Beverage Dispenser Market Synopsis:

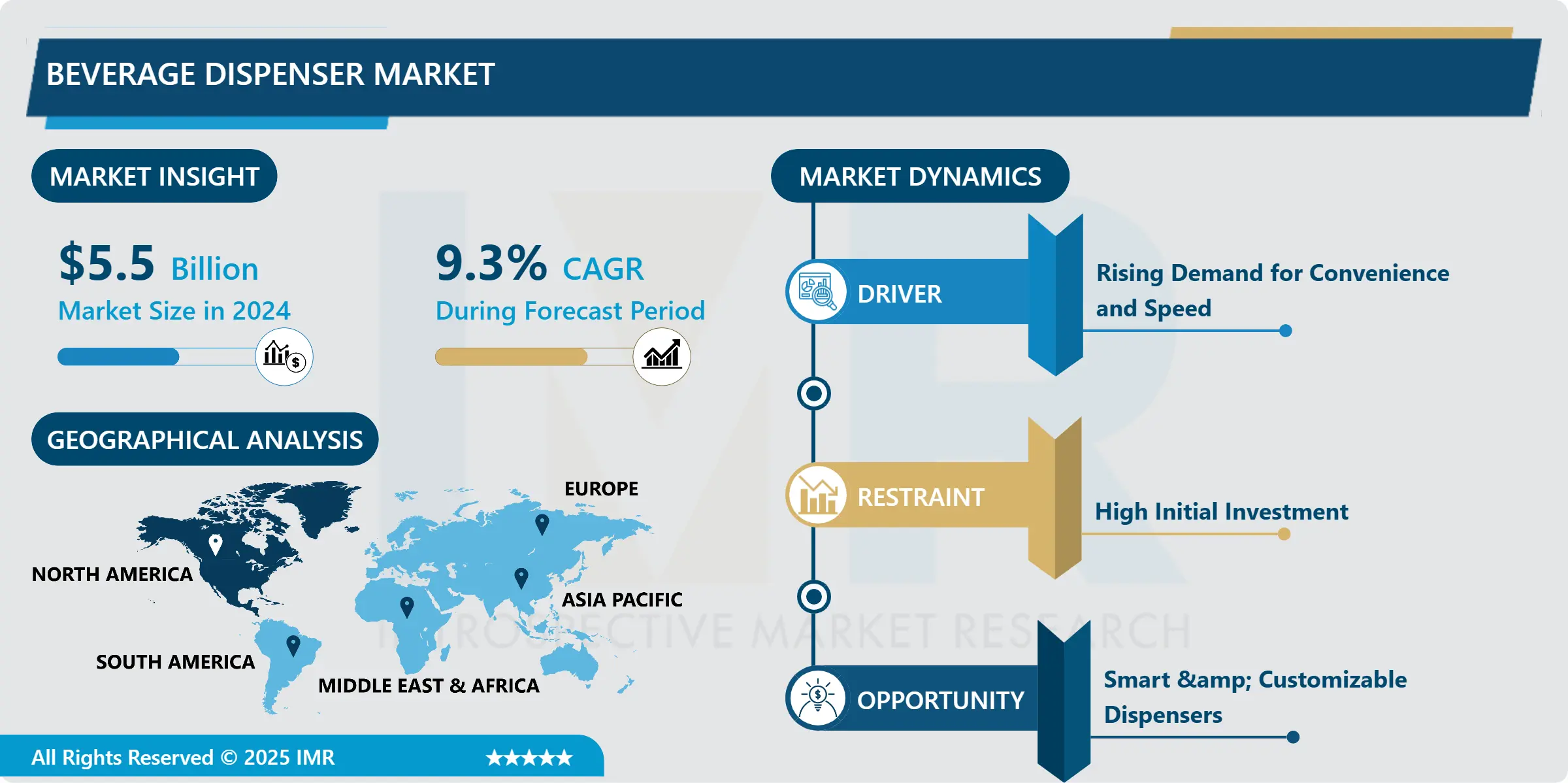

Beverage Dispenser Market Size Was Valued at USD 5.5 Billion in 2024, and is Projected to Reach USD 14.63 Billion by 2035, Growing at a CAGR of 9.3% from 2025-2035.

The beverage dispenser market is growing steadily due to rising demand for efficient and hygienic drink-serving solutions. Beverage dispensers are widely used in restaurants, hotels, cafes, convenience stores, and even offices. These machines help businesses serve drinks like juices, soft drinks, coffee, and flavoured water quickly and in controlled portions, reducing waste and improving customer satisfaction.

One major driver of this market is the growing popularity of self-service models, especially in fast-food chains and cafeterias. Consumers today prefer fast, clean, and contactless service, which has made automated and touchless dispensers more attractive. Businesses are also investing in dispensers that can serve multiple types of beverages, are easy to clean, and have digital controls.

Technology is playing a key role in shaping the market. New beverage dispensers come with features like temperature control, smart sensors, and even IoT connectivity, which allows businesses to monitor usage and maintenance needs remotely. These improvements not only enhance the customer experience but also help in reducing operational costs.

Additionally, health-conscious consumers are pushing for more customized options in beverages. Dispensers that allow users to adjust Flavors, sugar levels, or carbonation are becoming more popular. This demand for personalized drinks is expected to further drive innovation in dispenser design. Overall, the beverage dispenser market is evolving to meet the changing needs of both consumers and businesses, focusing on convenience, hygiene, and smart features.

Beverage Dispenser Market Growth and Trend Analysis:

Beverage Dispenser Market Growth Driver - Rising Demand for Convenience and Speed

- In today’s fast-paced world, people are always looking for quick and easy service, especially when it comes to food and drinks. Whether they are stopping at a fast-food restaurant, grabbing a drink at a café, or using a self-service machine at a convenience store, customers don’t want to wait long. They want their orders ready in just a few seconds. This need for speed has become a major reason why businesses are using beverage dispensers more than ever.

- Beverage dispensers help serve drinks quickly and in an organized way. Instead of waiting for a server to pour each drink, customers or staff can use the machine to get a drink in just a few seconds. This saves time, especially during busy hours when there are many customers. It also helps reduce long lines, improves the overall experience, and makes people more likely to return.

- For businesses, using beverage dispensers also means they can serve more people in less time. This leads to better efficiency and higher profits. These machines are easy to use, require less staff, and reduce the chance of mistakes in drink orders. As a result, both businesses and customers benefit.

- Overall, as people continue to expect fast and hassle-free service, the demand for beverage dispensers will keep rising. They offer a perfect solution for quick drink service, making them a smart choice in today’s convenience-driven world.?

Beverage Dispenser Market Limiting Factor- High Initial Investment

- One of the biggest challenges in the beverage dispenser market is the high upfront cost of the equipment. Modern beverage dispensers, especially those with advanced features like touchscreens, temperature control, or multiple drink options, can be quite expensive. For large companies or restaurant chains, this cost might not be a problem. But for small cafés, local shops, or new businesses, buying these machines can be a big financial burden.

- It’s not just the cost of the machine itself. There are additional expenses like installation, regular maintenance, and staff training to ensure everything runs smoothly. Some machines also need special parts or cleaning systems, which add to the overall cost of ownership.

- Because of these high costs, some businesses may decide not to invest in a beverage dispenser at all, especially if they are unsure about the return on investment. Others may choose simpler or older models that lack modern features, which can affect the overall customer experience.

- This financial barrier slows down the adoption of advanced beverage dispensers, especially in places where budgets are tight. To overcome this challenge, manufacturers may need to offer more affordable options, rental plans, or financing solutions that make it easier for smaller businesses to adopt the technology.

Beverage Dispenser Market Expansion Opportunity- Smart & Customizable Dispensers

- One of the biggest opportunities in the beverage dispenser market is the growing demand for smart and customizable machines. Today’s consumers are no longer satisfied with just a basic drink. They want more control and variety like adjusting the flavour, sweetness, temperature, or carbonation to match their personal taste. This has created a strong push for beverage dispensers that offer more choices and flexibility.

- To meet this demand, companies are designing advanced dispensers with digital touchscreens, mobile app controls, and smart technology. These machines can store customer preferences, suggest popular combinations, and even track consumption patterns. Such features appeal to tech-savvy users, especially younger generations who enjoy interactive and personalized experiences.

- Smart dispensers also offer benefits to businesses. They can reduce waste, monitor inventory in real-time, and send alerts when refills or maintenance are needed. This makes them more efficient and cost-effective in the long run. Businesses in areas like retail, fast food, offices, and hotels can use these smart machines to enhance customer satisfaction and brand image.

- As people become more health-conscious and expect more personalized services, the demand for customizable beverage dispensers will continue to grow. This creates a great opportunity for companies to innovate, build new partnerships, and expand into new markets with smart and user-friendly solutions.

Beverage Dispenser Market Challenge and Risk- Maintenance & Downtime

- One of the major challenges in the beverage dispenser market is the risk of machine breakdowns and maintenance problems. Beverage dispensers are used frequently, especially in busy places like restaurants, cafes, and self-service stations. If the machine stops working, it can quickly cause delays, unhappy customers, and lost sales. This not only affects daily operations but can also damage the business’s reputation.

- To avoid such problems, regular maintenance is very important. Dispensers need to be cleaned properly to stay safe and hygienic, especially when handling different types of drinks like juices, sodas, and dairy-based beverages. If machines are not maintained well, they can become dirty, wear out faster, or even stop working altogether. This can lead to unexpected downtime, which means the machine is out of service until it’s fixed.

- Downtime also increases operational costs. Businesses may need to call service technicians, order spare parts, or temporarily stop offering certain drinks. In some cases, customers may choose to go elsewhere if they can’t get the drink they want.

- For businesses using high-tech or multi-function dispensers, these issues can be even more complex. That’s why having a proper maintenance plan and trained staff is essential. Reducing downtime and ensuring reliable service is a key challenge the market must address to keep both businesses and customers happy.

Beverage Dispenser Market Segment Analysis:

Beverage Dispenser Market is segmented based on Type, Application, End-Users, and Region

By Type, Beverage Dispenser Segment is Expected to Dominate the Market During the Forecast Period

- Manual beverage dispensers are the most basic and budget-friendly type of drink dispensing equipment. These dispensers do not have any electric parts or automatic systems. Instead, they work through manual control, such as pushing a lever, turning a tap, or pressing a pump to pour the drink. Because of their simplicity, they are very easy to use, clean, and maintain.

- Manual dispensers are commonly found in small shops, juice stalls, local eateries, and households. For example, people often use manual dispensers at home to serve water, juice, or cold beverages during parties and gatherings. Small cafés or vendors may use them for serving drinks like lemonade, iced tea, or cold coffee.

- One of the main advantages of manual dispensers is their low cost. They are affordable for small businesses or families who don’t need high-volume or high-speed service. They also do not require electricity, making them useful in places with limited power supply or during outdoor events.

- However, manual dispensers have their limitations. They are not ideal for large-scale or busy settings, like restaurants, hotels, or fast-food outlets, where drinks need to be served quickly and continuously. In such places, relying on manual operation can slow down service and create inconvenience for both staff and customers. Overall, manual dispensers are great for basic use but not suited for high-demand environments.

By Application, Beverage Dispenser Segment Held the Largest Share in 2024

- In the beverage dispenser market, the commercial segment is the largest and most dominant. This includes places like restaurants, hotels, cafés, offices, shopping malls, and convenience stores. Businesses in these settings rely on beverage dispensers to serve drinks quickly, efficiently, and in large volumes.

- One of the main reasons for their popularity in commercial use is the need for speed and consistency. In busy environments, especially during peak hours, staff need to serve drinks fast without compromising on quality. Beverage dispensers make this possible by providing ready-to-serve drinks with just the push of a button or lever. This saves time, reduces errors, and helps maintain customer satisfaction.

- Another key benefit is labour cost savings. With dispensers, businesses can reduce the need for extra staff to manually pour and serve drinks. Self-service dispensers also allow customers to serve themselves, which is now more common in fast-food chains, buffets, and office cafeterias.

- In addition, beverage dispensers help with portion control and waste reduction. This means drinks are served in accurate amounts, avoiding over-pouring and cutting down on waste, which can lead to cost savings over time. Overall, the commercial sector sees beverage dispensers as a practical, cost-effective, and customer-friendly solution, making it the top application area in the market.

Beverage Dispenser Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is the largest market for beverage dispensers, holding an estimated 35% to 42% share of the global market. This dominance is driven by the region’s highly developed food and beverage service industry, which includes a wide range of fast-food chains, cafés, hotels, restaurants, office spaces, and convenience stores.

- In this region, consumers expect fast, clean, and efficient service, which has pushed businesses to adopt modern beverage dispensers with smart and automatic features. These include touchless operation, IoT connectivity, digital temperature controls, and self-cleaning systems. Such technology is in high demand, especially after increased hygiene awareness in recent years.

- Businesses in North America are also focused on cutting labour costs and improving efficiency. Beverage dispensers help by enabling self-service, reducing staff involvement, and speeding up service in busy environments. This makes them ideal for quick-service restaurants and office cafeterias.

- Another trend gaining popularity in North America is the demand for customized beverages. Consumers enjoy being able to select the flavour, size, or sweetness of their drinks. This is especially appealing to the region’s tech-savvy and health-conscious population. With strong infrastructure, high disposable income, and a focus on innovation, North America is expected to remain the leading region in the global beverage dispenser market.

Beverage Dispenser Market Active Players:

- Ali Group S.r.l. (Italy)

- Animo B.V. (Netherlands)

- BUNN-O-Matic Corporation (USA)

- Cal-Mil Plastic Products Inc. (USA)

- Cambro Manufacturing Co. (USA)

- Cornelius, Inc. (USA)

- Electrolux Professional AB (Sweden)

- FBD Partnership, L.P. (USA)

- Follett LLC (USA)

- Franke Group (Switzerland)

- Grindmaster-Cecilware (USA)

- Hoshizaki America, Inc. (USA)

- ITV Ice Makers (Spain)

- Keurig Dr Pepper Inc. (USA)

- La Cimbali (Gruppo Cimbali S.p.A.) (Italy)

- Lancer Corporation (USA)

- Marmon Foodservice Technologies (a Berkshire Hathaway Company) (USA)

- Middleby Corporation (USA)

- Nestlé S.A. (Switzerland)

- Ningbo Hicon Industry Co., Ltd. (China)

- PepsiCo, Inc. (USA)

- Rhea Vendors Group (Italy)

- SandenVendo America (USA/Japan)

- Schaerer Ltd. (part of WMF Group) (Germany)

- T&S Brass and Bronze Works (USA)

- Taylor Company (USA)

- The Coca-Cola Company (USA)

- Vollrath Company, LLC (USA)

- Welbilt, Inc. (Multiplex Beverage) (USA)

- Zummo Innovaciones Mecánicas S.A. (Spain)

- Other Active Players

Key Industry Developments in the Beverage Dispenser Market:

- In May 2024, companies like Ningbo Hicon from China and Animo from the Netherlands expanded into countries like India, Southeast Asia, and the Middle East. They introduced low-cost, semi-automatic beverage dispensers that are easy to use and maintain, making them a great fit for small businesses and growing markets.

- In 2025, some brands began testing AI-powered beverage dispensers that can learn user preferences, suggest drink combinations, and use ingredients more efficiently. These smart machines aim to improve the user experience while helping businesses reduce waste and improve service.

|

Beverage Dispenser Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.5 Billion |

|

Forecast Period 2025-35 CAGR: |

9.3 % |

Market Size in 2035: |

USD 14.63 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application

|

|

||

|

Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Beverage Dispenser Market by Product Type (2018-2035)

4.1 Beverage Dispenser Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Automatic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Semi-Automatic

4.5 Manual

Chapter 5: Beverage Dispenser Market by Application (2018-2035)

5.1 Beverage Dispenser Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Commercial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Residential

Chapter 6: Beverage Dispenser Market by Distribution Channel (2018-2035)

6.1 Beverage Dispenser Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online Stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supermarkets/Hypermarkets

6.5 Specialty Stores

6.6 Others

Chapter 7: Beverage Dispenser Market by Material (2018-2035)

7.1 Beverage Dispenser Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Plastic

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Metal

7.5 Glass

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Beverage Dispenser Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ALI GROUP S.R.L. (ITALY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ANIMO B.V. (NETHERLANDS)

8.4 BUNN-O-MATIC CORPORATION (USA)

8.5 CAL-MIL PLASTIC PRODUCTS INC. (USA)

8.6 CAMBRO MANUFACTURING CO. (USA)

8.7 CORNELIUS

8.8 INC. (USA)

8.9 ELECTROLUX PROFESSIONAL AB (SWEDEN)

8.10 FBD PARTNERSHIP

8.11 L.P. (USA)

8.12 FOLLETT LLC (USA)

8.13 FRANKE GROUP (SWITZERLAND)

8.14 GRINDMASTER-CECILWARE (USA)

8.15 HOSHIZAKI AMERICA

8.16 INC. (USA)

8.17 ITV ICE MAKERS (SPAIN)

8.18 KEURIG DR PEPPER INC. (USA)

8.19 LA CIMBALI (GRUPPO CIMBALI S.P.A.) (ITALY)

8.20 LANCER CORPORATION (USA)

8.21 MARMON FOODSERVICE TECHNOLOGIES (A BERKSHIRE HATHAWAY COMPANY) (USA)

8.22 MIDDLEBY CORPORATION (USA)

8.23 NESTLÉ S.A. (SWITZERLAND)

8.24 NINGBO HICON INDUSTRY CO.

8.25 LTD. (CHINA)

8.26 PEPSICO

8.27 INC. (USA)

8.28 RHEA VENDORS GROUP (ITALY)

8.29 SANDENVENDO AMERICA (USA/JAPAN)

8.30 SCHAERER LTD. (PART OF WMF GROUP) (GERMANY)

8.31 T&S BRASS AND BRONZE WORKS (USA)

8.32 TAYLOR COMPANY (USA)

8.33 THE COCA-COLA COMPANY (USA)

8.34 VOLLRATH COMPANY

8.35 LLC (USA)

8.36 WELBILT

8.37 INC. (MULTIPLEX BEVERAGE) (USA)

8.38 ZUMMO INNOVACIONES MECÁNICAS S.A. (SPAIN)

8.39 AND OTHER ACTIVE PLAYERS.

Chapter 9: Global Beverage Dispenser Market By Region

9.1 Overview

9.2. North America Beverage Dispenser Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Beverage Dispenser Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Beverage Dispenser Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Beverage Dispenser Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Beverage Dispenser Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Beverage Dispenser Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Beverage Dispenser Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.5 Billion |

|

Forecast Period 2025-35 CAGR: |

9.3 % |

Market Size in 2035: |

USD 14.63 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application

|

|

||

|

Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||