micro-Electro-Mechanical Systems) refer to miniaturized devices that merge biology with microfabrication technology. These systems integrate biological components, such as cells or molecules, with small-scale mechanical and electrical components on a single platform.

Applications of Bio-MEMS span various domains within healthcare. They're used in diagnostic devices like lab-on-chip systems, enabling rapid and precise analysis of biological samples. In therapeutics, Bio-MEMS facilitate targeted drug delivery and implantable devices for controlled release. Monitoring devices, including wearable sensors, provide continuous health data collection. Additionally, in surgical settings, Bio-MEMS aid in minimally invasive procedures and robotic-assisted surgeries, enhancing precision and reducing invasiveness.

Advantages of Bio-MEMS lie in their compact size, allowing for portability and minimally invasive procedures. They offer improved sensitivity and specificity in diagnostics, enabling early disease detection. Their integration with biological systems enhances compatibility and reduces adverse reactions, while their miniaturization decreases sample and reagent volumes, cutting costs and analysis time. Moreover, their ability to offer personalized and precise treatment options underscores their potential impact on advancing healthcare towards more tailored and effective interventions.

Bio-MEMS Market Trend Analysis

Rising Demand for Personalized Medicine

- Personalized medicine tailors’ medical treatments to individual characteristics, including genetic makeup, lifestyle, and specific health conditions. Bio-MEMS devices play a crucial role in this paradigm shift by enabling precise diagnostics, targeted therapies, and continuous monitoring, aligning perfectly with the ethos of personalized healthcare.

- Bio-MEMS devices facilitate the collection of real-time data, such as genetic information, biomarkers, and physiological parameters, allowing for a deeper understanding of an individual's health profile. These devices aid in early disease detection, offer accurate diagnostics, and enable the delivery of targeted therapies with reduced side effects. For instance, lab-on-chip systems integrated into Bio-MEMS platforms can analyze small samples of blood or tissue to identify specific biomarkers, guiding clinicians in prescribing personalized treatment regimens.

- As the demand for tailored healthcare solutions intensifies, Bio-MEMS technologies provide the means to develop and deliver these personalized interventions. Their ability to integrate biological components with micro-scale mechanical and electrical systems facilitates the creation of precise and efficient medical devices. This aligns with the evolving healthcare landscape, where customization and precision are becoming increasingly imperative for improved patient outcomes, driving the growth of the Bio-MEMS market.

Point-of-Care Diagnostics

- Point-of-care diagnostics (POC) represents a significant opportunity within the Bio-MEMS market, revolutionizing healthcare by providing rapid, accurate, and convenient testing at the patient's side. Bio-MEMS technologies play a pivotal role in this domain, enabling the development of portable and miniaturized diagnostic devices.

- These devices integrate microfluidics, sensors, and other components onto a single chip, facilitating quick analysis of biological samples such as blood, saliva, or urine. The ability to perform complex assays in a compact and automated manner offers immense potential for decentralized healthcare delivery, especially in remote or resource-limited settings.

- POC diagnostics powered by Bio-MEMS enhance accessibility to healthcare by reducing the reliance on centralized laboratories and lengthy turnaround times for test results. This is especially critical for rapid diagnosis and treatment initiation in emergency situations or infectious disease outbreaks.

- Moreover, these devices hold promise for managing chronic conditions by enabling frequent monitoring and timely intervention, thereby improving patient outcomes and reducing healthcare costs associated with hospital visits.

- The market opportunity lies in the continued development of Bio-MEMS-based POC devices that are user-friendly, cost-effective, and capable of performing a wide range of tests with high sensitivity and specificity. Their ability to democratize healthcare by bringing sophisticated diagnostics closer to the patient's bedside represents a transformative opportunity in the medical landscape.

Bio-MEMS Market Segment Analysis:

Bio-MEMS Market Segmented on the basis of type, material, product and application.

By Type, MEMS Sensors segment is expected to dominate the market during the forecast period

- In the realm of Bio-MEMS, the MEMS (Micro-Electro-Mechanical Systems) sensors segment is poised to dominate the market throughout the forecast period. MEMS sensors form a critical component of Bio-MEMS devices, facilitating the measurement and detection of various biological parameters and environmental factors with high precision and sensitivity.

- These sensors enable the monitoring of vital signs, biomarkers, and physiological parameters, playing a key role in diagnostics, continuous health monitoring, and therapeutic applications. Their miniaturized form factor allows for integration into wearable devices, implantable systems, and point-of-care diagnostic tools.

- As healthcare increasingly emphasizes personalized and remote monitoring, the demand for MEMS sensors continues to surge due to their ability to provide real-time data for timely interventions and treatment adjustments. Their versatility, low power consumption, and cost-effectiveness further contribute to their dominance within the Bio-MEMS market, catering to diverse applications and driving advancements in personalized medicine and healthcare delivery.

By Application, Patient Monitoring segment held the largest market share of 37.8% in 2022

- Within the Bio-MEMS market, the Patient Monitoring segment has emerged as a frontrunner, capturing the largest market share due to its pivotal role in continuous health tracking and disease management. Patient Monitoring Bio-MEMS devices encompass a spectrum of sensors, microfluidic systems, and wearable technologies that facilitate real-time monitoring of vital signs, biomarkers, and other physiological parameters.

- These devices enable remote and continuous monitoring of patients, providing healthcare professionals with critical data for timely interventions and personalized treatment adjustments. They find extensive use in chronic disease management, post-operative care, and elderly patient monitoring, enhancing patient comfort while ensuring timely medical attention.

- The rise in chronic diseases and the aging population has augmented the demand for these monitoring systems, driving their market dominance. Their ability to offer real-time insights into a patient's health status, coupled with advancements in sensor technology and data analytics, positions the Patient Monitoring segment at the forefront of Bio-MEMS applications, promising improved patient outcomes and efficient healthcare management.

Bio-MEMS Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to maintain its dominance in the Bio-MEMS market over the forecast period. This region's leading position is attributed to several factors, including robust technological advancements, significant investments in healthcare R&D, and a favorable regulatory framework supporting innovation in medical devices.

- The presence of key market players, research institutions, and a well-established healthcare infrastructure contributes to the region's prominence. Moreover, the growing prevalence of chronic diseases, an aging population, and the emphasis on personalized medicine in North America drive the demand for advanced biomedical technologies such as Bio-MEMS.

- Additionally, increased awareness among healthcare professionals and patients about the benefits of these devices, coupled with a higher adoption rate of novel medical technologies, further bolsters the market in North America. The region's conducive ecosystem for research, development, and commercialization of Bio-MEMS applications solidifies its position as a frontrunner in the global market landscape.

Bio-MEMS Market Top Key Players:

- Abbott Laboratories (U.S.)

- Amphenol Corporation (U.S.)

- Baxter International, Inc. (U.S.)

- Becton, Dickinson, And Company (U.S.)

- Bluechiip Ltd. (Australia)

- Boston Scientific Corporation (U.S.)

- Danaher Corp. (U.S.)

- Debiotech Sa (Switzerland)

- Integrated Sensing Systems Inc. (U.S.)

- Intellisense Software Corporation (U.S.)

- Medtronic Plc (Ireland)

- Micronit Micro Technologies Bv (Netherlands)

- Perkinelmer Inc (U.S.)

- Philips Engineering Solutions

- Redbud Labs, Inc. (U.S.)

- Sensera Limited (Australia)

- Stmicroelectronics Inc. (Switzerland)

- Taylor Hobson (Ametek Inc.) (U.K.)

- Teledyne Dalsa Inc. (Canada)

- Texas Instruments Inc (U.S.)

- Ufluidix, Inc (Canada) And Other Major Players

Key industry in the Bio-MEMS Market:

- In April 2024, Bosch announced a strategic collaboration with Randox Laboratories Ltd., a leader in laboratory and medical technology. Together, the companies are committing approximately 150 million euros to shared initiatives in research, development, and marketing. This partnership aims to expand the range of tests available for Bosch Healthcare Solutions' Vivalytic analysis platform. A key focus is the creation of a high-multiplex in vitro diagnostics (IVD) sepsis test, which will leverage cutting-edge BioMEMS technology for the first time.

- In July 2024, Bioserve India unveiled its advanced stem cell product line in collaboration with REPROCELL, aiming to accelerate scientific research and drug development in India. The offerings include cell culture products, reprogramming kits, 3D cell culture systems, cellular assays, drug discovery services, and a biorepository with over 600,000 biospecimens. Designed to enhance regenerative medicine and therapeutic discovery, the launch is set to drive innovation in India's rapidly growing stem cell market.

- In October 2023, Precision Neuroscience secured FDA breakthrough status for its brain-computer interface (BCI), marking a major advancement in the BioMEMS industry. By acquiring a MEMS foundry in Texas, the company has bolstered production capabilities for its Layer 7 Cortical Interface, which features 1,024 electrodes. Targeting FDA approval in 2024, Precision is solidifying its position as a leading biomedical MEMS producer in the United States.

|

Bio-MEMS Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.22 Bn. |

|

Forecast Period 2025-35 CAGR: |

16.92 % |

Market Size in 2035: |

USD 68.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bio-MEMS Market by Type (2018-2035)

4.1 Bio-MEMS Market Snapshot and Growth Engine

4.2 Market Overview

4.3 MEMS Sensors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Micro fluids

Chapter 5: Bio-MEMS Market by Material (2018-2035)

5.1 Bio-MEMS Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Silicon and Glass

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastics and Polymers

5.5 Paper

5.6 Biological Material

Chapter 6: Bio-MEMS Market by Product (2018-2035)

6.1 Bio-MEMS Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Injectables

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Implantable

Chapter 7: Bio-MEMS Market by Application (2018-2035)

7.1 Bio-MEMS Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Patient Monitoring

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 IVD Testing

7.5 Medical Imaging

7.6 Drug Delivery

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bio-MEMS Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ROUNDUP WORLD STREET KITCHEN

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MSM CATERING TRUCKS MANUFACTURING

8.4 FOOD TRUCK INDIA

8.5 FOOD TRUCK COMPANY B.VMALLAGHAN

8.6 VS VEICOLISPECIALI

8.7 PRESTIGE CUSTOM FOOD TRUCK MANUFACTURER

8.8 EASYTRACGPS INCBOSTONIAN BODY INCTHE FUD TRAILER COMPANY

8.9 ROAMING HUNGER

8.10 GOOD FOOD TRUCK COMPANY

8.11 UNITED FOOD TRUCKS UNITED LLC

8.12 M&R TRAILERS

8.13 FUTURISTO TRAILERS

Chapter 9: Global Bio-MEMS Market By Region

9.1 Overview

9.2. North America Bio-MEMS Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 MEMS Sensors

9.2.4.2 Micro fluids

9.2.5 Historic and Forecasted Market Size by Material

9.2.5.1 Silicon and Glass

9.2.5.2 Plastics and Polymers

9.2.5.3 Paper

9.2.5.4 Biological Material

9.2.6 Historic and Forecasted Market Size by Product

9.2.6.1 Injectables

9.2.6.2 Implantable

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Patient Monitoring

9.2.7.2 IVD Testing

9.2.7.3 Medical Imaging

9.2.7.4 Drug Delivery

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bio-MEMS Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 MEMS Sensors

9.3.4.2 Micro fluids

9.3.5 Historic and Forecasted Market Size by Material

9.3.5.1 Silicon and Glass

9.3.5.2 Plastics and Polymers

9.3.5.3 Paper

9.3.5.4 Biological Material

9.3.6 Historic and Forecasted Market Size by Product

9.3.6.1 Injectables

9.3.6.2 Implantable

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Patient Monitoring

9.3.7.2 IVD Testing

9.3.7.3 Medical Imaging

9.3.7.4 Drug Delivery

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bio-MEMS Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 MEMS Sensors

9.4.4.2 Micro fluids

9.4.5 Historic and Forecasted Market Size by Material

9.4.5.1 Silicon and Glass

9.4.5.2 Plastics and Polymers

9.4.5.3 Paper

9.4.5.4 Biological Material

9.4.6 Historic and Forecasted Market Size by Product

9.4.6.1 Injectables

9.4.6.2 Implantable

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Patient Monitoring

9.4.7.2 IVD Testing

9.4.7.3 Medical Imaging

9.4.7.4 Drug Delivery

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bio-MEMS Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 MEMS Sensors

9.5.4.2 Micro fluids

9.5.5 Historic and Forecasted Market Size by Material

9.5.5.1 Silicon and Glass

9.5.5.2 Plastics and Polymers

9.5.5.3 Paper

9.5.5.4 Biological Material

9.5.6 Historic and Forecasted Market Size by Product

9.5.6.1 Injectables

9.5.6.2 Implantable

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Patient Monitoring

9.5.7.2 IVD Testing

9.5.7.3 Medical Imaging

9.5.7.4 Drug Delivery

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bio-MEMS Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 MEMS Sensors

9.6.4.2 Micro fluids

9.6.5 Historic and Forecasted Market Size by Material

9.6.5.1 Silicon and Glass

9.6.5.2 Plastics and Polymers

9.6.5.3 Paper

9.6.5.4 Biological Material

9.6.6 Historic and Forecasted Market Size by Product

9.6.6.1 Injectables

9.6.6.2 Implantable

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Patient Monitoring

9.6.7.2 IVD Testing

9.6.7.3 Medical Imaging

9.6.7.4 Drug Delivery

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bio-MEMS Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 MEMS Sensors

9.7.4.2 Micro fluids

9.7.5 Historic and Forecasted Market Size by Material

9.7.5.1 Silicon and Glass

9.7.5.2 Plastics and Polymers

9.7.5.3 Paper

9.7.5.4 Biological Material

9.7.6 Historic and Forecasted Market Size by Product

9.7.6.1 Injectables

9.7.6.2 Implantable

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Patient Monitoring

9.7.7.2 IVD Testing

9.7.7.3 Medical Imaging

9.7.7.4 Drug Delivery

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Bio-MEMS Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.22 Bn. |

|

Forecast Period 2025-35 CAGR: |

16.92 % |

Market Size in 2035: |

USD 68.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||