US Food and Drink Market Synopsis

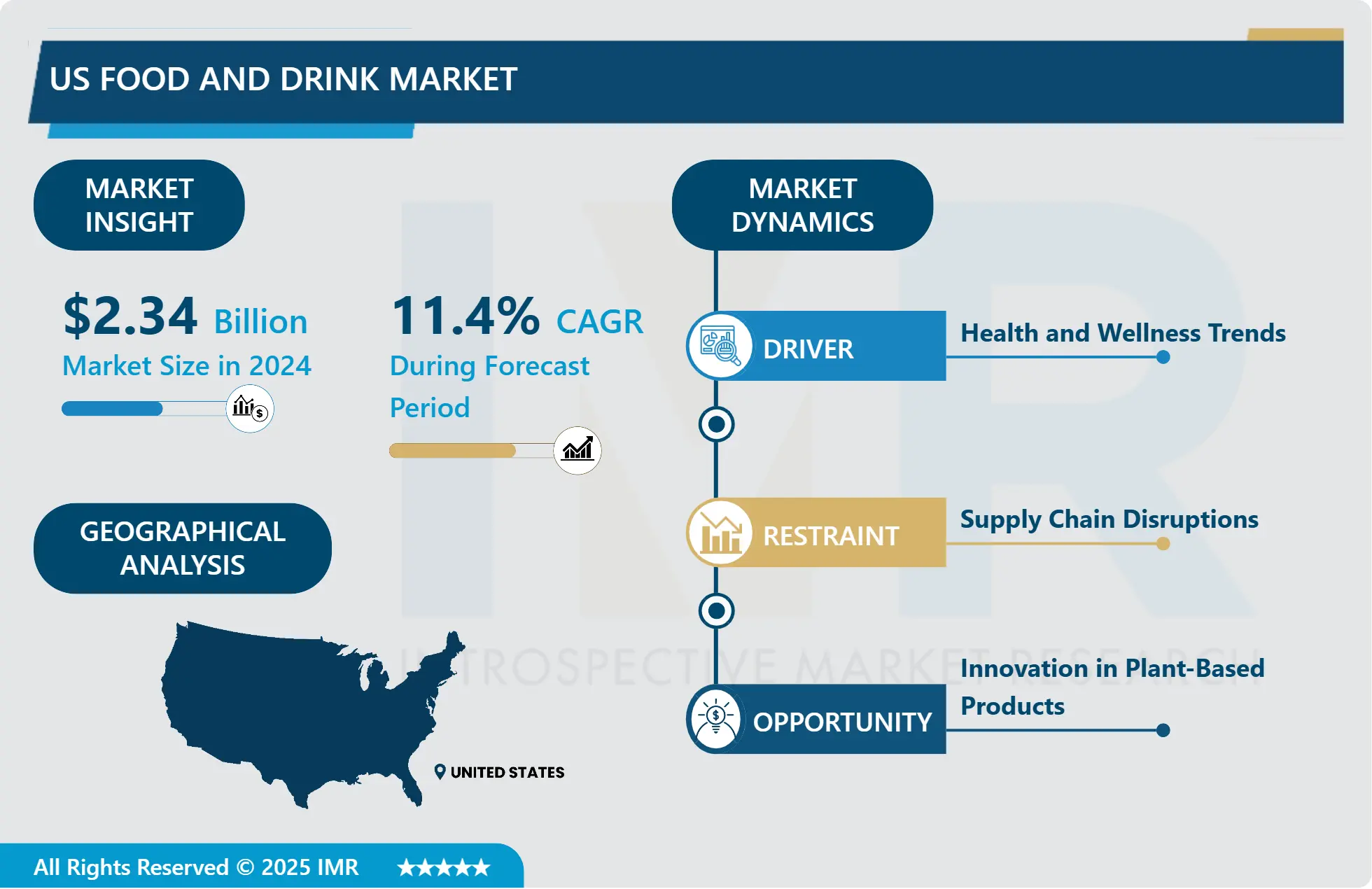

US Food And Drink Market Size Was Valued at USD 2.34 Billion in 2024, and is Projected to Reach USD 5.55 Billion by 2032, Growing at a CAGR of 11.4% from 2025-2032.

The US food and drink market is not only substantial but also pivotal in shaping global trends and standards within the industry. Comprising a diverse array of segments from fast food to gourmet dining, and from beverages to health foods, this market serves as a microcosm of consumer preferences and economic dynamics. Its sheer size and influence make it a significant player in the global economy, affecting agricultural practices, international trade, and consumer behavior worldwide.

Firstly, the market's vast scale ensures that trends originating in the US often set the tone globally. Innovations in product development, such as plant-based meats or functional beverages, frequently debut and gain traction here before expanding internationally. This leadership role extends to regulatory standards and sustainability practices, influencing how food and drink manufacturers operate and consumers perceive their choices.

Secondly, the US food and drink market acts as a crucial economic engine, supporting Billions of jobs across agriculture, manufacturing, distribution, and retail. Its interconnectedness with other sectors like advertising, packaging, and logistics further amplifies its economic impact. The market's resilience and adaptability, seen especially during economic downturns or health crises, underscore its role as a stabilizing force within the broader industry ecosystem.

Furthermore, the market's diversity reflects evolving consumer preferences and societal trends. From the rise of health-conscious eating to the demand for ethically sourced products, these shifts drive innovation and competition among brands. The market's responsiveness to consumer demand fosters a continuous cycle of product improvement and adaptation, benefiting both industry players and consumers seeking more choices and higher quality standards.

Lastly, the US food and drink market's influence extends beyond economic and consumer realms to encompass cultural and social dimensions. It serves as a focal point for culinary innovation and cultural exchange, showcasing a blend of traditional cuisines with contemporary tastes. This cultural impact not only enriches local communities but also attracts global attention, influencing food tourism and international perceptions of American cuisine.

In conclusion, the US food and drink market's multifaceted role as an economic powerhouse, trendsetter, cultural influencer, and consumer advocate underscores its vital importance within the global industry ecosystem. Its ability to drive innovation, support diverse employment sectors, and reflect evolving societal values makes it not just a market, but a dynamic force shaping the future of food and drink worldwide.

US Food and Drink Market Trend Analysis- Plant-Based Revolution in Food Products

- The plant-based food trend in the US has witnessed explosive growth in recent years, driven by consumer preferences for healthier, sustainable, and ethically sourced food options. This trend extends beyond traditional vegetarian and vegan demographics to mainstream consumers seeking alternatives to animal-derived products. Market data shows significant increases in sales of plant-based meats, dairy alternatives, and plant-based snacks. Companies like Beyond Meat and Impossible Foods have gained substantial market share, showcasing the demand for meat substitutes that mimic the taste and texture of traditional meats. Additionally, dairy alternatives such as almond milk, oat milk, and soy-based products continue to gain popularity, supported by their perceived health benefits and environmentally friendly profiles.

- The rise of plant-based eating is underpinned by several factors. Health consciousness among consumers has led many to reduce their intake of animal products due to concerns over cholesterol, saturated fats, and hormones found in traditional meat and dairy. Moreover, environmental sustainability plays a crucial role, with plant-based diets touted as more eco-friendly due to reduced greenhouse gas emissions, land use, and water consumption compared to conventional livestock farming. These factors are compelling enough to influence consumer behavior and drive market growth.

- In response to this trend, food manufacturers and retailers are expanding their plant-based product lines. Major grocery chains now dedicate more shelf space to plant-based options, making it easier for consumers to find and purchase these products. Additionally, restaurants and fast-food chains are increasingly adding plant-based dishes to their menus to cater to the growing demand. Innovations in food technology are also accelerating the development of new plant-based ingredients and products, enhancing their taste, nutritional profile, and texture to appeal to a broader audience. As this trend continues to evolve, it is expected to reshape the food and drink market, influencing product development, marketing strategies, and consumer choices for years to come.

Rise of Functional and Health-Enhancing Beverages

- Another significant trend in the US food and drink market is the increasing popularity of functional beverages that offer health benefits beyond basic nutrition. This category includes a diverse range of drinks such as probiotic beverages, energy drinks with natural ingredients, enhanced waters, and beverages fortified with vitamins, minerals, and herbal extracts. Consumers are increasingly seeking beverages that support specific health goals such as immunity boosting, gut health improvement, mental clarity, and stress reduction.

- The demand for functional beverages is driven by a growing awareness of the link between diet and health, prompting consumers to seek out products that provide functional benefits in addition to hydration. Probiotic beverages, for example, appeal to consumers looking to improve their digestive health and strengthen their immune systems. Similarly, energy drinks formulated with natural ingredients like green tea extract or adaptogenic herbs are favored over traditional caffeinated beverages for their perceived health benefits and sustained energy release.

- Market trends indicate a shift towards transparency and clean labeling in the functional beverage sector. Consumers are increasingly scrutinizing ingredient lists, preferring products free from artificial additives, preservatives, and excessive sugars. Manufacturers are responding by reformulating their products to meet these demands, using natural sweeteners like stevia and monk fruit, and avoiding controversial ingredients. Additionally, there is a growing emphasis on sustainable packaging practices and ethical sourcing of ingredients, aligning with consumer preferences for environmentally responsible products.

- Looking forward, the functional beverage market is poised for further innovation and growth. Beverage companies are investing in research and development to create new formulations that address emerging health concerns and cater to niche consumer segments. As the market expands, collaborations between beverage companies and health professionals are becoming more common to validate health claims and educate consumers about the benefits of functional beverages. With health and wellness remaining top priorities for consumers, the functional beverage sector is expected to continue its upward trajectory, offering new opportunities for brands to differentiate themselves and meet evolving consumer needs.

- These trends underscore the dynamic nature of the US food and drink market, driven by changing consumer preferences, technological advancements, and a growing focus on health and sustainability. As these trends continue to evolve, they will likely shape the future landscape of the industry, influencing product innovation, marketing strategies, and consumer behavior in profound ways.

US Food And Drink Market Segment Analysis:

US Food And Drink Market Segmented based on By Product Type, Distribution Channel, Consumer Demographics, and Packaging Type

By Product Type, Dairy Products Segment is Expected to Dominate the Market During the Forecast Period

- Dairy products are poised to dominate the US food and drink market in the coming years. This dominance is driven by several factors, including the widespread consumption of milk, cheese, yogurt, and butter across various demographic groups. Dairy remains a staple in American diets due to its nutritional value, versatility in culinary applications, and established consumer preferences.

- Additionally, innovations in dairy processing techniques and product formulations continue to expand the market reach, appealing to health-conscious consumers seeking fortified options and alternatives like plant-based dairy substitutes. As a result, dairy products are projected to maintain their leading position in the market, bolstered by strong consumer demand and ongoing product diversification efforts by industry players.

By Distribution Channel, Supermarkets and Hypermarkets Lead in Market Share

- Supermarkets and hypermarkets represent the largest distribution channel in the US food and drink market. These retail formats benefit from their extensive product offerings, competitive pricing strategies, and widespread accessibility across urban and suburban areas. Consumers prefer shopping at supermarkets and hypermarkets due to the convenience of finding a wide range of food and beverage products under one roof, coupled with promotional discounts and loyalty programs that enhance affordability and customer retention.

- Furthermore, these channels excel in catering to diverse consumer needs, from everyday grocery items to specialty and organic products, thereby solidifying their dominance in the market. The convenience and efficiency offered by supermarkets and hypermarkets ensure their continued prominence in serving the majority of consumers' food and beverage purchasing needs.

By Consumer Demographics, Adults Segment Holds the Largest Share

- The adult demographic segment commands the largest share in the US food and drink market. Adults constitute a significant portion of the consumer base due to their higher purchasing power, diverse dietary preferences, and lifestyle choices influencing consumption patterns. This segment encompasses a wide age range and varied socio-economic backgrounds, encompassing individuals and households making independent food choices based on taste, health considerations, and convenience.

- Moreover, the adult demographic is pivotal in driving trends towards premium and health-oriented products, including organic foods, functional beverages, and gourmet offerings. As a result, manufacturers and retailers tailor their marketing strategies and product portfolios to cater specifically to the preferences and priorities of adult consumers, thereby maintaining their market leadership position.

By Packaging Type, Flexible Packaging Emerges as the Dominant Choice

- Flexible packaging has emerged as the dominant packaging type in the US food and drink market. This trend is primarily driven by its lightweight nature, cost-effectiveness, and sustainability benefits compared to traditional packaging materials like glass and rigid plastics. Flexible packaging offers manufacturers versatility in design, allowing for innovative shapes and sizes that enhance product differentiation and shelf appeal. Additionally, its ability to extend shelf life, reduce transportation costs, and minimize carbon footprint aligns with growing consumer preferences for eco-friendly packaging solutions.

- As such, flexible packaging continues to gain traction across various food and beverage categories, including snacks, dairy products, and beverages, reinforcing its position as the preferred choice among manufacturers aiming to meet both consumer demand and regulatory standards for sustainable packaging practices.

US Food And Drink Market Regional Insights:

Western Region is Expected to Dominate the Market Over the Forecast Period

- The Western region of the United States is poised to dominate the food and drink market for several compelling reasons. Firstly, the region is renowned for its diverse culinary landscape, ranging from innovative food trends in cities like Los Angeles and San Francisco to the rich agricultural heritage in states such as California and Washington. This diversity not only caters to local tastes but also attracts a broad spectrum of consumers seeking unique dining experiences and locally sourced ingredients. The emphasis on fresh, organic produce and sustainable practices further enhances the region's appeal, aligning with growing consumer preferences for healthy and environmentally conscious food choices.

- Secondly, the Western region benefits from a robust network of food and beverage producers, distributors, and retailers. Major metropolitan areas serve as hubs for food innovation and trendsetting, influencing national consumption patterns. Silicon Valley's influence extends beyond technology to include advancements in food technology and distribution logistics, fostering a dynamic market environment where startups and established brands alike can thrive. Additionally, the region's proximity to key international markets in Asia and the Pacific enables efficient import and export of goods, facilitating a global exchange of culinary ideas and products that enriches the local food scene.

- Thirdly, demographic shifts and lifestyle preferences contribute significantly to the Western region's dominance in the food and drink market. Urbanization and population growth in cities such as Seattle, Portland, and Denver have created a concentration of affluent consumers with diverse tastes and high disposable incomes. These factors drive demand for premium and specialty food products, artisanal beverages, and dining experiences that cater to discerning palates. Furthermore, the region's embrace of food tourism and gastronomic events, coupled with a vibrant restaurant scene and thriving craft brewing industry, solidifies its reputation as a trendsetter and leader in the national food and drink market landscape.

- In conclusion, the Western region of the United States is expected to continue dominating the food and drink market over the forecast period due to its diverse culinary offerings, robust industry infrastructure, and evolving consumer preferences. As the region continues to innovate and adapt to changing market dynamics, it will likely maintain its position at the forefront of the nation's food and beverage industry, influencing trends and setting standards for quality and sustainability across the country.

Active Key Players in the US Food And Drink Market

- Nestlé USA

- PepsiCo

- The Kraft Heinz Company

- Mondelez International

- General Mills

- Tyson Foods

- Conagra Brands

- Kellogg Company

- Mars, Incorporated

- Anheuser-Busch InBev

- Constellation Brands

- Diageo North America

- Keurig Dr Pepper

- Monster Beverage Corporation

- The Boston Beer Company

- And Other Active Players

|

US Food and Drink Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.34 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.4% |

Market Size in 2032: |

USD 5.55 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Consumer Demographics |

|

||

|

By Packaging Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Market Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: U.S. Food And Drink Market by Product Type (2018-2032)

4.1 U.S. Food And Drink Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dairy Products

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bakery Products

4.5 Beverages

4.6 Meat and Poultry

4.7 Seafood

4.8 Confectionery and Snacks

4.9 Frozen Foods

4.10 Fruits and Vegetables

4.11 Grains and Cereals

4.12 Sauces

4.13 Dressings

4.14 and Condiments

4.15 Other

Chapter 5: U.S. Food And Drink Market by Distribution Channel (2018-2032)

5.1 U.S. Food And Drink Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Supermarkets and Hypermarkets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Convenience Stores

5.5 Online Retail

5.6 Specialty Stores

5.7 Foodservice

5.8 Institutional

5.9 Direct Sales

Chapter 6: U.S. Food And Drink Market by Consumer Demographics (2018-2032)

6.1 U.S. Food And Drink Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Adults

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Children and Teens

6.5 Seniors

6.6 Athletes and Fitness Enthusiasts

6.7 Special Dietary Needs

Chapter 7: U.S. Food And Drink Market by Packaging Type (2018-2032)

7.1 U.S. Food And Drink Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Bottled

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Canned

7.5 Cartons

7.6 Flexible Packaging

7.7 Glass

7.8 Rigid Plastic

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 U.S. Food And Drink Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 NESTLÉ USA

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 PEPSICO

8.4 THE KRAFT HEINZ COMPANY

8.5 MONDELEZ INTERNATIONAL

8.6 GENERAL MILLS

8.7 TYSON FOODS

8.8 CONAGRA BRANDS

8.9 KELLOGG COMPANY

8.10 MARS INCORPORATED

8.11 ANHEUSER-BUSCH INBEV

8.12 CONSTELLATION BRANDS

8.13 DIAGEO NORTH AMERICA

8.14 KEURIG DR PEPPER

8.15 MONSTER BEVERAGE CORPORATION

8.16 THE BOSTON BEER COMPANY

8.17

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

US Food and Drink Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.34 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.4% |

Market Size in 2032: |

USD 5.55 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Consumer Demographics |

|

||

|

By Packaging Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Market Opportunities: |

|

||

|

Companies Covered in the report: |

|

||