Barrier Material Market Synopsis

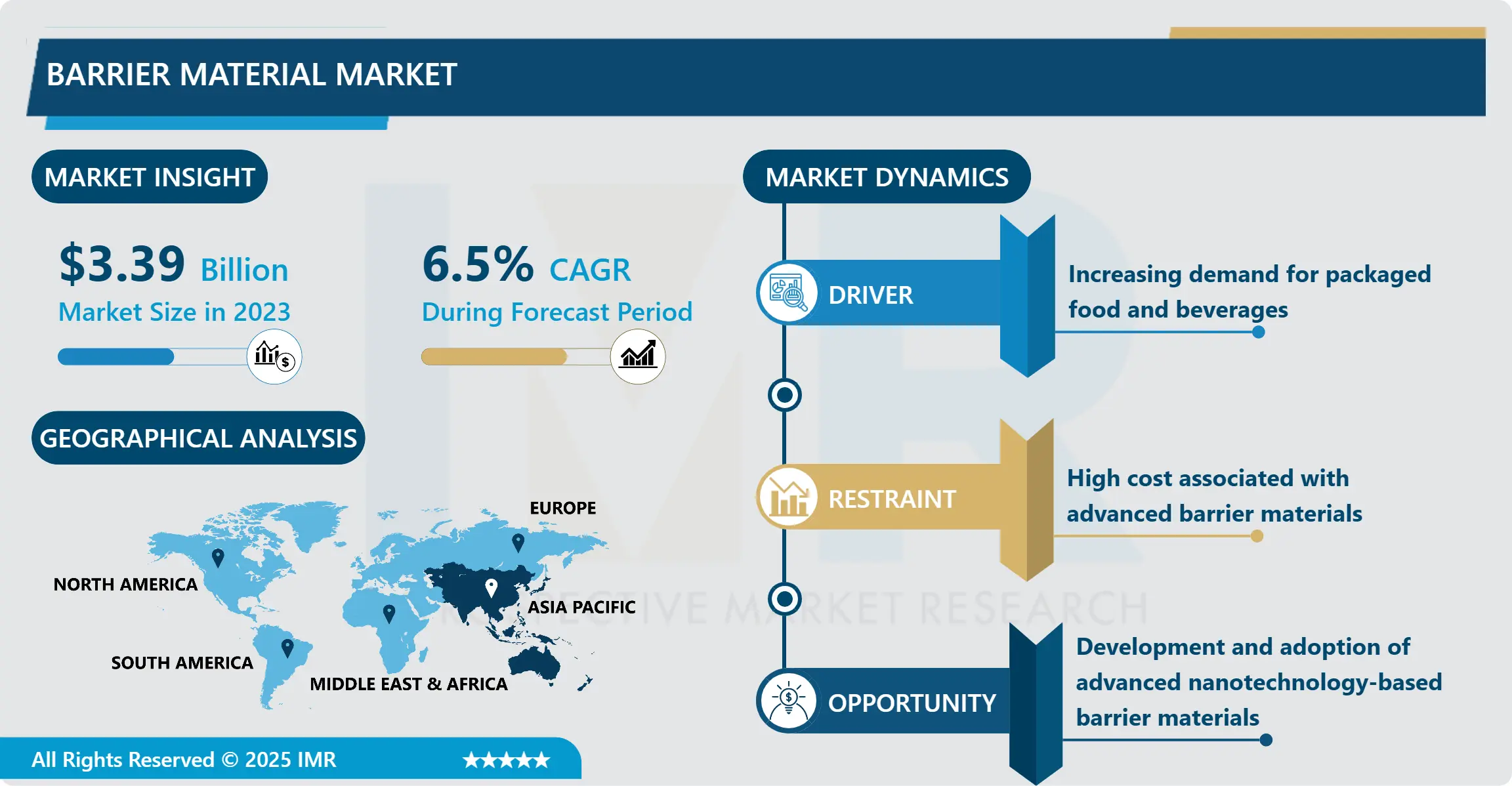

Barrier Material Market Size Was Valued at USD 3.39 Billion in 2023 and is Projected to Reach USD 5.98 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.

A barrier material is a prophylactic type of material intended to entirely prevent or minimally or retard the flow of any substance, liquid, gas, or vapor through the material. These materials are used in numerous applications concerning industrial businesses to enhance durability and safeguard products and equipment from environmental factors such as water and air, including impurities. Protective coatings are employed in products like food and pharmaceuticals being packed in bags made of barrier materials, Buildings for preventing water seepage and heat transfer, and electronic appliances to protect parts or chips from moisture and chemicals. The barrier material's ability depends upon the compound's nature, the thickness of the layer, and the types of hazardous substances it is designed to counteract.

At present, the market for barrier material is registering sound growth, especially in the global market, and is engaged by the growing demand in respective fields of packaging, construction, electronics, automotive, and others. the latest trend in the packaging sector involves the increasing market demand for the application of materials that provide long shelf life or enhanced barrier properties, especially for food, pharmaceutical, and beverage products. These flexibilities of materials such as polymers, metals, and glass assist in the barrier against gases, moisture, and other contaminants to maintain product quality and protect from hazards. Also, the increased focus on the use of sustainable and recyclable packaging materials has encouraged the growth of investment in new high-performance barrier solutions for the market.

In the global context, the Asia-Pacific is expected to show increasing growth shortly in correlation with industrial, and urban development, and an increasing middle-income population that needs packaged products and better construction materials. North America and Europe are still considered strategic markets due to the constant application and development of new technologies as well as high legislation demands that require the use of high-quality barrier material. However, there are risks which include the high costs of the more improved material, this market requires constant innovation to fill change in the industry standards as well as the ever-evolving customer tastes and preferences. Thus, the material market of barriers is expected to further develop and expand due to the constantly improving technology and the broadening range of industries that apply it.

Barrier Material Market Trend Analysis

Increasing emphasis on sustainability and eco-friendly solutions

- With increasing constraints on the environment and legislation across the globe, there is a requirement for effective barrier layers to complement biodegradable or recyclable properties or use sustainable resources. The key findings of the research are that firms are implementing capital expenditure for lean marketing by developing materials that provide competitive value for performance without the detriment of the environment. This kind of trend is especially noticeable in the packaging manufacturers market where the consumers as well as manufacturers are in search of 100 natural and recyclable packaging materials rather than plastic.

- For instance, the use of bio-based polymers and protective coating materials that can offer similar barrier protection as common materials is gradually emerging. This transformation of electricity markets toward sustainability is changing the market by encouraging the use of environmentally friendly technologies and materials and creating new opportunities for firms that consider the environment.

Development and adoption of advanced nanotechnology-based barrier materials

- The application of nanotechnology may conversely lead to increases in barrier properties by adding particles at the nanoscale level that act as better barriers for gases, moisture, and other substances or structures. This advancement can make a product thinner and lighter, and even more flexible with better performance, which is ideal for instance in packaged products, electronics, and medicine among other uses.

- For example, in the packaging sector, nanocomposites help enhance the features of packaging in terms of food safety and longevity without the use of such material and thus, no wastage. For instance, nano-enhanced barriers used in the electronics sector can shield delicate components from the unfavorable effects of the surrounding environment without making significant alterations to size and mass, a key to next-generation gadgets. Further, the pharmaceutical industry can also use nanotechnology to design or incorporate packaging for drugs that will enhance their stability and effectiveness in the long term. Those organizations, that make efforts to invest in the research and development of nanotechnology-based barrier materials possess a competitive advantage along with the ability to capture new market share thereby satisfying increased demand for high-performance sustainable products.

Barrier Material Market Segment Analysis:

Barrier Material Market Segmented based on Type and Application.

By Type, PVDC segment is expected to dominate the market during the forecast period

- The Polyvinylidene Chloride (PVDC) segment is expected to hold the largest market share for the barrier material market for the forecast period due to its excellent barrier characteristics to moisture, oxygen, and aroma. The ability to maintain the quality of perishable contents and their subsequent prolonged shelf life is why PVDC is indispensable in the food and beverage packing market.

- Moreover, PVDC is used commonly in pharmaceutical products because it shields the products from other elements. It is a versatile and highly efficient polymer, given its use in multi-layer finished films and coatings which offer durability under various environmental perimeters. Although there are new materials that have appeared on the market with environment-friendly properties that are comparable to that of PVDC, this material still enjoys wider and continued acceptance and use by many manufacturers because it has the reliability characteristic and versatility that makes it the market leader.

By Application, Food & Beverage segment is expected to hold the largest share

- The largest end-use application emerging in this barrier material market is in the Food and Beverage sector due to the very reason that such products cannot afford to evade barrier protection. This sector can be regarded as involving specialty barrier materials, which serve to shield food and beverages from environmental factors that may negatively impact them, such as oxygen, moisture, light, and other contaminants that may lead to product spoilage and reduced storage longevity. increasing concern for packaged and processed foods that are driving the convenience food industry has had a great impact in increasing the usage of high-performance barrier materials.

- Also, due to enhanced consumer concern regarding food safety and the empowered world regulation standards, food manufacturers are paying attention to complex barrier technology. Many value-added products like, Multilayer films, Bio-based coatings, and Active packaging are contributing toward making barrier material more effective in the Food & Beverage industry leading this market.

Barrier Material Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The market of barrier material is projected to be led by the Asia Pacific region in the course of the given forecast period due to high growth rates of industrialization, population urbanization as well as an increasing middle-class populace. Some of the endangered species of barrier materials are being consumed largely in countries like China, India, and Japan which have registered increased growth in such industries as packaging, construction, and electronics. The packaged consumer foods, drinks, and pharmaceutical commodities have well expanded the markets of these countries where there is an equal need for better packaging techniques to preserve and maintain the quality of the products.

- Furthermore, there is a growing electronics hub, especially in South Korea, where electronics manufacturers demand superior barrier materials that can shield circuits from moisture and other contaminants since electronics increasingly serve as the backbone to just about everything. This is also supporting the utilization of eco-friendly and recyclable barrier materials for packaging in the region which aims at sustainable development. Investments in infrastructure more so enhancing technological developments bolster the rapid growth of the barrier material market in the Asia Pacific region propelling the region’s status as a global contender.

Active Key Players in the Barrier Material Market

- 3M Company (United States)

- Amcor plc (Australia)

- Avery Dennison Corporation (United States)

- BASF SE (Germany)

- Berry Global, Inc. (United States)

- Clariant AG (Switzerland)

- Dow Inc. (United States)

- DuPont de Nemours, Inc. (United States)

- Mitsubishi Chemical Corporation (Japan)

- Mondi Group (United Kingdom)

- SABIC (Saudi Basic Industries Corporation) (Saudi Arabia)

- Sealed Air Corporation (United States)

- Sioen Industries NV (Belgium)

- Solvay S.A. (Belgium)

- Toray Industries, Inc. (Japan), and Other Active Players

|

Global Barrier Material Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

3.39 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5% |

Market Size in 2032: |

5.98 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Barrier Material Market by Type (2018-2032)

4.1 Barrier Material Market Snapshot and Growth Engine

4.2 Market Overview

4.3 PVDC

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 EVOH

4.5 PEN

4.6 Others

Chapter 5: Barrier Material Market by Application (2018-2032)

5.1 Barrier Material Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food & Beverage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceutical

5.5 Cosmetic

5.6 Agriculture

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Barrier Material Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 3M COMPANY (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMCOR PLC (AUSTRALIA)

6.4 AVERY DENNISON CORPORATION (UNITED STATES)

6.5 BASF SE (GERMANY)

6.6 BERRY GLOBAL INC. (UNITED STATES)

6.7 CLARIANT AG (SWITZERLAND)

6.8 DOW INC. (UNITED STATES)

6.9 DUPONT DE NEMOURS INC. (UNITED STATES)

6.10 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

6.11 MONDI GROUP (UNITED KINGDOM)

6.12 SABIC (SAUDI BASIC INDUSTRIES CORPORATION) (SAUDI ARABIA)

6.13 SEALED AIR CORPORATION (UNITED STATES)

6.14 SIOEN INDUSTRIES NV (BELGIUM)

6.15 SOLVAY S.A. (BELGIUM)

6.16 TORAY INDUSTRIES INC. (JAPAN)

6.17 AND

Chapter 7: Global Barrier Material Market By Region

7.1 Overview

7.2. North America Barrier Material Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 PVDC

7.2.4.2 EVOH

7.2.4.3 PEN

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Food & Beverage

7.2.5.2 Pharmaceutical

7.2.5.3 Cosmetic

7.2.5.4 Agriculture

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Barrier Material Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 PVDC

7.3.4.2 EVOH

7.3.4.3 PEN

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Food & Beverage

7.3.5.2 Pharmaceutical

7.3.5.3 Cosmetic

7.3.5.4 Agriculture

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Barrier Material Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 PVDC

7.4.4.2 EVOH

7.4.4.3 PEN

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Food & Beverage

7.4.5.2 Pharmaceutical

7.4.5.3 Cosmetic

7.4.5.4 Agriculture

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Barrier Material Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 PVDC

7.5.4.2 EVOH

7.5.4.3 PEN

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Food & Beverage

7.5.5.2 Pharmaceutical

7.5.5.3 Cosmetic

7.5.5.4 Agriculture

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Barrier Material Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 PVDC

7.6.4.2 EVOH

7.6.4.3 PEN

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Food & Beverage

7.6.5.2 Pharmaceutical

7.6.5.3 Cosmetic

7.6.5.4 Agriculture

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Barrier Material Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 PVDC

7.7.4.2 EVOH

7.7.4.3 PEN

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Food & Beverage

7.7.5.2 Pharmaceutical

7.7.5.3 Cosmetic

7.7.5.4 Agriculture

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Barrier Material Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

3.39 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5% |

Market Size in 2032: |

5.98 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||